Guest Post by Nick Giambruno

FTX—one of the world’s largest cryptocurrency exchanges—recently went bankrupt.

Many billions of dollars in value evaporated in minutes as this unsound institution collapsed.

It has created a genuine “blood in the streets” moment, weighing heavily on the Bitcoin price.

Bitcoiner Matt Odell summed it up best:

“This is a story of fiat incentives, shitcoin games, regulatory corruption, and counterparty risk that ended in inevitable disaster. It will serve as an expensive reminder that bitcoin held in self custody is unique in its lack of counterparty risk. You can easily and cheaply store it yourself and send it around the world without trusting anyone or asking for permission. Learn how to hold bitcoin yourself and use it in a sovereign way.”

It deserves emphasis that FTX, and other companies like it, are not at all the same thing as Bitcoin—an emerging global money that nobody can inflate or control and is accessible to anyone.

For example, suppose there was an unscrupulous gold storage company that went insolvent. That wouldn’t mean gold is faulty.

The collapse of FTX will undoubtedly be a drag on the Bitcoin price in the short term. But on the bright side, it will help cleanse the industry of bad actors and offer some crucial lessons.

I don’t expect the FTX meltdown to have a lasting negative effect on Bitcoin.

Bitcoin has gone through several more explosive incidents in the past and come out stronger than ever (see Mt. Gox’s bankruptcy in 2014, for example).

However, I expect Bitcoin to remain volatile—as it has always been since its inception.

Something doesn’t go from having no value to being significant global money without volatility.

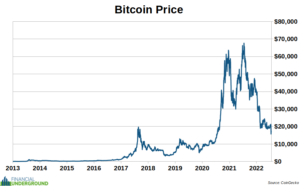

For example, Bitcoin went from having no value in 2009 to $69,000 in November 2021 to around $17,000 today, down more than 75% from its previous peak.

It’s essential to keep in mind recent volatility is par for the course.

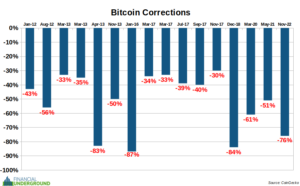

It is common for Bitcoin to have significant corrections of 50% or more, which has happened eight times. Further, there have been three occasions where Bitcoin has declined by 80% or more.

If you zoom out and look at the Big Picture, Bitcoin’s volatility has mainly been to the upside over the long term.

Suppose you went back four years ago and told someone that Bitcoin “crashed” to $16,000. It would have been so unbelievable that you would probably be laughed out of the room.

Bitcoin keeps bouncing back stronger than ever because of the fundamentals underlying this megatrend. It’s all about a new and superior form of money in the earliest stages of adoption.

The monetization of a new global money is unlike anything anyone alive has ever seen. It doesn’t happen overnight, and it’s inherently a volatile process.

As adoption grows and Bitcoin becomes more established as money, the volatility should smooth out—but probably at a much higher price. That’s why you want to buy Bitcoin—and the best Bitcoin mining stocks (more on that below)—before the rest of the world figures out its superior monetary properties, namely its total resistance to inflation of its supply.

It will be a wild ride—like a violent roller coaster—but I believe it will reward patient investors.

Stomaching Bitcoin’s volatility is the price we must pay to earn outsized gains as it undergoes the process of monetization.

Here’s the bottom line.

Investors will have to deal with Bitcoin’s volatility for the foreseeable future.

Instead of anxiously watching price charts daily, I suggest focusing on the Big Picture and the fundamentals of the underlying trend.

The key is understanding the disruption before most others do, investing early, and having small enough position sizes to ride the megatrend without worrying about volatility whipsawing you out at the worst possible time.

Whenever you see volatility in the Bitcoin price, ask yourself two things:

1) Does Bitcoin still have superior monetary properties (total resistance to inflation of its supply)?

2) Is Bitcoin still unstoppable?

If the answer to those two questions is “Yes,” I would not be too worried.

With that in mind, let’s look closely at three crucial strategies that can help tame Bitcoin’s wild volatility.

Strategy #1: Dollar Cost Average (DCA)

The best way to buy Bitcoin is to avoid buying it in one large lump purchase.

Instead, given Bitcoin’s volatility, a long-term dollar cost averaging (DCA) approach is optimal.

For example, suppose you’d like to invest $10,000 into Bitcoin. Instead of buying $10,000 at once, make a purchase of around $192 each week for a year.

DCA significantly reduces the risk of buying too much at the top of a cycle and not buying at the bottom.

That’s how DCA can turn Bitcoin’s volatility in your favor.

Swan Bitcoin offers a convenient platform that automates DCA purchases for you—including withdrawals to your own wallet, which is essential to eliminate counterparty risk. I’ve personally used it and found their service useful.

More details can be found at the link above, including a helpful calculator that displays how a DCA strategy performed in the past and a $10 bonus of free Bitcoin for signing up with this link.

Strategy #2: Don’t Let Someone Else Hold Your Bitcoin

Bitcoin is a digital bearer instrument. A bearer instrument gives whoever has it in their possession ownership of it.

If you hold your Bitcoin on Coinbase or some other platform, you don’t really own your Bitcoin and are taking on significant counterparty risk. Instead, you own a Bitcoin IOU, which is something very different—as FTX clients are finding out right now.

It’s much more secure to hold your Bitcoin off the exchange’s website in your own self-custodial wallet, where you control the private keys.

For beginners, start with the Muun Wallet or the Blockstream Green Wallet for your phone. Both are excellent choices and are among the easiest to use. BlueWallet is a good choice for intermediate users on mobile phones. Finally, Electrum and Sparrow Wallet are great options for laptops and desktops—which are often more secure than a mobile phone.

Whichever self-custody wallet you use, ALWAYS ensure that you have properly backed up your wallet. Each wallet is different and will give you instructions on doing the backup. That way, you won’t lose your funds if you lose your phone or laptop.

It is crucial to take this step when setting up your self-custody wallet because this is the ONLY way to recover your funds if something happens to your device. Bitcoin has no customer service department.

Strategy #3: Have a Four-Year Time Horizon

Plan on holding Bitcoin for at least four years—through one halving cycle.

According to its fixed protocol, we know precisely how Bitcoin’s supply will grow in the future. A key feature is that the new supply gets cut in half every four years, a process known as the halving.

There has rarely been a period when the Bitcoin price was lower than it was four years ago. When it occurred, they were fantastic buying opportunities. But, of course, past performance does not indicate future results.

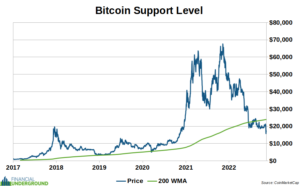

The 200-Week Moving Average (200 WMA) is a helpful metric, as it contains nearly four years of price data—around the length of a halving cycle. Historically, the 200 WMA has been a good indication of the Bitcoin price’s floor.

As we can see in the chart above, now is one of those rare times when the Bitcoin price is trading below its 200 WMA.

However, the opportunity could be gone soon.

Historically, Bitcoin’s biggest moves to the upside happen very quickly… especially amid a financial crisis.

With multiple crises unfolding right now, the next big move could happen imminently.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I’m sorry, but if people still believe cryptocurrency is a good idea, given recent events, they deserve to get what they get — scammed.

Not that fiat money is any realer, but at least it is tangible, and not subject to electrical outages or cyber attacks. Bitcoin is a nice fad, but too susceptible for bankster interference. Transparency is also an issue; who runs Bitcoin? Who started it (because evidently Satoshi Nakamoto is as shady as the currency)?

Who holds the chain of which block-chain traders are buying?

There are just far too many unknowns with cryptos.

Some people think Bitcoin is worth something, some people think we sent men who landed on the moon……coinky-dink…..I think not.

checking my dogecoin

“Ppplleeeeeeeeeeaaase keep buying bitcoin”

Crypto Contagion Is Spreading, Fast

The fallout from the collapse of FTX just won’t stop—and now it’s threatening one of crypto’s most important institutions. On November 16, Genesis Global Capital’s lending unit suspended withdrawals due to “unprecedented market turmoil.” Now, the firm is seeking emergency funding of at least $500 million to ensure it has enough cash on hand to pay its customers. All the while, the crypto industry watches nervously…

The impact from the potential fall of Genesis should not be underestimated. It might not be as well known as FTX and other exchanges, but it’s crucial to the day-to-day operations of the crypto world.

https://www.wired.com/story/ftx-collapse-genesis-crypto/

“Don’t Let Someone Else Hold Your Bitcoin”

thats the dumbest statement I ever heard, as the computer holds it,lol

maybe I can get one shipped to my home, so I can hold it

There is not much dumber than someone calling something they clearly don’t understand “dumb”.

Whenever you see a Tulipcoin pimping article, ask yourself two things:

1) What is the supposed “total resistance to inflation of its supply” based on?

A hard physical limit? No. A mathematical limit? Well, kind of…

2) But who set the ‘limit’ rules?

Mathematics, just as it “limits” the prime numbers by making it exponentially harder to find more?

No, the limit was set by arbitrary human decision (i.e. the completely arbitrary rule when a newly mined tulipcoin is valid), and as such it can be arbitrarily changed some day.

Maybe it cannot be changed by a single person, but at the very least it can be changed by the quantitative majority of miners – or you get a fork, also not by definition impossible.

That’s not

total resistance; the term is just marketing bullshit.Crack is a hell of a drug…

Better still are the idiots that believe cryptocurrencies are “anonymous”. HA!!! The distributed ledger known as the blockchain logs every transaction. Distributed means that it’s not stored in a single location, but it resides in many duplicate pieces all over the place.

It absolutely amazes me that people hear about law enforcement tracking down and confiscating crypto, and yet still believe that “their” transactions are secret. Yes, some bad guys are very sophisticated and manage to pull of transfers that are untraceable. What do you want to bet that 99.99% of those “invested” in crypto have traceability to a bank or trading account that they provided their SSN number for. Tell me how to purchase crypto with cash and no ID (not that I would ever do it). A fool and his money are soon separated.