Guest Post by Eric Peters

People worried about how much money they spend on gas ought to consider how much they spend on their cars.

Gas is among their smallest expenses – especially vs. the cost of a new car. Even vs. a super-economical new car.

If saving money is the issue – rather than spending money on gas – it’s worth doing some math.

Or at least, looking at some math already done on the subject.

The American Automobile Association put together a Cost to Drive worksheet (see here) which breaks down what people pay, on average, not just for for gas – but for everything else associated with owning and driving a new car.

Emphasis on new – because people are pitched aggressively on the false idea that they will save money if they purchase one. Especially one with all the latest “gas saving” technologies.

Well – as Ronald Reagan used to say – let’s see.

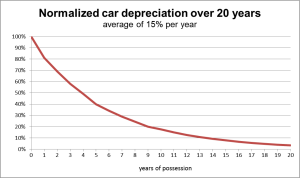

It turns out the thing which costs people the most money isn’t gas but depreciation – the hemorrhagging of value that afflicts new cars particularly.

It runs about 10 percent a year.

AAA pegs the figure at $3,000 annually, on average – which is about twice what the average person spends on gas every year, which is about $1,600 (around $32 per week).

Pu another way: Even if you drive a V8 SUV that gobbles $60 in gas every week, that’s still only about $280 per month and less than the annual cost of depreciation on most new cars.

Some new cars – luxury cars – cost their owners even more in depreciation, because the value of a luxury car is bound up in its newness above everything else. A year-old luxury car is last year’s luxury car – and often worth 20 percent less than it was worth when it was new.

If you bought it for $50,000 last year and it’s worth $40,000 twelve months later, that’s a mighty big hole in your pocket – and the cash that fell through it would have bought a lot of gas.

The highest depreciating cars of all, by the way, are electric cars.

They lose bleed value even faster than luxury cars – $6,000 annually, on average according to AAA – not because of fickle things such as not being the latest things but because of functional things – aging battery packs that can’t hold as much charge as they could when new.

Which means the EV can’t go as far it could when it was new.

And because that wasn’t very far to begin with vs. a non-EV, any significant reduction in battery performance (and so of driving range) can render an EV functionally useless. Or at least, a hassle that most people aren’t interested in putting up with given how long it takes to recharge an EV.

This is why you can find three or four year old Nissan Leafs – which stickered for $30,000 when new – for $10,000 or even less on the used car market.

That is a big hit to “save on gas.”

But people often overlook the cost of depreciation because they don’t pay it in regular installments – as they do for gas. Thus they do not see it – or feel it – until it’s time to sell or trade-in their car.

Uncle uses the same principle of deceit to hide the cost of what he steals; it is called “withholding.”

There are other costs associated with new cars that they will feel long before then, but which aren’t line items on the window sticker – and so people don’t take them into account until after they bought in.

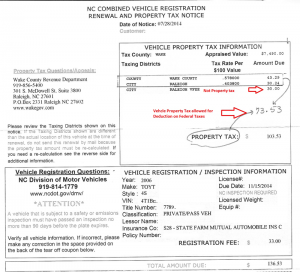

Things like full-coverage insurance and property taxes – either of which alone can amount to as much as the average person spends on fuel every year.

It costs about $1,000 annually to full-cover a new car – the high premium a function of the high cost to fix new cars. A supermarket parking lot fender bender is actually a plastic cracker – and tearer. The exposed front and rear “fascias” of almost all modern cars look sleek but are extremely vulnerable to damage and often throw-aways rather than fix-’ems.

You replace the entire plastic front clip to deal with a rip.

Now you know why it costs you so much to cover the thing – even though you have a perfect driving record and the car has all those saaaaaaaaaaaaaaaaaaaaaaaaaafety features you thought were going to save you money.

Property taxes – in states that apply them – can cost you as much as insurance, too.

Together, they can easily cost you more than gas. Over six or seven years, what you pay in full coverage insurance and property tax could have bought you a good used car – in cash. Which would cost you half or less as much to insure and a third or less in property taxes.

The best way to save money – so you have it, to spend on gas as well as other things, like repairs costs – is to not buy a new car.

If you aren’t spending $300 a month in new car payments – plus the hidden cost of depreciation on the new car, which is almost equivalent to another $300/month – plus full coverage insurance and rapacious property tax based on the value of a new car – spending even $60 per week to fuel a “gas hog” but paid-for older SUV can save you a fortune.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

When one drives a old school 4×4,say a 4 wheel van with 33″ tires/lift and a 460,well,you really are not worried about the gas costs!

Or a 2000 V6 diesel Ford Ranger.

I know people who bitch about the cost of gasoline and how they think the oil companies are screwing everybody. I then ask them why they aren’t complaining about the $70,000 they just went into hock for that new pickup truck. They always act like they are pissed at me! I’d love to hear someone explain that one.

I’ve owned a dozen or more cars and truck. I’ve only bought one new car for myself and that was a 2003 Toyota Corolla that is still running today with over 600K miles on it …with the original trans and motor.

I bought a 2017 Toyota Camry SE in August. 19K on the odometer . The sticker which was in the glove box was 25K. I bought it for 16.5K . That’s one hell of a depreciation for a 1 1/2 year old car.

As a side note. When I was married to wife # 2 she used to buy a new Honda Accord every 3 years. It would get to 36K on the odometer and she’d trade it in. She/we used the same salesman each time and typically the monthly payment went up 5 bucks from the previous model we were trading in. She/we bought 5 Accords in this fashion ( the 5th one was bought two months after we purchased #4 which was totaled)…never had to do anything but change the oil. I’ll admit it was nice not having to worry one bit about repairs etc .

I’ve got a 95 Ford F150 4×4 extended cab….130K on the odometer. I’ve had it since 2002…keep saying I’ll get a newer truck….maybe one day.

Get a newer truck?!Why,for computer problems/expensive fixes ect.?!The newer Ford 5.4 costs 1000’s to replace the timing chain,a old school motor,about 100 in parts and half a afternoon in drive!I know tis not just Ford with this insanity!

Get a mint body old school truck,hell,you replace motor/tranny/transfer/pumpkins ect. and all still into it for say 20 grand and have a classic looking truck that any shade tree tech(Like me)can work on,40 plus for new pickup,no thanks!

You really motivated could drop a deisel in a old Chevy S-10(Wip!).

You know how to take good care of your vehicles. My hat’s off. I like to buy one-owner cars with service records, at about 50k on the clock. Got one now that’s about to turn over 80k, 2012 Prius Plug-in. Just tires and oil & filter changes so far. Drives like new and still goes 8.3 miles on EV alone. That’s enough for most of my consumer missions. For longer trips it alternates between ICE and EV.

The event to fear for stretching your car budget dollars is Cash For Clunkers 2. The destruction wrought by the Obummers first one was to make affordable $6K and under cars disappear from the market for about 3 years. Sure you could buy a car for less than that but they all became claptrap beaters with heaters one breakdown from the junkyard. Most people took their older decent condition vehicles to dealers for the oversized government subsidized trade in, and BOOM. There went the majority of the low end decent cars which allowed you the best way for getting the most bang for your buck for your transportation budgeting requirements. The only vehicles left were really crappy ones that became inflated in value and decent ones were now above the $5K trade in allowance. For buyers on a budget you were now forced to blow $6K for a vehicle that would’ve been going for around half of that price before the CFC program was passed by Obummer’s idiots in CONgress. Another reason to hate politicians and especially democrats.

Property tax is one of my favorite examples for 1984 has become reality. So you have to pay to “own” something? Finest double think.

People pay for the ground they own, or even inherited, they struggle to do so, and don’t doubt.