PeakProsperity’s Adam Taggart writes that a legendary investor foresees hard times ahead…

Jim Rogers is not only one of the most successful investors of our era, he’s also an avid scholar of history.

Seeing that the world is buried under an unprecedented mountain of debt that is requiring more and more central planner intervention to keep from imploding on itself, Jim says history is clear on what happens next.

A clearing of the debt either via massive default, or destruction of the currency it’s denominated in.

He looks into the future and sees a terrible reckoning ahead; one he predicts will be “the worst economic crisis of my lifetime” — and Jim is 78 years old.

So where should investors look to preserve the purchasing power of their wealth against what’s coming?

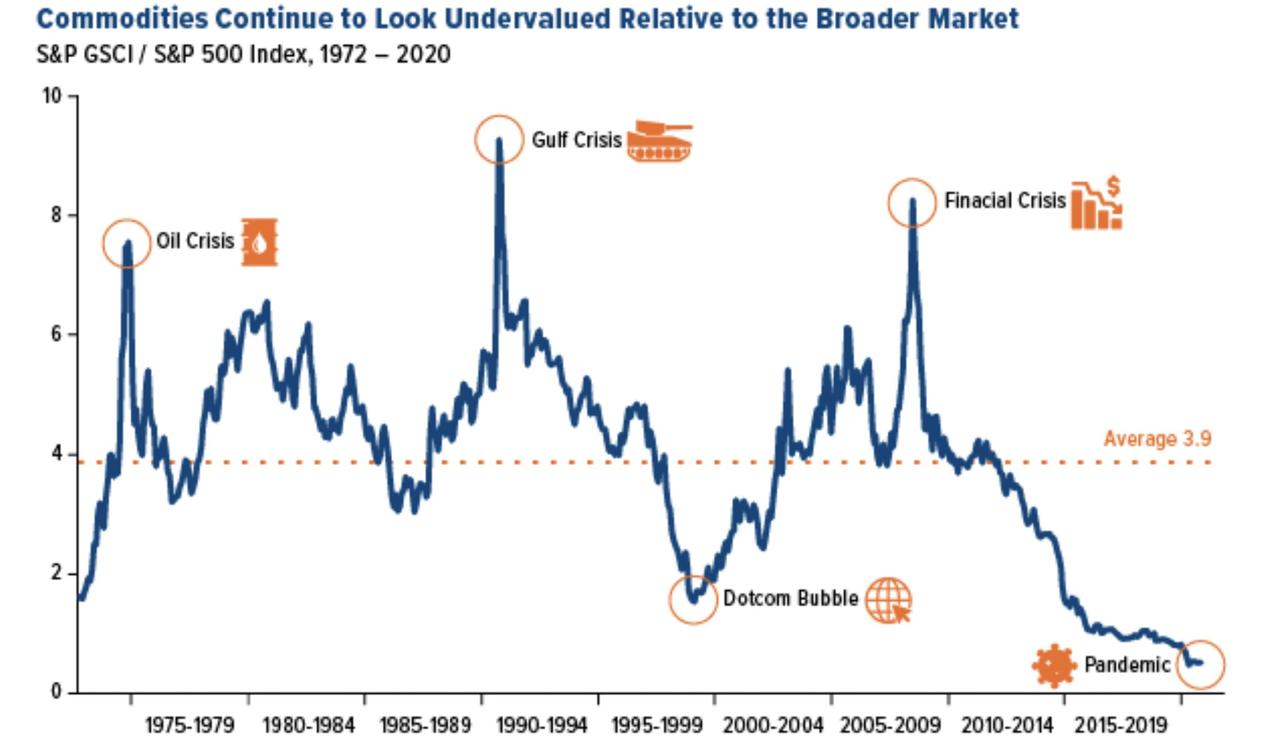

Jim highly recommends precious metals and other commodities as an important part of the solution. As an overall index, commodities are the cheapest they’ve ever been vs the general stock market in over half a century:

Like many of the previous guest experts on our program, Jim maintains the near-term environment will be one of the most challenging times to invest in our lives.

“I caution all of you, it’s been 11 years since we’ve had a serious bear market… and I would suggest to you that maybe next time when we have a serious bear market it’s going to be the worst in my lifetime,” Rogers told an international forum hosted by Russia.

Additionally, as RT reports, while the coronavirus outbreak triggered the deepest crisis in decades, “overreacting” politicians have only exacerbated the situation, Rogers said.

“This is probably the worst [crisis] that I have seen in my lifetime, because everything collapsed and you had politicians and media and everybody overreacting in my view, and everybody closed down,” he told the 12th annual ‘Russia Calling’ Investment Forum in Moscow, when asked if he sees any parallels with previous financial crises.

“We’ve had many epidemics in history, but never before did they close McDonalds, never before did they close all the airlines,” Rogers noted, adding that this overreaction has ruined many economies and the lives of many people.

Which is why now, more than ever, is the time to partner with a financial advisor who understands the risks in play, can craft an appropriate portfolio strategy for you given your needs, and apply sound risk management protection where appropriate:

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Met him once in NYC at the NC Society of NY banquet back in ’95 or’96. Jerk. We flew up from Charlotte, and my date was head of the speaker selection committee of the Chamber. He propositioned her after he spoke several months earlier, she refused.

Marengo County’s finest. But he is one smart cookie.

No way out of this. Those closed biz will never come back in time. Trump will have us 40 tillion in debt asap. Dems would have us 70T. After Trump we default if not before. Gold will be made illegal after the elite have made their deals. They wont allow the peasants to get rich. Move fast with your gold. Pay off debts or buy what you want. But it wont be allowed eventually.

If I owned any gold, I would definitely look at it as the equivalent of “dead money”; if, one day, you find that you really, really need to access your wealth stored in gold, you will not be able to.

If someone owns gold, they should think of it as an illiquid family heirloom. Silver bullion may fare somewhat better in terms of liquidity….

Prepare to duck the shit will hit the fan after tomorrow November 3 2020 regardless who wins people of Main Street America are now and will continue to be sacrificed !

Cannot run but still shoot straight . I’ll hold my high ground as long as I can buying time for those who can run and regroup !

Trump will win tomorrow and many nut jobs will lose their minds and loot and commit arson in mostly Democrat ran places. I agree tough times are ahead, created by people who want the system to fail for a reset.