Actually, dopey does not even begin to describe Paul Krugman’s latest spot of tommyrot. But least it appear that the good professor is being caricaturized, here are his own words. In a world drowning in government debt what we desperately need, by golly, is more of the same:

That is, there’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt.

Yes, indeed. There is currently about $60 trillion of public debt outstanding on a worldwide basis compared to less than $20 trillion at the turn of the century. But somehow this isn’t enough, even though the gain in public debt——-from the US to Europe, Japan, China, Brazil and the rest of the debt-saturated EM world—–actually exceeds the $35 billion growth of global GDP during the last 15 years.

But rather than explain why economic growth in most of the world is slowing to a crawl despite this unprecedented eruption of public debt, Krugman chose to smack down one of his patented strawmen. Noting that Rand Paul had lamented that 1835 was the last time the US was “debt free”, the Nobel prize winner offered up a big fat non sequitir:

Wags quickly noted that the U.S. economy has, on the whole, done pretty well these past 180 years, suggesting that having the government owe the private sector money might not be all that bad a thing. The British government, by the way, has been in debt for more than three centuries, an era spanning the Industrial Revolution, victory over Napoleon, and more.

Neither Rand Paul nor any other fiscal conservative ever said that public debt per se would freeze economic growth or technological progress hard in the horse and boggy age. The question is one of degree and of whether at today’s unprecedented public debt levels we get economic growth—–even at a tepid rate—–in spite of rather than because of soaring government debt.

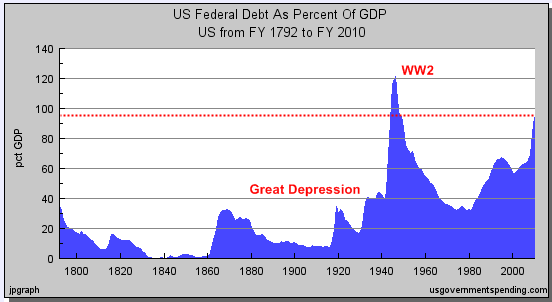

A brief recounting of US fiscal history leaves little doubt about Krugman’s strawman argument. During the eighty years after President Andrew Jackson paid off the public debt until the eve of WWI, the US economy grew like gangbusters. Yet the nation essentially had no debt, as shown in the chart below, except for temporary modest amounts owing to wars that were quickly paid down.

In fact, between 1870 and 1914, the US economy grew at an average rate of 4% per year——the highest and longest sustained growth of real output and living standards ever achieved in America either before or since. But during that entire 45 year golden age of prosperity, the ratio of US public debt relative to national income was falling like a stone.

In fact, on the eve of World War I, the US had only $1.4 billion of debt. That is the same figure that had been reached before the Battle of Gettysburg in 1863.

That’s right. During the course of four decades, the nominal level of peak Civil War debt was steadily whittled down; the Federal budget was in balance or surplus most of the time; and at the end of the period a booming US economy had debt of less than 5% of GDP or about $11 per capita!

In short, nearly a century of robust economic growth after 1835 was accompanied by hardly any public debt at all. The facts are nearly the opposite of Krugman’s smart-alecky insinuation that today’s giant, technologically advanced economy would not have happened without all of today’s massive public debt.

Indeed, on a net basis every dime that was added to the national debt between Jackson’s mortgage burning ceremony in 1835 and 1914 was 100% war debt that never contributed to domestic economic growth and was mostly repaid during peacetime. In effect, Rand Paul was right: In a modern Keynesian sense, the US was “debt free” during the 80 years when it emerged as a great industrial powerhouse with the highest living standard in the world.

Thereafter, there were two huge surges of wartime debt, but those eruptions had nothing to do with peacetime domestic prosperity; and they were quickly rolled back after the war-time emergencies ended. Its plain to see in the graph below.

During WWI, for example, the national debt soared from $1.4 billion to $27 billion, but the great Andrew Mellon, as Secretary of the Treasury during three Republican administrations, paid that down to less than $17 billion, even as the national income nearly doubled during the Roaring Twenties. That meant the public debt was back under 20% by the end of the 1920s.

To be sure, for the last 70 years the Keynesian professoriate has been falsely blaming the severity and duration of the Great Depression on Herbert Hoover’s balanced budget policies during 1930-1932. But none has ever charged that paying down the WW1 debt had actually caused the Great Depression. Nor have the Keynesian economic doctors ever claimed that had Mellon not paid down the peak WWI debt ratio of about 45% of GDP that the Roaring Twenties would have roared even more mightily!

Likewise, the national debt did soar from less than 50% of GDP in 1939, notwithstanding the chronic New Deal deficits, to nearly 120% at the 1945 WWII peak. But this was not your Krugman’s beneficent debt ratio, either. Nor is it proof, as per his current diatribe, that the recent surge to $18 trillion of national debt has been done before and has proven helpful to economic growth.

Instead, the 1945 ratio was a temporary and complete artifact of a command and control war economy. Indeed, the total mobilization of economic life by agencies of the state during WWII was so complete that Washington had essentially banished civilian goods including new cars, houses and most consumer durables, and had also tightly rationed everything else including sugar, butter, meat, tires, shoes, shirts, bicycles, peanut brittle and candied yams.

With retail shelves empty the household savings rate soared from 4% of disposable income in 1938-1939 to an astounding 35% by the end of the war.

Consequently, the Keynesians have never acknowledged the single most salient statistic about the war debt: namely, that the debt burden actually fell during the war, with the ratio of total credit market debt to GDP declining from 210 percent in 1938 to 190 percent at the 1945 peak!

This obviously happened because household and business debt was virtually eliminated by the wartime savings spree, dropping from 150 percent of GDP in 1938 to barely 60 percent by 1945, and thereby making vast headroom for the temporary surge of public debt.

In short, the nation did not borrow its way to victory via a Keynesian miracle. Measured GDP did rise smartly because half of it was non-recurring war expenditure. But even then, the truth is that the American economy “regimented” and “saved” its way through the war.

Once the war mobilization was over Washington quickly reduced it massive wartime borrowing, and set upon a 35 year path of drastically reducing the government debt burden relative to national output. Looking at the chart’s veritable ski-slope from 120% of GDP in 1945 to barely 30% of GDP when Reagan took office in 1980 you would think that the US economy should have been buried in depression during that period if Professor Krugman silly syllogisms are to be given any credit.

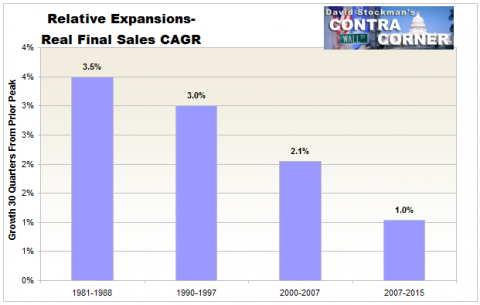

Of course, just the opposite is true. The greatest sustained period of post-war real GDP growth occurred between 1955 and 1973, with real output growth averaging nearly 3.8% per annum. But after that, as shown by the relative growth rates of real final sales in the chart below, the trend rate of growth steadily eroded. Thus, economic prosperity actually reached its highest level precisely when the national debt ratio was speeding down that ski-slope.

Indeed, during the very period when the fiscal deficit got out of control during the early 1980’s owing to the Reagan Administration’s impossible budget equation of soaring defense, deep tax cuts and tepid restraint on domestic spending, young professor Krugman was toiling away in the White House as a staff member of the Council of Economic Advisors.

During the dark days of the 1981-1982 recession when the economy was collapsing and the deficit was soaring I heard some pretty whacky ideas from the White House economists on how to reverse the tide. But never once did I hear professor Krugman argue that with the GDP at about $3.5 trillion while the public debt stood at less than $1.5 trillion or about 40% of GDP that it was time to turn on the deficit spending after-burners and get the national debt up to 100% of GDP forthwith.

No, this whole case for mega-public debt has emerged since 2008. For crying out loud, before the great financial crisis Krugman was one of the noisiest voices in the chorus denouncing George Bush’s massive tax cuts on the grounds that they would add to the national debt, which was then $6 trillion, not $18 trillion.

The fact is, the financial crisis was caused by the massive money printing campaigns of the Fed in the years after Greenspan assumed the helm in 1987. The resulting falsification of money market interest rates and distortion of prices and yields in the capital markets gave rise to serial booms and busts on Wall Street. But these financial market deformations had virtually nothing to do with fiscal policy and most certainly did not reflect an insufficiency of public debt.

These destructive busts——the dotcom crash, the 2008 mortgage bust and Wall Street meltdown and the stock market plunge just now getting underway——-are owing to the fact that Wall Street has been turned into a gambling casino by the Federal Reserve and the other major central banks.

But rather than acknowledge that obvious reality, Krugman actually manages to turn it upside-down. To wit, he argues that repairing the nation’s busted financial markets after September 2008 required the creation of “safe assets” in the form of government debt so that investors would presumably have a place to hide from Wall Street’s toxic waste:

Beyond that, those very low interest rates are telling us something about what markets want. I’ve already mentioned that having at least some government debt outstanding helps the economy function better. How so? The answer, according to M.I.T.’s Ricardo Caballero and others, is that the debt of stable, reliable governments provides “safe assets” that help investors manage risks, make transactions easier and avoid a destructive scramble for cash.

Now that puts you squarely in mind of the young boy who killed his parents and then threw himself on the mercy of the courts on the grounds that he was an orphan. That is, having experienced a runaway financial bubble owing to excessive monetization of the public debt during the Greenspan era, the nation’s economy now needed even more public debt in order to subdue the very Wall Street gamblers that the Fed’s printing presses had unleashed.

Every phrase in the above quoted passage is nuts, even if it is attributable to an MIT

You can’t make this stuff up. And here’s the rest of it for the purpose of any remaining doubt.

http://www.nytimes.com/2015/08/21/opinion/paul-krugman-debt-is-good-for-the-economy.html?_r=0

A factor no one ever considers when talking about historical debt.

Up until Nixon closed the gold window our money was gold -internationally only after 1933 restricted it to non domestic international use- and gold required real work by real people working to produce it.

Today our money is fiat which requires only decree to produce it, and that decree is arranged to come from the Fed by issuance of debt notes (Federal Reserve Notes in dollar denominations) that are originally loans to the government that then disseminate throughout the financial system (QE has substantially complicated this and made it more confusing to follow).

Pay off the debt -which is actually impossible since more is owed than was issued by virtue of it being issued as an interest bearing note- and you eliminate the money supply.

FWIW, we could actually pay off the debt by having the Treasury issue coins in the amount of it’s total value and give it to the Fed and other debtors (coins because of some quirks in the Federal Reserve Act).

Sort of what Kennedy started doing with those 2 and 5 dollar “red seal” United States Notes he ordered the Treasury to begin issuing in place of Fed bank notes. We’ll never know how well it world have worked since he got shot in the head soon after and the issuance was brought to an end shortly thereafter.

Very well said Anonymous . Now try telling that or explaining that to the next person you meet .They will look at you like you have lost your mind. Very frustrating.

Governments are drooling at the prospect of eliminating cash (very complicated process). Once cash is removed, gov’t will have no fear of printing electronic funds on their balance sheets – we have gone beyond any sensible hope of paying debt, so they will resign themselves to the new paradigm. Bank runs will be eliminated. What difference does it make!

At that point, Economics will no longer be studied at Uni and most of us will have EBT Cards. Krugman will again pitch his ‘Alien attack’ of Killer Clowns from Outer Space.

[img [/img]

[/img]

Krugman’s latest post has to be satirical. No one could possibly be that stupid.

Steve my Son , Krugman is getting paid north of 10 million dollars a year to be that stupid.Would you take that amount to be that stupid?

Actually, the governmment has NEVER paid off the national debt.

If memory serves, during Jackson’s administration a rich Scots man (I believe he was an American, but of Scots descent) died – Google him if you care about names. But his estate was left to the Treasury for the sole purpose of paying off the national debt. Back then, debt was looked on as a failure of character – you couldn’t live within your means. You didn’t have the discipline to save until you could afford whatever it was you wanted. And so forth. The Scotsman left his estate to cancel America’s debt because he felt it was bad for a country to owe so much.

Nowadays, our politicians believe it is bad for America to pay off its debts. Who do you think was correct?

Krugman belongs in a rubber room, no doubt. I said it before, I’ll say it again, in the sage words of the dear departed AWD, fuck this guy up the ass with a chainsaw.

(And I’ll say it again, I miss that fucking guy.)