I love getting tips from Uber drivers especially when it comes to buying real estate. We are now back at that level where real estate can do no wrong, the house humpers are confusing luck with investment acumen, and of course the sheep dive in head first at the most frothy time. It is clear that we are in a mania and hot money is flowing everywhere. Credit card offers are soaring and lending is booming across all areas: credit cards, auto loans, student debt, and housing. With housing, we are now seeing one of our favorite past-time events in treating a home like an ATM. Home equity withdrawals are now moving up in a direction that is not exactly positive if you believe in actually keeping your equity locked in instead of cementing your belief in the bubble and adding more debt. You do need to pay those loans back by the way which many tend to forget. Home equity withdrawals are simply one of the final steps in the delusional mania.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

The housing ATM is back

Real estate is blistering hot. It is fully disconnected from incomes or any sane measure of valuation. The only thing beer belly house lusters can say is that “well comps are selling for this so therefore the market has spoken!” Cult chasers were also buying tulip bulbs, beanie babies, and itching to get a piece of Bernie Madoff’s investment sauce. Now the hot thing of the day is buying a crap shack at all cost even if it means you are living on rice and beans to pay the mortgage.

The Fed knows we are close to having a turning point. Just look at how many times interest rates have been changed in various decades:

Hah! The Fed knows we are s-c-r-e-w-e-d. The Fed needs to “try” to keep rates low but the market can become unglued at any moment. After all, everything seems stable in our current economy and political system [/s]. I can’t help to think that we are aiming for a Black Swan type event shortly that simply is off the radar. By definition, these events are unforeseen and yet if you look at history they are replete with them. We know they will happen. To think otherwise is to be naïve and to ignore history and avoid the basic tenets of scientific inquiry. Markets by definition are operated by herd mentalities. The herd is running rampant.

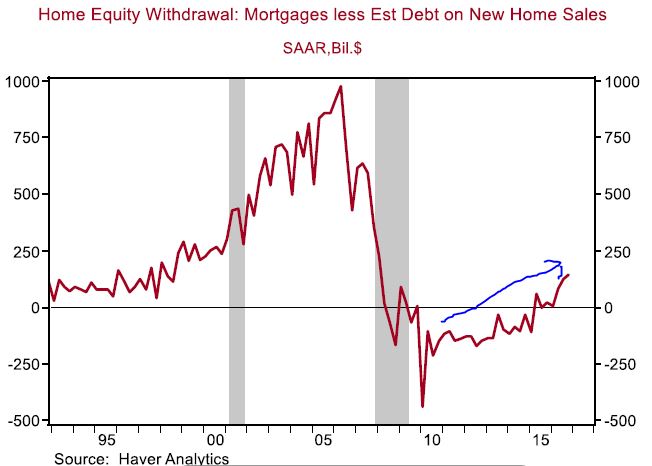

Using your home as an ATM is dumb. Yet here we go:

Home equity withdrawals are now getting back in fashion. People are already leveraged up to their eyeballs in other forms of debt (see later in article). So what if they don’t have a NINJA loan. What happens when there is a correction and the next recession hits? Just look at the balance sheets of many tech companies based in California. They are ridiculous. And these companies employ hundreds of thousands of high paid tech workers. Many of these workers are keeping the bubble afloat in places like San Francisco. Does it matter that you put 20 percent down on a $1 million crap shack but lose your job? Many of these tech companies have balance sheets that are not performing.

So the stock market is hot, the housing market is hot, and now the mania is making people think that using your home like an ATM is smart. It is not. This is simply “cheap” debt that is secured to an inflated asset. You need to pay this back. All debt requires a payment. And yet the issue in the last crisis wasn’t liquidity but solvency. The notion was that if you only fixed a couple of things, all would be well. But no, people made absurd bets on inflated valuations and it all came crashing down. People over paid on a grand scale and it imploded.

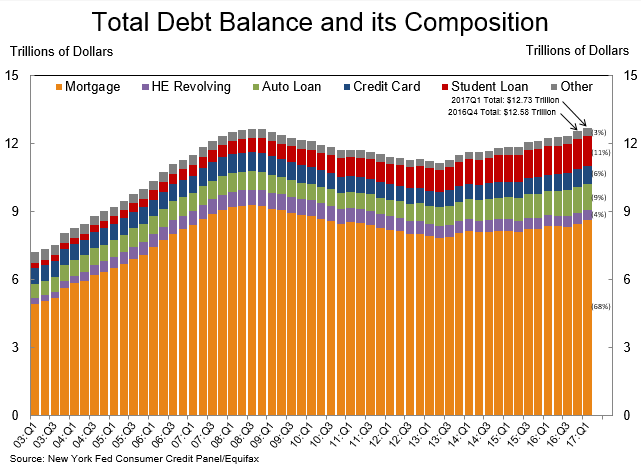

And make no mistake, there is a lot of debt out there:

Total debt is now at a record. And you know what is even more nuts? We have more debt in items that are more volatile than housing:

-$1.4 trillion in student debt

-$1.1 trillion in auto debt

-$1 trillion in credit card debt

People are in debt up to their eyeballs and many Taco Tuesday baby boomers are unprepared for retirement especially with their Millennial kids now moving back home. Time to tap that home equity to pay off those college loans.

Where do I sign up?

Supposedly Joe Kennedy got out of the stock market in 1929 because he started to hear stock tips from his shoeshine boy. Everything old is new again.

I don’t know. In the DC area homes are selling like crazy. Agents keep telling me there is very little inventory. There is no building going on except condos and even they are out of sight expensive. On my street a new apartment building went up and is charging $2,600 for a 1 bedroom with no parking. If there is no building then prices will continue to skyrocket.

Well Wip, I guess that proves that if you are the closest to the printing press, you too can fund anything with other people’s labor and savings.

In the real world, you know, outside of the imperial city and the parasite class, there is a different story.

See, in the real world, there is a stalemate going on, between buyers and sellers. If I sell, based on some real whore telling me to, and I get my high asking price, then what? So the seller sells, then they must live somewhere, unless they plan on just moving their millions to a bridge under the freeway or renting until the market comes to sanity (there are some good arguments to that BTW, but most people aren’t home traders like stocks) . So they are literally at parity when they buy something else, less the drag and fees imposed by the banksters, real whores, and of course, the master parasite – government. So, why sell? Your netting nothing (in fact losing money), unless you are downsizing or getting out of a home you are just breaking even on. Then, at the other end, you have the new entrants – indentured servant millennials that are being told to buy buy buy, from the same real whores, but they have a problem. It is pretty hard to afford a house payment (even at never before seen interest rates) and down payment, when they already have a house payment for college, must by an overpriced car at the dealership, oh and have “health insurance” to pay, and all this at a lower (much lower) in some cases base wage.

You can say that supply is limited, but if the beginning buyer cannot afford to even get in the market, then all you are doing is catering to lateral movers, and in more cases, I would imagine – downsizers. That may explain why supply is not coming on the market. Do you think that builders just don’t want to make money? No, I suspect that after some market analysis, they have figured out that all of these transactions are nothing but taking a 20 dollar bill from one pocket, giving 5 dollars to the government / realtors / banksters, then putting the other fifteen in the other pocket. Lots of volume, little actual growth.

I tried that idea by selling in Northern NJ in 2006 and renting ever since. However, the Fed f’d me by making fundamentals meaningless through ZIRP and the prices only dropped by 10% or so before coming right back, making my plan fail because I’ve spent a good chunk of my winnings (i.e., capital gains on the house) on the difference between what I was spending on my mortgage and taxes before selling and my rental rates which are considerably higher.

To top it off, most of the proceeds were invested in Silver, which (again, due to the Fed) has languished for the past several years.

It sucks being right and still losing because the Fed keeps changing the rules.

A sucker is born every minute______((Da Banks))

This is an excellent article that gives some sound advice. History tends to repeat itself and I don’t think it’s a coincidence that home equity loans are, again, on the increase. I also don’t think it will be a coincidence that the same outcome will occur in the not too distant future to the outcome that occurred in 2008 from the same practice of home equity mania and fiscal ignorance and irresponsibility.

If there is anyone in TBP realm who is thinking about getting a home equity loan, or has a loved one thinking about it, I implore you to get as much information as you can regarding such a step, including taking 10 minutes of your time to read this article. Even if your intentions are to use every bit of the money to make upgrades on your home, please please, please be very careful and know exactly what you’re getting into. Instead of jumping into a home equity loan maybe take advantage of the still historically low interest rates and make monthly payments on those new windows by the $0 down and 0% interest rate that is being offered by your local window company. Just because it may be a sellers’ market now doesn’t mean it will be three months after getting your loan. Then what? Now you have a home that is worth less, even with the upgrades, and you are saddled with debt on it. Chances are, interest rates have gone up and so have your monthly payments on your loan. Actually, it will be the interest on your loan you’ll be paying and your principle on that loan will only be reduced by a few dollars (at best) every month for several years.

If your intentions on getting a home equity loan are to use it to fund vacations, boats, autos or other personal pleasures, then you are making a serious, and quite honestly, a very stupid mistake. You will live to regret it and quite literally take it to your grave!

That last bit about tapping your home equity to pay off your student loans might not be a bad idea in certain situations, even though the suggestion was sarcasm. You can declare bankruptcy and walk away from all that housing debt. Can’t do that with student loans, so might as well get rid of the student loans before doing that.

I see it all the time. I do a side job, which involves no valuation whatsoever. All I do is take photos of the house from the street, verify the public records on beds/baths/garage count, and make sure it’s not for sale. I do about 3 of these a week in abut 5 towns.

Then I do another 2-3 week of people who are trying to drop their PMI by either showing values have gone up enough to show they have 20% equity in their homes (Most do not, they bought in 2004-2005 and homes are right at that level now) or “improved” it enough to add 20% value (they don’t. Carpet, paint, and new sinks and tubs do not add 20% value, especially if you did those things over 5 years ago, the “improvements” are aging out) and you are competing against very new or brand new construction homes for what your home would have to be worth the add the 20% and it just can’t happen. So these PMI people are SOL but the equity people are not. Crazy.

I will have a job forever selling foreclosures.

Borrow with low interest rates via a cheap HELOC and leverage up and invest the money in the stock market. What possibly could go wrong? 😉

Rojam, you make an excellent point. 99% of the homes I am doing these “drive by” photos on are already really nice houses that need no upgrades (at least none that I can see, and are usually already 3-4 beds and over two baths with garage, etc) so what are they paying for?

I have some guesses:

Credit card debt pay off (which is probably a smarter move since that debt is financed at 12% if you are LUCKY and more than likely at 19+ and more)

Little Johnny and Susie’s waste of time education at a liberal-arts school

Mommy’s new boobs/face/tummy

Daddy’s boob reduction/new hair/corvette

Second home/vacation spot and a new ring to keep Mommy happy with Daddy

All a waste. But people never spend money on stuff that matters anyway, like learning survival skills, putting in a really nice garden, solar panels, and a good generator. That’s for the credit poor plebes who never could buy a house anyway.

I had a friend who for years would rack up massive credit card debt and then just refinance his house to pay it off, until the party ended in 2008. He lost the house, filed bankruptcy, moved away, and just closed on a new house in a new state. Hope he learned from his mistakes.