Guest Post From John Wilder

“Would Homer cut away from Odysseus’s journey just as he was being enticed by the siren’s song?” – BoJack Horseman

My lack of knowledge of Greek mythology is often my Achilles’ Elbow.

We’ve reached the Scylla and Charybdis stage of our economy.

Scylla was, in Greek mythology, a six-headed monster that was probably less scary than the average half-dozen Congresscritters, and certainly less dangerous.

Charybdis was a whirlpool that sucked inside everything that got close to it three times a day, so it was pretty much exactly like Kamala Harris.

The idea is that if you’re between Scylla and Charybdis, life is on the edge because there are dangers on either side. When Odysseus tried to sneak between the two, he lost six crewmembers, one to each head of Scylla. Thankfully they didn’t go too close to Charybdis, since Kamala has a mean-looking canker sore, and some gifts last forever.

Trying to thread the fine line between Scylla and Charybdis: that’s where our economy is now.

Could it be that the Odyssey is just a made-up excuse by a husband as to why he’s ten years late?

As inflation rages through the system, every minute that we have an interest rate well below the rate of inflation, inflation is being fed. To quote Joe Biden from January 24, 2022, “It’s a great asset – more inflation. What a stupid son of a bitch.” You can tell he’s excited to Build Back Better!

Oddly, it’s not inflation in everything. Some items are starting to deflate now. Houses, for instance. The price of a house is tied to the interest rate – the more interest wrapped into a monthly payment, the fewer the number of buyers that can afford or qualify for a loan. And in Biden’s America® people have to qualify for more important things, like a Quarter Pounder™ or a tank of gas.

But back to home loans: fewer people qualify? Less demand. Less demand? Lower home prices.

When we moved to Modern Mayberry in the middle of the Great Recession, some houses had been on the market for longer than 350 days. These were decent houses, but there just wasn’t any demand. Recently, as people began to take my advice and flee the cities, houses disappeared off the market in days here in Modern Mayberry. With all the city folk moving in, at least I know what a hipster weighs: an Instagram®.

One hipster I knew poured water from an ice tray into his beverage. He liked ice before it was cool.

Now? Interest rates for mortgages are going up, so demand for houses will be going down. Eventually, the market for houses will go back to where it was when I got here. That’s okay, I never expected to walk away from Stately Wilder Mansion with a single dime of profit. For me, a house is where I live, not an investment.

So, interest rates up, housing prices down. Simple.

Also, interest rates up, stock prices down. For the last decade, stocks have been just about the only game for people who were trying to keep up with inflation. This was a continual pressure upwards on stocks. Now as interest rates go up, there are other options.

Traditionally, there was (this was something I read in an article a long time ago) a formula showing the value of a stock in relation to the interest rate: Maximum P/E=20-Prime Rate. That meant, with an interest rate of 0%, a stock was at fair value with a Price to Earnings ratio of 20. Likewise, if the interest rate was 10%, the fair market P/E would be about 10.

Obviously, it’s such a one-dimensional analysis that it was made back when “digital computing” meant counting on your fingers. There’s no way I’d suggest anyone use it to pick stocks (nor would I suggest taking the advice of an Internet humorist on any investment advice no matter how witty, charming, and handsome he might be), but it does show how the relationship between interest rates and stock prices and earnings was thought about once upon a time. But it summarizes the same idea – interest rates up, stocks down.

I bought some speakers. At least that was a sound investment.

Heck, it even led me to a never-fail way to manipulate individual stocks: if I buy a stock, it goes down.

There are other impacts, too. For instance, it makes debt harder to pay back for people around the planet. If Egypt owes money to ChaseAmericanFargo™ Bank and the interest rate is variable, that means that Egypt will have to start selling items to pay back New York, or London, or Beijing. Heck, the British would already have the Pyramids, but they wouldn’t fit in the British Museum

More money to the banking centers? Less money for chow for the Egyptians. We saw this exact scenario play out in the Arab Spring in 2012. Expensive stuff caused people to go hungry and then hungry people with no hope do what they always do when they can’t watch Netflix™ and buy Twinkies©.

They swap out the government. The new boss looks a lot like the old boss in Egypt, and it’s exactly the same boss as it was in Syria. Some things don’t change. If it’s bad enough, it also craters the economies in South America and, even Canada might have its assets frozen. Or, more frozen.

How did Kamala get her cold sores? She dated Herpules.

But when the interest rates go up, it’s not just the government in Egypt that gets squeezed. The current debt in the United States is $30.5 trillion. The total US debt, including personal debt, student loans, credit cards, and I.O.U.s to me from that one guy that owes me $20 is about $91 trillion. (All numbers from usdebtclock.org)

When the interest rates go up, the payments on interest go up. That means less money available for everything else. When last I looked, the mandatory payments the Federal government were as much as or more than the amount of money that they took in. That means that printing more money is now the only way the system can work. It’s like having a tobacco cessation class with a two-cigar minimum.

That leads to the difficult bit – the hall of mirrors. If we don’t raise interest rates, and raise them quickly and raise them high enough, inflation will devastate the economy. If we do raise them, interest payments will freeze the economy and dry up all the PEZ®, pantyhose, and elephant rides the government buys daily. We are in a classic trap, but it is a trap entirely devised by the Fed® and the politicians working long-term problems on short-term incentives.

By attempting to push back the moment of financial reckoning by any means possible, we’ve created a failure that is much, much larger. If we would have let financial companies fail in 2000 and 2008, and fixed the structural problems with Medicare, perhaps, just perhaps we wouldn’t be here today.

But we are.

How bad are things?

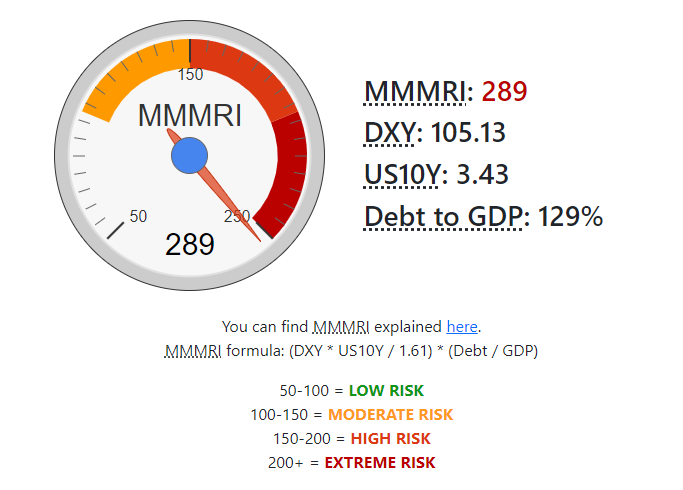

Again, people have been trying to gauge when things in the stock market are out of whack – Gregory Mannarino came up with a market risk index that he called the Mannarino Market Risk Index, which was modified by Nobody Special Finance into the Modified Mannarino Market Risk Index. You can watch the video on what makes it up here (LINK). It’s only twelve minutes, and it’s pretty simple. The MMMRI is simple, but it’s still quite a bit more sophisticated than the 20=P/E-Interest rate formula from back in the Stone Age. The summary is of selected past MMMRIs is:

- Black Monday (1987), MMMRI 234

- Dotcom Bubble Pop (2000), MMMRI 208

- Great Recession (2008), MMMRI 169

Right now?

You can find tracking information on MMMRI here (LINK) on Mannarino’s website.

Yup. MMMRI is screaming loudly that the stock market is really, really messed up. But you knew that. Things are broken, and they’re breaking faster as things go downhill. So, whatever you do, don’t buy canned goods and storage food and precious metals and PEZ® and ammo. Nope.

I’m sure that the team of Biden and Harris along with Janet Yellen, Treasury Secretary, (who had no idea that inflation was even a problem) or Jennifer Granholm, Energy Secretary, (who said that high gas prices are “a very compelling case” to buy an electric car) will be here to help us charter a safe course between Scylla and Charybdis.

Oh, wait, Biden and Harris are Scylla and Charybdis.

Stopped reading Wilder over a year ago. He still thinks we at #7 on a scale of 1-10 on the Civil War scale. Idiot. We’re at #10 already but he’s too naive to realize we’re already in a Civil War. I don’t tolerate fools.

I should apologize for calling him and idiot and a fool. He’s not. Writes funny stuff and insightful. But I don’t apologize for calling him naive.

Pot. kettle.

Kettle. pot.

Sounds like you’re stuck between a rock and a hard place.

https://www.greeklegendsandmyths.com/scylla-and-charybdis.html