This is one for the record books. During Janet Yellen’s last week in office, the Dow dropped by 1,095 points or 4.1%. But by her lights, apparently, that wasn’t even a warning bell— just the market clearing its collective throat.

So on the way out the door our Keynesian school marm could not resist delivering what will soon be seen as a grand self-indictment. There’s nothing to worry about, she averred, because Wall Street’s OK and main street is positively awesome:

I don’t want to label what we’re seeing as a bubble….(even if) asset valuations are generally elevated….(but) when I see the unemployment rate fall to 4.1%…I feel very good about the progress we’ve seen there.

No, there is a monumental bubble out there that was born, bred and nurtured at the hands of the Fed. At the same time, Yellen and her merry band of money printers had virtually nothing to do with the 4.1% unemployment rate—even if that were a valid measure of return to full employment prosperity, which it is not.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

To the contrary, the mainstreet economy is sick as a dog, and it is the Fed’s giant Wall Street bubbles which made it so. That said, hereupon follows the ringing economic and financial indictment that Janet Yellen so richly deserves.

In the first place, that Fed’s dangerous digression into massive QE and 100 months of near-ZIRP had virtually nothing to do with the limpid “recovery” that has transpired since the June 2009 bottom. And we do mean its contribution amounted to nothing—- as in zero, zip and zilch.

That’s because the Fed does not levitate the main street economy through some kind of magical mystery monetary potion. It’s one and only tool is fostering household and business credit growth, which, in turn, gets applied to enhanced spending for consumer and capital goods beyond what is supportable from current income.

If the Fed’s maneuvers in the money and capital markets do not end up in higher household leverage and a debt-financed spend-a-thon, for example, then no “stimulus” happened in the consumer sector. Consequently, the Eccles Building cannot validly claim credit for goosing the growth rate of household consumption spending (70% of GDP) and for its contribution to overall economic performance.

In general, our thesis is that central bank stimulus of household spending is equivalent to a one trick pony. Once all the latent headroom on household balance sheets and income statements to raise leverage levels is used up, cheap debt loses its efficacy in the main street economy.

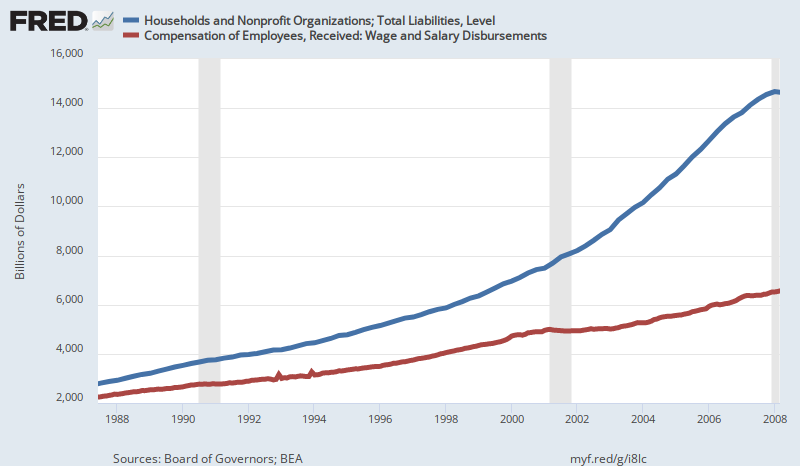

In fact, that is exactly what has happened. During the first 20-years of the Greenspan-incepted era of Bubble Finance, household leverage ratios exploded. Whereas wage and salary incomes rose by $4.2 trillion or 2.9X, household liabilities soared by nearly $12 trillion or 5.2X.

Over the two decades, therefore, household leverage ratios (liabilities to earned income) nearly doubled from 124% to 224%.

Not surprisingly, this eruption of household leverage enabled much of main street America to live beyond their means. Thus, during the 20 years from Greenspan’s arrival at the Fed to the credit bubble peak in Q4 2007, wage and salary disbursements grew at just 5.3% per annum (green line). Nevertheless, household consumption spending rose significantly faster at nearly 6.0% per annum (red line).

The gap was closed by borrowing, of course, which grew at the blistering pace of 8.5% per annum (blue line) or nearly 60% faster than earnings. Thus, the Fed’s cheap interest policy did “stimulate” household spending on a one-time basis.

So doing, however, it also buried them in an explosion of mortgage debt—including massive equity cash-outs—as well as credit card and auto loans.

Needless to say, the Great Financial Crisis (GFC) was in large part a warning that the one-trick pony had played itself out in the consumer sector.

Accordingly, there was zero credit stimulus to household spending after the financial crisis—notwithstanding the Fed’s massive QE program and more than 100 months of ZIRP. During the nine years after household credit peaked in July 2008, in fact, household liabilities grew by just 0.6% per annum in nominal dollars, while nominal wage and salary income rebounded at a 2.8% annual rate.

Consequently, the household leverage level dropped sharply from what we have termed Peak Debt at 224% of wage and salary income in mid-2008 to just 185% by Q3 2017. In effect, the household sector of the main street economy actually deleveraged modestly during the so-called post-crisis recovery.

To be sure, household leverage still towers way above its pre-1980 level (< 100% of wages and salaries) and would need to drop from the current vastly inflated level of $15.5 trillion to about $8.0 trillion in order to revert to its (healthy) historical norms.

But our point here is that whatever the Fed stimulated after Bernanke pulled out all the stop in September 2008, and which Yellen maintained at full throttle during her four years at the helm in the Eccles Building, it was not the huge household sector of the mainstreet economy. The modest peak-to-peak growth rate of nominal wage and salary incomes during the past nine years, which, in turn, was the entire source of the equally modest growth rate of household consumption during that period, was a product of the natural regenerative forces of market capitalism.

Janet Yellen didn’t have a damn thing to do with it!

The point is that the rate of both income and consumption spending growth slowed sharply during the post-GFC “recovery” because there was no after-burner from rising leverage and credit expansion. Personal consumption expenditures, for example, grew at just 3.6 per annum or at just three-fifths of the nearly 6.0% rate of 1987-2007.

Indeed, on the face of it, the proposition that the Fed had anything to do with the consumer recovery is belied by the blue line below, which represents household credit outstanding. Compared to the 8.5% rate of growth during 1987-2007, household credit expanded by just 0.8% per annum during the past nine years.

In short, there is no such thing as Fed monetary magic. If it is not operating through the credit channel of transmission to the household sector, it is not stimulating main street. Period.

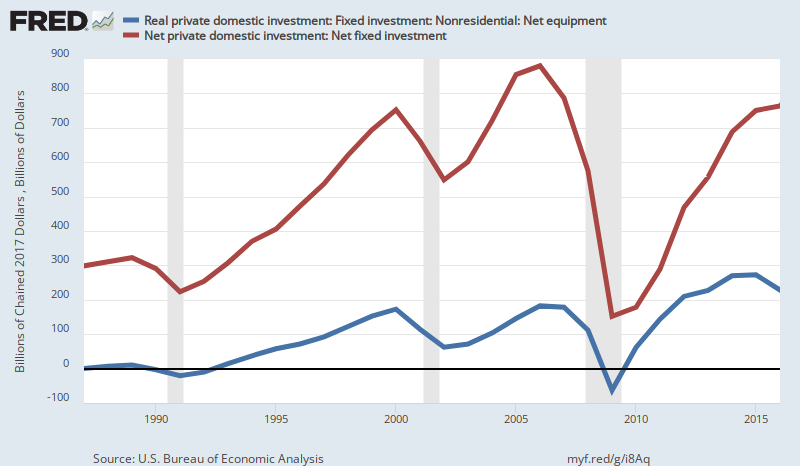

And that latter proposition is all the more true when you examine private fixed investment, which includes both residential housing and business sector investment in plant, equipment and software/technology. These investment categories are purportedly sensitive to interest rates and the cost of debt, and therefore have been the second target of the Fed’s cheap debt policies.

Generally, Fed stimulus in the fixed investment sector also worked effectively through the pre-crisis peak in 2007. Total real net fixed investment expanded at a 7.3% annual rate through the dotcom peak in 2000, and kept climbing until 2007, where it registered a 20-year gain of 5.5% per annum.

Moreover, it needs be recalled here that we are dealing with inflation-adjusted numbers and also net changes in the capital stock. In combination they are the sine qua non of true economic expansion and rising living standards.

In particular, “net investment” is a crucial factor because to the extent that reported gross investment outlays merely offset current period depreciation and other forms of capital consumption, that does not generate economic growth; it merely keeps the treadmill going. Actual economic expansion therefore requires investment in excess of the depreciation rate, and there was plenty of that during the first 20 years of the Bubble Finance experiment.

No longer. During the last nine years, real net fixed investment in the US economy (red line) has declined at a -3.2% annualized rate. Notwithstanding all of Janet’s money pumping, therefore, the nation’s real stock of productive capital assets has been shrinking.

The same story is evident in the sub-category measuring real net investment in business equipment, which represents the heart of productivity gains and tools per worker. After growing at a 13.6% annual rate during the two-decades ending in 2007, it has declined at a 1.3% annual rate since the pre-crisis peak.

It is not surprising, therefore, that productivity growth has been punk notwithstanding all the purported “stimulus” to capital investment. In fact, net real investment in equipment per worker declined from $1,610 in 2007 to $1,370 in 2016, representing a drop of 15%.

The question recurs, therefore, as to what happened to all the cheap debt that was available to the business sector, and which was, in fact, borrowed hand-over-fist by corporate and non-corporate business alike.

Thus, during the 20 years ending in the 2007 pre-crisis peak, corporate debt grew by 6.5% per year, but unlike in the case of real net investment, the corporate debt expansion rate has hardly slowed at all, posting at 6.2% per annum during 2007-2017. Since inflation was slightly lower during the latter period, real corporate debt growth has actually accelerated during the current recovery.

The obvious answer to the confluence of accelerating real debt growth and sharply decelerating real fixed investment trends is that the central bank fostered tsunami of business borrowings went not into productive assets, but corporate financial engineering. For instance, aside from a temporary peak in early 2007, stock buybacks and dividends by the S&P 500 averaged between $200 billion and $300 billion per year before 2010. Since then, they have been in the $400 billion to $600 billion per year zip code.

On top of that has come trillions more in M&A deals, LBOs and leveraged recaps. Virtually none of this financial engineering activity adds to economic efficiency—despite all the corporate IR department ballyhoo about synergies and savings.

If those claims were even remotely true, the US economy would have become an engine of soaring productivity growth decades ago—when in fact productivity trends have been in a nose-dive for the last decade. During that period, by contrast, the total amount of corporate cash plowed back into Wall Street (M&A, buybacks, dividends, LBOs and recaps)amounted to nearly $15 trillion. Overwhelmingly, it added to the bid for existing financial assets, especially equities and their derivatives, not the efficiency and growth capacity of the main street economy.

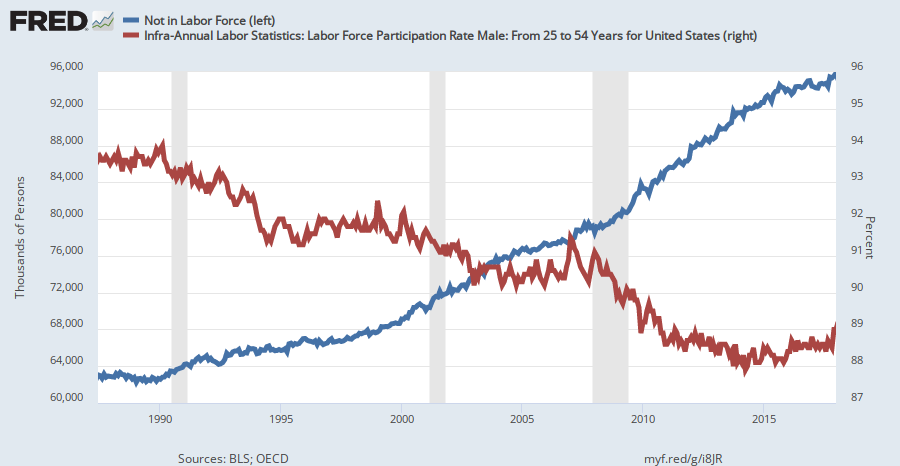

In part 2, we will address in detail Janet Yellen’s risible claim that the 4.1% U-3 unemployment rate is a measure of economic success. But that can hardly be true in the face of the chart below. To wit, there are now 96 million (per below) adults not in the labor force and 102 million “not employed” counting the official “unemployed”. That compares to only 50 million persons aged 65 years or higher.

Likewise, the labor force participation rate of prime age males (25-54) has dropped sharply during the same period. As we will show in Part 2, a far better measure of “slack” labor is potential work hours of the adult population compared to actual hours worked. At upwards of 25% to 40% depending upon what is counted as employed, the latter unutilized labor resource measure amounts to a mockery of Janet Yellen’s self-congratulations.

Even short of a detailed analysis of the labor force data, it is self-evident that Yellen is simply painting by the numbers—presuming that a minimum wage job clocking 10 hours per week ($4,000 per year in gross pay with minimum or zero benefits) is the same thing as a auto factory job paying $100,000 annually with overtime and generous health and pension contributions on top.

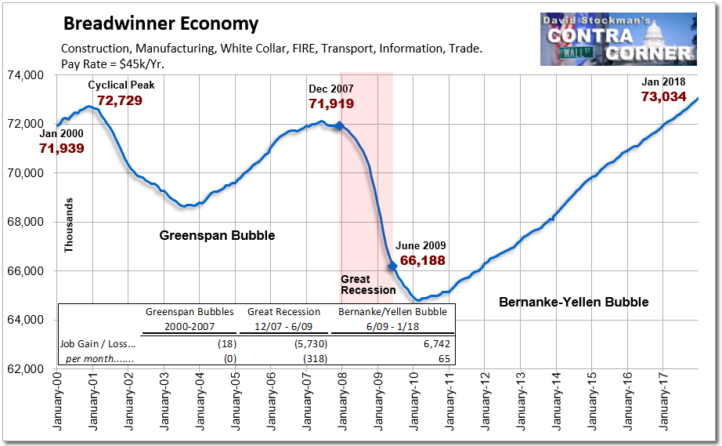

The obvious apples and oranges nature of the monthly jobs data is so transparent, in fact, that the constant recitation of it by Yellen has been proof all along that she is clueless about the condition of the actual main street economy. Apparently, she never noticed even once the chart below, which is a rough approximation of the growth trend of real full-time, full pay breadwinner jobs in the US.

In a word, after another “strong” January jobs report—-the growth rate remains tantamount to none. That is, since January 2001, the stimulus saturated US economy has generated just 305k net breadwinner jobs. That about 1500 per month for the entirety of this century!

There are 1200 TRILLION DOLLARS OWED to “NOTIONAL DERIVATIVES”. Those “Notional Derivatives” are owed to “short-sale bets” that are, in turn, predicated upon “forgerys (“robo-signing”)” and “Fraud (false witness- “Servicing Bank Employees” posing as “Lending Bank Employees”)”.

Don’t believe me? Google “1200 Trillion Dollars”. The 1200 Trillion is owed to “Notional Derivatives”. Those “Notional Derivatives” describe the “Notion” you and your family will “default” on your “Mortgage” payments.

Those “defaults” are phony- because the banks are manipulating the ability to describe those “defaults”, despite the fact the “loans” were “PAID-IN-FULL”, long before ANY “default” was EVER described by the Bank.

Newsflash: your “mortgage” has already been paid, multiple times, by multiple players; in a closed system you and the investors on your “loan” were never supposed to know about.

Don’t believe me?: Google a recent Bank of America 14 Billion Dollar Settlement, BOA paid to the investors on a group (pool) of “Loans”, that describe a phony “Trust”.

To gain the beginning of an understanding of how corrupt our financial sector has become, go see, “The Big Short”.

The movie is a good start but there is more… much more… and, likely… fabulous prizes!

Clinton’s marital infidelity opened the door to suppression of “Glass-Steagall”; suppression of “Glass-Steagall” allowed large banks to create FRAUDULENT MORTGAGES; “SubPrime Loans”, as an example.

Put simply, the Clinton impeachment was used as leverage in the ”Gramm, Leach, Bliley (3 republican senators- treason ? Anyone ?) Act”.

The GLB Act put the finishing touches on the destruction of “Glass-Steagall”, and, because that is true, it allowed the banks to manipulate the “CASH RESERVE REQUIREMENT- money, set aside, by the “Lending Bank” as a “cash reserve” each time that bank “wrote a loan”.

This meant more-and-riskier “loans” could be fabricated at a faster pace with the resulting “loan” issued in hap-hazard reliance on the rules.

For example, the bank issuing the “loan” couldn’t have cared less how solvent it was likely to remain, as an example.

It was during this time, the TBTFs began FRAUDULENTLY manipulating interest rates in their favor, Google: “THE LIBOR”.

Every single TBTF fraudulently monkeyed with interest rates, across every spectrum of bank “lending”.

NewsFlash- all foreclosures are FRAUDULENT!

The “REMIC Trusts” have zero assets.

Conversely, the Pension Plans that funded the “loans” also have zero assets. There is no “RES”, within and among those “pools” claiming those “RES” (“loans”).¬¬¬

Google: “Securitization Fail”. The “Pools of loans” (“Trusts”) were never registered as “legal entities”, hence: Fraudulent. A legal, “Non-Entity” can’t sue anybody for anything.

The TBTFs have rendered themselves “HOPELESSLY INSOLVENT”. They did it to themselves and are now lying about it.

A good example of this criminal behavior, as illustrated by “Pools of Loans”, placed in proprietary, “Bucket Trusts”, is the exposure, in France, last week, of UBS- they were concealing 24 Billion US, among 38,000, hidden, accounts (“Bucket Trusts”?).

Whether you are “PRESENTLY’, in foreclosure (stay tuned, you soon will be, if not), or not, your “loan” is a FRAUD, Google: “Lynn Szymoniak”.

Google: “HSBC Bank”, “Bank of America”, “Wells Fargo” and “Laundering Drug and Terrorist Cartel Money”.

The TBTFs are using American Mortgages to launder drug and terrorist money. Google: “Judge Gleeson”. A Patriot.

I created the petition below, before I was compelled to undergo heart surgery.

I would really like to re-invigorate it, even as I find it necessary to explain what is really going on. I also signed an Affidavit in Superior Court, explaining I destroyed thousands of mortgages and NOTES.

http://petitions.moveon.org/sign/the-wicked-which-of-the

People have to Google: “Lynn Szymoniak” and then Google, “Securitization Fail”- the banks have destroyed themselves- they are INSOLVENT.

THE ANSWER LIES IN PRESIDENT ABRAHAM LINCOLN’S “GREENBACK DOLLAR”, CREATED DURING THE CIVIL WAR.

IT STILL EXISTS AS A VIABLE, REPLACEMENT CURRENCY TO THE INTENTIONALLY- HYPER-INFLATED “US FEDERAL RESERVE NOTE”.

People that ridicule Senator Sanders will not admit that the Chinese YUAN is now sharing the role the US Dollar once enjoyed as “The International, Sovereign Currency” or “RESERVE CURRENCY”…

SO… the Communist Chinese have been allowed by the parasites in our US CENTRAL BANKING SYSTEM TO ELEVATE THEIR CURRENCY TO THE SAME STATUS ONCE CONTROLLED BY THE US DOLLAR ALONE.

Of course, these are the same, CRIMINAL -AND WHOLLY-UNAUTHORISED BY THE US CONSTITUTION- PARASITES, THAT USED A “SOCILAIST BAILOUT” (AMERICAN TAX-PAYER MONEY), TO CONCEAL THEIR CRIMES, WHILE ENJOYING THE PRIVATE, MONETARY GAINS THEY MADE ON THE TAXPAYER’S DIME, AS A PROFIT, ON THOSE CRIMES.

All of this is a direct result of Bill Clinton’s extra-marital dalliance with Monica Lewinsky and the fact he conspired, with “Gramm, Leach and Bliley” (3 republican senators ) to suppress “Glass-Steagall”.

NOW, IN THE WAKE OF THIS “TREACHERY”, “SERVICING BANKS” ARE MASQUERADING AS “LENDING BNAKS”- IT IS FRAUD.

HILLARY CLINTON IS SERVING THE BANKS REFRESHMENTS.

Sign the petition: Counterfeit Fortunes for Criminal Fraudsters and the Wicked…

Sign the petition: Counterfeit Fortunes for Criminal Fraudsters…

petitions.moveon.org

The TBTFs are INSOLVENT. Now is the time to utterly destroy them, once-and-for-all.

F&F were owned by these TBTFs during the time they put American Taxpayers on the “HOOK” for any number of their Fraudulent Behaviors (F&F, as GSEs-“Government-Sponsored-Entities”, were, and are, now, ultimately, the insurors and guarantors of this CRIMINAL BEHAVIOR).

That means: the US Taxpayer has been dragged into TBTF CRIMINAL BEHAVIOR.

Other TBTF CRIMINAL BEHAVIORS?: The TBTFs operate out of the intentionally-mislabeled, “Federal Reserve- the US Central Bank”; neither “federal”, while owned by private banks like “HSBC”, nor possessing ANY “reserves, our currency is created, as debt, out-of-thin-air, on computer screens.

The TBTFs within the criminal Cartel that claims to act for the American People also own and operate the DTC and DTCC. These two units are meant to report and regulate “THE DERIVATIVES MARKET”.

At the risk of repeating myself: there are, currently, 1200 TRILLION DOLLARS owed to international Derivatives described as “the NOTION your home will be foreclosed on”.

As such, those “Notions” have become, instead, a “SELF-FULFILLING PROPHECY”.

Did you stop breathing today? Well, our currency is created : OUT-OF-THIN-AIR. The only thing it cannot be used to FUND IS THE DESTRUCTION OF THE TBTFs, because the banks have deceived the electorate for at least 100 years while banging away at eroding our Constitution and “Bill Of Rights”.

I suggest We The People take a deep breath and then use it to demand a complete and utter repudiation of the banks and the politicians they have corrupted in an effort to STRANGLE OUR DEMOCRACY.

Senator Sanders and Abe Lincoln’s “Greenback” 2016

1.2 QUADRILLION dollars.. Wow. That’s a lot, right?

Sad thing is, if I live to my father’s age, who is now in his 90s … well, I got another 30 years to go.

FukMeDead ….I was hoping to pass into The Great Beyond unscathed. Guess I need a Plan B.

Regarding the “Good Riddance” in the title. What? Does Stockman think the next Fed Assklown will be better?

I think I heard something about michael’s claim that mortgages were indeed paid off once the lapsed. In a variation on the Big Lie theory, if you make the scam big enough, nobody will ever catch on.

Numbers like that are beyond my comprehension.

Au contaire – not a “failure”! Just another [globalist] “plant/weed” to be “tilled under”.