Famed philosopher Ayn Rand told us, “You can choose to ignore reality; but you cannot ignore the consequences of ignoring reality.” If you bury your head in the sand long enough, you will eventually get bit in the ass….

Famed philosopher Ayn Rand told us, “You can choose to ignore reality; but you cannot ignore the consequences of ignoring reality.” If you bury your head in the sand long enough, you will eventually get bit in the ass….

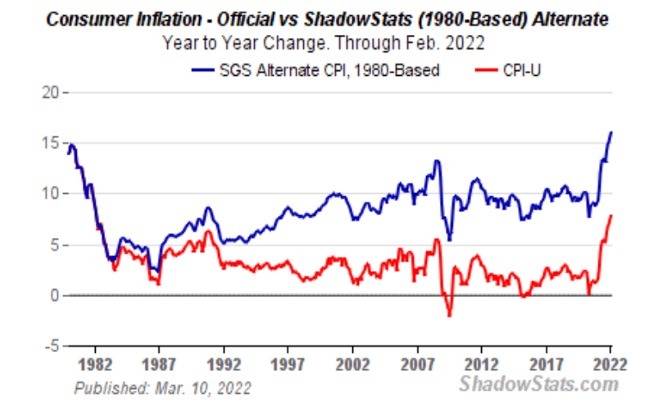

Inflation has been skyrocketing and the government/media can no longer ignore it.

John Williams, at Shadowstats.com calculates inflation using the same method used in the 1980’s. Today it’s well over 15%. A Dallas Fed survey expects it to go higher.

Why has inflation skyrocketed over the last decade? The Fed, has ignored reality, pretending it does not exist, calling it transitory. The consequences of ignoring reality are now coming home to roost.

It’s an election year so they keep up their BS, announcing a ¼% boost in interest rates with the possibly of more to follow.

Pundit Bill Bonner offers some straight talk:

“As expected, Jerome Powell, Fed Chief, told the world that he is getting serious about whipping inflation now. He’s calling up a platoon of very mean girl scouts to lead the charge.

Fox:

“With inflation well above 2% and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month,” Powell…saying that he is “inclined to propose and support a 25 basis point rate hike” at the Fed’s March 15-16 gathering.

Is he kidding? A quarter point increase? That will bring the Fed’s key rate to about MINUS 7%. Is this ‘tightening?’ Of course not. Powell is not fighting inflation; he is enabling it.”

A few days later, he adds: (Emphasis mine)

“Stop the presses!

AFP reports:

‘If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so,’ Powell said in a speech to an economics conference.

…. Now, if it were serious about fighting inflation, it would have to boost rates by as much as 1,000 basis points – 10% – to get ahead of rising prices. But even a smallish move in that direction will almost certainly crash the stock market and the economy.

What to do? Pretend to do battle with inflation…and change the subject as soon as possible!”

A decade ago, Richard Russell wrote: (Emphasis mine)

“July 11, 2012 – Years ago I coined a phrase that described the US’s predicament. The Phrase was, ‘inflate or die’.

…. Now with a national debt of over $15 trillion, the choice has really come down to ‘inflate or die’.

The die part of it would be to allow the bear market to play itself out to the end – to the bitter bearish end. But this would be Great Depression number 2, and the country would surely not stand for it. It might even foment a revolution.

But how about the inflation part? The printing presses would have to go wild. Furthermore, enormous inflation would almost surely wreck the country. …. So inflate or die would have serious (most likely disastrous) consequences.”

As Mr. Russell suggested, the printing presses went wild. In ten years, the Fed created more fake money since the beginning of time. Our debt is now $30 trillion and likely to double in less than a decade.

Inflate or die – who or what dies?

Rather than allow the free market to reign, with the normal rise and fall, the Fed is hell bent on Wall Street boom times forever. If they don’t inflate, the stock market will correct, adjust, revert to norm, whatever. If it continues to inflate, as Mr. Russell said, it would “surely wreck the economy.” When you are holding a candle, burning at both ends, you are going to get burned…perhaps badly.

Rather than allow the free market to reign, with the normal rise and fall, the Fed is hell bent on Wall Street boom times forever. If they don’t inflate, the stock market will correct, adjust, revert to norm, whatever. If it continues to inflate, as Mr. Russell said, it would “surely wreck the economy.” When you are holding a candle, burning at both ends, you are going to get burned…perhaps badly.

Why does Congress and the Fed fiddle, allowing inflation to soar?

Bill Bonner describes former Fed head, Paul Volcker:

“Paul Volcker was the last competent Fed chief. He was also the last one to tighten the money supply to stifle inflation. That is not to say that he was always right about what was going on. But when push came to shove, Volcker pushed back…and stopped inflation.

But that was 40 years ago.”

Don’t expect another Paul Volcker to swoop in like Mighty Mouse and save the day! Paul Volcker saw reality; skyrocketing inflation and a real risk of the dollar totally collapsing destroying the US economy. What he saw then, he would see today, only in trillions not billions.

Congress has wasted trillions on stimulus packages, buying votes and rewarding cronies, with the Fed’s printing presses working overtime.

House Speaker Pelosi was quoted, “@speakerpelosi: “When we’re having this discussion it’s important to dispel some of those who say, well it’s government spending. No it isn’t! The government spending is doing the exact opposite, reducing the national debt. It’s NOT inflationary.”

What kind of BS is that? What a commercial for congressional term limits…

Some pundits are discussing “The theory of unintended consequences”; decisions causing surprising unintended consequences. I DISAGREE. The government and the Fed know exactly what they are doing and what the consequences will be.

They choose to lie about reality, ignoring the consequences, while siphoning much of the wealth of the nation. They know exactly what will happen. Many in the political ranks want to destroy capitalism as we know it.

What they don’t want us to know!

The Federal Reserve is owned by the big banks, just like it was during the Volcker years. However, the nature of their banking business has radically changed.

In 1933 the Glass-Steagall Act was passed to protect the public. Banks were required to hold ample reserves and their loan portfolios were regularly audited. High risk loans and investment operations were not allowed by FDIC insured banks. Interstate banking was not allowed, no bank should ever be “too big to fail”. No depositor lost a dime after it became law.

The law was repealed in 1999, followed by a flurry of bank mergers and acquisitions. Big brokerage firms also merged with banks into what we now call “casino banks,” earning billions from their high-risk investment activities. The Fed’s owners are not focused on the banking business as we once knew it. They are now deemed “too big to fail.”

These top banks control much of the wealth of the nation, earning fees from investors. Their high-risk derivative exposure is in the trillions – all under the FDIC umbrella. The FDIC no longer protects us; but rather it uses taxpayer dollars to protect the casino banks making risky investments, while rewarding the elite.

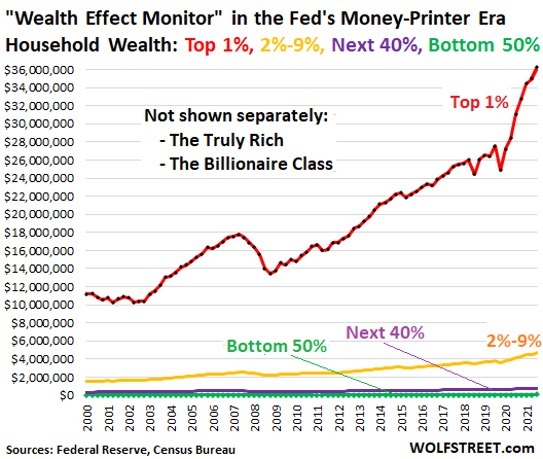

Wolf Street calls it, “The Most Reckless Fed Ever” and outlines, what I believe is the INTENDED CONSEQUENCES – totally expected when Glass-Steagall was repealed:

“The Fed’s meme that money-printing helps the working people turned out to be BS.

The Fed has been couching its crazy monetary policies and refusal to deal with inflation as a way of helping the lower end of the labor market. But that is patently BS. And the Fed knew it.

…. But wait…there was a small group of huge beneficiaries from the Fed’s policies.

The Fed has long had as its official monetary policy goal the ‘wealth effect’.

…. What this wealth effect doctrine has accomplished…is the greatest wealth disparity ever.”

Wolf shows us the Fed’s “wealth effect”:

The rich get richer, while the middle class gets destroyed. The Fed buys protection from congress by enabling their reckless spending – suppressing free market interest rates, putting outrageous government debt on their books, not allowing free market capitalism to work.

G. Edward Griffin sums it up, “The Federal Reserve is a cartel- it’s a banking cartel. And like all cartels, it only has one purpose – and that is to serve the benefit of the members of the cartel, period!

The rich get richer, prices rise, wages don’t keep up, and the bottom 90% see their wealth destroyed. The stock/bond market bubble is going to burst, the working class are going to see their 401k savings take a huge hit.

The rich get richer, prices rise, wages don’t keep up, and the bottom 90% see their wealth destroyed. The stock/bond market bubble is going to burst, the working class are going to see their 401k savings take a huge hit.

Expect the Fed (cartel) to call it a Recession, implying they will fix it in a short time. Don’t buy their BS!

Ayn Rand warns:

“All depressions are caused by government interference and the cure is always offered to take more of the poison that caused the disaster. Depressions are not the result of a free economy.”

Investopedia explains:

“Depression vs. Recession

A recession is a normal part of the business cycle that generally occurs when GDP contracts for at least two quarters. A depression, on the other hand, is an extreme fall in economic activity that lasts for years, rather than just several quarters.

Understanding Depressions

…. Economic factors that characterize a depression include:

-

-

-

-

- Substantial increases in unemployment

- A drop in available credit

- Diminishing output and productivity

- Consistent negative GDP growth

- Bankruptcies

- Sovereign debt defaults

- Reduced trade and global commerce

- Bear market in stocks

- Sustained asset price volatility and falling currency values

- Low to no inflation, or even deflation

- Increased savings rate (among those who can save)”

- Substantial increases in unemployment

-

-

-

Flooding the banks with more fake money will just fuel the fire. Cut the crap! Reinstate Glass-Steagall.

Unlike the Great Depression, we are no longer an agricultural society where most people can live off the land. Anyone with wealth will be a target by both the government and others.

Americans will have to survive by hard work, ingenuity, and preparation. Those who don’t ignore reality and prepare will survive much better than those who don’t! Got gold?

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

The USD is at 100.4 which causes me to think we are strangers in a strange land. Inflation raging, supply chains about to be tested way beyond anything we have ever seen with a dash of plague and war thrown in for good measure along with an actual invasion and a comedy act for President. My point is we have all this with a very high Dollar. If this is approaching the limit of a swing to strength, the reversion to mean or overshooting to junk status will light off Weimar type runaway inflation.

I’m feeling like Sgt. O’neal in Platoon after he has survived being overrun and the Captain tells him he’s the new platoon sergeant. It is time to be examining extreme measures because the criminally negligent morons running this asylum cannot or will not.

They are not ignoring anything….

Fed Governor Christopher Waller Predicts We Have Reached Peak Inflation, Here Is What they Will Not Say

The fed has been painfully slow to raise interest rates on purpose. They did not make a mistake. The reason for their delay is they needed to wait for the beginning of the first 2021 inflation wave to cycle through before they raised interest rates. It’s a game of mirrors that almost no one sees…

The rate of inflation will drop once the statistical year-over-year comparisons reach the same moment in the prior year. The fed will raise interest rates in May and then use the June inflation rate decline as a false talking point to highlight how their policy is working…

But here’s the worse part….

All of these U.S. Fed monetary policymakers are in full ideological alignment with the global and central bankers. They are all following the same Build Back Better agenda and policy instructions.

All of bankers know the shift from ‘dirty energy’, coal, oil, natural gas, will create inflation. All of the bankers know there is no economic bridge within the plan to shift from oil to their unicorn dust. All of the bankers know that shutting down oil exploration as a matter of western unified policy will, as a factual matter, destroy the economic systems that rely on energy….. which is to say everything.

All of these bankers know the severity of the inflation crisis this energy shift creates. None of them do not know.

Everything they are doing is coordinated to assist the climate change agenda.

That’s what this is all about.

I wonder if they fear the natural warming of the planet (we are still in a severe global freeze period) scares them. Resources will not appear so scarce when the warming growth bloom turns this planet back into Eden.

I do believe they are stupid enough to think Earth’s internal carbon cycle can be manipulated to affect mean surface temperature. Or at least arrogant enough. It is a huge nominal number or carbon, if you don’t understand the large numbers you are working with.

Inflation is good for tax revenue since they take a percent of the action. It is also good for them to make the older debts smaller. It is all by design.

John Williams at Shadowstats calculates the effects of inflation, not inflation itself.

Inflation is what you get when your money is comandeered by hostile aliens and replaced by debt which is created at interest. Inflation is built in since further debt (itself created at interest) must continuously be created to pay the interest, which eventually gets away from you.

It’s a system which is flawed by design (the flaw being a feature, not a bug). As such there is no better example of organised crime, since it robs absolutely everyone.

ATTICA, Athens. Circa 400/390-353 BC. AR Tetartemorion (4.5mm, 0.16g, 8h)

“reality is that which, although you ignore it, doesn’t go away”

-Philip K Dick