Guest Post by Eric Peters

New car sales are down – again – for the seventh month in a row. Which means they’ve been slipping all year long so far. The last time it was this slow was about ten years ago – which was the last time the car business fell down and almost couldn’t get back up again.

Several factors are in play – some of them undiscussed.

One, interest rates on new car loans have been inching up slowly but steadily since 2013, when they were near zero or actually were zero (free financing).

The average rate – assuming excellent credit, which many people haven’t got – is currently about 4.74 percent. It was closer to 4 percent a couple of years ago. It’s still extremely low relative to the double-digit financing that was common in the ’70s – but the average new car cost less then (you could buy a full-size American sedan like the 1970 Ford LTD for $22,700 in inflation-adjusted 2019 dollars) and people had more money available to buy them because they weren’t hemorrhaging money on things like health insurance (and medical care, which is something different) as they are today.

The average monthly cost of health insurance for a single – and healthy – individual is almost $500. Many people are paying a great deal more.

There’s less cushion in the budget now – which almost certainly explains why about half the new car loans made today are long-term (60 months or more). This is about twice as long as they were back in 1970 – when the interest rate on the average new car loan was 11.5 percent but the typical new car loan was paid off in just 36 months.

Today, it is common for people to make payments on a new car for 72 months – or even longer.

New car loans are made to seem more affordable by spreading out the payments over a longer period of time. But that doesn’t mean they are more affordable.

But it may be the hidden – or at least, undiscussed – costs of new car ownership that accounts for the wilting of new car sales, in spite of still-easy financing.

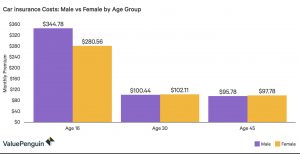

Insurance costs have been skyrocketing because of the skyrocketing repair costs of today’s cars, which can suffer thousands of dollars in damage from very low-speed fender-bender accidents – because new cars no longer have bumpers.

Instead, they have pretty but fragile body-colored plastic bumper covers (the structural parts of the car designed to absorb impact forces are behind the cosmetic parts of the car) that are easily torn or torn right off the car. Often, the whole “assembly” must be replaced after a minor accident – along with incidental (but not inexpensive plastic trim pieces, such as the grille).

Metal fender panels and hoods are made of startlingly thin metal that can literally be bent by hand. It is very easily bent beyond repair in an accident. Most new cars are unibody cars – meaning most major panels have to be cut out and new ones welded back in to effect repairs.

In the past, most cars had panels that bolted on – and were more easily – and inexpensively replaced.

Aluminum is being used in many new cars, also to save weight. But also more easily damaged – and much more costly to repair when damaged.

Air bag replacement costs are another big one – which didn’t exist at all before the mid-1990s.

Modern cars are more likely to be thrown away – totaled – after an accident because of the cost to repair them.

Thus, the average person pays about $1,500 annually to insure the average new car. Over the course of a 60 month loan, that’s $9,000 in addition to the loan. It is also equivalent to about a fourth of the price paid – and financed – for the average new car, which is just over $35,000.

In effect, the $35,000 new car actually costs $44,000.

According to the Bureau of Labor Statistics, the price of car insurance has risen 378.45 percent since 1985, with most of the increase taking place in the “modern” era of plasticized/thin-paneled and air-bag-laden cars.

It’s a hidden – but very real – cost of new car ownership that is almost certainly affecting new car sales.

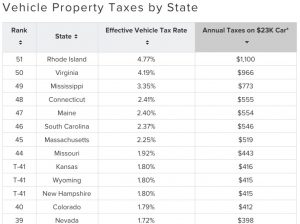

Another hidden-but-real cost of buying a new car is the property tax applied to new cars in many states. These taxes are based on the retail value of the car – and new cars have the highest value and are thus subject to the highest tax. These taxes can be as high as the cost of insurance – as much as $1,000 annually or even more, depending on the state.

Over the course of 60 months – the length of the average new car loan – the property tax on the car can add another $5,000 to the cost of owning a new car.

The $35,000 average new car is now a $49,000 car.

The total cost – including hidden costs – of buying an average new car now approximate the annual family income of the average American.

Is it any wonder people are shying away from buying new cars?

And just wait until electric cars become the only new cars you can buy. These cost 30-50 percent more than otherwise equivalent conventional (IC-powered) cars, will cost more to insure because of even higher repair costs (read up on Tesla repair costs) and are more disposable cars because of the shorter useful life (and high replacement cost) of a battery pack vs. an engine or transmission which usually never needs to be replaced over the useful life of a non-electric car.

We have bought the ticket, as the Dr. used to say.

And now it’s time to take the ride.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Still have the 92 Honda Accord and 96 Eagle Vision that were bought new.

I like the newer cars. Own two of them. But you have to be able to afford them.

However, I think we have reached ‘peak’ car. Not many more gizmos can they think of.

Unfortunately, Eric seems to think that 1965 was a nadir of automotive design – and anything else is frivolous. Air bags / 3 point belts / backup cameras are all worthwhile items. Also DRL’s, blind spot sensing, and automatic braking all help avoid accidents. Yes these cost more – but it’s really what should have been designed into cars a long time ago. It’s just the technology wasn’t there.

A late 1960’s full size car price adjusted for inflation would be $18,000 to 22.000. A mid-size car from the same era would be $14,000 to $18000. If today’s cars were like those cars at that price then many more would be sold because people could afford them. Now when you add in the air bags, backup cameras, automatic braking. and starter buttons plus all of the electronic engine/transmission controls wrapped up in a sub-compact body, then you pay what they cost today BECAUSE they have all of that garbage, and it’s ALL electrical.

-14 — Sorry to all you bitches that can’t earn enough to buy a new car.

My wife and I will NEVER buy another new car (and we have owned 4 in our 33 years together). In the past they offered value (got 26 years and 150,000 miles out of our ’86 Toyota 4×4 and anywhere from 130,000 to 198,000 out of all the others – all Toyotas), and allowed us to purchase even super-affordable bottom end vehicles ($5998 Toyota Tercel EZ with no A/C and no radio). They were simple, not too bad to repair, and didn’t come with Big Brother as an unavoidable add-on. Our past purchase was 2004 Toyota 4-Runner that we paid cash for. It has more crap on it than I would like, but WAY LESS than I am forced to pay today. A great car at a great price and our first used car (after our own starter cars in high school). Cash and used. Nothing else for us. Simply not worth it for anything else.

If you had a ’95 Buick Century and an excellent driving record then you would only be paying $58 month in car insurance.

And babes would be throwing themselves at you.

The insurance on my 84 Ford Pickup is only $330……..A Year!!!

I don’t care if Babes throw themselves at me, I’ve embraced the MGTOW philosophy of living. Enjoy your cats ladies!!!

New cars are too expensive, people can’t afford them…end of story.

Wow…..I drove a ’73 Buick Century for a long time……sure wish I had that car again

Here is why nobody is buying:

I use insurance brokers to get excellent car insurance rates.

Currently we pay in total 800 dollars a year for two cars, one car full coverage and another third party liability insurance.

Keep excellent driving records, a deductible of 1000 USD, and keep home insurance together.

Where do you live, Minot, ND?

Suburban Richmond VA.

Today’s car have are built with a very poor structure, meaning one little wreck, and it’s totaled. I know a frame bender with 35 years experience and he tells me that his job is not very good right now, for most of the wrecked unibody cars are totaled upon inspection and he only gets to work on a few body-on-frame trucks. He said he used to straighten older unit construction cars all of the time, and they were very repairable. People gloat about the safety of the new cars, but don’t realize that the poor structure is why we pay sky high auto insurance. The car doesn’t have to be designed to self destruct which happens all of the time today even in what used to be called a parking lot fender bender.

Are you kidding? They have the best crash survival. The idea is the car takes the impact – not the passengers.

People don’t die in collisions at parking lot speeds, but the cars sure do. About 2 years ago, I came upon a wreck where a new Subaru had just hit a Dodge compact coming out of a parking lot. No one was driving fast. The Dodge had a basketball size dent on the driver’s side front fender, but was drivable. The entire front end of the Subaru was shoved up to the firewall. I figured right then that was a reason of why our insurance keeps going up.

I’m not going to pay $35,000 for a new $20,000 truck, just because some incompetent fucktard incel at the car company decided every vehicle needs a standard equipment $15,000 ‘entertainment’ system that I’m never going to use and do not want.

The worst part of all of it is that these changes were NOT MARKET DRIVEN (but rather government/nanny-state driven).

boomers and gen x are the last generations who will still have the notion of driving, for the sake of driving.

the next 2 generations are being priced out of ownership, and as a result are changing their habits to avoid the concept. They are giving up the freedom of mobility for the comfort of ride share/taxi/car service.

The govt. absolutely loves this, as it means: an entire population that will no longer feel like moving to get a better job. They will instead, remain in the same place they grew up or graduated from, and not even notice the difference.

Sad but True…

the programming is so effective, I doubt there will be any issues with controlling the future non binary, gender fluid, non confrontational, professional youtubers and instagram influencers.

Mark my words, there will be college courses in the last two, in about 5 years.

I just bought a new F-250, bad ass truck.

Real world

You will never get rich making a car payment-Dave Ramsey.

I’d love to own and drive another sports car (besides my pick-up) and the price wouldn’t stop me but I’ll be damned if I’m going to pay the NYC Insurance SOBs a hundred a month more for the pleasure. The blood sucking insurance company CEOs should be drug out of those glass castles and strung up like the common horse thieves they are!

My Saturn station wagon worked well, was repairable and reasonably economical to drive. Until that last repair cost more than the residual value, it was great. And the polycarbonate side panels resisted impact, popped back out themselves until you smashed through them, and didn’t rust.

Saturn station wagons were outstanding cars! My wife drove one for about 12 years, a few minor repairs.

We gave it to a couple in a jam and many years later they were still driving it.