This week, Your News to Know rounds up the latest top stories involving precious metals and the economy. Stories include: A decade of gold in review, forecasters call for $2,200 gold in 2024 and physical gold bullion is coming to a retail store near you.

The big stories of gold over the past decade

With a decade of Your News to Know under our belts (and then some), we felt like doing an overview of the stories that stood out the most. Everyone’s writing “Gold in 2023” stories, so we might as well go a little broader.

We’ll try to keep it short and concise as we single out three main news items that we believe stand out the most. Our regular readers will be quite familiar with the points, but they are well worth underlining. These are:

- Where was gold technically in 2014 vs. today?

- Central bank buying: from Russia’s quirkiness to talks of a global gold standard

- Black swans are no longer a “maybe”

Strangely enough, it feels like we’ve seen more bearish headlines last year than between 2014 and 2016. These years marked a major dip in gold’s price from $1,910 in 2011 (a level many called overblown) to just above $1,000 in 2016. Keep in mind, falls in the gold market must be taken with a grain of salt: gold was trading below $800 in 2008, and even its lowest point in 2016 didn’t approach that.

The price of gold was clearly in correction territory, and it was a question of how far. We don’t doubt that as $1,000 neared, many wondered if we’re going back to $800 and all of the steam in the market came from the now-dissipated global financial crisis. Nope. By 2016, gold began a steady upwards trend and hasn’t looked back since in any significant manner.

While in 2014 many expected gold to go lower over a 12 or 24-month period, these days the opinion is a hard one to find. With rate cuts looming, gold looks set to explode. Its recent consecutive all-time highs have been captured with little, if any, sudden surprises. Rather, it looks like a slow-motion adjustment based on fundamental attributes like supply, demand and dollar strength.

Central bank buying moved from being a fringe Russian and emerging-market thing between 2014-2016 to talks of a gold standard. We now find ourselves covering well-researched analyses on whether BRICS and Europe are separately gearing for some kind of a gold standard. Mind you, central banks were still net buyers in 2014. It’s increasingly looking like a return to a global gold standard is looming, and last year’s total purchase figures from central banks very much entertain that. Or all the central bank gold buying could just be an attempt to de-dollarize globally?

If other nations do successfully reduce their dependence on the U.S. dollar, what do you think they’d use instead?

We also have to mention that black swans have evolved just a little since 2014. Remember the incident with North Korea in 2017? That gave gold quite a bit of wind in the sails, but there was no real military action. Compare that to the lockdowns, an event unlike any other in history, or the Russian invasion of Ukraine, each giving gold a new all-time high.

Those who bought the dip in 2014 are feeling pretty pleased with themselves right now. That doesn’t mean today is a bad time to diversify with gold. You can end up with more ounces, of course, if you time it just right (or get lucky). Today’s world seems like a far stranger and much more uncertain place than in 2014…

Gold’s price action last year, and even already this year, is testament to that. It’s a point few analysts have missed, along with noting that other safe havens look more and more turbulent.

If we had to make one forecast for the next decade, it’s that it will somehow be stranger and more uncertain than the previous one. And when has gold ever not been a raft for those treading into uncharted waters?

Gold ends the year over $2,000, and Wells Fargo says it’s headed to $2,200

Last week, we covered how pundits said that psychological levels are important in regards to gold being over $2,000. The longer it’s there, the more accustomed investors are to pricing it above that level.

Gold has actually gained since then, closing out 2023 above $2,063, again on no particular event. So we find ourselves in an environment where gold is steadily gaining for reasons seemingly unclear.

One other peculiar thing to us is that everyone’s praising how well the metal did in 2023. But we recall having to remind everyone that $1,650 during a summer with very hot interest rates was hardly a bad price for gold. Others seem to have forgotten it entirely some six months ago, and the headlines might have had you believe gold sank to $165. Even the precipitous climb to $1,900, also without any black swan event, was met with less fanfare than we would have liked.

It seems that there is indeed something to the $2,000 level, as gold is now finally getting the credit it is due. Kevin Wadsworth of NorthStarCharts says gold will have a historic yearly close, and we’re inclined to listen to him as he was one of the rare analysts daring to call for $2,500 gold when it was $1,650.

A level that might have seemed excessive just six months ago doesn’t seem like much of a stretch now, nor in the domain of particularly bullish traders. Wells Fargo, for example, says gold could now close out the year above $2,200, an upgrade from their previous forecast of $2,100 by the end of 2024.

With talks of three rate cuts and gold already around $2,050, we wouldn’t be surprised if it went higher. But even though these price gains look as bombastic as anything ever in the gold market, we continue to urge investors to pay equal attention to the fundamentals. There is a lot more happening behind the scenes in the gold market, and virtually all of it is bullish.

Walmart joins Costco in the retail gold business

How good was the gold business for Costco last year? Very good. The company reported sales of over $100 million in gold bars in just four months, a period that was riddled with out-of-stock labels and limits to two bars a customer in the online store. We’d again like to mention our inventory doesn’t deplete or impose limits on customers…

This overview shows differing opinions in a series of tweets (xeets?) covering Walmart’s foray into the retail gold business. Some find it affirmation that gold is returning to the financial system, while others feel like these retail giants are simply riding the wave of a strong period for gold.

Jo Harmendjian, portfolio manager at Tiberius Group AG, notes that gold “is the answer for many things at the moment – whether it’s inflation carrying on, rate cuts or the uncertainty with very costly wars going on.”

But just as U.S. analysts are excessively fixated on gold in dollar terms, so too does the latter naysaying group appear to be treating this as a localized phenomenon for unclear reasons. In reality, gold is being traded in physical form around the world and by the hour. To a Vietnamese holder of gold jewelry or bars watching minute fluctuations in gold’s price, going to the store to buy gold might be daily routine. From Asia to the Middle East, gold is oftentimes dealt in alongside local currencies or traded brick-and-mortar in a similar manner.

From that point of view, it’s us that are being weird with careful introduction of gold to the average citizen, though steps are being taken to amend this in what has been a slow but steady process.

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Gold has no “best year”. The entire point is ta gold retains value. One does not “invest” in gold. One stores value in gold.

It’s no-shit-fer-sure MONEY. FRNs and paper is debt derived fiat and crypto invisible plus dependent on computers and electricity (don;t forget vulnerabilities vis a vis Guv with other evil forces.).

I have been investing in lead for the past 6+ years.

I think my investment is going to pay off in the only things

that matter. Me and my family’s life.

Ammo up and become ungovernable.

not exactly related but you guys will like this —

a bill has been filed in the fl legislature ,and it will probably pass,that will ban most businesses from going cashless –

great law —

https://www.tampabay.com/news/business/2024/01/03/florida-may-ban-most-businesses-going-cashless/?

trk_msg=EFCTHTVT7V7431N7DD2NDMBSEG&trk_contact=4RRNFUI0NANVT5HIA59I801KEO&trk_sid=KQR0L3IECA6O1T7VO4A95D5RLG&trk_link=09B1MLD008F4V1LV59NEEI82TG&utm_email=02c0e1f3503ba87bf1d50e98be38f849d0190dec0a2f5868eff92eeeb657d5eb&utm_source=DayStarter&utm_medium=MG2_Newsletter&utm_term=but+the+Florida+Legislature+could+soon+put+a+stop+to+that&utm_campaign=King+tide+101+for+Tampa+Bay

Pathetic article – nothing new. What fucking importance has Wells Fargo in predicting gold price. Its was $2146 last year. Wow they do come up with some bold predictions LOL

These idiots are just trying to justify their existence. When gold breaks out from it’s 3.5 year base, it will go much higher than $2200.

CAN YOU EAT GOLD??? CAN YOU MELT IT DOWN AND MAKE BULLETS OUT OF IT???? CAN YOU WALK INTO A MOM AND POP FEED STORE AND USE GOLD TO BUY ANYTHING???? HOW ABOUT WALMART???? NO TO ALL OF THE ABOVE. GOLD IS A WORTHLESS METAL WHEN YOU GET RIGHT DOWN TO THE NITTY GRITTY. THAT’S WHY THE AZTECA, INCA, MYANS EVEN THE EGYPTIANS NEVER USED IT FOR ANYTHING OTHER THAN JEWELRY OR BURIAL. IT IS EASILY MELTED DOWN AND EASILY FORMED INTO PRETTY BABBLES. IT’S JUST A PRETTY METAL. IT’S NOT EVEN THAT RARE AND IT’S ONLY VALUE IS WHAT SOME BUERACRAT MAKES OF IT. YOU CAN HAVE A TON OF GOLD AND STARVE TO DEATH, SAME GOES FOR SILVER AND ANY OTHER SO CALLED PRECIOUS METALS AND JEWELS. AND ANYWAY MOST OF THESE SO CALLED GOLD COMPANIES JUST GIVE YOU A PIECE OF PAPER TELLING YOU HOW MUCH GOLD YOU SUPPOSEDLY HAVE. IF YOU WANT TO SPEND YOUR HARD EARNED CASH BUY LONG TERM FOOD STORAGE, BEANS, WHEAT, RICE, WATER TREATMENT EQUIPMENT, FLOUR, SALT, PEPPER, AMMO, FIRE ARMS THAT YOU CAN NOT ONLY HUNT WITH BUT FOR DEFENSE ALSO. REMEMBER YOU CAN’T EAT GOLD OR SILVER BUT YOU CAN USE TRADE ITEMS AS BARTER. FISH HOOKS, FISHING LINE, ROPE, EVEN WHISKEY, BOURBON, AND BRANDIES, HELL EVEN TOBACCO CAN BE A TRADE ITEM ESPECIALLY POUCH TOBACCO AND ROLLING PAPERS PAPERS. JUST MAKE SURE TO VACUM PACK THE TOBACCO. SEEDS ALSO FOR PLANTING AND TRADE ITEMS. THE LIST IS ENDLESS. REMEMBER MY FRIENDS, GOLD IS SURE PURTY BUT CAN YOU EAT IT????

No Mr. Wales, I can’t eat gold…but I can use it to buy what I can eat. It’s obvious you don’t own any…so stop shouting about it.

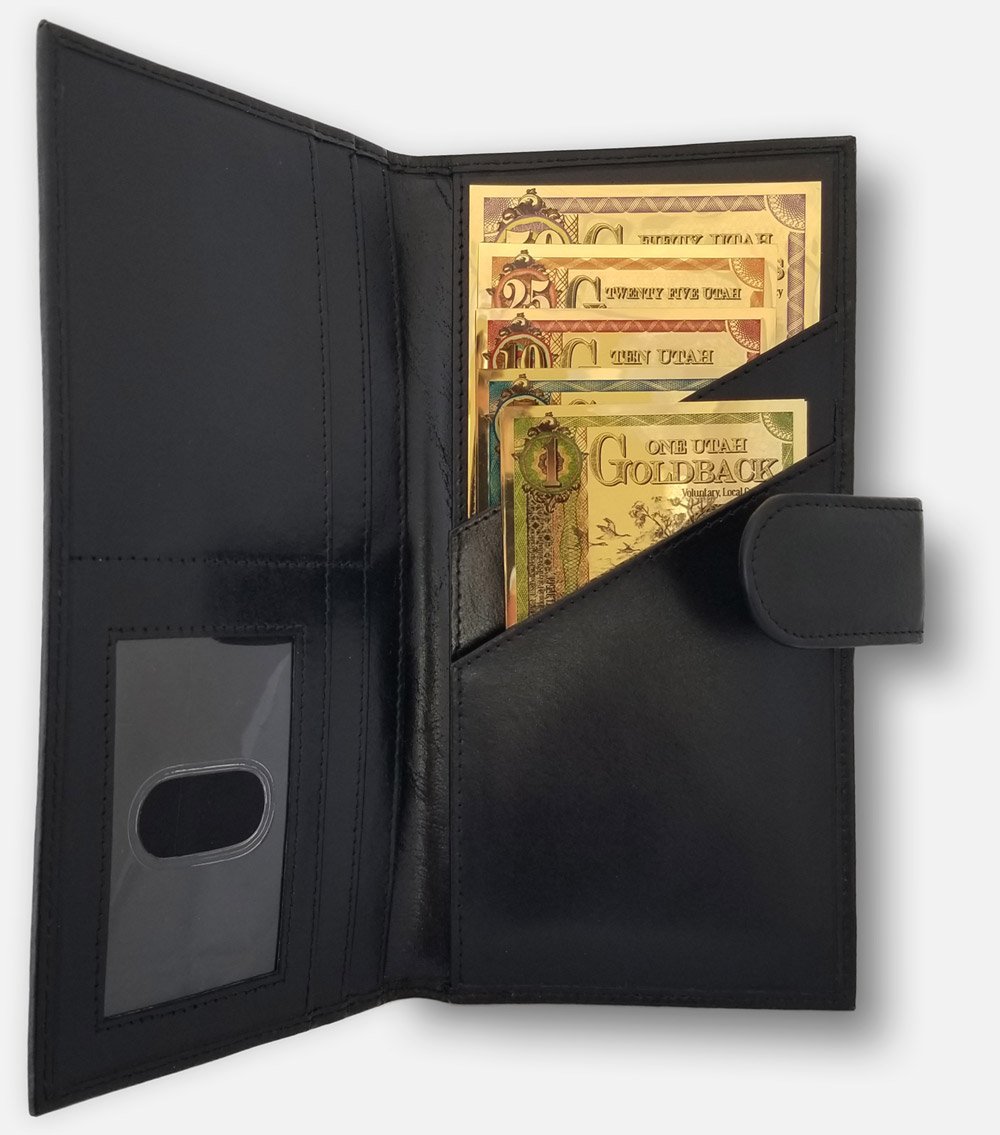

Goldbacks.

https://www.goldback.com/gold-price-history

What’s in your wallet???

?format=2500w

?format=2500w

https://www.goldback.com/