With Europe still on edge over the risk of an extended Nord Stream shutdown in 24 hours, moments ago Russian President Vladimir Putin eased tensions when he said that Russia would fulfill its commitments to supply natural gas to Europe, but he warned that flows via the Nord Stream pipeline could be curbed soon if sanctions prevent additional maintenance on its components.

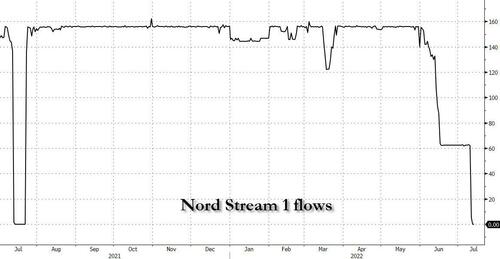

Translation: as we predicted, Putin will resume NS1 flows, but at levels at or below the pre-repair “new normal” of 40%.

As we reported previously, Nord Stream 1, the main artery for Russian gas to Europe, is currently down due to regular maintenance and European governments are worried the Kremlin won’t restore its flow when the work ends Thursday, roughly around the time the ECB announces a historic rate hike (as much as 50bps according to the latest press reports). A prolonged outage could lead to an even greater energy crisis, prompting governments to ration energy, hurting industry and sending the country into recession even faster.

Putin echoed comments made late Tuesday after his visit to Tehran, where the Russian president said that Kremlin-controlled energy exporter Gazprom PJSC, pipeline operator’s majority shareholder, “has always fulfilled and will fulfill all of its obligations.”

But he added that flows might fall to some 20% of capacity as soon as next week if a critical pipeline turbine that was undergoing repairs in Canada isn’t returned to Russia soon. Putin said that another turbine had to go for maintenance on July 26.

Even before the maintenance began, Gazprom last month cut deliveries on the pipeline to 40% of its capacity, blaming Canadian sanctions that had prevented the return of the turbine being repaired there. European officials have dismissed the turbine explanation as a pretext for Moscow to try and wreak economic havoc on the continent.

Germany has been racing to return the turbine to Russia after Canada earlier this month tweaked its own sanctions, allowing turbines for the Nord Stream pipeline to be repaired and returned to Russia.

In response to the threat of a complete Russian shutdown, the European Union has been pressing governments to step up their energy-conservation campaigns, rolling out new plans for possible rationing on Wednesday. The commission’s plan is expected to offer guidelines for curbing energy use and establish criteria governments can use to determine which industries to give priority to if there isn’t enough gas to go around. The guidelines also call for public buildings to limit air conditioning to 77 degrees Fahrenheit and cap thermostats at about 66 degrees during colder months.

Earlier this week, news hit that Gazprom invoked force majeure for its failure to deliver contractually agreed natural-gas shipments, according to European energy companies. It isn’t clear whether the notice—a legal declaration that exempts the company from fulfilling contractual obligations because of circumstances outside its control—covers a potential decision by Russia not to resume Nord Stream flows after the maintenance.

While some European officials have in recent days cast doubt on whether Nord Stream would come back online on Thursday, Putin’s comments helped fuel expectations the pipeline would restart. Separately, flows of gas through the pipeline spiked several times on Tuesday, which analysts say could be pressure tests ahead of the end of the maintenance.

Analysts at Goldman Sachs said they expected the pipeline to come back online Thursday at its pre-maintenance capacity of 40%.

A full stop “would remove flexibility from Russia’s supply decisions, once you’re at zero, there’s only one place to go: up,” the bank wrote in a note to clients on Tuesday, adding that such a scenario would also deprive Russia of gas revenues.

Below we excerpt from the Goldman Q&A (the full note is available to professional subscribers).

1. Why would Russia not keep NS1 at zero?.

Most of the clients we have talked to over the past week are split between the 40% and the 0 flow scenario for NS1 post maintenance, with many market participants in Germany in particular expecting the pipeline to indeed remain at zero. However, we still don’t see NS1 staying at zero as a likely scenario, as (1) it would remove flexibility from Russia’s supply decisions (once you’re at zero, there’s only one place to go: up); (2) it would significantly reduce Russia’s gas revenues, limiting its upside from a potential spike in European gas prices under that scenario; and (3) it would force an even faster rate of gas production shut-ins in Russia. Although we don’t see these shut-ins as a geological/technical issue for Gazprom, they effectively delay an increasing share of its gas revenues to the end of the life of the wells. The large number of clients that have expected the pipeline to remain at zero post maintenance suggests a sell-off in European gas prices from current levels is likely in case NS1 returns to at least 40% of capacity from July 21st. This is in line with today’s TTF move, down 5 EUR at 154 EUR/MWh, following media reports suggesting NS1 will restart below capacity as scheduled. To be clear, under a 40% NS1 flow rate scenario, we don’t believe such lower prices would be sustainable, with a return to a 170 EUR TTF range likely in our view in order to generate enough demand destruction to help take NW European storage to 90% full by end-Oct22.

2. What’s the risk to European gas markets if NS1 flows remain at zero

Under this tightest outcome, even taking into account offsets to the supply losses like coal restarts and government-driven demand destruction, among others, we would expect TTF to average over 210 EUR/MWh in 3Q22. This is based on our expectation that markets (and governments) will act to take NW European gas storage to 90% full ahead of the winter and our estimated demand elasticity of 1 mcm/d per 1.8 EUR/MWh move in price. This scenario would also likely push the Euro area into a clear recession, as recently highlighted by our economists.

3. What changes with the return of the turbine from Canada?.

Not much. Despite the recent focus around the timing of the repaired turbine’s return to Russia, now expected around Jul 24th, after NS1 maintenance is scheduled to end, we don’t believe this will be the sole driver of NS1 flows. In addition to the opaqueness behind the scale of the volume curtailments via NS1 last month, the absence of any Gazprom-driven re-routing of the reduced flows via an alternative pipeline to mitigate the impact to supply suggest Russia’s gas exports are as much a political/economic decision as a technical one.

4. Is it possible to track NS1 flows?

Maintenance is scheduled to end 6am CET this Thursday, July 21st. Intra-day flow data is available on Bloomberg using the OPAL (OPAMRXIF Index) and NEL (NELFPMIF Index) intra-day tickers, which added together show NS1 flows.

5. What is Gazprom’s recent force majeure declaration about?

The recent Gazprom force majeure (FM) declaration retroactively refers to realized export cuts (the NS1 cuts) over the past month, and does not reflect any new changes to gas flows. We see it as an effort by the company not to be seen as liable for the supply cuts to long-term customers observed since mid-June. We do not see this FM claim as particularly relevant to our NS1 flow expectations going forward.

6. Can Russian gas be diverted elsewhere, if it doesn’t flow to Europe?

Not really. The lack of pipeline connectivity between that particular producing region and alternative buyers has resulted in Russian gas export curtailments being split between domestic storage injections and production shut-ins. Specifically, Gazprom’s published data suggest its production is down 10% year-on-year year to date, and down more than 35% year-on-year for the fist half of July. We do not expect this to pose a geological issue, though, given Gazprom’s demonstrated ability to historically swing production up and down without damage to gas well pressure. The most recent example of that was its 50 Bcm production swing in 2020, during the peak of the pandemic. By 2021, Gazprom brought it all back and more, as demand recovered. We also note that, because Gazprom does not rely significantly on associated gas, its gas shut-in process has not impacted Russia’s oil production.

7. Why are our winter gas price forecasts so much lower than summer?

Although we are used to thinking of natural gas prices as being higher in winter than in summer, as that’s when demand is highest, we believe the current tightness in European gas balances flips that around. Without a recovery in Russian gas flows to Europe, the region’s blackout and heating risks in winter are potentially so high that we expect markets (and governments) to act now, in summer, to fix the problem. In particular, our 171 EUR/MWh TTF price forecast for 3Q22 under a 40% NS1 flow rate scenario solves for end-summer storage at 90% full. And the more work (i.e., storage building) is done in summer, the lower the work for prices to do in winter. This is especially the case in 1Q, because winter weather uncertainty drops significantly in the second half of winter vs the first half, taking our spot gas price forecasts then below 80 EUR. That said, this lower price would ultimately be driven higher once again during summer 2023 in our view, as price-driven demand destruction would likely be top of mind once more in the absence of normalized Russian gas flows.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I’m retired from 28 years of working in a natural gas transmission pipeline control room. For quite a while now, standard practice has been to send the turbines in to the manufacturer after a set number of run hours, rather than wait for something to break. As Russia is doing, this was always scheduled for summer when demand is lowest. And no, we never kept spares in some warehouse; the price on these things would make your eyes water.

I get a kick when I read that Russia is trying to pull something shady. They might be, Iwouldn’t know, but their pipeline operation is boringly normal.

Think poot’n NOT part-n-parcel? 😂

Totally!

His 40-year-spanning scheme is to become dicktator of the world, when he’s 90.

Anybody with three dead brain cells can see that.

Putin is keeping up the cash flow and strengthening the Ruble at the same time. This ain’t no fool and he is advised by some wise people, unlike Mr. Poopy Pants and his freak show band of advisers.

…unlike Uncle Stasi-Sam and its jackbooted minions…FIFY

Meanwhile….

Russian Military Given Formal Order To Target Ukraine’s Long-Range Weapons From US

Russia’s defense ministry has issued a formal order for Russian troops to target Ukraine’s long-range weapons and artillery supplied by the West, specifically the High Mobility Artillery Rocket System (HIMARS) provided by the United States.

In Defense Minister Sergey Shoigu publishing the order on Monday, the Kremlin is sending one of the most provocative messages to Washington thus far in the war, signaling the two powers continue stumbling toward direct confrontation.

“Army General Sergey Shoigu… instructed the commander to use surgical strikes and crush the enemy’s long-range missile and artillery means,” the Russian Defense Ministry said according to TASS.

https://www.zerohedge.com/military/russia-issues-formal-order-military-target-ukraines-long-range-weapons-us

HIMARS getting all blowed up is what we want!

You see …. those HIMARS cost $12 million each.

The more that get destroyed ….. the richer the USA!USA!USA! MIC becomes. And if you are a lowly factory worker at HIMARS, INC. … you too will make a ton of OVERTIME $$$! …. which the fatfuk worker will spend on Big Macs —— so this is a WIN for the entire USA!USA!USA! economy.

Putin could clean up in the stock markets through front companies. Announce your stopping gas flows and buy the dip. Following week change your mind and announce restoring gas flows, sell, take the profits. Rinse and repeat every 2 weeks. Genius

The Pelosis are probably all over that.