Guest Post by David Stockman

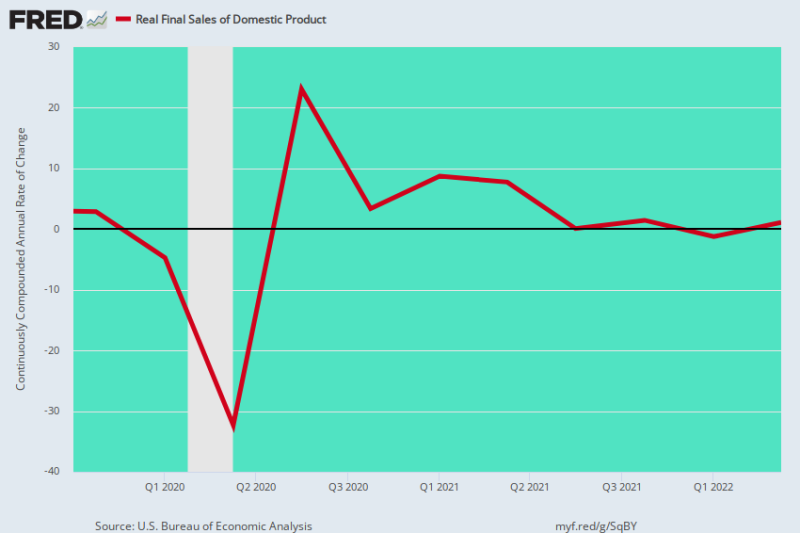

Yes, we have some stagflation. Subsequent to the pre-Covid peak in Q4 2019, real final sales of domestic product have slowed to a crawl, rising by just 0.73% per annum during the last 2.5 years.

We much prefer this measure over real GDP because it removes the abrupt inventory swings from quarter to quarter, which can have out-sized impacts on the headline number. Thus, during the first two quarters of 2022 the reported back-to-back real GDP contraction was owing to inventory liquidation, not an actual shrinkage of current activity.

As it happens, however, inventory swings cut both ways—so the chart below removes this statistical noise and gets to the underlying trend of production, income and spending.

What has happened, therefore, is that despite upwards of $11 trillion of monetary and fiscal stimmies since Q4 2019, the US economy has lurched along a path to essentially nowhere.

The original Lockdown-induced 32% annualized plunge in Q2 2020 was followed by a 23% annualized rebound in Q3 2020 and then a return to the pre-Covid starting point by Q1/Q2 2021. Thereafter, however, this aggregate indicator of current economic activity has essentially oscillated along the flat line.

Annualized Rate of Change, Real Final Sales Of Domestic Product:

- Q3 2021: +0.09%;

- Q4 2021: +1.45%;

- Q1 2022: -1.24%;

- Q2 2022: +1.08%;

The past four quarters would obviously be nothing to write home about, even under normal circumstances. But these limpid results actually happened on the heels of the most aggressive stimulus in recorded history; and also during a period in which the rising level of inflation was just getting up a head of steam.

This means that as the Washington stimulus fades and main street inflation surges in the months ahead, the US economy will be clobbered by the worst of both worlds. Accordingly, there is every reason to expect that the red line in the chart below will soon drop will into negative territory for several quarters to come.

Y/Y Change In Real Final Sales Of Domestic Product, Q4 2019 to Q2 2022

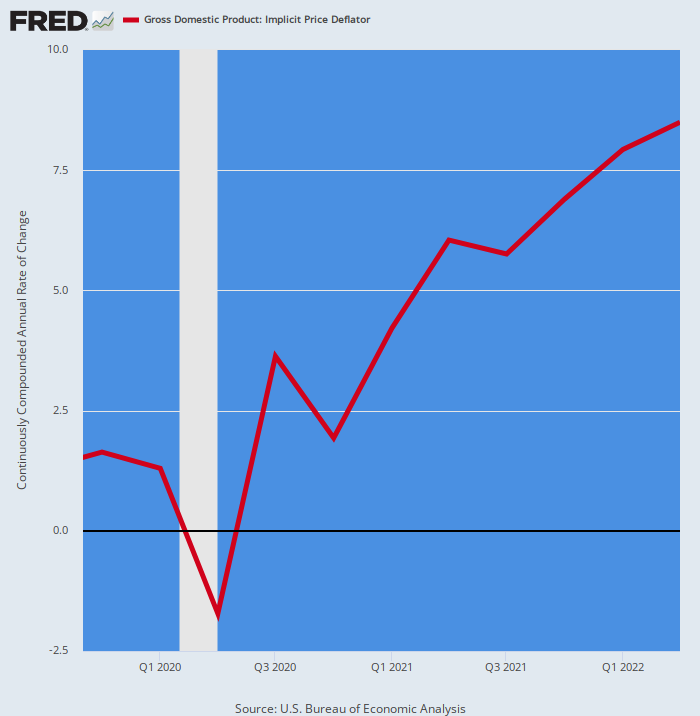

For want of doubt, here is the annualized rate of GDP deflator change for the same 2.5 year period. Self-evidently, it has moved aggressively higher, the very opposite of the flagging rate of gain in real final sales.

Annualized Rate of Change In GDP Deflator:

- Q4 2020: +1.93%;

- Q1 2021: +4.22%;

- Q2 2021: 6.04%;

- Q3 2021: +5.75%;

- Q4 2021: +6.90%;

- Q1 2022: +7.93%;

- Q2 2022: +8.50%;

The above depicted inflation-ramp is surely one for the record books. In fact, the last time the GDP deflator exceeded 8.50% was 42 years ago in Q4 1980.

It’s the reason why the real economy is faltering and stagflation has become embedded: To wit, the gains in nominal income are being more than eaten up by soaring prices, paving the way for the worst bout of high inflation and falling real growth since the 1970s.

Needless to say, that condition leaves the Fed high and dry. After years of its 2.00% inflation mantra as the be all and end all of macroeconomic stability and prosperity, it will have no choice except to keep pushing up interest rates to combat 6-9% inflation—until faltering output growth eventually collapses into a deep recession.

Y/Y Change In GDP Deflator, Q4 2019 to Q2 2022

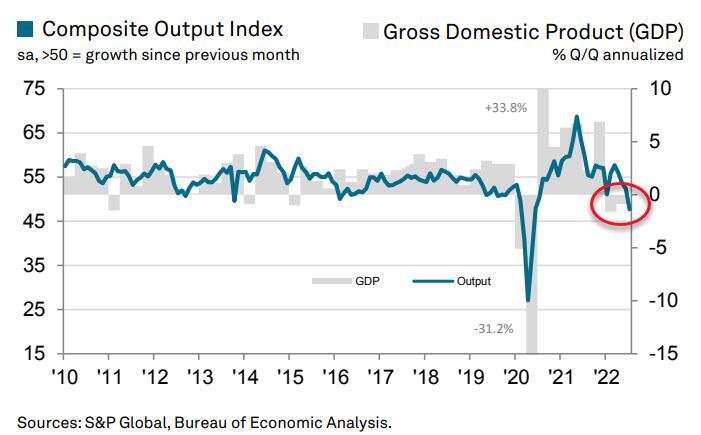

Today’s data dump, in fact, was a warning signal that the US economy may go down for the count as soon as Q3. That’s because the S&P Global US Composite PMI Output Index posted at an abysmal 47.7 in July.

The July reading was down from 52.3 in June and signals a renewed contraction in private sector business activity. As shown in the chart, GDP ordinarily follows the composite output index with a small lag.

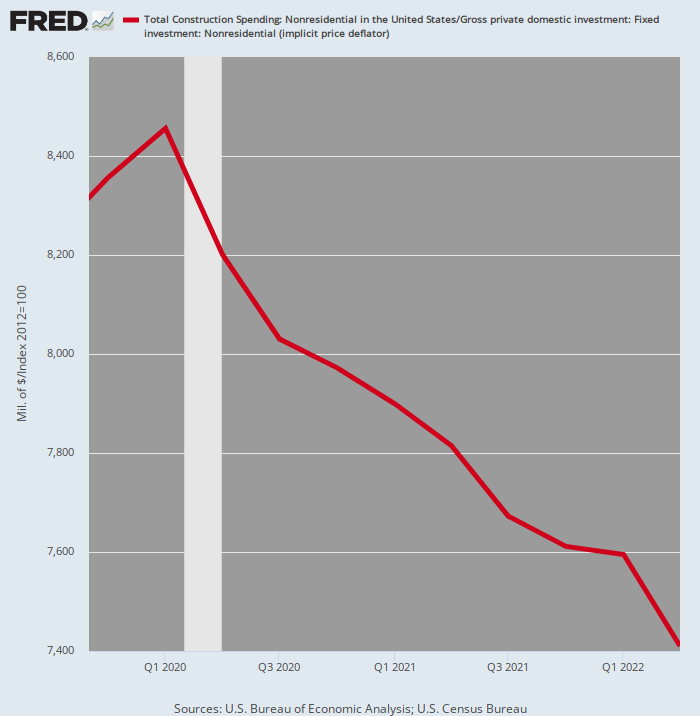

There is plenty of evidence, in fact, that large sections of the private sector are already heading south. For instance, inflation-adjust nonresidential construction spending during Q2 2022 was down 12.4% from the Q1 2020 peak.

With inflation soaring we see no reason to expect that real investment in the commercial, office, retail and industrial construction space is likely to reverse higher in the quarters just ahead.

Inflation-Adjusted Construction Spending, Private Nonresidential, Q4 2019-Q2 2022

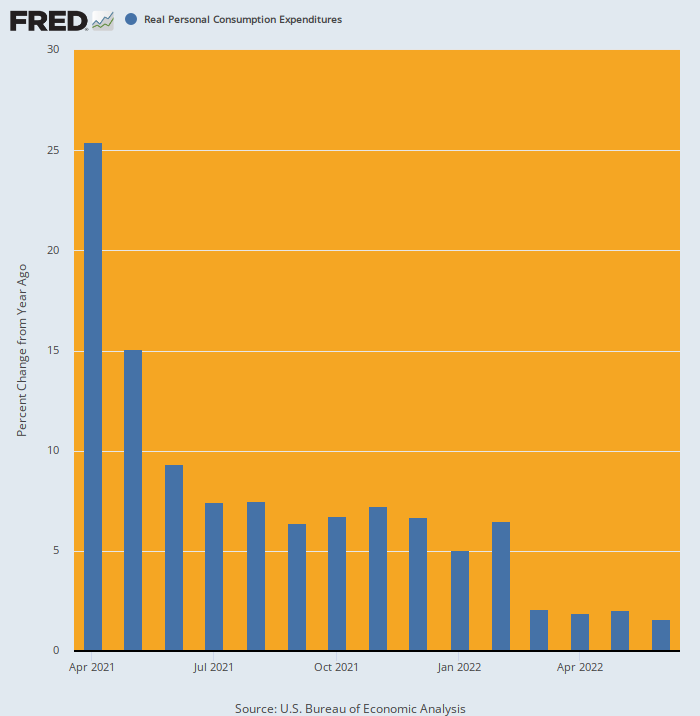

We also don’t see any reason for the vaunted consumer to rebound, either. In fact, from the time that real PCE shot the moon in April 2021 owing to Joe Biden’s $1.9 trillion stimmy, household spending has been marching downhill at a relentless clip.

After growing at 5.0% Y/Y in early 2022, the June figure came in at just 1.5%, continuing a steadily weakening trend. And what lies ahead is higher inflation and possibly Joe Biden’s tax increases—the opposite of the artificial stimmy-boosted spending shown in the earlier period of the chart below.

Y/Y Change In Real PCE, April 2021 to June 2022

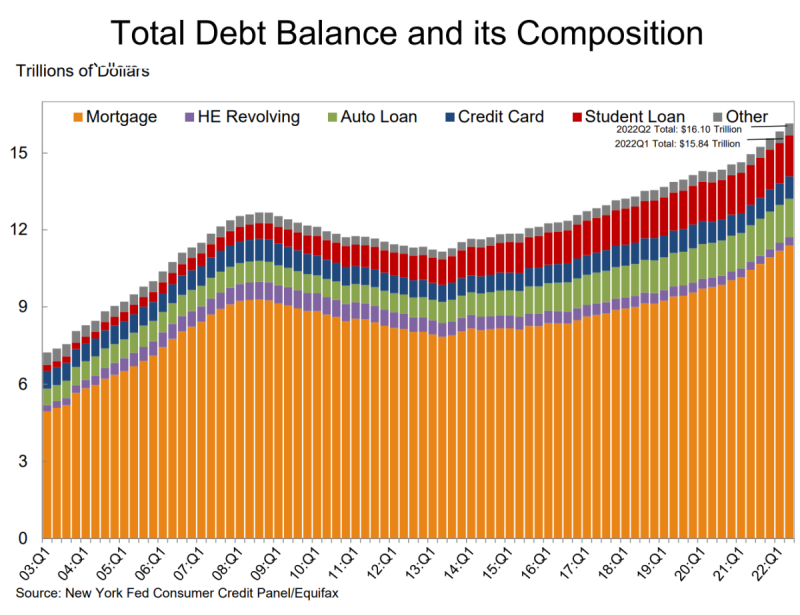

Finally, today’s Fed report on consumer debt provides just one more nail in the coffin. It showed that total household debt rose $312 billion during the second quarter to reach a record $16.15 trillion.

- Mortgage balances—the largest component of household debt—climbed $207 billion and stood at $11.39 trillion as of June 30.

- Credit card balances had a $46 billion increase since the first quarter. The 13% year-over-year increase marked the largest in more than 20 years.

- Aggregate limits on cards marked their largest increase in over ten years.

- And auto loan balances increased by $33 billion in the second quarter, continuing the upward trajectory that has been in place since 2011.

So, yes, consumer spending is just barely in positive territory in real terms, but that’s entirely due to continued increases in household debt. It is only a matter of time, however, until rising interest rates shut-off that avenue of expansion as well.

The crazy thing, of course, is that Wall Street now thinks that the Fed’s tightening phase will be over by December and that the battle against inflation has been won, thereby enabling a new round of rate cutting and soaring stock prices.

Dream on!

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I’ll tell you what stagflation looks like – 1974 version.

It looks like you have to wear your plaid Tough Skins another year even though you had a 4 inch growing spurt because your dad got laid off and can’t find another job. Your mom irons patches inside the knees of your pants to cover up the holes and the patches incessantly scratch your knees and your pants are so tight and high water that every day the kids whose parents are still working make fun of you and each week you inevitably get in a fight and sent to the principal’s office. And like the week before, all the principal cares about are the rules and he sends you home with another note about what a bad kid you are but you still don’t dare tell your parents that the kids make fun of your pants or your dad will yell at you again about how he thinks that you think that what he provides for you isn’t good enough so he takes off his belt and starts hitting you with it.

That’s what stagflation looks like.

Yes, you captured it. I remember some of those memories. I did hate those patches that scratched my knees. Yep.

And you enjoy a good ketchup sandwich when you get a loaf of bread.

You had ketchup?

Packets of it from the foster freeze. Hot sauce packets were a good snack as well. Always ordered soup when I got to go to Dennys because they gave a big basket of crackers.

More like Hamburger Helper 3 nights a week. The 1970s stagflation gave birth to such wonders as Hamburger Helper and baloney sandwiches for dinner.

Q3 2021: +0.09%;

Q4 2021: +1.45%;

Q1 2022: -1.24%;

Q2 2022: +1.08%;

Wa? I was told we had 2 consecutive quarters of negative growth.

These numbers are not GDP. GDP was negative for 2 quarters.

If you account for the REAL rate of inflation, we have been in a recession since 2000.

Auntie very much appreciates Mr. Stockman’s crunching the numbers, bringing the clear to read charts, and providing some expert insight into the economic-financial clusterfuck that is late-stage hyper-finance Crony Capitalism.

No shortage of fuel, irrespective of any inflation, for Wall St, Hollyweird, and WEPH types and their private jets plus 40-meter yachts parked in B.V.I. and other palm fringed island archipelagoes. Inflation? That’s for the little people.

And the only archipelagoes forthcoming to the Lumpenproletariat will be of the gulag type.

Enjoy.

Bob Moriarty, 321 Gold site owner. Hour-long interview on the beginning, NOW, of the worldwide revolution.

A quite smart guy that I have been acquainted with for years. Mensa society member.