In a world of incredulity, to suggest one chart is the “craziest” may seem a little braggadocio but we suspect after reading below, you will agree…

Something very odd is going on.

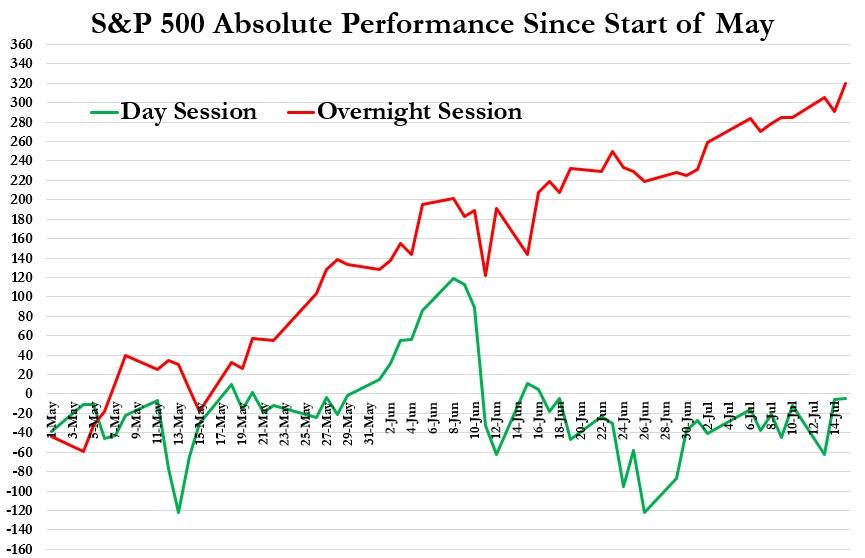

Since the beginning of May, the S&P 500 has risen 314 points – a significant surge.

However, as the chart below shows, more than all of those gains have come when the US equity market is closed.

Yes you are reading that correctly: During the US day session, the S&P has lost 5 points; and during the overnight session (from the cash close to the cash open), the S&P has gained 319 points.

Trade accordingly.

-----------------------------------------------------

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Sell at open, Buy at close?

That’s what it sounds like to me.

Shouldn’t be surprised at all if you are aware of the origins of Wall Street and who runs it. Crookeder than a proverbial barrel of snakes. Vipers actually.

Worms, nematodes and flukes would be a better descriptor, Panz.

FED after hour purchases to support (inflate) the market?

There is according to reports FIVE Trillion in cash on the sidelines. When something looks good a lot of dry powder is available.

The overnight markets are moved by Asian markets. Shanghai, Tokyo, Hong Kong, and Singapore.

https://www.marketwatch.com/investing/index/dxy

This is a site to track stocks, oil, gold, currency etc. in the overnight market. Nothing fancy, just a simple real time price check.

Thanks! That’s handy. Now I don’t have to go to CNN or MSNBC to check futures.

Interesting chart. I wonder how it looks over a longer term. Looks like the day traders are missing all the gains.

I read that the national debt will be 45 trillion by 2024. Is this correct?

Its a forecast. Forecasts are based on either a linear or parametric extrapolation of past data, usually the most recent past. Since its currently at 25T, there are an awful lot of assumptions that are going into that 45T number. Figure where we are and what we spend each year (these numbers can be googled) and judge for yourself. In the end, the debt doesnt matter because there is no paying it off, it only means one thing… the country is broke and the system is unsustainable. Prepare accordingly.

“Hove invests in the local stock market. Not for the value he sees in the companies whose stocks trade on it, but as a hedge against surging consumer prices: while annual inflation is running at 786%, the benchmark Zimbabwe Stock Exchange industrial index has risen sevenfold this year.”

https://www.gulf-times.com/story/667513/For-Zimbabwe-investors-stock-exchange-closing-is-t

Zimbabwe’s market was on a roll too!