Guest Post by

The ongoing oligarch theft labeled an “economic recovery” by pundits, politicians and mainstream media alike, is one of the largest frauds I’ve witnessed in my life. The reality of the situation is finally starting to hit home, and the proof is now undeniable.

Earlier this year, I published a powerful post titled, Use of Alternative Financial Services, Such as Payday Loans, Continues to Increase Despite the “Recovery,” which highlighted how a growing number of Americans have been taking out unconventional loans, not simply to overcome an emergency, but for everyday expenses. Here’s an excerpt:

Families’ savings not where they should be: That’s one part of the problem. But Mills sees something else in the recovery that’s more disturbing. The number of households tapping alternative financial services are on the rise, meaning that Americans are turning to non-bank lenders for credit: payday loans, refund-anticipation loans, pawnshops, and rent-to-own services.

According to the Urban Institute report, the number of households that used alternative credit products increased 7 percent between 2011 and 2013. And the kind of household seeking alternative financing is changing, too.

It’s not the case that every one of these middle- and upper-class households turned to pawnshops and payday lenders because they got whomped by an unexpected bill from a mechanic or a dentist. “People who are in these [non-bank] situations are not using these forms of credit to simply overcome an emergency, but are using them for basic living experiences,” Mills says.

Of course, it’s not just “alternative financial services.” Increasingly desperate American citizens are also tapping whatever retirement savings they may have, including taking the 10% tax penalty for the privilege of doing so. In fact, 30 million Americans have done just that in the past year alone, in the midst of what is supposed to be a “recovery.”

From Time:

With the effects of the financial crisis still lingering, 30 million Americans in the last 12 months tapped retirement savings to pay for an unexpected expense, new research shows. This undercuts financial security and underscores the need for every household to maintain an emergency fund.

Boomers were most likely to take a premature withdrawal as well as incur a tax penalty, according to a survey from Bankrate.com. Some 26% of those ages 50-64 say their financial situation has deteriorated, and 17% used their 401(k) plan and other retirement savings to pay for an emergency expense.

Two-thirds of Americans agree that the effects of the financial crisis are still being felt in the way they live, work, save and spend, according to a report from Allianz Life Insurance Co. One in five can be called a post-crash skeptic—a person that experienced at least six different kinds of financial setback during the recession, like a job loss or loss of home value, and feel their financial future is in peril.

So now we know what has kept meager spending afloat during this pitiful “recovery.” A combination of “alternative loans” and a bleeding of retirement accounts. The transformation of the public into a horde of broke debt serfs is almost complete.

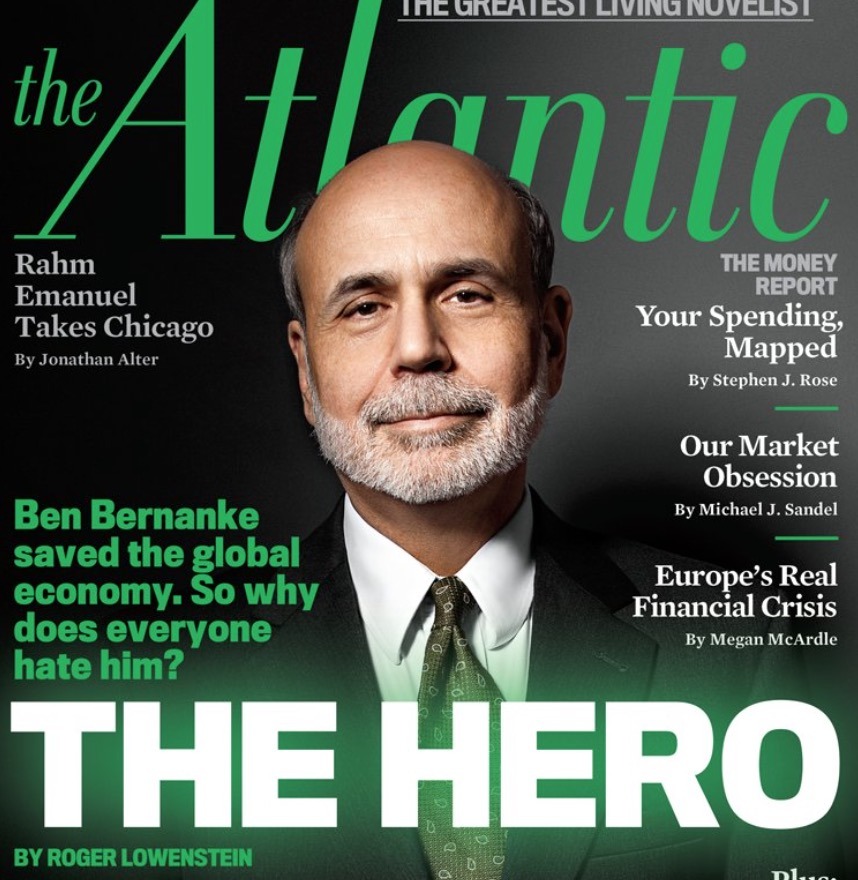

Don’t forget to send your thank you card to you know who:

For related articles, see:

The Oligarch Recovery – Low Income Americans Can’t Afford to Live in Any Metro Area

The Oligarch Recovery – Renting in America is Most Expensive Ever

Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

Census Data Proves It – There Was No Economic Recovery Unless You Were Already Rich

In Liberty,

Michael Krieger

Maybe the ones tapping their retirements will end up being the smart -or lucky- ones.

At least they’ll get something out of them while there is still something there to get.

@Anon, you betcha.

We continue to think that the old ways – such as never cashing out retirements – will work forever. Even as we see the game changing.

I seriously doubt my private savings will continue to be private once all these public sector unions pension funds go completely tits up. As we know, the can will continue to be kicked until it can’t. The day the stock market doesn’t recover, and returns to real valuations, is the day before the idea of stealing from us stupid schmucks becomes a nationwide battle cry. Silver lining is that the value would already be dramatically reduced, so they would be confiscating, ‘er investing, investing, yeah, much less that it appears I have now.

And those not invested in the market, but with large amounts of cash stored “safely” in banks. Good luck.

In 2009/2010 the FDIC promised it would “cover” the banksters’ derivatives before our deposits CONgress and O’bama made it official last year. The derivative/credit default/bullshit financial market has NEVER been larger. NEVER. And this is considered “fixed”?

What astounds me is that those that stand to lose the most under such a Cyprus’ing, are those that shout me down the loudest when I try to bring it up and talk about it. My hub will leave the room before even discussing with me the remote possibility of losing everything to the government/banksters, even WITH THE LAWS IN PLACE TO DO EXACTLY THAT. Sorry, for yelling, it makes me crazy when otherwise “smart” people trust myths more than they view, and learn, from ACTUAL history and ACTUAL American LAW. *sigh*

Greetings,

I see doom stuff like this all the time and anyone with a brain knows exactly what is going on. It is no longer in question that our elites have abandoned us so, with that in mind, we should move on to some workable solutions.

Where to begin. . . .

One of the easiest ways to figure out what works best is to see what makes the authorities the angriest and in my opinion, nothing made Uncle Sugar angrier than the Black Panthers.

Now, the Panthers did one of the smartest things possible in that they did not directly fight the system but set up their own alternative system. They had their own food distribution networks, their own schools and their own security forces. To get ourselves out of this mess, we must do the same.

Education: the first thing that must be done is to convince parents to stop sending their children to public schools. After all, it is difficult to undo 13 years of indoctrination and police state tactics. I’ve convinced a number of parents to do this by gently introducing them to literature and news articles that point out the simple fact that our children are now the worst educated in the industrialized world and then directing them to free online resources like the Khan Academy. After all, sending your child to public school is no different than sending them to the DMV every day for 13 years.

The underground economy: everyone must have roots in the underground economy. Make a plan so at least 20% of your income comes from that source. It only works if you participate in it.

Learn new skills: Americans have the love of learning beaten out of them by the public education system. You must relearn the love of learning and you can start by learning a new skill this week. It could be anything from bricklaying to making your own beer but the learning should never stop.

The power of the group: Find like-minded individuals and look for something to invest in. Stop using the corrupt banking industry and set up your own informal bank. There is no law that says we can’t loan money to one another or pool our money together.

It is a start.

The few I know that will talk about it are getting out and into pm.There is a distrust of the whole system.No one wants to be a Goldman muppet,or a Greece stain

TE….yes, Bail-In’s are set in place to screw depositors. Our slime gov’t will do anything to protect the slime Banksters.

Also, like Lehman, even thoug security laws prohibit using private brokerage account funds for by the brokerage prop trading desk, they did it anyway; thus, even the private brokerage accounts aren’t safe.

Nickel….good thoughts and concern for us all.

the fed has become the payday loan for the nation. the markets go down early with no positive news, rebound, the PPT in action. the middle class has not seen anything yet. the russell 5000 may become the russell 1000 as the other 4000 kick the bucket/. silicon valley speaks of start ups, that gig is up just like alibaba and other IPO’s wall street has run out of suckers, now the money trades in a circle, they will be eating their own soon.

A friend of mine that is retired, is not able to live on SS and over the last 8 years or so has been wanting to work but not able to find much. The only positive thing for him is an inheritance that allowed him to pay off his house about 10 years ago. The bad thing is he took out a line of credit on his house and that has been supplementing his short fall for many years now. What he owes on his line is just getting bigger by the month. He did finally get a job in June, but he just called me about an hour ago and said the company he is at just announced a layoff and he is again without work.

I have been telling him he needs to sell his house while he still can(I believe the housing market is about to head down again) but he thinks housing is going to keep going up and he’s just making more money hanging on.

Well we’ll see.

I like a lot of what nickelthrower said but the way big brother is going, I doubt a large enough group would form. They would be on it like flies on sheet as they were then on the BP.

When I see the cover of a magazine like this, I think of a bar mitzvah roll call. Look at all those names. It’s the same with any major publication–all Jews. I mean, did ANY Jews die in the so-called holoau$t (TM)?

If worse comes to worse there will be a lot of crazy passed off people out there.