Make no mistake about it, Ben Bernanke, Timmy Geithner, Obama and their Wall Street cronies have attempted to engineer a ponzi scheme housing recovery with your money. They have used the FHA to dole out mortgage loans to subprime borrowers requiring only a 3.5% downpayment. When has this ever caused problems? The FHA backed a miniscule percentage of mortgages prior to 2008. Obama has used this agency to prop up the housing market, just like he has artificially kept the unemployment rate lower by doling out your tax dollars to morons going to the University of Phoenix, and using his government run auto finance company – Ally Financial – to dole out loans for Cadillac Escalades to deadbeats in West Philly.

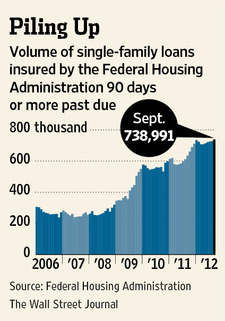

Now we know that FHA backed loans going bad are skyrocketing. The FHA is broke. Guess who will bailout the FHA because they gave loans to deadbeats? YOU!!!! The FHA will lose at least $16 billion of your tax dollars next year.

Ben Bernanke is buying up all the fraudulent mortgage debt from his buddies on Wall Street and transferring that bad debt to you. His balance sheet is leveraged 60 to 1 and is filled with toxic worthless shit mortgages. You are on the hook for that bad debt, while he pays you 0% interest on your savings.

Charles Hugh Smith describes the fraud in clear concise terms. Even a CNBC anchor could understand it, if they weren’t being paid to lie about it.

Real Estate: Is the Bottom In, or Is This a Head-Fake?

Everyone interested in real estate is asking the same question: Is the bottom in, or is this just another “green shoots” recovery that will soon wilt?

Let’s start by reviewing the fundamental forces currently affecting real estate valuations.

Expanding the pool of potential buyers has reached the upper limit

There are two ways to expand the pool of qualified home buyers, and they both rely on expanding leverage: A) lower the down payment from 20% cash to 3%, and B) lower the mortgage rate to 3.5%.

Lowering the down payment increases the leverage from 4-to-1 to 33-to-1, a massive leap.

Increasing leverage increases risk. Over 90% of all mortgages are guaranteed or backed by Federal agencies such as FHA. This “socialization” of the mortgage industry means that losses ultimately flow through to the taxpayers, who are subsidizing the housing industry via these agencies.

Lowering the mortgage rate increases the leverage of income. It now takes much less income to qualify for greatly reduced monthly payments.

With mortgage rates barely above the prime rate and Treasury bond yields negative in terms of inflation, there is simply no room left for lower rates or down payments. The “increase home sales by expanding the pool of buyers” game plan has been run to the absolute limit.

The pool of buyers cannot be expanded any further; that boost to sales is done.

The unintended consequence of enticing marginal buyers to buy homes is that defaults are rising: 1 out of 6 FHA-insured loans are delinquent. This is the “blowback” of qualifying everyone with an income above the poverty line as a homebuyer.

The mortgage industry has escaped any consequences of “robo-signing” mortgage fraud

If the rule of law existed in more than name, this is what should have happened:

- MERS, the mortgage industry’s placeholder of fictitious mortgage notes, would have been summarily shut down.

- All mortgages and derivatives based on mortgages would have been marked-to-market.

- All losses would be booked immediately, and any institution that was deemed insolvent would have been shuttered and its assets auctioned off in an orderly fashion.

- Regardless of the cost to owners of mortgages, every deed, lien, and note would be painstakingly reconstructed on every mortgage in the U.S., and the deed and note properly filed in each county as per U.S. law.

That none of this has happened is proof that the rule of law is “optional” for financial institutions in America.

The $25 billion mortgage fraud settlement turned a blind eye to the fraud, and now the banks are applying losses they have already booked to the $25 billion, mooting the supposed “benefit” of the settlement to consumers.

The Federal Reserve’s purchase of mortgages – over $1.1 trillion in 2009-10 and now another $40 billion a month – is essentially a money-laundering operation in which the Fed exchanges cash for dodgy mortgages.

Analyst Catherine Austin Fitts (QE3 – Pay Attention If You Are in the Real Estate Market) summarized what this means:

“The Fed is now where mortgages go to die.”

“Thousands of mortgages on homes that do not exist or on homes that have more than one ‘first’ mortgage are now going to the Fed to disappear. Thousands of multifamily and commercial mortgages will be bought up as well. With documents shredded, criminal liabilities extinguished and financial institutions made whole, funds can return without fear of seizure.

QE3 proves beyond any shadow of a doubt that the extent of the fraud was as bad as I said it was. You can count up the bailouts and QE1, QE2, QE3 the numbers speak for themselves. The fraud was indeed in the many trillions of dollars.”

In other words, the financial sector has gotten away with murder, and the “overhang” of systemic fraud has been erased with Fed connivance.

Banks are restricting inventory

The banks are withholding distressed properties to restrict the inventory of homes for sale.

If supply overwhelms demand, prices decline. That would be a bad thing for banks sitting on millions of defaulted mortgages and distressed properties. Millions of impaired properties are being held off the market so supply is lower than demand.

The strategy has costs. Thousands of defaulted homeowners have been living mortgage-free for years. But the gains have been impressive. With supply dwindling, beaten-down markets have seen gains of 20+% this year as strong investor demand has pushed prices higher.

Since the strategy has paid such handsome returns, why change it?

ZIRP has attracted investment

The Fed’s ZIRP (zero interest rate policy) has pushed investors into a “search for safe yield” that has led many to buy corporate bonds, dividend stocks and everyone’s favorite “safe” fixed asset, real estate.

In many markets, one-third or more of all sales have been to investors.

Some are buying distressed properties to “flip” in strong-demand markets, but many are buying the homes as rentals with the plan being to hold them for a few years as prices rise and then sell to reap appreciation.

Anecdotally, every investor class is getting into the act, from Mom and Pop to big players such as insurance companies and Wall Street funds. One of my contacts in the insurance industry told me that his firm was buying large multi-unit apartment complexes, as these rentals generated a yield of 6% to 7%, far above the 1.7% yield of ten-year Treasury bonds.

In a non-ZIRP world, Treasuries and other asset classes would offer similar yields but without the risks and costs of managing rentals. But in a ZIRP world of near-zero yields for low-risk financial assets, rental real estate is a compelling investment: decent yields, relatively low risk, and strong appreciation potential if housing has indeed bottomed.

“The bottom is in” – isn’t it?

Once potential buyers see prices rise and they conclude that “the bottom is in,” they jump in and buy, pushing prices higher in a positive feedback loop. The higher prices rise, the more evidence there is that the bottom is in, and the greater the incentives to jump in before prices once again rise out of reach.

Favorable rent/buy ratio

With mortgage rates well below 4%, the rent-buy ratio is favorable in many areas. It may indeed be cheaper to buy than to rent in some locales.

“Hot money” flowing into real-estate

As economies in Europe and Asia falter, “hot money” is flowing into perceived “safe havens” such as the U.S. and Canada. Some of this “hot money” ($225-$300 billion a year is leaving China alone) is flowing into real estate, a well-known phenomenon in markets such as Vancouver, B.C., Miami, and Los Angeles.

Conclusion

What can we conclude from this overview of fundamentals?

- The mortgage industry escaped any real consequence from its systemic fraud

- The Status Quo plan to reflate the housing market with super-low mortgage rates and down payments has worked to some degree

- The financial sector’s plan to boost home prices by limiting supply has also worked

- ZIRP has created a “crowded trade” in low-risk investments with attractive yields such as corporate bonds, dividend stocks, and real estate, which is being fueled by a self-reinforcing perception that “the bottom is in”

The question now is will these forces continue pushing prices higher? If so, the bottom may well be in. If these forces deteriorate or lose their effectiveness, then the “green shoots” of investor interest may wither as the U.S. economy joins Europe and Japan by re-entering recession.

In Part II: Forecasting the Future of Rental Housing and Home Valuations, we will examine what forces could change “the bottom is in!” to “this is just another head-fake” – with the real bottom still ahead.

Click here to read Part II of this report (free executive summary; enrollment required for full access).

“The question now is will these forces continue pushing prices higher?”

Incorrect.

The real question related to housing prices has to do with income. If income continues to drop, so will house prices.

I decided back in 2004 that I would never buy a house here in the US. It isn’t about the prices or equivalent rents or even taxes & maintenance. It’s that I knew by then that I would not be staying here if I could do anything about it. I’m in the only US city I’d consider living in and it’s getting worse every year. The FSA are taking over for the most part, most everyone else is fucking retarded. I’ve got another couple of years to stick it out until I get my tickets to the other side of the planet – where I probably will buy a small plot of dirt somewhere near a decent little town and fade into obscurity.

agree with Stucky….no (good paying) jobs no real estate market

Correct me if I’m wrong.

The government give a student a loan. The loan is borrowed out of thin air. (no capital). The student pays the professor. The professor takes the loan money and pays off some of his auto and home mortgage.

So the debt of the professor is retired by the burden put on the student.

While I can understand investors interest in buying homes and apartments for rental income you just don’t get 6 or 8% returns because the numbers show that. I think a lot of small investors are going to get badly burned as finding good tenants is not easy and as 1 month’s vacancy equals over 8% of annual rental income your expected return vanishes for the year everytime a tenant moves out.

If it takes you more than a month to turnover a rental unit your next year’s return vanishes too. Same thing for an eviction, you not only will lose a month or two of rent, but likely incur heavier than normal maintenance costs as deadbeat tenants are seldom concerned about leaving YOUR property in tip top condition.

That’s the other thing about rental properties, particularly single family homes. Neighborhoods that have them tend to become blighted. Landlords do not spend much on landscaping or upkeep and property values fall fast as homes transition from owner occupied to rental units. Upscale communities with HOA may limit the number of rentals allowed to avoid this problem and those association fees are due whether you have a tenant or not!

Owning rental property is a headache I’d not want again expecially if there is uniikely to be any capital gain on the property.

This is somewhat related but mostly not, and it is definitely me venting.

I recently interviewed for a job and if I get hired I’d only make $200 more a month than if I were to claim VA disability (for which I’m eligible and assuming 100% rating, which is very possible). In addition I’d most likely qualify for food stamps and would get free health care through the VA and perhaps through the atrocious Obamacare. I bet perhaps I’d even qualify for Section 8 housing. So here in America a person can be better off financially without lifting a finger than if they were to work a full time, salaried job. And with these prices and these wages, who the hell can purchase a home until they are in their 40s or 50s?

@ micro-be,

Starting pay is not final pay but it more or less is if you join the Free Shit Army. In fact, the FSA will likely experience benefit cuts in the coming years, either outright reductions or hidden cuts as benefits do not keep up with inflation. The GOP is even calling for a new forumula for COLAs that will accomplish this.

If all you want out of life is to be taken care of by a government that is very likely to go bankrupt or do not think you have much ability to advance yourself with your own talents and abilities then the Free

Shit Army maybe for you. However once you join up and spend a few years on their payroll the other option of being a productive person able to advance in the private sector becomes almost impossible to get back on. No one wants to hire a person who has demonstrated they have no drive or initiative.

sangell –

Didn’t mean to imply that I was actually torn between the two decisions, I’ll be taking the job if offered the position.Yes the gov(s) will (have) run out of money and I’m sure thanks to policies that allow this type of situation to transpire. A person sitting on their ass collecting disability or welfare can make a lot of money in the black market as well. As far as future earning power is concerned, I’d like to agree with you but I’m not convinced that future wages will be worth writing home about. Hope I’m wrong.

I remember a boss once saying something like, “Initiative is important — we’ll tell you when we want it.”

Anyway. What makes those mortgages toxic is, there’s no there there. The best specific example I’ve found so far is, a mortgage that was sold 40 times. In the Ambac suit against JMPC/Bear, one tranche of 5000 mortgages revealed 88% were fraudulent. Robosigning is still alive and well; trusts that died long ago are still passing on mortgages to ‘someone’. Mortgage modification was just code for passing on more fees, and smoke & mirrors to fool the public.

With Inspector Clouseau at the helm of the Department of JustUs, you certainly cannot expect any fat cats to suffer. Throw a ‘rogue trader’ under the bus with much fanfare to suggest justice happens. Ha!

RMBS being marked to market would be effectively zero (no there there) so unwinding this ball of fraudwax looks dicey. Surprisingly enough, there are still people paying off their mortgages to ‘somebody’ so what do you do with them? Their equity is effectively vaporized.

You couldn’t achieve a better clusterfuck by design.

real estate tip:

buy a house in detroit for $6K put another 4 K in it, finance the whole f-in thing

mortgage $42 per month, taxes $50, insurance (landlord policy) $60 total ( without maintenance) buck fifty or so, rent it section 8 to the good people of the USA

return: really freakin good,

and when they burn it down, you can re-build with insurance proceeds

now repeat 50 times

The only reason these folks speak out now, IMO, it is that..

It is

O B V I O U S

I love your stuff, seriously, you are the best political commentator and all-around cynic on the net, but please, can we bury GWBush’s “Make no mistake about it” trope? It brings bile right up into my mouth every single time I hear it.

It is almost as bad as “Think about it.” Or “prevail.” If something has to prevail, it should be a wind.

Micro-be: your post also ties into the joe vs. jose post…..

As cleary illustrated in that post Jose has an unbelievable advantage over Joe. Another item to consider is the fact that their are many other groups that have an advantage in job competetion, let’s take seniors:

Eligible for full SS benefits and medicare at age 65 (not sure how the prescription plan plays into this)….sitting on huge cash from the proceeds of the house they bought in 1965 for $7500 and a couple of box tops. They can earn the first $32K tax free on their SS benefits. Lot’s of additional programs out there as well they can take advantage of as well.

Mind you I am not talking about seniors that can’t work because of their age, that is why these programs where set up in the first place.

Now let’s add all the other folks that are getting a leg up, other SS receiptents other than seniors, various poverty programs, etc. etc. etc.

Now we add the fact we have evolved into two income families, as opposed the ancient system of a stay at home parent.

And let’s throw in the globalalization deal, where you get to compete for you job with a dude living in a straw hut in vietnam.

Labor conforms to the same rule of supply and demand, we have endless supplies of either low wage or subsidized labor competing for far fewer jobs.

I commend you for your principles, I only wish your fellow citizens ,goverment and us based multi-national companies shared your values.

sorry about spelling, have to get back to work

Economist Warns: Housing Prices Will Plummet

Friday, 13 Jul 2012 02:47 PM

By Newsmax Wires

Share:

The United States is headed toward another real estate collapse — and it will be worse than the one we just experienced, according to famed economist and New York Times best-selling author Robert Wiedemer.

During his recent appearance on the Aftershock Survival Summit, Wiedemer provided startling evidence to support his claim that real estate prices could fall another 32 percent.

That would wipe out another $64,000 in equity from the average home.

Before you dismiss Wiedemer’s claims as impossible or unrealistic, consider this: In 2006, Wiedemer and a team of economists foresaw the first collapse of the U.S. housing market and published their research in the book America’s Bubble Economy.

Now Wiedemer is back with an even stronger warning.

He says that all of the positive housing news lately misses one critical item, and it’s the one that will sink the housing market sometime in late 2012 or early 2013.

Wiedemer states that the media (and most notably the National Association of Realtors) wants us to believe that housing prices have bottomed, and that right now is the perfect time to go out and buy a home.

They will point to a leveling-out of home prices and a sudden lack of inventory as an indication that the housing market is heating back up.

One “expert” goes so far as to say that real estate “has not just bottomed, but is booming” and talks of reported bidding wars on homes in locations like Seattle, Austin, and Palo Alto.

But Wiedemer believes that all of this positive news for the housing sector ignores the one factor that will cause housing prices to plummet: Interest rates will eventually rise.

He points out that even with interest rates at historic lows, research shows that more than one out of every four homeowners are willing to walk away from their homes.

“Once the inevitable interest rate hikes set in, and values of people’s homes drop even further, that figure will jump even higher. The scope of the damage will be determined by how high interest rates eventually go,” said Wiedemer.

Wiedemer added, “Housing expert Robert Shiller believes homes prices could fall 25 percent in the next five years. I think it could be even worse.

Consider this: If mortgage rates hit a reasonable 7.5 percent, it means home prices would have to decrease by as much as another 32 percent. And a 7.5 percent interest rate is very reasonable.”

Wiedemer then displayed a chart with an even more upsetting data point: If interest rates rise to 10 percent, home values will be cut by a startling 45 percent.

Editor’s Note: See the frightening housing chart that exposes the ‘unthinkable.’