The average American needs their retirement savings to last them 14 to 17 years. With this in mind, Visual Capitalist’s Carmen Ang asks (and answers below), is $1 million in savings enough for the average retiree?

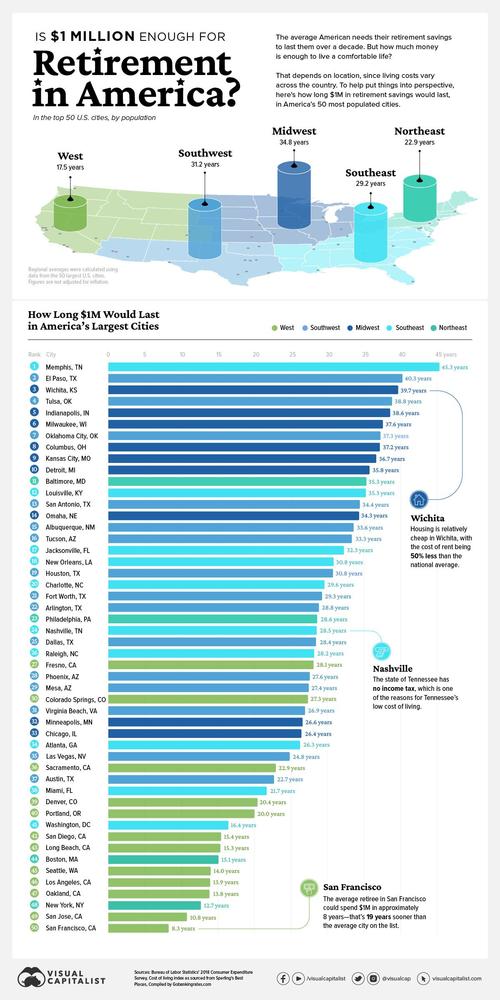

Ultimately, it depends on where you live, since the average cost of living varies across the country. This graphic, using data compiled by GOBankingRates.com shows how many years $1 million in retirement savings lasts in the top 50 most populated U.S. cities.

Editor’s note: As one user rightly pointed out, this analysis doesn’t take into account interest earned on the $1 million. With that in consideration, the above calculations could be seen as very conservative figures.

How Long $1 Million Would Last in 50 Cities

To compile this data, GOBankingRates calculated the average expenditures of people aged 65 or older in each city, using data from the Bureau of Labor Statistics and cost-of-living indices from Sperling’s Best Places.

That figure was then reduced to account for average Social Security income. Then, GOBankingRates divided the one million by each city’s final figure to calculate how many years $1 million would last in each place.

Perhaps unsurprisingly, San Francisco, California came in as the most expensive city on the list. $1 million in retirement savings lasts approximately eight years in San Francisco, which is about half the time that the typical American needs their retirement funds to last.

A big factor in San Francisco’s high cost of living is its housing costs. According to Sperlings Best Places, housing in San Francisco is almost 6x more expensive than the national average and 3.6x more expensive than in the overall state of California.

Four of the top five most expensive cities on the list are in California, with New York City being the only outlier. NYC is the third most expensive city on the ranking, with $1 million expected to last a retiree about 12.7 years.

On the other end of the spectrum, $1 million in retirement would last 45.3 years in Memphis, Tennessee. That’s about 37 years longer than it would last in San Francisco. In Memphis, housing costs are about 2.7x lower than the national average, with other expenses like groceries, health, and utilities well below the national average as well.

Retirement, Who?

Regardless of where you live, it’s helpful to start planning for retirement sooner rather than later. But according to a recent survey, only 41% of women and 58% of men are actively saving for retirement.

However, for some, COVID-19 has been the financial wake-up call they needed to start planning for the future. In fact, in the same survey, 70% of respondents claimed the pandemic has “caused them to pay more attention to their long-term finances.”

This is good news, considering that people are living longer than they used to, meaning their funds need to last longer in general (or people need to retire later in life). Although, as the data in this graphic suggests, where you live will greatly influence how much you actually need.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

This all assumes there actually will be a retirement there for us. I am 37 and have a good chunk in a 401(k) that has been increasing as fast as the value of the dollar has been decreasing. I have been tempted to withdrawal a big chunk and pay my mortgage off, which is my only real debt. I have been planning for my retirement and it doesn’t entail sitting on my ass expecting to rely on a 401(k) and SS. Setting up a little business and will work till I die. Also will be 100% homesteading by the time I retire, whether that is in 15 years or tomorrow.

Think of this. A good portion of that 401k could be gone very quickly . I saw this happen to people In 2009. You’re young so could possibly ‘make it back’…

There’s more, but that’s a big one.

Slo Joe got your account number and he’s lickin’ his chops to clean you out! Beware Slo Joe!

Your 401k will be taxed, so wipe out 1/3 of what you think you have, maybe much more 22 years from now when you can access that $ without penalties.

Remember 18 months ago when the markets tanked 30% in a month? By Thanksgiving you could be 30% poorer- it’s possible. Markets are still near all time highs. Will it continue? Who knows?

Being debt-free may make it worthwhile to cash out or take a loan against the 401k. Depends on where you live, how long you want to work. Could you pay back the 401k loan fairly easily? Also- how insane is your state’s government is regarding taxation?

Best of luck to you.

Thats the dilemma. I am a man of numbers, so losing 30% is a big hit. I should have used the Covid 401(k) hardship withdrawl when they offered it. Would have only paid the taxes on it with no penalties. I calculated the amount of interest that would be paid over the life of the remaining mortgage was more than the taxes.

Never look at 30% down as a big hit. Hold a sizable portion of that 401k in cash or equivalent. When the periodic crashes come you buy. Buy low-sell high is how it works. Normally I am 10% cash but right now I’m 25% and waiting because this market is smoke & mirrors.

I ran a spreadsheet from 1972 to present a few years ago. Plenty of crashes in there. From memory, no 3 year period had a negative return on a S&P Total Return Fund. Most years were 10% or higher.

I use mutual funds with solid records of beating the S&P. Put your $ into a Roth 401k and the growth is tax free. If you don’t have it in Roth transfer it at the next market crash and you will pay less in taxes to roll it.

Crashes and pullbacks are normal. See them as opportunity instead of fearing them and you will do well. Or, put your $ under the pillow, lose 5% per year in inflation, and be scared.

My husband “borrowed” the money from his 401K to buy the land here in the Missouri Ozarks while still working in Oklahoma. I cashed out with a big penalty to pay for the log home in 2011.

The oak log and kit for this home would cost over $250K now and I cannot imagine what the construction costs would be. I remember it cost $1500 to rent the equipment to lift and move the logs from the trucks to the pallets beside our barn and it took five of Omer’s sons to put the indoor finished wood inside the barn. That was in 2013.

Omer and sons constructed our log home (dried in, unfinished inside… my Nick did that himself) for $45K. They underbid my other two bidders by almost $20K because they would not have to charge for their living expenses. They didn’t mind living in the “treehouse.”

I had the privilege of seeing the entire build as the “on-site” general contractor and errand girl.

This is me in the summer of 2013 after I learned that the plumbing lines had to go under the basement floor. I found a retired plumber out of St. Louis who helped me lay the lines during a heat wave so the basement floor could be poured on time. I actually helped them dig the trenches and filmed him putting in the lines… just in case we ever have to find them again.

We won’t. He really was a professional plumber and knew what he was doing. This home and our barn are well-plumbed for the apocalypse.

I’m pointing at the toilet in the basement. My husband didn’t know I was putting a bathroom in the basement until I did it. Now, he is grateful I did so. But, digging those lines to drain a shower (not installed but plumbed) was a hard job for an old retired plumber, his grandson and me. We took ten minute shifts then ten minute breaks in the shade.

He charged me $1500 to plumb the barn, the basement and give me plans for the lines inside the home. He later charged Nick $150 for a lesson in laying pipe and told Nick that he would plumb the house for 5 grand if Nick decided he couldn’t do it.

There was no way Nick couldn’t do it just like there was no way I couldn’t help dig those lines.

I was so sunburned after doing that… and sore! EGAD!

But the crime in Memphis might take your life far sooner. Quality of life is also important.

Not quite to that mark. But I’m so tired of dealing with the job. I’ve noticed the last 20 months that the system is broken. Those following in behind are approaching a level of sheer incompetence thus making my job more stressful. Not to mention being acquired by a total crap large corporation that has been cutting our pay. So trying to reimagine what I can do at 60

I’m in the exact same boat… our firm was acquired by a total large crap corporation in 2015 and 6 years later it is sheer administrative overreach and dysfunction. I’m trying to reimagine what I can do just shy of 58.

Good news: I’m well past that mark and with a paid off house on top of it, but my $2M+ gross worth is denominated in northern pesos (Canuckistan) and pre-capital gains. Cost of living here is double American average. I really can’t afford to retire yet but just don’t know how much further I can hold out.

And now vaccine mandates. Makes me ill.

Hate to say this, 58 yo, work for a corporation that purchased your company six years ago. Better have a plan for getting laid off. You are now a target, not an employee. Just saying, better have a plan B and be mentally prepared for a lay off.

Russell Brand did a video yesterday about Americans quitting. It didn’t seem to have any deep insight, but it is interesting how many people are just saying “fuck it” – and a lot of them probably don’t have a ton of savings.

My next career is going to be movie star. I can accidentally shoot an assistant director as well as the next guy, and I’d do it for a measly $1/2 million upfront and 10% of the gate.

The figures don’t account for interest earned on the 1 million…

I don’t have 1 million, but I have 35k in a savings account for the last three years, and I have not yet received a sawbuck for total interest.

I’m guessing the interest on a million will get you another week or two.