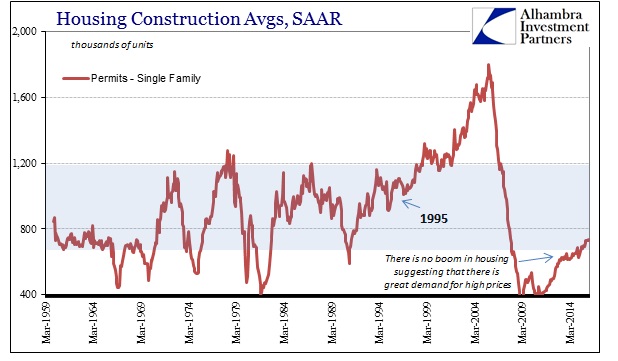

Tell me again about that strong housing recovery. I love those stories. With single family home permits at near 6 decade lows, why are home prices spiking? With millennials up to their ears in student loan debt, how are they supposed to afford these overpriced homes? When does this Fed induced/Wall Street hedge fund/Chinese billionaire/home flipper faux housing recovery come crashing down again?

For those priced out of the ownership market, rents are setting record highs all over the place as well.

I’m sort of doubtful you’ll see any reductions here if the housing market collapses, may see an increase instead since foreclosures (if it is like last time) will force more people into the rental market.

Or maybe I’m completely wrong. No money will mean no high anything, rent included, if it gets bad enough. (Barring new government subsidies creating a new government dependent class to finance the Landlord class)

Anything is possible with housing, as long as it is unethical,

and benefits the fat cats.

We’re back at the early 1990s levels. That has to count for something, right?

I’ve heard solid arguments for housing being a great hedge against the coming inflation. I’ve also heard solid arguments for housing being 30% overvalued as things stand today. By the looks of the chart, I think we have a ways to go before the housing market comes crashing down again. The taxpayer is on the hook for 90-some-odd-percent of the entire housing market so I think the long-awaited mother of all crashes will have to happen across the board to take down housing. In the meantime I’d get the best you can afford without a mortgage (or the absolute lowest payments possible) and enjoy it as a residence instead of simply an investment.