Guest Post by Alex Berenson

Do we really have no hangover after the largest economic orgy in history – more than $10 trillion in fiscal and monetary stimulus in 2020 and 2021? The charts below suggest we’re still just drunk.

The inflation crisis is over.

Or is it?

This morning a reader sent along an interesting analysis of Thursday’s supposedly positive inflation report showing that prices in July rose 3.2 percent annually – and an even more interesting chart.

First a little background. That 3.2 percent number is “headline” or overall inflation. That headline annual figure peaked at 9.1 percent in June 2022 and has since fallen sharply. Thus the growing consensus that inflation is back in check.

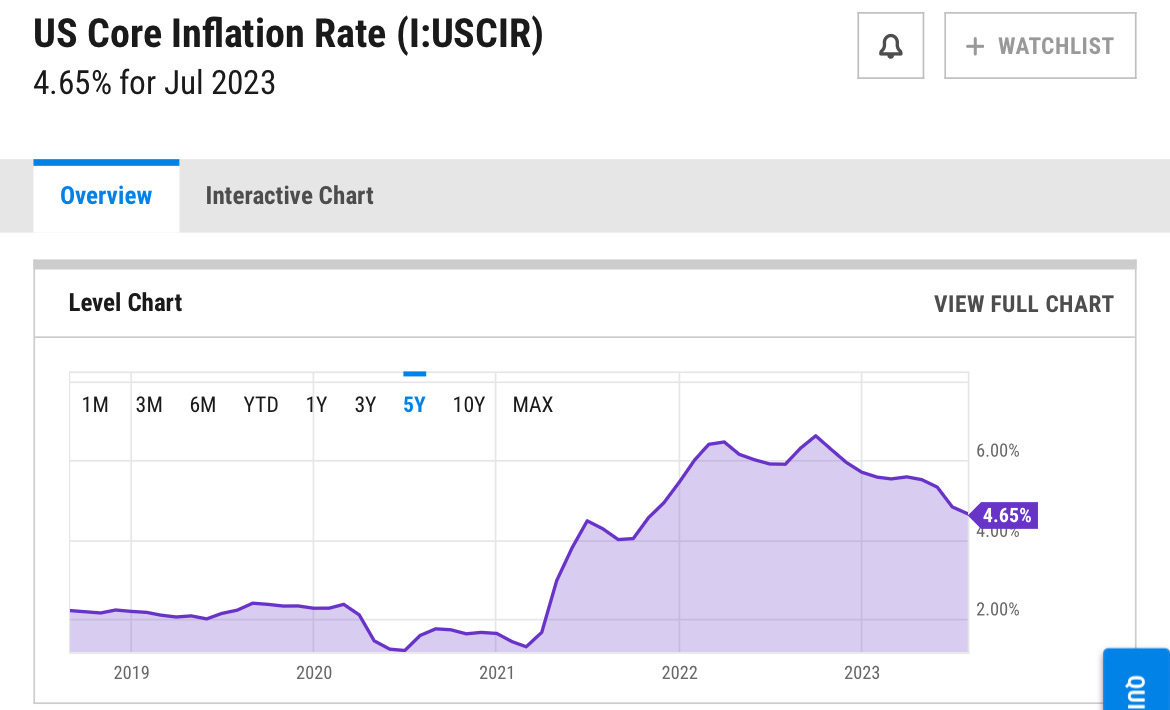

But the “core” inflation rate tells a less optimistic story than the headline number. Unlike overall inflation, the core inflation rate excludes changes in food and energy prices, which can move quickly. It is less volatile than the overall inflation rate. This chart (not the one from the reader, wait for that) shows core inflation since 2018:

—

As you can see, core inflation soared in 2021, following the passage in March 2021 of a $2 trillion Democratic Covid spending bill. The connection is stunningly clear – links in economics are rarely this obvious.

Core inflation peaked in late 2022 following another massive stimulus package, which Democrats initially referred to as “Build Back Better” but then rebranded the “Inflation Reduction Act,” a masterwork of cynicism even by Washington standards. Since then it has slowly come down, as the Federal Reserve has sharply raised interest rates to slow the economy.

Still, more than two years after taking off, core inflation remains far above the 2 percent annual level that the Fed and many economists view as the ideal long-term target. At 2 percent a year, inflation is low enough that most consumers will not notice it, but still far enough above zero to provide room to avoid deflation in the case of unexpected economic shocks.

(Policymakers dislike deflation because it can be hard to reverse. If money itself seems to be getting more valuable over time, people may take their assets out of the financial system and hold them in cash or gold, as well as delay purchases on the theory that they will be able to buy products more cheaply in the future. Companies may decide to delay hiring for the same reason. Central banks do not have great levers to reverse those decisions. Thus deflation can by itself harm an economy, as Japan has seen for much of the last 30 years. Low but stable inflation is preferred.)

Of course, Biden’s media cheerleaders, who wouldn’t even admit inflation was even an issue until it the headline number approached 10 percent annually, now say prices are under control. Yes, overall annual inflation is only about 3 percent now. But that’s because food and energy prices rose so much in 2021 and early 2022 and have come back down since.

The “headline” number exaggerates the trends on the way up and the way down. In fact, core inflation is still at almost 5 percent. And the longer it stays at that levels, the more people will expect it to go on and demand big wage increases to meet it.

In a tight labor market, companies won’t have much choice but to meet those demands. Then they have to raise prices to cover their increased costs. Seeing those increased prices, workers will demand more wage increases, and companies will agree – like the deal the Teamsters union reached with UPS last week, which increases the top compensation for drivers to $170,000 a year and offers part-timers a minimum of almost $26 an hour.

Economists call this a “wage-price spiral.” Once it happens in earnest it cannot be stopped until the labor market loosens up and employees have to fear for their jobs – that is, until the economy slows and unemployment rises.

Ultimately, this pattern is why inflation is so problematic. It is addictive, and breaking the addiction means damaging the economy.

Now to this morning’s email and chart:

Food prices heading back up, energy heading back up, wages up (and likely to get worse post the UPS deal as others will likely have to follow – seems like a classic wage price spiral), producer prices back up (+0.3% MoM – biggest jump since Jan 2023), and somehow inflation has been slayed? We will see, hopefully we don’t find out the hard way…

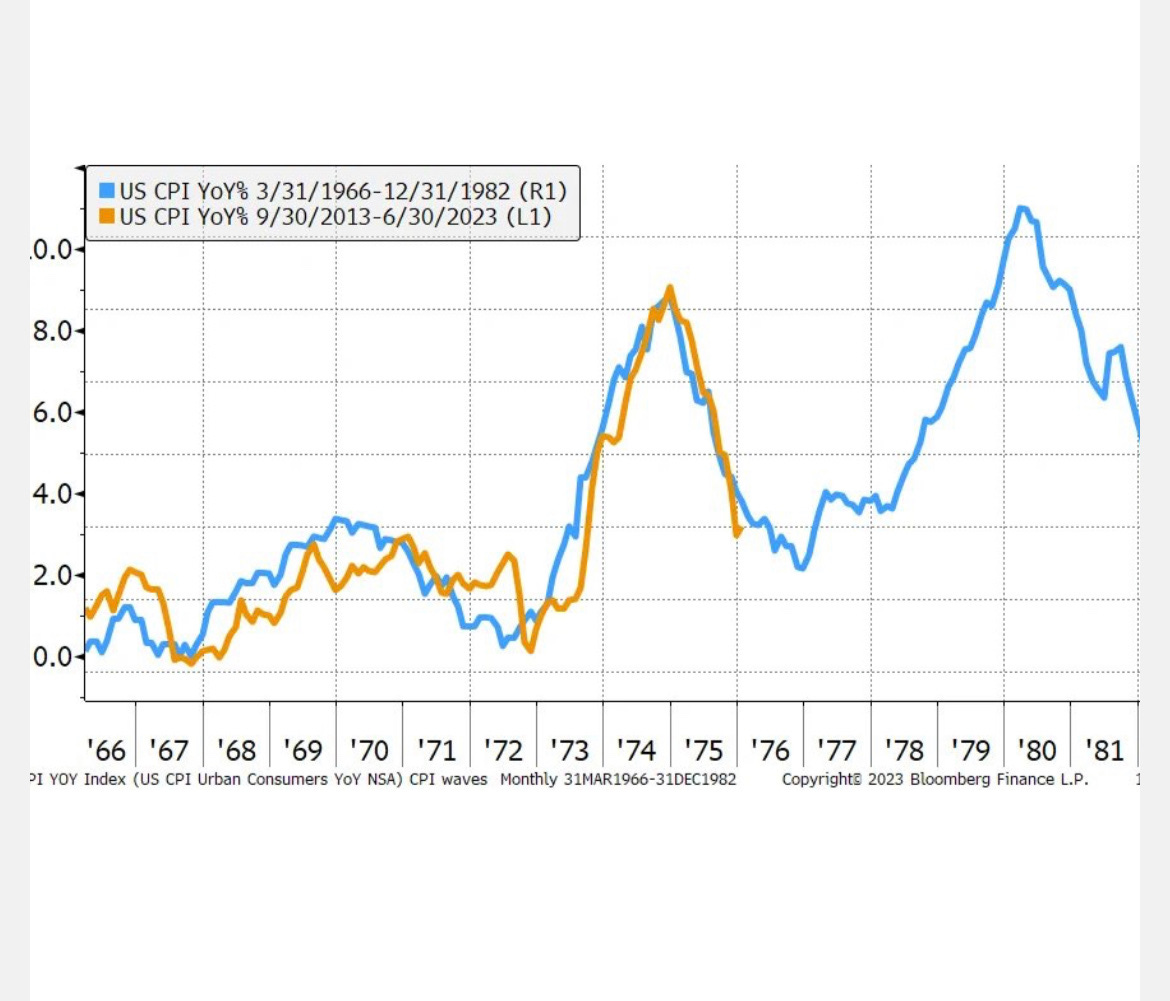

Chart below shows the pattern in the 1970’s, overlayed with what is going on now. Same pattern. An apparent lessening in inflation, which is largely due to base effects and policy gimmicks, without solving the underlying problem, so inflation came right back (it really never left, the base effect just masked it). Everything about policy now remains inflationary, including the amount of government spending and other policy which just increases price…

—

(And, finally, the chart: The yellow line is overall annual inflation since 2013; the blue line is overall annual inflation between 1966 and 1982, the last time inflation was a problem in the United States. History doesn’t repeat itself, but we’ll see if it rhymes.)

—

With respect to energy, now that oil and gas are starting to become a problem again… all the sudden we get the Iran deal yesterday, the entirety of which seems quite odd.

Maybe I am just too cynical in my old age, but it seems this is just one more thing that is more about political expediency than it is sound policy. Metaphor for a lot of our problems. The issue is, we have more than used up the wiggle room to behave in a less than prudent fashion, and actually need to start doing the opposite and behaving like adults.

—

He’s right, of course. The federal government is committed to running trillion-dollar deficits as far as the eye can see, and that’s before the Social Security and Medicare sinkholes really open up. And though the Federal Reserve did move interest rates higher, it blinked and backed off as soon as stocks really came under pressure.

Maybe the optimists are right and inflation really is under control.

Maybe we managed a soft landing from what was a very, very high jump. Maybe the clear problems in the Chinese economy will lead to a worldwide deflationary spiral that will bail us out.

Or maybe we’re still just hoping for the best while still refusing to make any hard choices about taxes, spending, and how we manage the financial system.

We actually need to start behaving like adults.

I wish I believed we will.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Central banks have no recourse to reverse deflation?

Of course they do……stop printing, however you really don’t want to see what happens then, because the whole clown show hits a brick wall.

Just Sayin’

Deflation, not inflation.

I was referring to the 9th or 10th paragraph. The one that’s in parentheses and that also says that people buy gold when the value of the dollar is going up. Almost nothing in that paragraph sounded right, so I stopped reading at that point.

Something about the past fifteen years tells me that the Fed DID have one particular trick up their sleeves that they used over and over again.

Central Banks have no business fixing the price of money. That they do, is the original sin, the fraud of frauds.

To fix the World, we must fix our money and deal with the American politburo.

The Fed said they’ve got this. Translated, next phase hyper is on the horizon, prepare for even higher prices and buckle your seat belts.

If there is always more debt outstanding at an given point in time then there are federal reserve notes in circulation used to pay back the debt, how is there not deflation from time to time to wipe some of the unplayable debt out? A long with the assets on the other side of the balance sheet that debt represents?

You must be monetarily insulated….ALL those things described are occurring in real time!!!……there is NOTHING that will reverse it!!…..unless,of course.the econocommunists reverse course…..not likely…..if your not about SURVIVING,you must be……as I stated above!!

This article is two decades late and 200 TRILLION dollars short!….

It is amazing how people today do not seem to be able to do math even on a elementary level. You may have a lower rate of inflation than you did the year before, but you are basing that inflation on a higher basis to begin with.

What part of compounding do people not seem to be able to grasp?

The only time you will ever see deflation, and prices of goods and services decrease, is when we have economic depression. Economic depression happens as a result of massive money destruction, which is caused by massive debt default, and loss of value of assets.

We are currently looking down the barrel of a perfect economic storm that will be beyond the imagination of most people. We have reached the point in the economic cycle where wage-price spiral inflation is taking hold, and at that point there are only 2 options. Either inflation spirals out of control due to future value calculations done by both labor and supply/manufacturing, or the Fed embarks on a interest rate increase cycle that is specifically designed to induce economic recession. It is clear which path we are currently on.

The depths of the recession or depression is determined by size of the asset inflated debt bubble that preceded it.

Another way to look at it, is how much of the sum of all assets are financed, and how skewed are the assumed values of those assets. What happens to the value of $80K pickup trucks and SUV’s when layoffs begin and people are no longer able to make their $1000 per mo. payments?

In addition to money destroyed by dropping asset values and debt default, you have the phenomena of dead money or zombie assets. These are the investments which while may not have to be sold or be subject to loan default, simply sit idle generating nothing to prevent realizing or admitting the loss. They are not appreciating, they cannot be borrowed against, and they usually have expenses attached to them. When commercial real estate sits empty because the companies who were the tenants have scaled down or gone bankrupt, the building still need to be maintained, and taxes paid regardless of them generating no income. Selling them would require the realization of large losses, and so they sit, slowly bleeding the owner who indulges in the hope that things will soon change.

The next economic collapse will be a time of asset transfer on a scale not seen for 100 years. Assets with debt attached will be lost on a massive scale, as everything from vehicles to real estate flow from debtors to creditors.

The government will offer relief from the depression in the form of digital currency wallets, where, if comply with mandates, you will be given UBI and everything purchase with your digital wallet will be monitored and controlled.

You will voluntarily comply with governmental controls in exchange for free / guaranteed money. You will eat what they mandate, you will work where they mandate, and you will think and socialize as they mandate. You will own nothing, and claim to be happy….

The Fed IS inflation, damnit. Enough. The Fed, and its national and international analogues, must be abolished. Inflation is merely a deliberate act of piracy and not an unavoidable organic process inherent in economics. It’s no dark, arcane, impenetrable mystery, which one would need a doctorate and a high IQ to understand.