By Benjamin Picton, Senior Macro Strategist at Rabobank

Here Be Dragons

I’ve been away on holiday for the last two weeks trying my best to pay more attention to my children than I do to the markets. Mission accomplished for the most part, but it has been hard to look away while momentous shifts seem to be occurring all around us. Indeed, at the Jackson Hole symposium over the weekend, ECB President Lagarde re-upped her comments from April by suggesting that “there are plausible scenarios where we could see a fundamental change in the nature of economic interactions”, “past regularities may no longer be a good guide for how the economy works” and “there is no pre-existing playbook for the situation we are facing.” Translation: “we really don’t know if rates are high enough or not, and that isn’t really the point anyway.”

So, according the second most senior central banker in the world we’re in uncharted waters, and as anyone who has ever taken an interest in the Age of Discovery will know, once you reach the edge of the known world, here be dragons.

The most obvious dragon is of course China, and its surrogates, which are making new attempts at formalizing challenger status to the G7 via the BRICS bloc. Michael Every notes:

The BRICS just expanded to allow in Argentina, Ethiopia, Egypt, Saudi Arabia, the UAE, and Iran, so with much hullabaloo we can colour in more countries, GDPs and commodities (like oil) as ‘anti-dollar’. However, Argentina is a serial defaulter with a plummeting currency, and may dollarize soon; Ethiopia is one of the world’s poorest countries, and recently brushed with civil war; Egypt has a wilting currency; Saudi Arabia and the UAE have their currencies pegged to the US dollar, and the former is haggling over a US defence deal and nuclear tech; and Iran is heavily sanctioned, again with a collapsing currency, and could be daggers drawn again with Saudi at any time. In short, the world is changing, but as the FT has pointed out, the BRICS+ (a name created by Goldman Sachs) don’t even have an official website. Meanwhile, it was the Euro, not the dollar, that saw its share of SWIFT transactions collapse to a record low in the latest data. You want to look at potential early victims of any global tectonic shifts? Look there.

This reads as a very ragtag group, with “relationships” built mainly around a common outsider status and no small dose of opportunism in seizing a perceived first-mover advantage in undermining dollar hegemony. We remain sceptical. As we’ve covered in this publication many times, the idea of commodity standard like some kind of petro-Yuan is laden with problems.

The auspices aren’t great for the new alternative multilateralism. The putative centre of the BRICS+ bloc, China, is struggling to revive its flagging growth engine while economic remedies that are taken as orthodox in the West are shunned for their perceived incompatibility with Xi Xinping thought. Markets have been waiting for months for signs of big-bang stimulus from the CCP or the PBOC, but as the WSJ reports, maybe it just ain’t coming. Chinese perceptions that Western consumerism is flabby, decadent and morally obtuse stands at odds with the need for China to fulfil the role of deficit-runner in order to get enough Yuan into the hands of the periphery. How can Argentina, Brazil, Iran and Egypt buy virtuous Chinese manufactures if they don’t have any Yuan? The answer here is that trade will continue to be conducted in dollars, one way or another.

China clearly has little appetite for further credit expansion either. The CCP has made several attempts over the years to rein-in debt levels, all of which have ultimately been abandoned in the face of a stalling economy. For the time being, Xi Xinping is resisting large-scale easing of credit conditions, urging “patience” while the economy passes through what policy-makers hope is a temporary soft patch, rather than the start of a Japan-style stagnation brought on by decades of malinvestment and speculative pump-priming of real estate assets.

The real question now is how strong the CCP and the PBOCs resolve to address burgeoning debt-levels will be in the face of economic slowdown. For an authoritarian regime whose legitimacy is built on the delivery of rapidly rising living standards, slow growth poses a potentially existential risk. The obvious retort here is that authoritarian states have no need to court popular opinion, but the speed at which the Covid-Zero policy was ultimately abandoned in the face of civil discontent should serve as an indication that the CCP is ultimately still sensitive to what the population thinks.

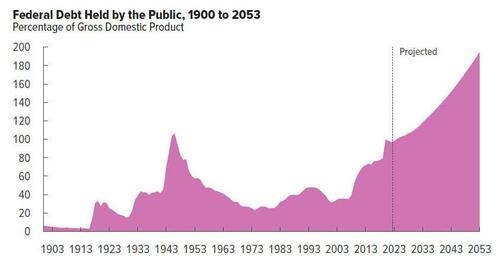

Looking back to Jackson Hole it’s fair to say that debt and popular discontent aren’t a uniquely Chinese problem. During the meeting of rich men north of Richmond (Jackson Hole is north of Richmond, I checked) a paper presented by Barry Eichengreen and Serkan Arslanap broke the bad news that “public debts will not decline significantly for the foreseeable future”, “primary surpluses of… 3 to 5 percent of GDP are very much exceptions to the rule” and that “inflation is not a sustainable route to reducing high public debts.” That all makes for sobering reading for already beleaguered millennials and Gen Z’s, who will be the can carriers for Eichengreen and Arslanap’s prognosis that “given ageing populations, governments will have to find additional finance for healthcare and pensions”.

What seems to be missing here is a dose of Huw Pill cod liver oil, whereby the West confronts the idea that we’re not as rich as we used to be, and that deteriorating demographics and higher spends on national security might necessitate a lowering of ambitions around what is possible in welfare economics. There are signs that the message is starting to get through. BOJ Governor Ueda nodded to the plight of the West when he suggested that the relocation of supply chains will result in lower productivity in the future, which ultimately means lower real incomes. Meanwhile, former French Ambassador to the United States Gerard Araud, echoes Michael Every’s assessment of Europe’s diminishing importance by writing in the UK Telegraph that “deluded Europe can’t see that it is finished.”

Nobody likes bad news, but telling young people that they need to pay a higher proportion of their stagnant incomes to fund the pensions of people who are wealthier than they are ever likely to be is sure to go down like a lead balloon, especially when pop culture is already communicating the sense that a Dollar doesn’t buy what it used to, and is taxed to the hilt.

So, the plates are shifting and policy makers in the West seem to be either totally unsure of the answers, or proffering answers that are anathema to the social fabric. We’re in uncharted territory and here be dragons.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

So, … everything going to plan, then.

Yeah, right up to point that a $100- bill will not buy a Chiclets® piece of gum.

(Chiclets® was 1st sold 1912).

I was paying 8 cents for a full size candybar in 1975, now its $2.79.

And they were 3oz not <2oz

Speaking of cents. Common and otherwise. Stamps are up to $0.63. You rarely see numerical stamps anymore since most are “forever” stamps to mask the rate of inflation.

I recently received a letter that was under-stamped. My jackass friend mailed it with one of his $0.01 stamps he has been trying to pass off.

So the PO marked it Postage Due and attached a payment envelope so that I could pay the postage. Because like the IRS, “bitch better have my money”.

Who actually owes them is a matter of the slippery anarcho-tyranny of the admin state. You want mail. FU pay me.

After laughing at the absurdity of it all I filled the envelope with 62 pennies and paid one of the growing number of embedded taxes on the residual american dream.

This, in a PO that does not meter bulk mail but instead sells you stamps to affix yourself in the lobby outside the air conditioned office.. They will spend the time, however, to chase down $0.62, because they have their reasons.

Just like I have my reasons for paying. Rural mail handlers are not to be mishandled if you want your mail somewhere near your box.

Plus, I want to be on the route when Kevin Costner makes his ride in the post-apocalyptic wasteland of FUSA so I can lay my best bleacherswing across his his smug face with a sawed-off Kentucky thumper for what he has done to Montana. There is no punishment, however, that could possibly redress the damage he has done through his abominable acting. Or baseball. And that corn field.

Its the little things. They have theirs, we need to take ours.

The Central Banks plan to own it all is on track…the banks really have no idea of what they’re doing, just that it will end as planned with a destroyed western economy and you owning nothing but worthless paper. Get your money out of dollars.

And yet, just like in Roman times, in the 1800’s, early 1900’s, and in present day, a 1 oz. gold coin can be used to barter for the finest set of garments and quality footwear.

That is, it maintains its purchasing power value.

Fiat FRN’s? Not so much.

Another thing that hasn’t changed through the centuries is the risks and danger of debt slavery.

Living within one’s means is severely underrated wise advice.

Really only one way out, if studied early enough in life.

“A portion of all you earn is yours to keep.”

And what you do with that portion saved, will make you or break you.

The Richest Man in Babylon, by George S. Clason. Good reco.

that portion seems to get smaller and smaller all the time.

Liberal incel virgin tears…Mmmm! Yummy!

As an X’er, the elders have been gloating over the fact that social security will be BK long before I get mine. I never really doubted it. So, I have been downsizing and withdrawing from the system for a good while now.

Now the kids are being told that their American Dream is to become the tax cattle for the sunsetting of their elders as the whole thing burns down.

And all the egg heads wonder what happened to the labor market. Well, the ones that dare drift from the Official economic prints that is.

I have a feeling the jokes on the blue-hairs. The kids arent okay. They want no part of the Dream that doesn’t immediately gratify their own, “inflation adjusted” wants and needs in the now. The future is for suckers and the boomers want to live forever. Luckily the future is also a brown female. To the moon we go!