It really isn’t hard to connect the dots and see the real economy in the real world, outside Wall Street, is a disaster and getting worse by the hour. Below are a bunch of dots that have been issued in the last 24 hours. Here are the facts.

Real disposable income has risen at a 1.8% annual rate over the last four months. Meanwhile, real consumer spending has increased at a 2.4% annual rate over the last four months. I thought all those jobs Obama talks about should result in wages. Why is disposable personal income so pitiful if the unemployment rate is really 5.9%? And of course, these figures are based upon a fake inflation rate of less than 2%. We all know it is 5% or higher.

If things are going so well, why are unemployment claims surging to the highest level in 3 months? Shouldn’t the wonderful holiday season be resulting in massive retail hiring to service all the well off citizens buying more shit they don’t need, with money they don’t have? Consumer debt outstanding will surely hit a new high in December.

Maybe the lack of disposable income is because the number of people receiving free shit for not working is now at a 14 year low. As we know, government transfers of our money to people not working counts as personal income in the warped minds of government bureaucrats. It looks like the free rides are getting shorter.

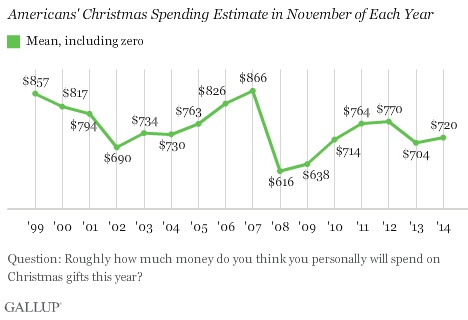

With the stock market hitting new highs every day, the millionaire pundits on the corporate mainstream media are ecstatic as the wealth of billionaires and bankers skyrockets. If it is good for Wall Street it must be good for Main Street. Right? Not according to Gallup. It seems the Americans living in the real world ain’t so ecstatic. They plan to barely spend more on Christmas than last year, and 6% LESS than they spent in 2011 and 2012. How about 17% less than they spent in 2007? How about 16% less than they spent in 1999? Does this jive with an economic recovery and a stock market at all-time highs?

Back in the real world of businesses, it seems things aren’t so good. Zero Hedge pithily describes the situation:

The Durable Goods ex-transports number dropped by a whopping -0.9%, far below the 0.5% increase expected, and the biggest drop since the December -1.8% tumble which was blamed on the Polar Vortex. It is unclear what the October tumble will be blamed on: the Ebola scare? The Bullard Bottom?

If the high level numbers weren’t enough proof, how about an iconic American manufacturer? Their sales and profits are falling. They expect sales for the current quarter to PLUNGE by 21%. That only happens in recessions. I thought the agricultural economy was booming. Maybe not.

Deere’s stock slips after downbeat outlook for equipment sales

By Tomi Kilgore

Published: Nov 26, 2014 7:18 a.m. ET

NEW YORK (MarketWatch) — Deere & Co.’s stock DE, +0.31% fell 3.4% in premarket trade Wednesday, after the farm equipment maker beat fiscal fourth-quarter profit and sales forecasts, but provided a downbeat outlook for equipment sales. For the quarter ended Oct. 31, the company reported earnings of $649.2 million, or $1.83 a share, down from $806.8 million, or $2.11 a share, in the year-earlier period, but above the FactSet consensus analyst estimate of $1.57. Revenue fell 5% to $8.97 billion, as equipment sales fell 7%, but topped analyst forecasts of $7.73 billion. For the current quarter, Deere expects equipment sales to fall 21%, on expectations of a continued pullback in the agricultural sector. “The slowdown has been most pronounced in the sale of large farm machinery, including many of our most profitable models.” The stock has lost 3.9% so far this year through Tuesday, compared with a 12% gain in the S&P 500.

The government laughingly told the sheep that GDP in the 3rd quarter had soared. A critical thinking person might wonder how that could be. We know from the data presented above that the consumer has not been spending, because they don’t have anything to spend. As detailed below, corporate profits crashed in the 3rd quarter. We’ve got corporate profits growing at 2.1% when the PE ratio of the S&P 500 is 20. Based on every valuation method ever used, the stock market is now overvalued by at least 50%.

Growth in corporate profits slows sharply in third quarter

By Jeffry Bartash

Published: Nov 25, 2014 8:31 a.m. ET

WASHINGTON (MarketWatch) – Growth in adjusted corporate profits slowed sharply in the third quarter, new government figures show. Adjusted pretax profits increased by $43.8 billion, or a 2.1% annual rate. That’s down from $164.1 billion, or an 8.4% increase, in the second quarter, the Commerce Department said Tuesday. Profit figures are adjusted for depreciation and the value of inventories.

So despite these factual data points, the MSM and Wall Street will party on with the belief that Grandma Yellen and the rest of the corrupt central bankers around the globe will devalue the world to prosperity. Or at least provide prosperity to the .1% that control them.

Don’t think the velocity of money will ever return, as the middleclass is dying off. Can’t buy your wants if you can barely afford your needs. Can’t believe the amount of debt the average joe has, it is crippling.

Greetings,

I did a symposium recently (I provide high level media services) and I watched a lot of scientists trying to connect with government officials to get the point across that the miracles they have been dreaming up will, without question, replace 60% of the American workforce within the next 10 years. There will be pretty much 0 need for drivers of any kind. Are you a trucker? Too bad, you are unemployed.

Not only will low wage workers be replaced but if I were a doctor or a lawyer I’d be worried as well as the gadgets these people have conjured up already do a better job. You’ll need nurse practitioners but that is about it as every other job in a hospital will be automated and done by machine to include the preparation of food & delivery of medication.

The economy will, at best, provide work for 20% of the eligible workforce. This is not fantasy – this is fact. These scientists realize that the things that they are inventing could set us all free and provide a great standard of living yet we live in an old paradigm where people must work. The government officials just seemed to think that these workers would magically find new and better jobs. That is the disconnect as they have not figured out how to tax machines though that may be coming.

BTW, the things these guys have waiting to unleash upon the public will just blow your mind.

Man, Obamacare and the Federal Reserve plans have worked beautifully to cover up the destruction of the real economy.

ALL our “gains” in income can be attributed to the increases in costs of insurance as the BLS includes said “benefit” in the cash/wages categories. If we were to be able to count ACTUAL “wage” increases separated out from the government-union increases (of which the Dems in CONgress doled out left and right, we now have the highest paid Federal staff EVER) and the health insurance increases, I’m sure that for 90% of us we have had actual decreases – much greater than reported.

Liars figures and figures lie. Has never been more true than today.

We, the productive, are being slaughtered. If they can’t get us by shutting down our businesses and jobs, they’ll get us by giving us cancer and then forcing us to divest our assets to pay for it.

One way or another, the bastards have us by the balls.

While the lies grow and bullshit continues to be presented as caviar.

I tell people to drive around and see the empty commercial buildings and look at the want ads.

Talk to people. And look around and ask themselves,do you see a 17000 economy? Are things smoking along?

Buying a house and not losing it. Is a dream for most. Everything costs more. Ebergy and transportation. I can only think that many are asleep. Denial,it must be nice.

No matter how bad things get in our country, government will continue to lie about economic “recovery” for one main reason – to keep the population under control while distracting them in numerous ways. No reason to go into detail since the Admin and many others have already made the case.

The stock market will likely keep rising via artificial Fed life support despite more citizens facing hardship and no opportunity to prosper.

No sane, rational person would believe that we can live in a fantasy indefinitely without economic collapse. 2008 proved this doesn’t have to take hundreds of years like other failed empires. I wish I could connect all the dots enough to predict when the house of cards will truly start to implode.

I got a 3% raise after almost two years without one. The CEO acted like I was being gifted with life changing money.

“It’s All Good, Right?”

Submitted by Tyler Durden on 11/26/2014 11:57 -0500

After GDP ‘beat’ yesterday in all its statistical instability, today was a disastrous data day for the Fed’s “everything is awesome” meme…

Mortgage Applications -4.3%

Durable Goods Ex-Transports MISS -0.9% vs +0.5% Exp

Initial Jobless Claims MISS 313k vs 288k Exp

Personal Income MISS +0.2% vs +0.4% Exp

Personal Spending MISS +0.2% vs +0.3% Exp

Chicago PMI MISS 60.8 vs 63.0 Exp

UMich Confidence MISS 88.8 vs 90.0 Exp

Pending Home Sale MISS -1.1% vs +0.5% Exp

New Home Sales MISS +0.7% vs +0.8% Exp

And that P/E ratio of 20, already irrational, is also a fake.

David Stockman wrote an article about the rampant abuse of “one time only” charges by publicly traded companies. Looking at a few previous years, he estimated that the true P/E ratio of the S&P 500 was 3 or 4 worse than officially stated because companies were routinely categorizing recurring costs as one time only and excluding them from the numbers.

So, how would a 2% increase in earnings look with a P/E ratio of 23 or 24?

Good writeup Admin.

Makes me want to eat many carbs [this includes beer] stuffed into a turkey [me], raise my blood sugar to extreme levels and fuggedbout the disaster that looms.

Happy Dead Bird Day!!

TE:

You are right about the health insurance costs.

A recent Milliman survey showed that for a family of four, employee premiums were $6,000 and employer premiums were $14,000.

These are premiums only, and do not include out of pocket costs for deductible, co-pays, and co-insurance.

Don Levit

Well assembled, Admin. Real statistics shown in charts are great for those of us that can still think and are willing to face the truth. But we are a minority. The sheep are pacified by the calming voices of the shepherds as they are lead from pasture to shearing to pasture to eventual slaughter. Most will be completely surprised when lead to the abattoir, and the majority will not rise up. The technology that NickelthroweR commented on above IS COMING. I also keep on the forefront of these things and the next decade will see changes that make the digital revolution look like peanuts. The wealthy will become ultra-wealthy and the ultra-wealthy will become something we’ve never seen before. The day of the trillionaire is coming soon. But the majority in the developed nations will not profit from these coming changes. The elites will have to have a major culling of the flock world-wide, because they will not want to care for all the useless sheep…

I need some information.Because i don’t know. So the market was under 10,000 for a long time. It seems to keep climbing.

It would be a good sign? Like an economy doing really well? And i don’t see it.

80 billion a month is pumped in by the fed? And Europeans are in such desperate shape they pick our market, To do something with their money.While they still have some.

So what else is making the market go up. It’s all some kind of mass delusion? A bubble waiting to pop? A bad thing waiting to happen,Hidden in plain sight?

@yahsure – read this.

10/29/2014 –

“$0 — that is how much the Federal Reserve will buy in mortgage and treasury bonds next month. As widely anticipated the Federal Open Market Committee announced the end of its multi-year asset purchases Wednesday.

In case you haven’t been watching, every month in 2013 the Federal Reserve purchased $85 billion worth of bonds, the peak of what was ultimately 37 months in a row of buying. The program, known as Quantitative Easing, was a key component of the central bank’s attempt to simulate job growth in an American economy that was still struggling to come back from the 2008 recession. After months of speculation brought on a when then Fed Chair Ben Bernanke implied we might have been closer to the end of the program than the beginning, in December 2013 the FOMC cut monthly asset purchases to $75 billion kicking off the tapering process. The committee promised to keep a close eye on incoming economic data but told investors— barring significant changes to its outlook that the economy was moderately expanding — they should expect the same small measured cuts at subsequent meetings.

Despite occasional hiccups from one data set or another, the economy broadly has continued to improve. The Fed cut $10 billion from its asset purchases at each of its six meetings leading up to October. Buried on the tenth page of minutes chronicling the group’s June gathering was news the program would end with a $15 million cut following the October meeting.

That brings us to today.

In space the statement once reserved for details on how much the Fed would spend on a given asset (mortgage back securities or longer-term Treasury securities) compared to the prior month, it now reads:

The Committee judges that there has been a substantial improvement in the outlook for the labor market since the inception of its current asset purchase program. Moreover, the Committee continues to see sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability. Accordingly, the Committee decided to conclude its asset purchase program this month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.”

http://www.forbes.com/sites/samanthasharf/2014/10/29/fed-cuts-monthly-asset-purchases-to-0-as-qe-comes-to-long-awaited-end/

The numbers don’t lie, but even more apparent are the boots on the ground experience I have garnered as a small business owner over the last seven years. Opening my restaurant in Cape May County, NJ durning the tail end of the last administration we saw the very last gasp of the contrived real economy. Housing was crashing, the stock market fell like a rock and the facade of the main street economy was being stripped away like make-up on Sunday morning at the Kardashians, and it wasn’t very pretty. As a Fed/PPP induced stock market finds ever new highs, try finding anyone who has found real meaningful employment opportunities and has the confidence to go out and spend. Not going to happen!

Most of the labor market in my local area has curtailed their consumer spending to subsistence levels, and when asked about it, the responses are very similar. They site: hours cut back due to ACA compliance, inflation at the grocery store, rising cost of health insurance coverage, and fear. I know this just anecdotal evidence, but this is what I hear as I engage my customers all day long, and there seems to be a consistency to it. Why? Because the Fed/Treasury/BLS/Commerce numbers are BS.

Real people with real families, with real bills to pay are twisting in the wind out here in the real world. Being located in a secondary/tertiary market of the Philadelphia economy the effect is exaggerated and pronounced. There were days this past summer where one could have laid in the busiest street in this shore resort town and found it impossible to be run over. No cars, no people, and of course no spending. Now ride around Cape May County and witness boarded up buildings, section 8 motels, shuttered businesses and no prospect of anything changing anytime soon. But Dow 23k here we come with direct Fed fueled injection of high octane printed money so everything will be OK for the 1%. If you are of the other 99% and your money goes toward things like your mortgage, your food and just getting by, be patient, everything will be alright once the central planners have total control and can rebuild it in Marx image. “One potato for you, now go back to your 600sqft tenement, the doctor will see you in 8 months, we’ll call you on your Obozo phone.”

NickelThrower is absolutely right. Unemployment is now a systemic problem caused by automation which in turn is caused by the corporate drive to reduce cost of production to as close to zero as possible. Ultimately that means no jobs for anyone. 99% of the population will be poor. When that happens capitalism no longer functions because only the owners of businesses will have any money.

It is time to realize that most poor people are not poor by choice, it is a by-product of automation. If you think you are invulnerable to automation and you have an actual job, think again. IBM and others are working on computers that can actually think like humans, that will end intellectual jobs – lawyers, doctors, chemists, even computer programmers. When we are all unemployed, capitalism will have to be replaced because only 0.1% of the population will have capital. The rest will be starving.

Rise Up, so i realized much of that,The last part was kinda confusing. I notice the markets get jittery when the fed talks about tapering. I just don’t get the numbers. Is the 17000 number mostly from the money pumped in?

People keep talking like the numbers will keep going up. Really? What would drive that? The economy?

First negative “interest” rates, then, in theory this would (normally) lead to bank runs (as everyone would want the money on hand to spend. But everyone knows there’s only about 1% of the money on “deposit” in actual existence. Hence you have to forbid cash as a next step. Still people, previously reluctant (causing the alleged “deflation”) might still want to spend. This can but needn’t, lead to hyperinflation or else to a shadow economy of epic proportions. Which then must be fought “at all cost” once again and then lead to a police state …

And just so that no one falls for this bull shit that the drop in gasoline prices is going to be some great boost to the economy let me shoot that down with some facts.

The YOY price change for a gallon of gas in the US is a decline of 12%. A year ago the average price in the US was $3.26 and today $2.80

http://charts.gasbuddy.com/ch.gaschart?Country=Canada&Crude=f&Period=12&

Areas=USA%20Average,,&Unit=US%20$/G

Average family spends about 4% of their income on gas.

http://autos.aol.com/article/gas-prices-fuel-economy-income-American/

Average family spends about 13% of their income on food.

http://www.theatlantic.com/business/archive/2013/03/cheap-eats-how-america-spends-money-on-food/273811/

Food prices for 2014 have gone up by 19%.

http://www.naturalnews.com/044711_increasing_food_prices_California_drought_subsidized_crops.html

So let’s take a family income of $50,000:

Food is 13% of their annual budget or $6500. A 19% increase in that food cost = $1,235

Gas is 4% of their annual budget or $2000. A 12% savings in price of gas = $240

So how is that $240 savings going to boost spending when their increase in food cost has already diverted that money and more? There is no savings in the average household budget due to the price drop in gas when you also consider their increase in food costs.

The average family budget is worse off not better.

Anonymous above was me

The average family budget is worse off not better.

True Anonymous, they have beat this gas thing to death with their bull shit.

While still important it has much less impact than it did in prior decades.

I cringe when thinking of my prior cars, some got 10 to 12 miles on a gallon. I have a new car with these new CVT transmissions, it gets 38 mpg on the highway, and thats not make believe like the prior stats were. This is never mentioned as well when they blab about the great tax cut from gasoline prices falling.

Pity the poor guy trying to raise a family today when he goes into a supermarket to buy food for two or three kids and a wife and himself for a week. Not only are the prices from another planet, but the packages have half the content they used too.