Update 2: – China’s central bank has confirmed that it is, indeed, on, saying that it is able to keep the yuan exchange rate at a reasonable and balanced level – whatever that means – while acknowledging that the Yuan plunging beyond 7 per dollar is due to market supply and demand, trade protectionism and expectations on additional tariffs on Chinese goods.

Meanwhile, resorting to its old, tired and worn out tricks, Dow Jones reports that the PBOC will crack down on short-term Yuan speculation, and anchor market expectations.

Which is great… if only the PBOC didn’t say exactly the same back in May, when it warned currenct traders that those “shorting the yuan will inevitably suffer from a huge loss.”

Three months later, it’s currency traders 1 – Beijing 0.

* * *

Update 1 – China is firing all the big guns tonight, because just an hour after Beijing effectively devalued the yuan, when it launched the latest currency war with the US, Bloomberg reported that the Chinese government has asked its state-owned enterprises “to suspend imports of U.S. agricultural products after President Donald Trump ratcheted up trade tensions with the Asian nation last week.”

China’s state-run agricultural firms have now stopped buying American farm goods, and are waiting to see how trade talks progress.

Translation: trade talks, even the fake kind, is now over, dead and buried, and the only question is how Trump will react.

* * *

Earlier today we had a feeling it was coming…

If CNH breaks 7, all hell will break loose as China declares start of currency war

— zerohedge (@zerohedge) August 4, 2019

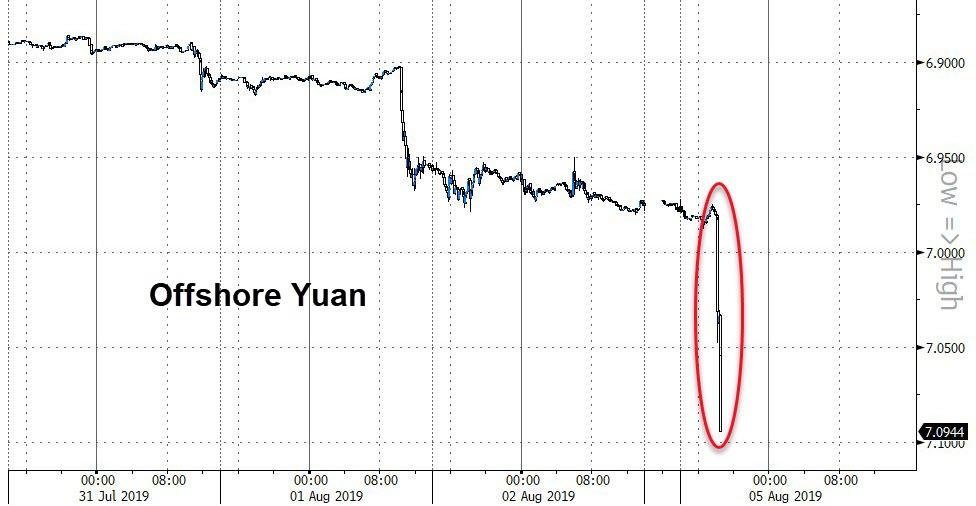

… and sure enough, just a few hours alter in a dramatically unsettling move for global stability, China’s offshore yuan just collapsed below 7/USD — after the PBOC fixed the onshore yuan below 6.90 for the first time in 2019 — the currency plunging a stunning 12 handles to its weakest on record against the dollar as countless stop losses were triggered and thousands of traders were margined out.

“A break of 7 is quite shocking to the market, and close attention will be paid to how China would deal with this move,” says Tsutomu Soma, general manager of the investment trust and fixed-income securities at SBI Securities Co. in Tokyo in a phone interview

This is the weakest offshore yuan has ever been against the dollar…

Onshore Yuan also broke below 7.00…

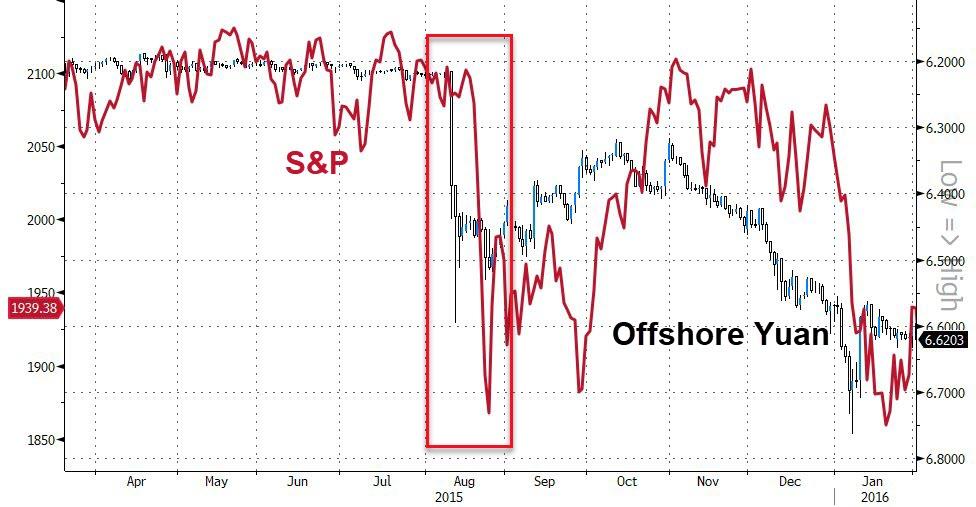

The last time China’s yuan moved with this velocity, the tremors rippled dramatically and rapidly through the rest of global financial markets.

So now what? Well, this is just the start:

“This week’s fixings will send very important signals on the PBOC’s stance,” said Tommy Xie, an economist at Oversea-Chinese Banking Corp. ”

A rate that’s stronger than 6.9 shows China’s preference for stability, but one that’s weaker will be seen as a strong hint that more drops will be allowed.”

Kyle Bass suggests the capital exodus has only just begun…

GAMETIME – CNH collapsing…HKD won’t be far behind. Mass Exodus of capital out of CNH and HKD. This collapse has just begun. #china #hk #bankingandcurrencycollapse pic.twitter.com/MQ8jpnSeQb

— ??Kyle Bass?? (@Jkylebass) August 5, 2019

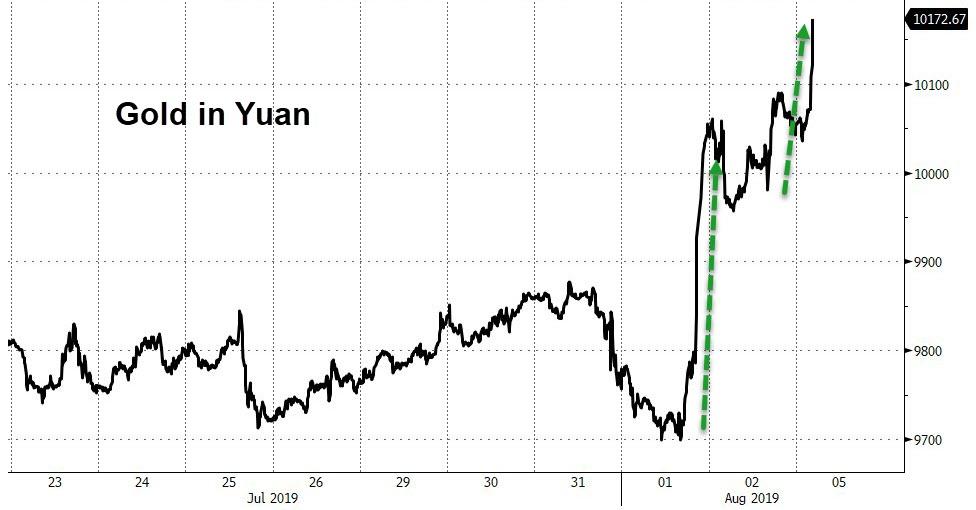

Gold in yuan is accelerating higher…

Additionally, Bitcoin is well bid…

We suspect an angry tweet from President Trump is imminent as China ‘weaponizes’ its currency.

Meanwhile, expect even more actions by China, such as this one which confirms that any pretense of politeness is now gone.

- CHINA SAID TO ASK STATE BUYERS TO HALT U.S. AGRICULTURE IMPORTS

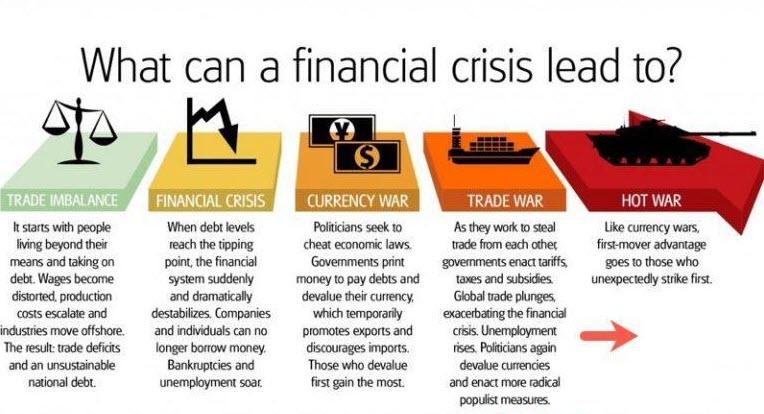

As Mick Jagger sang, a U.S.-China war is “just a shot away.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Can China which is a large land mass and thus assume could grow more food in a position to do this and not starve their people,really do not know their ag situation.I feel folks world wide getting fed up with the status quo(good band!)as shown by world wide protests ect.

Not really …. large parts of China are DESERT. And the water resources aren’t there to remediate. Coastal areas grow produce, livestock, anything you want, but inland isn’t real fertile. China has been a food importer for decades; since Communists aren’t real environmentalists, industrial pollution has ruined entire rivers and ecosheds that previously grew something.

https://www.ranker.com/list/disasters-in-china/devon-ashby

https://www.scientificamerican.com/article/chinas-three-gorges-dam-disaster/

https://www.theguardian.com/sustainable-business/rare-earth-mining-china-social-environmental-costs

I think the Emperor is about to crack down medieval style on Hong Kong. Partly because he is the “Emperor” and to show the rest of the world how bad ass they are regarding trades and tariffs and all the rest. Their economy is growing at the lowest in more than a decade, they cannot tolerate dissent domestically, and they have never had to deal with an actual businessman from Queens with a degree from the Wharton School.

Upcoming buying opportunity. Manufacturing will be moving away from China. We should be trying to move low skill mass manufacturing to Central America to help fix that shit and keep them there.

American agricultural products are x % of USA exports to China and are no longer be allowed into China. I suggest that x % of Chinese exports to USA be suspended. You pick the product class. I also suggest that any ship unloading Chinese exports into the USA be subject to enhanced Customs inspection regardless of the extended delay of their cargo.

“Enhanced Customs inspections” would be a sure way to bottle up import trade. Less than 1% of containers get checked now. It’s very labor intensive.

Exactly what I want to happen.

We buy a lot of shit from China. China buys very little shit from us. They have less leverage. The DOW is dropping because US tech companies expect to continue to charge Americans $1,000 for an i-phone that gets built by $1/hour Chinese labor. We’re not required to maintain that system.

Right? So they let the value of the Yuan drop against the dollar. They’re still taking our dollars for their “cheap” goods. We get the poison sheetrock and they get to hold our dollars while trying to keep their people from revolting on the party. Seems to me like one side of that equation is a bit less worse than the other there. Besides, all of the thieving twats on Wall Street are always running their mouths about how investors have to be in this for the “long haul”. Seems like that has always been a ploy to separate us from our savings.

The ag products ban is a hollow threat, just like their suspension of soybean contracts. They buy 1/4 of our beans. But bean yields will be 1/3 lower this year, anyways (corn will be even worse), so it doesnt matter if they refuse to buy any from us. Also, they have lost a large amount of their hogs from a viral outbreak in Asia, so they will be hurting from that, too. They have to buy those products from somewhere, unless they are going start eliminating several hundred million mouths that need fed. And whomever used to buy those products will then buy from us, assuming we have enough left over to sell. Ignore the manipulative know-nothing in the press.

lots of those ag products,esp soybeans,have been purchased by other countries & then resold to the chicoms–

as i write this rush limbaugh just said that the chicoms are mobilizing on the hong kong border,not sure if rhetorically or literally–

So, Trump puts on a say 10% tariff. China say devalues by 10%. Net result is no change to actual unit flow of goods. Chinese maintains their jobs. Wonder why they devalued?

Good question…then again, why devalue currency in the first place? Things seem to be lively in Hong Kong, dead hogs make for happy duck farmers and perhaps all is not well inside the Forbidden City/Country? …then again, how much cheap junk can one family buy?