Have you heard the news? Auto sales are booming. Total sales for the month of August were 1,285,202 vehicles, according to Autodata Corp, the highest monthly sales figure for any August since 2007, when 1.47 million autos were sold in the United States. Year to date auto sales have totaled 9.7 million and are on track to reach 14.5 million. Between 2006 and 2007, auto sales ranged between 16 million and 18 million. They crashed below 10 million in 2009. The Keynesians running our government have pulled out all the stops to restart this engine of consumer spending. First they wasted $3 billion of taxpayer funds on the Cash for Clunkers debacle. Almost 700,000 perfectly good cars were destroyed in order to keep union workers happy. This Keynesian brain fart distorted the used car market for two years, raising prices for cars needed by the working poor. After that miserable failure, they realized the true secret to selling vehicles is to give them away to anyone that can scratch an X on a loan document, with 0% interest for 60 months, financed by Federal government controlled banking interests. Add in some massive channel stuffing and presto!!! – You’ve got an auto sales boom.

General Motors sales are up 3.7% over 2011. Ford Motors sales are up 6% over 2011. The Obama administration continues to tout their saving of the U.S. auto industry with their bailout in 2009 that saved unions and screwed bondholders. If this strong auto recovery is not an illusion, how do you explain the two charts below? General Motors stock is down 42% since 2011. The highly proclaimed success story called Ford Motors has seen their stock collapse by 50% since 2011. This is surely a sign of tremendous success and anticipation of soaring profits for these bastions of American manufacturing dominance.

This is America, land of the delusional and home of the vain. The appearance of success is more important than actual success. The corporate mainstream media dutifully reports the surge in auto sales is surely a sign the economy is recovering and the consumer has finished deleveraging and is ready to spend again. The government propaganda machine proclaims the surging auto sales are due to their wise and forward thinking policies (like the Chevy Volt). Luckily for them, there are millions of gullible Americans who believe the storyline and are easily convinced that driving a $30,000 new car, financed over seven years, makes them a success. The decades of Bernaysian marketing propaganda has worked its magic on the government educated, math challenged citizenry. There are only two things that matter to the non-thinking auto buyer (renter) – the monthly payment and what the next door neighbor and his coworkers will think. Buying a fuel efficient car they can afford, paying it off in three or four years, and driving it for ten years, while saving the monthly car payment, is what a practical, rational thinking person would do. The fact that only 20% of the 9.7 million vehicles sold this year have been small cars and the average sales price of new cars sold is now $31,000 proves Americans are still living in a delusional fantasyland of cheap gas and monthly payments for eternity.

As gas prices surpass $4 per gallon across the country, somehow 4.7 million of the 9.7 million vehicles sold in 2012 have been pickups, vans, crossovers or SUVs. Three of the top eight selling vehicles are pickups. Luxury vehicle sales are booming, with Mercedes, BMW, Porsche, Land Rover and Audi showing double digit percentage sales gains over 2011. We’ve entered a recession, gas prices are approaching all-time highs, job growth is pitiful, and Americans continue to buy luxury gas guzzlers on credit. This will surely end well.

The average payment on a new car in 2012 is $461. For used cars, the average monthly payment is $346. Today, 77% of new car purchases are financed. About half of all used vehicles involve financing. Of those cars financed, 89% are through a loan vs. 11% with a lease. A critical thinking person might wonder how a country with 4 million less employed people than we had in 2007, median household net worth down 35%, and real wages lower than they were in 2007, could be experiencing an auto boom. The answer is a government/corporate/banker/media effort to funnel taxpayer funds to deadbeats across the land in a fruitless attempt to create a facade of recovery. Our governing elite are convinced that more debt peddled to the masses is the path to recovery for an economy that imploded due to excessive debt peddled to the masses in the first place. Essentially, it comes down to who benefits from the peddling of debt. It isn’t the masses, as they become enslaved in the chains of debt and monthly payments in perpetuity. Debt peddling benefits Wall Street bankers, politicians, and mega-corporations selling crap to the masses.

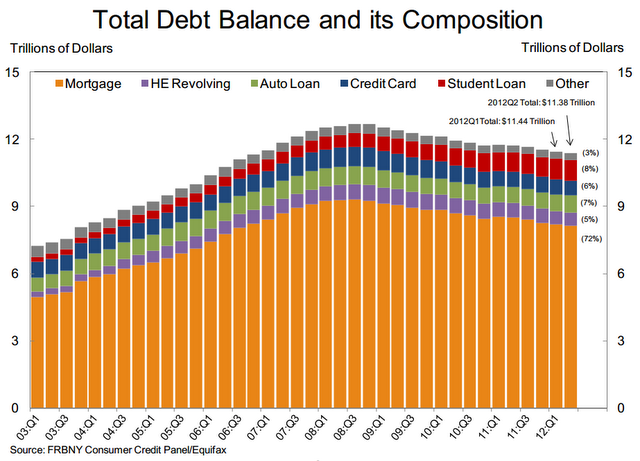

The storyline being sold to the vegetative dupes (watching Honey Boo Boo) that occupy space in this delusional paradise we call America, by the corporate media, is that consumers have deleveraged and are ready to resume their “normal” pattern of spending money they don’t have on stuff they don’t need. Of course, the facts always seem to get in the way of a good yarn. Consumers have never deleveraged. Consumer credit outstanding is at an all-time high of $2.58 trillion. The decline from $2.55 trillion in 2008 to $2.4 trillion in 2010 was NOT deleveraging. It was the Wall Street Too Big To Fail banks taking a big dump on the American taxpayers. They passed their bad debts to you through TARP, the Federal Reserve buying their toxic “assets”, and ZIRP.

Revolving credit (credit card) debt peaked at just above $1 trillion in 2008 and “declined” to $850 billion during 2010. The media storyline is that you buckled down and paid off your credit cards, therefore depressing consumer spending and creating a recession. Sounds convincing except for the fact that it’s a load of bullshit. The Federal Reserve’s own data proves it to be false. Your friendly Wall Street banks have written off $213 billion of credit card debt since 2008 and passed the bill to the few remaining taxpayers in this country. For the math challenged, this means that consumers have actually INCREASED their credit card debt by $68 billion since 2008. The bad news for our Chinese crap peddling mega-retailers is that the significantly poorer average middle class American household is using their credit cards to pay their property tax bills, IRS bills, and utility bills in order to survive.

Credit Card Charge-off in Dollars 2005 – 2011 — Not Seasonally Adjusted:

| Year | Dollar Amount |

| 2011 | $46,017,459,671 |

| 2010 | $75,090,106,350 |

| 2009 | $83,179,901,000 |

| 2008 | $53,506,353,600 |

| 2007 | $38,149,440,000 |

| 2006 | $32,111,934,400 |

| 2005 | $40,634,994,400 |

| Year & Quarter | Dollar Amount |

| 2012Q1 | $8,772,385,443 |

The category of debt that barely budged in the 2009 collapse was non-revolving credit. It stayed in the $1.5 trillion range in 2009 and has since surged to over $1.7 trillion in 2012. What could possibly have made this debt skyrocket by $200 billion when the GDP has only grown by 12% over the same time frame? You guessed it – your corporate fascist friends in Washington DC and on Wall Street. Non-revolving debt consists of auto loan debt of $663 billion and student loan debt of approximately $1 trillion. Student loan debt has shot up by $300 billion since 2008. This student loan debt is being distributed, like candy by a pedophile, from the Federal government in an effort to artificially hold down the unemployment rate.

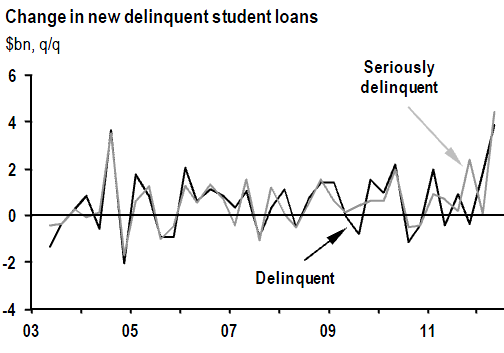

Approximately $500 billion of the student loan debt is held directly by the Federal government, up from $100 billion in 2008. The Feds guarantee the majority of the remaining student loan debt. Can you think of a more subprime borrower than a 40 year old former construction worker getting a liberal arts degree from the University of Phoenix, sitting at his computer in his underwear scratching his balls, and paying with a $10,000 Federal student loan from you? This fraudulent attempt to obscure the true employment situation will end in tears for the borrowers and the American taxpayer. It’s tough to make a loan payment without a job. The student loan bailout is just over the horizon and will cost you at least $300 billion. Delinquencies are already off the charts.

When has offering low interest debt in ample portions to people without jobs, income or assets ever backfired before? The bankers and politicians that control this country seem to be a one-trick pony. They will never admit that debt is the problem and reducing it the solution. The real solution would make them poorer, so their solution is to pour gasoline on the fire with more debt at lower interest rates to more people. The addict will keep injecting more poison into their system until sudden death. The bankers and politicians know we are a car-centric society and appeal to our vanity and poor math skills to keep the game going.

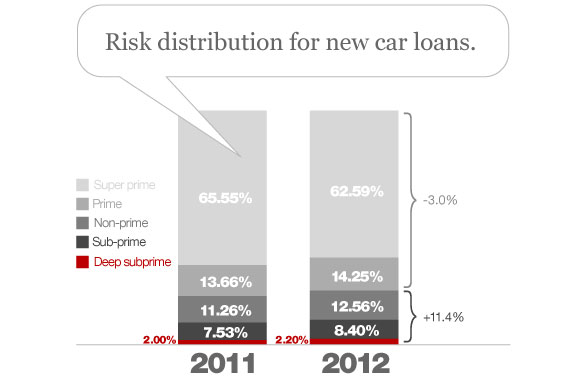

During the first quarter of this year, total U.S. car loans totaled $52.5 billion. That’s 49% higher than the same period in 2009. Also during the first quarter, the average amount financed on new vehicles rose by $589, to $25,995, and for used cars by $411, to $17,050. Furthermore, buyers are stretching out payments for longer terms: The average length of new- and used-vehicle loans jumped a full month during the first three months of this year, to 64 and 59 months, respectively. The surge in auto sales is being completely driven by doling out more loans for a longer time frame to deadbeat borrowers. Subprime auto loans now make up 45% of all car loans and the vast majority of all used car loans. They have even created a category called Deep Subprime. Borrowers classified as “deep subprime” (i.e. those with Vantage scores below 600) account for 10.7% of auto loans. You can also classify them as loans that will never be repaid.

Two thirds of all car sales are for used cars, so the fact that 37% of all new cars are being sold to subprime borrowers is exacerbated by the ridiculous lending practices for used cars. The fine folks at Zero Hedge have provided the outrageous data and a chart that proves beyond a shadow of a doubt what awaits the American taxpayer – another bailout. Zero Hedge has already revealed the GM fake recovery by detailing their channel stuffing over the last two years. Now they’ve dug up more dirt on why car sales are surging. What could possibly go wrong providing loans for more than the value of the asset to people with a history of not paying their debts?

- Subprime borrowers received 56.46% of loans on used cars in the quarter, up from 52.70% a year earlier.

- The average loan-to-value on new cars was 109.55%

- The average used car loan-to-value ratio rose to 126.62%

- 77% of Subprime Auto Loans are for a period greater than five years

It’s amazing how many cars you can sell when you aren’t worried about getting paid. This is the beauty of a fiat currency, a printing press, and a taxpayer available to pick up the tab after the drunken party gets out of hand. The chart below provides the details of our superhighway to disaster. The percentage of used car loans to prime borrowers is now at an all-time low, while the percentage of loans to subprime borrowers is near all-time highs reached just prior to the 2008 crash. When lenders cared about being paid back in the early 2000’s, they rarely made loans longer than five years. Today, more than 77% of all subprime used car loans are longer than five years and average FICO scores are now well below 600. Just to clarify – if your FICO score is below 600 – YOU ARE A DEADBEAT.

When you start to connect the dots, things that didn’t seem to make sense begin to crystallize. This is all part of the master plan concocted by Bernanke, Geithner, Obama and the Wall Street Shysters. The auto section of my local paper now makes sense. Offers of 7 year financing at 0% interest and monthly lease offers of $150 to $200 for brand new cars now are understandable. The newer model BMWs, Cadillac Escalades, Volvos, and Jaguars I see parked in front of the low income luxury gated townhome community in West Philadelphia now makes sense. A pizza delivery guy driving a new Lexus is now explainable.

The master plan is fairly simple. The Federal Reserve lends money to the Wall Street banks for 0% interest. These banks then turn around and provide credit card debt at 13% interest, new & used car loans to prime borrowers at 5% interest, and new & used car loans to subprime borrowers at 16%. When you can borrow for free, you can take a chance that a significant number of your borrowers will default. Essentially, Ben Bernanke is screwing the prudent savers and senior citizens by paying them 0.15% on their savings in order to subsidize the bankers that destroyed the country so they can make auto loans to the same people who took out the zero percent down interest only no doc mortgage loans in 2005. In addition, Wall Street knows the Bernanke Put is still in place. If and when these subprime loans explode in their faces again, Bennie, Timmy and Obamaney will come to the rescue with your tax dollars. Its heads you lose, tails you lose, again.

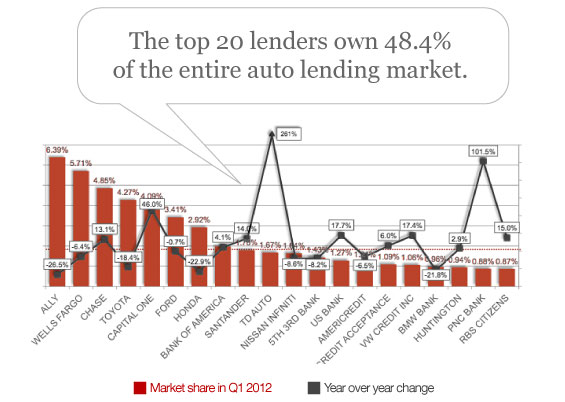

The chart below is like a who’s who of TARP recipients. The top 20 auto lenders control half the market. And look at the leader of the pack. Our friends at Ally Bank are the market share leader. You remember Ally Bank – they conveniently changed their name from GMAC (also known as Ditech – biggest subprime mortgage lender) after losing billions and being bailed out by you. They still owe you $11 billion and are 85% owned by the U.S. Treasury. No conflict of interest there. You have the biggest auto lender on earth controlled by the Obama administration. Do you think they have an incentive to make as many loans as humanly possible to help Obama create the illusion of an auto recovery? The only downside is for the American taxpayer when we have to eat billions more in Ally/GMAC losses. This insolvent excuse for a lending institution has been extremely aggressive in the subprime auto lending market and has forced the other wannabes – Wells Fargo, JP Morgan, Capital One and Bank of America – to lower their lending standards. Does this scenario ring a bell?

We’ve become a subprime auto nation, addicted to easy debt, living lives of hope, delusion and minimum monthly payments. Storylines about economic recovery, fraudulent government statistics showing lower unemployment, feel good propaganda from the corporate mainstream media, and a return to easy money debt fueled spending does not constitute a real recovery. Until the bad debt is purged from the system and saving takes precedence over spending, the country will stagger and ultimately fall under the weight of its immense debt. We are lost in a blizzard of lies. This subprime fueled engine of recovery will propel the country into the same canyon of reality we entered in 2008. The crack up boom approaches.

Great article, but you are missing the entire point of the Bail Out Auto Nation Strategy.

When the car loans all go tits up, the fed.gov wil come up with a big bail-out, and all these drivers will continue driving their cars without paying for them.

Just like the homeowners who continue to live in their homes without paying any mortgage payments (who were put into these homes with bubble loans in the first place).

See, if people can’t drive, they can’t :

1) buy gas, which is the largest tax revenue to come into the fed.gov,

2) go to the grocery food, which will stimulate the SNAP card business and JP Morgan will be sad,

3) go to the Mall, and spend those welfare checks,

and, and, and, wait for it,

4) go to the polls and vote for Obama or other Democrats.

So, at all costs, gotta keep folks in their cars.

That being said, I’m going right down to my Caddy dealer and buying the most blinged up, rim’ed up Cadillac Escalade at 0% with 0 intention of ever paying it back, heh.

Great article. Damn, HZK beat me to it. What I was going to say, so, instead “what she said”.

I’ll give you a little story along these lines you might enjoy:

“Mercedes, BMW, Porsche, Land Rover and Audi showing double digit percentage sales gains over 2011”

There’s a good explanation for this. Around here, there are more government employees than you could shoot with a 5 ninety round clips. They work at the prisons, for the park service, the state, the USDA, thousands at the USDA, offices everywhere, every third car on the road a brand-new government issued car, many of the Japanese (our tax dollars at work). Well, when they get off work, it’s different.

The new status symbol for government employees is driving a Mercedes. At first there were only a few, but now, every government employee office has a number of new Mercedes in the parking lot. Prison employees have new Mercedes, USDA drones have new Mercedes, Parks officials have new Mercedes. City workers have new Mercedes. They’re everywhere; the “must have” item for government drone workers.

Government employees, on average, get 60% more than everyone else, get huge salary increases every year, and are living the high life, complete with expensive German cars. As a side note, only one of the doctors around here drives a Mercedes. We can’t afford them.

Amazing article. Simply amazing.

If people bought cars like I do, the auto industry probably would have been doomed decades ago.

I will in all likelihood never purchase a brand new car in my lifetime. My current 15 year old car is good to go for another 5 -6 years. At which time I’ll buy another used car for 1/4 or less than that of a new car. Fuck that “I-need-a-new-car” shit.

Of course, if everyone did this then we’d soon run out of new cars that become old cars. So, all you people buying cars at their full and highest asset price (new) …. please continue doing so!! I might need to buy it in five or six years.

Different strokes. I just bought a new car, paid in full. It’s an ’89 Toyota 4×4 pickup with a 4 banger in it. Great mileage and gets me where most rational people would hesitate to venture. and back again with a bit of care. I think of it as recycling.

For H@ZK,

Chuck Berry at his finest!

http://www.youtube.com/watch?v=sehRjN0jJqE&feature=youtu.be

@Appalachian: Thank you!! That was delightful Chuck Berry is national treasure, his stuff is great and will be played in 100 years as it is CLASSIC.

The student loan bubble hasn’t seen enough victims yet, so why not inflate another bubble simultaneously? And it’s sub-prime, double bonus.

@prtrb’d, outstanding! In 1999 I bought what was even then a piece of shit (at least it looks like it anyway) 1986 Toyota 4Runner for $1500. It also has a 4 banger in it. It will go places that I KNOW forest service trucks can’t go. I’ve been told by rangers that certain roads are impassable shortly after I’ve driven them! It is my daily driver and runs like a top with 313,000 original miles on it. Counting all routine maintenance as well as original purchase price, tires, insurance and registration, I doubt that I have spent more than $12k on this rig in the 13 years I have owned it! Who says a poor working class stiff can’t get ahead in this world? The bonus is that if it got totaled tomorrow, I could care less and no self respecting thief would ever consider stealing it. Most days I don’t even lock it up! I’ve got a 1991 Toyota 4Runner with 80k miles on it waiting in the wings for the day the ’86 dies.

I_S

Admin falls off the wagon and comes out swinging on Wall Street.

Great food for thought.

“Can you think of a more subprime borrower than a 40 year old former construction worker getting a liberal arts degree from the University of Phoenix, sitting at his computer in his underwear scratching his balls, and paying with a $10,000 Federal student loan from you?”

I’m thinking on majoring in White American Male Studies,

BTW, I’m going to jump all over G Man Corporatist Motor’s 84 month C-Volt deal, but I’m holding out , waiting for them to sweeten the pot with SSI, Medicaid and monthly gas stamps.

I just love living in my Free-shit country.

Great article Jim. I call these “printable” articles so I can give copies to others for their indoctrination. Along the same lines, I flipped the channel two nights ago at the precise time Clinton was speaking on student loans, blabbering some shit about the USA being 16th in the world relating to college education. It’s what came out of his mouth that followed that my ears perked up. Paraphrasing ” a persons student loan payment will be based on the job the person has and not on the balance owed on the loan”…This country is loony.

Thank you American taxpayer

You loaned her $25,000 for this.

The last time anyone did an objective study on the cost to the public of all the direct and indirect subsidies for private auto ownership vs public transit, on a per-passenger basis,was in the mid-90.

A Libertarian think tank called the Midwest Institute, which I believe (I’m not sure) is now the Northeast-Midwest Institute, calculated that we subsidize each privately owned auto in this country to the tune of $2500 a year, while transit and rail passengers receive about $800.

So thank people like me, who live in cities close to rail lines and ride standing up (helps control weight) every day and who don’t own cars, for the tax money to maintain the highways, subsidize car loans and suburban house loans (and bailouts). I ditched my auto 25 years ago, realizing that as long as I owned a car I would own a car loan and be forever scrambling for money for the unending repairs and maintenance: and that the only way most people in this country can afford their cars is to be perpetually in debt for a rapidly-depreciating, trouble-prone appliance that gobbles money, space, and finite resources far in excess of benefits it generates for the owner or the country at large.

What people don’t realize is, even without subsidies for car builders and lenders, that mass car ownership in this country, in and of itself, is bankrupting the population on a private level while imposing massive costs on the public that are utterly unjustified by any benefit we receive in return. The destruction of our cities and their replacement by sprawl-burbs that have millions of people commuting as much as 80 miles each direction each day, and driving three miles on the highway just to pick up a gallon of milk and loaf of bread, and most of all, the dependence of our population on evermore consumer credit just to be able to travel to a low-to-middle-level job- all these destructive developments owe to our excessive car dependence.

This country has become such a hairball of subsidies for virtually every activity and every type of business, the type depending on locale and which way the political winds are blowing, that it has become absolutely impossible to tell what pays for itself and what is truly economical.

However, I have an inkling that if ALL subsidies for ALL transportation were to cease- except for surface roads essential for basic travel, ingress, and egress- that we would jointly and severally choose to re-organize our lives around “walkable” neighborhoods, retail-transit hubs, and public transit. We wouldn’t “choose” to do this, because most of us just plain wouldn’t have a choice. Car ownership, and especially the 3 car household, would become unaffordable for most people if they had to pay the full cost of their gasoline (jerk the subsidies for oil and gas production), the cost of the 8 and 10-lane interstate highways that cost $100M a running mile to build, and the cost of all the “free” street parking that now necessitates an additional lane on either side of the street to accommodate parking, never mind the oceans of lot parking.

Standing up on a crowded train or bus would begin to look good, especially for your teenager, who really shouldn’t be driving a car anyway. Auto wrecks are the no 1 killer of teens, ahead of shootings and every other cause of death in the young.

At the same time we’re de-subsidizing autos, we need to be weaning public transit off subsidies. But to do that, you have to end local utility monopolies, which guarantee transit agencies exclusive turf but make them run unprofitable, lightly-traveled service in return. Utility monopolies are one of the worst things that ever happened to this country. They are a product of Crony Capitalism- early utilities moguls, notably Samuel Insull (founder of Chicago’s Commonwealth Edison and builder of its early el train lines), who wanted guaranteed profits and sold political leaders on the notion that building out electrical, transit, and telephone infrastructure was too costly and risky for an operator in the absence of a guaranteed market. As a result, Chicago’s CTA and other city transit agencies are forced to run bus lines that haul 6 old people a day on sight-seeing tours of the nabes they’ve lived in since 1945, at the expense of heavily traveled lines that could support themselves profitably but are short equipment and investment, and running overcrowded, delayed, and dirty because of the funds that must be allocated to service that can’t justify itself economically.

Pulling all transportation subsidies would be disruptive at first. Millions would find themselves stranded in remote suburbs, unable to the rapidly escalating costs of auto ownership and operation. Meanwhile, property values would start ratcheting up in neighborhoods close to rail lines and good bus lines, both urban and suburban. This is already happening in the Chicago area. The transit would be overcrowded and the fares would rise, in the short run.

But as the dust settled, the vastly increased ridership on transit would enable greatly increased investment in equipment, infrastructure, and personnel, and fares would decrease on a per/mile basis as ridership swelled. Meanwhile, auto ownership and use would continue to drop as highways deteriorated and tolls on them rose to cover the costs of the gold-plated maintenance required to keep them safe to drive at high speeds. There would no longer be any question of providing cars for teens.

But this is just my fantasy. It would never work because we’d also have to end subsidies for suburban house-building and shopping center development and all the rest of the energy-guzzling, MONEY-guzzling crap we think of as “the American way of life”. There is no political impetus for doing that, to say the least- I can’t think of a faster way for a politician to kill his career than to suggest that the famous “American way of life” and mass car ownership are no longer affordable and never really were, and that we should not be subsidizing it with public money.

Admin – you are gonna get sued by Obamma and his crew for this stuff – it makes him look bad, and that cannot be allowed.

I will have to read this a couple of times to A) make sense of it all, and B) find something I can disagree with (so far, nada), as I never agree with everything, and that’s my policy and I ain’t changing now.

I stopped at a convenience store today and the lady behind the counter looked about in her 50’s with tattoos and the teeth were scarce. Her trashy looking son and skank of a girlfriend came in the same time as me. He was joking to her about queen skank driving moms new car. When they left they jumped into a new Mercedes. Not sure what model it was but it was a big 4 door. At least they had the windows down to save on gas so mom would not be late on a payment.

Now maybe this queen had a high dollar man but I really doubt it. Who knows, maybe we all will get a chance to make her payment someday.

The bright side of all of the subprime auto sales is I have a good friend who has a repo agency, and he said he stays busy.

Chicago999444

We can’t all live in big Shitties, and even then along bus/rail lines. Most of us wouldn’t want to. You touch my ancient car, I break you face.

I keep driving my 14-year-old beast. I am saving money and will not buy another car until the price of a Honda CR-Z comes down enough to equal the amount of money I have saved up. Even then, I might not buy one, because I am kind of attached to my old piece of crap.

Just give me back my 1967 Pontiac LeMans convertible, which I paid $300 for and drove it for 13 years until some idiot smashed into it after it had nearly 320,000 miles. It was as reliable as any Honda or Toyota out there today, and it didn’t have all this electronic sh!t…computers, sensors that crap out and cost hundreds of $$$ to diagnose & replace.

Fvck computerized climate control, automatic windshield wipers and give me windows that crank open & closed, and that knob next to your knee that you pull on to open the floor vent. Oh and give us back those wing-windows on the front doors too.

Mammoth

I bought a blue 1966 Lemans (hardtop) when I was stationed in Kansas. 60K miles, about $800. Only had it a year. GREAT car!

Stuck and his car:

[img]http://t1.gstatic.com/images?q=tbn:ANd9GcSJKStpv35pIg0BBXv5oKTdU82vl3mMweD01W_8LAr8GgTreoXluA[/img]

I couldn’t even fit my massive shlong in that thing.

I cannot find anything to dispute with the article – man, I hate that.

The only folks who should buy a car on credit are those who have no intention of paying. Those folks are buying like mad. Go figure.

As I understand it, Ms Freud is about 4 feet tall. Massive schlong my fat ass – she would have avoided you like the plague.

I took a shit the other day. It was a good 14 inches long and 3 inches in circumferance. Yeah, TMI. But, with a large body, comes large parts. That’s a fact, Jack.

Ok, so I posted this link in the Shit-on-Obama thread. Maybe one person looked at it.

This is car related. Ex-Michigan, Jennifer Granholm, at Dem Convention … talking about how Obama saved the auto industry. OK, BFD. But, you gotta see the delivery … fucking batshit crazy,

Also some good shots of the crowd up close. You, we, have nothing in common with ObamaSheeple.

Not the full speech. Just 4 min highlights.

Oh YEAH! Those wing-windows on the front doors! I had nearly forgotten about those. Good call, Mammoth. I want wing-windows!!!

Stucky, your car is safe from me.

You’re quite welcome to your car… as long as you can pay for it.

I don’t want to “take away” or “force” anybody to do anything. I just don’t want to subsidize everybody else’s wasteful consumption and irresponsible borrowing.. all to maintain a lifestyle they’ll feel is an entitlement as an American.

Here’s the deal I’m happy to make with my fellow ‘merikuns:

You don’t have to pay for my trains and buses if I don’t have to pay for your cars and planes.

You don’t have to pay for my museums and symphony orchestras if I don’t have to pay for your sports stadiums, shopping malls, and big box retail (do you know what a TIF is?)

You don’t have to pay for my nuclear power plants if I don’t have to pay for your “clean” coal, your windmills,and your solar farms.

You don’t have to pay for my birth control and tubal ligation if I don’t have to help support your kids (welfare, insane rates for women’s health insurance, tax deductions for each child and for child care).

You get what I’m saying, I’m sure.

And now, as is being advertised locally, you can buy a new car, drive it for 60 days, and if you decide you don’t like it, return it!

Gee, I find the timing peculiar.

(Keep that car at least long enough to get yourself to the polls to vote for…..)

I’m with you, Stucky, I’ll get another “new” gently used car in about 10 years. Maybe.

My car sits in the garage most of the time. In 10 years, it will most likely still look like new.

Let someone else pay the premium for the off-gassing new smell of a shiny new car.

People are way too impressed with the whole automobile thing in the first place, if you ask me.

Hey now, I may not get the best mileage around but for each gallon I do burn the government, no matter who pretends to be its president, gets 18 cents a gallon! Fuck those imports, how dare they come into my country and sip fuel and not support DC! Besides the back seat is huge!

You don’t have to pay for my birth control and tubal ligation if I don’t have to help support your kids (welfare, insane rates for women’s health insurance, tax deductions for each child and for child care). -Chicago

I printed for that! You pay nothing for it! Vote Bush 2012

Here’s a story for you: I work in the automotive industry and I would never buy a new car. We supply GM and Ford here in the USA and they are the WORST of our customers. I won’t tell you what component we supply, but they are poorly designed and the support we receive from GM and Ford is minimal at best. Ford and GM thump their chests on being “American” but they don’t give a damn about anybody under them.

Don’t buy GM’s or Ford – they are junk. But a foreign car. Tell UAW’s employees to go to hell!

So I haven’t even been thinking about buying a new car but I’m beginning to think shit – go buy a big old mother and just drive it without making any payments until the wrecker comes to repo it and then laugh when they start telling me that they will fuck with my credit rating. Drive for free MF.

Nice article, Admin. Muy bien hecho, amigo.

Unless I’m completely misreading the situation over the past few weeks, you are one completely driven and dedicated motherfucker. And I mean that in the most complimentary sense of being called a “motherfucker.” I’ve never seen anything like it

It should be interesting to see what happens with all these fancy late model cars with seven year loans when the SHTF. I suspect there will be a long line of tankers transporting slightly used cars across the Pacific for people that can afford them: the Chinese. Maybe they can send us their used bicycles.

3 9’s, 3 4’s, I’m glad you clarified your position.

Your first rant sounded pure Agenda 21. However, with a Libertarian spin…..

“I took a shit the other day. It was a good 14 inches long and 3 inches in circumferance. Yeah, TMI.”

—-Stucky

Actually, it’s not too much information. For the mathematically inclined, using the piexdiameter=circumference formula, the diameter of your shit log works out to be .96 inches. Given the 14 inch length, this would be one skinny dude evacuating your body.

Now, what WOULD be too much information is HOW you measured the circumference of said log. Please don’t explain. Please.

Common, this is Stucky sitting in his car. He only wears the clown outfit when he’s cruising for young boys to molest.

[img]http://t1.gstatic.com/images?q=tbn:ANd9GcTngMdyCO4ejxUixwxcD1dcsn7X9g8cr2rNrgWAIhwlYRCTrZwXEce9KFHx[/img]

The new GM car for the average American (not THE Real American)

It’s called the “Rotonda”

[img [/img]

[/img]

Isn’t this a driving hazard?

40 DDDD’s and steering aren’t compatible

[img [/img]

[/img]

Mammoth, one of my first cars was an old 69 ford Fairlane. It was a magnificent car with a 302. It was quite a bit smaller that other cars of its era and was a real joy to drive. Best part was that if it ever broke down, you could walk onto any farm in the country and find most any part to get it going again. One day I was cruising down the highway with the windows down and the entire headliner dropped down over my head. I thought for sure I was gonna die when it suddenly got dark. You could easily fit three bodies in the trunk too!

I_S

1969 Ford Fairlane [/img]

[/img]

[img

How many vehicles “sold” were actually “purchased” by the government (e.g. GSA)? It wouldn’t surprise me to find out that the surplus inventories were scooped up with taxpayer’s $ to help the gov. numbers game.

Ford or GM should produce a car called the “Black Swan”. It should only be available on 100% credit with no interest for 7 years but if either maker gets a bailout the owner forfeits the car and still owes the debt with no provision for bankruptcy.

Just messin’ with some creative solutions……

Yeah! an old car you own outright and don’t have to fully insure saves you $1000 per year in insurance and property taxes, (not to mention 5%sales tax on vehicle)

this more than pays for your annual gas, tires, and oil expense. I have an old 2000 luxury suburban, $59,000 new. but under 10,000 used, it fits my five kid family, and delivers my 5ton finished products to market on trailer. (i’m a sculptor).

I only drive it 4,-5000 miles per year, but go to the store, errand, shop and work by zipping around on my scooter ( a $700 used burgman gets 65 mpg) My restraint of use/need to drive, means I will drive this sucker for the next 20 years or til gas is $25/gal which ever comes first.

I am in the market for a vw type van that gets 50 mpg and costs $10,000. doesn’t have to go fast, til then my suburban/scooter combo gets that kind of milage combined in use, and cost a hell of a lot less. That saved dough goes into the silver pile in a vault at goldbullion. wonder what kinda car I can buy in 10 years with $10k of silver banked at 30/ oz today?

Don’t piss away your capitol on a shinny new car thing, save, be secure, thats real wealth.

Drive the cheapest car your ego will allow is advice I once received. I drove an ancient Ford for years due to that advice – finally gave it away when my customers begn to make negative comments. By then I could afford better. But it is good advice.

Here is the great thing about capitalism. All the idiots (individuals, businesses,corporations et cetera) have the absolute right to allocate their resources however they see fit. Feel free to laugh at them when they fail due to poor deployment of capital. But NEVER tell anyone how to make the best use of THEIR resources unless you have a vested interest , or have been asked by said person. I believe people have a right to make their own choices and live with them. If someone can afford an expensive car, who are you to tell them they can’t have it? If a dealership wants to sell a car to a poor credt risk individual, that is their business, so long as you are not on the hook through bailouts and the like.

P.S.

Just so you know, the subprime myth that anyone can just go sign for a new car with no income and bad credit is pure bullshit. Virtually all subprime lenders require proof of income sufficient to make payment, an adequate down stroke and other stipulations.

P.P.S

A huge number of people in the U.S. have “subprime” credit, so it would stand to reason that many auto loans are subprime.

Jean-yus/Fred Flinstone

You’re a pip.

You freaking nail every post. Glad you’re still on the treadmill after that post about Smokey. I’m a Wilmington boy that got out of The Race a few years ago – sold the house and business and now travel full time in a ’02 motorhome I bought for $60K. At least I’ll be mobile when the SHTF. As long as They don’t confiscate my liquid assets. You’re doing God’s work – keep it up, bro!

Jean-yus, I believe the whole point of this post is that lenders would not be making these loans if they could not count on government backup.

Or at least one really major idiot lender, Ally Financial (formerly General Motors Acceptance/DiTech) would not be making the lion’s share of the new car loans, to people who make less yearly than their 6000 lb. war machines cost, and get 7-year, 0% down, 0% interest adjustable loans to buy them. Ally just happens to be 85% owned by our government.

Can you connect the dots here?

Can you see that this wild upsurge in spending on gas-guzzler $40,000 autos is not exactly the result of “free market” operations, anymore than the home-lending debacle of the 00s was?

Admin, you are a conservative! Your problem is trying to fit values and logic into the Occupy mindset.

Try attending a Tea Party event–you’ll see lots of used cars that are paid for, whose owners don’t feel like paying for a new car for their neighbor.

Check out Susana Martinez, gov-NM, who realized after meeting with some conservatives years ago realized, “Well I’ll be damned–we’re Republicans!”

Look forward to seeing you on the light side!

Jane Gault

I’m a libertarian.

Are you voting for Mitt Romney?

Is he a conservative?

“If a dealership wants to sell a car to a poor credt risk individual, that is their business, so long as you are not on the hook through bailouts and the like.” – Jean yus (NOT!!!)

Can you comprehend what you read? The whole point of the analysis is that the faltering Middle-class WILL AGAIN be on the hook for these sham loans the Shysters’ originated. And it’s actually much worse then this because I’m quite sure these loans are (sound familiar) “securitized” in the form of CDOs which means this escalating debt bubble is leveraged far more than it appears on the surface.

9 Trillion in home equity destroyed by Vultures in the engineered housing bubble (Note this figure was from 2010)

http://www.businessinsider.com/zillow-9-trillion-2010-12

Thanks, as ever, Admin for another superb overview and analysis (I work in the automotive retail business – and yes – I’m DOOMED). Your caustic wit and cutthroat dissections are sorely missed, but we doomers understand and empathize COMPLETELY. I too have long marveled over your seemingly supranatural devotion and energy to this website and the cause of liberty/freedom.

Hope you are enjoying your well-deserved, overdue respite from the gathering storm.

Cheerio,

Stephanie

Libertarians are not “conservatives”.

We’re Radicals for Liberty.