John Hussman wonders how high we can go this week. Can we go one louder?

As Nigel Tufnel of Spinal Tap described the volume knobs on his guitar amplifier – “You’re on ten here, all the way up, all the way up, all the way up, you’re on ten on your guitar. Where can you go from there? Where? Eleven. Exactly. One louder. These go to eleven.”

Everyone knows the facts. They are still facts, even when they are ignored by the herd. The herd is showing no fear. Bulls reign supreme.

Here are the facts:

Current valuations now exceed those observed in 1901, 1929, 1937, 1972, 1987, and 2007. The 5-year market advance from the 2009 low, encouraged by yield-seeking speculation, now places the S&P 500 at more than double the level that we would associate with historically normal returns. Put another way, we presently estimate S&P 500 prospective nominal total returns of just 1.4% annually over the coming decade, with zero or negative average total returns out to roughly 2022. These valuations are coupled with extremely overbought conditions and the most lopsided bullish sentiment since 1987. Bearish sentiment is now down to 14.8% (Investor’s Intelligence), close to the low of 13.3% reached in September. Prior to this year, the last two times sentiment was nearly as lopsided were the April 2011 peak (just before a near-20% dive), and the October 2007 peak.

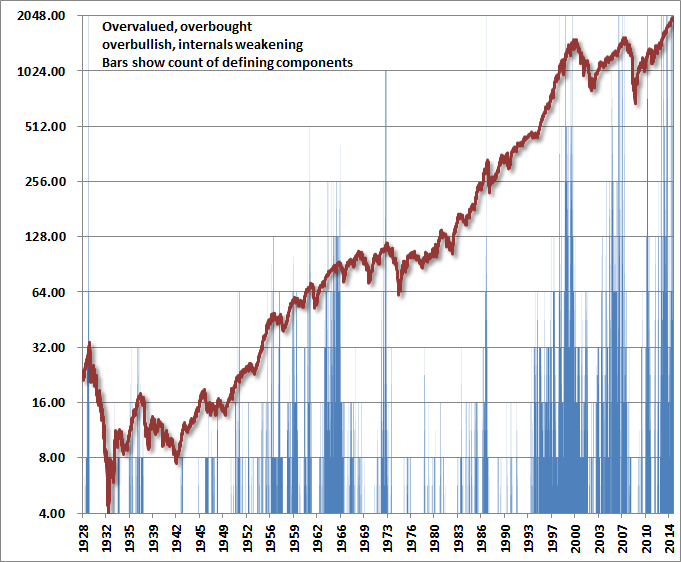

The chart below presents a slightly different perspective than similar charts I’ve presented over time. Rather than showing discrete instances where a whole syndrome of overvalued, overbought, overbullish conditions has occurred (points with bullish sentiment at extremes, valuations historically rich, prices pushing upper Bollinger bands, etc), the vertical bars show a count of individual components, coupled with additional components that reflect deteriorating market internals. This gives a less binary view of these syndromes. The spikes (such as 1929, 1972, 1998, 2000, 2007, 2011, and the past year) show points when a preponderance of conditions – extreme valuation, lopsided bullish sentiment, overbought conditions, widening credit spreads, and at least some aspects of deteriorating market internals – have been observed in unison. The red line shows the S&P 500 Index (log scale).

As I noted in Air Pockets, Free-Falls and Crashes the lessons to be drawn from the recent market cycle are not that historically overvalued, overbought, overbullish extremes can be dismissed. Rather, the lessons to be drawn have to do with the criteria that distinguish when such extremes have little near-term impact from periods where they suddenly matter with a vengeance. Those criteria have a great deal to do with measures of market action that capture subtle shifts risk aversion, such as widening credit spreads and deteriorating market internals. Sometimes those subtle shifts are all the warning you get, and while the 1987, 1998 and 2011 instances were expressed rather quickly in market losses that then subsided, it’s just as typical for downside consequences to be sustained over a couple of years. The market has been dodging boomerangs, not bullets, and they are likely to come back harder for it.

Are we certain that these measures of market internals and related adaptations we’ve identified in recent years will identify a collapse from these overextended extremes? No – certainty about the future is not a luxury that any amount of market research can provide. What we’re quite certain of, however, is that the measures we are attending to would have effectively navigated risk taking and risk avoidance not only in historical market cycles in a century of history, not only during the tech bubble, not only during the housing bubble, and not only since the 2007 market peak, but also in the advancing period since the 2009 low.

No one cares about Hussman’s inconvenient facts, valuation measurements that have been valid for a century, or historical precedent. They just want to know how to turn it up to eleven.

Nigel Tufnel FTW.