Authored by Charles Hugh Smith via OfTwoMinds blog,

In a real recession, what seemed safe and rock-solid melts into air.

We haven’t had a real recession in forty years (1981-82) and so only those who were in the workforce back then have any experience of how far and how fast things we think are solid can unravel. What’s a real recession? In the most basic terms, a real recession is an organic, i.e. unmanipulated by central banks, completion of the credit cycle, also known as the business cycle.

The credit / business cycle is intuitively easy to understand. When the cost of borrowing money (a.k.a. the cost of capital) declines and credit standards loosen so more enterprises and households can qualify for loans, the incentives to borrow and spend / expand increase. Lenders start making more money because they’re lending more, and borrowers expand their enterprise, buy assets such as bigger homes and retailers sell more goods and services to borrowers who can now access new sources of credit–home equity lines of credit, higher credit card limits, etc.

All of this credit expansion is self-reinforcing. Free-spending consumers boost sales and profits, lenders are expanding as borrowing soars, enterprises expand to meet new demand, and so on.

Then diminishing returns set in. To maintain the gushing river of profits from expanding credit, lenders loosen standards to the point that marginal enterprises, speculations and households all have access to low-cost credit. Since asset prices skyrocketed as credit pushed demand higher, new investments are increasingly at risk of becoming unprofitable. Those who overborrowed are increasingly at risk of defaulting should their income slip even slightly.

Eventually, those who were poor credit risks to start with overborrow and invest in marginal speculations that collapse. These marginal borrowers default, and eventually lenders are forced by the losses to tighten lending standards. This reduces the number of people who qualify for additional credit, and the credit river dwindles to a rivulet.

The wealthy who can still borrow have no desire to add more debt, and those desperate to borrow more no longer qualify to add more debt. (If you’re old enough, you might have heard the expression “Prove you don’t need the money and then the bank will lend it to you.”)

The self-reinforcing expansive cycle turns to self-reinforcing contraction. Lending, consumption, investment and speculation all drop, reinforcing the contraction, a.k.a. recession.

The organic credit cycle is self-clearing: the analogy of the forest fire is apt. All the dead wood of marginal loans and speculations are consumed–that is, marginal debtors default and unpayable debt is written down as losses–and this destruction of bad debt is necessary to clear the financial system and economy for the next growth cycle.

The Federal Reserve has unleashed floods of “free money” every time the credit cycle started its cleansing phase for the past three decades, effectively eliminating the essential writedowns of bad debt and the tightening of credit that set the stage for organic growth, i.e. growth that isn’t the result of stimulus extremes such as Zero Interest rate Policy (ZIRP).

Now four dynamics will usher in the long-suppressed real recession conflagration:

1. Diminishing returns on fiscal and monetary stimulus and the easing of credit. Every cycle of Fed largesse yields weaker, narrower growth and exacerbates wealth-income inequality.

2. Inflation is sticky due to fundamental scarcities and structural changes in the global economy. The global economy, demographics and the cost of capital have all changed. Locking interest rates at zero for another 15 years is no longer a viable “fix.”

3. Higher interest rates undermine speculation and the asset-bubble dependent economy. Since rates can’t be locked down at zero, a truly stupendous quantity of speculative skims and scams are no longer low-risk or profitable. As these skims and scams unravel or go belly-up, they self-reinforce the decay and collapse of all other debt-based skims and scams.

4. Cheap credit has raised costs. High fixed costs push households, enterprises and governments into insolvency. When credit is abundant and cheap, there’s little pushback against higher prices: just borrow more. Once credit contracts and the cost rises, borrowing more is no longer an option. The only remaining option is default and insolvency on a mass scale.

As I noted last week, our collective response is now limited to either 1. complacency / denial or 2. panic. We’re still anchored in complacency / denial, but the phase shift to panic is just around the next corner.

In a real recession, growth doesn’t dip slightly for a few months. It drops for years. In a real recession, employment doesn’t dip for a quarter or two, it plummets hard and keeps dropping, quarter after quarter. In a real recession, borrowing doesn’t dip for a quarter, it goes downhill for years. In a real recession, spending and consumption don’t dip for a few months, they fall off a cliff and then stumble further down the ravine.

In a real recession, the Fed’s tricks no longer work. Fiscal stimulus is limited by the overborrowing of the previous decades of inorganic (i.e. credit-dependent) “growth.”

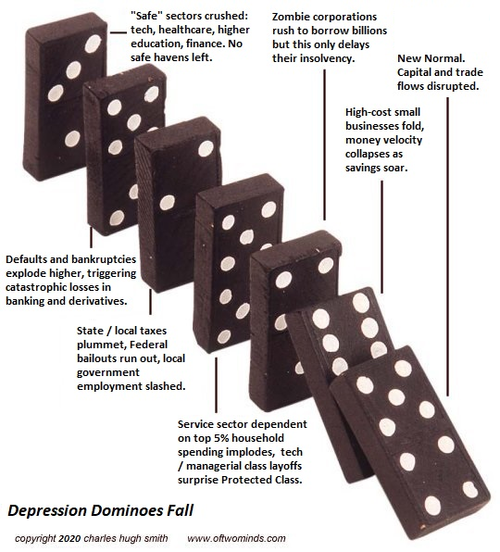

In a real recession, the dominoes fall regardless of what policy tweaks are rushed into place. This is what happens when you let the dead wood and risk pile up. Eventually you can no longer suppress the conflagration.

In a real recession, what seemed safe and rock-solid melts into air. Jobs, income, tax revenues and much else that sre seen as utterly dependable will evaporate. One week your bosses tell you how much they love your work and the next week you’re cashiered or the whole business is shuttered. Assets that “never go down” don’t just go down, they fall in half. And so on.

The solution for households and small enterprise is to change course now and seek to reduce risk and exposure to conflagration. I call this process improving our Self-Reliance.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

No recession in Mordor.

The Cantillon Effect:

https://petersainsbury.medium.com/what-is-the-cantillon-effect-7ed26a7709c9

The Greedy Evil Bastards closest to the monetary printing press are the last to feel any negative effects from all the imaginary money.

As if there is not enough gloom and doom governments are said to be facing pension shortages. That’s gone on for a long time of course. Good ol taxpayers will step up to the plate, eh?

Off topic, I paid insurance premiums today. Sometimes I wonder if not carrying insurance is the way to go. To hell if peeps are killed as a result of an auto accident involving me vehicle. What are “they” going to do? Squeeze blood out of a turnip? But maybe one ends up in a lawsuit “forced” to sell their home, their “assets” etc. Don’t know that is possible. Who knows though in a crazy world of litigation. Auto and homeowners insurance is UP 40-49% on average in Texas from policies in 2022. Each year I waste my time checking with other agencies and comparing policies because each year my rates go UP. And not as a result of filing claims or having accidents. One time I filed a claim when my wife ran over a light standard. 10MPH max making a turn from a dead stop and insurance totaled the PU.

In Texas the minimum liability required by man’s law is 30/60/25. 25 property damage for each accident. So if one happens to total someone’s 100k vehicle, where does the other 75k come from? How about one takes it from the “life long” savings. Anyway, someone may have a different perspective. I raised to the next level for $40 more for the year on two vehicles to 50/100/50 I believe the numbers. Texas is not a “no fault” state on auto accidents and in Texas people do be sue happy.

Enough rant. I know a man that thinks there should be no insurance required for auto liability. You know, run into a 100k vehicle and “we” all make it “right”. Sure. That is a rather humorous “world view”. The Bible says to take one’s grievances to his/her Brother i.e. avoid lawsuits. I like that idea. However…

On the subject of government pensions, what can I say, what can anyone say, government to too big. I’ve listened to Republicans for at least 50 years since I first made the mistake of listening to any of the scoundrels and even voted for Republicans that include “smaller government” in their campaign platforms. LMAO, good luck with that, hoodwinked.

BTW, I despise the system as much as anyone.

Ins rates going up to cover vax injuries at least.

My advice? Get very very skinny. Shed,shed,shed some more.

Uhhh, it’s like vehicles are skinny as they can be here.

Pay UP.

Texas is awesome for no income tax, but yes the insurance costs of everything is killing the bank account. Also liberals, Texas sucks and you shouldn’t come here

I started reading the article but paused to comment.

Every time the 81-82 recession is brought up I gotta laugh. I’ve always been self employed and in 81 I bought a boat. I never knew there was a recession in those years until they kept referring to it or comparing it to other recessions.

If you were in the oil industry you felt it.

+ 1,000, Joe. I’m sure you remember Penn Square Bank and the drive in loan window.

Had a house in OKC that we paid $81K for in early ’81 and it appraised for $45K in ’84. It ended up selling in foreclosure for $39K in ’86.

Oh yes, I remember.

’86 rings a bell. The Keating Five comes to mind, Alan Cranston (Democrat of California), Dennis DeConcini (Democrat of Arizona), John Glenn (Democrat of Ohio), John McCain (Republican of Arizona), and Donald W. Riegle, Jr. (Democrat of Michigan) and the impact in Texas.

At the time home construction and retail construction were blowing through the roof in DFW. Working in the land survey industry I remember well the “layoffs” and the people I knew that wanted to continue working in that industry but Texas could no longer provide the jobs. Friends I had worked with moved to the NE part of the country as the dupe had not quite caught up with some areas in the NE. One friend did well for about a year then, sorry, you are duped, we are going to have to let you go.

I was a life long Okie and was given the choice to transfer to Memphrica or go on unemployment. I chose the former and ended up with a great company for the last 24 years of my career.

Mom was working at Shell Corporate in Houston at that time. I remember a number of folks saying that Houston wasn’t in a recession it was in a depression.

Could have been in the repossession business. Sometimes what happens. Others misfortunes become someone’s treasure chest.

It’s been 96 years since the Great Depression, maybe Joe can accomplish another depression before the 100 year anniversary?

I’m thinking Trump will save US?

It’s all about what “they” say, don’t you know?

Nah, the die has been cast, there is no stopping it now. The Democrats would love it to take two more years so Trump would be in office and they could blame the economic collapse on him instead of Biden, but I don’t think it will take that long. Of course they will try to blame it on the Republican House, never on Biden’s bad policies.

Biden’s a prick but yeah when Trump had the government trifecta “policies” were freaking great, eh? How about a shot of jabola ? Anyone?

115th United States Congress

“Are You Ready For A Real Recession?”

I wonder,if I answer no will that put it off till I am ready……,asking for a friend!

These kinder eggs are banned in the usausa. I remember some years ago actually being asked at the border if we had any of these in our ‘care’ package when going down to commiefornia to visit the son. Priorities you know.

Everybody has a plan until they get hit in the mouth.

almost. had planned on it by now but settling my vexxed dad’s and brother’s estates in PA. takes years. that county does not do autopsies unless a violent death is suspected.

Not looking forward to this, most direct inlaws and a few family “vacced” hope they got the saline versions

Yeah buddy, borrow oneself into oblivion. Hey no problem, Joe Taxpayer is glad to bail your sorry butt out. THAT is how it works.