Guest Post by Nick Giambruno

The ultimate competition to become the world’s dominant money will have only one winner.

Anything else would amount to an inefficient barter system, which is why international monetary networks tend to converge on one thing as dominant money at the base layer.

Previously, the dominant base layer money was gold. Today, it’s the US dollar and Treasuries. In the future, I think it will either be Bitcoin or gold.

Over the long term, billions of people through trillions of transactions—in other words, the free market—will ultimately decide whether gold or Bitcoin will win.

I am all for free-market competition in money.

I say let the best money win.

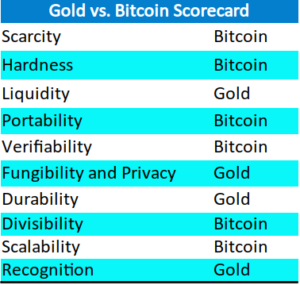

In a recent article, I analyzed the ten most decisive monetary attributes and examined whether gold or Bitcoin has an advantage. The table below summarizes the results.

Bitcoin wins in 6 out of the 10 categories, including hardness (resistance to debasement), which I believe will be the most decisive factor.

While gold has an advantage over Bitcoin in durability, that advantage will only be relevant in the case of an inescapable, global return to the Stone Age that lasts into eternity. Such an unlikely outcome is not relevant to investment decisions today.

Gold also has a fleeting advantage in liquidity, fungibility and privacy, and recognition. However, Bitcoin is eroding those advantages every day.

If current trends continue, I believe Bitcoin will overtake gold in these categories in the years ahead.

Putting it all together, gold’s advantages over Bitcoin are either irrelevant or melting away.

The inescapable conclusion is that Bitcoin has superior fundamental characteristics that make it a better tool for sending value through time and space.

Digital gold is better than analog gold.

In short, Bitcoin is likely to win the ultimate competition and become the world’s dominant money.

Allow me to explain how I see it playing out…

I am not saying it is 100% certain Bitcoin will demonetize gold.

What I am saying is this: over the long term—measured in years, likely decades—there is a good chance Bitcoin will demonetize gold because it has superior monetary properties.

However, the vast majority of humanity does not understand that Bitcoin has the potential to become the world’s dominant money… yet.

What we have here is an enormous information asymmetry.

With Bitcoin, it’s as if you discovered gold before most of the world understood that gold was useful as money.

Think about it.

You have the chance to front-run major investors, large multinational corporations, and even nation-states by getting in on this trend before they do.

Bitcoin’s potential ascent to the world’s dominant money—a megatrend I like to call The Bitcoin Supremacy—is an enormous once-in-a-lifetime opportunity and the biggest investment story I’ve ever seen.

There are a couple of necessary clarifications to this analysis.

Clarification #1: Black Swans

Any number of events with currently inconceivable and impossible-to-foresee effects—the arrival of quantum computing, asteroid mining, nanotechnology, etc.—could tip the scale in either direction.

Clarification #2: Timing

I do not believe Bitcoin is an immediate threat to gold.

Most likely, gold will be remonetized as the fiat currency system collapses, only to be demonetized by Bitcoin in the following years and decades.

Although Bitcoin has better monetary attributes than gold, it may take many years—potentially decades—for most people to recognize this.

A big factor in timing is how fast the fiat currency system collapses.

If I had to guess when that would happen, I would say the collapse of the fiat system should be evident by around 2030.

If the fiat currency system collapses faster than expected, it will likely benefit gold. Gold has better recognition, and more people will gravitate toward what they are familiar with. Bitcoin is novel and misunderstood.

If the collapse of the fiat currency system drags out longer, it could benefit Bitcoin. That’s because as time goes on and Bitcoin’s recognition grows, people become more comfortable with it as an alternative to fiat currency. They’ll skip gold and jump directly from fiat to Bitcoin.

In any case, I believe that Bitcoin won’t start to potentially demonetize gold in earnest until after the collapse of the fiat currency system is complete. My guess is that could happen around 2030, and then it could be many years—possibly decades—before Bitcoin fully demonetizes gold.

That said, a Bitcoin standard could spontaneously emerge faster than anyone expects. That’s a risk to gold and an excellent reason to have exposure to Bitcoin.

Clarification #3: Portfolio Allocation

I do not think it makes sense to go “all in” on Bitcoin… or anything.

100% exposure to any asset is not prudent risk management because nothing in life is 100% certain. With exponential increases in technology, not even death is certain, but that’s a story for another day.

What I can say with the highest confidence is that—for the first time in over 5,000 years—gold has a serious competitor that could demonetize it in the coming decades.

At a minimum, I view gold as a hedge if Bitcoin does not emerge as the world’s dominant money in the long term.

In the immediate future, gold is a superior monetary alternative to fiat currency. I believe it will be the primary beneficiary as the current fiat monetary system collapses in the years ahead.

In my opinion, the prudent thing to do is to allocate capital to gold and Bitcoin and update that allocation as time goes on and facts change.

In the short and medium term, I believe both gold and Bitcoin will do very well as the fiat currency system crumbles.

Right now, I want to have exposure to both, and the stocks of companies that benefit from higher gold and Bitcoin prices.

That’s why I’ve just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes.

Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Hey, Nick, you’ve screaming about the deriatives meltdoan for 30+ years. That would help Bitcoin’s cause, but the 800 lb. Go-rilla in the room is the deterioration of the electric grid. And it’s 1st cousin is an EMF.

Bitcoin is the Commodore 64 of digital tokens. Isn’t that problematic when we’re talking about the supposed “money” of the future?

Wish I’d have heard of Bitcoin a decade ago…

That said, the “winner” is Bitcoin.

Gold has been suppressed for God know how long.

I’d say that Bitcoin is “suppression-proof” since it’s decentralized, but that will ultimately depend on WHEN the cabal decides they’ve moved enough fiat into crypto and squeezed everything they could out of fiat, converted that into another unknown digital currency (based on crypto, but under THEIR CONTROL) to come online at a future date, crashing crypto.

Then gold wins.

But gold may be de-valued, too, by the cabal.

When the dollar dies people will not be running to bitcoin. They will begin to barter again.

In a world of barter, bitcoin will find it’s true value. It’s as big a scheme as EVs to steal everything you have. The internet has been around for 30 years, and people act like it is an unchangeable fixture in our world like the sun rising. I personally don’t like owning anything that if it was ever stolen the police response to my reporting it would be Stupid is as stupid does… idiot! We can’t help you Mr. Anonymous.

Wrong, wrong, wrong. divisibility of gold is near infinite. Gold is as easily used electronically as bitcoin. And is physically unique. Bitcoin is no more than a unicorn. Combine the two for perfection.

Gold works when electrons stop flowing.

In other words, it will always be there.

GOLD actually helps electrons flow.

Right? How does the author of this article not know that a gold backed currency is just as divisible as anything on earth?

Thanks Admin, I don’t have to read another bit Jew coin article from Nick the shilling for the despicable fucking Jews again.

I fucking said it!!!!

I am going to get some direct exposure to bitcoin this year. The electricity issue is there as well as government simply turning off the requisite servers and or digital connections.

Nick has lost his moorings. What we have here is not an “information discrepancy”, but a historical discrepancy. What are central banks all over the world buying? I say follow the money. Bitcoin is just a confidence game. When the pot gets big enough it will be hacked, confiscated, outlawed, taxed, or simply de-energized.

All you have to do is watch what hodlers DO, not what they SAY. They talk about BTC being a “store of value” but they don’t store it. As soon as the price is right, they sell it. For dollars. It’s nothing but an investment vehicle.

EMP resistance…GOLD WINS.

Power out…GOLD WINS

Gold and silver finally starting to go up because the dollar scheme is ending. This trend is just starting and has a long way to go. As gold/silver becomes more expensive so will all the things that contain gold/silver circuitry. The manufacturers will not be able to afford to make things with gold/silver because consumers will not be able to afford $25ooo computers or $5000 smart phones. Just think what a new car will cost especially an EV.

The dollar scheme has caused one of the worst and most unsustainable misallocation of resources the world has ever seen. When the dollar dies so does the world we are all use to. You have been warned.

Gold and silver are still on sale at bargain basement prices.

If the argument is you should go all in on gold because the whole power grid might go down for ever or there is an EMF event you are making a very bad investment decision. If you believe this invest in vodka, tinned food, bic lighters and ammunition, not gold.

Last week somebody transferred $1 billion + of BTC in a single transaction. The transaction was complete in minutes, no govt interference, permits, export controls, ID requirements or tax. Cost was $27. All done through a network of private individuals world wide without any official oversight or control.

Whether you want to believe it or not the electronic age is here to stay and is only going to become more dominant. For private citizens there is simply no comparison between BTC and gold.

LOL – come back to us when last week some 1 billion people transferred $1 each in BTC transactions!

It could be done. Couldn’t be done with gold

Could be done. But it isn’t.

Lightning has capacity for 1,000,000 transactions a second and can be scaled up. You really think you could as conveniently and securely complete 1,000,000 transactions a second for $1 each with gold? Downvote away goldbugs.

Sorry, update. Coinbase just announced the are integrating BTC lightning network and it can complete 40,000,000 transactions a second. So that would take, what 25 seconds for a billion transactions??

Downvote away

Lightning is not BTC.

The capacity of BTC is ingrained in its block structure. If you change that, it’s not BTC anymore.

Steve, bitcoin has been around for 15 years and is only at the beginning of its adoption cycle. How long did it take for gold to be considered valuable and a legitimate means of exchange? Hundreds or even thousands of years?? How stable was its value in the first 1000 years of human history??

All you people just keep saying “it’s not true” when the proof is out there and obvious to anyone with eyes to see. BTC has been proven to work and it’s currently in its mass adoption phase. You all seem to believe in CBDC’s. BTC is the non-centralised proof of concept.

The point I keep trying to make is that there is HUGE potential investment upside in buying BTC right now and limited downside. The arguments against it about total failure of the power grid or an EMF attack which destroys all technology on the planet are massive long shots and not realistic as an investment strategy. And even if they do occur gold will not suddenly be sought after. Barter will be the way to survive and people will have limited interest in shiny pieces of metal.

Downvote away.

It took me years before I started dabbling in Bitcoin, mostly cause of the potential power grid failure.

But where I live, power rarely goes out, and when it does, it’s almost always up within a few hours.

And gold will be used to bribe somebody to let you live.

I bet that transfer was into another account that will be accessible on the other side of the Great Reset – and it will be worth multi-billions.

Clarification #4: Buttcoin is fiat.

“Fiat” means “by decree,” backed by coercion, centrally controlled. Bitcoin is the opposite of these. if exchanged peer-to-peer, it can be entirely private and anonymous.

That said, silver IMO is best for peasants like me.

I’m not sure how Bitcoin has greater hardness than gold.

Perhaps what is meant is the number of paper contracts vs. physical gold? Well, just give them time, and the same will eventually happen with Bitcoin. We finally have Bitcoin ETFs. How much longer before all the other financial instruments exist that can do to btc what they do to gold?

I think Bitcoin is an interesting idea, but its fans are blind to its problems.

Besides an emp or being without an internet connection for any of a hundred different reasons, the next biggest concern is that it is simply code, and code can be changed. Sure it would take the majority of miners to agree to such a change, but that just proves it can happen. The cap on how many coins can be mined will surely, eventually, be changed. Not this decade, but give it time and there will be more and more desire to raise the cap. Maybe it’ll be because of all the ‘lost’ coins, or maybe just because miners want a bigger reward rather than a diminishing one. There is no such thing as permanent when code is the basis of something’s existence.

A bit further down on the list of problems is the possibility that the encryption might eventually be cracked. Should that happen (and given that one of the biggest conspiracy theories out there about Bitcoin is that it’s a product of the CIA, that shouldn’t be considered out of the realm of possibility) the price of Bitcoin would immediately drop to zero. All trust would vanish in an instant,… just as quickly as all wallets, even off-line, cold wallets, could be instantly drained.

It is wishful thinking that Bitcoin will replace gold anytime in the near future. The number one thing to watch is what the largest countries, biggest banks and wealthiest individuals will do as they see the dollar lose its value. Do they snap up every Bitcoin they can lay their hands on? Or do they buy gold, perhaps even while suppressing its price? Hate on them all, with every ounce and fiber of your strength, but they know better than you do what will retain value long term. Let’s just say they have a greater vested interest.

They’re all buying gold. BTC is too volatile.

Because there is no possibility there can ever be more than 21,000,000 BTC mined and even that number is inflated because credentials for wallets are lost etc reducing real supply.

Astronomers have observed PLANET SIZE LUMPS OF GOLD BEING PRODUCED DURING NOVA COLLISIONS. There’s a lot of gold in the universe. Just not a huge amount in the Earth’s outer crust we live on. Somebody could one day find an asteroid the size of manhattan made of gold.

That’s why BTC is harder than gold

Downvote away.

There can only be more than 21,000,000 different cryptocoins “invented.”

Downvote away.

Individuals are buying both gold & crypto, to hedge their wealth.

silver

So which central banks are selling their Gold to buy Bitcoin ?

“The gold is mine” says the Lord.

Bitcoin can’t be separated from the beast system.

It will be crashed when the Beast system is ready to go live, replaced by the cabal’s version of crypto.