“Thousands upon thousands are yearly brought into a state of real poverty by their great anxiety not to be thought of as poor.” – Robert Mallett

I hear the term de-leveraging relentlessly from the mainstream media. The storyline that the American consumer has been denying themselves and paying down debt is completely 100% false. The proliferation of this Big Lie has been spread by Wall Street and their mouthpieces in the corporate media. The purpose is to convince the ignorant masses they have deprived themselves long enough and deserve to start spending again. The propaganda being spouted by those who depend on Americans to go further into debt is relentless. The “fantastic” automaker recovery is being driven by 0% financing for seven years peddled to subprime (aka deadbeats) borrowers for mammoth SUVs and pickup trucks that get 15 mpg as gas prices surge past $4.00 a gallon. What could possibly go wrong in that scenario? Furniture merchants are offering no interest, no payment deals for four years on their product lines. Of course, the interest rate from your friends at GE Capital reverts retroactively to 29.99% at the end of four years after the average dolt forgot to save enough to pay off the balance. I’m again receiving two to three credit card offers per day in the mail. According to the Wall Street vampire squids that continue to suck the life blood from what’s left of the American economy, this is a return to normalcy.

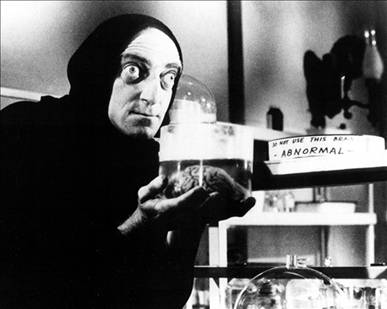

The definition of normal is: “The usual, average, or typical state or condition”. The fallacy is calling what we’ve had for the last three decades of illusion – Normal. Nothing could be further from the truth. We’ve experienced abnormal psychotic behavior by the citizens of this country, aided and abetted by Wall Street and their sugar daddies at the Federal Reserve. You would have to be mad to believe the debt financed spending frenzy of the last few decades was not abnormal.

The Age of Illusion

“Illusions commend themselves to us because they save us pain and allow us to enjoy pleasure instead. We must therefore accept it without complaint when they sometimes collide with a bit of reality against which they are dashed to pieces.” – Sigmund Freud

In my last article Extend & Pretend Coming to an End, I addressed the commercial real estate debacle coming down the pike. I briefly touched upon the idiocy of retailers who have based their business and expansion plans upon the unsustainable dynamic of an ever expanding level of consumer debt doled out by Wall Street banks. One only has to examine the facts to understand the fallacy of a return to normalcy. We haven’t come close to experiencing normalcy. When retail sales, consumer spending and consumer debt return to a sustainable level of normalcy, the carcasses of thousands of retailers will litter the highways and malls of America. It will be a sight to see. The chart below details the two decade surge in retail sales, with the first ever decline in 2008. Retail sales grew from $2 trillion in 1992 to $4.5 trillion in 2007. The Wall Street created crisis in 2008/2009 resulted in a decline to $4.1 trillion in 2009, but the resilient and still delusional American consumer, with the support of their credit card drug pushers on Wall Street, set a new record in 2011 of $4.7 trillion.

A two decade increase in retail sales of 135% might seem reasonable and normal if wages and household income had grown at an equal or greater rate. But total wages only grew by 125% over this same time frame. Interestingly, the median household income only grew from $30,600 to $49,500, a 62% increase over twenty years. It seems the majority of the benefits accrued to the top 20%, with their aggregate share of the national income exceeding 50% today, versus 47% in 1992 and 43% in the early 1970s. The top 5% are taking home in excess of 21% of the national income versus less than 19% in 1992 and 16% in the early 1970s. It appears the financialization of America, after Nixon closed the gold window and allowed unlimited money printing by the Federal Reserve, has benefitted the few, at the expense of the many. The bottom 80% of households has seen their share of the national income steadily decrease since the early 1970s. There are 119 million households in the United States and 95 million of these households have seen their wages and income stagnate. One might wonder how the 80% were able to fuel a two decade surge in retail sales with such pathetic wage growth.

Your friendly Wall Street banker stepped into the breach and did their part to aid a vast swath of Americans to enslave themselves in debt. As the chart above reveals, the slave owners on Wall Street have been the chief beneficiary of the decades long debt deluge. It seems that charging 18% interest on hundreds of billions in credit card debt can be extremely profitable for the shyster charging the interest. Decades of mailing millions of credit card offers, inundating financially ignorant Americans with propaganda media messages convincing them they needed a bigger house, fancier car, or latest technological gadget and creating complex derivatives that permitted banks to market debt to people guaranteed not to pay them back but not care since they sold the packages of these toxic AAA rated loans to pension funds and little old ladies, has done wonders for earnings per share, stock option awards, executive salaries and bonus pools. It hasn’t done wonders for the net worth of the average American who has been entrapped in the chains of debt, forged link by link over decades of purposeful deception and willful delusion.

The 135% increase in retail sales over two decades may have been slightly enhanced by the 213% increase in consumer credit outstanding. Consumer revolving credit rose from $800 billion to the current level of $2.5 trillion over the last two decades. Those 15 credit cards in our possession were so easy to use that we financed our trips to Dollywood, Sandals, and Euro-Disney, in addition to financing our 72 inch 3D HDTVs, granite countertops, stainless steel appliances, decks, pools, recliners with a built in fridges, home theatre rooms, Coach pocketbooks, Jimmy Cho shoes, Rolex watches, yachts, bigger and better boobs, and of course our smokes and beer. Much has been made about the great de-leveraging by the American consumer. There’s just one inconvenient fact – it hasn’t happened – yet.

Total consumer credit outstanding peaked at $2.58 trillion in July 2008. Today it stands at $2.50 trillion. Revolving credit card debt peaked at $972 billion in September 2008 and subsequently declined to $790 billion by April 2011. It now stands at $801 billion, as living well beyond our means has resumed its appeal. Meanwhile, non-revolving credit for automobiles, boats, student loans, and mobile homes peaked at $1.61 trillion in July 2008 and “crashed” all the way down to $1.58 trillion in May 2010. Once Bennie fired up the printing presses, the government car companies decided to make subprime auto loans again and the Federal government started doling out student loans like a pez dispenser, all was well in the non-revolving consumer loan world. The debt outstanding has soared to $1.7 trillion, a full $90 billion above the pre-crash peak. So, after three and a half years of “austerity” and supposed deleveraging, consumer debt outstanding has fallen by 3%.

The Big Lie of austerity and consumer deleveraging is unquestioned by the talking heads in the mainstream media. They are incapable or unwilling to examine the actual data which substantiates the fact that Americans have NOT deleveraged and have NOT taken austerity to heart. The most basic facts fly in the face of consumers even having the wherewithal to pay down their debt. Median household income has declined from $50,300 in 2008 to $49,400 today. There are 5 million less people employed today than employed in 2008. Total wages in the country have only grown from $6.6 trillion in 2008 to $6.8 trillion today. This increase was concentrated among the .01%, who do not carry credit card debt. They profit from credit card debt. Real disposable personal income has fallen by 5% since the peak in 2008 as Bernanke’s Wall Street bailout zero interest rate policy has caused prices for everything except our houses to surge. The people carrying most of the credit card debt are the least able to pay it off. These are the same people who have swelled the food stamp rolls from 28 million in 2008 to 46.5 million today.

A CNBC bubble headed arrogant bimbo might sarcastically ask, “If the American consumer isn’t deleveraging, than how did revolving credit card debt drop by $182 billion over three years?” Rather than do the minimal research needed to find the answer, they would rather parrot the company/government line. The chart below, compiled from Federal Reserve data, provides the answer. The Wall Street banks have written off $193.3 billion of bad debt since 2008. Now for some basic math, that will probably be over the head of most Wall Street analysts and CNBC parrots. If you start with $972 billion of credit card debt and you write-off $200 billion (assuming another $7 billion in the 4th Quarter of 2011) and your ending balance is $801 billion, how much debt did the American consumer pay down? It’s a trick question. The American consumer ADDED $29 billion of credit card debt since 2008 to go along with the $90 billion of auto and student loan debt ADDED onto their aching backs. So much for the deleveraging storyline. It’s comforting to convince ourselves we’ve changed, but we haven’t. And the powers that be need you to keep believing, so they can continue to keep you enslaved and under their thumbs.

Consumer Credit Card Debt and Charge-off Data (in Billions):

| Outstanding Revolving Consumer Debt | Outstanding Credit Card Debt | Quarterly Credit Card Charge-Off Rate | Quarterly Credit Card Charge-Off in Dollars | |

| Q3 2011 | $793.4 | $777.5 | 5.63% | $10.9 |

| Q2 2011 | $787.4 | $771.7 | 5.58% | $10.8 |

| Q1 2011 | $779.6 | $764.0 | 6.96% | $13.3 |

| 2010 | $826.7 | $810.2 | $75.1 | |

| Q4 2010 | $825.7 | $810.2 | 7.70% | $15.6 |

| Q3 2010 | $806.9 | $790.8 | 8.55% | $16.9 |

| Q2 2010 | $817.4 | $801.1 | 10.97% | $22.0 |

| Q1 2010 | $828.5 | $811.9 | 10.16% | $20.6 |

| 2009 | $894.0 | $876.1 | $83.2 | |

| Q4 2009 | $894.0 | $876.1 | 10.12% | $22.2 |

| Q3 2009 | $893.5 | $875.6 | 10.1% | $22.1 |

| Q2 2009 | $905.2 | $887.1 | 9.77% | $21.6 |

| Q1 2009 | $923.3 | $904.8 | 7.62% | $17.2 |

| Q4 2008 | $989.1 | $969.3 |

(Source: CardHub.com, Federal Reserve)

Loving Our Servitude

“There will be, in the next generation or so, a pharmacological method of making people love their servitude, and producing dictatorship without tears, so to speak, producing a kind of painless concentration camp for entire societies, so that people will in fact have their liberties taken away from them, but will rather enjoy it, because they will be distracted from any desire to rebel by propaganda or brainwashing, or brainwashing enhanced by pharmacological methods. And this seems to be the final revolution.” Aldous Huxley

The American people have come to love their servitude through a combination of self- delusion, corporate mass media propaganda, and an irrational desire to appear successful without making the necessary sacrifices required to become successful. The drug of choice used to corral the masses into their painless concentration camp of debt has been Wall Street peddled financing. Can you think of a better business model than being a Wall Street bank? You hand out 500 million credit cards to 118 million households, even though 60 million of the households make less than $50,000. You then create derivatives where you package billions of subprime credit card debt and convince clueless dupes to buy this toxic debt as if it was AAA credit. When the entire Ponzi scheme implodes, you write-off $200 billion of bad debt and have the American taxpayer pick up the tab by having your Ben puppet at the Federal Reserve seize $450 billion of interest income from senior citizens and re-gift it to you through his zero interest rate policy. You then borrow from the Federal Reserve at 0% and charge an average interest rate of 15% on the $800 billion of credit card debt outstanding, generating $120 billion of interest and charging an additional $22 billion of late fees. Much was made of the closing of credit card accounts after the 2008 financial implosion, but most of the accounts closed were old unused credit lines. Now that the American taxpayer has picked up the tab for the 2008 debacle, the Wall Street banks are again adding new credit card accounts.

With 40% of all credit card users carrying a revolving balance averaging $16,000, they are incurring interest charges of $2,400 per year. Some of the best financial analysts in the blogosphere have been misled by the propaganda spewed by the Wall Street media shills at Bloomberg and CNBC. The following chart, which includes mortgage and home equity debt, gives the false impression households are sensibly deleveraging, as household debt as a percentage of disposable personal income has fallen from 115% in June 2009 to 101% today. As I’ve detailed ad nauseam, $200 billion of the $1.2 trillion of “household deleveraging” was credit card write-offs. The vast majority of the remaining $1 trillion of “deleveraging” could possibly be related to the 5 million completed foreclosures since 2009. Of course, this pales in comparison to the unbelievably foolhardy mortgage equity withdrawal of $3 trillion between 2003 and 2008 by the 1% wannabes. Bloomberg might be a tad disingenuous by excluding the $1 trillion of student loan from their little chart. If student loan debt is included, household debt outstanding surges to $11.5 trillion.

Based on the Bloomberg chart you would assume wrongly that American consumers are using their rising incomes to pay down debt. Besides not actually reducing their debts, the disposable personal income figure provided by the government drones at the BEA includes government transfer payments for Social Security, Medicare, Medicaid, unemployment compensation, food stamps, veterans benefits, and the all- encompassing “other”. Disposable personal income in the 2nd quarter of 2008 reached $11.2 trillion. It has risen by $500 billion, to $11.7 trillion by the end of 2011. Coincidentally, government social transfers have risen by $400 billion over this same time frame, a 20% increase. Excluding government transfers, disposable personal income has risen by a dreadful 1.1%. For the benefit of the slow witted in the mainstream media, every penny of the social welfare transfers has been borrowed. Only a government bureaucrat could believe that borrowing money from the Chinese, handing it out to unemployed Americans and calling it personal income is proof of deleveraging and austerity.

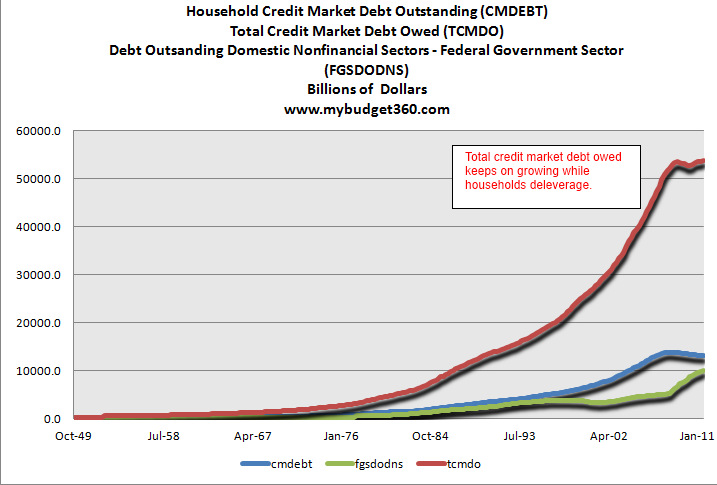

Household debt as a percentage of wages in 2008 was 185%. Today, after the banks have written off $1.2 trillion of debt, this figure stands at 169%. Meanwhile, total credit market debt in our entire system now stands at an all-time high of $54 trillion, up $3 trillion from 2007. It stands at 360% of GDP. In 1992, total credit market debt of $15.2 trillion equaled 240% of GDP ($6.3 trillion). Was it a sign of a rational balanced economic system that total credit market debt grew by 355% in the last two decades while GDP grew by only 238%? I think it is pretty clear the last two decades have not been normal or built upon a sustainable foundation. In the three decades prior to 1990 household debt as a percentage of disposable personal income stayed in a steady range between 60% and 80%. The current level of 101% is abnormal. In order to achieve a sustainable normal level of 80% will require an additional $2 trillion of debt destruction. No one is prepared for this inevitable end result. The impact of this “real” deleveraging will devastate our consumer dependent society.

The colossal accumulation of debt in the last two decades was the cause and abnormally large retail sales were the effect. The return to normalcy will not be pleasant for consumers, retailers, mall owners, local governments or bankers.

Demographics are a Bitch

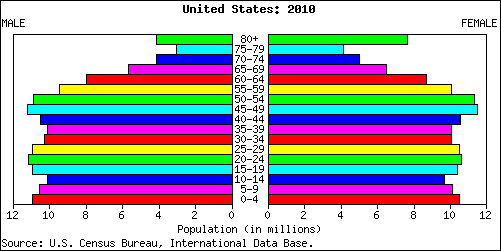

In addition to an unsustainable level of debt, the pig in the python (also known as the Baby Boomer generation) will relentlessly impact the future of consumer spending and the approaching mass retail closures. Baby Boomers range in age from 51 to 68 today. The chart below details the retail spending by age bracket. Almost 50% of all retail spending is done by those between 35 years old and 54 years old. This makes total sense as these are the peak earnings years for most people and the period in their lives when they are forming households, raising kids and accumulating stuff. As you enter your twilight years, income declines, medical expenses rise, the kids are gone, and you’ve bought all the stuff you’ll ever need. Spending drops precipitously as you enter your 60’s. The spending wave that began in 1990 and reached its apex in the mid-2000s has crested and is going to crash down on the heads of hubristic retail CEOs that extrapolated unsustainable debt financed spending to infinity into their store expansion plans. The added kicker for retailers is the fact Boomers haven’t saved enough for their retirements, have experienced a twelve year secular bear market with another five or ten years to go, are in debt up to their eyeballs, and have seen the equity in their homes evaporate into thin air in the last seven years. This is not a recipe for a spending up swell.

Demographics cannot be spun by the corporate media or manipulated by BLS government drones. They are factual and unable to be altered. They are also predictable. The four population by age charts below paint a four decade picture of reality that does not bode well for retailers over the coming decade. The population by age data correlates perfectly with the spending spree over the last two decades.

- 26% of the population in the prime spending years between 35 and 54 years old.

- Only 14% of the population over 65 years old indicating reduced spending.

- 31% of the population in the prime spending years between 35 and 54 years old.

- Only 13% of the population over 65 years old indicating reduced spending.

- 28% of the population in the prime spending years between 35 and 54 years old.

- A rising 14% of the population over 65 years old indicating reduced spending.

- 24% of the population in the prime spending years between 35 and 54 years old.

- A rising 17% of the population over 65 years old indicating reduced spending.

The irreversible descent in the percentage of our population in the 35 to 54 year old prime spending age bracket will have and is already having a devastating impact on retail sales. In addition, the young people moving into the 25 to 34 year old bracket are now saddled with $1 trillion of student loan debt and worthless degrees from the University of Phoenix and the other for-profit diploma mills, luring millions with their Federal government easy loan programs. The fact that 40% of all 20 to 24 year olds in the country are not employed and 26% of all 25 to 34 year olds in the country are not working may also play a role in holding back spending, as jobs are somewhat helpful in generating money to buy stuff. Even with Obama as President they will have a tough time getting onto the unemployment rolls without ever having a job. The 55 and over crowd, who have lived above their means for three decades, will be lucky if they have the resources to put Alpo on the table in the coming years. The unholy alliance of debt, demographics and delusion will result in a retail debacle of epic proportions, unseen by retail head honchoes and the linear thinkers in the media and government.

We’re Not in Kansas Anymore Toto

“We tell ourselves we’re in an economic recovery, meaning we expect to return to a prior economic state, namely, a turbo-charged “consumer” economy fueled by easy credit and cheap energy. Fuggeddabowdit. That part of our history is over. We’ve entered a contraction that will seem permanent until we reach an economic re-set point that comports with what the planet can actually provide for us. That re-set point is lower than we would like to imagine. Our reality-based assignment is the intelligent management of contraction. We don’t want this assignment. We’d prefer to think that things are still going in the other direction, the direction of more, more, more. But they’re not. Whether we like it or not, they’re going in the direction of less, less, less. Granted, this is not an easy thing to contend with, but it is the hand that circumstance has dealt us. Nobody else is to blame for it.” – Jim Kunstler

The brilliant retail CEOs who doubled and tripled their store counts in the last twenty years and assumed they were geniuses as sales soared are getting a cold hard dose of reality today. What they don’t see is an abrupt end to their dreams of ever expanding profits and the million dollar bonuses they have gotten used to. I’m pretty sure their little financial models are not telling them they will need to close 20% of their stores over the next five years. They will be clubbed over the head like a baby seal by reality as consumers are compelled to stop consuming. As we’ve seen, just a moderation in spending has resulted in a collapse in store profitability. Retail CEOs have failed to grasp that it wasn’t their brilliance that led to the sales growth, but it was the men behind the curtain at the Federal Reserve. The historic spending spree of the last two decades was simply the result of easy to access debt peddled by Wall Street and propagated by the easy money policies of Alan Greenspan and Ben Bernanke. The chickens came home to roost in 2008, but the Wizard of Debt – Bernanke – has attempted to keep the flying monkeys at bay with his QE1, QE2, Operation Twist, and ZIRP. As the economy goes down for the count again in 2012, he will be revealed as a doddering old fool behind the curtain.

There are 1.1 million retail establishments in the United States, but the top 25 mega-store national chains account for 25% of all the retail sales in the country. The top 100 retailers operate 243,000 stores and account for approximately $1.6 trillion in sales, or 36% of all the retail sales in the country. They are led by the retail behemoth Wal-Mart and they dot the suburban landscape from Maine to Florida and New York to California. These super stores anchor every major mall in America. There are power centers with only these household names jammed in one place (example near my home: Best Buy, Target, Petsmart, Dicks, Barnes & Noble, Staples). These national chains had already wiped out the small town local retailers by the early 2000s as they sourced their goods from China and dramatically underpriced the small guys. The remaining local retailers have been closing up shop in record numbers in the last few years as the ability to obtain financing evaporated and customers disappeared. The national chains have more staying power, but their blind hubris and inability to comprehend the future landscape will be their downfall.

Having worked for one of the top 100 retailers for 14 years, I understand every aspect of how these mega-chains operate. They all approach retailing from a very scientific manner. They have regression models to project sales based upon demographics, drive times, education, average income, and the size of the market. They will build any store that achieves a certain ROI, based on their models. The scientific method works well when you don’t make ridiculous growth assumptions and properly take into account what your competitors are doing and how the economy will realistically perform in the future years. This is where it goes wrong as these retail chains get bigger, start believing their press clippings and begin ignoring the warnings of sober realists within their organizations. When the models show that cannibalization of sales from putting stores too close together will result in a decline in profits, the CEO will tweak the model to show greater same store growth and a larger increase in the available market due to higher economic growth. They assume margins will increase based upon nothing. At the same time, they will ignore the fact their competitor is building a store 2 miles away. Eventually, using foolhardy assumptions and ignoring facts leads to declining sales and profitability.

There is no better example of this than Best Buy. They increased their U.S. store count from 500 in 2002 to 1,300 today. That is a 160% increase in store count. For some perspective, national retail sales grew by 42% over this same time frame. Their strategy wiped out thousands of mom and pop stores and drove their chief competitor – Circuit City – into liquidation. But their hubris caught up to them. There sales per store has plummeted from $36 million per store in 2007 to less than $28 million per store today, a 24% decline in just five years. They have cannibalized themselves and have seen a $6 billion increase in revenue lead to $100 million LESS in profits. It appears the 444 stores they have built since 2007 have a net negative ROI. Top management is now in full scramble mode as they refuse to admit their strategic errors. Instead they cut staff and use upselling gimmicks like service plans, technical support and deferred financing to try and regain profitability. They will not admit they have far too many stores until it is too late. They will follow the advice of an earnings per share driven Wall Street crowd and waste their cash buying back stock. We’ve seen this story before and it ends in tears. I was in a Best Buy last week at 6:00 pm and there were at least 50 employees servicing about 10 customers. Tick Tock.

You would have to be blind to not have noticed the decade long battles between the two biggest drug store chains and the two biggest office supply chains. Walgreens and CVS have been in a death struggle as they have each increased their store counts by 80% to 90% in the last 10 years. Both chains have been able to mask poor existing store growth by opening new stores. They are about to hit the wall. I now have six drug stores within five miles of my house all selling the exact same products. Every Wal-Mart and Target has their own pharmacy. At 2:00 pm on a Sunday afternoon I walked into the Walgreens near my house and there were six employees, a pharmacist and myself in the store. This is a common occurrence in this one year old store. It will not reach its 3rd birthday.

Further along on the downward death spiral are Staples and Office Depot. They both increased their store counts by 50% to 60% in the last decade. Despite adding almost 200 stores since 2007, Staples has managed to reduce their profits. Sales per store have declined by 20% since 2006. Office Depot has succeeded in losing almost $2 billion in the last five years. These fools are actually opening new stores again despite overseeing a 36% decrease in sales per store over the last decade. These stores sell paper clips, paper, pens, and generic crap you can purchase at 100,000 other stores across the land or with a click of you mouse. Their business concept is dying and they don’t know it or refuse to acknowledge it.

Even well run retailers such as Kohl’s and Bed Bath & Beyond have hit the proverbial wall. Remember that total retail sales have only grown by 42% in the last ten years while Kohl’s has increased their store count by 180% and Bed Bath & Beyond has increased their store count by 175%. Despite opening 200 new stores since 2007, Kohl’s profits are virtually flat. Sales per store have deflated by 26% over the last decade as over-cannibalization has worked its magic. Bed Bath & Beyond has managed to keep profits growing as they drove Linens & Things into bankruptcy, but they risk falling into the Best Buy trap as they continue to open new stores. Their sales per store are well below the levels of 2002. Again, there is very little differentiation between these retailers as they all sell cheap crap from Asia, sold at thousands of other stores across the country. With home formation stagnant, where will the growth come from? Answer: It won’t come at all.

The stories above can be repeated over and over when analyzing the other mega-retailers that dominate our consumer crazed society. Same store sales growth is stagnant. The major chains have over cannibalized themselves. Their growth plans were based upon a foundation of ever increasing consumer debt and ever more delusional Americans spending money they don’t have. None of these retailers has factored a contraction in consumer spending into their little models. But that is what is headed their way. They saw the tide go out in 2009 but they’ve ventured back out into the surf looking for some trinkets, not realizing a tsunami is on the way. The great contraction began in 2008 and has been proceeding in fits and starts for the last four years. The increase in retail sales over the last two years has been driven by inflation, not increased demand. The efforts of the Federal Reserve and Wall Street to reignite our consumer society by pushing subprime debt once more will ultimately fail – again. The mega-retailers will be forced to come to the realization they have far too many stores to meet a diminishing demand.

The top 100 mega-retailers operate 243,000 stores. Will our contracting civilization really need or be able to sustain 14,000 McDonalds, 17,000 Taco Bells & KFCs, 24,000 Subways, 9,000 Wendys, 7,000 7-11s, 8,000 Walgreens, 7,000 CVS’, 4,000 Sears & Kmarts, 11,000 Starbucks, 4,000 Wal-Marts, 1,700 Lowes and 1,800 Targets in five years? As our economy contracts and more of our dwindling disposable income is directed towards rising energy and food costs, retailers across the land will shut their doors. Try to picture the impact on this country as these retailers are forced to close 50,000 stores. Where will recent college graduates and broke Baby Boomers work? The most profitable business of the future will be producing Space Available and For Lease signs. Betting on the intelligence of the American consumer has been a losing bet for decades. They will continue to swipe that credit card at the local 7-11 to buy those Funions, jalapeno cheese stuffed pretzels with a side of cheese dipping sauce, cartons of smokes, and 32 ounce Big Gulps of Mountain Dew until the message on the credit card machine comes back DENIED.

There will be crescendo of consequences as these stores are closed down. The rotting hulks of thousands of Sears and Kmarts will slowly decay; blighting the suburban landscape and beckoning criminals and the homeless. Retailers will be forced to lay-off hundreds of thousands of workers. Property taxes paid to local governments will dry up, resulting in worsening budget deficits. Sales taxes paid to state governments will plummet, forcing more government cutbacks and higher taxes. Mall owners and real estate developers will see their rental income dissipate. They will then proceed to default on their loans. Bankers will be stuck with billions in loan losses, at least until they are able to shift them to the American taxpayer – again. No politician, media pundit, Federal Reserve banker, retail CEO, or willfully ignorant mindless consumer wants to admit the truth that the last three decades of debt delusion are coming to a tragic bitter end. The smarmy acolytes of Edward Bernays on Wall Street and in corporate America have successfully used propaganda and misinformation to lure generations of weak minded people into debt servitude. But, at the end of the day, you need cash to service the debt. Mind control doesn’t pay the bills. We will eventually return to normal, just not the normal many had in mind.

“If we understand the mechanism and motives of the group mind, it is now possible to control and regiment the masses according to our will without them knowing it.” – Edward Bernays

In looking at the charts which show spending at different times (decades), one might wonder if at 8% or 9%, etc., inflation, the charts scaled in dollars, have any relevance.

Of course people will need to spend more when their money doesn’t buy nearly as much.

Pictures associated with Oftwominds article are antisemetic. One thing seems to be sure:

When a libertarian blogger veers into antisemitic territory a strange thing happens. All the

predictions made in the article never come to pass. What does obtain is clear: In Deuteronomy

the re-establishment of the modern State of Israel is laid out, and with it a blessing and a curse.

The blessing to all those who support it and to those who do not, a curse. Who are you to

go up against the creator of time and space? To put your anger for central bankers on the shoulders

of the Jewish people and mock the clear intent the G-d of creation?

Looks like Andy and a bunch of nutjobs have been riled up. Fuck Israel Andy boy.

sensetti

That’s quite the cute picture you posted about DP.

I guess you googled “sucking your own dick”. What ELSE did you find?

Just like the both partners working to to have a decent income, It will take 4 retired couples living in the same house to retire comfortabley (if you can call that comfort) SSI should be eleminated over the next 3 generations. When you go your kids would at least get something. You should pay for your own retirement, your own unemployment, your own healthcare. It would require saving money, however, your wages would be much higher. Your employer could afford to pay you more. You just have to save it. Most employers might be able to match a 401k if they were not paying for Unemployment health care and SSI. Finance and home economic’s need to be taught in high school. However we will probabley attack Iran costing our kids another trillion in debtt, Thus elimenating SSI a few gernrations too soon.

Stuck

You dont want to know.

Hi!, Jim & His Readers:

Thanks Jim for passing along to us your brilliant DD reseached in major debth. In the end only the TRUTH counts and so our personal plans need the guidance only TRUTH can produce for our ultimate personal & National survival. May GOD help our Nation & our world return to sanity, by returning us to our Republic’s Constitutional moorings with renewed faith in the divine guidance once ganted us by our founding Fathers. Remember too as it has been said that success is failure turned inside out! Let us learn ultimately from failure and learn how to turn it inside out towards renewing our faith/hope into the benefits of true success our nation & our world can injoy.

RUSS SMITH, CALIFORNIA

[email protected]

To all my fellow Boomers out there, stop feeling guilty about charging it all up. Bernays conditioning and propaganda made you Want it All.

I Want it All, and I want it NOW!

[img [/img]

[/img]

http://www.doomsteaddiner.org/blog/2012/03/07/i-want-it-all/

RE

Andy

It is very astute of you to recognize the secretly disguised anti-Semitism that runs rampant on this site. Bunch of fuckin Jew haters. I fight these people on a daily basis. It’s a lonely and difficult task. Stick around. I sure could use your help.

Great call on that verse from Deuteronomy. I can take it a step further and actually prove that the Bible predicts THE VERY DAY that Israel would become a nation. That’s because I am both a bible scholar and very good at math. You might want to take notes.

1) — The punishment for the sins of the House of Israel 390 years (EZ 4:5-6)

2) — The punishment for the sins of the House of Judah 40 years

3) — Add those numbers and you get 430 years of punishment.

.

4) — 70 years of that punishment was spent in Babylon (JER 25:11)

5) — This started in 606BC

6) — King Cyrus freed them from Babylon in 536 BC

7) — That leaves 360 more years of punishment (430-70)

8) — That would have meant Israel becomes a nation in 176BC

.

9) — But that did not happen because Israel continued to worship Babylonian gods.

10) – So God applied the Levitical punishment which punishes sins 7 times over (LEV 26: 18-28)

11) – So, you must take the 360 remaining years and multiply it by 7, to get 2,520.

12) – But, the Bible uses a 360 day lunar year. Converting to a solar year gives us 2,284 years.

.

13) – OK. So now you count forward 2,284 from 536BC …. And you get 1948!!

14) – Now convert that to the number of days and you get 907,200.

15) – Lastly, if you count forward from the date of Cyrus’ decree to rebuild the temple (536 BC) …… and you end up with May 15, 1948! The VERY day Israel became a nation!! G-d is truly awesome and amazing!

May the L-rd give understanding to those who read this explanation. The Day of Salvation draws nigh.

I can also prove that G-d says Israel should NUKE the shit out of Iran. But, I’ll save that for another day. The Jew haters here couldn’t handle it.

Excellent Expose’ again Jim. I so much appreciate the amount of research you do to bring forth these articles. Many folks don’t understand that you are in no way a doomer but a very optimistic realist. You have, like I have sat back for more than 20 years and watched 98% of America enjoy the drug of debt and live in a dream world. In my earlier years I thought I was crazy. I thought I was left out of society because I refused to join the herd and dive into the credit abuse frenzy. Everyone around me for decades appeared to have more than me, better than me and more fun than me. They were going to Europe, taking cruises, buying houses with swimming pools, second homes, Beemers and Lexus’s, kids in private schools, perfect teeth, suntans in January and new boobs. Even my father thought I was a failure because I would not buy into all this. 20 years or so ago I looked at an ARM loan on a house and thought to myself, what do I do when the payment resets in 2 years and the interest goes up? But everyone else was getting the homes on a view lot, so why did’nt I just go ahead and take the plunge?.

There is one word that I have just picked up from another reading recently that I would like to share with all who read this. “Localism” the only chance any of us have left. There will be no correcting, fixing, bringing back, changing, healing of America. What has been set in motion is too far down the pike. There will only be the total collapse. It has been engineered and cannot be reversed. Your Aldous Huxley quote said it all and Ohhh how true that is. Your only chance for youself and family will be your journey to “Localism”. A close group of friends, family or community. A new type of very small community unit that looks out for each other. May even have your own type of money or medium of exchange or barter. There is a reason we are seeing all these futuristic movies like Battlefield LA and the old Terminator movies. Skynet from the old Terminator movies is alive and well now in the US with over 30,000 drones operating or planned to spy on us or take us out when they deem necessary. The smolering cities in these movies is the way the big metro areas are going to look. Total destruction, not from aliens but from each other out of starvation and desperation. To quote Gerald Celente, “When the money stops flowing to the streets, the blood will start flowing in the streets”.

Reality TV is making a mockery out of the “Doomsday Preppers”. It is picturing them as a bunch of obese tattooed pig fuckers when in reality they are smarter than the bankers and big hedge fund jackels on Wall St. They may all die standing side by side when the “Big Collapse” does come and Martial Law is imposed but they will stand proud and will have prepared well until then. The only place they are stupid is by sharing to a TV audience what they have done.

Localism will be the only thing that will allow anyone to last through what is coming. Sorry folks, no political changes, attempted job returns, economic quick fixes, currency changes, attempts at returning us to a manufacturing country or anything else that trys to “Take Us Back to the Good Ole Days” will work. The best we can do is hope for the collapse and hope that we can survive it. We must stay out of the way as much as possible and stay closely tied to your group or very local community. Localism, start thinking about it and start living it.

Peace and good fortune to everyone

As long as Uncle Ben can keep adding unlimited amounts of money to the mix can’t we extend the pretend forever…

OK, not forever, but long enough to make it someone else’s problem down the road?

Oh wait… we are “down the road” and that’s whats not working anymore.

I write a private letter that is not for sale. Your cause and effect post closely mirrored mine of a few days ago . I wanted to share it with your readers.

The economy is mildly improving. It is. But, as with medicine, we must ask, “Has institutional intervention healed the patient or just treating the symptoms?” When we treat symptoms the patient feels better but their health continues to decline. The same is true of the economy. We have structural issues that require hard choices that are not being made.

Reckless debt have fueled our prosperity for decades. Public and private borrowing by government and families made everyone feel ‘rich’. The ‘Soft landing” drivel from the Greenspan era followed by Helicopter Ben Bernake are evidence that the officials have only one tool to fix everything: print, print, print. Throw the likes of Krugman et. al. into the mix we see a perfect illustration of the principle, “If the only tool in the world were a hammer, everything would be a nail.” Because this debt burden remains unresolved, our future will not be a reflection of our past. We will not solve too much debt with more debt. Ask Greece. If you do not face these facts you will be blind-sided by the next crash:

All the talk about public (government debt) is relevant. However, compared to the private debt accumulated by the average American, government debt is a smaller problem by comparison. Government debt is $15 trillion. Private debt is $43 Trillion. Therefore, when Bernake prints $2-4 trillion in stimulus funds, it is a spec in the ocean compared to the amount of private personal debt that has to be de-leveraged. In a consumer driven economy, when the consumer is in severe debt and out of work, it will take years to become whole again.. The jobs that are being created are lower paying. Home prices are dropping and there will be no more home equity loans to pay for that new BMW, big screen TV, exotic vacation, expensive restaurants, Pilates, one on one trainers, etc. Home prices according to the Case-Shiller Index are at the lowest level in 10 years.

Historically, for about 100 years the private and public sector borrowed $1.50 to produce $1 of GDP growth. Today it requires $6 to create $1 of GDP. In the current environment, if we remove the Fed’s stimulus (symptom management) you have at best, 1% GDP growth.

The lame stream media Obama cheerleaders were jumping up and down because recent job data revealed that 131 million people were working. That number is equal to the February 2000 level, meaning we have gone nowhere for 12 years. By now everyone should know that equities have gone nowhere as well. All the talk about a return of manufacturing is good. But the percentage of GDP from manufacturing is anemic, and business investment (all business) has declined to 0.8 % according to the commerce department.

The Boomers, the generation of the greatest influence from a demographic view, are unprepared for retirement. Normally, when people enter these golden years they spend less on cars, homes, entertainment, etc. With so many boomers having lost their nest egg (their home values), and underfunded pensions and savings, this demographic group that has driven the economy for the last 40 years will become an enormous drag on future growth. The generation replacing the boomers is less motivated, less affluent, and cannot find work. These are structural problems that will not be solved by bailouts of the banks or unions, by Chevy Volt subsidies, or buttressing bank balance sheets.

The talk of another Lehman event surfaces occasionally, and is usually followed by, “Shares are up and the bull is back” by some hot looking mini skirted reporter on CNBC. Consider this; the Fed, a pathetic parent of the big Wall Street banks and traders, now works to keep these faulty structures/institutions from falling. If former Fed Chairman Paul Volcker was running the Fed, a person that was fearless, independent, and willing to scare the hell out of the market, 95 percent, of the speculative positions today would be gone. Worse than the lack of supervision is the degree of fraud that pervades Wall Street, the central banks, and their inseparable relationship to the government. Sadly, there are no Volkers in sight.

If MF Global does not scare the hell out of you than you are obviously a dedicated methadone patient and you have not missed your daily dose. Wall Street is a fraud factory and always has been. The difference now is they own Pennsylvania Ave. Do not expect justice. When the president can cancel the relationship between bond holders and debt obligations in favor of supporting his union buddies is there any doubt that we have abandoned the rule of law? How can Mark Zandy, CEO of Moodys, who lied to investors about the credit worthy nature of sub-prime mortgages be on the President’s council of economic advisors? How can Warren Buffet, economic adviser to the president, that claims we need to raise taxes on the wealthy, be in a multi year court battle with the IRS for billions of dollars? This phenomenon of cancelling the rule of law is not limited to the US. The credit default swap fiasco that is occurring in Europe is another reflection of Wall Street fraud. Credit default swaps on Greek banks are the latest Wall Street fraud, the total of which is $60 trillion dollars. CDS as they are known are insurance that investment houses use to make their risky investments appear less risky because they are ‘insured’ by other financial institutions. Remember AIG? One reason they were going under until the bailout is because of the CDS they wrote with Goldman. Greece bond holders are getting ready to take a 70% haircut on CDS insured Greek Bonds. The loss should have been compensated by the CDSs held by the big banks on Wall Street. Well, the ISDA (the governing body that regulates derivatives, including CDSs) has ruled that because the default on Greece bonds was only a 70% loss, not a 100% loss, therefore Wall Street banks providing the swaps are not responsible to honor the insurance that CDSs were supposed to provide. How you feelin’ about that muni bond insurance now?

If you are a Democrat and think that Obama has the answers, you probably could not read this far. If you are a Republican and think Romney, Santorum, or any of the other Rs that have a chance of winning can handle this, you are almost as stupid as the Obama supporters. (Almost as stupid as the Obama supporters because OBama has proven that he is merely another puppet, and of the Rs that are running, one has to be elected to prove that they are puppets as well. Sadly, forget Ron Paul coming to the rescue. It would be good for the country but it will never happen. Few women will vote for him as he does not have the look.

I fear we will be in for rough times in the short term (1- 5 years), and it will be a much longer time before we return to prosperity. Events in the middle east may serve as a prime diversion for our economic ills and war is a frequent tool used to hide the corruption and the structural problems created by poor government an a populous that has been dumbed down and become wards of the state (51% of the population pays zero taxes.) The really smart people in universities and on Wall Street have become high paid wards of the state, who, instead of groveling for unemployment and food stamps grovel for grants and billions in bail outs to pay for bonuses that they did not earn. Do not be fooled by this temporary blip up in the economy. Until these events resolve, every asset in the world is vulnerable. The last crash, 2008, stocks, real estate, gold, all took a nose dive. So did the Euro, Swiss Franc, Pound, and every other currency. The only currency that appreciated during that time was the US Dollar. For those that are dissatisfied with the returns on safety of , I understand. But if there are fewer times when return of principle meant more than return on principle, this is it.

Be well, Tom Kane

I couldn’t have said it better myself. The relentless push of the megastores across our landscape has destroyed the social fabric of the smaller cities and towns. When a megastore replaces a mom & pop store you are effectively saying that this town does not need brains anymore. Decisions are made somewhere else. So the smart youth leave town for the bright lights. Before you know it the get up and go of the town has got up and went and the town slowly disintegrates.

Mom & pop stores have the advantage that they can be passed down through the family (keeping it together) or packaged up and sold to an enthusiastic new owner who will carry on. It is called “opportunity”. When opportunities are missing so is the enthusiasm.

When I was young the local General Store had enough on its shelves to live on, would order in special items when asked and the groceries were delivered. Bought on tick and paid for on pay days. It was credit but not as we know it Jim. Now I have to hunt through several hectares of shelves trying to find the f&*%$ng baked beans. I personally don’t see it as an improvement.

Here in New Zealand we are also witnessing the corporatisation of farms. They are getting bigger and bigger and already having difficulty attracting decent staff even with relatively high unemployment. It seems living in the country, working antisocial hours 7 days a week, in all weathers and being held to ransome by the vagaries of the “market” isn’t all that attractive when you don’t own the place.

Car gearboxes have had a reverse gear for over 100 years. When will some financial wizkid come up with a sensible version of a financial reverse gear that can solve the mathematical problems of infinite growth ? I would step off the world and join a self sufficient commune somewhere except it is too hard and too costly to get permission in this day and age to set one up.

llpoh says: TeresaE – you said “t isn’t that we aren’t paying our bills, we are. It isn’t that we aren’t saving and investing, we are (just not enough and 100% in the stock market)”.

Whoa whoa WHOA! Slow that horse up. All in the stock market? Damn, that is risky as hell. Seriously. I am no financial guru, but 100% in the stock market. Teresa, you are a real smart lady, but I advice CAUTION there. All of your eggs are in a very poorly made basket could lead to disaster and wiping out all of your hard won gains.

No shit Sherlock, hence my pointing out the reasons why we shouldn’t do what he wants.

But, I have NO say. NONE. Zip. Zilch. Nada.

He believes with all his heart – and “our” future – that things are going to “swing back.” To the 80s/90s, I would guess is his belief.

So I either fight him, and get to live with his derision and ire and resentment. Or say fuck it and go and try to enjoy myself even as the misery of my situation flows over me.

AKAnon, yep, good and screwed.

Which leads me to a big life decision that I have been avoiding because both ways suck, I just don’t know which way will suck harder.

Being a grown up and realist sucks big ones.

Dear Robert

“Capitalism needs to be regulated so that it remains healthy instead of becoming cancerous.

The only institution that people have to regulate corporations is government.”

I admire your naive stance in the face of reality. The problem with regulators is that they regularly drop the ball, either by incompetence or turning a blind eye: Madoff, Stanford, just to name two. The Ponzi schemes were well recognized by others from the 90s onward. Response: crickets. MP Global is a more recent atrocity. Maybe the last regulator that did his job was William K. Black in the 90s.

MERS corrupted 200 years of property documentation. It was ‘legitimized’ in 1995 after a collusion of half a dozen banks and Fannie Mae. The legal justification for the scam was perpetrated by a law firm that Eric Holder was a partner of before ‘public service’ was his calling. Robosigning? Fruadclosure? Senile judges rubber stamping every forged document that passed their courts?

As for progressive/populist fixes, the historical record doesn’t support the belief. The 1894 attempt to resurrect Lincoln’s income tax (the original soak the rich scheme) was struck down by the Supreme Court but never mind, a concerted propaganda campaign over a dozen years got you what you wanted. Never mind it was co-opted by the very people you didn’t trust. But ol’ Woody (Wilson) certainly got busy his first year: the income tax, the direct election of senators, the Federal Reserve Act (fnny kind of banking reform, if you ask me) and best of all, a war to make the world safe for democracy. Pay no attention to the draft, Espionage Act and all the rest including the loss of the Lusitania (carrying munition) and even that did not entice the public.

No, it took Wilson’s Creel Committee to Bernays the public into saying “baaaaa!” And don’t forget the Liberty Bonds. The fourth issue thereof would return to haunt another Democratic administration. There wasn’t enough gold to redeem them, you see, so FDR simply confiscated citizen gold, revalued the dollar and paid off those bonds with cheaper dollars. Such a deal!

Don’t console yourself with the rationalization I just pick on Democrats. No, I am an equal opportunity critic that doesn’t believe the false paradigm of the two-party system. A pox on both their houses.

Went into my local grocery store today and inquired on the General Manager whom I haven’t seen

in months. The assistant manager said, “he was transfered to South Dakota.” Who will manage

the store?…the other manager of the other store across town. Two stores and one manager? Yep!

I talked to a dept. head and he stated that bonuses will be phased-out. Management is very un-

happy at this store. I live in West Central Nebraska.

When I first came to the USA, SoCal, from the UK some 35 years ago, I was astounded at the wealth I saw. Then in the early 1990’s I became aware that the US was transitioning from a creditor nation to a debtor one. This has accelerated, while the citizens appetite for “stuff” seems to know no bounds. This article foreshadows part of the sinking of the Titanic disaster, as the ship of state founders on the reef of debt. The rest of the events that may accompany this scenario may be even larger, noisier and more dramatic.

Persnickety, yes you are right. I think imaginative people might find a way to integrate mass democracy into our current representative government. Its use would be triggered by either special types of issues or an inability to act on the part of the Senate due to a filibuster? Mob rule would hopefully be avoided by the limitations. We need things like a law, Supreme Court decision or the like that would impose contiguity and competitiveness as the top priorities in drawing congressional districts so we have fewer extremists in Congress. Something like this should not be overly controversial and would, I believe, be quickly approved in a mass vote but is difficult in legislative assemblies and for the gang of 5.

The alternative way forward is limited democracy. I don’t think we want to go there unless we must or have a clear map ahead of time.

The right/fascist tendencies of politicians/billionaires who think everyone should live by their rules just because a human institution (in Ricky S’s case the Roman Catholic church and in the Koch brothers case their Daddy) says so might take us there before we are ready. The overthrow of a fascist system might be replaced by leftist limited democracy as our traditions would have been undermined by the previous era.

Excellent article. Well researched with in-depth information and analysis.

Novista, i agree with your pox on both their houses; however, we do need to fix the wagon because almost all of us are in it with no credible place to go. Both Democrats and Republicans have failed us, but only the Republicans have done so completely, totally and with no indication of any contrary intention. They are currently a dead end street with no speed limit or markings and they like it that way. Government is us and like us it is imperfect.

Nonetheless, it has had its great moments in our history mostly recorded in terms of great leadership. There is no other tool available for us, the masses, that has yet been fashioned. As you indicate the evidence currently supports the position that our regulatory system is inadequate. We need to bring people like Mr. Black to the fore and get rid of those who stand in the way of positive change. We need punishment for bankster wrongdoers, malefactors of great wealth and lawless Supreme Court Justices. I agree the present Republicans won’t give us justice, I agree Obama has failed to give us justice but I hope we can use the tool of government to get justice in the future. The Statute of Limitations on crimes of this magnitude be damned. Guilty billionaires fleeing the country be damned. As Israel hunted down the holocaust criminals a future American government will hopefully hunt down the financial and political holocaust criminals who populate our elites today.

Novista:

Because of some of the insane platforms of the Populists, instead of self-labeling a “Neo Populist”, and being a wage earner which leaves the term “Capitalist” fundamentally untrue, I have adopted a new philosophy to develop:

“Quasi-Physiocratic Mercantilist”.

It will save the country.

Administrator says:

“endoftheworldasweknowit

Sounds like a good thread for today. I’ll post some pictures and everyone can contribute their examples.”

Admin: That would be a great time… Pics of fucked up malls… I have to go out and take some funny pics for you around here. Trust me… Not exactly blight, but interesting. You wouldn’t believe it.

Robert

I certainly agree about the vampire squids — hunt them down and serve them with justice.

Colma

You might add empirical skepticism to the mix. Nassim Taleb recommends.

Admin. btw, this picture in the post is BADASS:

[img [/img]

[/img]

I never tire of Ygore (pronounced I-Gore).

NERD!!!

Novista:

Taleb did his duty, but seems to have caved as many other contrarians of 5 years ago have. Induction leaves one flabbergasted, deduction leaves one in-adaptable… Syllogism seems the safe route… No less, Kuhn and Lakatos had very good insights. I imagine, if you simply decrease the timelines for the development or decay of expected “progress”, these fellas weren’t all that full of shit.

“Time flies when you’re having fun….”

Such happens in paradigm shift as well, I’m almost sure.

I canceled all my credit cards when I graduated college 14 years ago. It’s great not having any debt, but at the same time, I feel like a sucker and a slave. All my peers have the house that I dream of, while I keep saving and collecting PMs. When will things finally be in favor of all of us who do it “right” and live within our means?

Hey Mike, whaddup…

You may not realize it, but you’re already ahead of the game. You’re not in debt, own hard assets and have cash. You could probably make a killing if markets weren’t warped… and that’s the issue really.

The real losers are the folks who believe otherwise…

Thanks, I know. But sometimes it feels like the current kicking-the-can limbo could go on past my lifetime. I’m getting impatient 😀

[img [/img]

[/img]

Mike

Colma is right, we’re all on the same page … and yeah, impatience is … but I believe there is a finite span of time for the shoe to drop. And then, we are validated in our approach. Patience.

The next challenge is the zombies. Heh.

Tom Kane, I agree with quite a lot of your post; however, your lost my respect when you stated, “Sadly, forget Ron Paul coming to the rescue. It would be good for the country but it will never happen. Few women will vote for him as he does not have the look.” I happen to be a Ron Paul supporter and a woman. Paul will not get the Republican nomination because the GOP and its corporate masters will not allow it. You insult all women by implying, no, actually stating, that women vote based on a candidates’s looks instead of on his/her substance. The women in your life must be simpletons, which says as much about you as it does them. Talk about delusional!

Teresa – sorry about your predicament. When spouses are not on the same page financially, it can lead to severe marital issues. I hope it works out for you, and really wish you all the best.

C.A.

Sorry, I think you are wrong.

Obama was elected because he looked good and sounded good with all those pretty speeches. He sure as shit didn’t get elected because of actual accomplishments.

I do think Tom Cane is wrong in limiting his remarks to just women. Men are equally as shallow.

Yes, sadly, many fall for the pathos.

Teresa

Divorce the SOB.

Then, gimme a call.

XOXOX

Stucky

OK, let’s see how this turns up:

[img [/img]

[/img]

[img [/img]

[/img]

No luck… WPES.

Stuck – I would consider it, but LLPOH has indicated you have a small wee wee, and that is a deal-breaker. Sorry, but I do appreciate the offer.

Fuckme. I can’t even pick up chicks onthe Internet.

This is post #100.

Thought I would post a pic of me (left) and my best friend, llpoh (right)

[img [/img]

[/img]

If I didn’t think it was worth it, I wouldn’t try it again, but it is…

[img [/img]

[/img]

That’s the Best Buy in Colma, California…

Yes, that is a mall next to a fucking graveyard.

Zombie shoppin’, buttnuggets!!!

That’s how we roll!!!

I’ll find the lone grave that ruined Home Depot’s plans soon enough. Great bit of lore. Promise.

A new ring to “Black Friday”….

Stuck – two stick figures with fallopian tubes? WTF?

BTW – this cartoon was modelled after me.

[img [/img]

[/img]

Stuck & LLPOH’s brand

[img [/img]

[/img]

Colma Rising

“Yes, that is a mall next to a fucking graveyard.”

Yea but then everything is next to a graveyard in Calma.

Fuckoff Admin

You’re always bitching about no one clicking your ads. I have a solution.

Place this ad somewhere to the right, and all us small dicked fuckers will make you a rich man!!

[img [/img]

[/img]

ASIG:

You are correct. I am going to go on a photo walkabout… make a post.

GD dopplegangers.

Size doesn’t matter to me Stucky no matter what the above comment says.

Stucky, don’t say things that you don’t mean.

Thanks for the kind words all, it is good to not feel crazy once in awhile.

Interesting article by Urban Land Institute

In-store retailing A tsunami of change

http://urbanland.uli.org/Articles/2011/Nov/GruenRetailing