Authored by Al Lewis via TheMessenger.com,

Economists have practically sounded the all-clear on a looming recession, but plenty of signs are still flashing red.

Clearly, economists were wrong earlier this year when they forecast an economic contraction that has yet to manifest. Could they be wrong now?

To be sure, economic growth, the labor market and consumer spending have proven unexpectedly resilient in the face of rising interest rates and elevated inflation. But there are still plenty of signs a recession might still be on its way.

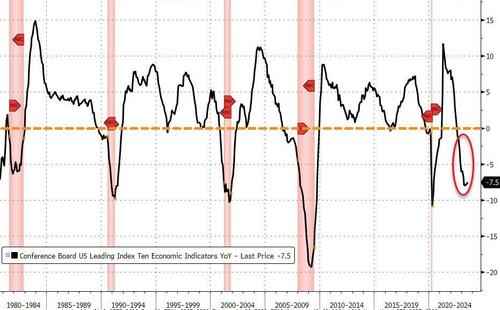

1. An “uncertain outlook” from leading indicators

Many mainstay economic indicators measure the past. So-called leading indicators reflect what likely lies ahead.

The Conference Board’s U.S. Leading Economic Index for July marked its 16th consecutive drop and its longest losing streak since the run-up to the Great Recession in 2007 and 2008.

“The outlook remains highly uncertain,” said Justyna Zabinska-La Monica, senior manager of business cycle indicators, at The Conference Board.

“The leading index continues to suggest that economic activity is likely to decelerate and descend into mild contraction in the months ahead.”

The index is based on 10 components, ranging from stock prices and interest rates to unemployment claims and consumer expectations for business conditions.

2. Consumer confidence is just a hair above recessionary levels

The Conference Board’s consumer confidence index came in at 80.2 in August, hovering just above 80, the level that often signals the U.S. economy is headed for a recession in the coming year.

It is also a leading indicator used to predict consumer spending, which drives more than two-thirds of U.S. economic activity.

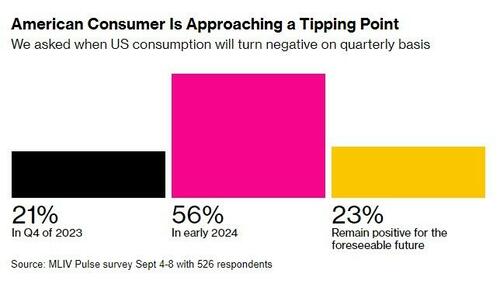

3. Consumers are foregoing big-ticket purchases

Retailers report that their customers have shifted their purchasing habits, spending less on furniture and other big ticket items in favor of necessities. They have also been trading down on grocery items, ditching pricier cuts of beef and buying chicken.

“We saw some switch even to some canned products, like canned chicken and canned tuna and things like that,” Costco’s Chief Financial Officer Richard Galanti told analysts on a May conference call.

Consumer spending has remained one of the bright spots in the economy, but most investors expect consumer spending to slow by as early as next year, Bloomberg’s latest Markets Live Pulse survey found.

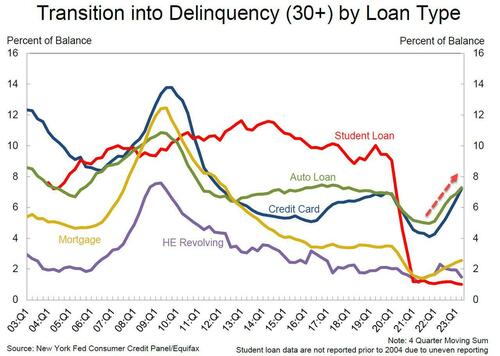

4. Credit cards are getting maxed out

U.S. consumers ran up their credit card debt past the $1 trillion mark for the first time last month, according to a report on household debt from the Federal Reserve Bank of New York.

Total household debt, which includes home and auto loans, has eclipsed $17 trillion.

The Federal Reserve Bank of St. Louis reports that credit card delinquencies, which are still low compared to periods such as the Great Financial Crisis, are on the rise.

5. Banks are increasingly reluctant to lend

The latest Senior Loan Officer Opinion Survey by the Federal Reserve reports tightening credit conditions across the board, from business loans to home mortgages and consumer credit.

“Regarding banks’ outlook for the second half of 2023, banks reported expecting to further tighten standards on all loan categories,” the Fed survey concluded.

“Banks most frequently cited a less favorable or more uncertain economic outlook and expected deterioration in collateral values and the credit quality of loans as reasons for expecting to tighten lending standards further.”

When banks pull back on lending, businesses curb their investments and consumers cut spending, and this trend is expected to continue for at least the rest of the year.

6. Corporate bonds are maturing and refinancing them will be costly

Goldman Sachs estimates that $1.8 trillion in corporate debt is coming due over the next two years and it will have to be refinanced at higher interest rates.

The expense will eat up more corporate resources, possibly leading to slower growth and investment.

Recessions occur as debt levels peak and borrowers begin to default.

Moody’s has already reported a surge in corporate defaults this year. In the first half of the year, it counted 55, that’s 53% more than the 36 that defaulted in all of 2022.

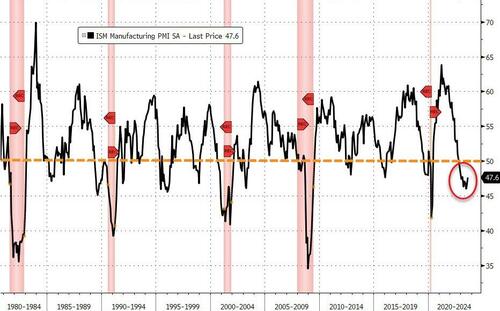

7. Manufacturing remains in a prolonged post-pandemic slump

Manufacturing has been in decline for 10 consecutive months, as measured by the ISM Manufacturing Purchasing Managers Index.

Respondents to the ISM survey reported weaker customer demand because of higher prices and interest rates.

“Orders are in fact falling faster than factories are cutting output, suggesting firms will need to continue scaling back their production volumes into the near future,” writes Chris Williamson, chief business economist at S&P Global Market Intelligence.

“An increasing sense of gloom about the near-term outlook has meanwhile hit hiring and led to a further major pull-back in purchasing activity.”

8. ‘Cascading crises’ could tip the balance of a slowing global economy

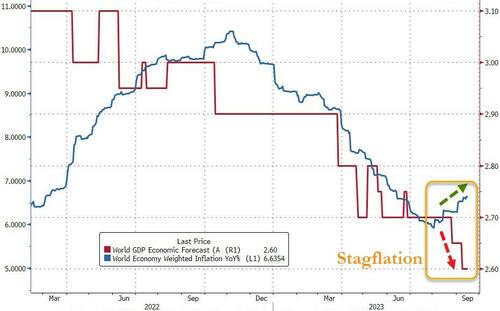

China, a growth engine for the past 40 years, is still struggling to recover from the pandemic, global economic growth has fallen below long-term average, and the ailing world could pull the U.S. economy down with it.

Like a plane crash, every economic disaster stems from a confluence of mishaps. Along these lines, G20 nations on Saturday put out a dire warning:

“Cascading crises have posed challenges to long-term growth,” the group said.

“With notable tightening in global financial conditions, which could worsen debt vulnerabilities, persistent inflation and geoeconomic tensions, the balance of risks remains tilted to the downside.”

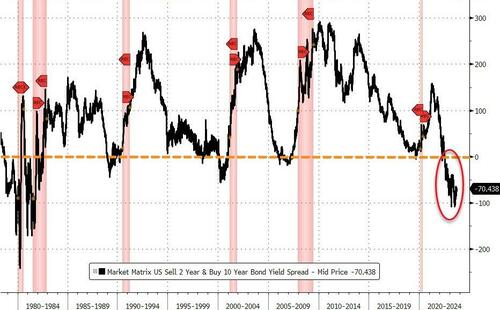

9. The yield curve, a classic recessionary signal, is still inverted

Investors should be paid more for taking a long-term risk than they should for a short-term risk. That’s why the yield on a 10-year Treasury is supposed to pay a higher yield than a 2-year Treasury.

When this is not the case, it’s called an inverted yield curve, and it has long been considered a sign that a recession is due within the next 18 months.

The yield curve for 10-year and the 2-year Treasury has been inverted since July 2022. It’s been inverted for so long that many observers have given up on its reliability — though it still hasn’t been 18 months since it first inverted.

As for history, the yield curve last inverted was in late 2019, just before the pandemic U.S. recession.

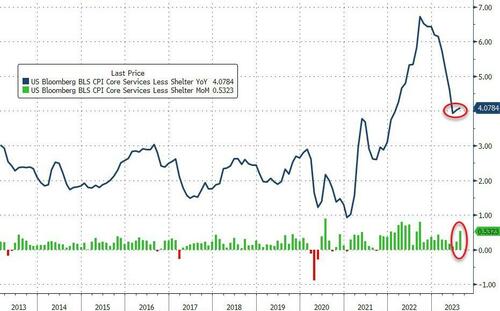

10. Inflation is sticky, and the Fed isn’t done

The soft landing scenario that is so widely embraced is based on observations that inflation has dropped precipitously as the economy continues to grow at a healthy pace and the labor market is still holding strong with the unemployment rate at 3.8%.

The Fed, which has raised interest rates 11 times since March 2022 to curb inflation, can now take a bow. The consumer price index, which measures inflation, has come down from a peak of over 9% in June 2022 to 3.2% on its last reading in July.

The latest reading on CPI, for August, came out Wednesday, and re-accelerated more than expected, with The Fed’s most-watched ‘Core Services CPI Ex-Shelter’ back above 4.00%…

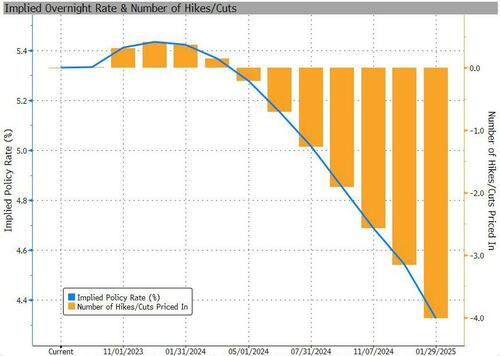

Meanwhile, the Fed, which next meets on Sept. 19-20 to decide on interest rates, is holding fast to its 2% target for inflation and will keep rates higher for longer, or possibly even raise them further to meet that goal.

Wall Street traders are not expecting another increase this month, according to the CME FedWatch tool, which is based on Fed funds futures trading.

Policy makers are still waiting to see what happens next after raising rates to their highest level in 22 years. Perhaps those actions have already sent the economy on a path of contraction. Or perhaps they haven’t done enough to continue slowing inflation.

Sticky inflation presents on ongoing risk of a recession.

“I believe we must proceed gradually,” Dallas Fed President Lorie Logan said last week, “weighing the risk that inflation will be too high against the risk of dampening the economy too much.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I guess you could label the collapse of the american empire a “recession”.

Although it’s been a depression – for many years. These folks call every little downturn within the Greater Depression a recession. The only thing they don’t want is for the general populace to put down their iStupids for ten minutes and learn what inflation is and its cause.

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” ~ Henry Ford

Insouciance relies on bread and circuses. Retention of ruling power relies on insouciance.

.

Rejection of servitude:

The financial collapse must be well timed, late October or early November 2024.. Such a crisis will nessitate the cancellation of all federal elections and the establishment of martial law.

Game, set, match.

And they don’t count the price of food and energy. That would reset their calculation if they did and we would be deep in throws of recession. Figures Don’t Lie, But Liars Figure.

And they’re clear that they want us not to eat & heat. In other words . . . die.

“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.” ~ Ludwig von Mises

.

.

“The advocates of public control cannot do without inflation. They need it in order to finance their policy of reckless spending and of lavishly subsidizing and bribing the voters.” ~ Ludwig von Mises

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” ~ Ludwig von Mises

“The government and its chiefs do not have the powers of the mythical Santa Claus. They cannot spend except by taking out of the pockets of some people for the benefit of others.” ~ Ludwig von Mises

“Innovators and creative geniuses cannot be reared in schools. They are precisely the men who defy what the school has taught them.” ~ Ludwig von Mises

“Socialism is not in the least what it pretends to be. It is not the pioneer of a better and finer world, but the spoiler of what thousands of years of civilization have created. It does not build, it destroys. For destruction is the essence of it. It produces nothing, it only consumes what the social order based on private ownership in the means of production has created.” ~ Ludwig von Mises

“Government is the only institution that can take a valuable commodity like paper, and make it worthless by applying ink.” ~ Ludwig von Mises

“Depressions and mass unemployment are not caused by the free market but by government interference in the economy.” ~ Ludwig von Mises

“The gold standard did not collapse. Governments abolished it in order to pave the way for inflation. The whole grim apparatus of oppression and coercion, policemen, customs guards, penal courts, prisons, in some countries even executioners, had to be put into action in order to destroy the gold standard.” ~ Ludwig von Mises

“The struggle for freedom is ultimately not resistance to autocrats or oligarchs but resistance to the despotism of public opinion.” ~ Ludwig von Mises

“The truth is that most people lack the intellectual ability and courage to resist a popular movement, however pernicious and ill-considered.” ~ Ludwig von Mises

#11 All gov. economic stats are BALDFACED lies.

11. This headline

https://www.marketwatch.com/story/the-u-s-debt-will-rise-by-more-than-5-billion-every-single-day-for-the-next-decade-775ed38d

The big one is consumer credit tapped out. We have a consumer economy and most people live on credit. When credit dries up and people can no longer buy on credit, manufacturing will slow down, layoffs will start, companies will go bankrupt from financed unsold inventory leading to more layoffs and we will be in real trouble. Tax revenues will go down and government expenses up, and no one will buy government debt. A recipe for disaster.