Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at: BOOM Finance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at: BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

TESTIMONY FROM A READER – “Boom’s finance and economics views are based on experience and wisdom, both of which are sadly lacking in today’s narrow-analysis focused commentary.”

A French historian, Alexander Dumas, described the fate of Johan and his brother Cornelius.

There is a lesson here today for all politicians, unelected bankers, unelected officials, and globalist NGOs (Non-Government Organisations) who seek and command excessive and corrupt power:

NEVER FAIL TO CONSIDER AND RESPECT THE PEOPLE… OR ELSE! “After having mangled, and torn, and completely stripped the two brothers, the mob dragged their naked and bloody bodies to an extemporised gibbet, where amateur executioners hung them up by the feet.

Then came the most dastardly scoundrels of all, who not having dared to strike the living flesh, cut the dead in pieces, and then went about the town selling small slices of the bodies of Johan and Cornelius at ten sous a piece.”

BANKMAN-FRIED GUILTY OF FRAUD AND CONSPIRACY – Yet another massive Crypto crime has been more fully revealed. On Friday in New York, Sam Bankman-Fried of FTX Crypto-exchange fame, was found guilty by a jury of two counts of fraud and five counts of conspiracy. He was accused of stealing US$8bn from his customers. His testimony in the court will go down in history as rare truth revealed.

- “We thought that we might be able to build the best product on the market”

- “It turned out basically the opposite of that.”

Over the last 14 years, since 2008, there has been a litany of Billion Dollar financial crimes in the Crypto markets. This is just the latest. Many investors have lost significant sums of money to fraudsters. But still the Crypto market persists and has a $1.3tn market capitalisation; Bitcoin has 52.4% and there are now more than two million other “Cryptos” available to buy on 671 Crypto exchanges. The madness of crowds continues 250 years after Tulip mania hit Holland.

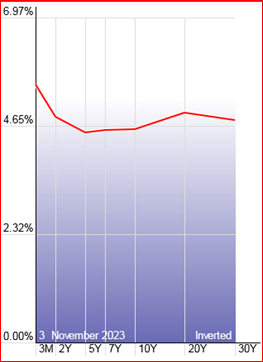

US YIELD CURVE DYNAMICS — A FLAT CURVE – OUTLOOK POSITIVE FOR US ECONOMY AND ASSET PRICES? The US Treasury Yield Curve from 3 months to 30 years is now essentially flat with a slight inversion overall. This is a much more comfortable curve than what has prevailed for the last twelve months. As a result, most well informed investors are much less anxious and willing to take on risk again. The Fed’s overnight rate is set at 5.5%.

- 1-Year Yield 5.44%.

- 5-Year Yield 4.82%.

- 10-Year Yield 4.88%.

- 20-Year Yield 5.2 %.

- 30-Year Yield 5.04 %.

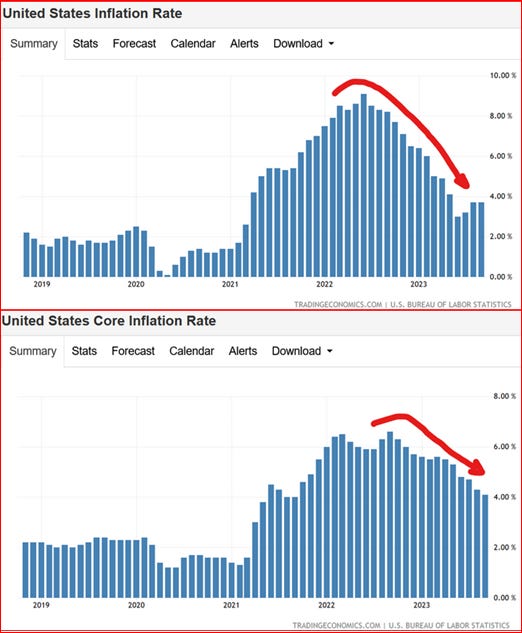

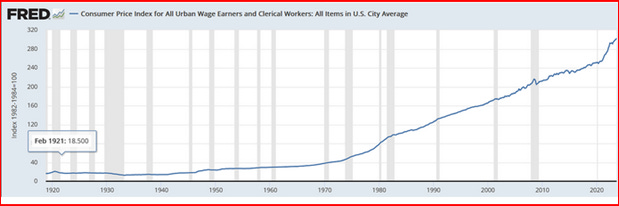

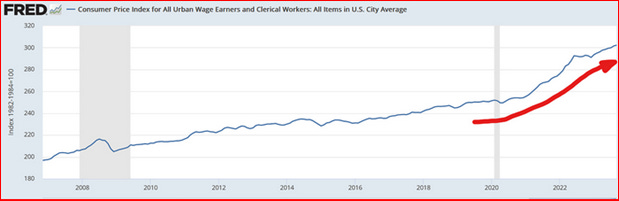

The next data points for US CPI inflation are due November 14. CPI inflation in the United States has been falling since May last year.

The formation of a clear, unambiguous bottom in Bond prices will improve investors’ confidence greatly and should create significant buyer interest in US stocks going forward.

BULL MARKETS IN US FINANCIAL ASSETS? In October 2022 BOOM forecast that we were past the Peak of CPI inflation in the US. BOOM also forecast a corresponding bottom in stock and bond prices. That forecast has proved accurate. Stock prices have risen strongly since then.

US HOME PRICES CONTINUE TO RISE. BOOM forecast in April 2023: “This suggests that US house prices may soon begin to rise in price”.

As per BOOM’s forecast in April, US annual home price growth has accelerated again. The price of homes rose for a third straight month in August according to data released by the Federal Housing Finance Agency (FHFA). Home prices rose 5.6% on a year-over-year basis in August, up from a 4.6% increase in the prior month. This is very reassuring for the US economy especially with regard to a recovery in the money supply.

PFIZER REPORTS LOSS AND CLOSES DOWN MANUFACTURING PLANTS AS COSTS MOUNT. Pfizer has reported a loss of $2.4bn for their latest quarter of operations. Sales of their Covid vaccine have collapsed with only 2-3% of Americans prepared to take their latest booster jab. The general public have woken up. Pfizer’s revenue fell by 42% and they had to report a $5.6bn write down on unused inventory. To make matters worse, there are reports of hundreds of job losses as the company attempts to save $3.5bn in costs. Two manufacturing plants are being closed in North Carolina.

Long term BOOM readers are familiar with the risks to solvency for all companies involved in manufacturing the so-called “vaccines” for Covid. The problems are compounding. It is now common knowledge that the mRNA injectables are contaminated with DNA and SV40 Promoters and don’t stop transmission of the virus. Enterotoxins have also been identified in some vials. Repeated doses may even increase the risk of becoming infected. That is called ‘negative efficacy’.

So the claims of, “95% effective” (Relative Risk Reduction) are questionable and were possibly misleading or fraudulent. ‘Absolute (Population) Risk Reduction’ for these products is in the range 0.7-1.3%. So statements of, “95% effective” without qualifications stating ‘absolute risk reduction’ numbers may be seen as deliberately designed to mislead.

Then there is the side effect profile. Experts have reported that these products have more reported adverse events in the VAERS data (Vaccine Adverse Events Reporting System) than all other previous vaccines in history combined!

BOOM has documented the precarious situation of these companies and the loss of faith from their investors as evidenced by the collapse in their share prices over the last two years. The first time BOOM warned of this was over two years ago, in June 2021. mRNA technology is now under a very dark cloud and may have no future. Legal challenges are now in their thousands and large class actions are amongst them. Large investor institutions with large financial losses mounting may soon join the party and start legal actions based upon fraudulent misrepresentation. Wall Street is stirring; billions or perhaps trillions of dollars could be at stake. No company could survive class action damages being awarded in the trillions.

KILLER JAB? 24% OF AMERICANS IN RASMUSSEN POLL SAY THEY KNOW SOMEONE WHO DIED FROM THE COVID-19 “VACCINE” – 42% READY TO JOIN A CLASS ACTION LAWSUIT. In a recent Rasmussen Poll of Americans, 24% said they knew someone who had died from COVID-19 vaccine side effects. Also from the Rasmussen website, an article dated November 3: “Killer Jab? 24% Say Someone They Know Died From COVID-19 Vaccine.”

“Forty-two percent (42%) say that, if there was a major class-action lawsuit against pharmaceutical companies for vaccine side effects, they would be likely to join the lawsuit, including 24% who say it’s Very Likely they’d join such a lawsuit.”

THE FUTURE OF MONEY – CONFUSION FROM THE BANK FOR INTERNATIONAL SETTLEMENTS. Long term readers will know what BOOM has stated many times, “Money is always a contract”. The history of money reveals this precept. Paper money was first used in China during the Tang dynasty 500 years prior to it catching on in Europe. During his visit to China in the 13th century, Marco Polo was amazed to find that people traded paper money for goods rather than coins made of silver or gold. He wrote extensively about how the Mongols resurrected paper money. Marco Polo reported that Kublai Khan, the great Mongol leader, had discovered the ‘secret of alchemy’ by making money from the bark of mulberry trees as well as the process with which a seal was used to impress on the paper to authenticate it.

Thus Cash Money obviously has an implied contract. It is a solemn promise from the Sovereign to the people and, originally, it was expended (issued) into the real economy by the Sovereign to build castles, fortresses, infrastructure, to fund armies, and to facilitate trade inside the local economy. Cash can always be recalled and cancelled by the issuer. This is an implied term of the contract. However, cash must always be issued by the Sovereign upon increased demand within the economy or from the people. In a modern economy, the banking system acts as both distributor and agent of recall.

Credit money (created when a bank makes a loan) also and always has contractual elements and is somewhat obvious; it’s no secret. The dumbest borrower understands that he/she is entering into a contract. Hyun Song Shin, Economic Adviser and Head of Research at the Bank for International Settlements (BIS) made a speech in Basel on June 25 this year at the Bank’s Annual General Meeting; the speech was titled, “A blueprint for the future monetary system”.

It sounds promising, new, and innovative. The speech was certainly grand, full of new technological terms and concepts but BOOM asks the most important question.

What problem (exactly) was he trying to solve? Shin said, “This year’s special chapter (in the Annual Report) argues that the monetary system could be on the cusp of another major technological leap in the form of tokenisation. Tokenisation is the process of representing claims digitally on a programmable platform. It can be seen as the next logical step in the long evolutionary arc of record keeping and asset transfer.”

“Tokens both define assets and specify what can be done with them”

All of that sounds “gee whizz” but reveals nothing new. BOOM would not describe it as “a major technological leap”. A good old fashioned printed share certificate is a token which represents (or “defines”) an asset as it specifies the right to ownership of a company and the right to receive dividends from net profits (if any) from that company and it can be traded on the open market.

The only difference is that the modern “Token”, to which Shin is referring, is in the form of digital code, held on an electronic ledger. But there’s nothing new here; we’ve had electronic ledgers run by computers in banks and large companies since the 1960s. The “programmable platform” Shin refers to implies “programmability” which is also nothing new.

All contracts contain “programs”. Legally they are called ‘the terms of the contract’.

Mr Shin goes on to say, “Tokenisation introduces two important capabilities. First, it enables the contingent performance of actions through smart contracts. And second, it provides greater scope for ‘composability’, whereby several actions are bundled into one executable package.”

BOOM cannot see how this differs from any ordinary contract as the elements of contingent performance and composability are certainly nothing new. There is no innovative step here. He goes on to describe “atomic settlement”: [BOOM’s comments are in brackets]

“Tokenisation [can] combine messaging, reconciliation and settlement in one step. Smart contracts and composability enable so-called atomic settlement, the instant exchange of two assets, such that the transfer of each one occurs only upon transfer of the other one. Such functionalities can increase efficiency and reduce risks”.

This sounds impressive. However, it is no different from any transaction for goods and services where cash is accepted as settlement. We are all familiar with these transactions. “Atomic settlement” happens at any market stall when one person hands over the bread and cheese or promises to deliver future bread and cheese and the recipient hands over the cash when instant settlement is achieved. It is “atomic” only in the new, gee whizz language of settlement.

Shin goes on to say, “Tokenisation can improve efficiency and mitigate risks in payments”, but why so? Because, “Tokenisation enables the combination of messaging, reconciliation and settlement.” Umm, yes possibly, it may be a small step towards increased efficiency and decreased time/number of steps. However, in BOOM’s opinion, it does not deliver much more than that. A hugely complex machine of events has to be constructed first based upon computer software which are notorious for “bugs”.

Shin says that it decreases settlement risk because it [may] speed the transaction. Umm, BOOM is not so sure this is true.

Shin goes on to say “A tokenised environment allows contingent performance of actions”

Yes, but so does any current use of money to settle a transaction. After all, money is a token by definition. It’s a representation of value.

He skips forward to deal with supply chain efficiency, trade settlement and trade finance. And certainly he describes magical scenarios supporting increased speed, increased efficiency, and decreased potential for fraud which can be imagined rather easily in such a “tokenised environment”.

It is akin to explaining [magically], to a novice in transport that, “a Ferrari is obviously better than a horse and cart”. But, it depends on the task at hand. A horse and cart can do some things much more efficiently, safely and more cheaply than a Ferrari.

Shin seems to realise that the advantages of technology are not so obvious in all circumstances so he quickly moves on to say, “Tokenisation efforts are already happening. Crypto and decentralised finance offered a glimpse of tokenisation’s promise. But recent scandals have made it clear that crypto is a flawed system that cannot take on the mantle of the future monetary system”.

Here, Shin is referring to the many scandals revealed by the FTX fiasco and many others. Last Friday, as previously stated, the FTX founder, Sam Bankman-Fried, was found guilty by a jury in New York of defrauding the customers of his bankrupt cryptocurrency exchange in one of the biggest financial frauds in history; he goes on:

“Away from crypto, efforts by commercial banks and other private sector groups have explored the capabilities of tokenisation for real-world use cases. But these efforts have been hampered by the silos erected by each project and the resulting disconnect from other parts of the financial system. In particular, they lack the ability to settle with finality, which depends on central bank money.”

“They lack the ability to settle with finality?” This is the killer phrase which defines the role of a central bank.

MAGICAL THINKING TO THE RESCUE! Shin then seeks to resurrect the entire argument for tokenisation with a solution to the problem of finality, something he calls “central bank money”. However, central bank money already exists and is not a new concept. It is called “reserves” in the world of central banking. Reserves are called ‘digital’ and they are banking assets.

But now Shin wants to introduce what sounds like a magical solution. He describes it as a whole new concept called a CBDC – a central bank digital currency – which can be made available to the public in the real economy and which can be “the solution” that will provide finality for settlement in an environment of tokenisation, and goes on:

“What these projects lack is integration with a tokenised version of the settlement asset in the form of a wholesale central bank digital currency (CBDC). The foundation of trust provided by CBDC and its capacity to knit together the various elements of the financial system derive from the central bank’s role at the core of the monetary system”.

Continuing he says, “Wholesale CBDCs would serve a similar role as reserves in the current system”.

Yes – BOOM can see that — so why have them?

What problem (exactly) do CBDCs solve in the real economy where goods and services are transacted for commonly agreed purposes?

He dresses up CBDC’s by describing them as having, “functionalities enabled by tokenisation, such as the composability and contingent performance of the actions.”

… “While the form of the settlement asset – CBDCs – in a tokenised environment is clear, there is greater room for debate concerning the appropriate form of private tokenised money that complements CBDCs. There are currently two main candidates: asset-backed stablecoins and tokenised deposits. Both represent liabilities of the issuer, but they differ in how they are transferred and in their role in the financial system”.

At this point, it begins to feel as if he has fallen in love with the Ferrari without considering what transport problem he is trying to solve.

In fact, he has not just fallen in love with the technology, the power, the sound and complexity of the Ferrari, he has donned a mechanic’s overalls and climbed deep into the engine bay with a feverish passion for the beast he is trying to subdue.

“Central banks are uniquely positioned to knit together the system as a whole”.

It all begins to sound like a comedy. He is mesmerised by the shiny new “innovations” of digitalisation (which is actually 70 years old) and tokenisation (which has been with us for thousands of years – ever since money was invented).

He has become dazzled by the size and power of computerisation while overlooking its inherent fragility and its limits. The Ferrari has dazzled him when all he needed was a horse and cart – or perhaps a modern Volkswagen.

None of this is any solution to ‘The Big Problem’ which all advanced economies currently face. Reference: BIS Speech by Hyun Song Shin, the Economic Adviser and Head of Research at the Bank for International Settlements, Basel June 25 https://www.bis.org/speeches/sp230625b.pdf

So what is that Big Problem (exactly)?

THE PROBLEM OF INSUFFICIENT BORROWERS. The Problem with which all advanced economies are confronted is the problem of inadequate and declining banking reserves in nations where working age populations are in demographic decline. All continents are facing this problem with one exception – Africa.

The core of the problem is actually to be found in the persistent decline of working age populations (ageing) and the consequent fall in fresh new credit money creation (bank loan volumes) over time. Older age groups do not borrow as much as younger age groups.

Rather than charging forward into a world of deeper and deeper technological complexity dressed up as “efficiency”, “speed” and “innovation”, BOOM suggests a much simpler solution to our current monetary system problems. It will boost banking reserves and solve many other problems too.

The BIS and central bankers are missing the most important ingredient in the monetary system that they have inherited. That ingredient is a form of money that can be issued in higher volumes upon demand from the real economy, is non-interest bearing, fungible, anonymous, and can be recalled when reduction of its volume is required. BOOM is referring to physical CASH.

Rather than abandoning it, we need to look much harder at the essential key role of physical cash money in our money system. In short, cash has huge potential to solve our problem of falling credit money creation.

Increased physical cash is an easy solution to the problem at hand. It can be issued by the Sovereign via expenditure into the real economy. The Government can pay many (most?) of its expenditures with cash. For example, it can pay its wages bill with cash for the army of public servants it employs. Such cash will increase commercial bank deposits instantly and thus automatically allows increased bank reserves at the central bank level. It also provides a natural buffer to excessive credit money creation and, thus, is not as inflationary as excessive credit money expansion.

Shin and the Bank for International Settlements (BIS) fail the first test that should be asked of any business. What problem (exactly) are you trying to solve here?

THE NON CASH SOLUTION – Apart from increased physical cash, BOOM has another solution called Quantitative Boosting (QB) whereby banking reserves and commercial bank deposits can be increased over time in reverse and complementary fashion to the Cash solution.

In Quantitative Boosting, however, there is a need for deep and complete, formal agreements of cooperation between our Governments, our Central Banks and our Commercial Banks. It involves Governments borrowing from the banking sector rather than using the Sovereign Bond market to raise funds sufficient to cover their budget deficits.

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch this short 15-minute video and see how Professor Richard Werner brilliantly explains how global banking systems really work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

“Those trying to use Section 3 of the 14th Amendment actions on Jan. 6, 2021, to disqualify him from being president even if he is elected, in all honesty, is in itself a crime of interfering in the 2024 election and rises to the level of Treason.”

I don’t rate Martin – sorry!

Peter,

I’m not arguing against any statements made by Boom in this article…I’m not bright enough.

But how is inflation going down when the FED is “creating/printing $trillions and $trillion deficits abound which portend more “printing” of fiat garbage going forward?

How do people “invest” in bonds earning 5% when true inflation is running at 15%?

Why would people buy stock when we’re in a recession, depression looming and everybody is tapped out financially(I’d be buying gold for safety and appreciation in such a climate)?

How are home prices expected to rise when mortgage rates have effectively doubled? Those with mortgages in the 3-4% range won’t sell to get a new mortgage at 7% and who can afford a 7+% mortgage when a $400 unexpected bill can’t be paid with anything except a credit Card?

As for Pfizer and Moderna, lawsuits against them will fail. Fail because they are only the “front” for the masters behind the curtain. Some 13 contracted companies actually produced the “vaccines” (one reason for such variability in the jabs). Pfizer and Moderna merely presented the fraud the Govt (DOD/HHS) contracted for. They are all but impervious to any legal attempts against them.UGH……

These are rhetorical questions. Don’t spend you valuable time answering them. I’m too dim to understand your answers-LOL.

You are quite intelligent enough to understand that inflation is not going down it continues and is getting worse, for all the reasons you listed and more.

Only if the economy expands VOWG – but BOOM and I believe it won’t and then we have more QE to prop it up once again? TBP doesn’t see my email to my readers: I said:

“This week BOOM offers a detailed analysis of the rationale behind the proposed CBDCs and provides a practical solution to the Banksters’ problem of falling credit demand due mainly to demographics in almost all the Anglosphere. However, before reading the discourse at the end of BOOM’s editorial, other subjects impacting everyone in advanced economies are explored.”

“Next BOOM examines the US Treasury Yield Curve which is now essentially flat with a slight inversion overall. But what does this mean. Investopedia advises, “A flat yield curve shows little difference in yields from the shortest-term bonds to the longest-term. This indicates uncertainty.” And we all know that uncertainty is not positive for markets. BOOM thinks that a reversion to QE will have to happen but I am not so sure. It might be that the Global Financial System has reached its limit? Yogi Berra states: “It is difficult to make predictions, especially about the future.”

LOL indeed Steve, so many questions, all valid my friend, and I am as confused as you! I too rest my case in gold/silver but BOOM is a financial analyst and runs with the fiat flock. You will know by now that my proposition is to invest in real assets because we all need, food, water, shelter and the love of our fellow man.

Landsman have difficulty understanding us yachtsmen. A fellow yachtie from SA is living with me at present and we have had long evenings chewing the cud. At sea, you are never far from disaster when you will have to rely on another fellow yachtsman to save your ass. And so, we give freely asking nothing in return, because you never know when another will call for help. On land it’s dog eat dog and does not fit my seaborne ethos.

I shall fly to CT, FBYC on Dec 10 (Plan ‘B’ phase 3) and from there to Simons Town FBYC and board my good friend’s 42ft cruising yacht, readying for sea next year and passage to Thailand (where his wife and daughter live) via Mauritius. Life is exciting at 78! LOL.

Peter,

Off-topic, but I ran across this article on the Boers and thought you might find it interesting….

A Primer on the Boers (the Afrikaners): from an Outsider Who Lived Among Them

Less than 10% of South Africa’s nearly 60 million are considered “white.” Of that number, just over ½ are considered “Boer,” or more specifically “Afrikaner.”

Over the course of 3 years, I lived among Afrikaners – I stayed, ate, laughed, worked, and worshiped with them, and have never been so readily and easily adopted by a group of people who were not my own, but treated exactly as if I were.

I learned to converse in Afrikaans, listened to Boer country music (simply called, “Afrikaans”), and even started wearing their particular brand of clothes (that makes it look like they’re like perpetually on a safari, which in some ways, they are).

https://threadreaderapp.com/thread/1720057831749984305.html

Thank you so much B_MC you have captured the spirit of SA in one, your reporter knows the truth. They are a great group of pioneer survivors and that’s why I am going back to Paradise. I hope that the propaganda on SA, the ‘war zone’, prevails because I don’t want too many Brits discovering what I had found in 1999! LOL 🙂

Go well my dear friend and I shall be reporting on progress in SA next year. (PS – I have the same shirts!)

Best movie on The Boer War is “Breaker Morant”. Starring Edward Woodward, TV’s “The Equalizer”.

A definitive explination. Yuuge difference ‘twixt Bitcoin & Tulips.

250 years?

Gonna see what other tidbits i can glom onto in the morning.

This might tickle your fancy: https://www.ukcolumn.org/video/ben-rubin-dissects-the-common-purpose-agenda

Tokenization is a big deal as TPTB intend and is something very new & different. By early 2024, the average American will have maxed their credit cards, 10s of millions will be recently laid off and broke, and the Recession will Officially be a Depression. Our Oligarch friends’ banks will Tokenize Useless Idiots’ real estate property and car equity, household appliances, weapons, etc, into FedCoins and deposit their value into their new CBDC account. They will then own nothing and be rich & happy again (for awhile). Tokenization and CBDCs are (exactly) like take a bite of the Apple, it’s really very good and the Snake swears it will make a huge improvement in our lives; what America needs to end the cycle of booms & bust is a (Rothschild) Central Bank, an IRS to assure the government has adequate operating funds, and a Social Security safety net; a temporary unliking of the US dollar from the Gold Standard to return prosperity and ensure our national gold supply; and America must temporarily impose Affirmative Action (Great Society quotas, bussing, etc) to enable the Black race to have a chance to compete equally with the White & Asian Races, and join the list of once downtrodden races that have risen from the ashes to shine and thrive on individual hard work, self responsibility and social achievements.

A perfect analysis rhs jr, as usual, thank you and on target. I am sure you have it right and I can’t add anything to your succinct discourse. All the best dear friend – I am due out UK on Dec 10 – can’t wait to get out of this dismal island!

Bon Voyage , I envy you.