The political class and their mouthpieces in the corporate controlled mainstream media are desperately trying to spin the oil price surge as a temporary inconvenience that will not derail their phony recovery story. Brent crude closed at $116 per barrel yesterday. West Texas crude closed at $104 per barrel. Unleaded gas has risen by 22% in the last month and 60% since September 1, 2010. I’m sure this slight increase hasn’t impacted Ben Bernanke or Lloyd Blankfein. Their limo drivers just charge it to their unlimited expense accounts. Joe Sixpack, driving his 15 mpg Dodge RAM pickup, is now forking over an extra $1,200 per year in gas expenditures, not to mention more for everything impacted by oil such as food, utilities, and anything transported to their local Wal-Mart by truck (everything). Luckily, the Federal Reserve and crooked politicians only care about their comrades in the top 1% elitist society, for whom oil is an investment, not an expense.

UNLEADED GAS

The “experts” speak as if they know what will happen, even though they never saw the rebellions coming in Tunisia, Egypt or Libya. They assure the masses that Libya doesn’t really have an impact on U.S. oil supply. It’s as if these shills never took Econ 101 in college. World oil demand is 88 million barrels per day. Oil supply is 88 million barrels per day. If 1 million barrels of oil supply are taken off-line, it doesn’t matter that the U.S. doesn’t get their oil from Libya. The Italians need their oil. Do the talking heads understand that oil is fungible? The supplier will ship the oil to the highest bidder. Presto!!! – $116 a barrel oil.

With Friends Like This, Who Needs Enemies

Let’s assess the probability of things getting better in the near, medium, long term or ever term. Take a gander at the chart below. These countries account for 29% of the daily world oil supply. Does it strike you as a list of stable countries with happy populations of employed young men? Egypt, Libya, Yemen, Syria and Iran have already experienced revolution or are on the verge of revolution. Algeria is dead man walking. The Saudi royal family is trying to buy off the masses to stay in power. The revolution genie is out of the bottle. It can’t be put back. Mix 40% unemployment, with millions of young men, no hope, and some Muslim fundamentalism and you’ve got yourself an out of control situation. No amount of public relations spin will create a positive outcome for the United States. The existing world order of despots, kings, and military juntas was just fine for Washington DC. They poured hundreds of billions of “aid”, tanks, helicopters and missiles to these “freedom fighter” despots who diverted the billions to their Swiss bank accounts and fell into line with U.S. policy. No matter who takes power when these revolutions succeed in toppling our puppets, the new regimes will not be friendlier toward America. And they still have the oil.

| Proven Oil | Oil | |

| Country | Reserves (bil barrels) | Production Per Day |

| Saudi Arabia | 265 | 8,400,000 |

| Iran | 137 | 3,700,000 |

| Iraq | 115 | 2,700,000 |

| UAE | 98 | 2,300,000 |

| Kuwait | 102 | 2,300,000 |

| Libya | 46 | 1,600,000 |

| Algeria | 12 | 1,300,000 |

| Qatar | 25 | 820,000 |

| Oman | 6 | 810,000 |

| Egypt | 4 | 742,000 |

| Syria | 3 | 376,000 |

| Yemen | 3 | 298,000 |

One look at the chart of self reported world oil reserves paints a picture of woe for the United States. Countries in the tinderbox of the Middle East and Africa control 65% of the world’s oil reserves. Saudi Arabia controls 20%, Iran and Iraq control 11% each, Venezuela controls 7%, Russia 5%, and Libya 3%. So, countries that can barely stomach our existence, hate us, or just despise us, control 57% of the world’s remaining oil. Sounds like a recipe for lower oil prices in the future. The two countries on our border are the only dependable suppliers for the U.S. Canada controls 13% of the world oil reserves, mostly in its tar sands. Mexico controls just over 1% of the world’s oil reserves, but supplies 13% of the U.S. daily oil supply.

Drill, Baby, Drill

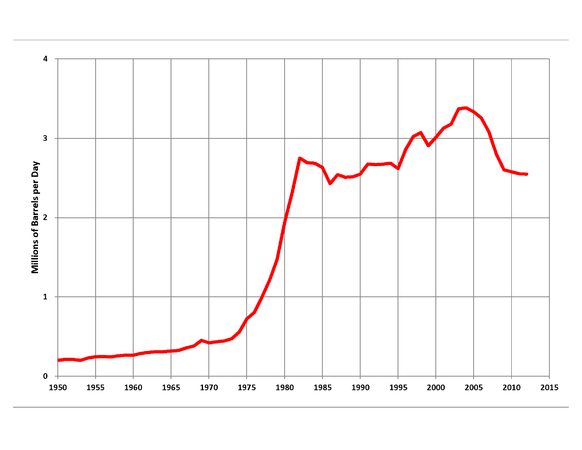

Now for a reality check on the “Drill Baby Drill” propagandists like Larry Kudlow and the other dishonest Republican shills. The United States controls a full 1.58% of the remaining oil reserves in the world. We have 21.3 billion barrels of reserves versus 264 billion barrels in Saudi Arabia. We are currently producing 9 million barrels per day. At that production rate, the U.S. will deplete its proven reserves in the next 6 to 10 years. New discoveries will not be able to keep up with depletion of existing wells. The good news just keeps coming. Mexico’s oil production has been dependent upon one giant oil field since 1976. The Cantarell oil field produced 2.1 million barrels per day in 2003 at its peak. It is currently producing 464,000 barrels per day. Peak oil has arrived in Mexico. By 2015, the country that currently supplies 13% of our daily oil supply will become a net importer of oil. Drill Baby Drill.

Based upon the monthly import data below from the IEA, it would appear that, to paraphrase Chief Brody in Jaws, we’re going to need more corn. As the Obama administration operates in denial of these simple facts, they will continue to push ethanol and Chevy Volts to save us from dirty oil. We are already diverting 40% of our corn crop to the ethanol boondoggle. I’m sure that has nothing to do with the 98% increase in corn prices in the last year. Maybe tax credits for solar panels on SUVs and rubber band propeller cars will save the day.

We know for a fact that Mexico’s 1.2 million barrels per day will evaporate in the next few years. But, at least we have that solid dependable 2.7 million barrels per day (30% of our daily imports) from those stable bastions of democracy Nigeria, Venezuela, Iraq, Angola, and Algeria. Makes you want to go out and buy a Hummer. The storyline being sold to the American people is that there is no need to worry. Saudi Arabia will step to the plate and make up for any shortfalls throughout the world. Just one problem. Saudi Arabia is lying about their reserves and their ability to increase production. They’d fit in very well in Congress and on Wall Street.

| Crude Oil Imports (Top 15 Countries) (Thousand Barrels per Day) |

|||||

|---|---|---|---|---|---|

| Country | Dec-10 | Nov-10 | YTD 2010 | Dec-09 | YTD 2009 |

|

|

|||||

| CANADA | 2,064 | 1,975 | 1,972 | 2,104 | 1,943 |

| MEXICO | 1,223 | 1,229 | 1,140 | 1,063 | 1,092 |

| SAUDI ARABIA | 1,076 | 1,119 | 1,080 | 870 | 980 |

| NIGERIA | 1,024 | 806 | 986 | 1,020 | 776 |

| VENEZUELA | 825 | 884 | 912 | 772 | 951 |

| IRAQ | 336 | 340 | 414 | 325 | 449 |

| ANGOLA | 307 | 263 | 380 | 266 | 448 |

| BRAZIL | 271 | 188 | 254 | 181 | 295 |

| ALGERIA | 262 | 379 | 325 | 336 | 281 |

| COLOMBIA | 220 | 489 | 338 | 179 | 251 |

| ECUADOR | 192 | 188 | 195 | 86 | 181 |

| RUSSIA | 158 | 85 | 252 | 168 | 230 |

| KUWAIT | 125 | 170 | 195 | 160 | 180 |

| UNITED KINGDOM | 124 | 80 | 120 | 67 | 103 |

| ARGENTINA | 85 | 35 | 29 | 33 | 53 |

Lies, Obfuscation, Misinformation & Denial

The late Matt Simmons made the strong case In his book Twilight in the Desert that Saudi Arabia has been lying about their reserves for years. Documents released by Wikileaks give support to this contention. Cables from the U.S. Embassy in Riyadh , released by WikiLeaks, urge Washington to take seriously a warning from senior Saudi government oil executive Sadad al-Husseini, a geologist and former head of exploration at the Saudi oil monopoly Aramco, that the kingdom’s crude oil reserves may have been overstated by as much as 300bn barrels – nearly 40%.

The UK Guardian reported:

According to the cables, which date between 2007-09, Husseini said Saudi Arabia might reach an output of 12m barrels a day in 10 years but before then – possibly as early as 2012 – global oil production would have hit its highest point. This crunch point is known as “peak oil”.

Husseini said that at that point Aramco would not be able to stop the rise of global oil prices because the Saudi energy industry had overstated its recoverable reserves to spur foreign investment. He argued that Aramco had badly underestimated the time needed to bring new oil on tap.

One cable said: “According to al-Husseini, the crux of the issue is twofold. First, it is possible that Saudi reserves are not as bountiful as sometimes described, and the timeline for their production not as unrestrained as Aramco and energy optimists would like to portray.”

The US consul then told Washington: “While al-Husseini fundamentally contradicts the Aramco company line, he is no doomsday theorist. His pedigree, experience and outlook demand that his predictions be thoughtfully considered.”

A fourth cable, in October 2009, claimed that escalating electricity demand by Saudi Arabia may further constrain Saudi oil exports. “Demand [for electricity] is expected to grow 10% a year over the next decade as a result of population and economic growth. As a result it will need to double its generation capacity to 68,000MW in 2018,” it said.

It also reported major project delays and accidents as “evidence that the Saudi Aramco is having to run harder to stay in place – to replace the decline in existing production.” While fears of premature “peak oil” and Saudi production problems had been expressed before, no US official has come close to saying this in public.

The overstatement of reserves by Saudi Arabia and most of the OPEC countries should be abundantly clear to anyone with a smattering of critical thinking skills. This eliminates just about everyone on CNBC or Fox News. Essentially, the self reported, unaudited declared oil reserves from OPEC members are a fraud. Production quotas for each member of OPEC are dependent upon their oil reserve amount. When this was instituted in the early 1980s, shockingly OPEC countries miraculously added nearly 300 billion barrels to proven reserves in a six year period with NO NEW DISCOVERIES of oil. The chart below shows the unexplained jumps in reserves in red. Do you honestly believe any self reported number from Iran or Venezuela? Dr. Ali Samsam Bakhtiari, a former senior expert of the National Iranian Oil Company, has estimated that Iran, Iraq, Kuwait, Saudi Arabia and the United Arab Emirates have overstated reserves by a combined 320–390 billion barrels and has said, “As for Iran, the usually accepted official 132 billion barrels is almost one hundred billion over any realistic estimate.”

Using some common sense, someone might ask, “How could Saudi Arabia’s oil reserves remain above 260 million for the last 22 years despite pumping over 60 billion barrels during this time frame, and not making any major new discoveries?” Maybe their statisticians did their training at Goldman Sachs or the Federal Reserve. The monster Saudi oil fields are over 40 years old. They will deplete. Oil is finite. They will not refill abiotically like some crackpots contend. Saudi Arabia’s production peaked in 2005 and it has been unable to reach that level since. The spin sheiks in Riyadh and spin doctors in Washington DC cannot spin oil out of sand. Peak oil is about to choke the American way of life.

| Declared reserves of major Opec Producers (billion of barrels) | ||||||||

| BP Statistical Review – June 2009 | ||||||||

| Year | Iran | Iraq | Kuwait | Saudi Arabia | UAE | Venezuela | Libya | Nigeria |

| 1980 | 58.3 | 30.0 | 67.9 | 168.0 | 30.4 | 19.5 | 20.3 | 16.7 |

| 1981 | 57.0 | 32.0 | 67.7 | 167.9 | 32.2 | 19.9 | 22.6 | 16.5 |

| 1982 | 56.1 | 59.0 | 67.2 | 165.5 | 32.4 | 24.9 | 22.2 | 16.8 |

| 1983 | 55.3 | 65.0 | 67.0 | 168.8 | 32.3 | 25.9 | 21.8 | 16.6 |

| 1984 | 58.9 | 65.0 | 92.7 | 171.7 | 32.5 | 28.0 | 21.4 | 16.7 |

| 1985 | 59.0 | 65.0 | 92.5 | 171.5 | 33.0 | 54.5 | 21.3 | 16.6 |

| 1986 | 92.9 | 72.0 | 94.5 | 169.7 | 97.2 | 55.5 | 22.8 | 16.1 |

| 1987 | 92.9 | 100.0 | 94.5 | 169.6 | 98.1 | 58.1 | 22.8 | 16.0 |

| 1988 | 92.9 | 100.0 | 94.5 | 255.0 | 98.1 | 58.5 | 22.8 | 16.0 |

| 1989 | 92.9 | 100.0 | 97.1 | 260.1 | 98.1 | 59.0 | 22.8 | 16.0 |

| 1990 | 92.9 | 100.0 | 97.0 | 260.3 | 98.1 | 60.1 | 22.8 | 17.1 |

| 1991 | 92.9 | 100.0 | 96.5 | 260.9 | 98.1 | 62.6 | 22.8 | 20.0 |

| 1992 | 92.9 | 100.0 | 96.5 | 261.2 | 98.1 | 63.3 | 22.8 | 21.0 |

| 1993 | 92.9 | 100.0 | 96.5 | 261.4 | 98.1 | 64.4 | 22.8 | 21.0 |

| 1994 | 94.3 | 100.0 | 96.5 | 261.4 | 98.1 | 64.9 | 22.8 | 21.0 |

| 1995 | 93.7 | 100.0 | 96.5 | 261.5 | 98.1 | 66.3 | 29.5 | 20.8 |

| 1996 | 92.6 | 112.0 | 96.5 | 261.4 | 97.8 | 72.7 | 29.5 | 20.8 |

| 1997 | 92.6 | 112.5 | 96.5 | 261.5 | 97.8 | 74.9 | 29.5 | 20.8 |

| 1998 | 93.7 | 112.5 | 96.5 | 261.5 | 97.8 | 76.1 | 29.5 | 22.5 |

| 1999 | 93.1 | 112.5 | 96.5 | 262.8 | 97.8 | 76.8 | 29.5 | 29.0 |

| 2000 | 99.5 | 112.5 | 96.5 | 262.8 | 97.8 | 76.8 | 36.0 | 29.0 |

| 2001 | 99.1 | 115.0 | 96.5 | 262.7 | 97.8 | 77.7 | 36.0 | 31.5 |

| 2002 | 130.7 | 115.0 | 96.5 | 262.8 | 97.8 | 77.3 | 36.0 | 34.3 |

| 2003 | 133.3 | 115.0 | 99.0 | 262.7 | 97.8 | 77.2 | 39.1 | 35.3 |

| 2004 | 132.7 | 115.0 | 101.5 | 264.3 | 97.8 | 79.7 | 39.1 | 35.9 |

| 2005 | 137.5 | 115.0 | 101.5 | 264.2 | 97.8 | 80.0 | 41.5 | 36.2 |

| 2006 | 138.4 | 115.0 | 101.5 | 264.3 | 97.8 | 87.3 | 41.5 | 36.2 |

| 2007 | 138.2 | 115.0 | 101.5 | 264.2 | 97.8 | 99.4 | 43.7 | 36.2 |

| 2008 | 137.6 | 115.0 | 101.5 | 264.1 | 97.8 | 99.4 | 43.7 | 36.2 |

The denial, accusations and misinformation have already begun. Congressional hearings will be called to blame Big Oil and the dreaded speculators. Americans always need a bogeyman to blame for their mindless decisions and willingness to be led to slaughter by corrupt politicians. Big oil companies do benefit from higher oil prices. Big oil companies spend millions buying off Congressmen. Big oil companies cut corners, ignore safety procedures, and seek profits by any means possible. But, they do not control the oil. Nations control the oil. Many of these nations are led by lying, corrupt, evil despots. That is a fact. Blustering moronic Congressmen going after oil executives and phantom speculators is just a sideshow. It will divert the non-thinking masses from the truth that our leaders haven’t allowed a refinery or nuclear power plant to be built since 1977. These leaders have promoted and subsidized corn based ethanol that requires more energy to produce than it creates and has driven the cost of our food sky high. We are more dependent on foreign oil than any time in our history.

The real speculators are the Americans who clog our highways every morning driving monster SUVs, turbocharged sports cars, gas guzzling minivans, and pickup trucks that make them feel like salt of the earth tough guys despite living in their 6,000 square foot energy sucking McMansions in suburban tracts 30 miles from their jobs, if they have one. The ignorance of the average American car buyer knows no bounds. The recent bounce back in auto sales was led by SUVs and pickups. The green clean cars are nothing but hype and bullshit. GM expects to sell about 10,000 Volts this year, and Nissan expects to sell about 25,000 Leafs in the United States, a piss in the ocean compared with the millions of sport wagons and SUVs purchased by Americans annually. Americans have the attention span of a gnat and are already dazed and confused by the surge in gas prices to $3.50 per gallon.

When oil prices spiked to $147 barrel in 2008, Americans were spending $467 billion per year for fuel. By early 2009, the collapse in energy prices due to the worldwide recession reduced the annual expenditure to $265 billion, freeing up over $200 billion for consumers to spend on other items, pay down debt, or save. Expenditures for fuel had already surged back to $400 billion before the recent spike in oil prices. Next stop $500 billion. That should do wonders for the faux economic recovery that has been touted by Obama and the MSM for the last year. The years of denial, lies, indecision, bad decisions, and inertia have left the country vulnerable and at the mercy of countries in far off lands that despise our way of life.

There are no good outcomes, only bad, really bad, and catastrophic. Take your pick. Could gas prices drop below $3.00 per gallon if the world sinks back into recession? Yes. But it would only be momentary. The easy to access supply is dwindling. The medium and long term direction of gas at the pump is up. There is nothing that can be done in the next five years to prevent significantly higher oil prices. A full court press of realistic ideas like converting our truck fleets to natural gas, a major effort to build nuclear power plants, more drilling, greater use of wind, geothermal, and solar would take at least a decade to have an impact. There is no consensus or resolve to undertake such an effort. Therefore, Americans will suffer the consequences. Be a good American and take advantage of GM’s no interest for 7 years deal on their biggest baddest SUVs and buy two. What could go wrong?

Angee

With all due respect, are you serious or joking around? Where did you get the idea that we have trillions of barrels of oil that can easily be extracted? Also, if we had as much reserves as you say and that oil companies are just waiting around before they decide to produce, why have they waited so long? The US peaked in production in 1970. We wouldn’t be importing 70 percent of our oil today if we were sitting on Saudi size oil fields. Finding new large oil reserves is a thing of the past. Secondly, if you are talking about oil companies mining oil shale, this is a very intense process and is only feasible with high oil prices. Trillions in reserves is insane. What are you guys in NZ reading?

ha, i’ve been needing a new ringtone. perfect. i was blasting ‘casbah’ during the egypt action, disappointed i didn’t think of using it.

Interesting, especially in view of what Lindsey Williams (via Alex Jones) has just come out with.

I don’t really follow Lindsey or even like him much but I’m forced to concede his claims do explain the big picture very well indeed, so until a better explanation comes along…

The next few weeks should prove or disprove his claims…

Admin – thanks. That was my point more or less. I believe jobs nned to go up 300k to keep things more or less even but do not have the stats at my fingertips. In any event the whole thing is a fucking farce.

Hope – one of my all time favorites. The Clash were way cool.

Jmarz – here is an alternative way of responding to Angee:

Angee, please don’t be such a fucking ignoramus. You have been breathing in way much sheep flatulence and need to get a fucking clue. Ignorance and stupidity is not welcome here.

What about all the undeveloped oil fields in North America that havent even been drilled? I’m very skeptical about how much oil we have left, people who rant about ‘Peak Oil’ always have the same cultish mindset as the AGW freaks, they will brook no dissent from lesser mortals. I don’t think its oil itself that it rare and precious but rather the petro-dollar, without that arrangement the US is finished but its got nothing to do with how much oil is actually in the ground

RCT

Ignorant non-thinkers like yourself love to call people with facts cultish. You offer no facts to back up your drivel because you are a clueless dupe.

Do you people imagine you are entitled to the Middle East oil?

In places like China and Russia they have announced massive new oil finds in the last ten years. Yet the Peak Oil crowd still quote the same statistics they did in the 1970s. Calling someone ignorant because they dont agree with you is just facile. I’m no fan of Big Oil, its a dirty business that rapes the environment, but a bit of research will show that its actually Big Oil who are pushing peak oil, artificial scarcity is a tactic as old as time, because it pushes up prices to who’s benefit? The petro-dollar is the real issue for the United States because if they lose that, they lose the ability to continually expand the money supply,while exporting the inflation to the rest of the world, because you can only buy oil in dollars.

RCT

Please document the “massive” new oil finds in China and Russia. Facts please. You got nothing. Ignorance is bliss.

What is happening now is a power move called “cutting the hands.”

Back in college in the late 70’s I was sitting next to an older Austrian couple on a flight from Frankfurt to Chicago. They told me they planned to pick up a rental car in Chicago (flight came in at 8 p.m.) and were going to drive all night so they could be in Salt Lake City by dawn to visit their daughter. When I told them they would be in S. Dakota at dawn, they just laughed at how little Americans knew about their own country.

All you need to know about Bakken: EROEI

TOO LATE. OIL IS ALREADY $116 A BARREL

Oil at $110 May Trigger Pain U.S. CEOs Weathered at $100

A recovering economy helped U.S. chief executive officers weather crude’s surge past the $100 mark. At $110 a barrel, the pain would start to kick in.

As oil traded at 29-month highs last week on concern that violence in Libya would further crimp Middle Eastern supplies, CEOs said they were waiting to see how much the price rises, and for how long.

“Any time something like oil goes up dramatically overnight, it becomes very hard to adequately plan,” said Samuel Allen, 57, chairman and CEO of Deere & Co. (DE), the world’s largest maker of agricultural equipment. “It has caused us to be more careful or cautious in watching the outlook, but we have still moved forward with all our plans.”

Corporate assumptions would have to start changing when oil reaches $110 a barrel, according to economists such as Chris Low of FTN Financial in New York. Crude at that price would offset the benefit from the tax cut approved by Congress in December, and begin to slow economic growth, Low said.

“As long as consumers are willing to pay up a little more, there really isn’t going to be a significant impact,” Low said in an interview. “But we’re pretty quickly running out of time there with oil through $100 a barrel. We’re getting to levels where we have to think about taking our forecasts lower.”

Oil Rises Again

Oil for April delivery rose 1.9 percent to $106.42 a barrel in New York today, the highest since Sept. 26, 2008. That pushed the gain to 24 percent since Feb. 18, when crude began climbing as Libya’s civil strife stoked concern that energy exports elsewhere in the region might also be at risk. Brent crude, the London benchmark used to price many European and African oils, was up 1.6 percent at $117.81.

As manufacturers such as Deere assess how prices may affect business, consumer companies already are adapting. U.S. airlines have enacted six broad fare increases in 2011, and General Motors Co. (GM) is tightening the stock of autos in case buyers shun showrooms as they did in 2008 when gasoline peaked at $4.11 a gallon before the financial crisis.

“We worry about $100 oil all the time,” Vice Chairman Stephen Girsky said in an interview. “We’re war-gaming that all the time. Part of the strategy is to keep inventories low.”

GM’s supply of 517,000 vehicles at the end of February represented about 2.5 months of deliveries, compared with about 2.9 months’ worth a year earlier at the Detroit-based automaker. The clampdown came amid industrywide sales running at the fastest annual pace since 2009.

Gasoline’s Rise

Consumers’ response to costlier gasoline is pivotal because they account for about 70 percent of the U.S. economy and feel oil-market disruptions with every fill-up, economists said. At $3.51 a gallon yesterday in a survey by Heathrow, Florida-based motorist group AAA, the average U.S. retail price for regular unleaded gasoline has risen about 14 percent this year.

The duration of higher prices will determine how consumers react, said Daniel Yergin, chairman of IHS-Cambridge Energy Research Associates Inc. in Cambridge, Massachusetts, and author of the 1991 oil-industry history “The Prize: The Epic Quest for Oil, Money and Power.”

“If it’s a short term, then take it in stride,” Yergin said in an interview. “If it’s longer term, if it extends out weeks or months, then it really becomes a very big question mark for economic recovery.”

‘Main Conduit’

A $10-a-barrel increase in crude would “reduce growth by somewhere between 0.2 to 0.3 percentage points per year in each of the next two years,” said Drew Matus, senior economist at UBS Securities LLC in New York. “It’s basically an overall impact on the economy, but obviously the main conduit through which it would act would be the U.S. consumer.”

While that kind of drag wouldn’t come close to pushing the U.S. back into a recession, it would slow the rebound from the worst economic slump since the Great Depression. For 2010, the world’s largest economy expanded 2.8 percent, the most in five years, after shrinking 2.6 percent in 2009.

Oil at $125 would be “really a crucial tipping point,” pushing gasoline to $4 a gallon, said Carl Riccadonna, senior U.S. economist at Deutsche Bank Securities Inc. in New York.

“That would be the level where we start to significantly downgrade our economic projections,” Riccadonna said, including a 50 percent slash in his forecast for growth of about 3.1 percent in household consumption.

‘Stall Speed’

“Suddenly we’re looking at GDP right around 2 percent,” he said in an interview. “At that 2 percent level on GDP, we’re very close to stall speed on the economy.”

Some pullbacks are under way. American Airlines parent AMR Corp. (AMR) and Delta Air Lines Inc. (DAL) are trimming planned growth in seating capacity to blunt fuel expenses, even with the boost from more fare increases this year than in all of 2010.

“Rising gas prices and still-high unemployment levels weigh on the minds of our customers,” Bill Simon, CEO of U.S. operations for Wal-Mart Stores Inc. (WMT), said on a conference call on Feb. 22. “These issues affect discretionary spending and figure into our assessment for guidance.”

The Bentonville, Arkansas-based retailer has posted seven straight quarters of declining same-store sales in the U.S., and it forecast a drop in such revenue this quarter of as much as 2 percent from a year earlier.

Boyd Gaming Corp. (BYD) expects that gamblers eventually may need some reassurance to help overcome any reluctance to pay more to drive to one of the Las Vegas-based company’s casinos.

‘Psychological Aspects’

“I’m sure you’ll start to see promotions around gasoline and other things as part of a marketing campaign,” Chief Operating Officer Paul Chakmak told analysts on a conference call on March 1. “People are generally fairly resilient, other than the psychological aspects of it.”

Pump prices in some states are approaching the $4-a-gallon mark, topped by the $3.90 average in California and $3.88 in Hawaii through yesterday, according to AAA’s website. Retail diesel fuel climbed to $3.88 a gallon, up 17 percent this year, according to AAA.

“Our near-term concern is more for our customers,” Deere’s Allen said in an interview. The product lineup at Moline, Illinois-based Deere includes lawnmowers, grain harvesters and construction equipment, some running on gasoline and others on diesel fuel.

For Boise Inc., a maker of paper and packaging, each 50- cent increase in diesel fuel means the loss of $8 million in earnings before interest, taxes, depreciation and amortization, Chief Financial Officer Samuel Cotterell said.

While the Boise, Idaho-based company doesn’t build fuel surcharges into contracts, it may be able to pass along some costs, Cotterell told analysts on a March 2 conference call.

Job Growth

Recent indicators suggest that the economy has been strong enough to handle the march toward $100 oil that began last month. The Bloomberg Consumer Comfort Index, formerly the ABC News U.S. Weekly Consumer Comfort Index, was minus 39.3 in the period to Feb. 27, little changed from the minus 39.2 reading the prior week that was the highest in almost three years.

Joblessness fell to 8.9 percent last month, and employment climbed by 192,000, the Labor Department reported on March 4.

Growth in payrolls and income should shield the nonfuel spending crucial to the economy, said Frank Badillo, a Columbus, Ohio-based senior economist for Kantar Retail.

“We won’t see a falloff in nonfuel spending,” Badillo said in an interview. “It will be affected, but it’s not like we are going to see huge declines. They are going to continue to spend more, it just may not be as much more.”

‘Blip Up’

Oil supplies in Saudi Arabia also are sufficient to ensure that oil at $120 or even $150 a barrel from disruptions elsewhere in the Middle East would only be a “blip up” that wouldn’t last long, said Nayantara Hensel, the U.S. Navy’s chief economist.

“Oil prices would need to exceed $125 per barrel for more than four years to substantively limit economic growth,” she said in an interview.

Like Deere, manufacturers such as Caterpillar Inc. (CAT), the world’s largest maker of construction equipment, haven’t made any changes yet to investment decisions in response to the jump in crude.

“We take a long-term view,” said Jim Dugan, a spokesman for Peoria, Illinois-based Caterpillar. “The prices of various commodities are a small piece of that.”

Drill-Bit Parts

At Dover Corp. (DOV), about a quarter of annual revenue comes from the oil and gas industry, where rising demand for equipment such as drill-bit parts buoys results. About the same amount is tied indirectly to consumer spending, because the Downers Grove, Illinois-based company also makes refrigerated display cases.

“For us, the increase in oil isn’t any different than the increase in steel, or nickel or copper or, goodness gracious, even the increasing cost of health care,” CEO Robert Livingston said in an interview. “When we can’t cover it with productivity initiatives, yes, we do pass it on to customers.”

Manufacturers tend to absorb energy-cost increases as long as they’re confident that the new levels are only temporary, because they don’t want to change their prices too often, according to FTN Financial’s Low. Unlike price surges triggered by market speculation, which tend to fade more quickly, oil- market fallout from the Libyan crisis may not end soon, he said.

“We’re talking about revolution that has spread across borders that is, if anything, getting hotter over time,” Low said. “It will likely be many months before the situation in the Middle East has calmed down.”

Fossil fuel, gotta love it. Bio-diesel, gotta love it more. Uncle Sam is subsidising this brilliantly green and horrendously unprofitable technology as if it will make a difference. Up to $1.50/gal for bio-diesel and they still can’t make a profit. They are even selling the credits (called RINS) like carbon credits.

My advice to you all is to find a way to make ALCOHOL. It is cheap, you can make it out of anything, gas engines are easily converted. So what if it doesn’t make your beemer go from 0-60 in 8 seconds. It works and we can do it at home. Oh yeah, did I mention the government doesn’t get to tax it? Ever wonder why they don’t offer alternatives to fossil fuels.

The pig of a government is there to suck you dry, so go on bitch about $4.00/gal gas. By the time they are through none of us will have any money, gas, homes or food. The last time gas hit $4.00 we had a subprime mortgage crisis. I wonder why? You gotta have gas to go to work. Let the mortgage ride, the government will bail you out. Yada yada…

@jmarz: Thorium reactors as a bridge to cold fusion.

All this…

While Obama talks to tapping the strategic petroleum reserve now for political gain.

Is now really the time to be tapping the reserve? Before all hell breaks loose and when we don’t actually have a supply interruption?

Par for the course actually.

Darwin

It all depends on your definition of strategic. Obama’s definition is whether it will help him get re-elected in 2012.

Magnificent goods from you, man. I have understand

your stuff previous to and you’re just too wonderful. I really like what you’ve acquired here, really like what you’re stating and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I can’t wait to read far more from you.

This is really a terrific website.

[img [/img]

[/img]

Magnificent goods from you, man. I have understand your stuff previous to and you are just extremely

wonderful. I really like what you’ve acquired here, certainly like what you’re saying and the way in which you say it.

You make it enjoyable and you still take care of to keep it wise.

I cant wait to read much more from you. This is really a great web site.