Guest Post by Chris MacIntosh

At a macro level it is worth understanding that for US hegemony to continue to exist it has relied on a level of global order – legal, political, and always backed up with the military.

The Mackinder Doctrine

The Mackinder doctrine essentially states that “who rules the World-Island -mainly the area ruled by Russia- commands the world”.

In order to retain this global power the US has been fueling both sides of proxy wars for decades, but these countries which have been subjugated have been relatively inconsequential in terms of global trade, like Afghanistan, Somalia, Iraq, etc. and certainly inconsequential in terms of military power.

But this has now all changed. The issue now is that the US is fighting multiple proxy wars on a much grander scale. This means that the cost of maintaining influence among all existing vassal states rises, and as this rises, the countries on that periphery (because they’re typically most heavily impacted) seek alternatives.

This is what we’re seeing with the BRICS becoming more and more emboldened. It is what we have been discussing with respect to OPEC+’s recent middle finger to the hegemon. It is much more a political statement than it is about oil. To highlight my point, consider that the US receives 7.5m barrels per day (bb/d) from OPEC+. That’s bugger all when the US is releasing 1m bb/d from the SPR right now. So clearly there is more at play than oil.

So as the core (US hegemony) attempts to not only maintain its position of power but increase it, it is plagued with socialist, nihilistic, and destructive snot-nosed brats who are now at this core. No surprise then that the core is imploding. And as the destruction accelerates they see their power waning and become more desperate, more aggressive, and more frantic in their attempt to increase reach and scope.

The most powerful financial tool available to the US is their currency, and as they’re weaponizing this the repercussions are truly massive on a global scale.

We’ve written at length about the rising US dollar, and our belief that we’ll see a wave of emerging market sovereign defaults as a result, but it’s not just emerging markets that are in trouble.

Which brings me to… Japan

The land of the rising sun

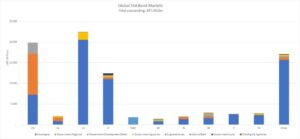

The third largest sovereign bond market in the world is kinda a big thing.

The BOJ (Bank of Japan) has been selling dollars in order to try and prop up their bond markets. And realize this. They are not selling USDs as part of some well-calculated plan because they want to. They are selling USDs because they HAVE to.

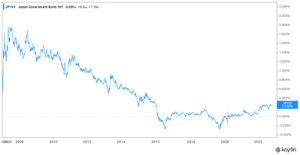

And it’s not working. Take a look at the Japanese 10-year bond yield.

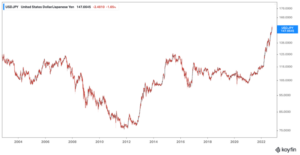

Now take a look at the yen.

Sure, they’ve kept the yield relatively low but at the expense of the currency. It is so extreme that they have been trading 20X the usual volume over the last few weeks. In September they blew through 4% of their USD reserves — 4% in a month. And guess what. October was much, much worse.

PauloMacro on Twitter referenced it like this:

They used 7% of reserves to only keep the Yen from depreciating another 2.5% since they last intervened 4 weeks ago. If the same math holds, the BOJ will blow through the other 93% while the Yen depreciates another 33%, which is roughly what the Yen has depreciated since last December.

Said differently, the BOJ will have to blow through all its reserves just to keep the Yen at the same depreciation rate it has incurred over the last 12 months if the math on the last 2 interventions are any guide.”

What they’re doing is the equivalent of what the US administration is doing with the SPR and oil. Neither can hold.

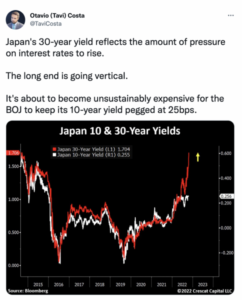

Tavi Costa pointed out that while they’re keeping the 10-year under control (sorta), the 30-year is blowing out. Whoops!

Japan’s problem is not unique. The entirety of the Western world is in the same proverbial bind. Central banks held rates far too low for far too long (thanks go to Bernanke for beginning this), and then on each successive attempt by market forces to correct imbalances, they proceeded to intervene with stimulus, adding kindling to the eventual inferno that would engulf the whole system. That is now.

The real issue now is that the entire system has become dependent on central banks to continue doing this and without it they will go into cardiac arrest. Their options now amount to:

Pause on interest rate increases and let inflation rip higher, wiping out the middle class, or

Keep raising rates, which will cause an overleveraged economy to contract massively with waves of corporate and then personal bankruptcies.

We’ve long said that the pointy shoes will pretend to “address inflation” but will ultimately keep rates well below inflation levels. If we are to use the Taylor Rule, then the pointy shoes at the Fed are way behind the curve as the Fed Funds Rate should be over 9% (it is at 3% today). It’s laughable to think of the Fed raising rates that high. The entire system would implode in a mushroom cloud.

The fact is they can’t raise rates at anything close to the real rate of inflation, and so they won’t. And that means we’ll have a continuous loss of or erosion of buying power — otherwise known as inflation. There are going to be few places to hide as a combination of stagnant economic growth, financial repression, and inflation all collide.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Yes, it could be the start of a financial crisis. Or maybe not. We’ll just have to wait and see.

Come on CC…I got a decade of serious Prep…just like me…getting OLD.

Bang a Gong…Lets Let It On!

Hasn’t the BOJ been implementing YCC

(yield curve control) for over 4 years?

The FED is going to have us feast on the slop they have been cooking since at least 1970.

Yum…………………..got gold?

Just one more piece of the potential for economic collapse.

What the Fed does is inconsequential. It is recession that ultimately corrects inflation, and paradoxically, recession occurs as the result of inflation.

The reason inflation is destructive is that once it passes a certain point, the cost of goods and services rise faster than wages, so “real wages” adjusted for inflation fall month after month. We have seen this happen now for 19 straight months.

When real wages fall, consumption must fall also. Despite the consumer use of credit to try to keep spending going, their increasing payments will soon make this practice impossible to sustain. At some point in the not too distant future, the consumer will have to drastically curtail spending and that is when the economic collapse shifts into high gear.

“Stocks tell you how people feel but Bonds tell you where we’re headed”

-Just Sayin’ 1991

Suck it up buttercup, we’re in for a wild ride for the next few years.

Just Sayin’

We are witnessing the final liquidation of western civilization’s bankruptcy.