Guest Post by Dr. Housing Bubble

Last year there was a report highlighting that LA and Orange County ranked number one in being the bubbliest housing markets in the US. The report essentially found that people in the area lagged in income relative to housing values compared to folks in New York or San Francisco and most in SoCal basically funneled a large portion of their net income into housing. LA and OC are also expensive to rent in. An article caught my eye stating that that the regular Angelino needed to make $33 an hour just to rent a basic apartment without eating Purina dog chow every night. This post came across my social media feed and I dug through the comments. I was impressed by how many people posted something along the lines of “me and my roommates split the rent in X area for an apartment” and how many other comments from those out of the area were stunned by the basic cost of an apartment. Hey, SoCal is expensive. I think most reading here have the means to buy but rent or own their home outright. Short of you buying a home with a suitcase full of cold hard green cash, you either pay rent to a landlord or a mortgage payment to a bank. The 2.3 million adults living at home with parents are probably not fretting about housing prices or rents. The issue with SoCal is that people are treading on razor thin budgets just to get by even in rentals.

The rent is so…hey, at least the weather is awesome!

The article that caught my eye had some interesting data points:

“(SCPR) You need to earn at least $33 an hour — $68,640 a year — to be able to afford the average apartment in Los Angeles County, according to Matt Schwartz, president and chief executive of the California Housing Partnership, which advocates for affordable housing.”

I should remind you that most households in LA County rent. That is simply a fact based on Census household data. And most people don’t make $33 an hour so you get many people tagging up with roommates. So is this the hidden group that is suddenly going to push the market up? No. You have folks thinking their local hood is going to be the next London but that is not likely. You still have to live in a $700,000 crap shack. You think having a Chipotle and a Whole Foods is suddenly going to push your home into the $1 million range? The big demand for the last few years has come from wealthy investors and big foreign money largely from China. Yet this money was surgically targeted at certain areas. You can still find good deals in other LA cities and I have shared a few with readers. If you truly believe in the “all of SoCal will gentrify” meme you will be on the ground floor for the next real estate renaissance.

The article goes on to say:

“That’s more than double the level of the highest minimum wage being proposed by Mayor Eric Garcetti, which he argued would make it easier for workers to afford to live here. “If we pass this, this will allow more people to live their American Dream here in L.A.,” Garcetti proclaimed when he announced his plan to raise the minimum wage to $13.25 by 2017.

The $33 an hour figure is based on the average L.A. County apartment rental price of $1,716 a month, from USC’s 2014 Casden Multifamily Forecast. An apartment is considered affordable when you spend no more than 30 percent of your paycheck on rent.”

I hate to say it but the American Dream ain’t happening in LA on a mass scale. Even if you make $13.25 an hour good luck being able to afford a place in a decent area.

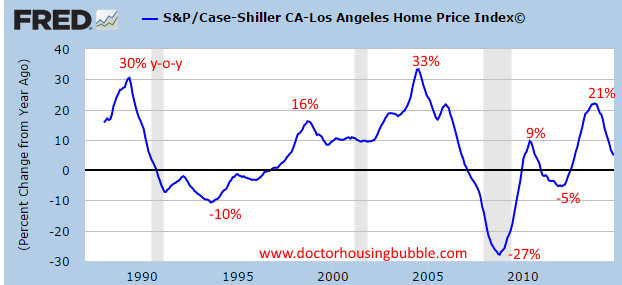

This is a boom and bust landscape. For better or worse, all of us are turned into real estate speculators. Just look at annual price changes for the Greater LA metro area over 25 years:

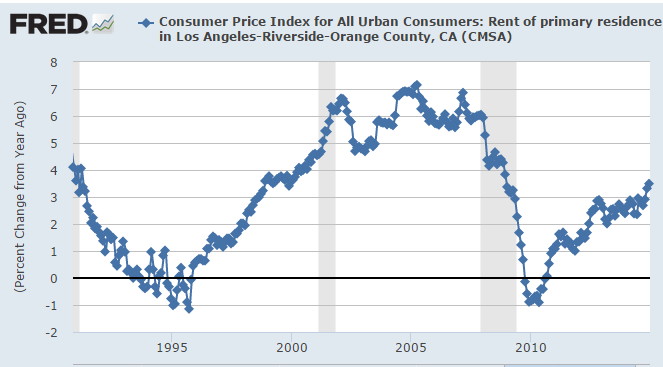

Boom and bust. Some on the fence, are making the calculus between renting in a good area with solid schools or buying a crap shack and rolling the dice that the area will gentrify quick enough before their offspring go off to schools with ratings unsuitable for a crappy Yelp restaurant. Rents rise at a more steady pace since they are paid via net income and don’t have the luxury of being leveraged by low interest rates. Take a look at annual changes in rents for the LA area:

You’ll notice that even in LA, rents do fall although it typically happens in a recession. I love some of the comments from these posts:

Buy now or be gentrified out forever! When I look at the boom and bust chart above, it always amazes me how quickly people forget about recent history. Over one million people lost their home to foreclosure in California in the last decade. That is massive given the number of actual homes bought. Yet the middle class is acting. California had a net loss of 221,325 residents between 2007 and 2013. 73% of those that left earned less than $50,000 per year. A large portion ended up in Texas.

Also, those arguing about rental parity make the convenient omission that you would need to have a sizable down payment to make it work. On that $700,000 crap shack, we are talking about $140,000 just for 20 percent down. Congrats! You now also carry a $560,000 mortgage on a stucco crapper. How do things look after 30 years if you stuck your down payment into a broad base market fund and added the difference between renting and buying? You are also locked into said market. There is mobility in renting and many in places like San Francisco value this (the vast majority in the area rent in an even more zany market). The calculus isn’t all that simple. One thing is certain and that is people are reluctant to move. People would rather eat Friskies out of their cat’s bowl before cashing in on their equity. Plus, many have children just waiting for the moment mom and dad take the long journey out of their HGTV upgraded home and pass their property over. “Hey dad! Time to gentrify out of this home.”

The beauty of our dysfunctional economy is that you are not locked in to stay here. I know many people that were itching to buy a big McMansion so plunked down some dough and bought in the Inland Empire. They make a horrendous commute to work but at least their family gets to enjoy the place while they idle along the traffic congested freeways and do a number to their health. I also know people that pay crazy rents to live along the coast. But to think that prices in SoCal follow an expected pattern is nuts. The past shows us that we are in a boom and bust market. When people are doubling and tripling into apartments just to get by you know that all it would take is a minor recession to tilt things to the other side again.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Just saw on Da N00ze where our Fearless Leader is wanting to jack up taxes on inherited property…

Stupid fucker. I am really starting to hate that halfbreed motherfucker…

My son might not have enough cash on hand to pay the taxes on property that will be rightfully his when I finally kick the bucket…

I am really, really… starting to hate that piece of dogshit…

I’ve seen these shit hole houses. 800 sq/ft is a mansion.

23.8% of California denizens are below the supplemental poverty measure (takes into account both cost of living and gov’t benefits: http://en.wikipedia.org/wiki/List_of_U.S._states_by_poverty_rate

Billy says: My son might not have enough cash on hand to pay the taxes on property that will be rightfully his when I finally kick the bucket…

Isn’t that why you wait to inherit rather than do a transfer right now, to keep the lower cost rather than use the appreciated property value?

The last ten years, all I hear is retiring folks talking of going to Oregon or Arizona. Even young folks go there looking to start out. It would seem they have been priced out of LA.

Blacks sold in Compton and move up here. Compton is now Beaner land. Downtown LA has been gentrified.

Santa Clarita has grown by leaps and bounds from the 5 on the west side to the east side of the 14, amazing. The once sleepy Antelope Valley has become more like Van Nuys in the last 2 years. Traffic everywhere. My favorite traffic free shortcuts are no more.

Traffic south of LA – Irvine and beyond to San Diego on the 5 – is a fucking nightmare, Phoenix rush hour traffic has got nothing on them. Phoenix is the only place I’ve seen that has a rush hour extending on to 10pm.

33 bucks an hour? Not if you’re a section 8 beaner. You just show up, say, ‘I’ll take it’, and let your caseworker handle the messy details

“Billy says:

My son might not have enough cash on hand to pay the taxes on property that will be rightfully his when I finally kick the bucket… ”

Not if you somehow end up in long term care before you kick the bucket. The state will seize all of your property, title and deed – house, cars, bank account, investments, Social Security checks.

Source: Dealing with this now for elderly relatives. Asset stripping aplenty.

we are dealing with the asset stripping now too Stanley. the system is set up so everyone not well connected with old money dies broke. no worries for the Kennedys however

San Jose Ca (South Bay): Just to give you a few numbers. A decent 2 Bd 1 Ba will be between $2000 to $3000 per Mo. You can find places priced below $2K but you wouldn’t want to live there. Something “Nice” will be over $3K.

San Francisco A decent 2 Bd 1Ba will be between $3000 and $5000 per Mo. Nice will be $5K – $10K and under $3k you don’t want to live there.

One of my renters just told me his company is about to have a lay-off.

And So It Goes

@Big Tom,

I am noticing a pattern of asset stripping here. First when the citizen is young you force him to take out student loans that strip his earned income for the next 20 years in order to pay back. Then you strip his wages for housing in order to have a place to live. When he gets old, you steal anything he has managed to accumulate before he dies.

Net: 0% for the citizen

Net: 100% for the government and financial industry

@ EL,

I’ve been trying to find a way to transfer the farm into his name since we bought this place in an effort to get around the Death Tax.

Goddamned vampires… no, not vampires. Necrophiliacs. They just keep on fucking you, even after you’re dead…

Rent in California is cheap. Not in relation to wages but in relation to home prices. In Minneapolis (and most places outside of NYC and Beacon Hill) a $400,000 house might rent for $2,500. In Silicon Valley a condo that you could rent for $2,500 would be north of a million to buy. Buying a property to rent out in much of CA makes no sense in terms of the numbers/cash flow. It only makes sense to buy in CA if you expect prices to continue to rise. Greater Fool theory.

Shitballs from far up yonder. Billy and El Coyote are sharing info from the heart. Billy Jr ate uh egg roll at the Sirloin Stockade last night and I knew it was a sign that Billy’s deep hatred of the off colored mongrel races would be tempered by angelic forces. Now he’s making nice with a beaner and talkin as if passin on the trailer to our slobberin retard offspring was a possibility. Might as well talk about Richard Simmons kickin mike Tysons ass in the ring. Billy, you need ter git yer rank anus home and ya better have some crisco.

“San Francisco A decent 2 Bd 1Ba will be between $3000 and $5000 per Mo. Nice will be $5K – $10K and under $3k you don’t want to live there.”

—-ASIG

Got a serious question for AGIG, Iska Warren, Admin or anyone else who might wish to comment.

The only big cities I’ve ever lived in was San Salvador, El Salvador during that country’s civil war and Bogota, Colombia at the height of the 1990s drug war. Rent and cost of living was not an issue. Getting shot was.

So, because of personal inexperience living in urban U.S., I just can’t get my arms around how lower income people get by. Especially in high-end places like San Francisco, which employs tens of thousands of low paying service industry employees which cater to, for example, the massive tourist industry which San Francisco enjoys.

Who are those people and where and how do they live? For example, maybe the staff and waiters at restaurants on Fisherman’s Wharf make good money, but someone has to bus the tables, wash the dishes, and clean the restrooms. How about the maids in Frisco’s dozens and dozens of upscale hotels?

Where the fuck do they live? Some rundown slum in Oakland, which might mean a pricey commute on busses and BART? Is there a huge, sleazy, low-rent housing district in Frisco?

You can apply my questions to any big city that’s expensive. Manhattan. Downtown LA. San Diego. Boston. I just don’t see how this upscale lifestyle can continue without some serious blowback in the future.

Thanks for any feedback.

Billy says: I’ve been trying to find a way to transfer the farm into his name since we bought this place in an effort to get around the Death Tax.

The topic interests me because my mom wants to leave her house to my sister. I have read that if she transfered the house right now, she’d owe taxeson the current value, if she waits to inherit, she would pay less.

It’s a small house, nothing like your property. Another tactic would be to add the second name to the title, that could avoid probate but it might incur a gift tax though.

I wonder if anyone here has a general answer for both situations?

EC –

It’s a sticky wicket, and Medicaid which pays for long term care, has different eligibility requirements depending on the state.

I recently looked into the state of Texas and they required records of any property transfers within the last 5 years, plus 6 months of complete financial and bank records. I don’t know ho they would claw back an asset that had been transferred/sold years before, but I’ll bet they have their ways.

Now is probably good.

“The topic interests me because my mom wants to leave her house to my sister. I have read that if she transfered the house right now, she’d owe taxes on the current value, if she waits to inherit, she would pay less. It’s a small house.”

—-El Coyote

Three options if your mom, while she’s living, makes a gift of her home to her sister. Your mom pays all of the taxes on the gift, your mom and her sister agree to split the cost in some manner (50/50, 60/40, etc), or her sister can agree to pick up the whole tab. The government just wants the taxes.

Don’t know the financial positions of your mom and her sister. You do the math, EC.

SSS, I don’t know if this helps any.

1. Poor people are unusually mobile. My mom said someone told her the only reason they hadn’t been to a particular city is because they don’t know anyone there. I think poor peeps invented couch surfing. Illegals tend to rent rooms they use as a home base to shower, they sleep in shifts on any open space on the floor, they pay their portion of the rent and send money back home.

2. My son rented one bedroom of a large house in the San Clemente area for his family before he left California because his friend told him job were plentiful in Phoenix. He said when he got there, he applied to several places as he had grown used to doing over here. He said one guy asked him if he could start in 10 minutes. He said he slept in the rear portion of an apartment building in Phoenix because it was gated, while everyone was eager to go home, he hated leaving his job at Taco Bell because he was only going to go to his little concrete sidewalk bed.

3. When my daughter and her undocumented husband lived in Phoenix, they both worked, he would find temporary work in roofing or apartment maintenance. Rent was cheap in the old apartments north of Glendale Blvd. You buy electricity the way some phone plans sell minutes. My daughter said the old Mexican women liked to work at TB because they could eat there for free. They also drank a lot of Red Bull to keep going on the graves shift. She said a lot of fucked up assholes would come by the drive thru and she learned how to deal with the douchebags who were so zonked, they didn’t know what was going on when the pulled up to the window.

SSS, Thank You. She’s my sister though. I also think this is the way to go because if it is settled beforehand there will be no squabbling over who actually gets the house.

Thanks Stanley, I missed your reply.

@ EC

Whoops. YOUR sister, as you stated. My mistake. Advice still applies.

And you are correct … no squabbling. Bonus: your mom KNOWS there will be no squabbling.

SSS

I don’t deal with anyone in the group so I don’t know. What I do know is there are a lot that are renting rooms. Rent sharing.

http://sfbay.craigslist.org/sfc/apa/4845850920.html

But even those aren’t cheap. I suspect there are a large number still living at home with parents. And yes there are what you call low rent areas although I have no idea how “Low” the rent might be. What I know is that there are areas in San Francisco and Oakland you don’t want to go to.

What you might be surprised by is that there are a huge number of people that work in the bay area but live in the San Joaquin Valley primarily because housing is too expensive here. A three to four hour commute per day is common. They cross the mountains by both train and car. The freeway is 10 lanes 5-5 and some are already starting for work as early as 4 in the morning.

I know of one guy that has a commute of around 100 mi ONE WAY. Now that is a rather extreme case but in his case he is able to work from home 2 to 3 days a week.

60 to 70 miles one way is not unusual. My brother in-laws brother travels from Stockton to San Francisco every work day and I believe that distance one way is about 80 mi.

Those of you looking to minimize taxes, pass on property, protect assets in the event you have to go on govt. assistance, avoid probate and generally keep your affairs private need to look into establishing a living trust.

In essence, you own nothing. All assets are owned by the trust including real estate, vehicles, art, bank accounts, insurance policies etc. Those setting up the trust are the trustors and if so desired they are also the trustees. Trustors and trustees are free to use, buy and sell assets of the trust. You also establish contingent trustees to carry on after you pass.

You need to seek out an estate planning attorney and it might run $1500-$5000k depending on how involved your situation is. Since the trust essentially owns your estate, you avoid probate when when you die. If you need to go on the dole, the trust owns everything so you are not required to spend down or dispose of assets to qualify.

It is extremely important to have these things established and assets transferred to the trust prior to actually needing the protections of a trust so the earlier you things set up the better protected you are. As with doom preps, it’s better to be years early than a single second too late. You also need to be careful how you set things up and trust the people designated as trustees because a trustee has full power to liquidate everything on their signature alone.

How does asset stripping work when there is a surviving spouse, if there is no living trust?

Yes, but, but, but, the weather is great!

@IS: Another option besides trusts are Family Limited Partnerships. Under Texas Law, anything in an FLP, only 1% is “owned” by me as the General Partner LLC and thus subject to creditors, including the fed.gov. All my land/vehicles, etc are in my FLP for that purpose and it is listed as the beneficiary, when allowed, for several investment accounts I have. There is no tax consequences if inherited property flows into this.

It is also VITAL on any IRAs and bank accounts to have your beneficiaries listed as POD (payable upon death) or TOD (transfer upon death). That means whatever is in there automatically flows to the beneficiary without a will or probate. (You have to set up a special “inherited IRA” to do this.)

Of course, a good safe with oodles of cash and gold is also good to leave to your kiddies.

IS’s point about being proactive about this cannot be overstated. I overlooked ONE CD and ONE life insurance policy of my mother stuff (totally $25K max) and I had to spend $3K on lawyers, several days out of work and mucho aggro to get that distributed to my brother and I.

Real estate prices in CA, particularly big city areas such as San Fran and Los Angeles, have been completely insane for at least 20 years now. The only places in that state where prices are reasonable are places that no one would want to live because they are too far from the coast, too hot, too arid, and have no access to jobs.

Add the insane costs of living in even half-desirable and semi-blighted areas to CA’s well-known structural problems such as high taxes and perpetual and increasing water shortages that canNOT be cured by stealing still more water from other areas with still more costly water projects, and the lack of jobs for anyone not in IT or other high tech, the only thing a sensible person of middling means or worse can do is JUST LEAVE.

There are dozens of other locales that offer much more opportunity, and a much higher quality of life for less money. There are even many that offer nice weather. Why add yet another body to 38,000,000 already frantically competing for ever-scarcer decent jobs, dwindling water supplies, and 60 year old 650sq ft hovels priced at $500K, when you can go to cities like Nashville, the suburbs of Atlanta, Austin, and dozens of other places with relatively mild climes, increasing employment opportunity, and low prices for splendid homes?