Trying to come to a consensus on tax policy in this country is futile. The article below addresses a number of things I’ve addressed before. The bullshit about the rich paying all the taxes in this country is a storyline perpetuated by the rich and their media cronies. When payroll, property, and sales taxes are taken into account, the middle class in many cases pays a higher percentage of their income in taxes than the rich. There is one thing that you cannot dispute. The rich and powerful individuals and corporations can afford to buy the politicians that write the tax code. What does the chart below tell you? It tells me that over time those who have the money have arranged for loopholes to be created so that tax rates don’t really matter. No rich person or mega-corporation ever pays anywhere near the top tax rate. They have highly paid tax specialists and Washington DC lobbyists to insure they pay the least possible. This is why my 76 year old mother living on only Social Security paid a higher tax rate last year than GE.

I’m not in favor of raising taxes on the rich or anyone for that matter. We have a spending problem, not a tax revenue problem. I would be in favor of eliminating all deductions, credits, loopholes, subsidies and exemptions for every individual and corporation in the country. I have better chance of seeing God today. The tax code is power to politicians. Obama and Romney love the existing tax code. It’s how they dole out favors and paybacks for contributions. The statists in Congress think they can change the world by tweaking the tax code. The existing oligarchy will do nothing but tweak the current code. The number of pages in the tax code will surpass 100,000 by 2016.

In my perfect world, this is what I would do:

- Completely scrap the existing individual and corporate tax code.

- I’d replace it with a national consumption tax that excluded food and clothing.

- I would not tax income or savings.

- I would put a stiff tariff on all foreign imports, even if the company is based in the U.S. If the product is made outside of the U.S. it would be taxed.

- I would jump all over the writer’s #5 idea. I’d put a tax on every High Frequency Trade done by Wall Street. These shysters have screwed America and it’s time to screw them back.

And that’s all I have to say about that.

But they just print up fiat whenever they need it so explain again to me why they need to take any of my money through taxation ?

Why do they need my money when they can print whatever they need?

CONTROL.

Tariffs????

ernie

Do you believe in the global free trade fallacy? Do you think China and the rest of the Far East allow free trade? If so, you are gullible.

Frankly don’t care if they allow free trade or not. If they want to subsidize cheap goods to us, sounds like a win to me. Tariffs are always a political animal that support more crony-capitalism. Tariffs do more harm to the country they are trying to protect than good.

Common sense tells me in a free country I should be able to purchase anything I want from anywhere I want.

ernie-If they want to subsidize cheap goods to us, sounds like a win to me.

At what cost?

ernie-Tariffs do more harm to the country they are trying to protect than good.

Do you have proof?

ernie-Common sense tells me in a free country..?

What free country do you refer to?

And ,who makes the choices of products you’re allowed to buy in this mythical free country?

Did Britain and the US become economic superpowers under free trade? No, both declined under it. Did Germany and Japan (and the US in the 19th century), become economic superpowers under a tariff regime? Yes.

ernie musta’ choked on his chocolate covered NAFTA bar.

Wow – another fucking dipshit. Well done Ernie! Glad to see morons continue to pass by. So a country should be allowed to dump goods below cost on another country for the purpose of driving the other country’s businesses broke? and you think that is fine because you get cheaper goods?

That is the dumbest fucking thing I have read here in a very long time. I bet you own only spoons because you would surely maim yourself with a fork.

Though llpoh left only scraps… again…

Ernie: A “Free Trading” nation is fodder for nations with mercantilist policies. Period. End of story. Look at the facts, not the fancy bullshit theories spoon fed to you by pointy-headed pill-sucking academics.

Your haughty question in the face of reality makes me almost pity you free-traitor types.

You Americans are dumping (selling for less than production costs) F-35 jets in Canada, Italy, Britain, and a couple of other nations.

Why is that?

Randy – that would be foreign aid! 🙂

a lot said here is hogwash. SS and medicare taxes are paid back (usually more than paid in), while federal income taxes (half don’t pay) are pure income redistribution, and property taxes are just like consumption taxes, paid based on value spent and have little correlation to services consumed.

i agree with eliminating all deductions and loopholes, the rich clearly win here and it’s BS.

i am up in the air on tariffs and cap gains / dividend taxation.

Oh Ernie, Ernie, Ernie.

Drive around your town, check out the old industrial buildings/sites.

See the blackened, possibly broken, windows?

See the empty parking lots?

See the full parking lots at Walmart?

See your property tax bill? Look at it without looking at the reduction in value, look at the rates. Look back a couple years.

Do the same with your sales & use taxes, your insurance taxes, your fees, fines and the like.

Our “free” country has traded real, family supporting jobs for the masses for cheap socks and fake food at Walmart and McDs.

The truth would explode your wee little mind.

Enjoy your cheap goods, and most especially, your future when the real bill for those goods comes due.

The Lincoln tariff was a significant factor in the War of Northern Aggression.

And Hoover’s Smoot-Hawley had negative consequences.

God, if I ever wanted to get a dose of american undereducation and outright ignorance, I have no further to go than reading this article and its comments. Let’s see the great intellectual power people have applied to the conversation –

Administrator apparenly believes inputing character traits to person is some form odf supporting their argument. For example Admin says, “Do you believe in the global free trade fallacy? …. If so, you are gullible.” So, instead of citing empirical evidence to support a contention, Admin says if you don’t believ as he does than you have some negative attribute. There’s a word for that kind of thought process Admin.

Llpoh says: “Wow – another fucking dipshit. Well done Ernie! Glad to see morons continue to pass by …” Truly, what brilliant intellect … what astounding mental prowess you have LIpoh. You, like Admin, mistake ad hominem attack for reason … wow, that’s some stout ability to provide rational thought you guys have.

Lipoh continues the hystrionics saying “That is the dumbest fucking thing I have read here in a very long time.” Wow … frankly, that’s the dumbest thing I’ve heard Lipoh. YOu’re too stupid to understand that an ad hominem attack does not substitute for reason .. in fact it is a cheap, shallow, void form of argument that peple use when they haven’t the ability tpo actually articulate a cogent argument … instead the ignorant prefer to just attack character.

Colma Rising says: “Your haughty question in the face of reality makes me almost pity you free-traitor types” What? Haughty? What precisely makes Ernie’s statement/questions haugfhty? And then again Colma, instead of citing material, or data to form one’s own argument, or even remotely evidencing the ability to think for oneself … instead of that Colma resorts to the emotive device of just lkabeling someone. In this case, the label “free traitor.”

Then TeresaE says:

Oh Ernie, Ernie, Ernie.

Then Teresa says, “…. The truth would explode your wee little mind.”

Hahahahahahaha OMG! After a string of anecdotes Teresa errs in belief that correlation is necessarily causation. And then he goes on to attribute a little mind to the target of her statements? How eerily ignorant and ironic.

If this is the processing power and level of understanding of the “occupy” movement … you guys make tea baggers look like einstein.

So, first you guys fail to see the extent of just how much the entire financial crisis was caused by government intervention, government central planning, and then you want government to step in yet again to do more central planning, and protectionism thereby remaining in the position of manipulating end results … when we have just gone through 4 painful years of government planning end results.

Wow, …. seeing that ad hominem attacks seem to be how this forum works – you morons are pathetic idiots. Please just one of you pathetic morons spend a week or two studying the great depression. Actually go back and study the economic data of the depression… the history of GNP/GDP under gold and silver standards, the history of the relationship between the gold standard and protectionism, the relative drop in global trade.. Instead of drinking the koolaid … to paraphrase Admin .. try for once to not be so gullible.

ntn

I’ve written multiple articles on the Great Depression and the bullshit storyline about Smoot Hawley being a major reason for the Great Depression. Non-thinking ideologues like yourself, Krugman, and Bernanke believe we will buy your bullshit. So Solly. We think on this site and use facts. Idiots like yourself sell storylines.

ntn douses the flame wars with his own special brand of ad hominem nonsensical spew.

LOl…Atta-boy ntn- you’ve really shown the light and opened up all our eyes to the fallacy of the free trade myth fallacy.Thanks for clearing all that up.

another under-educated American on free trade.

http://www.freetradedoesntwork.com/

Ian Fletcher on Why Free Trade Doesn’t Work

From the Thom Hartman is a leftwing asshole blog, but nevertheless this assessment of the

Smoot-Hawley myth is dead on.

http://www.thomhartmann.com/users/unlawflcombatnt/blog/2011/03/tariffs-smoot-hawley-fairy-tale

Tariffs: The Smoot-Hawley Fairy Tale

Once again, it’s necessary to debunk the Globalist fairy tales about the “damage” caused by the Smoot-Hawley Tariff. Below is a copy of U.S. GDP from 1929 through 1939. These are official government figures from the US Bureau of Economic Analysis

(Here is a link to graphic copy of the 1929-39 GDP chart with the key numbers underlined. The Trade Balance has been underlined in Red. Exports have been underlined in Blue. Imports have been underlined in Orange.)

[img [/img]

[/img]

Notice that there is a slight decline in both exports and imports by the end of 1930. The trade balance remained around 0 during the entire time. Exports bottomed in 1932 — 2 years before any revision or modification of Smoot-Hawley occurred.

The Smoot-Hawley Tariff was signed into law on June 17, 1930, and raised U.S. tariffs on over 20,000 imported goods. Legislation was passed in 1934 that weakened the effect of the Smoot-Hawley Tariff. In effect, the 1934 legislation functionally repealed Smoot-Hawley. Thus, the effects of Smoot-Hawley cover only the period between June 17, 1930, and 1934. This is the time frame that should be focused on.

So in reviewing the chart, what evidence is there that the Smoot-Hawley Tariff “hurt” the economy?? Is there any evidence at all?

No, there is practically NO evidence that Smoot-Hawley hurt our economy.

The US was already in a Depression when Smoot-Hawley was enacted. Prior to Smoot-Hawley, the 1929 Trade Surplus was +0.38% of our GDP. In other words, it contributed less than 1/200th to our economy.

What happens if we focus on exports alone? Exports were $5.9 billion in 1929, and had declined to $2.0 billion in 1933, for a -$3.9 billion decline. This $3.9 billion decline was roughly 3.8% of our 1929 GDP, which had already declined by a whopping 46% over the same period of time. Thus, of the -46% GDP decline, only 3.8% of it was due to a fall in exports.

But the effects on trade must also include the reduction in Imports, which ADDS to GDP. (A decline in imports increases GDP). If the import decline is added back to the GDP total (to measure the net trade balance), the “loss” becomes only -$0.2 billion from our GDP — or less than ½ of 1% of the total GDP decline.

In other words, the document-able “loss” from the Smoot-Hawley Tariff — the “net export” loss — contributed less than ½ of 1% of our our -46% GDP decline. Overall, the Smoot Hawley Tariff caused almost 0 damage to our economy during the Depression.

To put this in better perspective, let’s compare all the GDP components together:

1929 …………………………………………………. 1933

GDP $103.6 billion———————–>$56.4 billion ( decreased -$47.2 billion)

Consum. Expend $77.4 bil————> $45.9 billion ( decreased -$31.5 bill)

Private Invest $16.5 bil—————-> $1.7 billion ( decreased -$14.8 billion)

Trade Balance +$0.3 bil———–>+$0.1 billion ( decreased -$0.2 billion)

Exports $5.9 billion———————-> $2.0 billion ( decreased -$3.9 billion)

Imports $5.6 billion———————-> $1.9 billion ( decreased -$3.7 billion)

Again, to re-emphasize, how much difference to US GDP did the export loss make? The Trade Balance worsened by only -$0.2 billion, or about 0.19% of our 1929 GDP ( less than ½ of 1% of 1929 GDP).

Meanwhile, our total GDP decreased a whopping -46% (or $47.2 billion).

How much effect did a ½ of 1% loss of GDP have on the Great Depression, especially when spread over a 4-year period? Not much.

Based on available statistics, Smoot-Hawley had almost NO effect on the Great Depression. At the very most, caused a -3.8% decline in GDP from loss of exports. But factoring in the GDP increase from a decline in imports, it caused less than 1% of the GDP decline.

The Smoot-Hawley Tariff did not cause the Great Depression, nor did it worsen it or extend it. Claims to the contrary are not only false, but easily refutable. The evidence to disprove those claims is abundant, overwhelming, and freely available to the public.

The Smoot-Hawley myth needs to be put to rest, once and for all. The claim that it worsened the Great Depression is nothing but a fairy tale.

flash

I find it hilarious you, of all people, cite a leftwing asshole using government numbers as proof of anything. Next, you’ll be telling us that Hoover was a do-nothing president.

That “The Smoot-Hawley Tariff did not cause the Great Depression” was a nice spin, though.

. implying the ‘myth believers’ assume One Big Cause. Nice try. The trouble with aggregates (and, indeed, GDP itself) is misleading in itself. Crunch a small slice of numbers in a framework that supports your ‘proof’ and you can say in the best voice of llpoh (or Smokey) “I win!”

Would you prefer a dozen or so links from non-assholes that argue the opposite case? Or perhaps you prefer to defend the railroad lawyer’s case?

… damn I will be glad to get my real computer back instead of this XP Pro piece of shit.

ernie

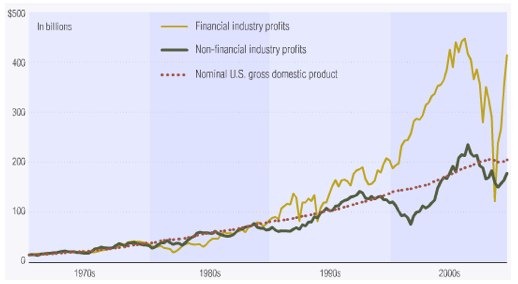

The entire Federal government was funded with just tariffs from 1789 until 1913. Global free trade is a scam by big corporations and the Wall Street banks to lure idiot Americans into debt. It has worked like a charm. Please examine this chart. The global free trade bullshit began in the early 1980s. This is what global “free trade” has wrought. Guess what a chart of Wall Street profits would show?

[img [/img]

[/img]

npn

I await your critique of my series-in-progress “Money in America” (search this site at the top, thanks.)

One would guess you have not visited here before. Read the one article and talk the talk but not walk the walk, is it? It is to laugh. No PC in comments here, nay. Ad hominem puts you off and you do not set a better example, meh.

ernie and ntn

Do you see any correlation between global free trade, consumer debt and financial industry profits? If not, than you reveal yourselves to be dumbasses of the highest order. Facts are so very inconvenient to ideologues with a storyline.

[img [/img]

[/img]

Novista

Hartman didn’t pen the piece. It C&Ped was from a member blog.

And, you well know that aggregated meddling by central planning is never brought up as an issue contributing to the great depression by so called free marketers on any scale that the Smoot Hawley demon is evoked.

The damage allegedly done to global free trade by Smoot-Hawley is non sequitur

Sure, Hoover and cronies at the Fed set the ball in motion with price controls,wage, central panning of business ventures(vital to national security and welfare) via The Fed flooding the country with cheap credit leading to boom, bubble ,bust.

But ,Smoot Hawley was only a bit player in the we’re from the government and we know best grande production.

And,as a Libertarian, I believe in free trade, but the currency manipulation by government , both foreign and domestic has created a situation of win -win for global corporations and an ass -raping for middle America.

As far as global corporatist controlled governments suddenly becoming true laissez-faire free trades, it ain’t going to happen,so pragmatism must come into play.

American business/job/citizens must be protected or the American economy will continue to collapse until we reach the dog eat dog cycle wherein global trade will no longer be relevant to anything relating to survival.

e.g. this is what passes for American history.

The first three can be tied to Hoover/FDR domestic policy and expanding /contracting whiplash monetary policy.

#4 is a footnote

and #5 is an act of God, that wouldn’t have been near as the harbinger of doom had not FDR went on a wild price control binge that saw the wholescale destruction of crops , the dumping of tons of milk and the slaughter of thousands of pigs.

http://americanhistory.about.com/od/greatdepression/tp/greatdepression.htm

Top 5 Causes of the Great Depression

1. Stock Market Crash of 1929

2. Bank Failures

3. Reduction in Purchasing Across the Board

4. American Economic Policy with Europe

5. Drought Conditions

Randy-.. Americans are dumping (selling for less than production costs) F-35 jets in Canada, Italy, Britain, and a couple of other nations.

Randy,

Tell it to the hand..I’ve seen way too many lumber mills and logging operations put out of business by crappy ass dumping of inferior Canadian lumber products on US soil.

WTO rules for U.S. in softwood appeal case

Canadian subsidized wood products market; duties Ok on below-market-price ‘dumping’

By JAMES RONALD SKAIN

http://www.thepineywoods.com/wtorules.htm

The WTO Appellate Body confirmed that Canadian private timber prices are depressed by government sales, as ruled earlier by a North American Free Trade Agreement (NAFTA) panel.\par }{\plain On January 16, a different WTO dispute panel reportedly confirmed U.S. government findings that Canadian lumber producers are dumping lumber in the United States at unfair prices.

Novista- defend the railroad lawyer’s case.

I understand you’re referencing Lincoln and Morrill tariff , but I see no relation to the Smoot Hawley or the imposition of new tariffs by any state.

The South seceded from the Union in part because of the tariif , which by right as a sovereign state should have been their option .

Lincoln’s answer to southern secession was to attack and force payment pf tribute which is a very extreme route to take to force taxation, but nevertheless that’s exactly how it when down.

No country was attacked because of Smoot-Hawley and hopefully if the Federal government were to induce tarrifs,say against imported Chinese goods, they wouldn’t nuke China if they decided to cut imports.

Paying tarriffs leaves one a choice.

Tariffs are not the cause of war, naked aggression is.

“dd says:

a lot said here is hogwash. SS and medicare taxes are paid back (usually more than paid in),”

My wife paid thousands into SS and medicare. When she died SS called and I get a check for $255. Great return on that money. Bastards.

EF

efarmer

I’m very sorry for your loss.

I sent you a note, you’ll get it soon. Prolly would get there quicker if I rode it to you on horseback.

EF

efarmer

Please accept my sincere condolences for the loss of your wife.

Here’s another good one we just found out. Our three kids all went to Iowa State University. We just found out that 20% of their tuition went to other students in the form of scholarships. Every semester is $7500, so $2000 or so went to pay other kids college costs.

So for the about $200,000 tuition our family paid, about $40,000 was an undisclosed tax that went to some else’s pocket, mostly small private colleges.

Where do I send that bill??

EF

efarmer.

The loss of the love and support of a good woman is a hard cross to bear.

I’m truly sorry for your loss and will include you and yours in my prayers.

to whomever 2 morons who thumbed me down: please tell me where i was wrong.

didn’t think so.

Nice to see at least a couple of people with some actual understanding of economics. As for the rest of you…

England, America, Germany and Japan all became major economic powers by exploiting relative advantages, not because of tariffs. Tariffs, and mercantilist policies generally, are actually just one more form of corporate welfare. They enrich a privileged few at the expense of many. And just how much good do they do? Sure, Japan was riding high for a while, but the Japanese economy has been spinning its wheels for what, twenty years now? Yeah, that’s working out well… In the US, the government has acted again and again to protect certain industries, and where has it gotten us? Years of protection don’t seem to have helped the American steel industry, which went from leading the world to barely existing. Or how about automobiles? Tariffs and quotas have distorted the auto market for decades, yet the government still found it necessary to bail out Chrysler (for the second time) and GM. The fruits of this intervention? The Chevy Volt, an over-hyped, underdeveloped lump that no one is buying, despite the fact that it’s heavily subsidized.

In economics as in other areas of life, the state is not your friend.

****

In reference to point 1 in the article, the author seems to be (possibly deliberately) confusing tax rates and total taxes paid, which can be very different things. Let’s say I make $50k and pay an effective tax rate of 20%; that means I pay $10k in total taxes. Meanwhile, Joe Fatcat makes $50 million and pays an effective rate of 10%; he pays $5 million in taxes. So my tax rate is twice his, yet he pays 500 times as much in total as I do. See the difference there?

Fact is, the rich pay a higher share of total tax revenue in the US than in almost any other country. As admin freely admitted, we don’t have a problem with too little tax revenue, we have a problem with too much spending.

Wizard

Your thinking cap slipped off.

China and the rest of the Far East impose tremendous levels of restrictions on imports. There is no free trade. The existing system encourages US conglomerates to move their operations off-shore and take the jobs with them. This process has gutted the US economic system and left us with no real wage gains in 40 years and record levels of consumer debt. The impostion of equal trade restrictions upon foreign produced goods would even the playing field. Only the CEOs of massive mega-corporations would suffer. If you think a society built upon by cheap foreign produced shit bought on credit is sustainable, then you are on the wrong site.

I think your tax example also proves you are on the sauce. A fair tax system would tax the $50,000 at the same rate as thr $50 million. Who do you think is more impacted by living on $40,000 or $45 million? My 76 year old mother paid an overall tax rate of 27% last year on her meager earnings, while Ben Bernanke stole $4,500 per year from her with his 0% policy. You sound like you’ve been watching too much Faux News.

Wow! Touched on a good subject here. Being The Burning Platform, keep the “idiot, gullible, fucking dipshit, and wee little mind” comments coming. That is why I love and come to the site everyday. Uncensored viewpoints. : -) Let me see if I can expand upon my beliefs.

Being a Rothbardian Libertarian and supporter of Ron Paul, I will state yes, I support free trade. My understanding Ron Paul is a supporter of free trade and rejects protectionism (tariffs are a form of protectionism). He advocates “conducting open trade, travel, communication, and diplomacy with other nations”. His rejection of all “Free Trade agreements”, which I agree with, is based on the notion that “free-trade agreements are really managed trade” and serve special interests and big business, not citizens.

I still fail to see how “I would put a stiff tariff on all foreign imports, even if the company is based in the U.S. If the product is made outside of the U.S. it would be taxed.” helps. Again, I think it would create more and more crony capitalism and other rent seeking behavior.

I stick with “Common sense tells me in a free country I should be able to purchase anything I want from anywhere I want.”. What right does the government have to tell me what I can purchase and from where?

My definition of free trade (free market) is probably the same as Murray Rothbards.

“The Free market is a summary term for an array of exchanges that take place in society. Each exchange is undertaken as a voluntary agreement between two people or between groups of people represented by agents. These two individuals (or agents) exchange two economic goods, either tangible commodities or nontangible services. Thus, when I buy a newspaper from a news dealer for fifty cents, the news dealer and I exchange two commodities: I give up fifty cents, and the news dealer gives up the newspaper. Or if I work for a corporation, I exchange my labor services, in a mutually agreed way, for a monetary salary; here the corporation is represented by a manager (an agent) with the authority to hire.

Both parties undertake the exchange because each expects to gain from it. Also, each will repeat the exchange next time (or refuse to) because his expectation has proved correct (or incorrect) in the recent past. Trade, or exchange, is engaged in precisely because both parties benefit; if they did not expect to gain, they would not agree to the exchange.

This simple reasoning refutes the argument against free trade typical of the “mercantilist” period of sixteenth- to eighteenth-century Europe, and classically expounded by the famed sixteenth-century French essayist Montaigne. The mercantilists argued that in any trade, one party can benefit only at the expense of the other, that in every transaction there is a winner and a loser, an “exploiter” and an “exploited.” We can immediately see the fallacy in this still-popular viewpoint: the willingness and even eagerness to trade means that both parties benefit. In modern game-theory jargon, trade is a win-win situation, a “positive-sum” rather than a “zero-sum” or “negative-sum” game.

How can both parties benefit from an exchange? Each one values the two goods or services differently, and these differences set the scene for an exchange. I, for example, am walking along with money in my pocket but no newspaper; the news dealer, on the other hand, has plenty of newspapers but is anxious to acquire money. And so, finding each other, we strike a deal.”

http://www.lewrockwell.com/rothbard/rothbard106.html

P.S. Admin, I live and work i the same great city as you, Philly. Home of the “30 blocks of Squalor” and the “Free Shit Army”. Let me know if you would like to have beers after work sometime. Go Flyers.

efarmer

We exist is a modern world where little makes sense and injustice is our lot. We just do the best we can to get through today and strive to make a better tomorrow for our children.

Ernest: I find Ausstrian Economics insiightfull, and Ron Paul is an honest, good man who will probably receive my vote…

That being said, I think you missed the memo on “free and open trade with no travel restrictions blah blah”…. As much as you would hate to admit it, that would require a global body to enforce such drooling and bird-watching in foreign lands.

You could be the most open country on earth and receive a nice gang-bang from every other nation coming for your gaping snatch….

So at the very minimum, one would have to mirror tarrif activity of foreign governnments.

Only a fool like wiznard would ignore the fact that mercantilist policies produce wealthy nations…. Such wealth that a $ree-Traitor might think that their theory applies well to a net importer.

Your heads in the clouds, folks.

ernie

Lets define free:

per Dictionary.com

free ;exempt from external authority, interference, restriction, etc., as a person or one’s will, thought, choice, action, etc.; independent; unrestricted.

If you agree with that definition, can you provide any examples of global “free” trade that is totally free as in the much ballyhooed in Ricardain/ Rothbardian model?

“In economics as in other areas of life, the state is not your friend.” Agree with Wizard here.

Just an observation. Everyone on this site seems to love Ron Paul ( I know a big generalization), but no one seems to support core Austrian economics which, as Paul says, was the biggest influence in his life. In the Austrian literature I have read(a lot), I have found no support for tariffs or mercantilism. Again, just an observation.

At the end of the day, I find the statement “I would put a stiff tariff on all foreign imports, even if the company is based in the U.S. If the product is made outside of the U.S. it would be taxed.” hard to defend. Seriously, tariffs on everything coming from another country. Thinks about that for a moment. Oil-tariff, French wine – tariff, watch you love made in Europe – tariff, Fresh produce in the winter from South America – tariff, fine incense made in Japan – tariff. How much is the tariff? Who decides how much? Is it equal across the board or special considerations give to “important” industries?

Remember the Theory of Unintended Consequences. As Frédéric Bastiat said when speaking about the seen and unseen. “There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.”

ernie

Theory and reality are different animals. Ron Paul is practical. Even though he hates the Federal Reserve, he said he wouldn’t get rid of it.

Even though he knows our entitlements can’t be paid, he wouldn’t cut them. He’d cut the military first.

He believes in free trade, but he favors real free trade, not theoretical free trade.

About Japan: Is it a monetary issue or an import issue?

Open your eyes.

That goes for you, Ernest….

You quote Bastiat, and that’s great. You point out Paul’s Austrian foundation. Wonderfull.

Now look at the data and hold your breath. Unless you establish a World Order to enforce trade agreements, you’re dreaming. Neo-Liberalism is a bastardized function of extremely monied and power-hungry interests.

If you don’t understand the nature of GLOBAL free trade, how other cultures ARE NOT fans of Bastiat, how silly and ignorant it is to declare “unintended consequence” in the face of 21st century reality…. that the world isn’t gumdrops and malted milk balls trading goods with happy, smiling, multicultural brothers in humanity…. you’re a lost cause.

Tariffs would make it economically feasible to produce in the US again. Right now our manufacturing sector is a joke.

Unless you count diabetes as a product. Then we are #1 baby!

Admin

Ron Paul is smarter than that. He states he only want competition in currency. Good money always pushes out bad. Therefore, the Fed dies. End of story.

Have not seen anything from Ron Paul encouraging your form of Tariffs. Don’t think he would go for it.

ernie

Ask Ron Paul whether he would favor generating revenue through income taxes or tariffs and see which answer he would give. You favor raising revenue through taxing the income and savings of Americans versus taxing goods produced by slave labor in foreign countries that encourages Americans to go into debt because they don’t have the jobs or wages to actually afford the cheap Chinese shit?

Is that your position?

Admin

On theory and practice, how is your tariffs on all imports remotely practical. See my point above on tariffs on all imports.

ernie

I said goods produced in foreign countries. It’s extremely practical and implementable. This country had no income tax until 1913. We functioned pretty fucking well for the 1st 124 years of our country with only tariff revenue.

Tariffs would not be necessary if trade was truly free. It is not.

Colma Rising you miss my point. I advocate for this country to abandon all tariffs on imports, allow us to export to anyone. If another country proposes to either subsidize their exports or ban our imports, their loss. See no need for a “World Order”.

Free trade ernie?

Do you have any twenty first century real life examples-please no potlatch- you can cite.

Theory is great , but meanwhile Americans are hurting.

I’m going to have to go with Buchanan on this one

http://www.youtube.com/watch?v=jTW0y6kazWM

Free Trade and Funny Math

http://www.humanevents.com/article.php?id=19590

To the devout libertarian, free trade is not a policy option to be debated, but a dogma to be defended. Nowhere is this more true than at that lamasery of libertarianism, the Cato Institute.

But with America running the worst trade deficits in history, the monks are having a hellish time of it. Hence, like the neocons who cherry-picked the intel to stovepipe to Scooter to bamboozle us into believing national survival hung on invading Iraq, they feed us irrelevant truths and deny us the whole truth.

Case in point — the Feb. 22 column in The Washington Times by one Daniel Ikenson, “associate director at the Cato Institute’s Center for Trade Policy Studies.” Bewailing the “barrage of hyperbole and misinformation about trade and its relationship to jobs and economic growth,” Ikenson assured us, with impressive statistics, that globalism is working out wonderfully well for America.

“(T)he Census Bureau data show that U.S. export growth was phenomenal in 2006, increasing by 14.5 percent. … Exports to Europe increased by 15.2 percent and to China by nearly 32 percent. The growth in exports to Japan was a slower 7.5 percent, but it grew. Since 2001, U.S. exports have increased by more than 42 percent.”

Wow. Phenomenal indeed. And it does sound like we are cleaning those foreigners’ clocks. But Ikenson ignored the other side of the ledger.

That the U.S. trade deficit in 2006 rose to an all-time record of $764 billion. That the deficit in goods hit $836 billion. That the deficit with China rose 15 percent, from $203 billion in 2005 to $233 billion in 2006, the largest trade deficit ever recorded between two nations. That the deficit with Japan rose to $88 billion, the largest ever between us.

Under Bush, the U.S. trade deficit has set five straight world records, as has the U.S. trade deficit in autos, parts and trucks. So reports Charles MacMillion of MBG Services, who has for years tracked the decline and fall of American manufacturing.

For manufactured goods, our trade deficit rose to $536 billion, from $504 billion. In Bush’s six years, America has run a total trade deficit of $2.6 trillion in manufactured goods, as 3 million U.S. manufacturing jobs have disappeared and wages in that sector have fallen 3 percent in three years.

Query to Ikenson: If these numbers represent a successful trade policy, what would a failed trade policy look like?

Recall NAFTA.

In 1993, we had a trade surplus with Mexico. Some of us warned it would be gone with the wind if NAFTA passed. And NAFTA did pass, through the collaboration of Clinton Democrats with Gingrich Republicans, over the opposition of the American people.

Since 1994, we have run a trade deficit with Mexico every year. In 2006, it hit a record $60 billion. Grand total: almost $500 billion in trade deficits with Mexico since NAFTA. Mexico now exports more than 900,000 vehicles to the United States every year, while the United States exports fewer than 600,000 cars and trucks to the entire world.

This is success?

Where did Mexico get an auto industry? Is it good that our auto industry is being exported? Has the price of a new car plunged because Mexicans get paid a fraction of what U.S. autoworkers earn?

“In 2006, the U.S. economy grew by an additional 3.4 percent,” writes Ikenson. True, and China’s economy grew by 10 percent — and by 140 percent over the last 10 years, tripling the growth in the United States. Not only are we shipping factories, technology, equipment and jobs to China, we are exporting our future to China.

Nor should this shock any student of history. For contrary to free-trade mythology, every nation that has risen to pre-eminence and power — Britain before 1860, the United States from 1860-1914, Germany from 1870-1914, postwar Japan, China today — has pursued a mercantilist or protectionist trade policy.

Economic nationalism is the policy of rising powers, free trade the policy of declining powers. For great powers have ever regarded trade as an arena of struggle in the clash of nations. It is no accident all four presidents who made it to Mount Rushmore were protectionists.

“Thank God I am not a free trader,” wrote Theodore Roosevelt. “Pernicious indulgence in the doctrine of free trade seems inevitably to produce fatty degeneration of the moral fibre.”

Think Teddy might have had a point, Mr. Ikenson?

Probably not. For libertarianism is an ideology, and evidence that contradicts the dogma of an ideology is to be disregarded or denied. For the dogma cannot be wrong.

Indeed, should Ikenson awake from his dogmatic slumber and decide that free trade is failing America, he would not last long as associate director of the Cato Institute’s Center for Trade Policy Studies. The folks who fund Cato are not paying to have dogma debated, but defended. For if the dogma be untrue, then the ideology, the whole system of beliefs, the faith itself, is called into question. And we can’t have that.

To find out more about Patrick Buchanan, and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate web page at http://www.creators.com.

COPYRIGHT 2007 CREATORS SYNDICATE INC.

“Their loss.”

-Ernie

Looking at the negative signs on the balance sheet show that assumption to be false.

ernie

This country runs a $500 billion trade deficit per year. Your solution is to eliminate tariffs on imports so this trade deficit can go higher? This country embraced free trade at the behest of big business in the mid 1980s. Look what happened.

[img [/img]

[/img]

Now that’s a telling graph! Actual history trumps philosophy and economics (i.e., philosophy with math) every time.

Free trade only really works where there is an uber-authority that prevents cheating. But who really wants an uber-authority? Viz. the WTO hasn’t been too helpful. Honestly, you can’t have truly free trade with any country that does not let its currency float. And other than between U.S. states and similar arrangements, it does not really exist except in the imagination.

Theory is when you know everything but nothing works.

Practice is when everything works but no one knows why.

In our government, theory and practice are combined: nothing works and no one knows why.

flash @ 2nd May 2012 at 8:20 am

I think we are mostly in agreement; my take on Smoot-Hawley is influenced by several libertarian writers. The trouble with those aggregates doesn’t reflect what factors were lost but replaced by others for the gross total; the trade war did happen with 37 countries invoking tariffs in retaliation and those effects were felt a long time after.

No, there’s no correlation of S-H and Lincoln’s situation. Just two examples of unintended consequences.

As I’ve said before here, free trade aint free and fair trade aint fair. And the worst self-styled free markets are a travesty — it’s all a type of debasement of language by design.

flash

Thanks for the link. I read it, bookmarked the site — someone who knows of Steven Keen is worth following up on. I see his point about a uniform tariff but leave it to the gubmint, it doesn’t always work out that way.

But it’s good to have a real dialogue and I appreciate it.

admin

If you are now talking tax policy, I would support tariffs over income taxes. Knowing how this country, we would end up with both. Lose/Lose scenario in my book.

ernie

I know that none of my proposals would ever stand a chance of being implemented because the existing warped system was put in place by those in power. They like it just the way it is.