“I was part of that strange race of people aptly described as spending their lives doing things they detest, to make money they don’t want, to buy things they don’t need, to impress people they don’t like.” ― Emile Gauvreau

If ever a chart provided unequivocal proof the economic recovery storyline is a fraud, the one below is the smoking gun. November and December retail sales account for 20% to 40% of annual retail sales for most retailers. The number of visits to retail stores has plummeted by 50% since 2010. Please note this was during a supposed economic recovery. Also note consumer spending accounts for 70% of GDP. Also note credit card debt outstanding is 7% lower than its level in 2010 and 16% below its peak in 2008. Retailers like J.C. Penney, Best Buy, Sears, Radio Shack and Barnes & Noble continue to report appalling sales and profit results, along with listings of store closings. Even the heavyweights like Wal-Mart and Target continue to report negative comp store sales. How can the government and mainstream media be reporting an economic recovery when the industry that accounts for 70% of GDP is in free fall? The answer is that 99% of America has not had an economic recovery. Only Bernanke’s 1% owner class have benefited from his QE/ZIRP induced stock market levitation.

The entire economic recovery storyline is a sham built upon easy money funneled by the Fed to the Too Big To Trust Wall Street banks so they can use their HFT supercomputers to drive the stock market higher, buy up the millions of homes they foreclosed upon to artificially drive up home prices, and generate profits through rigging commodity, currency, and bond markets, while reducing loan loss reserves because they are free to value their toxic assets at anything they please – compliments of the spineless nerds at the FASB. GDP has been artificially propped up by the Federal government through the magic of EBT cards, SSDI for the depressed and downtrodden, never ending extensions of unemployment benefits, billions in student loans to University of Phoenix prodigies, and subprime auto loans to deadbeats from the Government Motors financing arm – Ally Financial (85% owned by you the taxpayer). The country is being kept afloat on an ocean of debt and delusional belief in the power of central bankers to steer this ship through a sea of icebergs just below the surface.

The absolute collapse in retail visitor counts is the warning siren that this country is about to collide with the reality Americans have run out of time, money, jobs, and illusions. The most amazingly delusional aspect to the chart above is retailers continued to add 44 million square feet in 2013 to the almost 15 billion existing square feet of retail space in the U.S. That is approximately 47 square feet of retail space for every person in America. Retail CEOs are not the brightest bulbs in the sale bin, as exhibited by the CEO of Target and his gross malfeasance in protecting his customers’ personal financial information. Of course, the 44 million square feet added in 2013 is down 85% from the annual increases from 2000 through 2008. The exponential growth model, built upon a never ending flow of consumer credit and an endless supply of cheap fuel, has reached its limit of growth. The titans of Wall Street and their puppets in Washington D.C. have wrung every drop of faux wealth from the dying middle class. There are nothing left but withering carcasses and bleached bones.

The impact of this retail death spiral will be vast and far reaching. A few factoids will help you understand the coming calamity:

- There are approximately 109,500 shopping centers in the United States ranging in size from the small convenience centers to the large super-regional malls.

- There are in excess of 1 million retail establishments in the United States occupying 15 billion square feet of space and generating over $4.4 trillion of annual sales. This includes 8,700 department stores, 160,000 clothing & accessory stores, and 8,600 game stores.

- U.S. shopping-center retail sales total more than $2.26 trillion, accounting for over half of all retail sales.

- The U.S. shopping-center industry directly employed over 12 million people in 2010 and indirectly generated another 5.6 million jobs in support industries. Collectively, the industry accounted for 12.7% of total U.S. employment.

- Total retail employment in 2012 totaled 14.9 million, lower than the 15.1 million employed in 2002.

- For every 100 individuals directly employed at a U.S. regional shopping center, an additional 20 to 30 jobs are supported in the community due to multiplier effects.

The collapse in foot traffic to the 109,500 shopping centers that crisscross our suburban sprawl paradise of plenty is irreversible. No amount of marketing propaganda, 50% off sales, or hot new iGadgets is going to spur a dramatic turnaround. Quarter after quarter there will be more announcements of store closings. Macys just announced the closing of 5 stores and firing of 2,500 retail workers. JC Penney just announced the closing of 33 stores and firing of 2,000 retail workers. Announcements are imminent from Sears, Radio Shack and a slew of other retailers who are beginning to see the writing on the wall. The vacancy rate will be rising in strip malls, power malls and regional malls, with the largest growing sector being ghost malls. Before long it will appear that SPACE AVAILABLE is the fastest growing retailer in America.

The reason this death spiral cannot be reversed is simply a matter of arithmetic and demographics. While arrogant hubristic retail CEOs of public big box mega-retailers added 2.7 billion retail square feet to our already over saturated market, real median household income flat lined. The advancement in retail spending was attributable solely to the $1.1 trillion increase (68%) in consumer debt and the trillion dollars of home equity extracted from castles in the sky, that later crashed down to earth. Once the Wall Street created fraud collapsed and the waves of delusion subsided, retailers have been revealed to be swimming naked. Their relentless expansion, based on exponential growth, cannibalized itself, new store construction ground to a halt, sales and profits have declined, and the inevitable closing of thousands of stores has begun. With real median household income 8% lower than it was in 2008, the collapse in retail traffic is a rational reaction by the impoverished 99%. Americans are using their credit cards to pay their real estate taxes, income taxes, and monthly utilities, since their income is lower, and their living expenses rise relentlessly, thanks to Bernanke and his Fed created inflation.

The media mouthpieces for the establishment gloss over the fact average gasoline prices in 2013 were the second highest in history. The highest average price was in 2012 and the 3rd highest average price was in 2011. These prices are 150% higher than prices in the early 2000’s. This might not matter to the likes of Jamie Dimon and Jon Corzine, but for a middle class family with two parents working and making 7.5% less than they made in 2000, it has a dramatic impact on discretionary income. The fact oil prices have risen from $25 per barrel in 2003 to $100 per barrel today has not only impacted gas prices, but utility costs, food costs, and the price of any product that needs to be transported to your local Wally World. The outrageous rise in tuition prices has been aided and abetted by the Federal government and their doling out of loans so diploma mills like the University of Phoenix can bilk clueless dupes into thinking they are on their way to an exciting new career, while leaving them jobless in their parents’ basement with a loan payment for life.

The laughable jobs recovery touted by Obama, his sycophantic minions, paid off economist shills, and the discredited corporate legacy media can be viewed appropriately in the following two charts, that reveal the false storyline being peddled to the techno-narcissistic iGadget distracted masses. There are 247 million working age Americans between the ages of 18 and 64. Only 145 million of these people are employed. Of these employed, 19 million are working part-time and 9 million are self- employed. Another 20 million are employed by the government, producing nothing and being sustained by the few remaining producers with their tax dollars. The labor participation rate is the lowest it has been since women entered the workforce in large numbers during the 1980’s. We are back to levels seen during the booming Carter years. Those peddling the drivel about retiring Baby Boomers causing the decline in the labor participation rate are either math challenged or willfully ignorant because they are being paid to be so. Once you turn 65 you are no longer counted in the work force. The percentage of those over 55 in the workforce has risen dramatically to an all-time high, as the Me Generation never saved for retirement or saw their retirement savings obliterated in the Wall Street created 2008 financial implosion.

To understand the absolute idiocy of retail CEOs across the land one must parse the employment data back to 2000. In the year 2000 the working age population of the U.S. was 213 million and 136.9 million of them were working, a record level of 64.4% of the population. There were 70 million working age Americans not in the labor force. Fourteen years later the number of working age Americans is 247 million and only 144.6 million are working. The working age population has risen by 16% and the number of employed has risen by only 5.6%. That’s quite a success story. Of course, even though median household income is 7.5% lower than it was in 2000, the government expects you to believe that 22 million Americans voluntarily left the labor force because they no longer needed a job. While the number of employed grew by 5.6% over fourteen years, the number of people who left the workforce grew by 31.1%. Over this same time frame the mega-retailers that dominate the landscape added almost 3 billion square feet of selling space, a 25% increase. A critical thinking individual might wonder how this could possibly end well for the retail genius CEOs in glistening corporate office towers from coast to coast.

This entire materialistic orgy of consumerism has been sustained solely with debt peddled by the Wall Street banking syndicate. The average American consumer met their Waterloo in 2008. Bernanke’s mission was to save bankers, billionaires and politicians. It was not to save the working middle class. You’ve been sacrificed at the altar of the .1%. The 0% interest rates were for Jamie Dimon and Lloyd Blankfein. Your credit card interest rate remained between 13% and 21%. So, while you struggle to pay bills with your declining real income, the Wall Street bankers are again generating record profits and paying themselves record bonuses. Profits are so good, they can afford to pay tens of billions in fines for their criminal acts, and still be left with billions to divvy up among their non-prosecuted criminal executives.

Bernanke and his financial elite owners have been able to rig the markets to give the appearance of normalcy, but they cannot rig the demographic time bomb that will cause the death and destruction of our illusory retail paradigm. Demographics cannot be manipulated or altered by the government or mass media. The best they can do is ignore or lie about the facts. The life cycle of a human being is utterly predictable, along with their habits across time. Those under 25 years old have very little income, therefore they have very little spending. Once a job is attained and income levels rise, spending rises along with the increased income. As the person enters old age their income declines and spending on stuff declines rapidly. The media may be ignoring the fact that annual expenditures drop by 40% for those over 65 years old from the peak spending years of 45 to 54, but it doesn’t change the fact. They also cannot change the fact that 10,000 Americans will turn 65 every day for the next sixteen years. They also can’t change the fact the average Baby Boomer has less than $50,000 saved for retirement and is up to their grey eye brows in debt.

With over 15% of all 25 to 34 year olds living in their parents’ basement and those under 25 saddled with billions in student loan debt, the traditional increase in income and spending is DOA for the millennial generation. The hardest hit demographic on the job front during the 2008 through 2014 ongoing recession has been the 45 to 54 year olds in their peak earning and spending years. Combine these demographic developments and you’ve got a perfect storm for over-built retailers and their egotistical CEOs.

The media continues to peddle the storyline of on-line sales saving the ancient bricks and mortar retailers. Again, the talking head pundits are willfully ignoring basic math. On-line sales account for 6% of total retail sales. If a dying behemoth like JC Penney announces a 20% decline in same store sales and a 20% increase in on-line sales, their total change is still negative 17.6%. And they are still left with 1,100 decaying stores, 100,000 employees, lease payments, debt payments, maintenance costs, utility costs, inventory costs, and pension costs. Their future is so bright they gotta wear a toe tag.

The decades of mal-investment in retail stores was enabled by Greenspan, Bernanke, and their Federal Reserve brethren. Their easy money policies enabled Americans to live far beyond their true means through credit card debt, auto debt, mortgage debt, and home equity debt. This false illusion of wealth and foolish spending led mega-retailers to ignore facts and spread like locusts across the suburban countryside. The debt fueled orgy has run out of steam. All that is left is the largest mountain of debt in human history, a gutted and debt laden former middle class, and thousands of empty stores in future decaying ghost malls haunting the highways and byways of suburbia.

The implications of this long and winding road to ruin are far reaching. Store closings so far have only been a ripple compared to the tsunami coming to right size the industry for a future of declining spending. Over the next five to ten years, tens of thousands of stores will be shuttered. Companies like JC Penney, Sears and Radio Shack will go bankrupt and become historical footnotes. Considering retail employment is lower today than it was in 2002 before the massive retail expansion, the future will see in excess of 1 million retail workers lose their jobs. Bernanke and the Feds have allowed real estate mall owners to roll over non-performing loans and pretend they are generating enough rental income to cover their loan obligations. As more stores go dark, this little game of extend and pretend will come to an end. Real estate developers will be going belly-up and the banking sector will be taking huge losses again. I’m sure the remaining taxpayers will gladly bailout Wall Street again. The facts are not debatable. They can be ignored by the politicians, Ivy League economists, media talking heads, and the willfully ignorant masses, but they do not cease to exist.

“Facts do not cease to exist because they are ignored.” – Aldous Huxley

The $17 trillion dollar question is how can the giant Ponzi scheme called the US (and world economy) be endlessly propped up by the fed without collapsing? Even the Fed and the very Wealthy meeting in Davos Switzerland can’t just decree that inflation (one of the most serious dangers we face) doesn’t exist.

Even if big banks, the wealthiest investors, and those at the top of the financial system all agree that nations will never repay or even pay down their debt, how can the financial system keep going when most citizens can’t find decent jobs as personal and national debt rise?

Accounting tricks, lies, and misleading propaganda (plus inflation, etc) cannot prevent economic collapse but they shouldn’t be able to keep the world economy afloat for much longer either. Economic stability can’t be based on lies.

How many who post here would be willing to speculate on a timeline for economic implosion?

ss

I predicted the implosion last year and the year before that.

I now predict the implosion for this year.

Next year I’ll do the same.

And eventually, I’ll be right.

“Once you turn 65 you are no longer counted in the work force.”

[I believe this is incorrect! Definition of ‘Civilian Labor Force’: A term used by the U.S. Bureau of Labor Statistics (BLS) to describe the subset of Americans who have jobs or are seeking a job, are at least 16 years old, are not serving in the military and are not institutionalized. In other words, all Americans who are eligible to work in the everyday U.S. economy.]

http://www.bls.gov/dolfaq/bls_ques23.htm

The 2010 Census says there were 243 million people 16 years or older.

The BLS says the Working Age population in 2010 was 237 million.

Why aren’t they the same?

“The 2010 Census says there were 243 million people 16 years or older. The BLS says the Working Age population in 2010 was 237 million. Why aren’t they the same?” ————- Admin

from the BLS

“Labor force measures are based on the civilian noninstitutional population 16 years old and over. Excluded are persons under 16 years of age, all persons confined to institutions such as nursing homes and prisons, and persons on active duty in the Armed Forces.”

http://www.bls.gov/cps/cps_htgm.htm

The real problem with Sears and Penneys is anachronism. The engine of our retail culture is the need to stay ahead of the pack, to be trendy, to feel good about yourself because you have the latest cool thing while he dolts around you still sport last year’s model. S & P never got this and so continued to carry the stigma of the old boring retailers. They both should have completely retooled themselves, including name changes, 20 years ago.

[img [/img]

[/img]

KMES

SRES

Thanks for the informative and timely post.

Please tag the toe of Dots appropriately, too: Women’s retailer Dots LLC files for Chapter 11 bankruptcy protection. It was owned by an LBO firm with an expertise in retailing (Irving Place Capital), apparently.

Crain’s Cleveland Business published the article today:

http://www.crainscleveland.com/article/20140121/FREE/140129949

I have a great nostalgia for Sears and JC Penney, but it’s hard to feel sorry for their upcoming demise. Like a number of great chains that lost touch with their customers, these stores too, must go the way of A&P, First National, etc etc etc.

But why? This is why: the founders of these companies knew their customers, and knew what they wanted, and hired help to help the customers with quality material. I’ll bet dollars to donuts that the big guys who run these companies haven’t stepped foot in one of the stores they’re supposed to CEO. But that’s the way of the world, and their demise opens the door to merchants that do care and know how to schmooze the customers.

I agree with about 99% of the analysis in this article. I specifically disagree with your blanket statement that government workers are unproductive. They are not all employees of the SEC, the DMV, and the IRS. My husband is an employee of a city parks department and he works very hard to give the customers at his facility a great experience. The problem is that he is underemployed — involuntarily working part time, when he wants to work more and his supervisor wants to schedule him more but cannot because of a quota system for part-timers. I’m 58 and have no retirement savings; I was bought out of the only plan I was nearly vested in when the company I worked for 23 years ago was bought out. That money, less than $10,000, is long gone. My father-in-law’s retirement nest egg was destroyed in the Enron – WorldCom debacles and he had to work until he was 71 as a security officer for a Blockbuster distribution facility. Blockbuster has since gone under.

I have been self-employed for years and not terribly successfully, I am a journalist in the alternative/community sector where people want more programs and information, but want the workers to be volunteers. There is more work available than I have time to do, but little pay. Ever try to compete with FREE?

Anyone can see the problems if they want to. But few have an answer. I am part of a growing group of people who say the money-jobs system is an epic fail. We must abandon money and jobs to move to a world view in which we produce only what we as individuals or as a community need, and we stop working when that need is met, until the next time we need something again. Everyone works alone or in voluntary groups to make what they are good at and interested in doing. No production for the sake of productivity, and no production for the sake of profit. No forced unemployment, no doing things we detest for money we don’t want. No fat cat billionaires like Charles Koch telling us that the poor would be better off if there were no minimum wage. This will also be good for the environment because we will not be wasting energy making stuff we don’t need.

This will require a shift in societal values away from productivity for its own sake, away from profit, and away from exceptionalism. You aren’t special because you have more money. We were all born, naked and helpless,from the womb of a woman, and we are all going to die and you can’t take it with you. Get used to it.

We have the gift economy now. You did not whip a dollar out of your diaper when you wanted your mother’s milk. We all have friends and family with whom we share without accounting. We all get the gifts of nature — if we don’t screw up the environment. The trees on our block don’t send a squirrel to our door once a month with a bill in its mouth for oxygen services rendered. So what we need to do it to expand the concept and practice of gifting globally.

We can do that if we take in a few questions: Where are we headed now with our constructs of money and jobs? Do we really want to go there? Why must we “earn a living”? Aren’t we already living?

Why must we pay to live on the planet we’re born on?

Same thing downunder. The trouble is, way too many greedy landlords, small business can’t afford to compete cost wise with online stores. Retail is all but over. Going to be a lot of empty shops and sad landlords not ripping off folk no more. . And we are also sick to death of crap Made In China products that last days if not hours. Its a throw-away society. We reap what you sow.

Why must we pay to live on the planet we’re born on? -KRW

You raise an interesting question.

Work is required whether we dig up roots or shoot arrows into fleeing warm-blooded things require energy.

In what form should we barter that work I, or you did, be in the form of?

Shall we trade calories burned (AWD would love this)

Or in what we extract from the planet, our 67,000 mph spaceship, holds?

Remember when Gateway and Egghead had great little stores everywhere? Between the two of them, I bought all of my computer shit there. Then they both closed them all and went online. Do either of those companies even exist anymore?

I’ve seen Sears efforts at becoming an online marketplace. Walmart is kicking their butts. I order online every 6 months or so for essentials like laundry soap, etc. It cuts down on trips to the grocery store.

It’s a shame American consumerism lacked the discipline to enforce quality and durability over price.

Beautifully done Jim.

Bleak and scary, with nary a mention of the true fallout.

What will become of this nations’ schools, firemen, roads and cops when the remaining retail goes dark?

I would shed a tear for these workers and owners if they ever would have opened their eyes to see what they were creating.

Small business used to account for 75% of new, non-government, jobs. We used to pay nearly 70% of all local taxes too (that would be cops, firemen, teachers).

None of these workers, their shoppers, their buyers, or most telling, the CEOs minded when their profit margins increased as they quit buying from American manufacturers and shipped jobs to China.

No tears shed by them when Craftsman quit offering lifetime warranties and American-made steel.

This is what you get when you lobby for the destruction of your very customer base.

Now the city employees are out lobbying for the destruction of what little is left while the likes of the banksters and WallyWorld are being gifted no-tax zones.

Reap what we sow indeed.

We no longer sow a damn thing, other than fiat, fantasy and debt.

The reaping is going to be show-stopping.

Thanks again Admin.

Anonymous, I am not arguing against work. We need to work to deepen our human experience and to provide practical goods and services to our community. What we do not need is to “earn a living” at the hands of other people. Other people have the right to accept or reject our products or labor time as they will, as they do now, but they do not have the right to determine the fact or quality of our existence by virtue of that acceptance or rejection. Anyone here has the same right to exist and live well as the Queen of England, the President of the United States or the Koch Brothers.

Furthermore, money is irrational. We pay for some tasks under some circumstances and don’t pay for the same tasks in other circumstances. Why is it that a student teacher might be paid to work in a classroom as a teacher’s aide three days a week, but a parent is volunteering the other two days in the same classroom, doing the same things? If a task is paid, it should always be paid.

As to your specific question, you ask it because you assume one-to-one exchange for everything. I question even the notion of exchange! (As does Genevieve Vaughan, author of “For-Giving: A Feminist Critique of Exchange”) What if we just do want we want to do and make it publicly available and take what we need from others who are doing what they want to do and making it available? The only accounting is from people keeping track of how much of their stuff or time is in demand, so that they have enough materials on hand and have scheduled their time appropriately. This would not mean that one person could not ask another for something custom-made and if someone wanted to give a gift to the person who made that thing, it would be fine. But the one-to-one exchange would not be mandatory.

For example, I am a writer. My work is in public for people to read or not as they choose. Perhaps I also teach adult literacy (something I really would like to do if I did not have to spend so much time doing things for money!) Perhaps I read to children in the public library on Saturday afternoon. These are things I like to do, so I do them. I get my food from the farmers market where farmers who believe in organic agriculture congregate. I get my health care from healers, not people who pursue medicine primarily as a profitable business. My work is typed on a computer maintained by a local geek who is into fixing computers. Even the trash and recycling is picked up by people who understand and appreciate the need for a clean city. Maybe once a quarter I join them a la the California coastal cleanup.

All work is needed at some time or another. The money-jobs system actually is perverse in recognizing this. We all need to eat, and to stay healthy, we all need a certain amount of fruits and vegetables. Yet farm workers are among the lowest paid people. Neurosurgeons have a very specialize set of skills that some people need. But if you need a crop harvested, a neurosurgeon is of no help.Why should the neurosurgeon be rich while the farm worker is poor?

People do the best work when they want to do the task, not because they won’t eat if they don’t do what someone else wants them to do. This is the pleasure principle at work. Why not have an economy organized according to the pleasure principle, instead of production out of fear, resentment, or material need? Respect for the diversity of humanity will produce a wide mix of goods and services. People would not have to worry that they can’t get what they need because they are cut out of the “productive” economy because of discrimination against their race, gender, sexual orientation, ethnicity, religion, age, size or whatever. Those prejudices won’t go away, but they won’t affect anybody’s ability to live, either.

Drop the age-old propaganda that you must earn your existence and answers to our economic problems will be obvious. Cling to that notion and see that options are all bad. There are more important things to do than buy and sell. We are headed for destruction as a species if we done see that.

Admin,

A belated thanks for your reply to my query regarding our country’s likely economic implosion.

I can’t imagine how even the financial crooks on Mount Olympus (the Fed, big banks, and the wealthiest citizens) can maintain a charade (Ponzi scheme) indefinitely. It’s as if there is agreement behind the scenes to completely ignore debt while rising inflation created by the Fed is also ignored and stricken from the economic dictionary as if it doesn’t exist.

It would be interesting if most posters here would be willing to offer commentary regarding this and even their own timelines for potential collapse.

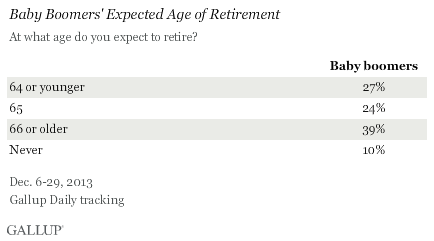

Another indication of long-term employment for Boomers:

Many Baby Boomers Reluctant to Retire

Engaged, financially struggling boomers more likely to work longer

WASHINGTON, D.C. — True to their “live to work” reputation, some baby boomers are digging in their heels at the workplace as they approach the traditional retirement age of 65. While the average age at which U.S. retirees say they retired has risen steadily from 57 to 61 in the past two decades, boomers — the youngest of whom will turn 50 this year — will likely extend it even further. Nearly half (49%) of boomers still working say they don’t expect to retire until they are 66 or older, including one in 10 who predict they will never retire.

[img [/img]

[/img]

Concerns about money likely play a significant role in explaining why so many baby boomers see themselves working longer. Even before the 2008-2009 recession, financial advisers were warning that some baby boomers were carrying too much debt, saving too little, and relying too heavily on Social Security to retire comfortably. And then came the economic collapse — a perfect storm of layoffs, pension and stock losses, and plummeting home values — which was particularly ill-timed for boomers who might otherwise have been in financial shape to retire on schedule with the start of their Social Security benefits.

Gallup finds that baby boomers who strongly agree that they currently “have enough money to do everything [they] want to do” expect to retire at age 66. Boomers who strongly disagree with this statement predict they will retire significantly later, at age 73.

http://www.gallup.com/poll/166952/baby-boomers-reluctant-retire.aspx

Looks like Sears isn’t making a big grand announcement, but they are doing it one by one.

They announced the closure of two Kmarts in Philly yesterday. One is downtown near the Liberty Bell.

Without Rebirth, Malls Face Extinction: Developer

American malls are facing a rebirth, and without a complete reinvention, they will be extinct within 10 to 15 years, the head of one of the nation’s largest privately held real estate companies says.

“At one point [the indoor mall] may have met the developer’s needs—and even for awhile, the consumer’s needs—but it has outlived its usefulness,” Rick Caruso, founder and CEO of Caruso Affiliated, said in a keynote address Sunday at the National Retail Federation’s annual convention in New York.

http://www.cnbc.com/id/101329283

With the continued lowering prices of consumer goods it is harder for store to make a profit.

eg laptops, printers, furniture, clothes are all cheaper and cheaper.

I can’t understand why Sears didn’t fade the entire K-Mart operation back in the 80s. It was a dud then. I didn’t know there were any K-Marts left until I read it here.

But, then, I hardly ever get out to the burbs, or to malls or suburban big box stores so how would I know?

This article confirms why I keep coming back to this website. Just when I want to believe the lies that are told to us are actually suggesting a bright future, I get a snap back to reality when observing the data contained here. FASB waiving mark-to market rules allowed the extend and pretend environment to exist. When the consumer gets tapped out, the thousands of barges carrying shit made in China will slow their arrivals and you will see China slowing down as well causing a global depression. Walmart, JCPenny, Target and all the box stores will have a major reset.

Not Dead Yet: The American Shopping Mall is Changing, Not Going Away

March 17, 2014

Last Friday sandwich chain Quiznos filed for bankruptcy protection citing high debt loads and heavy completion. Coming just days after a similar filing from pizza chain Sbarro, Quiznos’ bankruptcy was the second half of a one-two gut punch for shopping malls at a time when they’ve never been more vulnerable. A decade ago there were more than 1,100 enclosed shopping malls in the U.S. Since then more than 400 have either been “re-purposed” or closed outright. No new malls have been completed since at least 2009.

The trend has become so pronounced it has its own website, DeadMalls.com where shoppers and developers swap stories and mourn the demise of their childhood haunts.

Earlier this year Starbucks’ CEO Howard Schultz told analysts that the drop in mall foot-traffic last year marked a permanent shift in consumer behavior; a simple strategic shift for his company but a death sentence for malls. Nimble retailers can redirect their marketing energy to on-line sales but shopping malls raison d’etre is to act as gathering places. Moving to the Internet isn’t an option.

It’s no surprise that malls are facing a life-threatening shift in consumer tastes but their decline seems to have gone from chronic to acute in the last few months. While destination attractions like Minnesota’s Mall of America with 520 stores, a theme park, wedding chapel, its own zip code and more than 4.2 million feet of real estate continue to thrive, b-list locations are ghost towns.

E-commerce didn’t kill the shopping mall

Contrary to popular belief, online shopping didn’t kill malls. As of the fourth quarter of 2013 only 6% of all U.S. retail sales were done online. Sales are migrating away from brick and mortar stores but the demise of lesser malls is due to a confluence of consolidation in the retail industry as a whole, the death of the smaller specialty store “hang-outs” and the rise of retail Death Stars like the Mall of America or the Mall at Short Hills.

Retail consolidation

Malls thrive on big box department stores acting as anchor tenants. Twenty-five years ago chains like Bloomingdales, Marshall Fields, Hudson’s, Dayton’s and Macy’s (M) would fight for a prime corner. Today all five chains are part of Macy’s. Donaldson’s, Mervyn’s and Gimbel’s are gone to bankruptcy. Left standing are Macy’s, Nordstrom (JWN), Neiman-Marcus and Saks at the higher end with weaklings like Sears (SHLD) and J.C. Penney (JCP) struggling to stay alive.

With fewer companies bidding for prime locations mall rents have collapsed and vacancies increased. Quite understandably Macy’s doesn’t have any interest in having its brands compete against each other at a single location.

Dead or dying “hang-out” stores

As Aaron Task and I discuss in the attached video, malls used to be places to hang out as much as shop. The Internet actually legitimately killed bookstores, arcades and record stores and the days of parents letting their kids roam freely around the mall are long gone. With the food court emptying out thanks to the bankruptcies of greasy spoons like Sbarro, that leaves movie theaters as the only legacy of days when kids would spend a full day just roaming from store to store.

Higher Expectations

When Southdale became the first modern enclosed mall mid-50s it was a groundbreaking social experiment. Located just outside of Minneapolis in a town called Edina, the opening of Southdale was a major media event. Life magazine called it the “splashiest center in the U.S.” and marveled at the mall’s “goldfish pond, birds, art and 10 acres of stores all . . . under one Minnesota roof.” I personally once spent an entire day in Southdale just looking at birds while my mother shopped.

Today it takes something more along the lines of an Imax theater and indoor roller coasters to get a teenager’s attention. The economics of having multiple such destinations within driving distance of one another simply don’t work.

The Future

Malls as a whole aren’t dying, but the country no longer needs several thousand of them. From roughly 1,100 shopping malls today there will likely be somewhere around half that number within the next 20 years. Of the ones that are closed, some will indeed become ghost malls but most will be converted into more useful public spaces to serve the communities that have been built up around them over the last 50 years.

That’s a much different picture but it’s not the same as an outright disappearance of centralized markets. What the doomsayers don’t understand is that malls have never been entirely about shopping. They are about interacting with other living human beings. Victor Gruen, the man who created Southdale, wasn’t a merchant. He was a sociologist. Beyond bringing Minnesotans in out of the cold Gruen was trying to create a centralized community to counter the stifling banality of American suburbs.

What Gruen understood was that humans have been gathering in centralized meeting areas since at least 10th century BC. Americans aren’t becoming shut-ins just because Amazon.com allows them to shop at home.

Ghost malls are depressing, but vibrant shopping centers serve community needs well beyond concentrated shopping. For the elderly in particular malls are a place to gather socially and even get some exercise. The Census Bureau estimates there will be more than 88 million people over 65 in America by 2050, more than twice the current figure.

That alone gives modern malls a core customer base. Add to that the economies of scale allowing developers to replace antiquated shopping centers with Mega Malls featuring fine dining, monster theaters and virtual amusement parks and it becomes clear that the future of malls looks very much like retail itself: fewer locations, better execution and survival of the fittest. It’s hardly cause for mourning.