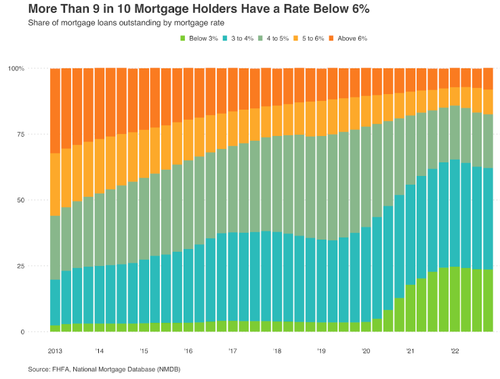

A recent Redfin analysis revealed that 92% of homeowners with mortgages have rates significantly lower than the current weekly 30-year fixed mortgage rate of 7.16%. Specifically, 92% have rates under 6%, 82% are beneath 5%, 62% are under 4%, and 24% are below 3%. This has led to many homeowners feeling trapped by their mortgage rates nationwide.

The reluctance of many homeowners to sell their homes has exacerbated the inventory shortage, which has only propped up home prices. No homeowner in their right mind would give up a sub 3% 30-year fixed mortgage rate for the current market rate. People just don’t want to pay more interest after an inflation storm wrecked household finances for the last two years under ‘Bidenomics.’

Millions of Americans are sitting on very cheap mortgages, trapped in their homes in this high-rate environment. For them, moving is no longer an option.

A new study from MoneyGeek found homeowners in the southern part of the US feel the most trapped. In four cities, Gainesville, Georgia; Atlanta-Sandy Springs-Alpharetta, Georgia; Ocean City, New Jersey; and San Diego-Chula Vista-Carlsbad, California, homeowners were the most trapped.

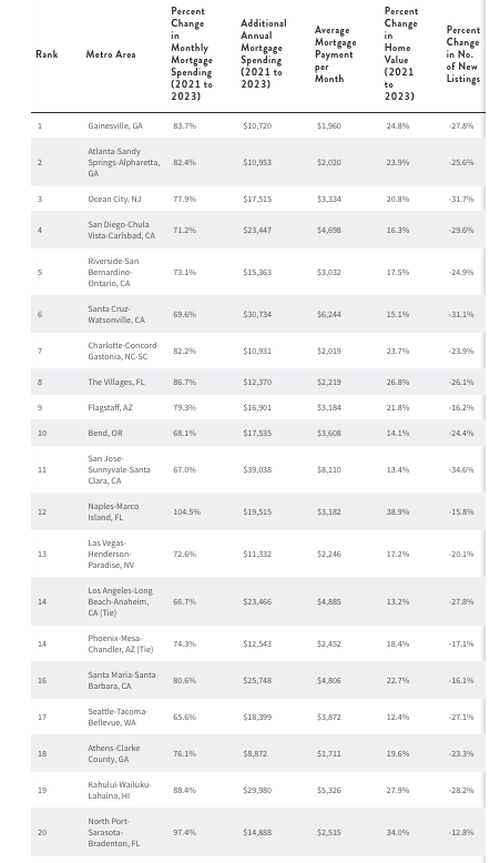

MoneyGeek researchers analyzed data for 312 metro areas across home values, historic mortgage rates, and housing supply and demand trends. To determine cities with the most trapped homeowners, average mortgage spending had to increase while the housing supply deceased.

Most trapped homeowners were in the southern part of the country:

- Gainesville and Atlanta, Georgia, rank as the No. 1 and No. 2 metro areas where homeowners are most trapped in their mortgages. Homeowners looking to buy would face increases of more than 82% in annual mortgage spending. Further south, in the Naples-Marco Island area of Florida, mortgage costs have more than doubled since 2021.

In the Northeast, the report found Ocean City, New Jersey, had the most:

- National housing trends reveal a tightening grip on supply and demand. In the Northeast, Ocean City, New Jersey, is seeing a 31.7% plunge in housing supply, while Austin, Texas, grapples with a 56.5% surge in listing-to-close time, signaling a dip in demand.

Southern California also made the top of the list:

- San Jose, California, has the highest average mortgage payment, which surged by 67% to $8,110 per month between 2021 and 2023, posing a challenge for budget-conscious homeowners. To manage this cost without exceeding 28% of income, prospective homebuyers would need an annual income exceeding $420,000.

Best and Worst Areas for Homeowners Trapped in Mortgages

Here are the top 20 cities where homeowners feel the most trapped:

In April, we outlined this powerful dynamic in a note titled “Owners Trapped By Low-Rate Mortgages, Buyers Thwarted By High-Rate Mortgages.”

Dampened affordability means homebuyers and homeowners are paralyzed. Jacob Channel, senior economist at LendingTree, recently called this environment: “In many ways, we’re in uncharted territory right now.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

We’re at 2.5%. Not moving… Chip

Why is this a problem?

Many years ago, had a job opportunity 5 hours away requiring a relocation to a slightly higher cost of living atea. The salary increase vs the added living cost had a break even after 5 years. I did not take the job for a different reason, but it made me realize how expensive moving and sell / buying a house is.

Turns out I accidentally made a good decision, 2 years later they shut down the location, laid off most of the people, fired the ceo. Another lesson in changing jobs.

2.625% here….and I don’t feel trapped at all. I have a nice place with land, surrounded by farms, a 1200 sq ft. shop and a pool….wouldn’t leave anyway.

Not all orcs are trapped…reeee

Yup, I’m trapped paying 0%. Fuck the banks. Never again

Payed off my mortgage with pandemic $$$

And now, you just owe the annual “rent” to the city/county/state.

Or……,buy in unincorporated township,sure,no homeowners insurance but also no inspectors/taxes.

But James,also no police,hmmmm…..,living in no where the cops are at best a half hour away/dogs/guns ect. the police dept.,my friends 5 year old can do a body outline in chalk if needed,i.e.,do not need cops.

But James,no fire dept,again……,so far away your place is cooked(literally)by the time they show up,one can add own fire suppression system if they choose to.

I am at this point seriously looking into this as perhaps the place to have final home,rare but still out there.

In TN, the County issues building permits, so you cannot avoid them. County also provides LEO, Fire and ambulance. Mortgage companies require insurance, if you have a mortgage. If no mortgage, then you do not have to have insurance of any kind.

You don’t have a backhoe? 😉

Yeah, I know a guy who bought a new Bentley and a new yacht with PPP money, actually two guys.

Was it PPP that paid for your house?

Most people do, regardless if they’re up to their eyeballs in mortgage. Dying is a good way to end that.

and there is a 100% chance your body will die.

Amen to that. The only way now is to tax me to death.

Paid cash for ours. Paid the other one that we left off. Not completely free (me, I have a small loan in spite of our decent nest egg). But I’m retired with a good private pension and social insecurity. So no complaints. Not the state I’d personally choose to live but it’s still a great place, here.

People used to buy a home and live there till the kids at least had flown the coop . Now people change houses like underwear.

Perhaps I missed it, but the article never explains how the “study” decided people were feeling trapped. It looks as though they: 1) did a factual look at mortgage interest rates; 2) surmised (reasonably) that people with such low rates would be deterred from selling because they would get a new mortgage at a much higher rate; and then 3) made up out of whole cloth the idea that all of these folks were “trapped”. Here is another possibility: the folks with a mortgage like mine (2.5%) are thankful and blessed to have such a low rate in a place they love. The entire premise of the article is built on a supposition unsupported by evidence.

It’s more likely the real estate agents are trapped in their professions with dwindling commissions.

Not just the RE agents but the whole grift chain in housing…..including bamks.

In the early 80’s the housing market in Oklahoma tanked and Real Estate Agents raised their commissions from 4% to 6% to help offset the lack of sales. That is one of the reasons I despise them.

Real Estate Disaster

https://market-ticker.org/akcs-www?blog=Market-Ticker

Yup, commercial RE is already turning over. This is going to be a financial bloodbath.

Just Sayin’

Well Joe Biden says it’s the greatest economy in 50 years so what’s the problem …🤪

He has never made more. It is a lot more lucrative selling influence as potus than as veep.

We have a daughter in the mortgage business and each month she has been assigned to cut staff in her region. Her biggest fear is that soon, there will be no staff left, so no need for a regional office.

Well Joe Biden says it’s the greatest economy in 50 years so what’s the problem …🤪

[img [/img]

[/img]

These people need to stay exactly where they are and stop playing real estate roulette. The longer people stay in their mortgages the more likely they’re going to be invested in their communities and fix their own problems. Tired of these people ruining the cities with Democrat policies and then fleeing like locusts when it’s time to reap what they sowed. People being “trapped” in their mortgages is the quickest way to kill off bad policy.

Refinanced to a 15-year @ 2.875 back in 2020. Not going anywhere. Not sure if it really matters much if SHTF.

I’m at zero ’cause I never had a mortgage, or any debt for that matter. But the wife and I do own a home worth a little more than the national average. Guerrilla Economics for the win.

This is just another of the ‘backwards’ economic things going on:

As rates rise, home PRICES should decline but they are still going UP! go figure

Stocks went UP as rates went DOWN, now, stocks are going UP as rates rise! go figure

Debt increased as rates went DOWN, now debt increasing more as rates go UP! go figure

“Cats and dogs living together. Mass hysteria!!”

Good point, just goes to reinforce that all the smart people / economists are full of BS

Wait until house prices begin to fall, and they will because buyers cannot afford the current combination of ridiculously-high prices and high rates.

The so-called “trapped” owners will begin to panic sell because most of their net worth is tied up in their house, which they don’t want to lose. They will want to sell while prices are still “reasonably” high, and they will list that house for sale. But buyers will not materialize, as they wait for lower prices, and the free fall in prices will roll.

What would you do as a homeowner, if you thought prices would experience a major decline in the next year or two? For a glimpse into the future, look at what is happening right now in China.

Yes, China is dying right before our eyes. In a few years, they’ll definitely have to sell off the entire country. And then here in the USA, people will be “panic selling” their houses, except nobody will be buying them, because … well, some reason or other. And the people wanting to sell their houses because they need to … uh … well they’ll want to sell so bad that they’ll keep lowering the prices, because … uh … well, nobody will be buying anything anyway because they’ll all be waiting on the sidelines for houses and cars to get cheaper, which they will, because everybody will be “panic-selling” and then using the money to … uh … buy a house and/or car at a cheaper rate, I guess.

Not to worry, a DEW will come along any day and they won’t have to worry about their house, their car(s). their dogs or most anything else.

I am fond of my 0% mortgage but will still move as soon as possible to get out of a purple state turning blue.

My first house 1984 18% interest

They told me it was a bargain

I have never listened to a banker since.

TPTB cleared out #19 on the list.