By Ye Xie, Bloomberg macro commentator

Another day, another stock record. The S&P 500 soared to a fresh all-time high on Tuesday, while the yield curve steepened on optimism about more fiscal stimulus and the imminent deployment of vaccines. The seeming disconnect between financial markets and the economy is kind of surreal, considering that 11 million people remain unemployed and the virus is spiraling out of control.

The fact that U.S. policy makers are still pedal-to-the-metal with monetary stimulus stands in sharp contrast to China, where officials have set their sights on an exit from loose policy. Consider recent events:

- Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, described China’s property market as the biggest “gray rhino” – an obvious yet ignored financial risk.

- Guo also pledged to impose “special and innovative regulatory measures” on financial technology behemoths such as Jack Ma’s Ant Group. The recent regulation changes have essentially put these fin-tech companies under the similar supervision umbrella as traditional banks to avoid excessive leverage.

- Beijing has allowed a number of SOEs to default, breaking the implicit government guarantee.

- PBOC Governor Yi Gang vowed to avoid monetizing government debt. In addition, officials have said low interest rates contributed to social inequality.

Clearly, there’s a sense of urgency to address financial risks and close the gap between markets and the economy. In the meantime, the buzz in Beijing is that the financial industry should serve the real economy and people.

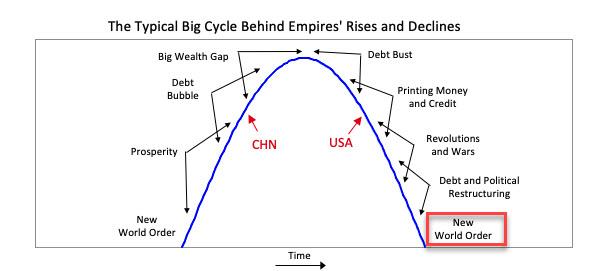

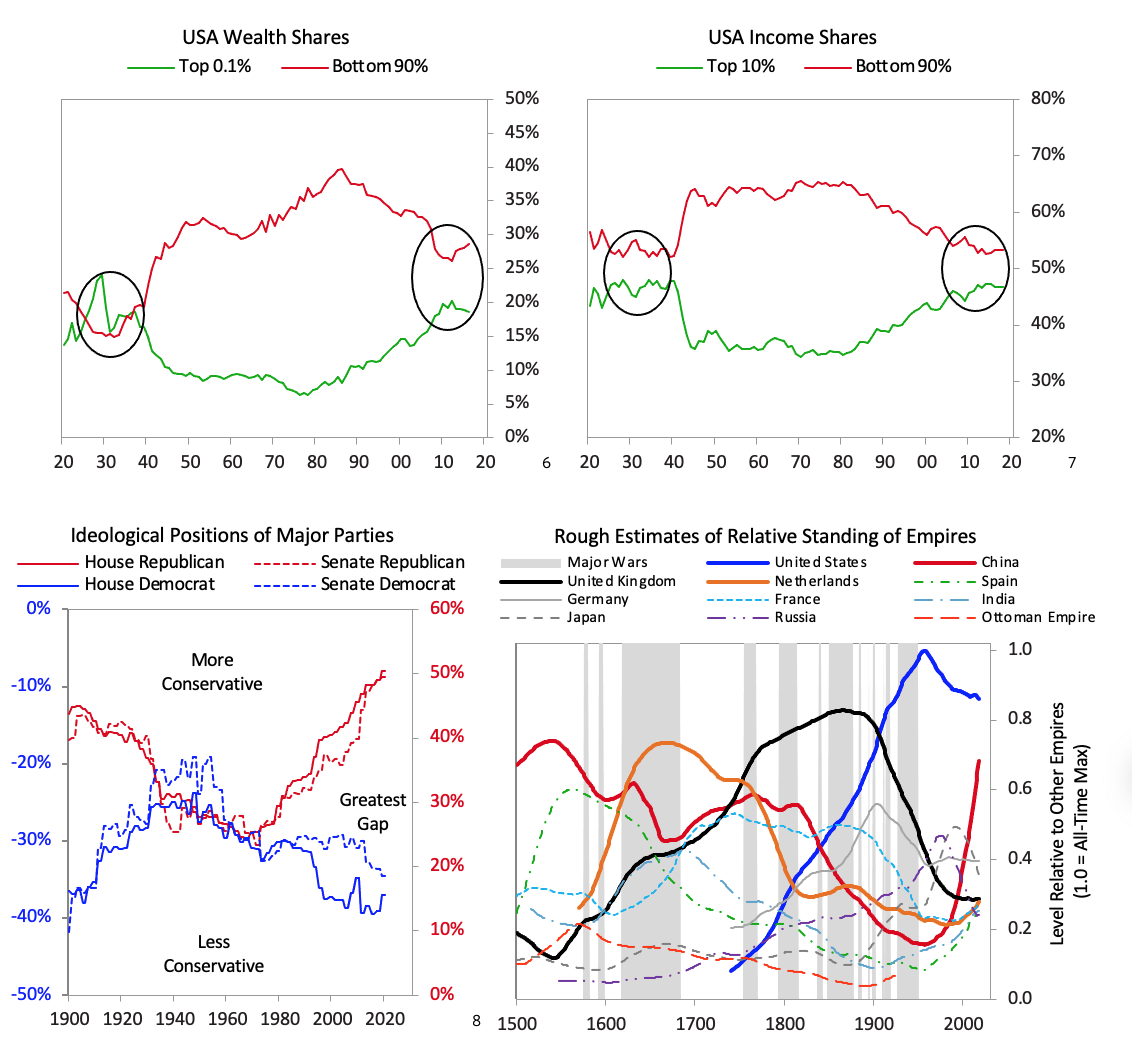

What China is doing makes perfect sense in the context of the big economic cycle described by Ray Dalio. In his latest essay published Tuesday, Bridgewater’s founder showed that China is in the midst of a debt bubble and the beginning of widening wealth gap. Apparently, China wants to tackle both before it’s too late.

In contrast, the U.S. has passed the peak of its economic power, settling into the stage of money printing after the burst of the debt bubble, according to Dalio.

“It is in this stage when there are bad financial conditions and intensifying conflict,” wrote Dalio. “Classically this stage comes after periods of great excesses in spending and debt and the widening of wealth and political gaps and before there are revolutions and civil wars. United States is at a tipping point in which it could go from manageable internal tension to revolution and/or civil war.”

That’s a dire warning. Apparently, President Xi Jinping is trying to avoid the same path.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

“…and the virus is spiraling out of control.” Oh, is it? You mean the scamdemic is spiraling out of control.

….considering that 11 million people remain unemployed and Government is spiraling out of control.

FIFY.

Just Sayin’

more than 20 million are unemployed, indicating this author is clueless

The paper dollar is worth something as a hedge currency. Where as the paper Euro is not outside of Europe.

No one buys Euro bonds outside of Europe because of negative real rates . The Europea Union is trying to shaft the citizens of Europe by canceling paper currency and devaluing outstanding bonds. They will tax the digital Euro through devaluation. Your bank account and pension will not be adjusted for inflation.

If the paper dollar is not canceled, all transactions currently using paper Euros will switch to dollars. Vist France sometime. The bakery, cheese shop, and the whole supply chain depend on under ground money.

If the Euro goes digital, its baked in the cake that an agreement has been made for the dollar to also go digital. In that case, the dollar is sold to buy the local currency at the banks around the globe. Massive devaluation of the dollar. If the opposite holds, and the paper dollar remains, the dollar will be bought . A massive appreciation of the dollar.

Its the abandonment of the paper dollar that is the choak point for revolution.

This statement isnt exactly true. The US dollar is held almost exclusively as treasuries…not direct dollars… And only because it is needed to transact in certain commodities. This forced demand for dollars is what propped it up to the euro. The euro hasnt been a purchased bond for almost 15 years since their interest rates went negative.

The primary buyer is now central banks, specifically the Fed for the US dollar. Deficit spending has spiraled out of control in all countries and is the reason there is a need for a digitized currency. The actual fact is that countries are no longer buying anyones bonds and the bond buying is done strictly by the worlds central banks through to printing of currency with no productivity attached.

The digital currency is not just desired but essential to continue the current fiat system and for the financial institutions to maintain control. With out a shift to digital their will be a hyperinflation/debasement collapse.

This has happened over and over with physical currency. The people override the system because they begin to realize productivity has value but printed money is worthless without market confidence.

A digital currency prevents market pricing and eliminates competitive markets. Money is controlled and distributed, prices set and the hope is that this will prevent hyperinflation when combined with the elimination of private property.