Guest Post by Nick Giambruno

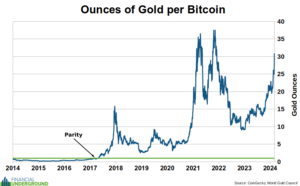

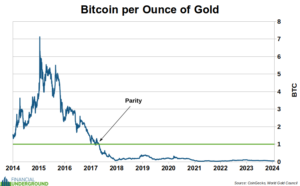

Did you know the Bitcoin price reached parity with the gold price in April 2017 and never looked back?

Today, buying a single Bitcoin takes over 30 ounces of gold.

Put differently, it takes about 0.032 BTC—3,200,000 satoshis—to buy an ounce of gold.

In the last year, Bitcoin’s market cap grew by over $883 billion—from around $457 billion to about $1.34 trillion today.

Annual gold production is estimated at around 118 million ounces, worth about $254 billion.

The increase in Bitcoin’s market cap last year alone was more than triple the value of global gold production.

If just 10% of that $883 billion increase in Bitcoin’s market cap instead went into gold, it could have rocked the market and sent prices soaring.

With that in mind, and looking at the above charts, it’s not surprising that many have wondered, is Bitcoin demonetizing gold? How should investors position their portfolios?

These are critically important, fundamental questions I will answer.

MicroStrategy founder Michael Saylor thinks gold is an outdated monetary technology compared to Bitcoin. He once said:

“You can cling to gold, but it’s like clinging to your Kodak stock because you like photos instead of buying Apple. Or like Rand McNally maps compared to Google Maps.”

For the first time, gold indeed has a worthy monetary competitor that presents a serious challenge to its status over the long term.

However, I don’t believe the outcome is 100% certain or preordained.

Nobody knows whether gold or Bitcoin will ultimately emerge victorious in the ultimate competition to be the world’s best money.

Below, I’ll describe how I see it playing out.

First, it’s crucial to clarify a fundamental point.

We are talking about a competition to be the world’s best money. So, let’s define what money is.

Money is a good, just like any other in an economy. And it isn’t a complex notion to grasp. It doesn’t require you to understand convoluted math formulas and complicated theories—as the gatekeepers in academia, media, and government mislead many folks into believing.

Understanding money is intuitive and straightforward.

Money is simply something useful for storing and exchanging value. It’s a tool for sending value through time and space. That’s it.

Therefore, I’ll analyze gold and Bitcoin to see which is best suited to send value through time and space.

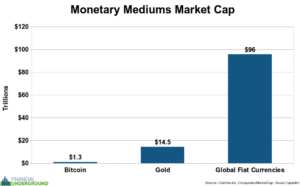

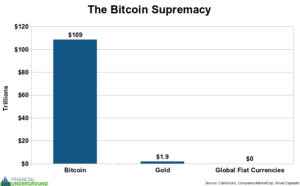

Today, three monetary goods—fiat currency, gold, and Bitcoin—compete as the best vehicles for storing and exchanging value.

The chart below shows their approximate sizes.

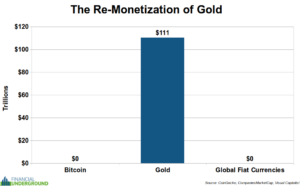

I believe the above chart will be flipped entirely in the future. The only question is whether Bitcoin or gold will reign supreme.

While fiat currency is today’s dominant form of money, it is well on its way to collapse.

I estimate that by around 2030—or perhaps sooner—the collapse of fiat currencies could be complete.

The chart above estimates that about $96 trillion is stored in global fiat currencies. I believe most of that value will migrate to better store-of-value assets, primarily gold and Bitcoin.

That’s why Bitcoin and gold could do exceptionally well in the short and medium term as the fiat currency system crumbles.

However, over the long term—after the fiat currency system has fully collapsed, which I estimate to happen around 2030—I expect an epic competition between Bitcoin and gold as one or the other will necessarily emerge as the world’s dominant form of money. That competition could take many years.

Suppose gold wins. The above chart might look something like this.

If gold emerges as the world’s dominant money, I estimate a gold price of around $16,168 per ounce in purchasing power in today’s dollar.

It also implies a Bitcoin price of $0.

That’s because Bitcoin is purely a monetary good with no industrial or other non-monetary uses. Bitcoin is either useful as money or worthless.

Industrial Use Doesn’t Make a Good Money

A common misconception says money also needs to have some industrial use for it to be good money.

However, that’s like saying a shoe must also be useful as a hammer to be a good shoe.

Many people incorrectly reason that Bitcoin can’t be a good money because it has no industrial or non-monetary utility.

However, industrial use is not needed to make something useful as money. Using something as money—i.e., to store and exchange value—is sufficient for it to be money.

The fact that gold has some industrial use doesn’t give it superior monetary properties. People value gold as money primarily because it’s the one physical commodity most resistant to debasement—not because it’s used in dentistry, electronics, or other industries.

On the contrary, I’d argue that gold’s relatively small industrial uses do not enhance its monetary characteristics. If they did, why aren’t metals with more industrial use—like copper or nickel—more desirable as money?

When it comes to money, I’m only interested in its ability to store and exchange value. I’m not interested in something whose value is hostage to the whims of ever-changing industrial conditions.

This is why industrial use is not a monetary benefit but, in fact, a potential detriment.

Gold would be an even better money without the variation in its supply and demand from its industrial uses, which are unrelated to its use as money.

Further, the competition to be the world’s dominant money is essentially winner-take-all. Anything else would amount to an inefficient barter system, which is why international monetary networks tend to converge on one thing as dominant money at the base layer.

Previously, the dominant base layer money was gold. Today, it’s the US dollar and Treasuries. In the future, I think it will either be Bitcoin or gold.

The current status quo for Bitcoin seems untenable.

Over the long term, I believe Bitcoin will become the dominant form of money or end up at $0 as a superior money—most likely gold—beats it out.

On the other hand, suppose Bitcoin emerges as the world’s dominant money—a megatrend I like to call The Bitcoin Supremacy.

The above chart might look something like the one below.

Even if Bitcoin emerges as the world’s supreme form of money, gold will still have industrial and non-monetary uses, which I estimate comprise around 14% of its total demand. So it won’t be worthless.

If gold were to lose all of its monetary demand to Bitcoin, it would become a pure industrial metal like copper or aluminum. I estimate that monetary demand—to store and exchange value—makes up around 86% of the overall demand for gold. Therefore, if Bitcoin demonetizes gold, I estimate the gold price could drop by 86%.

If The Bitcoin Supremacy occurs—and gold is demonetized and rendered a purely industrial metal—it would imply a gold price of $278 an ounce and a Bitcoin price of $5,171,429 per BTC in purchasing power in today’s dollar.

After the collapse of fiat—which I estimate to be around 2030—nobody knows how long the competition between gold and Bitcoin will last. It could be over quickly or drag on for many years. My guess is that it won’t be over quickly.

I am confident that this competition will happen and there will only be one winner.

Over the long term, billions of people, through trillions of transactions—in other words, the free market—will ultimately decide whether gold or Bitcoin will win.

I am all for free-market competition in money.

I say let the best money win.

In the meantime, I think the stars are aligned for a massive Bitcoin bull market.

That’s why I just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes.

Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Obviously I have no idea what wins out in the end but this frenzy for Bitcoin reminds me of the Tulip mania from the 17th century. Gold has been a store of wealth for thousands of years. Bitcoin is just another form of fiat with the Achilles heel of electricity. Maybe I’m just a Luddite.

Simply call them Tulipcoins.

I wonder how far ahead the family who bought tulip bulbs 400 years ago is by now?

EMP attack or solar flare. No electricity for months, maybe years. How much is your BC worth? Okay, now the grid is back up. Who has done the maintenance on the systems while the grid was down. To me BC is like owning the movement of electrons across a closed system. How is this wealth?

BTC is not money nor will it ever exhibit the requisite properties to be money.

I just finished the first class ever offered in Bitcoin at a large Tech University. Your ignorant statement represents a lot of old school thinkers who don’t have a clue why that perspective is in the process of being demolished. The future is evolving fast despite you.

This thread’s article is also ignorant to be leaving out the most critical issues that makes Bitcoin the first trading currency in history that fixes the primary things eternally wrong with every other currency prior, especially including gold, stemming from the ramifications of Bitcoins’ core foundation of decentralization, fixed supply and proof of work…… for starters.

I thought I signed up for a class in trading a particular crypto and it wasn’t even about trading at all. There’s a huge paradigm shift just beginning under our feet with massive numbers of institutions, countries, suppliers and innovators all over the world jumping in and all coalescing fast. There won’t be any one controller shutting it off. It’s in your best interest to get educated before picking a side.

LOL, your “class” ignorance seems to be off the charts as well…

Tell us again

a) what good is a “fixed” supply, if that “fix” is entirely human-chosen and -defined, i.e. can be changed tomorrow?

b) and more generally what good is a “fixed” supply of valueless tokens?

1. Your ignorance is showing by having no clue why the supply limit can’t be changed, the gigantic difference between BC and every other crypto, and why each token not only represents value, but accrues in value due to the permanent record of movement of each token of the supply limit.

2. How is our criminally endlessly increasing supply of continuously devaluing worthless paper working out?

The technological age is going to go forward and the ‘supposed’ gold standard will never be reinstated. How would it be in our best interest anyway since it would just transfer to the control of the same lying and manipulative criminals able to say anything about how much gold they control and NEVER be any way to verify how much gold there is/where?

BC is a big threat to the controllers whose fiat is failing and now the first currency that has ever been accountable is emerging. But please stop standing on a shallow understanding soapbox and demanding proofs of gigantic issues in a few sentences. I know all your reasoning, you don’t know any of the other perspective. The valid things to discuss are long past the old school observational/beginner stage – like why the big financial names jumped in headfirst too/are rapidly increasing participation with humongous amounts of BC purchases since the recent ETF approvals.

So the only thing you can present as proof “the supply limit can’t be changed” is your word on it?

Hey, feel free to put all your net worth into Tulipcoins!

Just don’t try to bullshit others into the same.

Did they teach you about the Carrington Event?

Gold is already out of the ground; the only energy required to use it is one’s ability to carry it around and protect it.

ALL crypto, on the other hand, requires BOTH more energy AND a working network to be even remotely viable to use (and, yeah, I know about “cold storage”, but that USB key in your faraday cage isn’t going to help if there’s no working grid or computers to get your wealth off of it.)

Claiming that something with less than 30 years of shelf-life while being dependent on a (working) grid and a network to function as THE money is beyond risible. (And, yes, I say this as a would-be anarchist, fully aware and supportive of the decentralizaton elements of crypto.)

Like good ole Nancy said about drugs, when it comes to crypto, just say no.

Yep, all beginnings… in this case ‘only’ 30 years in…. of huge paradigm changes are overflowing with protests of can’t/shouldn’t/wouldn’t….. then they happen anyway and we’re in the middle of technological propelling factors way beyond past catalysts.

Re Carrington – it’s NOT selective!! If BC gets wiped out, it means all evil financial/gov/military/pharma/retail/entertainment/media/communications systems…CONTROL SYSTEMS….etc fully dependent/intertwined with electricity/the internet get just as wiped out too. Good! In the meantime, that ‘threat’ is not stopping any technology from moving forward full force and I’m going to live in the now and play it the best I can.

Oh well, you studied at an institution of ignorance so you must have it all worked out now.

Aside from being another fiat method of wealth storage and transfer, cyber coins work only as long as the grid is up and the internet is not curtailed or shut down. Some governments have already put limits on citizen access to the World Wide Web. There is also the problem of the enormous amount of energy used in verifying transactions. Years ago I read a book on running a small business. The author advised to have multiple income streams for survival, and to not depend on a single source. The same advice would apply to shepherding your assets.

Our whole society “work(s) only as long as the grid is up and the internet is not curtailed or shut down.”

Apples to apples there is no comparison…digital fiat vs. bullion.

The cabal obviously favors crypto in the short term, since they are THE primary reason for crypto’s recent all-time high, and a 125% increase in value over the past 12 months, and I wanna say a 300% increase in the past couple years. It’s another vehicle to suppress gold’s true value while rapidly increasing their own net worth.

They’ll then pull the plug on crypto when they’re ready to implement the Great Reset. But electricity will still be around, and flowing for most people – how else will they get the masses to submit so easily?

Don’t worry about gold – they will devalue that too. Who knows what gold’s value will be on the black market?

Gold is money and has history to prove it. Bit Coin is a highly unstable investment it is not money.

Bitcoin is a 64-digit electronic . . . nothing. Its intrinsic value is 0. It’s been bid up past $60 grand based on speculation and greed . . and probably bankers manipulating price now that it can be bought as part of an ETF. It’s not useful as money because it’s far too volatile. It’s successful chiefly because buyers are betting on greater fools buying their 64 digits from them at even more ludicrous prices. . . like a Ponzi scheme. So what the hell is this guy talking about?

“Or like Rand McNally maps compared to Google Maps.””

I will take map books/printed topo maps ect. over gaggle any day,…..just saying.

Just bought a new big book edition of Rand McNally…just in case.

A road atlas works even when the lights are out.

Like gold.

Tried and true beats new and sketchy EVERY DAY.

And even an old fashioned garmin GPS suction cupped to your windshield as a backup to the Rand McNally at least does not use data or needs the internet to work.

I could be wrong, but I think gold is more EMP resistant than bitcoin.

You win the Internet for the month, Joe.

Actually? It’s not. At least in the literal sense. Nevertheless, you ain’t wrong.

As a speculation at least, it has been the best opportunity in the past 100 years.

I bought 10 for 8k in 2013, or so, due entirely due to the fact, that is a payment system separate from the banks.

It’s real value is NOT the price. It’s that it can be used to send money worldwide.

So you’re a half-millionaire (in US$) and are still posting here?

Sounds plausible

And you believe, after being used to send money worldwide, the exchange back into local fiat isn’t/cannot be controlled by the big banks/government?

What happens when you want to convert to fiat. Somewhere, someone down the trading line will want fiat cash for bitcoin.

Sure you can send digital “money” worldwide but what happens when the local taxman lets retailers, wholesalers, manufacturers, traders and any one else who accepts bitcoin know, that an arse raping via complete audit is coming your way. Who will want to accept bitcoin then. What will happen when the kunt banks want a 10% processing fee for bitcoin conversion. Right royally fucked you or the person holding, will be.

Before you say, they wouldn’t do that, the Aus Taxation Office went after scrap metal dealers who dealt in cash. Audit after audit after audit till the point was rammed home, NO more cash trading. Blunt force government power in action. With your new 87000 IRS diversity agents, tell me how bitcoin is going to be a good investment.

Nick has been around for 30+ years spouting crap. In the mid-90s it was the coming derivatives crash. Well, it might come soon. 30 years late.

Bitcoin is a second away from an EMP or the Fed ruling it worthless.

This is the dumbest gold vs. Btc rehash of irrelevant talking points article ever. It’s like nobody gets it! Btc is revolutionary, it’s a digital bearer bond. Requires only the network to settle transactions, but nobody is really trading amongst each other. We are not living in bladerunner, yet. It is just a speculative asset that requires the crooked exchanges and the unbacked stable coins to function. Think about Robin hood or ftx, this can’t end well. I sold some at 45k and it was like pulling teeth. I had to scan my face. It’s about a half degree removed from Cbdc. When it comes time to sell, so sorry exchange is broken. It happened yesterday with bitmex and several times in the last few weeks. And what of a grid or internet disruption? The feds can shutter the exchanges at will. Au and Ag are wealth of the ages. Get a jewelry scale and some calipers. In the coming mad max scenario your local warlord will still be stacking.

The once-in-a-month moment that someone gives usable advice in TBP

Only need to add “and print out a list of common coins’ size and weight, and put that in a zipperbag”

“When it comes time to sell, so sorry exchange is broken.”

This has been my experience and the reason I have not acquired more. It’s just not usable without a big learning curve and a lot of hoops to jump through.

I have enacted a new heuristic I have felt for years now. I will never again read anything about Buttcoin that shows gold in the image.

I do wish I had some bitcoin, though. I’d be yelling Geronimo and bailing the fuck out before everyone notices this ship is on fire.

Gold is something but does nothing

Bitcoin is nothing but does something

Failing to realize the value in Both of these is a failure to diversify against your loss of freedoms.

Let me tell you a little Fairy Tale…Once upon a time there was a magic algorithm…

Should’ve listened to my 13 year old when it comes to investments: Little Pony Secret Lair Magic cards were on preorder for $49.99 and are now selling for $200 unopened package just 6 months later. Tangible, sought after, scarce and don’t require electricity or internet to carry around. Just don’t give your little brother some scissors to “open the package and see what’s inside”, instantly halving the value. Ask me how I know.

What do you buy Bitcoin and gold with?

I trade fiat for bullion…I guess you also have to trade paper fiat for digital algorithmic fiat…in the end it’s the last one standing.

so all three require people’s belief that they are worth something.

It is truly dismaying to realize that most of the people on this planet are actually this stupid.

You see…when 20% of the population is stupid and 80% are average (truly smart people are a rounding error), then the 80% prospers.

When you invert that formula and 80% are stupid and 20% “average”? NO ONE prospers.

You ————————- are———————– here —————-^

All you need to know about Bitcoin:

Have you ever had someone tell you something and you knew they were wrong and didn’t know what they were talking about? That’s old farts talking about Bitcoin. Try to use gold or silver, try to sell it at coin dealers and they don’t want it. try carrying it on an airplane. A BTC seed phrase can be remembered and this talk about no electricity or internet, if that happens we have larger problems. You should keep BTC on a cold wallet. It isn’t going anywhere. TPTB always wants cell phones and the internet working because they are such excellent surveillance tools for tracking and controlling people. If anything a problem will be the Fed wanting everyone to use a Fed CBDC. I’d bet that growing food and raising small livestock will come in more handy than any gold silver or bitcoin when you get cutoff for not playing along with Gov. mandates. Your non-prepping neighbors won’t have anything of value to trade. Do what you think will serve you best in the future, sorry for the one paragraph.

Taken from http://www.coloradogold.com …Don’s Columns…lots of wisdom in Don’s Columns over the decades.

IT BEEN 95 YEARS!

My wife Bonnie, and I, went to an expensive, really classy restaurant the other evening, and we had a great time. I looked around, and there were perhaps 20 tables, and most of the diners were obviously well dressed and enjoying the rewards of great incomes. We do this many times, but this time, I looked around, and realized that probably 100% of the restaurant’s patrons, had their surplus assets stored in stocks, bonds, CD’s, and many other dollar denominated investments. I checked on the internet, and it says that 35% of adult Americans are invested in stocks and bonds, and another 35% use financial advisors to invest for them, I am certain charging, at least 10% for their services.

Fox Business News, is watched by me weekdays. I watch the metals prices, stock market prices, and the latest fraud in the form of bitcoin. Regardless of which host is being broadcast, never are there any worries about the future.

In Friday’s Journal, a full page spread about one of Europe’s biggest bankruptcies in many decades, has taken close to a billion dollars out of multiple banks, individual investors, unions, retirement funds, and even some government funds. All ‘investments’ have evaporated, and one bank ‘wrote off’ $700 million. China is in ever more hot water, as its real estate sector is hundreds of billions in debt, no way to pay it off, other than the printing press. GM has lost big, as has Ford on electric cars, and Tesla’s head has been found out to have turned on many times by hallucinogenics, not counting losing billions on Twitter. I read the Journal, and as opposed to most other media, the obvious economic news is printed, and as an aside, Trump’s stupid speech, and Biden’s obvious mental decay.

I’ve recently read an elaborate summary of what happened in 1929, and I never thought it could be as bad as it really was. Hundreds of people, 98% men, were jumping out windows, their plight had become so hopeless. People who were formerly well off, and an example of this, might have been the restaurant diners I observed, suddenly, and with no warning of any kind had lost everything. Banks closed, some never to re-open, and my parents lost money in a bank which never re-opened, but they weren’t harmed too much as their drug store kept on doing O.K. Every sector of the world’s economy crumbled, and it is today beyond anyone’s even most vivid imagination, to comprehend what went on as a result of the 1929 crash.

What causes a crash? It’s really pretty simple. Economic crashes of anything denominated in paper money, be it stocks, bonds, CD’s, futures, et al, depend on general approval of things. When buyers and holders of various items, lose respect, goodwill, distrust of management they crash. It can be bad profits, huge bankruptcies, horrendous earthquakes, disasters of all kinds, or just the general attitude of holders of the investments, causing them to sell, to get out. Massive selling, causes a chain re-action, and a severe depression occurs, which can take many years to recover, and generally, only at a level many percentage points of where it was before the crash.

Did gold and silver crash during the great depression? No, because the spot prices of metals are close to their mining, milling, smelting, and distribution costs, and there is no fluff, printing press, ‘blue sky,’ massive retailing, advertising, and huge physical properties involved and interest costs of all the borrowing.

NO, I AM NOT PREDICTING A STOCK MARKET CRASH, but it will be a hundred years since the massive 1929 horror episode in five years. When it eventually happens, and it will, I hope you readers will not be hurt.

P.S. the internet also says that 10.8% of adult Americans own gold and silver, which is not nearly enough, and that’s why we’re here. I hope your team won the Super Bowl!

-Don Stott, [email protected]