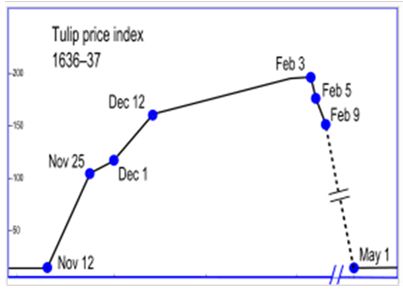

Our self proclaimed “expert” on the Great Depression, Ben Bernanke, seems to be feeling the pressure. His theories worked so well when he modeled them in his posh corner office at Princeton. He could saunter down the hallway and get his buddy Krugman to confirm his belief that the Federal Reserve was just too darn restrictive between 1929 and 1932, resulting in the first Great Depression. I wonder if there will be a future Federal Reserve Chairman, 80 years from now, studying how the worst Federal Reserve Chairman in history (not an easy feat) created the Greatest Depression that finally put an end to the Great American Military Empire. Bernanke spent half of his speech earlier this week trying to convince himself and the rest of the world that his extremist monetary policy of keeping interest rates at 0% for the last two years, printing money at an astounding rate, and purposely trying to devalue the US currency, had absolutely nothing to do with the surge in oil and food prices in the last year. Based on his scribbling since November of last year, it seems that Ben is trying to win his own Nobel Prize – for fiction.

His argument was that simple supply and demand has accounted for all of the price increases that have spread revolution across the world. His argument centered around growth in emerging markets that have driven demand for oil and commodities higher, resulting in higher prices. As usual, a dollop of truth is overwhelmed by the Big Lie. Here is Bernanke’s outlook for inflation:

“Let me turn to the outlook for inflation. As you all know, over the past year, prices for many commodities have risen sharply, resulting in significantly higher consumer prices for gasoline and other energy products and, to a somewhat lesser extent, for food. Overall inflation measures reflect these price increases: For example, over the six months through April, the price index for personal consumption expenditures has risen at an annual rate of about 3.5%, compared with an average of less than 1% over the preceding two years. Although the recent increase in inflation is a concern, the appropriate diagnosis and policy response depend on whether the rise in inflation is likely to persist. So far at least, there is not much evidence that inflation is becoming broad-based or ingrained in our economy; indeed, increases in the price of a single product–gasoline–account for the bulk of the recent increase in consumer price inflation. An important implication is that if the prices of energy and other commodities stabilize in ranges near current levels, as futures markets and many forecasters predict, the upward impetus to overall price inflation will wane and the recent increase in inflation will prove transitory.”

So our Federal Reserve Chairman, with a supposedly Mensa level IQ, declares that prices have risen due to demand from emerging markets. He also declares that US economic growth will pick up in the 2nd half of this year. He then declares that inflation will only prove transitory as energy and food prices will stop rising. I know I’m not a Princeton economics professor, but if US demand increases due to a recovering economy, along with continued high demand in emerging markets, wouldn’t the demand curve for oil and commodities move to the right, resulting in even higher prices?

Ben Bernanke wants it both ways. He is trapped in a web of his own making and he will lie, obfuscate, hold press conferences, write editorials, seek interviews on 60 Minutes, and sacrifice the US dollar in order to prove that his economic theories are sound. They are not sound. They are reckless, crazy, and will eventually destroy the US economic system. You cannot solve a crisis caused by excessive debt by creating twice as much debt. The man must be judged by his words, actions and results.

November 4, 2010

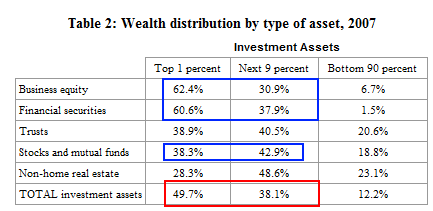

With the U.S. economy faltering last summer, Ben Bernanke decided to launch a desperate attempt to re-inflate the stock market bubble. The S&P 500 had peaked at 1,217 in April 2010 and had fallen 16% by July. This was unacceptable to Bernanke’s chief clientele – Wall Street and the richest 1% in the country. At Jackson Hole in August he gave a wink and nod to his peeps, letting them know he had their backs. It was safe to gamble again. He’d ante up the $600 billion needed to revive Wall Street. It worked wonders. By April 2011, the S&P 500 had risen to 1,361, a 33% increase. Mission accomplished on a Bush-like scale.

Past Federal Reserve Chairmen have kept silent about their thoughts and plans. Not Bernanke. He writes editorials, appears regularly on 60 Minutes, and now holds press conferences. Does it seem like he is trying too hard trying to convince the public that he has not lost control of the situation? QE2 was officially launched on November 4, 2010 with his Op-Ed in the Washington Post. He described the situation, what he was going to do, and what he was going to accomplish. Let’s assess his success.

“The Federal Reserve’s objectives – its dual mandate, set by Congress – are to promote a high level of employment and low, stable inflation. Unfortunately, the job market remains quite weak; the national unemployment rate is nearly 10 percent, a large number of people can find only part-time work, and a substantial fraction of the unemployed have been out of work six months or longer. The heavy costs of unemployment include intense strains on family finances, more foreclosures and the loss of job skills.” – Ben Bernanke – Washington Post Editorial – November 4, 2010

Ben understands his dual mandate of high employment and low inflation, but he seems to have a little trouble accomplishing it. Things were so much easier at Princeton. Since August 2010 when Ben let Wall Street know he was coming to the rescue, the working age population has gone up by 991,000, while the number of employed Americans has risen by 401,000, and another 1,422,000 people decided to kick back and leave the workforce. That is only $1.5 million per job created. This should get him a spot in the Keynesian Hall of Shame.

The official unemployment rate is rising after Ben has spent $600 billion and stands at 9.1% today. A true measurement of unemployment as provided by John Williams reveals a true rate of 22%.

Any reasonable assessment of Ben’s success regarding part one of his dual mandate, would conclude that he has failed miserably. He must have focused his attention on mandate number two – low inflation. Bernanke likes to call inflation transitory. Inflationistas like Bernanke will always call inflation transitory. His latest proclamations reference year over year inflation of 3.5%. This is disingenuous as the true measurement should be since he implemented QE2. The official annualized inflation since December 2010 is 5.3%. The real inflation rate as calculated exactly as it was in 1980 now exceeds 10%.

Mr. Dual Mandate seems to have slipped up. As he stated in his editorial, he wanted to fend off that dreaded deflation:

“Today, most measures of underlying inflation are running somewhat below 2 percent, or a bit lower than the rate most Fed policymakers see as being most consistent with healthy economic growth in the long run. Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling. In the most extreme case, very low inflation can morph into deflation (falling prices and wages), which can contribute to long periods of economic stagnation.”

He certainly has succeeded in fighting off deflation. Let’s list his anti-deflation accomplishments:

- Oil prices have risen 35% since September 2010.

- Unleaded gas has risen 50% since September 2010.

- Gold has risen 24% since September 2010.

- Silver has risen 85% since September 2010.

- Copper has risen 20% since September 2010.

- Corn has risen 67% since September 2010.

- Soybeans have risen 40% since September 2010.

- Coffee has risen by 44% since September 2010.

- Cotton has risen 88% since September 2010.

Amazing how supply and demand got out of balance at the exact moment that Bernanke unleashed a tsunami of speculation by giving the all clear to Wall Street, handing them $20 billion per week for the last seven months. Another coincidence seemed to strike across the Middle East where the poor, who spend more than 50% of their meager income on food, began to revolt as Bernanke’s master plan to enrich Wall Street destroyed the lives of millions around the globe. Revolutions in Tunisia, Egypt, Libya, Yemen, Bahrain, and Syria were spurred by economic distress among the masses. Here in the U.S., Bernanke has only thrown savers and senior citizens under the bus with his zero interest rate policy and dollar destruction.

Bernanke’s Virtuous Circle

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.” Ben Bernanke – Washington Post Editorial – November 4, 2010

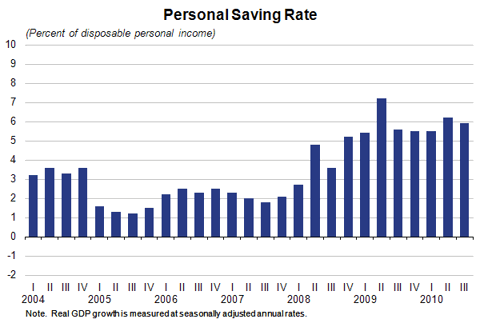

Ben Bernanke could not have been any clearer in his true purpose for QE2. He wanted to create a stock market rally which would convince the public the economy had recovered. As suckers poured back into the market, the wealth effect would convince people to spend money they didn’t have, again. This is considered a virtuous cycle to bankers. He declared that buying $600 billion of Treasuries would drive down long-term interest rates and revive the housing market. His unspoken goal was to drive the value of the dollar lower, thereby enriching the multinational conglomerates like GE, who had shipped good US jobs overseas for the last two decades. Bernanke succeeded in driving the dollar 15% lower since last July. Corporate profits soared and Wall Street cheered. Here is a picture of Bernanke’s virtuous cycle:

Whenever a talking head in Washington DC spouts off about a new policy or program, I always try to figure out who benefits in order to judge their true motives. Since August 2010, the stock price of the high end retailer Tiffany & Company has gone up 88% as its profits in the last six months exceeded its annual income from the prior two years. Over this same time frame, 2.2 million more Americans were forced into the Food Stamp program, bringing the total to a record 44.6 million people, or 14.4% of the population. But don’t fret, Wall Street paid out $21 billion in bonuses to themselves for a job well done. This has done wonders for real estate values in NYC and the Hamptons. See – a virtuous cycle.

Do you think Bernanke mingles with Joe Sixpack on the weekends at the cocktail parties in DC? Considering that 90% of the US population owns virtually no stocks, Bernanke’s virtuous cycle only applied to his friends and benefactors on Wall Street.

But surely his promise of lower interest rates and higher home prices benefitted the masses. The largest asset for the vast majority of Americans is their home. Let’s examine the success of this part of his master plan. Ten year Treasury rates bottomed at 2.4% in October 2010, just prior to the launching of QE2. Rates then rose steadily to 3.7% by February 2011. I’m not a Princeton professor, but I think rising rates are not normally good for the housing market. Today, rates sit at 2.9%, higher than they were prior to the launch of QE2.

I’m sure Ben would argue that interest rates rose because the economy is recovering and the virtuous cycle is lifting all boats (or at least the yachts on Long Island Sound). Surely, housing must be booming again. Well, it appears that since Ben fired up his helicopters in November, national home prices have fallen 5% and are accelerating downward at an annual rate of 10%. There are 10.9 million home occupiers underwater on their mortgage, or 22.7% of all homes with a mortgage. There are over 6 million homeowners either delinquent on their mortgage or already in the foreclosure process. It certainly looks like another Bernanke success story.

Bernanke’s conclusion at the end of his Op-Ed in November 2010 was that his critics were wrong and his expertise regarding the Great Depression trumped rational economic theory. By enriching Wall Street and creating inflation, his virtuous cycle theory would lead to job creation and a chicken in every pot.

“Although asset purchases are relatively unfamiliar as a tool of monetary policy, some concerns about this approach are overstated. Critics have, for example, worried that it will lead to excessive increases in the money supply and ultimately to significant increases in inflation. But the Federal Reserve has a particular obligation to help promote increased employment and sustain price stability. Steps taken this week should help us fulfill that obligation.” Ben Bernanke – Washington Post Editorial – November 4, 2010

Anyone impartially assessing the success of QE2 would have to conclude that it has been an unmitigated failure and has put the country on the road to perdition. In three weeks, the Federal Reserve will stop pumping heroin into the veins of Wall Street. The markets are already reacting negatively, as the S&P 500 has fallen 6% and interest rates have begun to fall. As soon as Bernanke takes his foot off the accelerator, the US economy stalls out because we never cleaned the gunk (debt) out of the fuel line. Jesse puts it as simply as possible.

“The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.” – http://jessescrossroadscafe.blogspot.com/

Bernanke and his Wall Street masters want to obscure the truth so they don’t have to accept the consequences of their actions. The economy and the markets will decline over the summer. Bernanke is a one trick pony. His solution will be QE3, but it will be marketed as something different. He will appear on 60 Minutes and write another Op-Ed. Ben Bernanke will go down in history as the Federal Reserve Chairman that brought about the Greatest Depression and hammered the final nails into the coffin of the Great American Empire.

![[SNLCreditSuisse.jpg]](https://3.bp.blogspot.com/_pMscxxELHEg/S41iYJmDurI/AAAAAAAAHpo/DfLns3uE_J8/s1600/SNLCreditSuisse.jpg)