Powell Is Caught In A Trap – but – We Don’t Have To Be!

Guest Post by Dennis Miller at Miller On The Money

Guest Post by Dennis Miller at Miller On The Money

Fed Chairman Powell has the impossible task of guiding the economy to a “soft landing” – balancing the need to tame out-of-control inflation while preventing a major market crash and recession/depression.

Here’s what is bearing down on America.

- The Fed bailed out the banks; $9 trillion+ in phony money.

- Government debt skyrocketed over $34 trillion and climbing. Soon the interest cost will exceed 50% of tax revenue.

- Government deficit spending continues accelerating.

- Government debt to Gross Domestic Product (GDP) ratio is projected to be 150% by 2028. A Hirschman study shows 50 of 51 countries topping 130% have defaulted on their debt, either through collapse or inflation.

- The stock market continues to levitate. A John Hussman analysis study shows a 99.9% probability of a major correction looming.

- Inflation still rising despite 11 rate increases since 2022.

- Much of the “cheap money” debt has to be rolled over at higher interest rates; creating problems for both lenders and borrowers.

While Powell tries to balance his approach, a soft landing isn’t gonna happen, something has to break.

If he holds rates steady, government interest and deficits will continue to soar, “too big to fail” banks will lose money and the economy will head into a major recession. If Powell pivots and drops rates, inflation will skyrocket; the economy, and possibly the dollar will collapse.

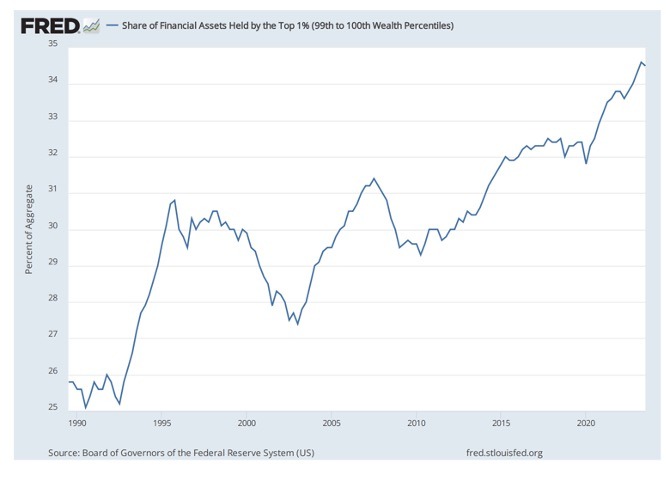

The elites (top 1%) own over 1/3rd of the nation’s wealth. Not wanting to lose their wealth/power, they’re pushing Powell to reduce rates.

“Inflation is not caused by the actions of private citizens, but by the government: by an artificial expansion of the money supply required to support deficit spending.

| No private embezzlers or bank robbers in history have ever plundered people’s savings on a scale comparable to the plunder perpetrated by fiscal policies of statist governments.” |

Since 2008, trillions have been borrowed, creating a historic credit and stock market bubble. Much of that debt can’t be repaid and must be purged from the system to get back on track.

Gold silver ratio all out of whack.

Making silver a buy.

GOLD TO SILVER RATIO

Interpretation

The gold-to-silver ratio is a financial metric that compares the price of gold to the price of silver. It is calculated by dividing the current market price of gold per ounce by the current market price of silver per ounce. The resulting ratio indicates how many ounces of silver are needed to purchase one ounce of gold.

The gold-to-silver ratio is primarily used as a tool by investors and traders to evaluate the relative value between gold and silver. It can provide insights into market trends and potential investment opportunities. Historically, the ratio has varied significantly over time, with different ranges considered favorable for either gold or silver investments. A higher gold-to-silver ratio suggests that gold is relatively more expensive compared to silver, indicating a potential opportunity for silver to outperform gold in terms of price appreciation. Conversely, a lower ratio indicates that silver is relatively more expensive compared to gold, suggesting a potential opportunity for gold to outperform silver.

The gold-to-silver ratio is influenced by several factors. Both gold and silver are considered precious metals and are often sought after as safe-haven investments during times of economic uncertainty. However, gold has traditionally been favored as a store of value and a hedge against inflation, leading to its higher demand and higher price relative to silver. Furthermore, Silver has various industrial applications, including in electronics, solar panels, and medical equipment. Therefore, shifts in industrial demand can impact the price of silver and, subsequently, the gold-to-silver ratio.

For hundreds of years the ratio was often set by governments for purposes of monetary stability and was fairly steady. The Roman Empire officially set the ratio at 12:1 and The U.S. government fixed the ratio at 15:1 with the Coinage Act of 1792.

https://www.longtermtrends.net/gold-silver-ratio/

SUMMARY:

• For hundreds of years prior to 1873, the gold to silver ratio stood relatively constant near 15:1.

• After 1873, silver was demonetized in favor of gold exclusively, and its value began to plummet relative to gold, reaching an all-time low of 131:1 in March 2020.

• For the gold/silver to return near 15:1, monetary demand for silver must return, as money is the strongest of all demands since money is half of every transaction.

• The old monetary ratio was regained briefly twice, in 1919 and 1980, when consumer price inflation was near 20%.

Here is the tease…I believe coming soon:

• If confidence in the dollar collapses and price inflation once again reaches those levels, that ratio could be reestablished, meaning silver could outpace gold by 5x from there.

Powell and Yellen. It took both the Fed and the Treasury to set the trap.

Why would you ever think he’d want to? These psychos want it all to crash and burn.

That would also be “rendering unto Caesar that which is Caesar’s”. Just sayin’. Those dancing ass clowns have it coming.

Ayn Rand would never admit to rampant corporate opportunistic price-gouging as a driver of inflation. “Look over there, it ain’t us! We’re just trying to make an honest livin’ over here! Scrapin’ by, dontcha know!” LOL

Where other than monopoly or monopsony is that occurring? You sound like the senile pedophile in chief here.

When I saw the headline, this is first thing that popped into my head….

Powell’s caught in a trap, he can’t walk out

Because he loves us too much, baby

Why can’t he see what he’s doin’ to me

When we don’t believe a word he’s sayin’?

We can’t go on together

With suspicious minds (With suspicious minds)

And we can’t build our dreams….

with apologies to Elvis.