Authored by Charles Hugh Smith via OfTwoMinds blog,

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold.

The ideal setup for a crash is a consensus that a crash is impossible–in other words, just like the present: sure, there are carefully measured murmurings about a “correction” but nobody with anything to lose in the way of public credibility is calling for an honest-to-goodness crash, a real crash, not a wimpy, limp-wristed dip that will immediately be bought.

What I’m calling for is a rip your face off, weeping bitter tears over the grave of the speculative wealth that you thought was forever crash. All those buying the dip because the Fed will never let the market go down will be crushed like scurrying cockroaches and all those trying to rotate into the next hot sector or asset class will also be crushed like scurrying cockroaches because when the Everything Bubble pops, well, everything pops. There is no shelter in a risk-off cascade.

The crash is coming as a result of multiple mutually reinforcing dynamics, the first being that no “serious person” believes a crash is possible, much less imminent. In no particular order, here are a raft of other causally consequential triggers of a cascading market crash:

1. As I noted in my call for the top, Is Anyone Willing to Call the Top of the Everything Bubble? (September 6, 2021), there is no history to support the widespread confidence that the extremes of over-valuation, leverage, euphoria and speculation last forever, or even much longer than the lifespan of a cockroach. We’re well past that benchmark into unprecedented insanity. So what happens next: squish.

Just for the record, the Dow topped out on August 13, the S&P 500 topped out on September 2 and the Nasdaq topped out the day after my call, September 7. (Close enough for gummit work…)

2. The credibility of the Federal Reserve is in the dumpster, which just caught fire.

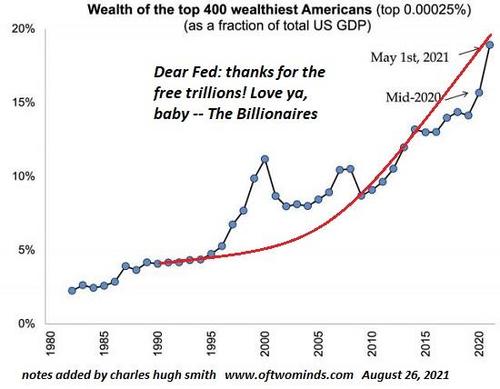

As I explained in The Fed Is Fatally Corrupt– And So Is the Rest of America’s Status Quo (September 10, 2021), the Fed is corrupt on multiple levels–thoroughly, completely corrupt, and so are all its minions, proxies, apparatchiks, toadies, apologists and lackeys.

This is finally leaking through the Fed corruption containment vessel as even the lackeys in the billionaire-owned corporate media are now fearful of losing whatever tattered shreds of credibility they still possess by refusing to acknowledge Fed corruption, over-reach and hubris. And so at long last, the Fed no longer walks on water. The Fed’s fraudulent travesty of a mockery of a sham scam has finally breached the three-foor thick containment walls and the putrid stench of Fed corruption can no longer be bottled up.

Like any good kleptocratic Politburo, the Fed cashiered the two most indefensible scapegoats to divert attention from the equally corrupt incumbents presiding over the collapse of Fed credibility.

Don’t be surprised if the scapegoats are airbrushed out of official photos, per officially approved propaganda.

3. As I detailed in The U.S. Economy In a Nutshell: When Critical Parts Are On “Indefinite Back Order,” the Machine Grinds to a Halt and Sorry, Fed, Inflation is Already Embedded, the fuel of the inflation rocket has just ignited and the clueless, corrupt Fed is watching the boost phase in abject, humiliating confusion, as the Fed is now completely powerless, having blown the opportunity to get ahead of the curve by reducing their making billionaires richer “stimulus” a year ago.

Inflation is not just embedded, it’s global.

Natural gas prices could triple in entire regions without even breathing hard, and the costs of other essentials could just as easily triple without breaking a sweat.

Inflation crushes risk-on speculative markets like, well, scurrying cockroaches.

Squish.

4. The Fed has lost control of yields. We all know that liars reveal their dishonesty via micro-signals, and with this is mind, slow down the video of Fed Politburo speakers, starting with Chairperson Powell. Wealth inequality soaring? It’s not our doing! etc.

Oops, the cat is out of the bag: the Fed has lost control of yields. Trust in the Fed’s god-like powers is wavering, as punters and players realize the Fed’s shuck-and-jive has finally lost its power to wow the greedy and the credulous.

Rising yields crush risk-on speculative markets like, well, scurrying cockroaches.

Squish.

5. China is not “saving the world” this time.

As I explained in What’s Really Going On in China (September 23, 2021), China has other fish to fry and it isn’t bailing out global markets as it did in previous bubble pops. Squish.

6. The rising US dollar is Kryptonite to speculative markets, emerging market debt and risk-on euphoria.

Sorry about that, but you know what happens next: Squish.

7. The retail bagholders are now all-in. As I noted in Please Don’t Pop Our Precious Bubble! (September 8, 2021), the retail punters have finally gone all-in on the “this bubble will never pop” Everything Bubble. As I observed in August, The Smart Money Has Already Sold (August 18, 2021) as the retail bagholders have poured more cash into the Everything Bubble than they did in the past decade or two.

This is of course the most reliable signal that a bubble is about to pop.

Sorry about that: squish.

8. The buy the dip crowd has been so well-trained that they will provide the necessary buying to keep the cascade from gathering too much momentum. A stairstep down that sucks in buy the dip buyers is ideal for those profiting from the decline. First up: a rally to close the quarter positively to make it appear that every money manager beat the index funds. And so on.

But the net result is still: squish.

Consequences can be put off for quite some time, but the rot beneath the machinations only amplifies the eventual collapse.

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

The greatest crash in the history of the world is finally ready to blow?

Strike one: the dot com bubble-1990s

Strike two: the housing market bubble-2008

Strike three: the EVERYTHING bubble

The only good point of this is, we get to see history in the making…….and how the cities burned…..

I lived in Houston TX during the 80’s, oil dropped to $12 and by ’85’ we had the Savings and Loans (S&L) crisis. It was the biggest economic hit and drain on the FED since the great depression, but only affected a few states. (that was then dwarfed by the Credit bubble). Whole neighborhoods were empty, people walked away from their homes bankrupt, business failed, people lived under bridges to have access to water. It was a depression, but local.

As a young, single man, those consequences stayed with me ever since. I am now debt free, have some money in the stock market but most is out and protected, but not earning much. I sleep at night prepared for the next big one. So far I have been wrong, but it will happen. Certainly, No One knows when.

My plan as well Craw. You can find me on the sidelines cowering in fear.

Good article, but it seems to me I’ve been reading much the same case for a crash for a good 10 years now. The most horrific financial crash of all time is supposedly imminent every autumn. Why can’t the central banks keep printing trillions to keep the charade going indefinitely? It’s worked since 2008. What makes 2021 different?

2021 is different because largely all of those articles you read fell on deaf ears.

Inflation. You will start paying $50.00 for a quart of milk. That will be identical to a crash.

So long as the Fed’s PPT is around the markets won’t crash…unless that’s what they want to happen. There is no real market, there is a Potemkin market and it is all the Federal Reserve.

This Act (the Federal Reserve Act, Dec. 23rd 1913) establishes the most gigantic trust on earth. When the President signs this bill, the invisible government by the Monetary Power will be legalized. The people may not know it immediately, but the day of reckoning is only a few years removed. The trusts will soon realize that they have gone too far even for their own good. The people must make a declaration of independence to relieve themselves from the Monetary Power. This they will be able to do by taking control of Congress. Wall Streeters could not cheat us if you Senators and Representatives did not make a humbug of Congress… The greatest crime of Congress is its currency system. The worst legislative crime of the ages is perpetrated by this banking bill. The caucus and the party bosses have again operated and prevented the people from getting the benefit of their own government.”

~ Charles A. Lindbergh, Sr.

Hang on Martha, not only is it going to blow but the borders have collapsed and guess who is coming to dinner….

I like CHS but I believe he missed with this one. The business channels are the only mainstream news I watch or listen to. Everyone is cautious. I’ve been posting on here that at the beginning of Sept all the perma-bulls started to get cautious with their recommendations.

Just yesterday one explained that sentiment has turned negative and most are positioning for a major pullback. But, in his opinion that is why it wouldn’t happen and he was starting to nibble on the dips..

My own speculation is that if we make it through Oct we are probably good until after 2022 election. Reality is that it has been so long since we’ve had honest-to-goodness inflation no one has experience with it. Traders and money managers from the Carter years are long gone and the current crop has only known bull markets and brief pullbacks.

If the old saying that history rhymes has any validity, keep your wits about you in October.

One of these Nostradamuses has to be right someday.

We hear this all the time…. i.e.

“As I observed in August, The Smart Money Has Already Sold (August 18, 2021) as the retail bag-holders have poured more cash into the Everything Bubble”

If the Smart Money has already sold and the Smart Money owns 80-90% of the market then retail investors now own 100% of the market. Doesn’t add up.

The Smart Money (the owners of the world) may have made hedges but they are certainly not out.

I’m out, hey I’m the smart money.

Everybody gets scalped in a crash, especially the Smart Money who own most everything in every asset class.

Greetings,

The people making these predictions are mostly Macro Guys.

Here are two ways to think about it: Let’s say I have a power supply that I built to run a very complex machine that can not ever be turned off. With me so far? OK, let us go further and say that I was smart enough to put a temperature sensor on my voltage regulators so I could always measure and chart the health of these voltage regulators. Easy stuff, right? OK, if I see that the temperature of all of my regulators going parabolic (hockey stick) then I know that a fundamental catastrophic failure has occurred.

Once I see such a thing occurring, I know that the power supply and the machine it runs are doomed but because of tolerances (elasticity), I can’t quite predict when it will occur. After all, I can try to do some “artificial” fixes like putting the power supply in a very cold room and have fans blowing on the supply 24/7. Such a “fix” might give me enough elasticity to keep it all running but at great cost as I now need a very cold room and fans.

Now, instead of a supply that can never be turned off, I also have to have fans that never fail and a room that is always cold. I added an incredible amount of complexity in order to gain some elasticity. Now, instead of just the supply, I have other items that can never fail.

See where I’m going with this?

Two: Historians mostly agree that Rome ceased being an Empire in 476AD. People alive and going about their business in 476AD wouldn’t have known this. Some would have continued living out their lives as proud Roman citizens. After all, the Empire spent several hundred years circling ’round the toilet bowl and the events of 476AD wouldn’t have been at all out of place for a 5th Century Roman.

It is only when looked at in the Macro that we realize that 476AD was the year when the fans shut down and the room turned warm.

Guys like Kunstler, Smith, Schiff, etc are just pointing out that the system is in terminal decline and is being artificially kept alive through very complex means that are, themselves, failing. Like with Rome, our system may have already collapsed but we just do not know it yet.

I can’t really understand all the technobabble… so poor I can’t afford to pay attention, mostly.

I think I read that someone in the Bible used a stone for a pillow at least once. So I can understand this penchant for gold and silver, much more shiny and lustrous than a stone.

All smarminess (is that even a word?) Aside, Though it may at some point ‘worthless’… Will HARD CASH be a viable means of exchange until we are reduced to bartering food for water? *

* ‘value’ determined by local available supply? I don’t think we have to worry about the Weimar Republic, this is transitory.

I incorrectly assumed they’d pull the plug with Trump in office. This is assuming Trump is not one of them. They didn’t. (That’s a tell right there.) What would be the reason to pop the bubble with their guy in office?

Nobody’s doing the “popping”. The bubble already popped in early 2020 but was immediately “duct taped” with “quantitative easing”.

The bubble pops when the Fed runs out of duct tape.

https://www.statista.com/statistics/1121416/quantitative-easing-fed-balance-sheet-coronavirus/

Does the Fed ever run out of duct tape? Honest question. Deficit to 100 trillion. 1,000 trillion? If they keep pumping money into the system and people (somehow) remain comfortable, this could go on for a long time, no?

I have no idea. Boggles my mind. If I could print my own $100 bills I’d do it and keep on doing it. What reason would I have to stop? I can buy anything I want! Forever.

It’s just an illusion I know, but if the illusion is maintained the illusion will continue. Crazy…

OH NO!!! SOMETHING BIG IS COMING!!! BE WORRY BOIZ!!!

…After a while…

Same old, same old… Except a lot of fliers being squatted and a bunch of fat pigs got a lot fatter.