Authored by Mike Shedlock via MishTalk,

What’s behind the ever-increasing need for emergency repos? A couple of correspondents have an eye on shadow banking.

Shadow Banking

- The shadow banking system consists of lenders, brokers, and other credit intermediaries who fall outside the realm of traditional regulated banking.

- It is generally unregulated and not subject to the same kinds of risk, liquidity, and capital restrictions as traditional banks are.

- The shadow banking system played a major role in the expansion of housing credit in the run up to the 2008 financial crisis, but has grown in size and largely escaped government oversight since then.

The above from Investopedia.

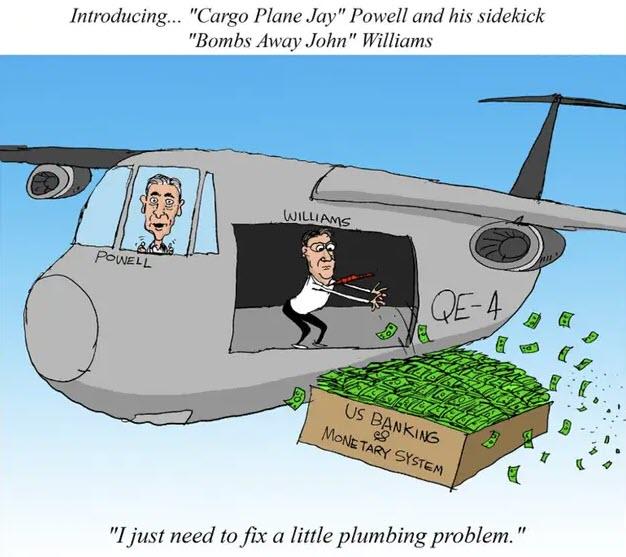

Image courtesy of my friend Chris Temple.

Hey It’s Not QE, Not Even Monetary

Yesterday, I commented Fed to Increase Emergency Repos to $120 Billion, But Hey, It’s Not Monetary.

Let’s recap before reviewing excellent comments from a couple of valued sources.

The Fed keeps increasing the size and duration of “overnight” funding. It’s now up $120 billion a day, every day, extended for weeks. That is on top of new additions.

Three Fed Statements

- Emergency repos were needed for “end-of-quarter funding“.

- Balance sheet expansion is “not QE“. Rather, it’s “organic growth“.

- This is “not monetary policy“.

Three Mish Comments

- Hmm. A quick check of my calendar says the quarter ended on September 30 and today is October 23.

- Hmm. Historically “organic” growth was about $2 to $3 billion.

- Hmm. Somehow it takes an emergency (but let’s no longer call it that), $120 billion “at least” in repetitive “overnight” repos to control interest rates, but that does not constitute “monetary policy”

I made this statement: I claim these “non-emergency”, “non-QE”, “non-monetary policy” operations suggest we may already be at the effective lower bound for the Fed’s current balance sheet holding.

Shadow Banking Suggestion by David Collum

Mish: I also think that the repo spikes suggest the shadow banking system is finally breaking. These are spasmotic movements that nobody seems to understand.

— Dave Collum (@DavidBCollum) October 24, 2019

Pater Tenebrarum at the Acting Man blog pinged me with these comments on my article, emphasis mine.

While there is too much collateral and not enough reserves to fund it, we don’t know anything about the distribution [or quality] of this collateral. It could well be that some market participants do not have sufficient high quality collateral and were told to bugger off when they tried to repo it in the private markets.

Such market participants would become unable to fund their leveraged positions in CLOs or whatever else they hold.

Mind, I’m not saying that’s the case, but the entire shadow banking system is opaque and we usually only find out what’s what when someone keels over or is forced to report a huge loss.

Reader Comments

- Axiom7: Euro banks are starving for dollar funding and if there is a hard Brexit both UK and German banks are in big trouble. I wonder if this implies that the EU will crack in negotiations knowing that a DB fail is too-big-to-bail?

- Cheesie: How do you do repos with a negative interest rate?

- Harry-Ireland: [sarcastically], Of course, it’s not QE. How can it be, it’s the greatest economy ever and there’s absolutely nobody over-leveraged and the system is as healthy as can be!

- Ian: Taking bad collateral to keep banks solvent is not QE.

In regards to point number four, I commented:

This is not TARP 2009. [The Fed is not swapping money for dodgy collateral] Someone or someones is caught in some sort of borrow-short lend-long scheme and the Fed is giving them reserves for nothing in return. Where’s the collateral?

Pater Tenebrarum partially agrees.

Yes, this is not “TARP” – the Fed is not taking shoddy collateral, only treasury and agency bonds are accepted. The primary dealers hold a huge inventory of treasuries that needs to be funded every day in order to provide them with the cash needed for day-to-day operations – they are one of the main sources of the “collateral surplus”.

Guessing Game

This massive, daily Fed intervention business appears to be getting worse & worse. What is the Fed hiding? The longer this goes on & the bigger the interventions get, the more my confidence is shaken. I expect that's true for other investors too. https://t.co/ozqdtUwuwv

— fred hickey (@htsfhickey) October 24, 2019

We are all guessing here, so I am submitting possible ideas for discussion.

Rehypothecation

I am not convinced the Fed isn’t bailing out a US major bank, foreign bank, or some other financial institution by taking rehypothecated, essentially non-existent, as collateral.

Rehypothecation is the practice by banks and brokers of using, for their own purposes, assets that have been posted as collateral by their clients.

In a typical example of rehypothecation, securities that have been posted with a prime brokerage as collateral by a hedge fund are used by the brokerage to back its own transactions and trades.

Current Primary Dealers

- Amherst Pierpont Securities LLC

- Bank of Nova Scotia, New York Agency

- BMO Capital Markets Corp.

- BNP Paribas Securities Corp.

- Barclays Capital Inc.

- Cantor Fitzgerald & Co.

- Citigroup Global Markets Inc.

- Credit Suisse AG, New York Branch

- Daiwa Capital Markets America Inc.

- Deutsche Bank Securities Inc.

- Goldman Sachs & Co. LLC

- HSBC Securities (USA) Inc.

- Jefferies LLC

- J.P. Morgan Securities LLC

- Merrill Lynch, Pierce, Fenner & Smith Incorporated

- Mizuho Securities USA LLC

- Morgan Stanley & Co. LLC

- NatWest Markets Securities Inc.

- Nomura Securities International, Inc.

- RBC Capital Markets, LLC

- Societe Generale, New York Branch

- TD Securities (USA) LLC

- UBS Securities LLC.

- Wells Fargo Securities LLC.

The above Primary Dealer List from Wikipedia as of May 6, 2019.

Anyone spot any candidates?

My gosh, how many are foreign entities?

It’s important to note those are not “shadow banking” institutions, while also noting that derivative messes within those banks would be considered “shadow banking”.

Tenebrarum Reply

In this case the problem is specifically that the primary dealers are holding huge inventories of treasuries and bank reserves are apparently not sufficient to both pre-fund the daily liquidity requirements of banks and leave them with enough leeway to lend reserves to repo market participants.

The Fed itself does not accept anything except treasuries and agency MBS in its repo operations, and only organizations authorized to access the federal funds market can participate by offering collateral in exchange for Fed liquidity (mainly the primary dealers, banks, money market funds,…).

Since most of the repo lending is overnight – i.e., is reversed within a 24 hour period (except for term repos) – I don’t think re-hypothecated securities play a big role in this.

But private repo markets are broader and have far more participants, so possibly there is a problem elsewhere that is propagating into the slice of the market the Fed is connected with. Note though, since the Treasury is borrowing like crazy and is at the same time rebuilding its deposits with the Fed (which lowers bank reserves, ceteris paribus), there is a several-pronged push underway that is making short term funding of treasury collateral more difficult at the moment.

So I’m not sure a case can really be made that there is anything going on beyond what meets the eye – which is already bad enough if you ask me.

Preparation for End of LIBOR

What about all the LIBOR-based derivatives with the end of LIBOR coming up?

The Wall Street Journal reports U.S. Companies Advised to Prepare for Multiple Benchmark Rates in Transition from Libor

Libor is a scandal-plagued benchmark that is used to set the price of trillions of dollars of loans and derivatives globally. A group of banks and regulators in 2017 settled on a replacement created by the Federal Reserve known as the secured overnight financing rate, or SOFR. Companies must move away from Libor by the end of 2021, when banks will no longer be required to publish rates used to calculate it.

“We don’t expect that 100% of the Libor-based positions today will migrate 100% to SOFR,” Jeff Vitali, a partner at Ernst & Young, said this week during a panel at an Association for Financial Professionals conference in Boston. “It is going to be a scenario where entities are going to have to prepare and be flexible and build flexibility into their systems and models and processes that can handle multiple pricing environments in the same jurisdiction.”

Repro Quake

I invite readers to consider Tenebrarum’s “Repro Quake – A Primer” but caution that it is complicated.

He informs me “a credit analyst at the largest bank in my neck of the woods sent me a mail to tell me this was by far the best article on the topic he has come across”.

Note: That was supposed to be a private comment to me. I placed it in as an endorsement.

Tenebrarum live in Europe. Here are his conclusions.

What Else is the Fed Missing?

- Contrary to similar spikes in repo rates in 2008, it was probably not fear of counterparty risk that led to the recent repo quake. What’s more, the Federal Reserve without a doubt knew that something like this was coming. We say this because even we knew it – it was not a secret. A number of analysts have warned of just such a situation for months.

- It is astonishing that the Fed somehow seemed unprepared and quite surprised by the extent of the liquidity shortage. We would submit that this fact alone is a good reason for markets to be concerned. If the Fed is not even able to properly gauge such a “technical problem” in advance, what else is there it does not know?

Effective Lower Bound

Finally, Tenebrarum commented: “I agree on your effective lower bound comment, since obviously, the ‘dearth’ of excess reserves was pushing up all overnight rates, including the FF rate.”

For discussion of why the effective lower bound of interest rates may be much higher than zero, please see In Search of the Effective Lower Bound.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

End the FED. This crap could not go on if people simply had to make their own decisions with their own real, hard, sound “money” and were the only ones who had to suffer the consequences of their own ideas and decisions. I don’t recall anywhere in history where we all signed on to let some Wizard of Oz wave wands for some and supply phony paper to others with us as the guarantors.

Most adjustable rate mortgages in the US are tied to LIBOR. Even new ones (those few being done) are LIBOR ARMs. It’ll be interesting to see how they replace LIBOR. Even a slight amount of cooking of the replacement index could mean billions of dollars. A few billion here, a few billion there and pretty soon you’re talking real money.

Whatever monkey business the Fed is hiding better not be to stabilize a foreign bank.

It is. Douchebank.

I used to visit Mishs old site. Then he went to something complicated. He lost me.

This is an example of the new web site.

Mishagosh.

Me too. I guess the punchline is we have to read the links to understand it. Didn’t Nancy say something like “we have to pass it to see what’s in it”.

I think we have more to fear in the Fiat worthiness than we do the collateral worthiness.

State Sovereignty. Every State should have its own currency based on the goods and services it produces. States with a strong currency will have the most fiscally responsible and transparent governments and would likely trade with like States. The rest….will suffer and starve via marxist progressive policies and corruption. (One can dream, eh.)

When Fed scheme Z fails, the Oligarchs will implement Fed scheme AA. The Fed Rackets will not end until the BRICS refuse their Green Toilet Paper and demand gold, Yuan, Rubles, etc; then the starving & freezing American people should refuse whatever new replacement/Reset scheme the Fed announces, and instead shoot all the Elite Traitorous MF’ers like the Romanians did Nicolae Ceaușescu and then hangs them like the Italians did Il Duce; and then create an honest government with a honest currency based on PMs etc and an honest Federal Constitutional Budget. We did it that way for 137 years (1776-1913) until the Fed was created and the Financial System became our Money Master.

“And instead shoot all the Elite Traitorous MF’ers”

Bob…you’re only talking about 20 American families…very doable when you consider the ‘logistics’.