PRICE OF A BARREL OF OIL 1978 – $14.00

“We are the generation that will win the war on the energy problem and in that process, rebuild the unity and confidence of America.” – President Jimmy Carter, 1979

“We have it in our power to act right here, right now. I propose $6 billion in tax cuts and research and developments to encourage innovation, renewable energy, fuel-efficient cars, and energy-efficient homes.” – President Bill Clinton, 1998

“I think that in ten years, we can reduce our dependence so that we no longer have to import oil from the Middle East or Venezuela. I think that’s about a realistic time frame…That’s why I’ve focused on putting resources into solar, wind, biodiesel, geothermal. These have been priorities of mine since I got to the Senate, and it is absolutely critical that we develop a high fuel efficient car that’s built not in Japan and not in South Korea, but built here in the United States of America.” – President Barack Obama, 2008

“We don’t have to wait on OPEC anymore. We don’t have to let them hold us hostage. America’s got the energy. Let’s have American energy independence.”- Rick Perry, CNN Debate, October 18

“We must become independent from foreign sources of oil. This will mean a combination of efforts related to conservation and efficiency measures, developing alternative sources of energy like biodiesel, ethanol, nuclear, and coal gasification, and finding more domestic sources of oil such as in ANWR or the Outer Continental Shelf (OCS).” – Mitt Romney

PRICE OF A BARREL OF BRENT OIL 2011 – $114.00

It is too bad that our 255 million cars can’t run on hot air. American presidents have propagated the Big Lie of energy independence for the last three decades. The Democrats have lied about green energy solutions and the Republicans have lied about domestic sources saving the day. These deceitful politicians put the country at risk as they misinform and mislead the non-thinking American public. They have been declaring our energy independence for 30 years, but we import three times as much oil today as we did in the early 1980’s. The CPI has gone up 350% since 1978, but the price of a barrel of oil has risen 800% over the same time frame. Today, I hear the same mindless fabrications from politicians and pundits about our ability to become energy independent. Any critical thinking analysis of the hard facts reveals that the United States will grow increasingly dependent upon other countries to supply our energy needs from a dwindling and harder to access supply of oil and natural gas. The fantasy world of plug in cars, corn driven vehicles and solar energy running our manufacturing plants is a castle in the sky flight of imagination. The linear thinking academic crowd believes a technological miracle will save us, when it is evident technology fails without infinite quantities of cheap oil.

I know the chart below requires some time to grasp, but I’m sure the average American can take five minutes away from watching Jersey Shore, Dancing with the Stars, or the latest update of the Kardashian saga to understand why the propaganda about energy independence is nothing but falsehoods. You have U.S. energy demand by sector on the right and the energy source by fuel on the left. Total U.S. energy use is nearly 100 quadrillion Btu. In physical energy terms, 1 quad represents 172 million barrels of oil (8 to 9 days of U.S. oil use), 50 million tons of coal (enough to generate about 2% of annual U.S. electricity use), or 1 trillion cubic feet of natural gas (about 4% of annual U.S. natural gas use).

Please note that 37% of our energy source is petroleum, which supplies 95% of the energy for our transportation sector. That means your car and the millions of 18 wheelers that deliver your food to your grocery stores and electronic gadgets to your Best Buy. You can’t fill up your SUV with coal, natural gas, nuclear energy or sunshine. Without the 7 billion barrels of oil we use every year, our just in time mall centric suburban sprawl society would come to a grinding halt. There is no substitute for cheap plentiful oil anywhere in sight. The government sponsored ethanol boondoggle has already driven food prices higher, while requiring more energy to produce than it generates. Only a government “solution” could raise food prices, reduce gas mileage, and bankrupt hundreds of companies in an effort to reduce our dependence on oil. Natural gas as a transportation fuel supplies 2% of our needs. The cost to retro-fit 160,000 service stations across the country to supply natural gas as a fuel for the non-existent natural gas automobiles would be a fool’s errand and take at least a decade to implement.

The green energy Nazis despise coal and nuclear power, which account for 31% of our energy supply. They want to phase coal out. They aren’t too fond of fracking either, so there goes another 23% of our supply. You might be able to make out that itsy bitsy green circle with the 7% of our supply from renewable energy. And more than half of that energy is supplied by hydro power. Less than 2% of our energy needs are met by solar and wind. For some perspective, we need to use the equivalent of 17 billion barrels of oil per year to run our society and solar and wind supplies the equivalent energy of about 300 million barrels of that total. I think our green energy dreams will come up just a smidgen short of meeting our demands. Nothing can replace oil as the lifeblood of our culture and there is no domestic supply source which will eliminate or even reduce our dependence upon the 10 million barrels per day we import from foreign countries. There are some hard truths that are purposefully ignored by those who want to mislead the public about the grim consequences of peak cheap oil:

- The earth is finite. The amount of oil within the crust of the earth is finite. As we drain 32 billion barrels of oil from the earth every year, there is less remaining within the earth. We have drained the cheapest and easiest to reach 1.4 trillion barrels from the earth since the mid 1800s. The remaining recoverable 1.4 trillion barrels will be expensive and hard to reach.

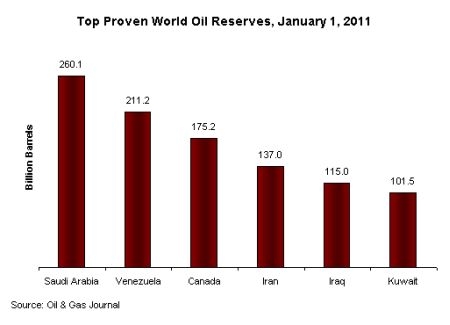

- The United States has about 2% of the world’s proven oil and gas reserves, but consumes 22% of the world’s oil production and 27% of the world’s natural gas production.

- Demand for oil will continue to rise no matter what the United States does, as the developing world consumption far outstrips U.S. consumption. Oil is fungible and will be sold to the highest bidder.

- The concept of energy returned on energy invested (EROEI) is beyond the grasp of politicians and drill, drill, drill pundits. EROEI is the ratio of the amount of usable energy acquired from a particular energy resource to the amount of energy expended to obtain that energy resource. When the EROEI of a resource is less than or equal to one, that energy source becomes an “energy sink”, and can no longer be used as a primary source of energy. Once it requires 1.1 barrels of oil to obtain a barrel of oil, the gig is up.

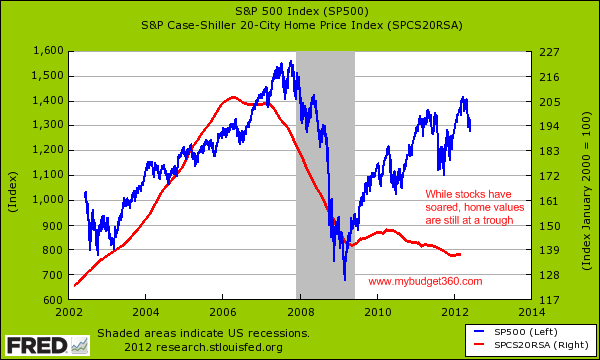

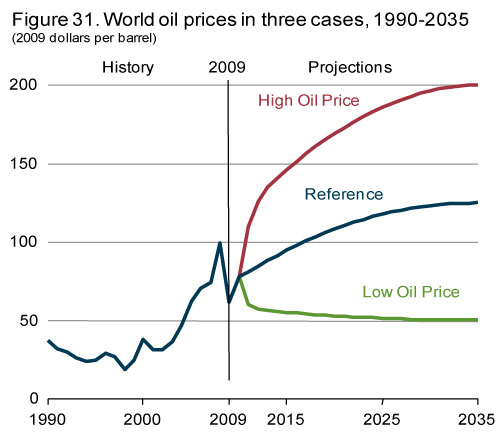

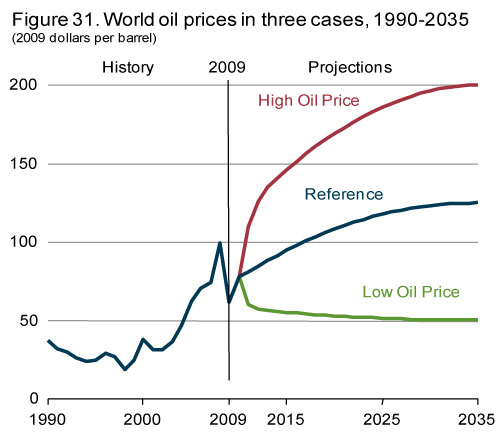

- There is a negative feedback loop that revolves around oil supply, oil price and economic growth. As demand continues to rise and supply is more difficult to access, prices will rise. Since oil is an essential ingredient in every aspect of our lives, once the price reaches $120 to $150 a barrel economic growth goes into reverse. Demand crashes and investment in new sources of energy dries up. Rinse and repeat.

Finite World

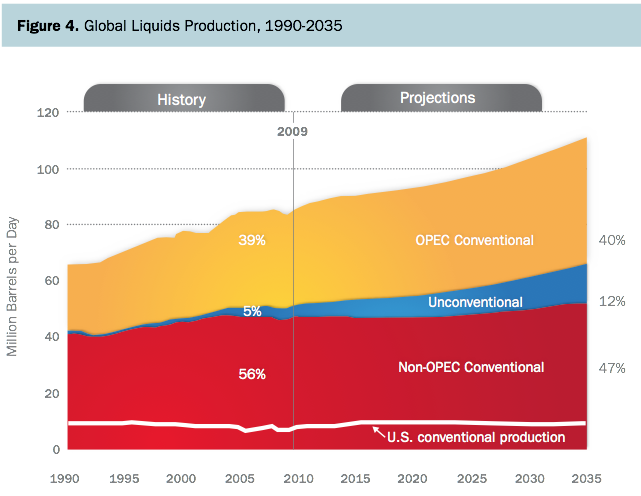

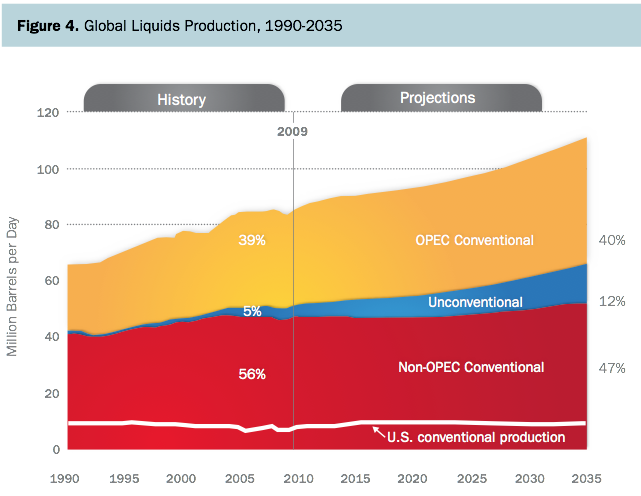

World oil production peaked in 2005 has been flat since then, despite a continuous stream of promises from Saudi Arabia that they are on the verge of increasing production. The chart below from the U.S. Energy Information Administration propagates the standard fabrications about energy supplies. Even though worldwide oil production has clearly peaked, the oil industry PR whores and government agencies continue to project substantial production growth in the future. The mainstream media trots out Daniel Yergin whenever it wants to calm the masses, despite his track record of being 100% wrong 100% of the time. The brilliance of his July, 2005 Op-Ed shines through:

“Prices around $60 a barrel, driven by high demand growth, are fueling the fear of imminent shortage — that the world is going to begin running out of oil in five or 10 years. This shortage, it is argued, will be amplified by the substantial and growing demand from two giants: China and India. There will be a large, unprecedented buildup of oil supply in the next few years. Between 2004 and 2010, capacity to produce oil (not actual production) could grow by 16 million barrels a day — from 85 million barrels per day to 101 million barrels a day — a 20 percent increase. Such growth over the next few years would relieve the current pressure on supply and demand.”

Oil production capacity has not grown by one barrel since Yergin wrote this propaganda piece. This is despite the fact that prices have almost doubled, which should have spurred production. The current energy independence false storyline – the Bakken Formation – has gone from production of 10,000 barrels per day in 2003 to 400,000 barrels per day now, while the hundreds of millions invested in developing the Canadian tar sands have increased production by 50% since 2005. Despite these substantial increases in output, worldwide production has remained flat as existing wells deplete at the same rate that new production is brought online.

The facts are there is approximately 1.4 trillion barrels of recoverable oil left in the crust of the earth. We currently suck 32 billion barrels per year out of the earth. This means we have 44 years of oil left, at current consumption levels. But we know demand is growing from the developing world. Taking this fact into consideration, we have between 35 and 40 years worth of recoverable oil left on the planet. That is not a long time. Additionally, the last 1.4 trillion barrels will much more difficult and costly to extract than the first 1.4 trillion barrels. The remaining oil is miles under the ocean floor, trapped in shale and tar sands, and in the arctic. Despite these hard facts, governmental agencies and politicians continue to paint a rosy picture about our energy future. I watched in stunned amazement last week as five bozos on the McLaughlin Group news program unanimously proclaimed the U.S. would become a net exporter of oil in the coming decade. Do these supposedly intelligent people not understand the basic economics of supply, demand and price?

It seems the governmental organizations always paint the future in the most optimistic terms, despite all facts pointing to a contrary outcome. The EIA predicts with a straight face that oil production will rise to 110 million barrels per day, while the price of a barrel of oil remains in the current $100 to $125 per barrel range. Non-OPEC production has been in decline since 2004, but the EIA miraculously predicts a 15% increase in production over the next 25 years. OPEC production has been flat since 2005, but the EIA is confident their 50 year old oil fields will ramp up production by 25% in the next 25 years. Does the EIA consider whether OPEC even wants to increase production? It would appear that constrained supply and higher prices would be quite beneficial to the OPEC countries. And then of course there is the unconventional oil that is supposed to increase from 4 million barrels per day to 13 million barrels per day, a mere 325% increase with no upward impact on prices. These guys would make a BLS government drone blush with the utter ridiculousness of their predictions.

The picture below is an excellent representation of how the easy to access oil and gas of the earth have been tapped. They were close to the surface. The remaining oil and gas is deeper and trapped within shale and sand. The new technology for extracting gas from shale has concerns regarding whether fracking and disposal of waste water can be done safely, especially near highly populated areas. The relationship between fracking and earthquakes could also prove to be problematic. The wells also have rapid decline rates. Add a mile of ocean to the picture below and you have some really expensive to access oil and potential for disaster, as witnessed with the Deep Water Horizon.

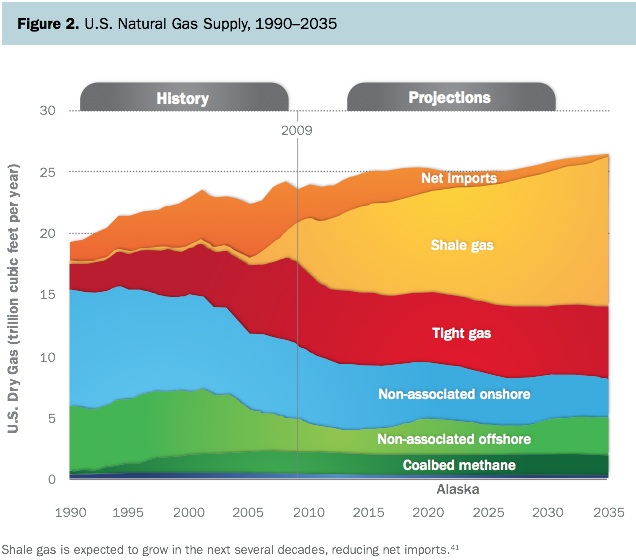

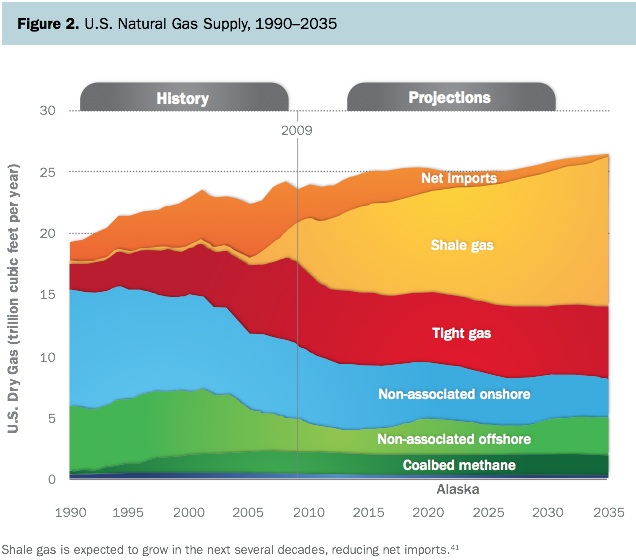

The EIA projects natural gas supply to grow by 10% between now and 2035 due to a 300% increase in shale gas supply. It seems the EIA believes the fantasy of 8 Saudi Arabia’s in the Bakken formation of North Dakota and decades of gas within the Marcellus Shale. These fantasies have been peddled by the natural gas industry in order to get support for their fracking efforts. This false storyline is damaging to the long-term planning that should be taking place now to alleviate the energy scarcity that is our future. In 2006 the EIA reported the possibility of 500 billion barrels of oil in the Bakken formation, based on guesswork. The U.S. Geological Survey has since scaled this back ever so slightly to 3.65 billion barrels, which is six months of U.S. consumption. The deceptions peddled regarding Marcellus shale are also colliding with reality. The U.S. Geological Survey recently produced an estimate of Marcellus Shale resources, which will cause the EIA to reduce its estimate of shale gas reserves for the Marcellus Shale by 80%. The price of natural gas is currently $3.54 MMBtu, down from $13 a few years ago. Extracting natural gas from shale has high capital costs of land, drilling and completion. It is not economically feasible below $6 MMBtu.

Based on the known facts and a realistic view of the future, there will be less supply of oil and natural gas as time goes on. We can already see the impact of these facts today. Even though Europe and the U.S. are in recession, the price of oil continues to rise. The developing world continues to demand more oil and the supply is stagnant. Stunts like withdrawing oil from the Strategic Reserve are foolish and politically motivated. Is the world then running out of oil then? No, but any increase in future global oil production will be modestly incremental and production could be thrown off course by any number of possible events, from an Israeli attack on Iran to (another, but successful this time) al Qaida attack on Saudi Arabia’s Abqaiq oil refinery. Any forecast regarding future oil production and prices isn’t worth the paper it is written on unless consideration to wars, revolutions and terrorism are factored into the equation.

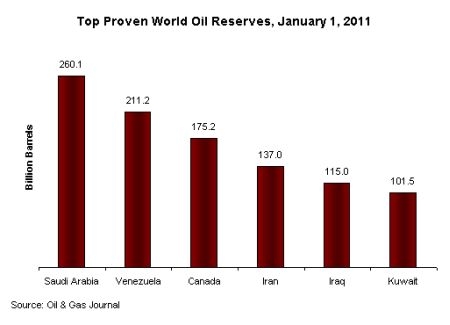

We Don’t Matter

Americans like to think we are the center of the universe. Those who propagate the misinformation about U.S. energy independence are clearly math challenged. The total proven oil reserves in the world total 1.4 trillion barrels and the United States has 22 billion barrels of that total, or 1.6% of the world’s oil. The U.S. burns 7 billion barrels per year, so we have enough oil to survive for three whole years. The U.S. consumes 22% of the world’s oil despite having 4.5% of the world’s population and less than 2% of the world’s oil. Do these facts lead you to the conclusion the United States will be exporting oil in the near future?

When you hear the pundits breathtakingly describe our vast natural gas resources you would think we are the dominant player in this market. Not quite. The United States has 4% of the world’s natural gas reserves. Predictably we consume 22% of the world’s natural gas. Russia controls 25% of the world’s natural gas reserves, with the Middle East countries controlling 40% of the world’s reserves. The pundits can hype our “vast” supplies of natural gas, but the facts clearly reveal it is nothing but hype.

The U.S. is consuming less oil than it was in 2005. U.S. consumption is not the crucial factor in determining the price of oil today and our consumption will matter even less in the future. Emerging market countries, led by China and India, will be the driving force in oil demand in the coming decades. According to the IEA, “Non-OECD [emerging markets] account for 90% of population growth, 70% of the increase in economic output and 90% of energy demand growth over the period from 2010 to 2035.”

This demand is being driven by the growth in vehicles in emerging markets. The U.S. market has reached a saturation point, but China, India and the rest of the world are just beginning their love affairs with the automobile. The accumulation of facts regarding both supply and demand should even convince the most brainless CNBC talking head that the price of oil will continue to rise. The 2008 peak price of $145 per barrel will not hold. The tried and true American method of ignoring problems until they reach crisis proportions will bite us in the ass once again.

Slippery Road Ahead

The concept of EROI is incomprehensible to the peak oil deniers. When Larry Kudlow or one of the other drill, drill, drill morons proclaims the vast amount of oil in North Dakota shale and in Alberta, Canada tar sands, they completely ignore the concept of EROI. Some estimates conclude there are 5 trillion barrels of oil left in the earth. But, only 1.4 trillion barrels are considered recoverable. This is because the other 3.6 trillion barrels would require the expenditure of more energy to retrieve than they can deliver. Therefore, it is not practical to extract. When oil was originally discovered, it took on average one barrel of oil to find, extract, and process about 100 barrels of oil. That ratio has declined steadily over the last century to about three barrels gained for one barrel used up in the U.S. and about ten for one in Saudi Arabia.

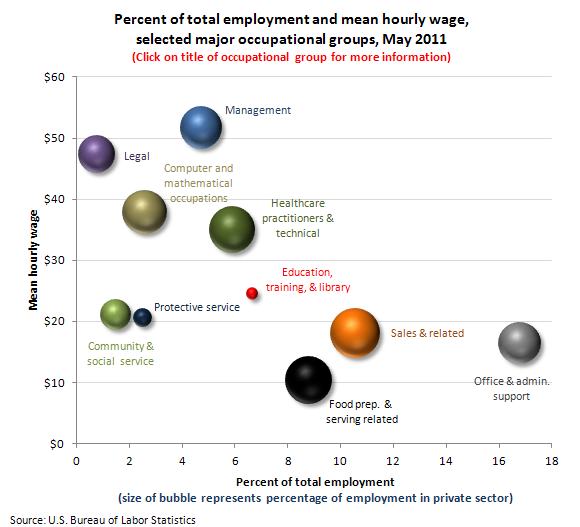

The chart below clearly shows the sources of energy which have the highest energy return for energy invested. I don’t think I’ve heard Obama or the Republican candidates calling for a national investment in hydro-power even though it is hugely efficient. The dreams of the green energy crowd are shattered by the fact that biodiesel, ethanol and solar require as much energy to create as they produce. Tar sands and shale oil aren’t much more energy efficient. It’s too bad Obama and his minions hate dirty coal, because has the best return on energy invested among all the practical sources.

Worse than the peak oil deniers are those who pretend that oil isn’t really that important to our society. They declare that technology will save the day, when in reality technology can’t function without oil. Without plentiful cheap oil our technologically driven civilization crashes. We are addicted to oil. Americans consume petroleum products at a rate of three-and-a-half gallons of oil and more than 250 cubic feet of natural gas per day each. You might be interested in a partial list of products that require petroleum to be produced.

| Solvents |

Diesel fuel |

Motor Oil |

Bearing Grease |

| Ink |

Floor Wax |

Ballpoint Pens |

Football Cleats |

| Upholstery |

Sweaters |

Boats |

Insecticides |

| Bicycle Tires |

Sports Car Bodies |

Nail Polish |

Fishing lures |

| Dresses |

Tires |

Golf Bags |

Perfumes |

| Cassettes |

Dishwasher parts |

Tool Boxes |

Shoe Polish |

| Motorcycle Helmet |

Caulking |

Petroleum Jelly |

Transparent Tape |

| CD Player |

Faucet Washers |

Antiseptics |

Clothesline |

| Curtains |

Food Preservatives |

Basketballs |

Soap |

| Vitamin Capsules |

Antihistamines |

Purses |

Shoes |

| Dashboards |

Cortisone |

Deodorant |

Footballs |

| Putty |

Dyes |

Panty Hose |

Refrigerant |

| Percolators |

Life Jackets |

Rubbing Alcohol |

Linings |

| Skis |

TV Cabinets |

Shag Rugs |

Electrician’s Tape |

| Tool Racks |

Car Battery Cases |

Epoxy |

Paint |

| Mops |

Slacks |

Insect Repellent |

Oil Filters |

| Umbrellas |

Yarn |

Fertilizers |

Hair Coloring |

| Roofing |

Toilet Seats |

Fishing Rods |

Lipstick |

| Denture Adhesive |

Linoleum |

Ice Cube Trays |

Synthetic Rubber |

| Speakers |

Plastic Wood |

Electric Blankets |

Glycerin |

| Tennis Rackets |

Rubber Cement |

Fishing Boots |

Dice |

| Nylon Rope |

Candles |

Trash Bags |

House Paint |

| Water Pipes |

Hand Lotion |

Roller Skates |

Surf Boards |

| Shampoo |

Wheels |

Paint Rollers |

Shower Curtains |

| Guitar Strings |

Luggage |

Aspirin |

Safety Glasses |

| Antifreeze |

Football Helmets |

Awnings |

Eyeglasses |

| Clothes |

Toothbrushes |

Ice Chests |

Footballs |

| Combs |

CD’s & DVD’s |

Paint Brushes |

Detergents |

| Vaporizers |

Balloons |

Sun Glasses |

Tents |

| Heart Valves |

Crayons |

Parachutes |

Telephones |

| Enamel |

Pillows |

Dishes |

Cameras |

| Anesthetics |

Artificial Turf |

Artificial limbs |

Bandages |

| Dentures |

Model Cars |

Folding Doors |

Hair Curlers |

| Cold cream |

Movie film |

Soft Contact lenses |

Drinking Cups |

| Fan Belts |

Car Enamel |

Shaving Cream |

Ammonia |

| Refrigerators |

Golf Balls |

Toothpaste |

Gasoline |

The propaganda blared at the impressionable willfully ignorant American public has worked wonders. The vast majority of Americans have no clue they have entered a world of energy scarcity, a world where the average person is poorer and barely able to afford the basic necessities of life. This is borne out in the vehicles sales statistics reported every month. There have been 10.5 million passenger vehicles sold through the first 10 months of 2011. In addition to the fact they are “purchased” using 95% debt and financed over seven years, the vast majority are low mileage vehicles getting less than 20 mpg. Only 1.8 million small energy efficient vehicles have been sold versus 6.1 million SUVs, pickup trucks and large luxury automobiles. Americans have the freedom to buy any vehicle they choose. They also have the freedom to not think and ignore the facts about the certainty of higher prices at the pump. By choosing a 20 mpg vehicle over a 40 mpg vehicle, they’ve sealed their fate. How could the average soccer mom get by without a Yukon or Excursion to shuttle Biff and Buffy to their games? Have you ever tried to navigate a soccer field parking lot in a hybrid? The horror!

The American public has been lulled back into a sense of security as gas prices have receded from $4.00 a gallon back to $3.40 a gallon. This lull will be short lived. Oil prices have surged by 15% in the last two months, even as the world economy heads into recession. The link between high oil prices and economic growth are undeniable, even though the deceitful pundits on CNBC will tell you otherwise. Ten out of eleven recessions since World War II were associated with oil price spikes. Gail Tverberg sums up the dilemma of energy scarcity for the average American:

“High-priced oil tends to choke economies because high oil prices are associated with high food prices (because oil products are used in food growing and transport), and people’s salaries do not rise to offset this rise in food and oil prices. People have to eat and to commute to their jobs, so they cut back on other expenditures. This leads to recession. Recession leads to lower oil consumption, since people without jobs can’t buy very much of anything, oil products included. In some sense, the reduction in oil extraction is due to reduced demand, because citizens cannot afford the high-priced oil that is available.”

But don’t worry. The rising oil and food prices will only impact the 99% in the U.S. and the poorest dregs across the globe that spend 70% of their income on food. The 1% will be just fine as they will bet on higher oil prices, therefore further enriching themselves while the peasants starve. The market for caviar, champagne, NYC penthouses, and summer mansions in the Hamptons will remain robust.

There is no escape from the ravages of higher priced oil. There is plenty of oil left in the ground. But, the remaining oil is difficult, slow and expensive to extract. Oil prices will rise because they have to. Without higher prices, who would make the huge capital investment required to extract the remaining oil? Once oil prices reach the $120 to $150 per barrel range our economy chokes and heads into recession. We are trapped in an endless feedback loop of doom. The false storyline of renewable energy saving the day is put to rest by Gail Tverberg:

“Renewables such as wind, solar PV, cellulosic ethanol, and biogas could more accurately be called “fossil fuel extenders” because they cannot exist apart from fossil fuels. Fossil fuels are required to make wind turbines and other devices, to transport the equipment, to make needed repairs, and to maintain the transport and electrical systems used by these fuels (such as maintaining transmission lines, running-back up power plants, and paving roads). If we lose fossil fuels, we can expect to lose the use of renewables, with a few exceptions, such as trees cut down locally, and burned for heat, and solar thermal used to heat hot water in containers on roofs.”

Predictably, the politicians and intellectual elite do the exact opposite of what needs to be done. We need to prepare our society to become more local. Without cheap plentiful oil our transportation system breaks down. Our 3.9 million miles of road networks will become a monument to stupidity as Obama and Congress want to spend hundreds of billions on road infrastructure that will slowly become obsolete. The crumbling infrastructure is already the result of government failure, as the money that should have been spent maintaining our roads, bridges and water systems was spent on train museums, turtle crossings, teaching South African men how to wash their genitalia, studies on the mating habits of ferrets, and thousands of other worthless Keynesian pork programs. If our society acted in a far sighted manner, we would be creating communities that could sustain themselves with local produce, local merchants, bike paths, walkable destinations, local light rail commuting, and local energy sources. The most logical energy source for the U.S. in an oil scarce scenario is electricity, since we have a substantial supply of coal and natural gas for the foreseeable future and the ability to build small nuclear power plants. The Fukushima disaster is likely to kill nuclear as an option until it is too late. The electrical grid should be the number one priority of our leaders, as it would be our only hope in an oil scarce world. Instead, our leaders will plow borrowed money into ethanol, solar, and shale oil drilling, guaranteeing a disastrous scenario for our country.

The United States is a country built upon the four C’s: Crude, Cars, Credit, and Consumption. They are intertwined and can’t exist without crude as the crucial ingredient. As the amount of crude available declines and the price rises, the other three C’s will breakdown. Our warped consumer driven economy collapses without the input of cheap plentiful oil. Those at the top levels of government realize this fact. It is not a coincidence that the War on Terror is the current cover story to keep our troops in the Middle East. It is not a coincidence the uncooperative rulers (Hussein, Gaddafi) of the countries with the 5th and 9th largest oil reserves on the planet have been dispatched. It is not a coincidence the saber rattling grows louder regarding the Iranian regime, as they sit atop 155 billion barrels of oil, the 4th largest reserves in the world. It should also be noted the troops leaving Iraq immediately began occupying Kuwait, owner of the 6th largest oil reserves on the planet. Oil under the South China Sea and in the arctic is being hotly pursued by the major world players. China and Russia are supporting Iran in their showdown with Israel and the U.S. As the world depletes the remaining oil, conflict and war are inevitable. The term Energy Independence will carry a different meaning than the one spouted by mindless politicians as the oil runs low.

And as things fell apart

Nobody paid much attention

Nothing but Flowers – The Talking Heads