Dr. J Michael Burry of “The Big Short” fame went on a massive Twitter rant Tuesday, where he posted a series of tweets – including a fact check on Ivermectin, who’s actually paying their ‘fair share’ of taxes, ow many genders exist, and a defense of former President Donald J. Trump.

On taxes, Burry – who has since locked his account – tweeted “Top 1%, 20.9% of income, 40.1% of taxes. Bottom 90% paid just 28.6% of taxes. Top 1% tax rate is 7X HIGHER than rate paid by the bottom 50%. Biden tells rich to “pay like everybody else does.” So, a tax cut for the rich? Or class warfare built on lies.”

Burry – the head of Scion Asset Management who rose to prominence after making a mega-successful bet against mortgages into the 2008 financial crisis, linked to this article from taxfoundation.org. His tweet comes as Congressional Democrats debate a $3.5 trillion social spending bill that hinges on taxing the wealthy.

On Trump, Burry noted that the former president “NEVER said to inject bleach,” adding “If you did, again, you fail Darwinism. If you still believe it, you did not read his comments, or you cannot read his comments, or you cannot hear his comments, or you just blindly follow people on the internet #TDS”

He then set the record straight on the oft-repeated lie that Trump called white supremacists neo-nazis “fine people” following the Charlottesville protest (and receipts).

Burry notes that Trump “DID suggest internal UV light was an interesting therapeutic approach” and was “Pilloried for it.”

“Turns out it is a valid approach that holds promise. Social media still jokes about this. That is how toxic the left is to COVID progress.”

On Ivermectin, Burry noted that it’s “a drug that works well in humans and other mammals,” adding “Ignorance reigns supreme in the media and on social media regarding this drug. Used in humans since the 70s, wide experience, safe, Period.” (And of course, receipts).

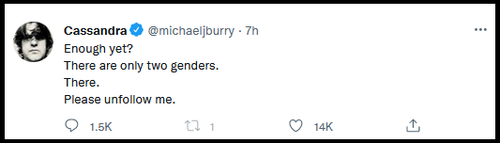

On Gender:

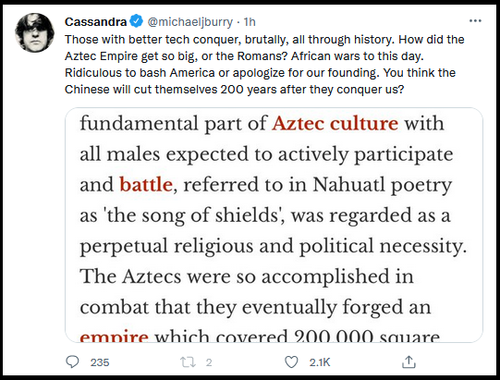

On self-hating Americans who trash the nation’s history, Burry wrote “Those with better tech conquer, brutally, all through history. How did the Aztek empire get so big, or the Romans? African wars to this day. Ridiculous to bash America or apologize for our founding. You think the Chinese will cut themselves 200 years after they conquer us?”

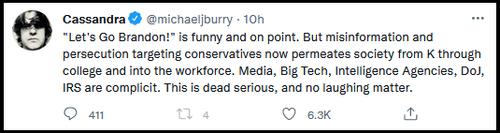

On the state of ‘persecution targeting conservatives’ – Burry says that it “permeates society from K through college and into the workforce,” adding “Media, Big Tech, Intelligence Agencies, DoJ, IRS are complicit. This is dead serious, and no laughing matter.”

Before making hundreds of millions as an investory, Burry was originally a doctor – earning his MD at the Vanderbilt University School of Medicine.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

His “cancelling” is in the works. Too much truth in what he says and points out.

Time for us folks who still love America to take up the gauntlet thrown down by the Marxists. Use their tactics to defeat them.

Thank you, Mr. Burry, for your courage in slamming all the lies perpetrated by the idiots in the MSM, government and, sadly, medicine.

He can’t be cancelled. His Big Short netted him over $1 billion.

Exactly. We need people with “Fuck You” money to start actually saying “Fuck you.”

Who’s running a big short right now? There must be one somewhere.

Burry has a huge short on Tesla, but it’s been a losing bet so far. But so was his last Big Short, until it wasn’t.

Tesla wouldn’t exist without government tax/other subsidies. Just like Bezos, Musk knows how to milk the system.

In addition, Tesla has made millions selling zero-emission vehicle credits. As John Lippert of Bloomberg Business pointed out in March:

“Since its founding in 2003, the company, which went public in 2010, has earned a profit in just one three-month period. In 2014, it lost $294 million on $3.2 billion in revenue…Some $217 million of that revenue came from the sale to its competitors of zero-emission-vehicle, or ZEV, credits and other pollution allowances.”

In addition, Tesla has made millions selling zero-emission vehicle credits.”

“Tesla cars don’t use gasoline, so why does Tesla care about RFS? Because stricter standards force more costs onto other mainstream car manufacturers, which drives up the price of those cars, and arguably makes gasoline more costly, making Tesla’s all-electric car look better by comparison.

So when you see a Tesla on the road feel free to embrace that sense of pride in ownership, because even if you don’t own the title, you helped pay for it.”

Tesla is a private company. It does what it wants.

Subsidy Summary Subsidy Value Number of Awards

State/Local $2,166,519,089 28

Federal (grants and allocated tax credits) $339,597,164 82

TOTAL $2,506,116,253 110

Federal loans, loan guarantees and bailout assistance (not including repayments) $466,500,000 2

TOTAL $466,500,000

https://subsidytracker.goodjobsfirst.org/prog.php?parent=tesla-inc

Tesla is a joke… Chip

Tesla made starfcker a millionaire!

😁

Agree with much that he said, but the part about taxes is completely disingenuous. It’s not about “income” or “income” taxes. It’s about all taxes and wealth.

Our tax system is regressive in the extreme. Sales Tax, Gas Tax, Social Security Tax are just 3 examples of exceedingly regressive taxes. The regressive nature of Sales and Gas Taxes are obvious, but the Social Security Tax is much worse. Mookie Betts makes $30 million a year but pays Social Security Tax on only the first $142,800 of that $30 million. The other $29,857,200 is tax free! How nice for Mookie. And we claim that the Social Security Trust Fund is going broke! Ridiculous.

With regards to “income,” Warren Buffet has a Net Worth of $100 Billion, but has an “income” of $100,000 salary per year. Being the hypocrite that he is, he constantly complains (brags) that his secretary pays more tax than him. The ONLY way to address this is through a Wealth Tax, but if you mention that to Ole Uncle Warren, stand back, because he is going to blow his top!

The Capital Gains Tax Rate is 15% vs Income Tax Rate of 37%. Huge benefit to the rich and only the rich. The Carried Interest Loophole allows Wall Streeters to pay the Capital Gains Rate instead of the Income Tax Rate on their income. Why? Campaign Contributions.

And don’t even get me started on tax deductible contributions! Suffice to say that it seems like the entire tax system exists to benefit the rich. Imagine that!

“And don’t even get me started on tax deductible contributions! Suffice to say that it seems like the entire tax system exists to benefit the rich. Imagine that!”

Sweet Jesus…you idiot. Wealth tax? So you think Capitol gains taxes are ok? Taxing profits is ok? Taxing that which has already been taxed many times over is ok too? You are a blistering idiot who has swallowed the socialist bullshit hook line and sinker. Taxes and more taxes, tax the rich, tax the poor tax the rich til there are no rich no more.

I am vehemently anti-tax and anyone who honestly believes ALL those taxes are good or going to something good need to WAKE UP AND PULL THEIR HEAD OUT OF THEIR ASS.

How many billions were left in Afghanistan? Your tax dollars hard at work helping the Taliban become all they can be….yeah, but keep quibbling how those ‘rich’ have loopholes and please, keep on dutifully paying your taxes to support a corrupt and evil regime…Biden thanks you.

Afghanistan? WTF are you talking about? You are a complete goofball. Taxes are a reality in any organized society. They have always existed and they always will. The only question is how the taxes are administered.

My obvious point, since you are too dim to figure it out for yourself, is that the current tax system is set up by the rich to favor the rich. It is unfair to those of moderate or middle class income.

God, there are a few real dipshits on here!

Calm down. Read some history. The problem is not that some don’t pay enough tax, but that government arrogates to itself so much power. Giving a totalitarian government more money will not improve matters.

It is not by chance that vast fortunes are made under such governments.

What is really needed is honesty and integrity in all aspects of life, which would impose natural limits on power to the benefit of all.

I can see that I am beating dead horse here, so I will give this one last try.

Try to focus. I am talking about our tax system and ONLY our tax system. Not Afghanistan. Not Biden. Not government power. Not “honesty and integrity in all aspects of life.” Who is against that, by the way? Not government spending. Taxes. Only Taxes.

Our tax system is grossly unfair and inequitable. If you can’t see that, then you are a complete and utter dunce. I have pointed out numerous clear examples of how it is unfair and inequitable. The unfairness of the tax system is one of the most important ways that the wealthy and powerful gain and increase their wealth and then use their wealth to gain power over society (that’s you).

If you don’t care about the tax system, I can assure you that the people running our society DO care about it and they will continue to exploit it to control you and to enrich themselves at your expense.

“Inequality.” Connected billionaires are happy to bury unconnected billionaires, along with unconnected billions. Burry might be insulated from “cancellation” per se, but he’ll almost certainly never successfully short Buffett et al. Like Barnes, in Platoon, only Buffett et al can kill Buffett et al. With a little help from Charlie Sheen, who went on to embody the dienamic.

The silvery moon Hunt bros…..

Dr. Burry has a fuzzy math calculator that only shows dollars pain in taxes not based solely on a percentage of income !

The majority of wealthy earn income from capital gains while average middle income earners derive income from actual work performed !

Average earners pay about 28% of income in direct taxation while not certain but at one time capital gains tax was 15% !

Obviously taxes on several million at 15% is more paid in total dollars BUT 28% on under $100k is a bigger tax bite per dollar earned !

Equal treatment & protection under the law !

That is where the fair share argument has real world foundation backed by real dollar figures !

No the investor class Big Club do not pay a true equal fair share !

After all, if we don’t pay our fair share the government will have to print more currency to pay for the thousands of murders they commit in Afghanistan, Syria, Iraq, Yemen, Ukraine, Libya, etc. That’s why we pay taxes: for the greater good.

Hey big A aren’t the printing presses and computer currency running out of control regardless !

Smart wealthy people don’t own much on paper and pay little taxes.

How many trillions in corporate welfare does the bottom 50% get? Hard work and sacrifice , bruh . It’s how the free market works.

Major Industry: aerospace and military contracting

Subsidy Total: $26,887,392,917

Major Industry: financial services

Subsidy Total: $11,745,401,693

Major Industry: airlines

Subsidy Total: $2,892,552,260

Major Industry: entertainment

Subsidy Total: $2,620,935,978

Major Industry: information technology

Subsidy Total: $6,219,081,949

Major Industry: pharmaceuticals

Subsidy Total: $3,470,578,466

https://www.goodjobsfirst.org/subsidy-tracker

All you billionaires depositing S600.00 OR MORE into you bank accounts , better beware. The IRS is coming for you.

Tucker Carlson had an enormously epic rant against Dictator Dementia yesterday.

Worth watching … it’s on whatfinger.com and Jootube.

Meh.

Burry clearly doesn’t understand the concept of “disposable income”.