Guest Post by Jim Kunstler

“There is no other endeavor in which men and women of enormous intellectual power have shown total disregard for higher-order reasoning than monetary policy.

— David Collum

American Notes

Apart from all the ill-feeling about the election, one constant ‘out there’ since November 8 is the Ayn Randian rapture that infects the money scene. Wall Street and big business believe that the country has passed through a magic portal into a new age of heroic businessmen-warriors (Trump, Rex T, Mnuchin, Wilbur Ross, et. al.) who will go forth creating untold wealth from super-savvy deal-making that un-does all the self-defeating malarkey of the detested Deep State technocratic regulation regime of recent years. The main signs in the sky, they say, are the virile near-penetration of the Dow Jones 20,000-point maidenhead and the rocket ride of Ole King Dollar to supremacy of the global currency-space.

I hate to pound sleet on this manic parade, but, to put it gently, mob psychology is outrunning both experience and reality. Let’s offer a few hypotheses regarding this supposed coming Trumptopian nirvana.

The current narrative weaves an expectation that manufacturing industry will return to the USA complete with all the 1962-vintage societal benefits of great-paying blue collar jobs, plus an orgy of infrastructure-building. I think both ideas are flawed, even allowing for good intentions. For one thing, most of the factories are either standing in ruin or scraped off the landscape. So, it’s not like we’re going to reactivate some mothballed sleeping giant of productive capacity. New state-of-the-art factories would require an Everest of private capital investment that is simply impossible to manifest in a system that is already leveraged up to its eyeballs. Even if we tried to accomplish it via some kind of main force government central planning and financing — going full-Soviet — there is no conceivable way to raise (borrow) the “money” without altogether destroying the value of our money (inflation), and the banking system with it.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

If by some magic any new industrial capacity were built, much of the work in it would be performed by robotics, not brawny men in blue shirts, and certainly not at the equivalent of the old United Auto Workers $35-an-hour assembly line wage. We have not faced the fact that the manufacturing fiesta based on fossil fuels was a one-time thing due to special historical circumstances and will not be repeated. The future of manufacturing in America is frighteningly modest. We’ll actually be lucky if we can make a few vital necessities by means of hydro-electric or direct water power, and that will be about the extent of it. Some of you may recognize this as the World Made By Hand scenario. I’ll stick by that.

Similarly for “infrastructure” spending touted by the forces of Trump as the coming panacea for economic malaise. I suspect most people assume this means a trillion-dollar stimulus spend on highways and their accessories. Well, that also assumes that we expect another fifty years of Happy Motoring and suburban living. Fuggeddabowdit. We’re in the twilight of motoring anyway you cut it, despite all the chatter about electric cars and “driverless” cars. We won’t have the electric capacity to switch over the Happy Motoring fleet from gasoline. The oil industry itself is already headed for collapse on its sinking energy-return-on-investment. And our problems with money and debt are so severe that the motoring paradigm is more prone to fail on the basis of car loan scarcity and unworthy borrows before the fueling issues even kick in. Every year, fewer Americans can afford to buy any kind of car — the way they’re used to buying them, on installment loans. The industry has gone the limit to help them — seven-year loans for used cars! — but they have no more room to maneuver. The car financing system is broken. Bear in mind the original suburbanization of America back in the 20th century — along with its accessory automobiles — must be regarded as the greatest misallocation of resources in the history of the world. So, a rebuild of all this stuff would represent more and possibly even greater malinvestment. We could have applied our post-WW2 treasure to building beautiful walkable towns and cities with some capacity for adaptive re-use, but we blew it in order to enjoy life in a one-time demolition derby. Life is tragic. Societies make poor choices sometimes, and then there are consequences.

We also might have been in better shape now if, beginning twenty years ago, we began a major rebuild of our railway infrastructure. But we blew that off, too, and shortly it will be very difficult to get around this geographically large country by any mechanical means. It may be too late now to do anything about that for the financing reasons already touched on — and which I will elaborate on next. The bottom line is that President Donald Trump will be overwhelmed by a sea of financial troubles from the very get-go, and here’s why.

Designated Bag-Holder

The American people have been punked by their own government and their central bank, the Federal Reserve, for years and the jig is now up. In 2017 both will lose their authority and legitimacy, a very grave matter for the survival of this republic.

Insiders surely have seen this coming for a long time. The people running this so-called Deep State of overblown and overgrown institutions probably acted at first with the good intentions of keeping the national lifestyle afloat. But in the end (now approaching) they stooped to too much duplicity and deceit in the desperate attempt to not just preserve the system, but to protect their own reputations and personal perquisites. And now there ought to be some question with the election of 2016 that they have engineered all of this system fragility to blow up on Mr. Trump’s watch, so they can blame him for it. It was going to blow up anyway. But had Hillary Clinton won the election, at least the right gang would have had to take the blame — the people in charge for the past twenty years. Instead, Donald Trump has been elected Designated Bag-Holder.

About That “Big Fat Ugly Bubble” and its Consequences

Part 1: History Lesson

The USA ran out of growth capacity around the turn of the millennium because we ran out of affordable energy to run our techno-industrial economy. It was hard to see this with seemingly plenty of oil available. And, of course, the computer tech fiesta was blossoming, but for all that glitzy stuff to attract dwindling real capital, other old stuff had to go, and did go, and when all was said and done the computers did not generate much wealth or social value. In fact, the diminishing returns and blowback of computer tech were arguably more damaging than beneficial to society and its economy. Look at where the middle class is today. Computer tech gave the magical appearance of growth while actually undermining it.

By affordable energy I mean energy with a greater-than 30-to-one energy-return-on-investment, which is the ratio you need for the kind of life we lead. That’s what the now-ridiculed Peak Oil story was really about: not running out of oil, but not getting enough bang for our bucks pulling the remaining oil out of the earth to maintain our standard of living. I’ll return to this issue in more detail later. But that was what provoked America’s 21st century economic malaise. Everything we’ve done in finance since then has been an attempt to compensate for our fundamental problem with debt — borrowing from the future to maintain our current (unaffordable) standard of living. Our debt has grown ever larger and faster each year, and our methods for managing it have become more desperate and dishonest as that occurred.

The culprit at the center is America’s central bank, the Federal Reserve, which is actually not a government agency as it seems, but a consortium of the nation’s biggest private banks, lately known as Too-Big-To-Fail. The Fed was created in 1913, when the complexities of capital finance were multiplying in step with the complexities of industrial production, which, remember, was a new and evolving phenomenon of human history. Mankind had no prior experience with industrialism. We discovered toward the end of the 19th century — decades of unprecedented industrial growth — that the system’s dynamic produced booms accompanied by very destructive busts. The operations of banking usually outran the cycles of trade, industry, and war that were coloring evolving Modernity. So the Fed was created to smooth out these cycles. It had two basic mandates for this: acting as the lender of last resort between banks during financial panics so that some money would always be available in an emergency; and stabilizing the money supply and prices in the system. The Fed failed spectacularly to smooth out the cycles of boom and bust and to maintain the value of the dollar over time.

Sixteen years after the Fed’s creation, America entered its worst economic downturn ever, the Great Depression, which was only mitigated by the colossal abnormality of World War Two. America emerged from that episode as the last industrial society standing amid everyone else’s smoldering ruins. That gave us an extraordinary advantage in world trade lasting roughly thirty years. That high tide of the era of seeming “normality” — the 1950s and 60s, which the Trumpian-minded might recall as “great” — started unraveling in the 1970s, which was not coincidentally the moment of America’s all-time oil production peak.

In 1977, the Fed was given a third mission of promoting maximum employment with a trick-bag of tools for manipulating the money supply and credit creation that have proven to be fatally mischievous. This new task elevated Fed officials, and especially its chairperson, to the status of viziers — magicians using occult mathematical models and formulas — to cast spells capable of controlling the macro economy the way wizards are thought to control external reality. Their pretenses seemed to work for reasons unrelated to the spells they were learning to cast.

It is still largely unrecognized that America recovered from the financial disorder of the 1970s not because of the charms of “Reaganomics” but for the simple reason that the last giant finds of oil with greater than 30-to-one energy-return-on-investment came on line in the 1980s: Alaska’s North Slope, Britain and Norway’s North Sea fields, and Siberia. That allowed the USA and the West generally to extend the techno-industrial fiesta another twenty years. As that bounty tapered down around the year 2000, the system wobbled again and the viziers of the Fed ramped up their magical operations, led by the Grand Vizier (or “Maestro”) Alan Greenspan, who worked the control rods of interest rates as though the financial system were a great nuclear powered pipe organ that could be revved up and tamped down by a wondrous Fed control panel. This period of Fed spell-casting was characterized by ever more systemically complex finance, growing systemic fragility, pervasive institutionalized accounting fraud, and ever-greater bubbles and busts. Deregulation, especially the 1998 repeal of the Glass-Steagall Act of 1932, sealed America’s financial fate.

Debt was the meat-and-potatoes of the Fed’s wizardry, but the “secret sauce” of Fed magic was fraud, in the form of market interventions, manipulations, regulatory negligence, and just plain systematic lying about the numbers that defined the economy. It amounted to nationalized financial racketeering. Under the consecutive Grand Vizierships of Greenspan and Ben Bernanke, control fraud (using official authority to cover up misconduct) was perfected by banking executives, eventuating in the mortgage securities fiasco of 2008, which took down the housing market and the economy. (That housing market, by the way, was made up mainly of suburban houses, the sine qua non of the greatest misallocation of resources in the history of the world.)

Of course, nobody paid a criminal penalty for any of this misconduct besides the maverick Ponzi artist Bernie Madoff, and a few other small fish. The regulators looked the other way, on orders from their bosses. Unlike the earlier Savings and Loan bank crisis of the late 1980s, none of the leading bank officer perps went to jail. The damage of the 2008 crash was epic and never repaired, only papered over with more debt, more deceit, and more racketeering.

The supposed remedy, the Dodd-Frank Act of 2010, was a cover for continued pervasive fraud and the institutional “capture” of government by the banking industry and its handmaidens, really a fascist melding of banking and government, a swindle machine in which anything goes and nothing matters. The frauds have only been rechanneled since 2008 into college loans, car loans, corporate stock buyback monkey business, currency arbitrage shenanigans, private equity asset-stripping, and the gigantic black box of derivatives trading.

About That “Big Fat Ugly Bubble” and its Consequences

Part 2: 2017, the Year of Living Anxiously

Under Bernanke’s successor, UC-Berkeley Professor Janet Yellen, the emphasis in Fed policy has been an elaborate game of “data-dependent” foot-dragging — a lot of talk with no action — with the data itself largely fraudulent, especially the easily gamed employment and GDP numbers that supposedly determine the rise or fall of interest rate policy. In short, the racketeering continues while the authorities quail in the face of accumulated and now inescapable debt quandaries ever more certain to end in systemic collapse.

Get this: the Fed is completely full of shit. It is terrified of the conditions it has set up and it has no idea what to do next. The “data” that it claims to be so dependent on is arrantly fake. The government’s official unemployment number at Christmas 2016 was 4.6 percent. It’s a compound lie. The 4.6 percent does not include the 95 million people out of the workforce, most of them able-bodied, who have simply run through their unemployment benefits and given up looking for work. Nor does it figure in the fact that roughly 90 percent of the new jobs created are part time jobs, many of them held by people working several jobs (because they have to, to pay the bills). Nor does it detail the quality of the jobs created (minimum wage shit jobs.)

That 4.6 unemployment figure is the main pillar of the Fed’s “data.” They interpret it as meaning the economy is roaring and has their full confidence. They‘re lying about that, of course. They have been touting “the recovery” (from the crash of 2008) continually and heralding a program of “normalizing” interest rates upward for two years. In 2015 they didn’t do anything until the very last Fed meeting of the year when they raised the Fed Funds rate 25 basis point (that’s a measly one-quarter of a percent). They raised, they said, because they were “confident” about the economy. No, that’s not why. They did it because they talked about it all year without doing anything and their credibility was on the line. They also promised four rate hikes altogether in 2016, which they then failed to carry out.

After that December 2015 rate hike, the stock markets tanked 10 percent. By springtime, the markets appeared to be bouncing back, so the Fed started talking about more rate hikes again. They talked it up all year without acting, an impressive act of fakery. The surprise Brexit vote gave them the heebie jeebies. They laid low. Meanwhile, the US election season was on. The Fed denies this, but they did not raise interest rates for eleven months in 2016 solely because they wanted to make the Democratic administration look good heading into the November vote, and they knew the economy was fragile. Once Hillary was nominated they were determined to usher her into the White House on a high tide of fake good economic news.

When she lost the election the stock markets surprised everyone by entering a super-bubblicious Trumpxuberance rally. There is a narrative for that too in the media chatter and it is simpleminded nonsense based on the sheer hope that Trumponomics will be great for business. More on that below.

Roaring stock markets were a secondary pillar of the Fed’s economic world-view. The post-election 2000 point upsurge in the Dow, along with the historically low 4.6 unemployment number, gave the Fed the opportunity on December 15 to do the same thing they did the previous year: cover their asses and preserve some credibility by hiking the Fed Funds rate one-quarter percent. You’d think if they were really confident in the economy — especially given the year–end rally — they would venture to raise by half a percent or more. They are not confident. They are lying with their fingers crossed.

The Fed Funds rate is one thing. As it happens, the Fed does not directly control the interest rates on US treasury bonds, and they have been rising shockingly through the second half of 2016. The crucial ten-year treasury rate has gone up a hundred percent since the summer. Because bond values move inversely to bond rates, the price of ten-year treasuries has tanked, inducing trillions of dollars in losses to bond-holders around the world. The bond market is many times larger than the stock markets. Bonds have been in a bull market since the early 1980s and that bull rolled over in mid-2016. A bear market is now on, meaning bond-holders are dumping their bonds. China and Saudi Arabia are among the leading dumpers of US Treasuries because they need the money for one reason or another. They will dump more in 2016 because both countries are in deep economic trouble. Too many bond sellers and not enough buyers in the market drive interest rates up. Rates have a lot room to move up, since they started at near-zero. Accordingly, their value has a long way to fall.

Bonds, of course, represent debt. Total US debt has doubled under President Obama from around ten trillion to twenty trillion dollars (as it doubled under Bush Two from five to ten trillion dollars). The reason, as stated above, is that we don’t produce enough to cover the cost of our national way of life, so we have to borrow continually at ever-greater volume. Every year, the Treasury has to pay interest on all that debt. It’s a lot of money. This year, with interest rates starting out at historically unprecedented lows (not seen since well before the Roman Empire, and yes, there are records of it), the Treasury paid over a quarter-trillion dollars in interest. By the way, the government borrows money to make these interest payments too. An interest rate rise of one percent, would drive the annual US debt higher by $190 billion. As the late, great Senator Everett Dirkson (R-Ill) once pungently remarked: “…a billion here, a billion there, sooner or later you’re talking about real money.”

A sharply rising interest rate on the ten-year Treasury bond will thunder through the system. A lot of other basic interest costs are keyed to the ten-year bond rate, especially home mortgages, apartment rentals (landlords hold mortgages), and car payments. When the ten year bond rate goes up, so do mortgage payments. When mortgage rates go up, house prices go down, because fewer people are in a position to buy a house at higher mortgage rates, and rents go up (more competition among people who can’t buy a house). Zero Interest Rate Policy (ZIRP), in force for ten years, has driven house prices back to stratospheric levels. They are now primed to fall, perhaps severely, leaving many homeowners “underwater,” with houses worth way less on the market than the amount of mortgage left to pay off. The re-financing market is dead. Housing starts were already down by a stunning 19 percent in November. Automobile sales are rolling over. Manufacturing and retail sales numbers are down at year end. What’s up: stocks, stocks, stocks.

Yet investors did not execute the usual end-of-year profit-taking in the expectation that Trump would lower the capital gains tax in 2017, so why sell now? You can wait until January 3, 2017 to sell, and then not have to pay tax on your profits until April of 2018. Will investors start dumping in the first trading days of 2017? I think so. And will that selling beget a stampede for the exits? And what will happen if the interest rate on the ten-year bond hits three percent? (It doesn’t have far to go). Or maybe even four percent? What happens is the stock markets go down in the first quarter of 2017. My forecast is 20 percent down on the S & P. That will only be a preview of coming attractions once Trump gets his mitts on the levers of power. A still bigger crash ahead later in the year!

Why Trump Can’t Pull a Reagan

When Reagan came into office in 1981, inflation was raging largely because of the effects of the oil crises of 1973 and 1979, which had produced the “stagflation” that confounded the reigning economists’ models (they knew nothing about the relationship between energy dynamics and capital formation). The Fed Fund rate was almost 20 percent in 1981. It had a lot of room to move down. The national debt was less than one trillion (Reagan eventually ran it up to $2.8 trillion). Reagan was able to endure a sharp recession early in his first term — and voodoo economics got him through all the rest of his tenure, with both inflation and interest “normalizing” — as mentioned earlier, he enjoyed the bonanza of the last great non-OPEC oil discoveries coming on-line during his two terms, which ramped up economic activity and growth.

Today, the US is in a box and Trump comes on the scene with nowhere to move. Too much debt can only be managed if interest rates are kept low. Everybody and his mother around the world is dumping US Treasuries. With a bear market in bonds on, the Fed as buyer of last resort will have to sop up whatever comes on the market to keep the interest rate from rising above three percent on the ten-year, and even that may not prevent it. Trump’s vaunted infrastructure stimulus plan will be impossible to carry out without the Fed monetizing the necessary debt. So stimulus implies bigger deficits, which means more bonded debt that nobody wants to buy. The result will be inflation and accordingly further upward pressure on interest rates. Higher interest rates, in turn, will negatively impact economic activity, lowering tax revenue, inducing larger fiscal imbalances and greater instability.

Trump may never even get the stimulus he seeks. The Republican controlled-congress has vowed not to increase the national debt. How can Trump fulfill his pledge to cut taxes and bring on stimulus without hugely increasing the debt? If there is war over spending between Trump and Congress, Congress is likely to win, since they control the fiscal purse strings. Of course, Donald Trump cannot abide not winning. Hostilities between them may become permanent early in Trump’s term and bring on even more dangerous paralysis of governance.

Also early in 2017, the Fed will abandon its “dot plot” talk about further interest rate hikes. They may also surrender their credibility in the process. The system can’t take the strain of three interest rate rises in 2017. It may be that Janet Yellen has raised the Fed Funds rate a total of one-half a percent in two years solely to be able to lower them again when the real economy finally tanks under that strain of incessant central bank chicanery. By the second quarter of 2017, following a 20 percent stock dump, the Fed will start making noises about Quantitative Easing 4 (QE), or they will cook up some other program that accomplishes the same thing under a new cockamamie label. More QE (or something like it) will drive the dollar back down and gold back up. The housing market will be in the toilet and the rest of the economy will follow it down the drain. By the end of Trump’s first year in office, there will another, greater, dump in the stock markets after the initial 20 percent drop in the first quarter. America will be great again, all right: we’ll be entering a depression greater than the Great Depression of the 1930s.

Desperate Measures

One of the other big and dark trends of the past year has been the move of governments around the world — and among the economist / necromancers who advise them — to ban cash from the scene in order to herd all citizens into a digital banking system that will allow the authorities to track all financial transactions and suck every possible cent of taxes into national coffers. It would also be an opportunity for the bank-and government cabal to impose negative interest rates (NIRP) on bank accounts so that money herded into the digital system could be surreptitiously “taxed” by charging account holders just for being there (against their will). It’s a little hard to see how that might happen just now in a broad rising rate environment, but it would be the natural accompaniment to banning cash — and renewed aggressive QE (QE forever!) might do the trick.

Harvard economist Kenneth Rogoff literally wrote the book on this (The Curse of Cash; Princeton University Press, 2016), a mendacious argument that cash money merely enables drug dealers and terrorists to operate and has no useful place otherwise in a regular economy. Rogoff appeared to be angling for the Treasury slot in Hillary’s cabinet, and would have fit in perfectly with this totalitarian assault on the public’s financial liberty — but, as we know, Hillary didn’t make it.

Efforts to eliminate cash are already underway around the world. The EU officially discontinued the €500 note from circulation. Ken Rogoff’s Harvard colleague, Larry Summers, was calling for abolition of the $100 bill a year ago. Sweden is successfully herding its people out of fiat krona. India’s Prime Minister Narendra Modi pulled a fast one in November by banning the 1000 and 500 rupee note (worth respectively $14 and $7), and threw India’s economy into a epileptic seizure. The idea was to discipline tax evaders who operate in a cash economy. The catch was that more than 85 percent of India’s economy operates on a cash basis among people too poor to have bank accounts and credit cards — including millions of truck drivers and ordinary laborers. Naturally, the Indian economy froze. Nobody could get paid. Food rotted in stalled trucks. ATM withdrawals were limited to a few day’s walking-around-money. Citizens could not even exchange their 1000 and 500 rupee notes at the banks without going through onerous time-consuming bureaucratic rigmarole, including fingerprinting and the submission of tax records. The process caused discouraging long queues to form at the banks, and was probably designed to discourage the exchange of the 1000 and 500 rupee notes altogether and instead just retire them from circulation — which means a lot of poor people lost the minimal cash savings they had.

It’s hard to see the US government banning cash as clumsily as India did, but they have other ways to herd the multitudes into the black box of all-digital banking. Financial author James Rickards calls this the “Ice-Nine” program, in reference to the isotope of water in Kurt Vonnegut’s sci-fi novel Cat’s Cradle that freezes the world in a horrifying chain reaction. Rickards’ Ice-Nine financial nightmare would include features like freezing bank accounts, bail-ins (confiscation of accounts), limits on ATM withdrawals, and the “gating” of investment funds. Ice-Nine would be invoked in a banking emergency — say, a derivatives “accident” that took out some Too-Big-Too-Fail giant, or really anything that triggered the extreme fault lines in the ultra-fragile system that the world’s money elites have cobbled together to keep the garbage barge of global finance from sinking. In his recent book, The Road to Ruin, Rickards reminds readers that the emergency act signed by Bush Two after 9/11 has remained in effect under Obama, so that America is “just one phone call away from martial law.”

Another method for depriving citizens of their financial liberty would be for the government to declare that retirement accounts had to contain a set percentage of US Treasury paper — once again herding people into a financial corral against their will — in order to prop up the value of bonds and tamp down interest rates. David McAlvany (his excellent podcast here) makes the interesting point that if herding the public into the digital financial corral was a key ingredient to “making America great again,” who could object? — because now you’d be opposing American greatness! Trump inherited a much bigger problem than Barack Obama did in 2009. Obama still had enough soft-soap left in the machine to blow more bubbles. Trump arrives on the scene with the machine out of bubble-blowing mojo. He’ll be overwhelmed by financial disorder in 2017 and then the nation’s focus will turn to a tumultuous political scene

Wild in the Streets

The public is just plain pissed off, and remains pissed off after the Trump Victory. Their anger has been fermenting for decades as their economic prospects dwindled and they began to understand how it all worked against them. The battered middle class might have gotten a temporary thrill from the election, but an awful lot of them are still out of work, or working at the humiliating shit-jobs that replaced their old lost jobs in the old real stuff economy. Worse is coming their way in 2017. Theirs is a true existential crisis.

Even under the most favorable circumstances, a stimulus program would not likely get out of congress until much later in 2017, and I personally doubt that it will get through at all. The so-far-fortunate retirees plugged into pensions represent another potential trouble spot. Pension funds are going bust all over the country from the incapacity to stay solvent in a near-ZIRP environment. In 2016, fissures started to show in places like the Dallas Police and Firemen’s Pension fund, when pensioners’ redemptions were shut down. There are pension funds all over the country floundering from the same conditions, since the Fed took the “fix” out of “fixed income.” In the absence of decent “yield,” the pension funds have been herded into risky stock markets, and if those markets blow up, the pension funds are going to blow with them… and then the pensioners’ lives are going to blow up… and then maybe civil order dissolves around the country.

That may be the moment when President Trump and his militarily-weighted cabinet appointees opt for martial law. What a goddamned mess that will be. There is no civilized country on earth with as many small arms per capita than the USA, and despite the fearsome appearance of militarized police forces, you cannot overstate how much deadly mischief a small number of pissed-off people can make with automatic rifles, rocket-propelled-grenades, Semtex plastic explosive, and other fun stuff. It could morph easily to a literal war on bankers and Wall Street in particular, especially if Ice-Nine goes into effect. Bear in mind that a lot of veterans of the endless Middle East wars belong to this suffering economic class, and they actually have some training in the warrior arts.

Their political counterparts in the Democrat / Prog coastal elite, hardcore Hillary, PC-and-unicorn crowd are moving through their post-election Kubler-Ross Transect-of-Grief from denial to anger too. So both sides are quite pissed off and primed for conflict. The Left will certainly do everything possible to oppose Trump and try to make him look bad, whether it’s in the public interest to do so or not. They will throw every monkey-wrench possible into the machinery of governance, up to and including the (mostly Democratic Party weighted) Federal Reserve hierarchy, whose interest rate “dot plot” could be truly a plot to exact revenge on Trump. Of course, that would blow up in their faces since proportionately the coastal elites own much more stock than the Trumpenlumpenprole red-staters, and they could be wiped out in a significant market crash triggered by rising interest rates. But that’s the thing about political rage: it’s the opposite of rational.

There’s no sign that the Democrat / Progs have recognized that their poisonous identity politics played a significant role in their electoral defeat. They will not abandon that endeavor in 2017. They will double-down on it. And as that happens, the Democratic Party will go the way of the Whigs in 1856 — with a whimper, not a bang. God knows who or what will replace them as a credible opposition to Trumpist crypto-Republicanism, although Trump himself stands a good chance of leading that party to oblivion, too, if my forecast of a big financial blow-up comes to pass.

The Red Guard-like action on campus may continue, though it’s hard to imagine the “Snowflakes” besting their infantile hijinks of 2016. What they are demonstrating now is that coercive identity politics is just a new form of leisure-time recreation on campus, like Ultimate Frisbee and the beer blasts of old! Have fun wrecking faculty careers and basking in the Facebook feed! A few still-sane people of all political persuasions are sick of their censorious attacks, reckless persecutions, and insults to reality — such as the mandatory “white privilege” trainings and gender identity personal pronoun crusades. I predict that there will be a revolt among the university trustees and boards of directors against college presidents and deans who pander to the Maoist hysteria, as the damage to higher education and intellectual freedom more generally finally manifests in dropping enrollments and the loss of public funding.

There is every sign that black and white racial conflict will grow worse in the year ahead. The week after Christmas 2016 saw an impressive number of shopping mall mass melees of black teens all over the country. For years, the media went along with the hyperbolic story that innocent black men were being killed by police for no reason — when the overwhelming majority of those cases involved victims brandishing guns or grossly misbehaving in some way liable to get themselves in trouble. Victimology still rules in America. It’s a psychological defense mechanism to relieve the Dem / Prog’s shame and anxiety with the outcome of the long civil rights campaign — namely, black family disintegration, educational failure, and a shocking rate of black-on-black murder. A subsidiary grievance industry, lately led by Black Lives Matter, fans the flames of vengeance against the universal villain, Whitey, whose “privilege” keeps other people down (except, notice, immigrants from China, Korea, Vietnam, India, and other places where Whitey is absent.)

So, now Left and Right are both equally pissed off. It also means you have two adversarial groups who might give themselves permission to turn violent to justify their grievances. If the financial markets tank and the economy freefalls, it is easy to imagine the potential for violent conflict between the Dem / Progs with their Black Lives matter proxies against the Trumpista lumpenproles. It would be a terrible tragic distraction from the business of repairing the common weal, the economy, and the common culture — but so was the Civil War

The Oil Quandary

The reports of Peak Oil’s death are exaggerated, to borrow a gag from Mr. Twain. It’s just been playing out in ways that many of us didn’t quite anticipate and it is still at the heart of our economic predicament — which is that you can’t rationalize an annual debt growth rate of 8 percent if your actual economic growth rate is under 4 percent (paraphrasing Chris Martenson at Peak Prosperity.com).

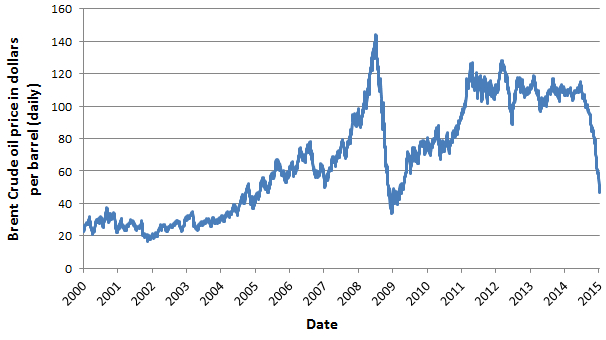

We haven’t run out of oil, but we have run out of oil that is rationally economical to pull out of the ground. The so-called “shale oil miracle” extended the oil age a few years by debt-financed legerdemain. Yes, we drove US oil production way up, almost back up to the 1970 peak production level around 10 million barrels-a-day (b/d). The trouble was that the companies producing it didn’t make a red cent in the process. They just ran up a huge amount of debt to pursue the shale project. The pursuit was on wholeheartedly beginning around 2006, because 1) the Peak Oil story was scaring folks, including folks in the oil industry, and 2) the market price of crude oil soared after 2004 and shale looked like a possibly winning venture — especially since conventional exploration in recent years was turning up almost nothing of significance.

From 2004 the price of oil skyrocketed from around $40-a-barrel until 2008, when it reached a high point of about $140-a-barrel. Then, of course, the price crashed catastrophically for a year, along with Wall Street and the economy. But, by then, the fracking industry was all ramped up in the Bakken fields of North Dakota and the Eagle Ford range of Texas. Plus the industry was learning some additional new fracking tricks to goose more oil out of the “tight” rock. So they were full of confidence, despite the price crash. Then, in 2009 the oil price turned sharply upward again — with central bank ZIRP and QE and other maneuvers to prop up the economy with more debt at lower interest rates. And the price of oil just climbed and climbed again back into the $110-plus range in 2011, and lingered there until 2015, when it crashed again.

Of course, most of the producers weren’t making any money even at the $110-a-barrel, but they expected improved technology to mitigate that eventually. In the meantime, they just produced too much shale oil and the market was flooded and OPEC got into the act and pumped all-out trying to crash the price further to put the US shale producers out of business, and then nobody made a red cent fracking for shale oil. So, you can see there was a pattern.

The pattern nicely describes the dynamic advanced by Joseph Tainter in his seminal work, The Collapse of Complex Societies: namely that over-investments in complexity lead to diminishing returns. That is, as you keep making your systems extra-hyper-complex, you get less value back for doing it, until you get to the point where there’s no benefit whatsoever, and then the system implodes. And that is exactly what has happened with oil and the economy that was engineered to run on it, and the financial system that evolved to manage the wealth it used to produce.

A few other things happened the past few years on the oil scene. The American oil companies bowed out of Arctic drilling. The Canadian Tar Sands went bust. The overthrow of Muammar Gaddafi choked off Libyan production, which was offset by Iran coming back onto the international market, which was offset by political mischief in Nigeria that choked off production, which was offset by increased Iraqi production, which was offset by the collapse of Venezuela. Most of the world’s oil producers had entered decline anyhow.

Don’t be fooled. The low prices at the gasoline pumps only mean that US oil companies are going broke fast, as are American “consumers.” There’s a basic equation I’ve repeated a few times on this blog: oil over $75-a-barrel destroys industrial economies; oil under $75-a-barrel destroys oil companies. That’s were things stand when the energy return on investment falls to 5-to-1, as is the case with shale oil. Steve St. Angelo over at the SRSRocco Report makes the excellent point that it takes at least 30-to-1 energy return on investment to maintain plain vanilla modern life. Anything below that and parts of the economy have to be sacrificed. Trucking, air travel, commuting, theme park vacations, your job…. It’s just another way of describing the pernicious effects of the diminishing returns of over-investments in complexity.

In the fall of 2016, OPEC members tried again to agree on an oil production output limit, as they have done many time before. Each time, they all managed to cheat in order to sell greater volumes of oil and make more short-term money — a classic Tragedy of the Commons story. Consequently, the price of oil went up to about $53-a-barrel by Christmas 2016. Don’t expect that to last. Unless, of course, there is a geopolitical event somewhere out on the oil scene, most likely in the Middle East, though Venezuela’s economy is approaching total collapse. The forecast here is for oil prices to follow the stock markets down in the first quarter of 2017. A lot of junk bonds in the oil space will default as a result, leading to a general crisis in shale oil investment.

Vagrant Thoughts on Geopolitics

As I write just before New Year’s Eve, President Obama is trying to start World War Three with Russia as a parting gift to the voting public. I’m among the skeptics who think that the “Russia Hacks Election story” is a ruse to divert the public’s attention from the stupendous failure of the Democratic Party to win, as expected. Rather, Wikileaks should get the Pulitzer Prize for revealing so much about the nefarious workings of the Clinton Foundation and the Democratic National Committee.

Regular readers know I didn’t vote for Trump, that I heaped considerable abuse on him in the campaign commentaries. But I didn’t take any comfort in the nostrum about being “better off with the Devil you know (Hillary) than the one you don’t know (Trump).” Both candidates were awful, and the condition of the country is pretty awful as we turn the corner onto 2017. Readers also know from these commentaries and from my books that I expect we will have to make big changes in our living arrangements up ahead as the techno-industrial fiesta winds down. I won’t reiterate the particulars here, but 2017 is the hinge year for that. The strains on global finance are so spectacular that something’s got give. President Trump is sure to be overwhelmed by epic dislocations in markets, currencies, debt, and misguided central bank efforts to hold back the tides of a necessary re-set — a re-set which will see a lot of wealth vanish and a lot of pain inflicted on the losers of wealth, including whole societies.

We have three major European elections to look forward to in 2017: The Netherlands and France in the Spring, and Germany in the fall. Geert Wilders (a member of the Trump Big Hair Club), is virulently against the “Islamisation” of his country. He has campaigned previously to leave the European Union and for the return to the old guilder currency. Should the right-wing Marine LePen win in France, the EU experiment will likely end — she has made express promises to take France out of the EU. Angela Merkel has made herself impressively unpopular by opening the gates to a flood of immigrants fleeing the breakdown zones of the Middle East and Africa. And then, because of the Schengen Agreement (free passage across EU borders), the immigrants were unleashed on the rest of Europe.

Those of us paying attention may have easily lost count of the terror atrocities carried out across Europe by Islamic fanatics. Charlie Hebdo, Bataclan, the Bastille Day truck attack in Nice, the Brussels airport, the Berlin Christmas Market were only the most recent and spectacular. For years, individuals have been stabbed, had their heads cut off, throats cut, been blown up, machine-gunned. Take a look at this comprehensive list going back to 2001. You may be astonished. In that light, it’s pretty hard to keep waving the “diversity” banner, and I sense that Europe has had enough of it. One big question is whether the new European right-wing leaders will actually move as far as mass deportations. I rather think they will.

The UK “Brexit” vote was surprise all right. (I hit a white-tailed deer on the Maine Turnpike at 70mph that June morning, uccchhh, and lived to tell about it.) Now there’s a fair chance that Parliament will find a way to wiggle out of Brexit. Noises are also emanating out of Brussels to the effect that the EU could loosen up some of their rules — e.g. the Schengen Agreement — to induce Britain to stay in the EU. But there are so many other fissures and fragilities in that system that the Brexit may not matter anymore. The European banking system is melting down and there is absolutely no way to rescue it on the macro EU scale. Italy was heading for a banking crackup before Christmas. Deutsche Bank has been whirling around the drain for a couple of years. When the US markets and banks shudder in 2017, Europe will get the vapors. Hence, I’ll forecast breakup of the EU by this time next year.

We’ve come to the pass where “all that is solid melts into air,” in the poetic phrase of old Karl Marx. Marx was referring to the “specter” of communism that loomed over burgeoning industrial society of the mid-19th century, and indeed it turned into quite a world struggle through the century that followed. But now communism is down for the count and we begin to see what is truly melting into air: Modernity itself, this colossal, hulking, grinding, machine of destruction that threatens the global eco-system, and all its sub-systems including the human realms of money and politics.

The idea that Modernity itself might go down is inconceivable to those in thrall to the Religion of Progress, which declares that the world (and life in it) only gets better and better every year. This would appear demonstrably untrue, just in the visible damage to the landscape and the living things that struggle to dwell there. The most obvious problem with Modernity has been human population overshoot. The truth is, we’re not going to do a darn thing about it. There won’t be any policy or protocol, despite the good intentions of the groups inveighing against it. It will just go on… until it can’t, to paraphrase the late Herb Stein. Of course, people still have sex under conditions of hardship, so the population may plateau for a while until we are well into the long emergency. But the usual suspects of starvation, disease, and war are all still out there, doing their thing, and will only ramp up their operations.

The reason the Middle East and North Africa are melting down most conspicuously is because they are geographically among the places least well endowed for supporting the swollen populations they acquired over the past two hundred years. Iraq, Syria, the whole Arabian peninsula. Egypt, Libya, et. al. are all deserts artificially supported by the perquisites of Modernity: cheap energy, irrigation, fertilizers made from that, money derived from it, and continuing life-support subsidies from even wealthier modern nations outside the region. In recent years that life-support has flipped into deadly violence imposed from both within and without, as homegrown Sunni ad Shiite vie for supremacy and their puppeteers in the First World rush in with bombers, rockets, and small arms to “help.”

Iraq and Libya were already goners in 2016. They’ll never be politically stable again in the modern sense. Egypt is still headed down the drain despite the grip of General al-Sisi and his army. In all these places the “youth bulge” has no prospects for earning a living or supporting a family. The young men, especially, put their energy into Jihad, revolution, and civil war because there’s nothing else to do. Making war may be thrilling, but it won’t lead to a better future because those benefits of Modernity are running out and there’s nothing to replace them.

Syria is the current goner-du-jour. Whatever it ends up being, either under Assad or someone else, it will not be stable the way it was. The USA ended up arming and funding the Sunni Salafist “bad guys” there because they opposed Shiite Iran and its regional proxy Hezbollah plus Assad. Russia eventually came in on that side on the theory that another failed state is not in the world’s interests. President Obama blinked after he drew his infamous “line in the sand” years ago and now America is too spooked to act directly. In fact, the Russians and Assad have the best chance of restoring a semblance of order, but America’s support for the “moderate” Salafists will necessarily keep undermining that. In the meantime, all this activity has sparked a demographic emergency as refugees flee the country for Europe and elsewhere, creating greater tensions where they land. Trump could stop the flow of US arms to our favored maniacs in Syria. He may see the practical benefit of letting Russia be the policeman on the beat there, and maybe he can sort out the underlying competing interest between the Russian-sponsored gas pipeline proposed to cross Syria and the American-sponsored one — a dynamic underlying all the mayhem there — and make some kind of “deal.” Or maybe he’ll just fuck it up even more.

The situation will grow increasingly acute in Saudi Arabia, where population growth outstrips the ability of oil production to pay for it. Their old “elephant” oil fields are aging out and they know quite well that they cannot depend on oil wealth many decades ahead. The trouble is, they have no realistic replacement for it, despite noises about creating other industries. The truth is, the country was cursed by its oil. It grew its population too much too fast in one of the most inhospitable corners of the globe, and it will take only a modest decline in oil income to destabilize the place altogether. To buffer that, Saudi leaders plan an IPO for shares in Saudi Aramaco — which was originally composed of American and western oil companies nationalized decades ago. That may get them a few hundred billion or so in walking-around money that won’t last very long considering that just about everybody in the nation is on the dole.

The big news in that corner of the world last year was the collapse of Yemen, which occupies a big slab on Saudi Arabia’s southern border. That poor-ass country is the latest Middle East basket-case and Saudi military operations there continue to date, using airplanes and weapons supplied by Uncle Sam — just another case of feeding Jihadist wrath.

Make no mistake — as our Presidents like to say — all these countries are heading back to the Middle Ages economically, maybe even further beyond. Their culture is still basically medieval. The main point is that Modernity inflated them and now Modernity is over and they’re either going to pop or deflate. One wild card for now is what effect climate change may have in ME/NA. If the trend is hotter, than that’s not good news for a region so poorly watered and so hot that air conditioning is mandatory for the pampered urban elites. Last one out, please turn off the lights.

Then there’s Turkey, for decades known as “the sick man of Europe.” Now, of course, it can’t even get into Europe, the EU, that is, and it’s probably too late to sweat that anyway. Back when it was “sick” it was quiet at least. You barely heard a peep from the fucker through the entire cold war and beyond. But now that the countries on its border are breaking down, things have understandably livened up in Turkey. It was, until World War One, the very seat of the Islamic Caliphate, and it controlled much of the territory now occupied by the nations creatively carved out of the Sykes-Picot Agreement. Turkey is still a power in the region, with a lot of well-watered, habitable territory and a GDP half the size of Italy’s, though shrinking. Its current president, Recep Tayyip Erdo?an, has shown twinges of megalomania in recent years, no doubt in fear of the radical Islam epidemic so close at hand. Lately, Kurdish extremists have been planting bombs around the country, too. Turkey has a lot to be paranoid about and Erdo?an wants to change the constitution so he can act the strongman without a wimpy, pain-in-the-ass parliament weighing him down. He endured a coup last summer and came out of with consolidated power. But he’s capable of making another bonehead move like shooting down a Russian jet (2015). Meanwhile, Turkey’s currency is collapsing. The population is over 80 million. In the event of serious political upheaval, how many of them will try to flee to Europe?

Russia? It’s apparently stable. We hear no end of complaints about “Putin the Thug,” but in this time of altered reality and disinformation fog, it’s honestly impossible to tell what the fuck the score is. Has he bumped off some journalists? So they say. But, not to get to baroque about it, consider the impressive trail of dead bodies said to be left in the wake of Bill and Hillary. That story was so toxic that Google squashed searches for it during the election campaign. Putin seems to me, at worst, a competent and capable Czar, in a country that likes to be ruled by them. That’s their prerogative. He’s hugely popular, anyway, and it’s one of the unsung miracles of recent times that Russia transitioned out of the fiasco of communism into a pretty much normal modern society, with shopping, movies, tourism travel, and everything. The Russian people may look back at these decades as a golden age. They’ve been punished by Western sanctions for a few years now, but it has prompted them to promote their own version of a SWIFT Code for international banking transactions, and their own counterpart to the EU, the Eurasian Customs Union, and to manufacture some products of their own (import replacement).

Personally, I think the meme of “Russian aggression” is not born out by actual recent geopolitical reality. They are castigated constantly for wanting to march back into the Baltic States, Ukraine, and other former Soviet territories. Ukraine was made a basket case with direct American assistance. (Remember Deputy Secretary of State Victoria Nuland: “Fuck the EU!”) Ukraine was rendered an instant failed state. As far as I could tell, the last thing Russia wanted was to take on Ukraine as an economic dependent. Same for the Baltic States. They need to subsidize these places like they need a hole in the head. Russia’s 2015 annexation of the Crimea was a special case, since it had been part of Russia one way or another for most of the past 200 years, except for the period after Khrushchev gifted it to his homeboys in Ukraine around 1957. Anyway, the Crimea was the site of Russia’s only warm-water naval ports. They’d rented it from Ukraine before the US pranged the country. The Crimean inhabitants voted to join Russia (why do we assume that was not sincere?).

Finally, as renowned Russologist Stephen Cohen has said, wouldn’t it make sense for the US and Russia to drop all this antagonism nonsense and make common cause against the real threat of our time: Islamic Jihad? How many Westerners has Russia killed or harmed the past twenty years compared to the forces of Jihad? The tensions in Syria are admittedly complex, but why are we making them worse while Russia attempts to stabilize the joint? Perhaps The Donald can start there….

As I write, Mr. Putin just announced that his country would not take any reciprocal action against American diplomats in retribution for Mr. Obama’s fugue of punishments meted out last week for the still-unproven “Russia Hacks Election” story. Personally, I’m content to wait three weeks and see if relations improve after Mr. Obama departs the Oval Office.

Finally, there’s China. I’m among those who believe China is running the most farkakta banking system on God’s green earth. We should not be surprised if it implodes in 2017, and does so pretty badly, in a way that might shake the foundations of the entire banking system. On that note, I confess that I have run out of forecast mojo for the year, and anyway this bulletin in long enough. If you’ve gotten this far, I commend and admire you hugely for your remarkable patience. Have a happy 2017 everybody, and don’t let our Trumpadelic president get you down.

I didn’t see any good news in there. So all will be failure?

Kunstler makes me look like a raving optimist.

Yeah, me as well…

Thing is about Kunstler – he keeps banging the “fossil fuel” drum. The theory is that petroleum is formed from ancient decaying organic matter… and as such, has the designation of “fossil fuel”.

Thing is, no fossil – the remnants of a once-living organism – has been found below 16,000 feet of depth in the Earth. Ever.

Yet, we regularly drill down 25,000 or 35,000 feet to access petroleum deposits.

Something to chew on:

Colonel Prouty has the professional chops to rub elbows with guys like Kissinger and other serious players in past governments – his talk about the Bay of Pigs is just amazing, he KNEW all those guys personally.

I’m more than willing to give him an honest hearing…

These leftist have a lot of hate – how could anyone write (9000 words – I’m guessing) about how everything is shit, going to shit, and there’s no way out.

Manufacturing jobs coming back? My dad worked for the Bethlehem Steel. A plant 14 miles long, 3/4 miles wide. Had it’s own rail road. Made the beams for the Verazano Narrows bridge ( worlds longest single suspension). Made battle ship gun barrels, made reactor cores. Is this a bullshit industry?

AT&T made all the phone systems. What a bullshit industry?

Kunstler: You know what you get when your optic nerve is connected to your anal sphincter? A shitty outlook on life.

There ate two ways to view the future:

1 There are a huge number of obstacles that make it impossible for us to do anything about it.

2 There are many obstacles presenting problems that we are going to have to solve to get where we want to be and those solutions will produce much of what we want in the process of solving them.

Kunstler seems to be hard core in the first category and has already given up on the future while I am in the second category and intend to lend as much support to finding the solutions as possible.

Who knows, maybe even I’ll get to contribute to some tiny part of one of the solutions, don’t know if I don’t try do I?

9,334 words from the two-time Oreo voting joo boy.

To all you who read his tripe I award you the first annual Stucky Massively Persistent Sucker Award.

It is clear that Kunsler believes that Hitlery would be unlikely to suceed and he wishes Trump to fail no matter what happens. Such a shame, that damned 22nd Amendment prevents BHO from starting 3rd term on January 20 and more hurtfully it keeps BJC from starting term 7.

I rarely lose my temper and reading this post is about as close as I am likely to come to it, but man this infuriates me.

So many words, so many completely false conclusions.

1) Stop with the end of oil already. If it were actually depleted and it did cost more to extract from the ground than it would fetch on the open market, the price would be higher rather than lower. How he continues to beat that dead horse week in and week out perplexes me to no end.

2) Yes, we could have had great mass transit and walkable cities but the elites wanted diversity and you can’t have both. Suburbs were the result of desegregation, not happy motoring. People can tell you all the live-long day how tolerant and inclusive they are, but they vote with their feet.

3) The Federal Reserve was never for the benefit of the people, it was for the benefit of the Bankers. It didn’t fail to achieve its stated goals, it lied about them in order to be wildly successful in stealing the wealth of the productive classes. The Chicago White Sox didn’t lose in 1919 because the other team was better, they lost ON PURPOSE. Same/same with the Fed.

4) Modernity sucks for more reasons than I can enumerate. But let me try. It is unnatural, it is not sustainable, it is hollow, it is wasteful, it is degenerate, it is ugly, it is sick, it undermines and corrodes every aspect of human life- physical, mental, spiritual, moral and historical. It is completely reliant on the efforts and production of those it despises and maligns and its most fervent adherents contribute little or nothing in return. It can only be kept in power through the combined efforts of relentless indoctrination, ceaseless propaganda campaigns and the threat of force. Its cobbled together like Frankenstein’s monster from an assortment of fractious and combative identity groups who loathe each other almost as much as they do anything wholesome and upright.

We are in a phase of the collective human social lifespan that is decline. It is not something that can be turned around, tweaked, reformed, set right or made good. It will continue on following its own destiny until such time as a new and completely organic form arises from its ashes and then and only then will a culture appear that is vigorous and healthy, ready to fill the space left by our dissolution. Does this mean that mankind itself must perish? Not necessarily, but it is possible. What is likely is that the remnants will pass on their genetic inheritance to a new people with an identity and an alien vision different from anything we understand today.

I have read JHK for many years often wondering what the problem was, that a man with such a superb intellect could be so woefully inadequate to synthesize reality to his personal vision and it never dawned on me until this day that he is not a prognosticator of the future as he sees himself, but hopelessly mired in the concepts and beliefs of the past. Rather than a visionary, he is, in fact, an anachronism.

Bummer, dude.

You wrote: “Does this mean that mankind itself must perish? Not necessarily, but it is possible.”

Scientists believe, without much proof or reasons why, that the earth has experienced five major extinctions, and we are already experiencing number six.

It is also believed that if your outstretched arms signified the age of the earth, your hand would measure life on earth, and a single scrape of a nail file across your finger nail would signify human life.

We’ve been here a very short time, and made such a big mess of things that maybe you are correct, and after another 250 million years or so, a new mankind will “arise from its ashes and then and only then will a culture appear that is vigorous and healthy, ready to fill the space left by our dissolution.”

“It is a curious feature of our existance that we come from a planet that is very good at promoting life but even better at extinguishing it.

It is easy to overlook this thought that life just is.

As humans we are inclined to feel that life must have a point. We have plans and aspirations and desires. We want to take constant advantage of the intoxicating existence we’ve been endowed with. But what’s life to a lichen? Yet its impulse to exist, to be, is every bit as strong as ours-arguably even stronger. If I were told that I had to spend decades being a furry growth on a rock in the woods, I believe I would lose the will to go on. Lichens don’t. Like virtually all living things, they will suffer any hardship, endure any insult, for a moment’s additions existence. Life, in short just wants to be.”

― Bill Bryson, A Short History of Nearly Everything

“Others have said (and I concur) that 2008 will be the year that the issue of Peak Oil not only takes stage in the forefront of American politics, but pushes global warming aside as the most immediate threat to the “modern” way-of-life. There is every reason to believe that the world has arrived at its all-time oil production peak ”

——- CUNTsler’s 2009 forecast

http://www.24hgold.com/francais/actualite-or-argent-forecast-for-2008.aspx?contributor=James+Howard+Kunstler&article=1034151140G10020&redirect=False

He is so consistenly full of shit it’s amazing he even has any readers left. Then again …. McShits continues to sell billions of so-called “hamburgers”

Ya, I made it through the whole thing and had many of the same thoughts. White people moved out of the cities and into the suburbs not because they enjoy an hour in the car each way to work, but because they wanted a decent place to live and raise their families, which “diversity” made damn near impossible in every city, unless you can afford the gated community/private school set up. My parents couldn’t which is why they lived out in the suburbs, where there are good schools. Or, I should say ‘were’ good schools, since diversity has now spread its tentacles out to the suburbs.

He has also been banging this peak oil drum for close to a decade, it seems. Sometimes the peak oil people remind me of the global warming crowd, which JHK seems to also be a member of. No matter what happens with oil availability and price, they twist it to mean they were right. More and cheaper oil somehow means the end is near, just like it was near in 2008. Just like the global warming crowd claimed that we would be seeing increasingly violent hurricane seasons due to global warming, when that didn’t materialize, it somehow proved them correct. Makes sense if you don’t think about it…

I agree 100% that what he calls modernity has a finite lifespan. I just don’t think it has nearly as much to do with peak oil as it does with the financialization of everything and the fact that our debt has been going up twice as fast as actual growth for so many years. We also support an unsustainable amount of dead weight, not just in america but around the world. Modernity has made it possible for 10’s of millions of people to live a comfortable lifestyle without ever lifting a finger working for it, and that is unsustainable. Same with the populations of MENA. I do agree that the massive populations growth there will lead to a huge die-off. I just don’t think its global warming that will cause it. Once the rest is no longer financially able to subsidize them with food and the means to get fresh water, medicine, etc, the continent of africa will revert back to a population its people are capable of sustaining on their own. I don’t know what that number is, but since they tend to be about a century behind us in their ability to build things like indoor plumbing, I’d start there.

I think everyone here, including JHK, is viewing the concept of peak oil incorrectly. The indisputable fact is that EROEI has fallen dramatically and this is not unexpected–low hanging fruit is ALWAYS taken first in any system. Talking about “price” and “availability” of oil is specious. We all know oil price has long since been divorced from supply/demand curves. Just because something is readily available does not mean that it will continue to be so. And HSF – “If it were actually depleted and it did cost more to extract from the ground than it would fetch on the open market, the price would be higher rather than lower.” I think you know that this is ONLY true in an rational economic system and that we have not had one of those for decades. But, by far the biggest problem in the common thinking on Peak Oil is that it is a POINT in time–No, however it plays out, Peak Oil is an EPOCH, just like economic collapse. Gradually then suddenly. I do believe that the financial/debt/corruption/greed boogeyman will get us before Peak Oil will play out, but falling oil EROIE is already playing a big role and will continue to do so (“price” and current availability notwithstanding)…but, it is just a subset of the bigger issue of attempting exponential (infinite) growth on a finite planet.

Now, as for the rest of it, HSF nails modernity for me. It sucks. People screaming how we live in the best age of all of human history drive me nuts–I find it the worst. Perhaps, that’s why I am somewhat drawn to JHK–I too want to go live in the past, in a world made by hand–but it will not happen. Whatever the future looks like, it will NOT be a return to a time before technology. We can never go back.

Hope HSF is right and Kunstler is wrong.

I take back my characterization of Admin as a pessimist. I nominate him to be optimist of 2017.

Wow, depressing for sure. I think I’ll go back to bed. Wake me up in 2018.

Dude, who pissed in YOUR cheerios? ROI getting too small for the petroleum industry?Ever heard of “fracking”? It drove down the world price of oil–true, it’s too low for healthy growth within the industry, but just healthy enough that we STILL have low-priced gasoline, without “shortages”, or boarded-up gas stations dotting the countryside. Fracking was a successful experiment in increased extraction efficiency. Stay tuned for greater entrepreneurial experimentation. With oppressive govt off the backs of industry, I believe we’ll see much bluer skies in the years to come. As far as robotics are concerned–so far, no robot can replicate or repair itself without LOTS of human interfacing. Somebody’s gonna have to build AND service them. Sounds like jobs to me…

Happy New Year, ALL!

So one person repairs and services a robot that replaces 20 people.

Net gain or net loss of jobs?

People are increasingly obsolete, get used to it.

You guys make me laugh. First of all, as has been beat to death here numerous times, people are particularly bad at making predictions. Second of all, rinse/repeat, people are particularly bad at analyzing complex systems in a meaningful way. We attempt to mitigate our poor performance by utilizing models built of concepts and relationships we do understand, and we congratulate ourselves for our own cleverness when the models make sense while we tend to deny the obvious when the models fail, as they all do.

In the great pantheon of opinions I find on this site I think Admin’s, HSF’s, Stucky’s, LLPOH’s, NickelthroweR’s, SSS’s, Theresa’s, and many others all have, at times, deep wisdom. It is what brings me back again and again. That said, we all have our own particular filters and blind spots and pet theory’s and biases we like to stroke and confirm. I certainly do despite much effort to “see” other perspectives.

In this case I think there are two main parts to the “prediction”. The list of largely factual information presented is the first part, and the interpretation of the information is the second part. To the former I challenge you to point out some part of the synopsis given that is incorrect, misleading, or an outright falsity. You could split hairs on some things if you try hard enough, but you are going to have a hard time presenting an alternate view on oil/energy, geopolitics, national politics, debt, the Fed, etc.

To the latter you are welcome to your own interpretations. I’d be more interested in hearing what you think is going to happen than to hear your lame rejections.

@ Stucky: past performance doesn’t prove or disprove anything. Even a broken clock and all that. Tell me why he’s wrong or what you think will happen instead. If being wrong consistently was a disqualifier then no one could post here (or anywhere else, I think). I have been spectacularly (and expensively) wrong about things from time to time, but I’m still right more often than I’m wrong or I would have a hard time functioning day to day (I suspect you are too).

@HSF: “1) Stop with the end of oil already. If it were actually depleted and it did cost more to extract from the ground than it would fetch on the open market, the price would be higher rather than lower.”

Your comment is patently and demonstrably false. Price is a negotiation based on the values of the participants in the transaction. I often sell something far below its cost in order to clear out space. Owning something costs me money in terms of storage, labor, etc. Every day I own something it (in general) becomes worth less. If I have something that I can’t use and that I can’t sell at a profit I’m faced with a choice of holding on to it at a continual expense (while it gets progressively less valuable) or off loading it and cutting my losses.

In my opinion the oil industry is in that situation. They have invested a huge amount of money poking holes in the ground, developing technology, and building infrastructure to go after hard to get oil. That money is spent or borrowed, and there is no undoing it. At this point they, in my opinion, are attempting to survive long enough for oil prices to rebound to a profitable level. At the same time there are many participants effectively doing the same thing. As they produce to survive they all combine to produce enough to keep prices low. They could stop, and prices would rise, but they would go bust before that happens and it would be a moot point. They are working to preserve their investment as long as possible in the hopes that they will survive long enough to see the benefit. It is a catch 22, but it is a real problem and not one in Kunstler’s imagination.

Regardless the core concept of Energy Returned of Energy Invested (EROEI) is real. You won’t husband cows if the cows take more than they give you. You won’t tap trees if it costs more to make the syrup than you can get from the people who buy it.

Lastly he’s established by his posts and books that he has a particular view of the future. Like everyone else he reinforces that viewpoint more than he tries to break it, and since the core issue hasn’t changed I’m not overly surprised that his core belief about it hasn’t changed either.

@All: Give your own prediction or point out where you disagree and follow up with what you think instead. It is easy to be a negative.

Sonic

Goddammit! You gonna force me to be honest???! Damn you!!!

OK, look …. as you stated above, at least the beginning part of JK’s rant is spot on … especially the comments about debt and The Fed. He’s right much more often than the twice a day broken clock.

It’s an emotional thing for me. I just hate the fucker. I think he’s two faced. I think he’s a massive hypocrite. I read his stuff 20 years ago … when he was a rabid fan of Dems, and skewered Conservatives. I don’t forget. I don’t forgive. I don’t give a fuck if he changed his tone, has become more reasonable, etc. I dislike him, and that’s that.

“Regardless the core concept of Energy Returned of Energy Invested (EROEI) is real. You won’t husband cows if the cows take more than they give you. You won’t tap trees if it costs more to make the syrup than you can get from the people who buy it.”

Not everything is reducible to an economic equation. The above two examples are proof.

Humans are not corporations, labor is not a widget and not all human activity and industry can be factored into a bottom line, something the study of economics ignores completely because it cannot account for it as a line item.

Your example of gas prices somehow being tied to consumer demand thereby determining price is not tied to reality. A person who burns 25 gallons per week getting back and forth to their job pays $1.79 one week and $4.50 another depending upon all the BS variables we have heard since the 1970’s and no one asks what he’s willing to pay. Storage is another misdirection as well- it’s oil. Word on the street is that it’s been keeping just fine for the past several million years in the ground, that’s all the storage capacity you could ever ask for.

Just because someone has modeled a decline in production does not mean it is true and based on current costs adjusted for inflation gas is about as cheap as it has ever been.

You want a prediction? Western civilization- the people of European ethnic heritage and their social/art/religious/value systems- are in terminal decline and will cease to exist in any recognizable form in the next century unless there is a massive and successful campaign to resettle more than a hundred million non-European people’s to their homelands and close the borders to further incursion. That’s based on three facts: specific humans are the source of specific cultures, reproductive success is determined by the creation of a genetic posterity, zeitgeist.

I don’t fault JHK on his conclusions because of some kind of pre-filtered world view I have regarding historic possibilities but on the history of our species AS IT HAS HAPPENED IN THE PAST. Whenever you hear the term “this time is different” you can rest assured that it isn’t.

https://www.youtube.com/watch?v=n4IdJPFHEY4

That’s JHK in the black shorts, reality in white.

Brings to mind another favorite Howieism: You can trust me, I’m not like the others.

“A person who burns 25 gallons per week getting back and forth to their job pays $1.79 one week and $4.50 another depending upon all the BS variables we have heard since the 1970’s and no one asks what he’s willing to pay.”

The answer is always going to be “as little as possible” so no one needs to ask him.

The first station that cuts prices over the one he has been using gets his business, it’s always been that way. that’s why stations advertise their prices as loudly and visibly as possible to every driving past their location.

For that matter, it’s also reflected in people buying high gas mileage cars when they buy new ones during periods of highest gas prices, and lower gas mileage ones when gas is cheap.

I guess I should have read your comment before posting mine…said the same shit and more…and you fucked with Stucky’s head. Well done, Sir.

This was an excessively long opinion describing our socieatal failures , long on substance short on solutions !

My original question regarding Trumps slogan “MAKE AMERICA GREAT AGAIN” , great idea but with what and by who our industrial production centers are all abandoned scrap heaps and we have not trained steel fabricators pipe fitters welders electricians by any number sufficient to build squat and the production of materials is as mentioned non existant . Then there is the wage issue : the investor class want skilled people to work for shit wages and be taxed to provide a government worker with a 20 year retirement so our answer : SHOW US THE FUCKING MONEY OR WE WILL SHOW YOU WHAT WE ARE CAPABLE OF IF PUSHED ANOTHER INCH ! We do not owe the delapadeted system the 1% left us with shit THEY OWE US !