Guest Post by Chris MacIntosh

It seems that each week that goes by we come up with variations of the same themes, one of which is supply destruction and restriction of fossil fuels. For want of doubt check out the latest garbage from Deutsche Bank. It seems that the energy crisis of last year taught them nothing. Without coal, where would Germany be?

Deutsche Bank’s actions are nothing short of malthusian (depopulation):

Deutsche Bank AG is expanding restrictions on its financing of coal, one of the main sources of energy in its home market of Germany, as part of a wider crackdown on high-emitting sectors.

Companies that have “no credible plans” to reduce thermal coal’s contribution to their revenue below half by 2025 will see their financing cut off, the Frankfurt-based bank said in its initial transition plan, published on Thursday. For companies operating outside the OECD, the revenue threshold is 30% by 2030.

Here comes the “contradiction:”

For coal, Deutsche’s target covers both thermal and metallurgical coal and builds on an existing thermal coal policy. The bank is aiming for a 49% cut in absolute terms in the broadest measure of financed emissions — known as Scope 3 — by 2030. By 2050, its goal is a 97% reduction. In cement the bank is targeting a 29% reduction in Scope 1 and 2 physical emissions intensity by 2030, and a 98% reduction by 2050.

We say contradiction because without met coal you don’t have any steel, and without coal you don’t have any cement (thermal coal is mainly used in the cement manufacturing process). And without thermal coal you don’t have any electricity… and without electricity you don’t have any aluminium (amongst other base metals) or polysilicon.

Cutting a long story short: without coal you cannot produce renewable energy producing equipment.

But wait, this story becomes even more logic defying. From a bloomberg article:

Here is an excerpt from the EU Commission press release:

Achieving the recently agreed EU target of at least 42.5% renewable energy by 2030, with an ambition to reach 45% renewables, will require a massive increase in wind installed capacity with an expected growth from 204 GW in 2022 to more than 500 GW in 2030.

Can this be achieved?

Well, miracles have been known to happen from time to time:

In 2022, the cumulative EU-27 offshore installed capacity amounted to 16.3 GW. This means that to bridge the gap between the 111 GW committed by the Member States and the 2022 capacity, we must install almost 12 GW/year on average – that is 10 times more than the new 1.2 GW installed last year.

The only poetic phrase we can think of to describe the EU’s thinking is bat shit crazy.

We shudder to think of the magnitude of the energy/economic crisis it will take for the Europeans (and most other Western nations) to realize their stupidity. Guess we will find out sooner rather than later.

Wind Power is Far from Being Cheap

Putting aside the fact that wind power isn’t base load and you have to include the cost of backup generation sources for when the wind isn’t blowing, wind is far from being “the cheapest source of electricity” as many would have us believe.

It doesn’t take much to figure out that electricity generated by offshore wind farms is likely significantly underpriced:

Offshore wind developers are reevaluating some New York projects after regulators rejected higher rates by Equinor ASA, Orsted A/S and others that would have added as much as $12 billion in costs.

Developers planning to build more than 4 gigawatts of wind-power capacity off Long Island must abide by existing contracts to deliver power, the New York Public Service Commission unanimously ruled during a meeting Thursday.

The ruling is the latest blow to the US offshore wind industry already contending with inflation and supply-chain issues. The future of projects such as Orsted’s Sunrise Wind is now in question after Thursday’s decision.

Equinor, along with BP Plc, is planning the Empire and Beacon offshore developments, with a combined total capacity of 3.3 gigawatts that could together power around 2 million New York homes. The companies in June told the state that “adverse economic impacts have imposed unprecedented and escalating cost increases on the projects.” To remain viable, they asked the state to approve a 54% price increase.

So when it is all said and done, anyone expecting electricity prices to come down due to the wonders of “free wind” is in for a nasty surprise. This ultimately is going to lead to higher electricity prices and that is higher inflation, higher interest rates, and everything thereafter.

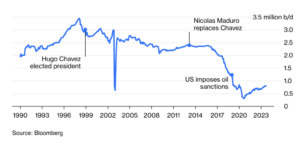

Venezuela is Far From Getting Back to Previous Oil Production Levels

There has been quite a bit of talk about sanctions being relieved on Venezuela so as to allow it to produce more oil, but will that actually result in any material increase in production?

Here is the common narrative (from Bloomberg article):

The resumption of unimpeded Venezuelan oil exports after the US eased sanctions will mark yet another major reshuffle to global crude flows in the past two years.

The Biden administration’s decision to relax sanctions appears likely to boost shipments of Venezuelan crude to the US and Europe while squeezing out some deliveries from Canada, Mexico and Colombia. It also means fewer cargoes from the Latin American nation making the long trek to China, currently the top destination for Venezuelan oil.

Exports to the US are expected to swell from the current daily level of roughly 116,000 barrels to satiate Gulf Coast refineries specially designed to process the type of heavy, dense oil Venezuela produces. Before sweeping sanctions were imposed in 2019, the US imported an average of half-a-million barrels daily from the OPEC founding member and Venezuela was the primary source of oil for Gulf Coast fuel makers.

“The scope of the sanctions easing package was surprisingly comprehensive, effectively lifting most restrictions on the oil sector,” said Fernando Ferreira, director of geopolitical risk at Rapidan Energy Advisors LLC. “The immediate impact should be an increase of crude oil exports from Venezuela to the US, and of US petroleum products, including diluents, to Venezuela.” Diluents are lightweight crude components mixed with heavy crude so it can flow on pipelines and into tanker ships.

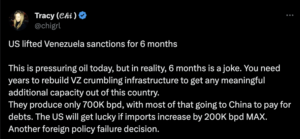

Well, the Venezuelan oil industry infrastructure is in disarray after years of neglect, underinvestment, vandalism, and corruption. It will take years to bring it back to standard. As our friend Tracy explains:

Here is Venezuela’s oil production:

The long and short of it: those who are expecting Venezuelan oil production to get back to where it was some five years (let alone 10 years) ago, this side of 2030 are going to be sorely disappointed.

Editor’s Note: The Western system is undergoing substantial changes, and the signs of moral decay, corruption, and increasing debt are impossible to ignore. With the Great Reset in motion, the United Nations, World Economic Forum, IMF, WHO, World Bank, and Davos man are all promoting a unified agenda that will affect us all.

To get ahead of the chaos, download our free PDF report “Clash of the Systems: Thoughts on Investing at a Unique Point in Time” by clicking here.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Probably in retaliation to Germany’s plan to re-open coal plants.

Germany To Reopen Shuttered Coal Plants In Winter

In a press release, the German Ministry for Economic Affairs and Climate Action (BMWi) has announced the government will reactivate a series of shuttered coal plants during the upcoming heating season in an effort to reduce the nation’s need for gas, and to help prevent power supply shortages during the upcoming heating season.

In the release, the ministry said that the government issued an order on Wednesday which will allow the nation’s biggest power producer, RWE, to reopen two coal blocks at the Niederaussem plant, as well as an additional block at the Neurath plant which will add additional electrical supplies to the nation’s power grid. The same order authorizes the nation’s second largest energy producer, LEAG to reactivate 2 blocks at its Jaenschwalde coal plant.

(https://www.thefinancialtrends.com/2023/10/08/germany-to-reopen-shuttered-coal-plants-in-winter/)

Leave Maryland now.

Power grid operator warns that shut down of coal plant may disrupt millions

https://www.washingtonexaminer.com/policy/energy-environment/power-grid-operator-warns-that-shut-down-of-coal-plant-may-disrupt-millions

( Nothing to replace them until 2027-28 ? What could go wrong ? You’ll own nothing , sit in the dark and be happy )

The Warrior Run power plant in Cumberland, Maryland, will stop burning coal on June 1, 2024, according to the Baltimore Sun.

Two other coal power plants in Maryland — Brandon Shores and H.A. Wagern in Curtis Bay —- previously announced plans to stop burning coal by 2025.

https://justthenews.com/politics-policy/energy/announcement-plant-shutdown-date-will-leave-maryland-coal-power-free-2025

June 1 = start of peak summer demand , brilliant.

And go where???

South of the Mason Dixon Line would be a good start.

Nope – don’t need em down here.

No. We certainly do not. Look to Cali and Texas, people. There’s your future…to be overrun by liberal butt sucking KARENS.

Coal plants are shuttering here , too…

FY? Just spitballin’ here…

In all of Creation, there was never a time when that wasn’t good solid advice!

We need to have a mostly peaceful protest at douche bank.

I’m starting to think the eternal energy source is fiat. Perpetual motion is fiat.

Well the leftist world woke assholes are all in unison . Never fix anything when you have an opportunity to create FUBAR .

This is something the Biden Administration has developed into a fine art like Hunters masterpieces of masturbation

Appoint incompetent, low self control people to positions of authority in dottgov agencies, then, give them the agency credit/debit cards with millions in the accounts. .. …

What could possibly go wrong?

“Surely just a Starbucks coffee in the morning is ok to out on the account.. .. …

And these shoes. I need them to look professional, for my new position. And a suit,

a car, a driver, a….vacation, a second home…Rolex watch”

Oops!

Major emergency!

Where’s Waldo?

He’s on vacay!

Where’s the money?

He’s on vacay!

And without electricity you won’t have ‘smart’ stuff, even CBDCs and EVs will not operate without that sweet, sweet, ye olde electricity.

The more wind farms you install?

The more drag on earth rotation.

The more drag on earth rotation against the motive force?

The more hot the earth becomes due to friction against the motive force.

Ergo, wind farms heat up the earth.

“Prove him wrong”

Biggest con in world history.

Everybody must go green!

Is this related to all the oil refinery explosions in the current tear. WUWT ?

DEVELOPING STORY: Massive explosions have rocked a refinery in White Lake, Michigan. Residents reports their homes and businesses shook when the blasts erupted. The explosions were so significant they showed up on weather satellite radar. There are no reports of injuries or what caused the blasts. Watch videos below. Click here to get Todd’s exclusive newsletter for conservative news and commentary.

Another totally random event like 1000 food plant fires or dozens of train derailments or pipeline ruptures in the gulf.

Nothing about that on the news this morning here in Tucson

Removing sanctions and expecting Venezuela to start producing oil again is akin to interest rates dropping and expecting banks to start lending because of it. Why would anyone want to invest in Venezuelan oil production when the underlying issues of why it fell off a cliff in the first place hasn’t been addressed (the Venezuelan government system)? The same as why would banks want to increase lending if interest rates drop when the underlying problem of counter-party risk hasn’t been addressed (a recession). Just because there is more demand for loans at a lower interest rate doesn’t mean banks want to loan more just the same just because there is more demand for oil from Venezuela doesn’t mean oil companies want to invest more there!

China keeps building coal plants to supply its electricity.