“We’ve got strong financial institutions…Our markets are the envy of the world. They’re resilient, they’re…innovative, they’re flexible. I think we move very quickly to address situations in this country, and, as I said, our financial institutions are strong.” – Henry Paulson – 3/16/08

“I have full confidence in banking regulators to take appropriate actions in response and noted that the banking system remains resilient and regulators have effective tools to address this type of event. Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again.” – Janet Yellen – 3/12/23

With the recent implosion of Silicon Valley Bank and Signature Bank, the largest bank failures since 2008, I had an overwhelming feeling of deja vu. I wrote the article Is the U.S. Banking System Safe on August 3, 2008 for the Seeking Alpha website, one month before the collapse of the global financial system. It was this article, among others, that caught the attention of documentary filmmaker Steve Bannon and convinced him he needed my perspective on the financial crisis for his film Generation Zero. Of course he was pretty unknown in 2009 (not so much anymore) , and I continue to be unknown in 2023.

The quotes above by the lying deceitful Wall Street controlled Treasury Secretaries are exactly 15 years apart, but are exactly the same. Their sole job is to keep the confidence game going and to protect their real constituents – the Wall Street bankers. And just as they did fifteen years ago, the powers that be once again used taxpayer funds to bailout reckless bankers. Two hours before the only solution the Feds know – print money and shovel it to the bankers – Michael Burry explained exactly what was about to happen.

When Biden, Yellen, and the rest of the Wall Street protection team tell you the banking system is safe and they have it under control, they are lying, just as I said fifteen years ago.

“Our economy and banking system is so complex and intertwined that no one knows where the next shoe will drop. Politicians and government bureaucrats are lying to the public when they say that everything is alright. They do not know. Should you believe a governmental agency that wants the public to remain in the dark to avoid bank runs, or an independent analysis based upon balance sheet analysis?”

Back in the days of The Big Short, before the public knew about toxic subprime mortgages issued by criminal bankers and packaged into derivatives given a AAA rating by the greedy compliant rating agencies, the Wall Street cabal knew time was growing short, but that didn’t keep the lying bastards like John Thain (Merrill Lynch), Dick Fuld (Lehman Brothers), Angelo Mozilo (Countrywide), Kerry Killinger (Washington Mutual), and others from pretending their institutions were healthy and profitable – right up until the day they collapsed. Lying is in the DNA of every financial executive, politician, government bureaucrat, and Federal Reserve hack.

The quote from Hemingway seemed pertinent in 2008 and is just as pertinent today.

There are many similarities between what was happening in 2008 and what is happening today. Bear Stearns went belly-up in March 2008 and was taken over by JP Morgan in an arranged marriage by Bernanke and the Fed. The usual suspects assured the country this was a one off situation and the banking system was strong. The Wall Street banks had been reporting huge profits because they were hiding the massive losses on their balance sheets. If they didn’t foreclose, they didn’t have to write-off the mortgages. The toxic debt just kept building.

In the summer of 2008 the banks started to report losses, but assured investors it was only a one time hit. All was well. The week I wrote my article Wall Street bank stocks had soared 20% or more because their reported losses for the 2nd quarter were less than expected. My article cut through all the BS being shoveled by the likes of Larry Kudlow, Jim Cramer, the Wall Street CEOs, and the supposed analyst experts who still had buy ratings on these bloated debt pigs. My assessment was somewhat contrary to the CNBC lies:

“I would estimate that we are only in the early innings of bank write-offs. The write-offs will at least equal the previous peaks reached in the early 1990s. If a large bank such as Washington Mutual or Wachovia were to fail, it would wipe out the FDIC fund. If the FDIC fund is depleted, guess who will pay? Right again, another taxpayer bailout. What’s another $100 or $200 billion among friends.”

Merrill Lynch was reporting billions in losses and issuing new stock to try and survive. They were clearly in a death spiral and I saw the writing on the wall:

“How long will investors be duped into supporting this disaster? You can be sure that the other suspects (Citicorp, Lehman Brothers, Washington Mutual) will be announcing more write-downs and capital dilution in the coming weeks.”

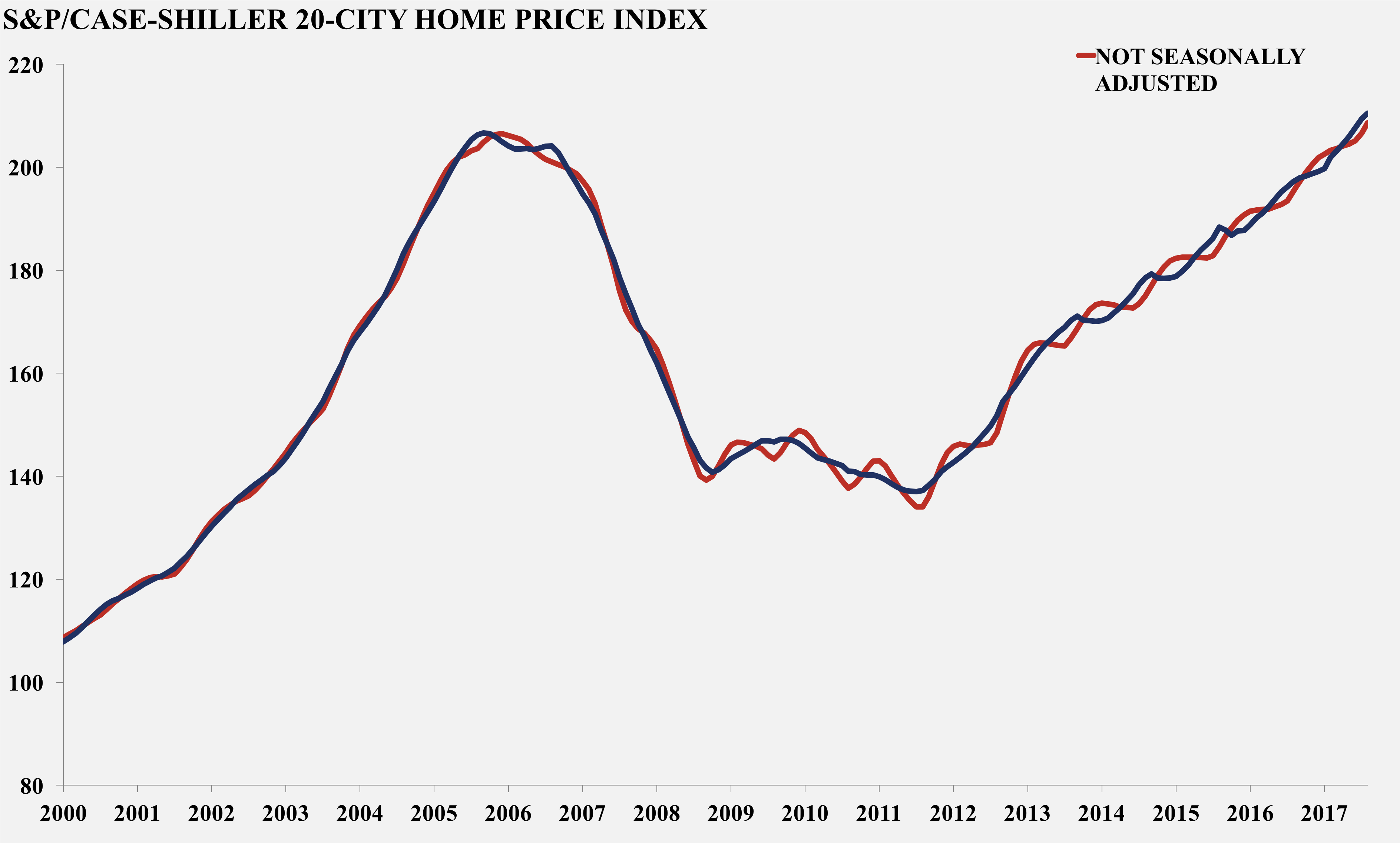

By the end of September Lehman Brothers and Washington Mutual were gone. Merrill Lynch and Wachovia were acquired for pennies, and Citicorp became a zombie bank sustained by the Fed for years. My article was dire and my analysis showed we were in for years of pain and the worst drop in housing prices in history:

“There are $440 billion of adjustable mortgages resetting this year. That means that the majority of foreclosures will not occur until 2009. This means that the banks will still be writing off billions of mortgage debt in 2009. The reversion to the mean for housing prices and the continued avalanche of foreclosures is not a recipe for a banking recovery. Home prices have another 15% to go on the downside.”

“The consumer is being forced to cut back on eating out and shopping. The marginal players will fall by the wayside. Big box retailers, restaurants, mall developers, and commercial developers are about to find out that their massive expansion was built upon false assumptions, a foundation of sand, and driven by excessive debt.”

It seems I was quite accurate in my assessment, as home prices went down more than 15%, not bottoming until 2012. This global financial collapse brought an end to the big box expansion phase, as many went under, and the survivors concentrated on their existing stores. We entered the worst recession since the 1930s. The most interesting part in going back to my 15 year old article was the psychology of the crowd revealed in the comment section. Despite my use of unequivocal facts, I was branded a doomer, overly pessimistic, and an idiot. Many commenters said the Fed would save the day and it was time to buy the dip. If they had bought the dip on the day of my article, they would have lost 44% over the next 8 months during a relentless bear market.

The question now is whether the current situation is better or worse than the situation we faced in 2008. There are some factual items which may help in assessing where we are. In August 2008 the national debt was $9.5 trillion (67% of GDP). Today it is $31.5 trillion (130% of GDP). Total household debt was $12 trillion in 2008 and stands at $17 trillion today. The Fed’s balance sheet was $900 billion in 2008 and now stands at $8.3 trillion. Inflation was at a 17 year high in August 2008 at 5.9% and stands at 6.0% today. GDP was growing at 3.2% in 2008, versus 2.7% today. An impartial observer would have to conclude our economic situation is far worse than 2008.

But all you hear is happy talk and false bravado from Wall Street analysts covering their own insolvent industry. They constantly harp on the fact mortgage lending is much more risk averse and secure. Of course the next liquidity driven crisis is never driven by the same exact factors as the previous liquidity driven crisis. But the key factors are always the same. Loose monetary policies by the Fed lead to excess risk taking by greedy bankers, hedge funds, and corporate executives. Then something blows up and the billionaires get bailed out at the expense of the taxpayers who have been getting devastated financially by the inflation caused by Powell and his printing press.

So far, this latest banking crisis “that no one could see coming”, except any honest financial analyst who understands math and history, is following the same path as 2008. The narrative about banks not taking credit risk and peddling bad mortgages is being blown up as we speak. Instead of the risk being centered on toxic mortgages like 2008, the risk has permeated every crevice of the financial system due to years of 0% rates by the Fed. Virtually everything is overvalued by 30% to 50% because cheap debt was available to everyone for everything. Extremely low interest rates led to extreme risk taking by bankers, corporations, home buyers, auto buyers, and politicians. The unleashing of inflation by Powell’s policies has led to the tide going out and revealing who was swimming naked.

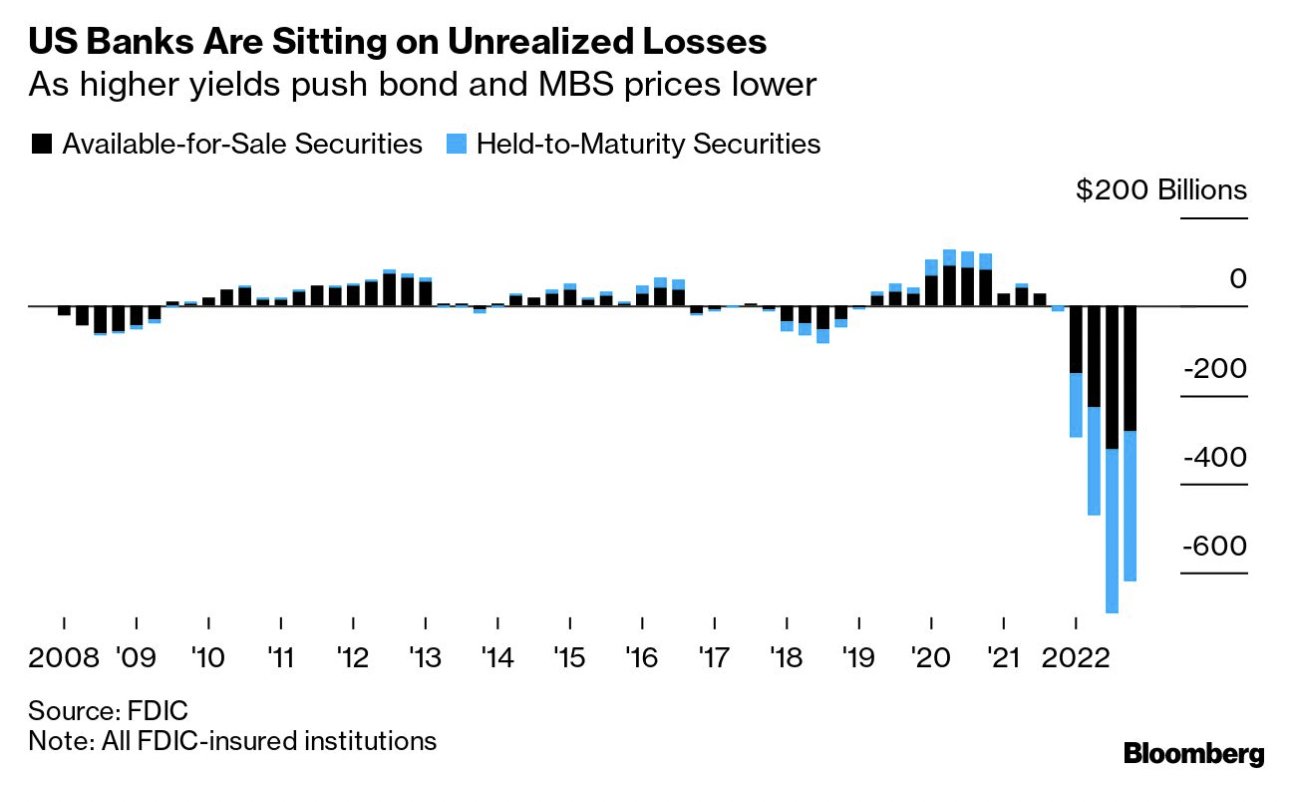

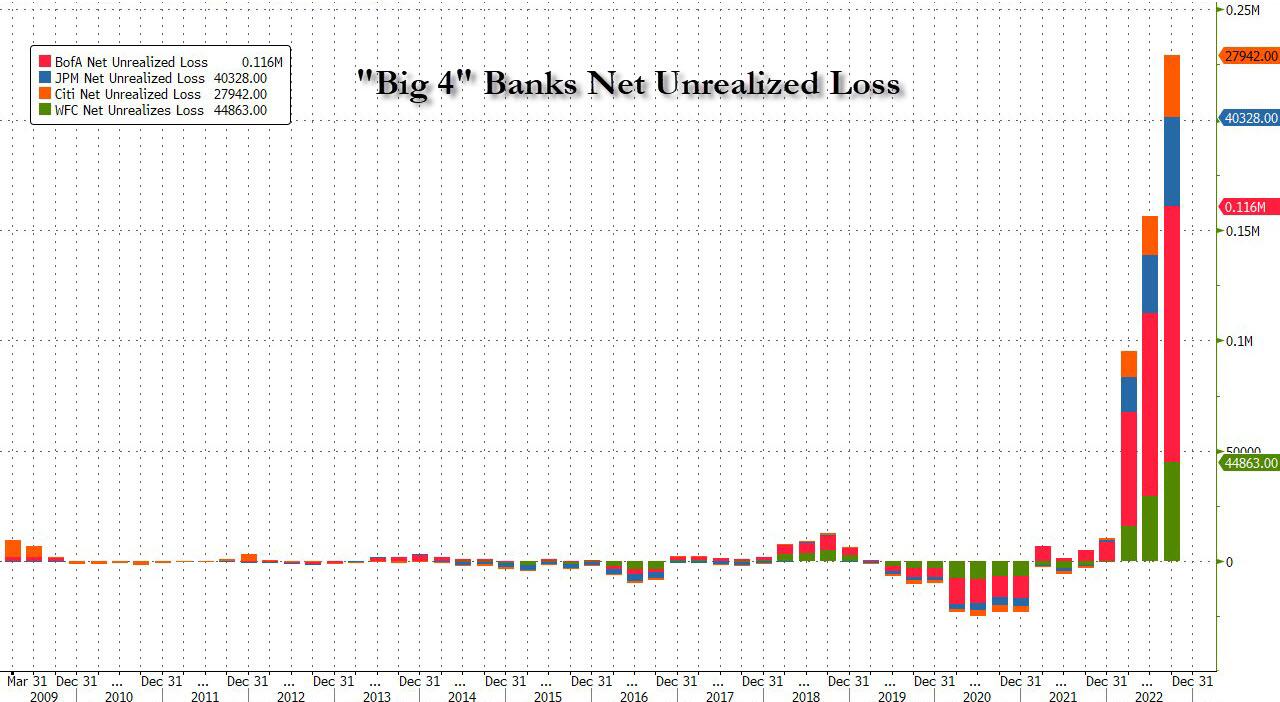

While risk managers at banks across the world have been concentrating on diversity and pushing woke agendas about transgender rights, climate change and practicing ESG investing, they ignored the simple concept that bonds they acquired at 1% lose money when interest rates go to 4%. Just as the banks in 2008 were sitting on billions of unrealized losses from the toxic mortgages on their books, the same banks are now sitting on billions of unrealized losses from the newest toxic asset – U.S. Treasuries. Everyone knows it. It’s just math. They have been counting on Powell to reverse course, but with reported inflation still at 6%, he’s trapped. Silicon Valley Bank and Signature Bank were swimming naked and when depositors realized that fact a bank run ensued. Poof!!! Sudden Crisis.

The narrative being spun is this is a regional banking crisis confined to smaller banks. This narrative is being spun by the big Wall Street banks and their captured media mouthpieces, with the intent that depositors at smaller banks would panic and shift their deposits to the “safe” Wall Street banks. The truth is that the Wall Street banks have massive levels of unrealized losses and desperately need deposits to keep them from facing the same fate as Silicon Valley and Signature. Those unrealized losses aren’t going away and will have to be realized in the near future.

Credit Suisse has been the crazy uncle of the financial industry, kept in the basement for years. Their demise is a foregone conclusion, but that has been covered up and ignored by those in the know. They appear to be the new Lehman Brothers, which will blow up the already insolvent European financial system and spread a contagion of losses across the financial world. Those quadrillions in obscure derivatives are an unknown element in the coming meltdown. But you can be sure they won’t have a positive impact.

Both small and large banks have little to no reserves left to lend. Debt issuance is the Potemkin ingredient in keeping this farce of an economic system running. Without debt to finance overextended consumer lifestyles, funding wars in Ukraine, and the woke agendas of corporations and politicians, the entire facade collapses.

Real wages have been negative for 23 consecutive months. A banking crisis means banks will reduce lending dramatically. Consumers have been forced to live off their credit cards for the last two years, as their savings dried up and their wages bought less. A deep recession is in the cards. Consumers are already pulling back and spending less. With credit drying up and spending going down, employers across the globe will start laying people off. As unemployment rises, people will stop paying their enormous mortgage and auto loans. This will lead to more losses at banks, just like 2008/2009.

Everyone will look to the Fed to save the day. And they will pretend they have everything under control, but they don’t. Back in 2008 their balance sheet was only $900 billion. Today it is 9 times as large. The relentless QE while interest rates were suppressed has left them with enormous unrealized losses on the mortgage and Treasury bonds they bought. They let the inflation genie out of the bottle and now it is ingrained in the economy. Companies who gave 2% annual raises to their employees for a decade are now forced to give 4% or more due to the Fed created inflation.

If the Fed slashes rates and goes back to money printing through QE, the current 6% inflation rate will skyrocket back to double digits. If Powell does nothing or continues raising rates, the banking system will likely collapse. His choices are deflationary collapse or hyper-inflationary collapse. He’s stuck between the proverbial rock and a hard place. Since he is controlled by Wall Street, he will slash rates, restart QE, backstop the bankers, and screw the average American, as always. My conclusion reached in my 2008 article, just before the financial system imploded seems, for the most part, to apply today.

“The U.S. banking system is essentially insolvent. The Treasury, Federal Reserve, FASB, and Congress are colluding to keep the American public in the dark for as long as possible. They are trying to buy time and prop up these banks so they can convince enough fools to give them more capital. They will continue to write off debt for many quarters to come. We are in danger of duplicating the mistakes of Japan in the 1990s by allowing them to pretend to be sound. We could have a zombie banking system for a decade.”

We never paid the piper and cleaned out the excesses of the previous banking crisis. The financial condition of the nation is far worse than it was in 2008. The financial condition of the average American is far worse than it was in 2008. The financial condition of the Federal Reserve is far worse than it was in 2008. The financial condition of the banking system is far worse than it was in 2008. Our leaders kicked the can down the road in order to give the system the appearance of stability, and we let them do it. We could have taken the pain in 2008 and let the system reset after purging all the bad debt and bad banks, but we chose the wrong path and will now suffer the consequences described by Ludwig von Mises a century ago.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

My advice 15 years ago at the end of the article was to reduce your deposit exposure at all financial institutions, don’t invest in financial stocks, follow the writings of honest truthful analysts and this final piece of advice, which is as solid now as it was then:

“When you see a bank CEO or a top government official tell you that everything is alright, run for the hills. They are lying. They didn’t see this coming and they have no idea how it will end.”

We are at the beginning of the next global financial crisis, not the end. Fourth Turnings do not fizzle out. They build to a crescendo of chaos and war. This financial crisis will usher in the military conflict that has been beckoning for the last year. Time to buckle up and prepare for the coming storm.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Are they safe? Absolutely.

Did anyone of you lose your deposits in 2008?

WTF had “deposits”? Everyone was living hand to mouth on the crest of the good times wave. New cars, new McMansions, no interest, no money down, new derivatives, endless opportunities. Everyone was living on maxxed out credit. They got caught with their trousers down then and it’s happened again.

This time something gets chopped off.

Every time something’s chopped off. There’s no such thing as a free lunch. More people are noticing this time, is all. The latest fake free lunch was bigger. The chopped-off pendulum compensation will be bigger. A demonstration of Newton’s Third Law. Nothing more complex than that.

This time people better have 25% to spare…..

Babble- Checking accounts aren’t the target, the criminal banking system goes for the big money, pensions, retirement accounts etc. Savings for old age is just too juicy for them to pass up. Now ask how many people have been screwed out of their retirement $$$$$.

The average median checking balance in 2023 is $2,900, banksters pay more for a couple hours with a hooker. Chump change means nothing to them.

I hit the monthly limit for my checking card acct. after 2 days in Amsterdam. Fun Times.

Not if you still have checks left in the book.

They didn’t freeze my acct. while there, I realized it when it wouldn’t work back in Canada. Got off the plane and went to buy something. Had to go to the branch. I don’t travel with cheques.

That Red Light District is expensive!

Cheaper than divorce.

And more satisfying than marriage.

Sign reads:

New employees welcome to Corporation X. Be sure to open your 401-k SAVINGS plan with XYZ Investments. Don’t delay.

Yeah buddy. At least the gubmit SS check was deposited. Next month, anyone’s guess.

Just before I retired, the default position for any new hire was automatic enrollment in the 401k at 3% of pay. The new employee had to go to the 401k website to change the %. If the company did not get a certain % employee participation, then the officers were penalized on how much they could have withheld in their 401’s

I went with the 6% all along then, bam, no more pension. To “make up” for THAT the company was gracious enough to match 100% of contributions up to the 6%. Pension by far was a bit more “secure” while the 401k stuff continued to be like being thrown to the wolves. 100% sounds great and it was for a while then bam! Just what is taking place today.

401k is a scam, hence why the rich buy life insurance policies that pay dividends, and trust funds. All the pretaxed stuff. The poor and working class get screwed because they peomote only what doesn’t work for making wealth.

They screw you officers harder than the public you oppress.Yet you still serve them,enforcing their communist codes.. Smh. Back the blue Falcons. 🤣🤣🤣 Pigs from animal farm, is more fitting.

And THAT, BL, is what is worrying me. I’m a retired Texas teacher (Texas’ Teacher Retirement System is regarded as one of the best run pension systems in the country), and while I don’t expect the system to collapse, I do anticipate having to face a reduction in my annuity. However, in the event of a total collapse, I have enough ammo hold out for some time.

I would also mention that the coming crisis is going to make the Great Depression look like a picnic. There are so many more people depending on the government for their financial security today than there was in the 1930s. What happens when the government reneges on it’s promises of the last 90 years and tells John Q. Public that the gravy train has run off the tracks? I have a feeling the world is going to look very different in the next twelve months than it does today.

And people were a lot tougher and more resourceful than today’s whiny wokesters

ConservativeTeacher- I seriously believe that your pension will take a 50-60% haircut. The KY teacher retirement pension has been belly up for years and the day of reckoning is coming. The Texas Teacher Retirement Fund is 48 BILLION $$$$ underwater. Ask me what I did with my pension money??

** Clue- I took my money out of the system and it has increased in value 120%.

Is that a lot? /s

This in TEXAS? I thought Texas was bulletproof to all things.

And a lot more of the population lived on farms and could at least produce food

What’s happened then on steriods. Just think how violent it was then. PS, it’s not how much you have ,it’s how much you can carry, the mobs can burn down homes you know?

ConservativeTeachersExist,

That is why they will call it THE GREATEST DEPRESSION.

I did.

Warning! Due to Credit Suisse Situation-Bank Run Expected on Thursday According to Dr. Marco Metzler

March 15, 2023

They’re getting a loan from SNB for 54 billion.

Great read Jim, I will pass it out but they won’t read it.

If CS had any High quality, Unencumbered assets , and I repeat, if it HAD High Quality, Unencumbered assets it share price would not reflect the cost of a Half serve of Mickey Dees French Fries. It has Nothing just juggling balls.

I know the Saudis are not that sharp a pencil but even they know it is over.

CS is a Zombie but it is not as big a Zombie as some EU (German) banks. They are hiding the Rancid Frankfurt

No i didn’t lose my deposits. All i lost was more than 100K in my 401k. Got out of wall street altogether and have done my own investing since. Got GOLD & SILVER?

No, only 30-35% of the “value” of a sacred 401k savings. Or was it 2012? Or was it both?

50% match on 401k contributions up to 6% of of one’s salary…”everyone” did it. Suck ’em in, suck it out.

You are correct BabbleOn. The overwhelming majority of banks are safe but the media would like for us to believe that they are teetering on the brink of a collapse that only our benevolent leaders in government can save us and our hard earned dollars from. What TPTB need us to believe is that if only the banks were formally nationalized, we would be able to sleep soundly knowing our savings are safe from those dirty bankers. And what would make our money safer would be to convert it to a digital currency. Don’t fall for it!

SVB was a VC bank trying to do business in an unfriendly business economy. To make matters worse SVB’s criteria for business loans was not how solid of a model or product your business produced but how many “boxes” it checked. Minority owned…by a nonbinary female…trying to stop global warming…that should be enough boxes checked to get a hefty start-up loan. This was by far the biggest reason for SVB failure. Their only real source of capital came from bonds purchased by SVB that as of the past 2 years became an asset with continued loss of value.

And the script is being followed most wonderfully, the plot thickens and the propaganda and fear and manipulations of the lugenpresse and the government minions are fully in effect.

Be afraid, be very afraid. This is merely the next phase of the plan and it is going swimmingly. Fear is driving people to do foolish things with their money and fear is driving them into those big, too big to fail Banks. Now, what happens when you kill off the little alternatives that offer a modicum of freedom and replace it with centralized banking and finanacial controls? Why you get the government in control of every aspect of your life. You get your Central Bank Digital Currency and you get the government controlling your money and you life via social scores. Get vaxxed or no bank access for you…why fear China when your very own unelected government politicians and bureaucrats makes the communist Chinese look like rank amateurs…?

Stand back and look at the bigger picture, look at the prior events and then understand them as a connected whole, including the bullshit with Ukraine et al. Then examine the destruction of food production, attacks on energy production and strategic train derailments and the open borders and realize that there is an agenda and a plan in place to enforce that agenda and fear, as was used in the ‘Covid Pandemic,’ will now be used to destroy the little banks and economy so that they can fulfil the goal of a WEF world government where you will indeed eat bugs and be happy…

In Chuck Schumer and Mitch McConnell’s cases, it goes further than that. They were present, they were in charge, they had the ability, along with Nancy Pelosi, to prevent it and it turns out now, they were all involved in the entrapment, conspired to create the illusion of an insurrection in order to punish peaceful protesters. Why? To put a definitive end to protests about their coup.

These are big time politics, these are Caesar, King Lear and the Trojan Horse all rolled into one storyline. Someday, AI will write plays about this moment when the whole of the government of the US turned against its citizens, when it unleashed a bioweapon to depose a sitting president, then when the protests came, they faked an insurrection to imprison their victims. As a writer, I find this whole scenario, these true facts too convoluted and outlandish to propose as a storyline, knowing that I’d be told to just focus on the insurrection, or the fake election, or the pandemic bioweapon and not try to tie them all together, but that’s exactly what’s happened.

https://tldavis.substack.com/p/treasonocracy?utm_source=post-email-title&publication_id=700076&post_id=107485045&isFreemail=true&utm_medium=email

Hey Mygirl

Come back often.

Never squat with spurs on.

https://worldyturnings.wordpress.com/2023/03/13/a-letter-to-steve-forbes/

They failed because they are WOKE! shitheads with no finance acumen. Being a queer or minority box to check was considered qualification. They didn’t make bad loans. They did not know what to do with mountains of cash, beyond giving $73 million to BLM and stuff like that. They bought tens of BILLIONS of the wrong maturity bonds. This is Finance 101 stuff but of course they had only one finance person on the board and did not have a risk officer for the last nine months while the staff made videos and commercials at a cost of millions about how fanfriggintastically diverse and perverse they were. “We take it up the ass! How can you compete against that?!”

I put this at the end and then decided to move it because it fits better here

Oh my…no words. I wonder if they all get together and do…never mind.

I’m sure there are safe banks out there. I’m not sure it’s “the overwhelming majority”.

Maybe in the number of banks — but in the size of the banks? No way …

I did not. But everyone who held CDs or simple savings accounts was robbed of the value of their deposits by inflation.

Nearly everyone (99% of us) who is forced to use the federal reserve note is being robbed of the fruits of their labors. The 1% (so to speak) are those who have such vast holdings / investments that their returns outpace the true inflation rate, which is at least 15%.

Ignorance is Darkness

Knowledge is Light

JB, the way it works for those having access to the FED Window is summed up best by Ron Paul. They get “First Use” of the newly summoned fiat. They get handed a pile of money and spend it on things at today’s price which will likely go up tomorrow as they have caused dilution of the “money” supply by spending it into the economy with no parallel increase in the net worth/intrinsic value of the nation. The full faith and credit of the US remains the same divided between an increased number of Dollars, each worth less than before the creation of these Dollars.

$300k losses combined on my and my wife’s 401k’s. Fuck you.

Not arguing with you necessarily. Was the 300k loss from the initial investment?

One observation about “losses” in 401k. As an example say I “gained” 5k on an initial 50k 401k to IRA rollover. Then the “balance” was sucked down to 47k. Did I actually lose the 5k? I never had it except on paper. Yes, I “lost” 3k on the initial 50k. I suppose peeps don’t see it that way. My opinion I’ve lost nothing that I never had in my hand.

I get the fact we are talking about additional contributions to these hoax plans thus “losses” perhaps.

Jews love 401 ks.

401k’s are not a deposit they are an investment ie gambling. You lost value. If you had a deposit you would have been whole.

Risk Management. Fiduciary Responsibility.

Have a nice day. Poof!

I’m amazed at how many people think money market funds and annuities are safe.

Yes , a better way to describe the loss. And “value” is questionable in itself.

“I lost value of my Unrealized Theoretical Gains as I made a Bad Bet at the Casino.”

Did the admn delete mine and flashes eaelier comments? If so shame. This sitevisnt supposed to censor like Democrats do. Guess the don’t like movies about Frank L Buam, or my views on religion and Jesus.

Disregard. Got the threads mixed up.

Everyone is losing deposits BabbleOn.

The bankster with one degree of Kevin Bacon.

Are socializing their losses by inflation..

People don’t want fair. They want to pimp their mansions.

I used to do something useful for a living, but then I sold out and sat at a desk for a pointless temporary raise:

This is what shows up in thread for that video in Canada.

Wondering why that is….

“Margin Call” a movie from 2011.

Why would that movie trigger a block in Canada..

Well,your government there loses there shit over everything so… I guess no good reason.

My cash has half the buying power since 2008 so yeah I think I lost something.

Only halved, i.e. you experienced an average inflation of just 4.73% per year over the last 15 years?

Count yourself lucky!

My brain just don’t function anymore when trying to figure the hoax out. Thinking about it hurts my brain too much. I seen it coming though.

I’m in Indiana the cost of living is lower than blue states yet it is climbing steadily.

Small town az and nevada, average 2 bed apt in 2012 was 285 a month in small to midsize towns. Average now for the same apt is 900 to a over a 1200. Yeah our dollar aint worth shit.

Not to worry … once the Fed and its CBDC kicks in, you’ll lose the other half if you ‘color outside the lines’ …

Fednow pay is set to kick in at most banks and corps this july. 😩😬

Thanks! Lol, I have to buy a new keyboard again…..Lmao 😉

See? Even discussing money seriously is risky. Let’s leave it to the experts.

Why not just call for censorship like Senator Kelly {D} Arizona? Me smells a troll.

Sure, asshole. You’re not this stupid – you’re a troll.

I remember when banks had Christmas clubs, passbook savings accounts sold travellers cheques and bonds .Now they just fucking harass you and charge fees.

In my single-digit years and into my paper boy years, I would sometimes take my passbook and have the nice lady stamp it with another twenty-eight cents in interest. My ID was my face and her decades at the same job.

America was never perfect, but oh, was it better. I have apologized to several thoughtful young people and begged them to read and talk and take back their robbed futures.

I’m 70, grew up in the 60s. Every afternoon walked a block with a gunny sack to pick up Coke bottles. Took them to the nearby Tote-Sum store to redeem at 2¢/bottle. Made around $2/week. Big $$$ back then. Cokes were 10¢.

A person can cash beer bottles/cans, plastic/glass soft drink bottles, any number of bottles for 10¢ each in Oregon. Of course one pays the same 10¢ when purchasing. Sounds corny but one generally does not see these and other trash along the roads unlike Texas where chunking any number of disposables line the roads by the hundreds of thousands. It’s a Texas thang to throw crap out the windows while driving. Yee-haw.

Around here, you can tell when you enter a colored section of the city as the roadside trash becomes much heavier. The last time I was in Ontario, I noticed how clean the roadsides were and how few coloreds I saw.

Sad to say TN, around these here parts the populous is about 83% white. And the 17% others mostly live in or close to the towns. Sure there is trash in the towns while the county roads are absolutely disgusting. I don’t know what aluminum cans are bringing these days. Just to contribute something to the community I’ll be walking some roads with a big ol trash bag. Might make enough for a a couple sixers of real beer, IPA/APA.

Lots of white trash. Get it? 🙂

You’ll be gettin some excercise picking up the trash left by the white trash AND gettin a six pack to boot. Sounds like a good idea.

Here in Ontario. I threw out four bags of garbage last week. All of it was litter picked up by me. Lol, I even had a chat with a new resident and they are on board keeping the community clean! 😉

” It’s a Texas thang to throw crap out the windows while driving. Yee-haw.”

People with the ‘cleanest’ vehicle interiors? Biggest culprits.

Let’s have another big round of applause, ‘Celebrating’…

SAME as it EVER was.

The bottle deposit is a tax.

Many are never returned and guess who keeps the deposit?

Trash foragers benefit however when finding such in the trash cans. In Oregon trash foragers don’t bother with the roadsides.

And that dime was made of silver and will now cost you more than 2 fiat dollars to buy. Got Gold & SILVER?

I did that too as a very young kid, circa 1968. The subdivision was still being built and lots of the workers would let me have the empty glass coke bottles that, once I collected enough, were redeemed for my first Tonka toy truck. Those were made from steel back in that day.

Days gone by when the currency actually bought something. After school almost every day I would buy a big 16oz Topp cola for 7c. A snickers or other candy bar was a nickel. Of course if no empty bottle to return the Topp cost another 2c deposit. A kid could usually pick up enough empties to support the habit each week. I think my allowance was 50c/week which bought a lot of Topp cola.

My Grandparents lived just down the street from the local VFW and when I was a kid staying with them on a Saturday night, I would get up early Sunday to scarf up all the coke bottles the guys would leave on the sidewalk and in the parking area. It was a veritable gold mine. Their clean-up crew did not come around until mid morning and I had already cashed in my loot. When the bottle deposit went to 3c, I was in hog heaven, until the candy bar & coke went up to 10c each.

I remember when a dollar used to cost a nickle.

Lol that’s good my father bought me an uncirculated Morgan dollar after I had my tonsils out from Millers Mint in Patchogue Ny in 1970 . It was 5 dollars lol . Saw the same today for a hundred.

I have a silver dollar my Granddad carried around in his pocket. He carried it so long, it is now a smooth as a baby’s butt. It is only worth an ounce of silver, but to me it is worth a lifetime of memories.

And now it has come full circle and is only worth a nickel.

I forgot they also had a desk and a man that sold SBLI.

No giant, centrally-controlled, top-down system, banking or otherwise, can be safe, or survive for long. Reality never stops fluctuating; conditions always change. There is no way to lock down the Universe. Adapt and survive. One must respond to the organic markets, not attempt to command Mount Everest to stop turning into beachfront sand.

I don’t think you appreciate how much power is in the hands of so few. It is the Matrix.

The few only have the power that the many yield to them.

They have the power of generations of stolen labor. It is real power.

I do, we’re in a David vs Goliath on steroids type scenario. We need many Davids, Solomon’s, Samson’s, soldiers/ guerrillas, assassins, and sincere leaders to get us through this. Time to stop being raped. Time to kill the rapists.

“…and someone…Get this man a shield!” – Black Panther, Infinity War

“They’re holding all the keys. They’re guarding all the doors. Sooner or later, someone is going to have to fight them. EVERYONE who has fought an Agent has died, but where they failed you will succeed.”

And, why, pray tell, would he succeed? Because he HAD TO.

That’s just what’s going to happen here…nothing…until it HAS to.

Morpheus, the Matrix.

Is the banking system safe?…….. Lord NO.

If banks shuttered, the FDIC only has 1.4% of total deposits in cash on hand to cover losses. Most failed banks are taken over by large banks, if we ever saw a systemic failure on a large scale, don’t look at FDIC to save you.

It IS safe – and effective – for its owners.

It’s a big bank, and you ain’t in it.

Secede.

2023 = 1776

Its just as Safe and Effective as everything else they say is Safe and Effective.

In order of preference….

1. Counter Coup.

2. Parallel economies.

3. Secession (possible Civil War).

4. Get the F outtahere.

It’s that for sure, all of the above, only way out now. You can’t vote freedom,liberty, wealth,or life back. One can only take it back by any means necessary.

What still has not been pursued -Grand jury indictments for every Gov worker in violation of article 1 section 10 of US Constitution – this is the lawful first step to permanently removing their criminal injury from our midst.

All of them are in breach of duty over the tender issue. Why is no one (even so called patriots) seeking their indictments?

I don’t get it. People will do everything to find a solution EXCEPT uphold the law.

The people flooding the grand juries with valid causes of action would make the courts have no other business to conduct outside of bringing the people who work there to justice for their on-going breach and criminal injury upon everyone.

It took nearly a thousand years for people to gain the power of equal justice, yet now no-one even knows they have the power to remedy the injury while everyone complains about the injury and look to chaotic ‘solutions’ instead of orderly, matter of fact, solution of simply upholding the law.

What are ‘judges’ and ‘prosecutors’ and ‘law enforcement’ going to say when ALL grand juries indict them for breach of Constitutional tender laws? It won’t matter what they say once they are convicted.

Though I agree with the fact they are in breach of article 1. Good luck with filing it,or having it heard by these courts nowadays . Even if they filed it,the judge would probably laugh you out of the court as the bar owns them all. Even the good ones. but anythin is possible. Good luck though.

Its a con game, so they won’t give up the con until it all goes BOOM !

Newman and Redford did only 2 movies together — this and ‘Butch Cassidy and the Sundance Kid’ … and that was enough to prove how great they were together.

Excellent article.

It remains to be seen how long the charade can continue until it implodes. I’ve been guessing “this year” for a decade. It could well be this year, but the ability of the financial market/press to deny reality is otherworldly, so it wouldn’t shock me if I’m saying the same thing next year, the year after . . .

If I had to place a bet it would be somewhere along 2029-2032.

Only ONE member of failed SVB’s board had a career in investment banking – and the rest were Obama, Clinton mega-donors

Just one member of Silicon Valley Bank’s board of directors had a career in investment banking, while the others were major Democratic donors, it has been revealed.

Tom King, 63, was appointed to the board in September after previously serving as the CEO of investment banking at Barclay’s. He has had 35 years of experience in investment banking.

But he is the only one on the board with a career in the financial industry, while others are a former Obama administration employee, a prolific contributor to former House Speaker Nancy Pelosi and even a Hillary Clinton mega-donor who prayed at a Shinto shrine when Donald Trump won the 2016 presidential election.

https://www.dailymail.co.uk/news/article-11859379/Only-ONE-member-failed-SVBs-board-experience-investment-banking.html

I was wondering if you were working on a new article. I’m sure you will have more to write about in the next couple weeks.

Hank “Tanks in the street” Paulson. What a jackass! I was wondering what he’s doing now, so I ran a search.

I was listening to Liberty and Finance early this morning. It’s worth your hour. According to Andy Schectman people are starting to have their wire transfers refused. Also Lynette Zang mentioned this, as well. Money still in banks is stuck there unless you withdraw it a little at a time. I don’t think there is much time left.

I keep hearing this is a set up for CBDCs. I don’t think that will work out like they think it will.

The SVB Collapse: How financial crisis boosts the rise of CBDCs

The next phase will likely be arguing that small, regional, private banks cannot guarantee the security of their customer’s money, and it would be safer for individuals to bank with either giant international banks or directly with the central bank.

It’s already being reported that Bank of America has seen a huge boost in deposits since the SVB crash. This process of consolidation in the major banks is likely to continue…

Going forward, CBDCs can be pitched as more secure than traditional banking, and more regulated than “traditional” crypto. Further, since the FDIC is now fully guaranteeing deposits in failed banks, you’re practically banking with the Fed anyway. Why not just cut out the middle man?

We know they’re going to make these arguments because they already started making them.

In January this year, the World Economic Forum published a paper titled:

But more than that, it’s possible bank runs will actually be encouraged in future, because they could increase the uptake of digital currency.

According to a report from the Bank of International Settlements [emphasis added]:

A commenter to the Off-Guardian article “Maxwell” said….

We are in the midst of global hyperinflation being orchestrated to vaporize the assets of the masses and the states in order to hand over public assets to private investors. This allows the ruling class to mop up properties (bankrupted small businesses, foreclosed homes etc.) in order to stake limitless claims on everything in the world.

The financial elites know that they have run up massive unpayable debts and deficits. They know the promises of pensions and benefits cannot be paid. They know the system has reached its Waterloo and social unrest is inevitable.

The scale of the deception is too large for even many who consider themselves “in the know” to accept or comprehend, others are still asleep or traumatized as the social fabric is being smashed to pieces as the world around them is being completely transformed.

Put simply, Covid-19 was not a widespread medical emergency, it was a money laundering scheme, a massive psychological operation and a smoke screen for a complete overhaul and restructuring of the current social and economic world order.

Inflation is meant to erode govt debt. It was always on the cards. The issue is can they contain it from going hyper.

Inflation is meant to fund .gov activities without direct taxation, which may be sidestepped by the savvy, the connected, and the wealthy.

Erosion of purchasing power, by the theft that is inflation, cannot be avoided, especially by the poorest.

Add in the insanity of bundling debt into “assets”, which may be used as collateral to amass more property, and you have our current mess.

The little guy has to eat his own ass, or his kids, or his neighbors. Or commit suicide. All roads lead to depop.

The old saying about the big club. Piss ain’ts simply ain’t in the club. I’m thankful.

That was so 2008 ,now we print trillions every year.

What if TLPTB decided that it would be safer and easier to destroy America rather than prepare it for CBDC? I don’t think the electric grind in the USA makes CBDC feasible in the foreseeable future. So, what would it look like if they were just trying to defang it while they subject the rest of the world? I wonder how they would neuter the military.

Notice how the people who just got caught engineering pathogens and killing millions of people worldwide, are also the same people who are engineering new ways to justify taking away our weapons. @WarClandestine

Are you awake yet?

The same people that got caught engineering pathogens are crashing the banking system.

That fits too.

HSBC is the new Lehman. Always gotta have a rogue bank to rely on for shading funding deals. Understand HSBC is getting the UK SVB branch. Shows you where things are aligned eh?

Everything is fine.

Breaking from a @CreditSuisse employee: “panic, meltdowns, people crying.”

Charles Gasparino

@bonker_99

WHOA!

JM Bullion buying #Gold & #Silver back at > spot price!!

The funny thing is a hundred is worth what a 20 was 45 years ago . They scrutinize a hundred dollar bill like I’m a counterfeiter everytime I use one lol.Whats amazing is that in the 1920s they still had 500.and 1000 dollars notes in circulation . That at a time when 1 k a year was a normal salary lol.

Spot on Iggy.

The look on people’s faces when handed a C note is extremely telling.

Why does everything bad always seem to begin in March?

I have been thinking about this. ” they ” seem to follow the old earth centered religions. Sun , Moon , stars and the seasons.

The old world or system gets taken down ( dies ) in winter. We are still in winter a few more days. Then a ” New ” world system , or a start of it , can be re-born in Springtime. Here’s a few dates to watch ( occult calendar )

3/15-3/17 Ides of March: Rites of Cybele and Attis (begins twelve-day death and resurrection ritual)

3/18 Jacques de Molay Day (Knights Templar) beginning of the new year (orgies)

3/20 Spring Equinox. Children dedicated to Satan

Interesting take. It’s probably nothing though. /s/

@CBS has deleted their tweet after saying they’re “ready to worship” ahead Sam Smith’s Satanic Grammys performance,” Jillian Anderson tweeted.

National radio host Todd Starnes said the disturbing performance “was further evidence of how Hollywood has surrendered to evil,” adding, “they openly worship the prince of darkness.

Ides.

Beware the Ides of March.

I hate March. Usually the weather is crappy and while you believe it has 31 days, it really has 331 days. It’s worse than January.

It is under the sign of Aries, the god of war.

I guess that is why soldiers MARCH instead of shuffle. 🙂

You’ve obviously not seen our ‘new’ military …

Are they mincing about now?

It is always frustrating with the weather in March. The planet just doesn’t believe in smooth seasonal transitions. It is nice enough to want to be outside, but usually too wet to do anything, and then there are all the surprise freezes.

Tell me about it, this last go-round with the wind I had 4 trees uprooted. Tree service Mexicans here have more money than anybody. Why go to college, learn how to grind stumps and wield a chain saw. 🙂

I keep racking up the hours on the chainsaw. I haven’t been paying myself, though.

Beware the Ides of March all began with the betrayal and assassination of Julius Caesar

March Madness?

I’m betting the Fed stays the course with a short term cessation of raised rates. What’s Yer bet, Admin. Be bold.

I think he’ll do .25% next Wednesday and that will be the last increase. As the banking crisis spirals, he’ll start cutting.

Seems likely. ECB raised 50 Basis Points today.

I think Tom Luongo is correct. This is an all-out war between Fed/NY Banks/Wall Street vs. Davos/City of London/Democratic Party et al.

The Fed cannot afford to pivot but, of course, cannot allow systemic banking failure. The non-bailout bailout was a quid-pro-quo with the Treasury (aligned with Davos), but really not a big deal to the Fed/JPM. In fact, the big banks benefitted…where else did people wire all their fiat that caused these collapses? I guarantee less that 1% went to crypto to precious metals. No, most went to JPM, Wells, BOA, et al.

This is a war that the Fed will win, but at what cost? What level of victory are Powell/Dimon willing to take. Also, what Lungo doesn’t really discount is what if the People take a hand. Real bank runs end the whole shitshow in a week. Collapse and chaos for all, including the NY Banking assholes AND the Davos assholes.

As Drud pointed out the ECB raised 50 bps. They(US Fed) may pause once after the .25%, but they will keep raising slowly for “Economic Health”. They are currently at 4.58% they will need to go over 5%. Why? To kill not the Banks but the people swimming in debt. The Banks are fine, the people are not. People are scurrying at 4.5%. They will go ballistic at 5%. I think they go at least 5.5%.

Excellent call, Admin.

Never was an economics guy, but have always listened to Admin and took most of his advice. I used to put a lot into my 401(k), but stopped that practice years ago. No other “investments” into the markets either. I keep a certain amount of savings for a rainy day but not too much. Over the years I have paid my house off, bought more land, bought more silver, and continue to buy guns. All of the mentioned investments have done nothing but increase in value (and not just dollar value).

Good moves all around Winchester.

A few hours ago I met one of my neighbors at my second gate and we had a Bank chat that I started…he is a regional VP with Wells Fargo and a real Christian! (I know they sound mutually exclusive but not in his case).

He and his wife (another real Christian) have 34 acres boarding my 14, and they have egress through my first gate to get to their modest weekend home, 3 horses, a massive hanger like outbuilding filled with an RV and all the rural toys. She is a CPA and they seem to have done extremely well. Wonderful neighbors!

He is always completely candied with me about his employer and has four more years until retirement.

He thinks cascading Bank Runs are more than possible and is now going to start building a home on the 34 acres (he was at the second gate to meet the builder) and after it is complete then sell his home in the burbs of the local blue bubble. He is obviously wealthy…but personally I am surprised he has waited so long.

I think soon we all will be in a different reality…and a lot of Americans are about to get punched in MOUTH! (So much for their fight plan).

There is not one honest or moral element in the entire banking system. It is just a Rube Goldberg system of Rube Goldberg systems to obfuscate that it is nothing more than thievery and usury.

Don’t forget “fractional reserves” .

“… and I continue to be unknown in 2023.”

Maybe that’s not such a bad thing. Is Bannon out of prison yet?

Great article.

QE and hyperinflation it will be.

The stimulus checks to buy you off will be for $5,000/ head this go round.

It is not better because apparently the regulators are charter members of Clownfaggotworld. SVB had only one person with a finance background on their board. The other directors at this “Democrat Party ATM” were High Dollar Dem contributors or ex officials from the Clinton and Obama regimes. Some of these doorknobs sat on other bank boards like Signature which went pfffft on Sunday and cross pollinated others as well. Virtually all of SVB’s accounts were not insured whereas the majority of accounts are normally insured at most banks.

These big shot Masters of the Universe/Smartest guys in the room should eat the losses. If they were “qualified” to be on the board they must accept the results of their own actions.

No to belabor the most important point, but I shall. The end result of the insane credit expansion of zero rates that empoverished the poor and other savers that didn’t invest in stocks is massive inflation. And its MUCH higher than that 6% number. If it was actually 6% we would not be on verge of a banking collapse. My guess is that they will choose the inflation collapse scenario while of course lying even more about it to further kick the can. That means rate pause (not lowering) to let the still overpriced stock market fall on its own another 25%. Then they decide again what to do. Of course, I could be wrong.

One additional little gem. The shithead Powell does not have a financial background either. He was an a attorney who got whisked into bureaucracies and wound up in charge of the FED.

If it can only be understood by wizards in robes, it is a scam to begin with.

They are in thrall to the “PhD Standard.” Those saying it means “Piled high & Deep” are on to something. I have no doubt the people posting here could do a better and certainly more thoughtful and honest job than any of these “lettered” people.

Now you are onto something.

Here is a little Gem.

A lesson on Numerology from Christine Lagarde.

Simple and short. If all your assets are denominated in any fiat currency you will be wiped out. Got GOLD & SILVER?

Burn those fuckers down and let it all collapse.

Zombie banks need a bullet in the brain and that is that.

Privatize the profits and publicize the losses.

2008 should have started us on a revolt, but nothing. Here we are again because of crony socialism violating every tenet of free market operation.

Jump you fuckers.

ZFG, out.

P.S. invest in lead, copper, steel and aluminum…. bullets and guns my friends. Those two items never lose value….even a HiPoint has value when no one else has a smoke wagon.

It was over a long time ago for me. Still…this is one that needs to go wide and deep.

Spread the word.

LIBOR ends in June, we don’t have long to wait.

Lynette Zang says they have to have a crisis before then.

Admin :

1) of course you were/are right. I never doubted it.

2) that people watch the smoke and mirrors instead of understanding what is right in front of them is amazing. And then they howl down truthsayers as being the deluded ones.

I have a neighbor that is reliant on getting a govt pension. He flatly states that his money is secure forever. I said umm, righto. I pointed out that the state we live in is racking up huge debt and is running a huge deficit each year. And perhaps that bodes poorly in the long term for unfounded liability? And that guaranteed pensions were being shown not to be so guaranteed worldwide in such situations. And oh, as that pension isn’t indexed to inflation, how might that affect his plans over day 30 years in retirement? His mouth hung open and a small glimmer of a lightbulb began to light up.

3) I have pointed out time and again that the US has been living far beyond its means, and that the “middle class” lifestyle so cherished by TBPers HAS to fall by around 35%. It simply has to – it cannot be funded by debt forever. I have pointed out that 5% of the world’s population cannot continue to consume 25% of the world’s resources. I have pointed out that manufacturing jobs are never coming back – never. I have pointed out that the unique opportunity that occurred after WW2 has been squandered, and that the US spent its wealth instead of invested it.

And I was howled down and abused by those that want to believe that the US middle class lifestyle that has only existed for a blip in time is sustainable if only x,y or z is done, which entirely ignores the $200 trillion in debt and unfunded liabilities – there is no magic wand waving that away.

The US – hell the entire western world – has indebted itself. It has abandoned work ethic, family, thrift, education, culture, common sense and has become reliant on welfare and government handouts. It will end poorly.

Thanks Admin for again pointing out reality. I expect there will still be resistance to the truth as convincing unprepared people that their lifestyle is about to change is nigh on impossible. Many will bury their heads deeper in the sand. TBPers are generally awake, as opposed to woke, but many will be hit in times to come. It is impossible to know where this is going to finish.

But on a positive note – the next years will offer the greatest opportunity for success for those young people that have an understanding of the fundamentals of family, hard work, thrift, skills and education as has occurred in generations. The competition is so poor and unprepared that those who are ready will reap the benefits, and the rest the whirlwind.

“The US – hell the entire western world – has indebted itself. It has abandoned work ethic, family, thrift, education, culture, common sense and has become reliant on welfare and government handouts.”

Could there be any doubt about this?

Yep, an important point. I’m not letting the scummy pols and banksters off the hook, but WE have to take a lot of the blame too. We lived way beyond our means, and no-one started complaining until interest rates began to creep up.

Nope.

As usual, we are in complete agreement about what has happened to our world.

Interesting tidbit to my article. I thought these unrealized losses were only centered in banks. I was talking to the Treasurer of my institution today and he revealed he has $5M of unrealized losses in his investment portfolio due to the rise in interest rates. I now realize there are hundreds of billions of unrealized losses in corporations all over the world. This is a ticking time bomb.

Admin – your ability to see this stuff is top notch – none better. It is amazing your followers are not in the tens of millions.

I am of course concerned about having cash in banks. I need to spread it around better than I have. I have taken some losses – but nowhere near what your Treasurer has. I do have enough in convertible property to be fine if it comes to an enormous crunch. I do recommend people have hard assets – being overloaded in cash is risky. Re stocks, I am able to sit for the long run, so am not panicking but maybe should.

Most folks are going to find it very difficult. Those that understand the fundamentals will do well. Those that think that the govt gravy train will last forever and are dependent on it will do poorly. I suspect those who are going to do poorly will be the vast majority. Having followed the progress of your family these many years, I have no doubt that it will thrive in hard times.

Thanks again.

Maybe I should go ahead and invest in that stock trailer and manure spreader. Are those what you mean by hard assets?

That’s the issue, really. It is either blow up the bond market or lose the dollar.

I don’t think there is a way through this…but I do think Powell/Dimon are trying. Not that they’re suddenly whitehats, but simply out of self-preservation and a strong desire to crush the Eurodollar system and bankrupt Davos in the process.

Yeah. And we’re ALL about to experience some macro to micro trickle down.

They’ll tell you it’s raining while they piss down your back.

Wait for it.

llpoh,

regarding your last paragraph about opportunity 4 young people who r prepared, will we come out of the other side of this as an intact nation?

if no,what language will we be subservient to?

Tred- Loop will be subservient to the folks that speak Chinese. 🙂

All your money are berong to us Loopy.

Ingrish.

Personally I don’t see any occupying country taking over places like the US, canukistan, australia. The occupying force would have to be VERY large and administering even a small country like Afghanistan was not possible in the long run. To costly in blood and treasure.

Imo, when it collapses, the people will build up around themselves and a new form of govt will grow into it. Then it will simply start the repeat cycle all over again. We never learn from history.

Well give government less powers and money to work with. Outside defense and defending the free economy is it’s only reason for existence . We’d have less problems.

Spanish of the Mexican variety if I were to guess.

I keep telling my kids to learn skills separate from technology. Learn how to use tools, fix things and garden. Those will provide confidence, besides getting their faces away from screens.

I think it is true that the American middle class lifestyle is funded on the backs of global theft and usury, and so it is not sustainable. I think a lot of people see that, just not a big percentage.

The natural wealth the country possesses could support high living for the majority, but not with any paradigm they are used to. It would require real productive labor from that same majority.

What I’ve learned is that ultimately, fiat is satanic.

It’s even worse than satanic; it’s worthless

Indeed Steve.

Yup.

The toxic assets are US Government bonds this time, not mortgages.

Which is fucking scary, because Gubmint bonds are supposed to be as safe as it gets.

Nothing from nothing means nothing, you gotta have something, if you wanna be wit me….

The Israelis got theirs out:

https://www.newswars.com/israeli-banks-transferred-1-billion-out-of-svb-before-collapse/

They got some of it out. The banks set up crisis centers working around the clock helping their clients move money. Not for nothing though – the Israeli banks got the deposits. Tens and tens of billions of funds managed to be withdrawn. Interesting that the Israelis that got one billion out get all the attention by some factions, no?

Christian catholics, evangelicals,and southern baptists love to be apologists for the satanic Zionists in Izrahell. Wonder what their excuses for this latest betrayal will be?

You probably listen to John Hagee often? Kidding. 🙂

🤣🤣, God I hate Hagee, gives John a bad name.🤣

Great article. So here’s the question – if I want to take cash out of a big bank, where does it go? I thought about my brokerage account, just leaving it in cash there, as that’s insured by SIPC (is it though?). Thought about spreading it around to a few smaller banks/credit unions, just not sure if that’s really any better. To be clear, the amount is below the $250K limit, for whatever good that insurance does.

No, I’m not going to buy more ammo. No, I’m not going to go out and buy gold/silver. I have no more room under my mattress or in my couch cushions. I’m thinking about practical short-term solutions. As a lurker here forever I know this group has the answers. Any thoughts?

Harry – https://www.treasurydirect.gov/ 90 day bills pay 4.5%. This is the safest place to store your fiat. If you have excess, and already have your house paid off, solar panels, preps etc., paradoxically treasury direct is the safest.

If US gov defaults it’s all Mad Max any way; no SS or medicare, no .guv pensions, no IRS, no Mortgage payments, nothing. We’ll be on our own, with what you have in your hands and underfoot. So as long as the system is alive, this is it.

Buy another deep freezer, Harry.

Buy unimproved land cash and rent it to a farmer for the taxes.

Sounds great . Then the farmer has an accident around the combine severing a leg and sues you the land owner. Better have that liability insurance, it’s not terribly expensive.

Jim Quinn is a legend. Unfortunately for all of us such legends are not to be seen or heard in the current state of the system of finance. A lesser man would have given up long ago but our Admin has been pushing truth for almost two decades. Perhaps the truth will out the lies and perpetrators or the system will collapse but either way we here at TBP have been given a front row seat in this fourth turning.

Read that again…60%!!!!!!!

Well, that is interesting and all, but it is unlikely that those “losses” will ever crystallize so long as the bank stays solvent until the bonds mature, when poof all the losses evaporate into nothing. Based on the chart, the treasuries/bonds have dropped by around 25%, because as follows:

The BoA buys a 10 year treasury for $100 at 0.1% interest. Rates immediately go up to say 5%. People are unwilling to pay $100 for something that pays 0.1% interest when they can pay $100 to the government and get 5% interest. Maybe they would only pay you $80 or $60 for it at that low interest rate, depending on time to maturity.

But here is the deal. Over time, whatever they will be willing to pay increases, assuming that the interests rates remain unchanged.

At the end of ten years, the original $100 treasury will be worth ……. $100.

So the unrealised losses disappear over time, and the only way those losses crystallise s if the bank has to sell the treasuries now. Otherwise in time, all the unrealised losses disappear entirely as the treasuries mature. And per the chart, they are intended to be held to maturity.

I agree with your assessment, as long as they can wait until maturity. But if they are forced to sell due to liquidity needs (SVB, Signature) then the losses become realized. If we go into a deep recession, all the banks and corporations with these bonds may have to sell to meet liquidity needs. That would devastate their results and their stocks would crater. This could all result in a downward spiral across the world. I’m such an optimist early in the morning.

That is indeed the issue. If they have to dump the treasuries, and burn the cash, real losses incur.

Here is a little known fact by most. The treasuries they bought have cratered for the moment. If however they sell those cratered treasuries at a loss today, and buy new treasuries, they in fact will be at the exact same financial situation at the date the old treasuries were to have matured, assuming no further interest rate changes, allowing for interest earned. That is how treasuries are valued at any point in time. New treasuries cost = old treasuries cost +/- the interest accumulation differences.

So as Admin says, the issue really only occurs if the bank craters to such an extent that they have to not only sell the treasuries, but also spend the money to pay out creditors. Otherwise it is pretty much a wash over time.

So, is gold a bargain now?

Food definitely still is!

Gold is undervalued and your only way to maintain/preserve your wealth. Nothing in this banking system is safe, you must move your wealth outside of this system or you will lose it. Debating this scenario or that scenario about banks is irrelevant.

EDIT: NO MATTER what, the CBDC is on the horizon and you should commit to holding your money outside that digital system without fail.

banks, money, stocks, bonds, its all going down, all of it.

For the average Joe, yes. The .0001% will be made whole per usual.

Not going down, just transitioning……

Not transitioning as much as reset to zero starting a new sting operation for 100 years. …..suckers! 🙂

Joe,

The key to BL’s answer is the word ‘WEALTH’…if you don’t have real wealth SILVER is the wisest choice, and has more upside potential, plus less risk of a government grab.

Babble is right too!

Mark- Future wealth will be measured by how well a person can avoid the system. if we use PM’s to get goods and services outside the government funny money will be a true exchange of wealth. So ,does that mean the folks with the chip in the palm of their hand is getting less? I believe the restrictions with digital currency will define what you buy, when and where. Private exchange is limited also with the exception that another individual won’t bust your balls to worship Satan or limit your diet or force you to get Big Pharma injections.

Will TPTB take back money from your account if you don’t toe the line? I think so. I don’t view that as wealth, more like a controlled script from the company store like the minors dealt with back in the day.

BL,

I was talking about Joe’s ‘current Wealth’ that I have no knowledge about.

Both Gold and Silver have their place…I just meant if you don’t have wealth…stick with Silver.

But…depending both have their place.

They can take their digital CBDC and all the control that will have and shove them were the sun don’t shine…

The kicked can approaches the brick wall at the end of the road.

And they will do what has always been done: They will print. They will print, print, print. They will print like there’s no tomorrow. They will print to oblivion.

And every dollar is debt; another brick in the wall. So get off the road and go back to the old. Trade paper for silver and bytes for gold.

Mark of the Beast in 3 . . 2 . . 1 . .

https://www.federalreserve.gov/newsevents/pressreleases/other20230315a.htm

This is just the latest form of tyranny to have to be fought against. Nothing special about it ,technology is just better now that tyrants don’t have to work so hard at expanding tyrrany over the planet. If that technology went bye bye it wouldn’t be so easy.

Can you imagine the EU that had negative interest rates for so long . They have raging inflation and the Banks, ALL the banks have massive losses that are not yet marked to Market. This is why they will print fake money and paper over the leaks. If Credit Suisse had anything on its books that was of any quality other than one side use toilet paper they would not have a share price equal to Half a Mickey Dee’s small fries packet.

It is not even remotely possible to say this is saved, it is a raging inferno hidden to the poor Taxpayer.

I am shocked a press release and some jawboning has not fixed things yet ……

Breaking Market News

@financialjuice

SWISS CABINET TO HOLD EXTRAORDINARY MEETING TO TALK ABOUT CREDIT SUISSE – MEDIA REPORTS.

Admin, your article is pinned at the top of Zerohedge this morning!

I owe ZH a lot for the modest success of TBP. They have posted every article I’ve written since we both started in 2009.

Maybe I missed it in the past but this is the first time I’ve seen one pinned at the top.

Maybe a couple times in the last 14 years.

I re read the article, and couldn’t help but think to myself how amazingly scripted life is. It feels like were almost to the end of the VHS tape. Not only is what is coming already planned. It feels like it was scripted a long long time ago. Jim calls this the fourth turning. Sure every story has a beginning, the main plot, the twist, and then the end. And we are surely near the end. So what happens after this apocalypse? After the dust settles, do preppers, and believers hope to march forth and start all over again? Once this collapse gets underway, and it already is, the environmental toll it will take on the planet will surely only have space for very few to exist. There will be no Utopia or Cube or Split Society. It isn’t only Banks that sitting on losses, massive losses. The soil and air and water are inundated with bad loans made from years ago. Heat from nuclear plants is pumped into Oceans, Lakes and Rivers. The air is also a dumping ground for all sorts of pollutants. Whether they are dropped from airplanes, or thrown upwards by “controlled burns” . Klaus Schwab tells us we will eat ze bugs, but we along with all the other life forms on this planet we are already eating plastic. Breathing plastic, expelling plastic. The Megadeath is already happening with bug populations down almost 75% from normal. Animal Populations are down by 70%. These species have been absolutely devastated. Our bad loans are piling up and the losses are real. Microplastics alone will take thousands of years to degrade. It is just plastic right? Tell that to residents of Ohio. Even the air will take more than just money printing to come back. Oxygen in the atmosphere is mainly produced by plankton. But these have been decimated, and will not be coming back en masse. City planners are helping to cut down as many trees as possible, and forests are not healthy at all and are declining. With nothing left to kill, we already well into the process of killing the children. Drugging them instead of educating them. Sexualizing them instead moralizing them. We have even found new ways to cause Turbo Cancer, CJD, Heart attacks with our new high tech mRna. Tesla’s are supposedly environmentally friendly, but you can’t get one with a roll down window. No instead it is electric, and you can use a cellphone app to roll it up or down, or use the buttons. How cool is that? It is not, it is so stupid. A roll up window would be much environmentally friendly. The Environment of the planet will not be saved by technology. At most extended and pretended. All of the bad loans we whispered to the planet are collapsing life as we know it. Oxygen, Animals, Plants, Habitats and Humanity have been borrowed against to extinction. But has anyone changed their personal life? Not one bit. Garbage bins are full every week. Hauled of to pollute someone or something elses backyard. Electricity waste is even higher, Teslas burn Electricity just sitting there. 365 daily newspapers that are easily recycled are gone replaced by a new Toxic Phone Every year. Backyards filled with plastic crap to sit on and Astro turf instead of just the ground. Our friends the bugs, the birds, the wild horses etc, are collapsing faster than our banks. But no one thinks they matter. “Oh no! I might lose some money, what will we do?” These people take action fast, they call up the silver and gold guys. They run to the ATM and try save as many bills for themselves as possible. They jump up and move large sums from here to there and everywhere. They monitor EFlyers for deals to stave of the dreaded inflation. They carry points cards for every store to caress and hold 1 or 2 % cashback. They worry and obsess about money, cars, technology, even the kids to the point of sexualizing them and preying on them. It is downright sickening. Who cares about money? You can’t take it with you. Most just use it to destroy our wildlife friends, and feel proud throwing out a working ICE car to get an environmentally crippling Electric car. Hoarding the cash so that they can continue to buy Chinese crap and throw it in a landfill. Their only care in life is money. They won’t run or jump or monitor or even watch the nature show outside. They watch pure garbage like Kevin O’Leary on Sharks Den, and try emulate being the most cold hearted, environment trashing, wildlife murdering thug like it is the only goal of their life. People are worried about the banks collapsing, why is nobody at all helping the wildlife? Humans are the elephant on the planet stomping on it with rehypothecated plastic boots with a logo that says they are valuable. There will be no “getting to the other side” or “Surviving by prepping”. At the end of this short Fourth Turning will be an interlude of Millenia. That is how long it will take the Earth to absorb and work though all of our bad loans, busted fuel pools, dioxin farms, and oxgyenless air. Then we can Rewind the VHS tape of life and do it all over again. We will be starting over from some point. Where, When, Who knows….. But it won’t be the first or the last time. We are Human after all. Stuck doing evil over and over and over again. I guess that is fine for most as long as they get paid.

I went over the one hour mark while editing it, so it’ll just have to stand as is….

@Admin Congrats on top billing over at Zerohedge.

Of course the money is safe. But the fear in people that it won’t, will be used against them to roll into a new system. “You won’t lose any money, just sign up for Digital IDS and CBDCs, oh don’t forget your money will only be healthy and safe if you stay up to date on your vaccines.”

People will do anything for money.

Hey Jim

I read your article on ZH today. Very prescient and timely. This fourth turning stuff can be a bitch and all I can do is….

look squirrel!

Top headline on ZH. Good for you Jim… Chip

Comment on ZH

Banks are failing because:

1. During COVID Fed reduced reserve requirements to 0% where they remain

2. When 30 year rates increase by 3%, 30 year bonds lose over 50% in value if unhedged.

Total US deposits are $23T across 4800 banks, FDIC covers maybe 5% of them. That leaves over $20T of uninsured deposits. The Fed’s balance sheet would need to triple to cover all deposits.

When you put propeller heads in charge of money, you get smoked.

As a side note, there were 5,500 banks when I wrote my 2008 article.

That ZH comment should light up like neon to everyone with half a brain cell left. There is no way to save this system if it starts to collapse.

2008 was a bank bailout, this will be a bailout of private equity. that is the difference.

It will be a split. Countries using IMF/UN/WEF Bonds, Citizens using CBDCs.

When I try to tell anyone that, they think I’m smoking crack.

Me to, sent the news articles around.

To my knowledge the reserve requirement has never been zero in the US until 2020. In normal times (which are long since past) that would imply license for banks to use maximum leverage in their investments, though the bank is free to set its own policy as far as aggressiveness (or foolishness?) of their loan operations. Thinking about it, though, a zero reserve requirement may be offset by newer facilities central banks have made available to the perpetually weak banks that allow them to not go under.

Investopedia has a chart of reserve requirements in effect in about 40 or 50 countries-more than a few have no reserve requirement.

Seems reasonable that the prevalence of bank compensation schemes that rely heavily on annual bonuses coupled with sometimes or often weak internal oversight are the perfect recipe for financial mayhem.

@bonker_99

#JPMorgan #JPM loading physical #Gold in a very big way today

‘ Remain Calm …. All is well ! ‘

@Fxhedgers