No, this isn’t about copfuks choking on a doughnut.

6 million hits in 3 days. Pretty funny chit.

No, this isn’t about copfuks choking on a doughnut.

6 million hits in 3 days. Pretty funny chit.

We now know the name of the man who committed the desperate act of self-immolation. We know where he lived. He was a senior citizen, so I’m sure he has family, friends and neighbors who can provide some insight into his life. He lived in Mount Laurel NJ, just outside of Philadelphia.

If he was just depressed over something, he could have committed suicide in his house. But he drove to the nation’s capital and committed a ghastly suicide in a spot where it would generate huge notice. He was making a statement. Of course, the MSM has been keeping an extremely low profile on this tragedy. If he was a white man who had shot a few black kids, I’m guessing the MSM would be all over it 24/7.

The MSM and the powers that be don’t want the American public to see how desperate people are becoming in this Greater Depression. It is their job to distract, mislead, and misinform.

This public hari kari on the National Mall was designed to send a message. This man surely left a manifesto describing why he did this. When will it be revealed? Or will the authorities cover it up? We’ll see.

“An impasse over the federal budget reaches a stalemate. The president and Congress both refuse to back down, triggering a near-total government shutdown. The president declares emergency powers. Congress rescinds his authority. Dollar and bond prices plummet. The president threatens to stop Social Security checks. Congress refuses to raise the debt ceiling. Default looms. Wall Street panics.”

The Fourth Turning – Strauss & Howe – Page 273 – Written in 1996

Bernanke has lost $544 billion on gold. Ouch.

Gold Befuddles Bernanke as Central Banks’ Losses at $545 Billion

By Nicholas Larkin & Debarati Roy – Oct 7, 2013

Ben S. Bernanke, the world’s most-powerful central banker, says he doesn’t understand gold prices. If his peers had paid attention, they might have stopped expanding reserves that lost $545 billion in value since bullion peaked in 2011.

Bernanke, who holds economics degrees from Harvard College and the Massachusetts Institute of Technology and led the Federal Reserve through the biggest financial disaster since the Great Depression, told the Senate Banking Committee in July that “nobody really understands gold prices and I don’t pretend to really understand them either.”

Central banks, which own 18 percent of all the gold ever mined, will add as much as 350 tons valued at about $15 billion this year, the London-based World Gold Council estimates. They purchased 535 tons in 2012, the most since 1964. Russia is the biggest buyer, expanding reserves by 20 percent since prices reached a record $1,921.15 an ounce in September 2011. Gold slumped 31 percent since then.

As policy makers were buying, investors were losing faith in the metal as a store of value. The value of exchange-traded products dropped by $60.4 billion, or 43 percent, this year, saddling hedge fund manager John Paulson with losses, according to data compiled by Bloomberg. Billionaire investor George Soros sold his holdings in the biggest gold-backed ETP this year and mining companies wrote down the values of their assets by at least $26 billion.

Worst Drop

Gold, which entered a bear market in April, slid 21 percent to $1,316.28 in London this year on Oct. 4, set for the biggest drop since 1981. It rose sixfold as it rallied for 12 successive years through 2012, beating a 17 percent gain in the MSCI All-Country World Index of equities as the Standard & Poor’s GSCI gauge of commodities more than doubled. It’s this year’s third-worst performing raw material, after corn and silver. Gold today rose to $1,321.69 an ounce.

Policy makers, who are responsible for shielding their economies from inflation, often mistime gold investment decisions, buying high and selling low. They were reducing holdings when bullion reached a 20-year low in 1999 and as prices as much as quadrupled in the next nine years. Central bankers became net buyers just before the peak in 2011.

“Central bankers have typically bought when you probably should be selling and selling when you probably should be buying,” said Michael Strauss, who helps oversee about $25 billion of assets as chief investment strategist and chief economist at Commonfund Group in Wilton, Connecticut. “It’s going to be a difficult market and sometimes the price of gold is driven by emotions rather than fundamental factors. Central banks have been bad traders of gold.”

Policy Makers

Holdings were little changed from the start of 2008 through early 2009. Then, policy makers increased gold reserves as prices doubled and they have purchased a net 884 tons since the 2011 peak, International Monetary Fund data show. Russia was the biggest buyer, adding about 171 tons. Kazakhstan bought 67.2 tons and South Korea purchased 65 tons. Turkey’s reserves swelled about 371 tons in the past two years as it accepted bullion in reserve requirements from commercial banks.

In addition to buying when prices rose, central banks sold into slumping markets, disposing of about 5,899 tons in the two decades from 1988, equal to about two years of current mine supply.

The U.K. auctioned about 395 tons from July 1999, a month before prices reached a two-decade low, through March 2002. Gold averaged about $277 as the country was selling. The Bank of England’s hoard of ingots and coins, including a bar smelted in New York in 1916, now totals 310.3 tons, or 13 percent of the nation’s total reserves.

Gold Standard

Warren Buffett, the fourth-richest person in the Bloomberg Billionaires Index and the world’s most successful investor, has said the metal has no utility because it moves to vaults once mined. While countries from the U.S. to the U.K. adopted a gold standard by the 19th century to limit inflation, no central bank or government institution links currencies directly to the metal anymore. The Fed, created a century ago, cut the dollar’s ties to gold four decades ago.

Bernanke, when asked to explain gold’s volatility and the long-term impact of reducing economic stimulus, told the Senate Banking Committee July 18 that investors see a reduced need for “disaster insurance.” In a Congressional hearing two years ago, he described the commodity as an asset rather than money and said central banks own bullion as a “long-term tradition.”

Following that tradition has proved a poor investment decision. Kazakhstan almost doubled reserves the past two years and South Korea expanded them sevenfold since mid-2011.

“Bernanke was suggesting in his own way that too much importance is given to gold, it’s too hyped,” said Nouriel Roubini, professor of economics and international business at New York University. “Gold is not a currency.”

Inflation Hedge

Bullion rose 70 percent from December 2008 to June 2011 as the Fed debased the dollar by pumping more than $2 trillion into the financial system, spurring demand for a hedge against inflation. That protection hasn’t been needed, because U.S. consumer prices have risen at an average annual pace of 1.7 percent in the past five years, compared with a four-decade average of 4.3 percent, Bureau of Labor Statistics data show.

After taking inflation into account, gold is worth almost half of what it was in 1980. It reached a then-record $850 that year after U.S. political and financial turmoil in the late 1970s caused a surge in consumer prices. The metal is valued at $464 in 1980 dollars, according to a calculator on the website of the Fed Bank of Minneapolis.

Price Forecasts

The most accurate analysts say the bear market will deepen. Goldman Sachs Group Inc. and Societe Generale SA correctly forecast this year’s rout. New York-based Goldman says prices will drop to $1,110 in 12 months and Societe Generale, in Paris, sees an average of $1,125 in 2014. Prices will average $1,300 in the fourth quarter, the lowest in three years, according to the median of 12 analyst estimates compiled by Bloomberg.

Central banks bought metal as the Fed’s balance sheet swelled fourfold since 2008 and policy makers around the world lowered interest rates to record low levels. Greece, Ireland, Portugal, Spain and Cyprus needed bailouts since the European debt crisis erupted four years ago, sparking concern that nations would be forced out of the euro.

“There was a widely-circulated belief that the euro as a currency will cease existing,” said Michael Aronstein, the president of Marketfield Asset Management LLC in New York, whose MainStay Marketfield Fund beat 97 percent of its peers in the past five years. “A lot of foreign central banks thought they cannot keep the euro and did not want to increase dollars. It was desperation and fear that drove the surge in demand.”

Purchasing Power

While gold is trading below the 1980 high on an inflation-adjusted basis, it has still been better than the dollar in preserving its purchasing power. A dollar bought about three quarters of a gallon of milk in 1970, a year before the peg to gold ended, and an ounce of gold 28 gallons. By the end of 2011, a dollar got you about a quarter of a gallon and an ounce of bullion 420 gallons.

Holding gold is a reasonable, prudent strategy and central bankers probably build reserves with a one- to two-decade view rather than one to two years, Nathan Sheets, the former head of the Fed’s international-finance division and now the global head of international economics at Citigroup Inc., said in an interview in August. The U.S., Germany and Italy, which together own 44 percent of all central-bank holdings, changed gold reserves by less than 3 percent since the start of 1999.

Fort Knox

U.S. holdings of 8,133.5 tons, valued at $344.2 billion and accounting for 72 percent of total reserves, are the world’s largest. Most is stored at the U.S. Bullion Depository at Fort Knox in Kentucky and has been held at a book value of $42.22 an ounce since 1973, the U.S. Mint’s and Fed’s websites show. The hoard contracted by about 450 tons, or 5 percent, since then.

Former Texas Representative Ron Paul, the Republican who pushed for an independent count of U.S. gold holdings to prove they exist, also urged that a commission consider “a metallic basis for U.S. currency.” Utah recognizes precious metals as currency and lawmakers in at least six other states have or are considering bills to accept bullion coins as legal tender.

“The gold standard era, at least from an academic view and I think from people that were contemporaries in the 19th century, were that it didn’t work very well,” St. Louis Fed President James Bullard said Aug. 23 in Jackson Hole, Wyoming. “It seems like it would be very problematic to tie the dollar to gold in an environment where gold is fluctuating like crazy.”

Fixed Amounts

Returning to a gold standard, a monetary system in which currencies are converted into fixed amounts of metal, wouldn’t be feasible because there’s not enough available and it would prevent governments loosening monetary policy, Bernanke said at George Washington University in March 2012.

Central banks’ gold holdings are valued at $1.35 trillion now and totaled $1.9 trillion in September 2011 at prices then. Nations will buy more than another 500 tons by 2018, Morgan Stanley says. Their appetite contrasts with investors who cut the value of holdings in ETPs by 43 percent this year to $81.4 billion, data compiled by Bloomberg show.

The most recent central-bank buying began less than a year before Soros called bullion the “ultimate asset bubble” in January 2010. The 83-year-old sold his entire stake in the SPDR Gold Trust (GLD), the biggest gold-backed ETP, in the second quarter. Paulson cut his company’s stake by 53 percent in the period.

Emerging Markets

Venezuela holds 67 percent of its reserves in gold, the most among emerging-market countries, compared with less than 9 percent for Russia. While Russia’s central bank will continue buying, the pace may vary, former First Deputy Chairman Alexei Ulyukayev said in January. Bullion’s fluctuations failed to change the bank’s view on the role of gold in reserves, former Bank Rossii Chairman Sergey Ignatiev said in June.

“There’s been a perception that they are a contrary indicator when they buy and sell, but they’re not traders,” said Quincy Krosby, a market strategist for Newark, New Jersey-based Prudential Financial Inc., which oversees more than $1 trillion of assets. “Some central bankers have come to see gold as an alternative currency, certainly as a defense against potential inflationary pressures from the historical deployment of quantitative easing and low rates by global central banks.”

Remarks of David A. Stockman at the Edmond J. Safra Center for Ethics, Harvard University, September 26, 2013

The median U.S. household income in 2012 was $51,000, but that’s nothing to crow about. That same figure was first reached way back in 1989— meaning that the living standard of Main Street America has gone nowhere for the last quarter century. Since there was no prior span in U.S. history when real household incomes remained dead-in-the-water for 25 years, it cannot be gainsaid that the great American prosperity machine has stalled out.

Even worse, the bottom of the socio-economic ladder has actually slipped lower and, by some measures, significantly so. The current poverty rate of 15 percent was only 12.8 percent back in 1989; there are now 48 million people on food stamps compared to 18 million then; and more than 16 million children lived poverty households last year or one-third more than a quarter century back.

Likewise, last year the bottom quintile of households struggled to make ends meet on $11,500 annually —-a level 20 percent lower than the $14,000 of constant dollar income the bottom 20 million households had available on average twenty-five years ago.

Then, again, not all of the vectors have pointed south. Back in 1989 the Dow-Jones index was at 3,000, and by 2012 it was up five-fold to 15,000. Likewise, the aggregate wealth of the Forbes 400 clocked in at $300 billion back then, and now stands at more than $2 trillion—a gain of 7X.

And the big gains were not just limited to the 400 billionaires. We have had a share the wealth movement of sorts— at least among the top rungs of the ladder. By contrast to the plight of the lower ranks, there has been nothing dead-in-the-water about the incomes of the 5 million U.S. households which comprise the top five percent. They enjoyed an average income of $320,000 last year, representing a sprightly 33 percent gain from the $240,000 inflation-adjusted level of 1989.

The same top tier of households had combined net worth of about $10 trillion back at the end of Ronald Reagan’s second term. And by the beginning of Barrack Obama’s second term that had grown to $50 trillion, meaning that just the $40 trillion gain among the very top 5 percent rung is nearly double the entire current net worth of the remaining 95 percent of American households.

So, no, Sean Hannity need not have fretted about the alleged left-wing disciple of Saul Alinsky and Bill Ayers who ascended to the oval office in early 2009. During Obama’s initial four years, in fact, 95 percent of the entire gain in household income in America was captured by the top 1 percent.

Some other things were rising smartly during the last quarter century, too. The Pentagon budget was $450 billion in today’s dollars during the year in which the Berlin Wall came tumbling down.

Now we have no industrial state enemies left on the planet: Russia has become a kleptocracy led by a thief who prefers stealing from his own people rather than his neighbors; and China, as the Sneakers and Apple factory of the world, would collapse into economic chaos almost instantly—if it were actually foolish enough to bomb its 4,000 Wal-Mart outlets in America.

Still, facing no serious military threat to the homeland, the defense budget has risen to $650 billion—-that is, it has ballooned by more than 40 percent in constant dollars since the Cold War ended 25 year ago. Washington obviously didn’t get the memo, nor did the Harvard “peace” candidate elected in 2008, who promptly re-hired the Bush national security team and then beat his mandate for plough shares into an even mightier sword than the one bequeathed him by the statesman from Yale he replaced.

Banks have been heading skyward, as well. The top six Wall Street banks in 1989 had combined balance sheet footings of $0.6 trillion, representing 30 percent of the industry total. Today their combined asset footings are 17 times larger, amounting to $10 trillion and account for 65 percent of the industry.

The fact that the big banks led by JPMorgan and Bank America have been assessed the incredible sum of $100 billion in fines, settlements and penalties since the 2008 financial crisis suggests that in bulking up their girth they have hardly become any more safe, sound or stable.

Then there’s the Washington DC metropolitan area where a rising tide did indeed lift a lot of boats. Whereas the nationwide real median income, as we have seen, has been stagnant for two-and-one-half decades, the DC metro area’s median income actually surged from $48,000 to $66,000 during that same interval or by nearly 40 percent in constant dollars.

Finally, we have the leading growth category among all others—-namely, debt and the cheap central bank money that enables it. Notwithstanding the eight years of giant Reagan deficits, the national debt was just $3 trillion or 35 percent of GDP in 1989. Today, of course, it is $17 trillion, where it weighs in at 105 percent of GDP and is gaining heft more rapidly than Jonah Hill prepping for a Hollywood casting call.

Likewise, total US credit market debt—including that of households, business, financial institutions and government— was $13 trillion or 2.3X national income in 1989. Even back then the national leverage ratio had already reached a new historic record, exceeding the World War II peak of 2.0X national income.

Nevertheless, since 1989 total US credit market debt has simply gone parabolic. Today it is nearly $58 trillion or 3.6X GDP and represents a leverage ratio far above the historic trend line of 1.6X national income—a level that held for most of the century prior to 1980. In fact, owing to the madness of our rolling national LBO over the last quarter century, the American economy is now lugging a financial albatross which amounts to two extra turns of debt or about $30 trillion.

In due course we will identify the major villainous forces behind these lamentable trends, but note this in passing: The Federal Reserve was created in 1913, and during its first 73 years it grew its balance sheet in turtle-like fashion at a few billion dollars a year, reaching $250 billion by 1987—at which time Alan Greenspan, the lapsed gold bug disciple of Ayn Rand, took over the Fed and chanced to discover the printing press in the basement of the Eccles Building.

Alas, the Fed’s balance sheet is now nearly $4 trillion, meaning that it exploded by sixteen hundred percent in the last 25 years, and is currently emitting $4 billion of make-believe money each and every business day.

So we can summarize the last quarter century thus: What has been growing is the wealth of the rich, the remit of the state, the girth of Wall Street, the debt burden of the people, the prosperity of the beltway and the sway of the three great branches of government which are domiciled there—that is, the warfare state, the welfare state and the central bank.

What is flailing, by contrast, is the vast expanse of the Main Street economy where the great majority has experienced stagnant living standards, rising job insecurity, failure to accumulate any material savings, rapidly approaching old age and the certainty of a Hobbesian future where, inexorably, taxes will rise and social benefits will be cut.

And what is positively falling is the lower ranks of society whose prospects for jobs, income and a decent living standard have been steadily darkening.

I call this condition “Sundown in America”. It marks the arrival of a dystopic “new normal” where historic notions of perpetual progress and robust economic growth no longer pertain. Even more crucially, these baleful realities are being dangerously obfuscated by the ideological nostrums of both Left and Right.

Contrary to their respective talking points, what needs fixing is not the remnants of our private capitalist economy —which both parties propose to artificially goose, stimulate, incentivize and otherwise levitate by means of one or another beltway originated policy interventions.

Instead, what is failing is the American state itself—-a floundering leviathan which has been given one assignment after another over the past eight decades to manage the business cycle, even out the regions, roll out a giant social insurance blanket, end poverty, save the cities, house the nation, flood higher education with hundreds of billions, massively subsidize medical care, prop-up old industries like wheat and the merchant marine, foster new ones like wind turbines and electric cars, and most especially, police the world and bring the blessings of Coca Cola, the ballot box and satellite TV to the backward peoples of the earth.

In the fullness of time, therefore, the Federal government has become corpulent and distended—a Savior State which can no longer save the economy and society because it has fallen victim to its own inherent short-comings and inefficacies.

Taking on too many functions and missions, it has become paralyzed by political conflict and decision overload. Swamped with insatiable demand on the public purse and deepening taxpayer resistance, it has become unable to maintain even a semblance of balance between its income and outgo.

Exposed to constant raids by powerful organized lobby groups, it has lost all pretenses that the public interest is distinguishable from private looting. Indeed, the fact that Goldman Sachs got a $1.5 billion tax break to subsidize its new headquarters in the New Year’s eve fiscal cliff bill— legislation allegedly to save the middle class from tax hikes— is just the most recent striking albeit odorous case.

Now the American state—-the agency which was supposed to save capitalism from its inherent flaws and imperfections—-careens wildly into dysfunction and incoherence. One week Washington proposes to bomb a nation that can’t possibly harm us and the next week its floods Wall Street speculators, who can’t possibly help us, with continued flows of maniacal monetary stimulus.

Meanwhile, the White House pompously eschews the first responsibility of government—that is, to make an honest budget, which is the essence of what the Tea Party is demanding in return for yet another debilitating increase in the national debt.

To be sure, the mainstream press is pleased to dismiss this latest outburst of fiscal mayhem as evidence of partisan irresponsibility—that is, a dearth of “statesmanship” which presumably could be cured by stiffer backbones and greater enlightenment. Well, to use a phrase I learned from Daniel Patrick Moynihan during my school days here, “would that it were”.

What is really happening is that Washington’s machinery of national governance is literally melting-down. It is the victim of 80 years of Keynesian error—much of it nurtured in the environs of Harvard Yard—- about the nature of the business cycle and the capacity of the state—especially its central banking branch— to ameliorate the alleged imperfections of free market capitalism.

As to the proof, we need look no further than last week’s unaccountable decision by the Fed to keep Wall Street on its monetary heroin addiction by continuing to purchase $85 billion per month of government and GSE debt.

Never mind that the first $2.5 trillion of QE has done virtually nothing for jobs and the Main Street economy or that we are now in month number 51 of the current economic recovery— a milestone that approximates the average total duration of all ten business cycle expansions since 1950. So why does the Fed have the stimulus accelerator pressed to the floor board when the business cycle is already so long in the tooth—-and when it is evident that the problem is structural, not cyclical?

The answer is capture by its clients, that is, it is doing the bidding of Wall Street and the vast machinery of hedge funds and speculation that have built-up during decades of cheap money and financial market coddling by the Greenspan and Bernanke regimes. The truth is that the monetary politburo of 12 men and women holed up in the Eccles Building is terrified that Wall Street will have a hissy fit if it tapers its daily injections of dope.

So we now have the spectacle of the state’s central banking branch blindly adhering to a policy that has but one principal effect: namely, the massive and continuous transfer of income and wealth from the middle and lower ranks of American society to the 1 percent.

The great hedge fund industry founder and legendary trader who broke the Bank of England in 1992, Stanley Druckenmiller, summed-up the case succinctly after Bernanke’s abject capitulation last week. “I love this stuff”, he said, “…. (Its) fantastic for every rich person. It’s the biggest redistribution of wealth from the poor and middles classes to the rich ever”.

Indeed, a zero Federal funds rate and a rigged market for short-term repo finance is the mother’s milk of the carry trade: speculators can buy anything with a yield—-such as treasuries notes, Fannie Mae MBS, Turkish debt, junk bonds and even busted commercial real estate securities— and fund them 90 cents or better on the dollar with overnight repo loans costing hardly ten basis points.

Not only do speculators laugh all the way to the bank collecting this huge spread, but they sleep like babies at night because the central banking branch of the state has incessantly promised that it will prop up bond prices and other assets values come hell or high water, while keeping the cost of repo funding at essentially zero for years to come.

If this sounds like the next best thing to legalized bank robbery, it is. And dubious economics is only the half of it.

This reverse Robin Hood policy is also an open affront to the essence of political democracy. After all, the other side of the virtually free money being manufactured by the Fed on behalf of speculators is massive thievery from savers. Tens of millions of the latter are earning infinitesimal returns on upwards of $8 trillion of bank deposits not because the free market in the supply and demand for saving produces bank account yields of 0.4 percent, but because price controllers at the Fed have decreed it.

For all intents and purposes, in fact, the Fed is conducting a massive fiscal transfer from the have nots to the haves without so much as a House vote or even a Senate filibuster. The scale of the transfer—upwards of $300 billion per year—-causes most other Capitol Hill pursuits to pale into insignificance, and, in any event, would be shouted down in a hail of thunderous outrage were it ever to actually be put to the people’s representatives for a vote.

To be sure, all of this madness is justified by our out-of-control monetary politburo in terms of a specious claim that Humphrey-Hawkins makes them do it—that is, print money until unemployment virtually disappears or at least hits some target rate which is arbitrary, ever-changing and impossible to consistently measure over time.

In fact, however, this ballyhooed statute is a wholly elastic and content-free expression of Congressional sentiment. In their wisdom, our legislators essentially said that less inflation and more jobs would be a swell thing. So the act contains no quantitative targets for unemployment, inflation or anything else and was no less open-ended when Paul Volcker chose to crush the speculators of his day than it was last week when Bernanke elected (once again) to pander obsequiously to them.

In truth, the Fed’s entire macro-economic management enterprise is a stunning case of bureaucratic mission creep that has virtually no statutory mandate. Certainly the author of the Federal Reserve Act, the incomparable Carter Glass of Glass-Steagall fame, abhorred the notion that the central bank would become a tool of Wall Street.

To that end, the Fed originally had no authority to own government debt or to conduct open market operations buying and selling treasury securities on Wall Street. And Carter Glass would be rolling in his grave upon discovery that the Fed was rigging interest rates, manipulating the yield curve, providing succor to financial speculators by propping-up risk asset markets, placing a Put under the S&P 500 or bragging, as Bubbles Ben did recently, that he had levitated an ultra-speculative stock index called the Russell 2000.

Summing up a wholly opposite Congressional intent in the early 1920s, Senator Glass was almost lyrical: “We cured this financial cancer by making the regional reserve banks, not Wall Street, the custodian of the nation’s reserve funds… (And) by making them minister to commerce and industry rather than the schemes of speculative adventure. The country banks were made free. Business was unshackled. Aspiration and enterprise were loosened. Never again would there be a money panic.”

Except…except….except that the Fed eventually strayed from its original modest mandate to be a “banker’s bank”—-and in due course we got the crashes of 1929, 1974, 1987, 1998, 2000, and 2008, to name those so far. In the original formulation, however, these cycles of bubble and bust would not have happened: the Federal Reserve’s only job was the humble matter of passively supplying cash to member banks at a penalty spread above the free market interest rate.

In this modality, the Fed was to function as a redoubt of green-eyeshades, not the committee to save the world. Central bankers would dispense cash at the Fed’s discount window only upon the presentation of good collateral. Moreover, eligible collateral was to originate in trade receivables and other short-term paper arising out of the ebb and flow of free enterprise commerce throughout the hinterlands, not the push and pull of confusion and double-talk among monetary central planners domiciled in the nation’s political capital.

Accordingly, the Federal Reserve that Carter Glass built could not have become a serial bubble machine like the rogue central banks of today. The primary reason is that under the Glassian scheme the free market set the interest rate, not price controllers in Washington.

This meant, in turn, that any sustained outbreak of speculative excess—- what Alan Greenspan once warned was “irrational exuberance” and then promptly hit the delete button when Wall Street objected—would be crushed in the bud by soaring money market interest rates. In effect, leveraged speculators would cure their own euphoria and greed by pushing carry trades—that is, buying long and borrowing short—to the point where they would turn upside down. When spreads went negative, the bubble would promptly stop inflating as overly exuberant speculators were carried off to meet their financial maker—or at least their banker.

And, yes, Carter Glass’ Fed did function under the ancient regime of the gold standard, but there was nothing especially “barbarous” about it—-J. M. Keynes to the contrary notwithstanding. It merely insured that if the central bank was ever tempted to violate its own rules and repress interest rates in order to accommodate speculators and debtors, more prudent members of the financial community could dump dollar deposits for gold, thereby bringing bank credit expansion up short and aborting incipient financial bubbles before they swelled-up.

Needless to say, a central bank which could not create credit-fueled financial bubbles could not have become today’s monetary central planning agency, either. Indeed, the remit of the Glassian banker’s bank did not include managing the business cycle, levitating the GDP, targeting the unemployment rate, goosing the housing market or fretting over the rate of monthly consumer spending.

Certainly it did not involve worrying whether the inflation rate was coming in below 2 percent—the current inexplicable target of the Fed which Paul Volcker has rightly pointed out amounts to robbing the typical laboring man of half the value of his savings over a working lifetime of 30 years.

In short, in the Glassian world the state had no dog in the GDP hunt: whether it grew at an annual rate of 4 percent, 1 percent or went backwards was up to millions of producers, consumers, savers, investors, entrepreneurs and, yes, even speculators interacting on the free market. Indeed, the so-called macroeconomic aggregates—-such as national income, total employment, credit outstanding and money supply—-were passive outcomes on the market, not active targets of state policy.

Needless to say, no Glassian central banker would have ever dreamed of levitating the macro-economic aggregates through the Fed’s current radical, anti-democratic doctrine called “wealth effects”.

Under the latter, the 10 percent of the population which owns 85 percent of the financial assets—and especially the 1 percent which owns most of the so-called “risk assets” managed by hedge funds and fast money speculators—are induced to feel richer by the deliberate and wholly artificial inflation of financial asset values.

In the case of the Russell 2000 which is Bernanke’s favorite wealth effects tool, for instance, the index gain from 350 in March 2009 to 1080 at present amounts to 200 percent and that is for un-leveraged holdings; the Fed engineered windfall actually amounts to a 400 or 500 percent gain under typical options, leverage and timing based strategies employed by the fast money.

In any event, feeling wealthier, the rich are supposed to spend more on high end restaurants, gardeners and Pilate’s instructors, thereby causing a “trickle-down” jolt to aggregate demand and eliciting a virtuous circle of rising output, incomes and consumption—-indeed, always more consumption.

Having been involved in another radical experiment in “trickle down”—-the giant Reagan tax cuts of 1981—-I no longer believe in Voodoo economics. But at least the Gipper’s tax cuts were voted through by a democratic legislature. The Greenspan-Bernanke-Yellen version of “trickle-down”, by contrast, is a pure gift from a handful of central bank apparatchiks to the super-rich.

Nevertheless, the more virulent form of “trickle-down” being practiced in 2013 is rooted in the same erroneous predicate as the mistake of 1981—-namely, the Keynesian gospel that the free enterprise economy is inherently prone to business cycle instability and perennially under-performs its so-called “potential” full employment growth rate. Accordingly, enlightened intervention—if that is not an oxymoron— by the fiscal and monetary branches of the state is claimed to be necessary to cure these existential disabilities.

The truth of the matter, however, is that Keynesian monetary and fiscal stimulus has never really been needed in the post-war world. Among the ten business cycle contractions since 1950, two of them were unavoidable, self-correcting dislocations resulting from the abrupt cooling down of hot wars in Korea and Vietnam.

The other eight downturns were actually caused by the Federal Reserve, not cured by it. After the Fed first got carried away with too much stimulus and credit creation in 1971-1974, for example, it had to trigger a short-lived inventory correction to halt the resulting inflation and speculative excesses in financial, labor and commodity markets. But once these necessary inventory corrections ran their course, the economy rebounded on its own each and every time.

To be sure, the Reagan tax cut intervention of 1981 came in a quasi-libertarian guise. By getting the tax-man out of the way, GDP growth was supposed to be unleashed throughout the economic hinterlands, rising by something crazy like 5 percent annually— forever and ever, world without end.

But in practice, “supply-side” was just Keynesian economics for the prosperous classes—that is, it ended-up being a scheme to goose the GDP aggregates by drawing down Uncle Sam’s credit card and then passing along the borrowings to so-called “job creators” thru tax cuts rather than to dim-witted bureaucrats thru spending schemes.

Indeed, the circumstances of my own ex-communication from the supply-side church underscore the Reaganite embrace of the Keynesian gospel. The true-believers—led by Art Laffer, an economist with a Magic Napkin, and Jude Wanniski, an ex-Wall Street Journal agit-prop man who chanced to stuff said napkin into his pocket— were militantly opposed to spending cuts designed to offset the revenue loss from the Reagan tax reductions.

They called this “root canal” economics and insisted that the Republican Party could never compete with the Keynesian Democrats unless it abandoned its historic commitment to balanced budgets and fiscal rectitude, and instead, campaigned on tax cuts everywhere and always and a fiscal free lunch owing to a purported cornucopia of economic growth.

So supply-side became just another campaign slogan—a competitive entry in the Washington beltway enterprise of running-up the national debt in order to perfect and improve upon the otherwise inferior results of the free market economy. In the fullness of time, of course, supply-side economics degenerated into Dick Cheney’s fatuous claim that Reagan proved “deficits don’t matter”.

From there came two giant unfinanced tax cuts and two pointless unfinanced wars under George W. Bush. And then there arose, finally, the GOP’s descent into fiscal know-nothingism during the Obama era— wherein it refused to cut defense, law enforcement, veterans, farm subsidies, the border patrol, middle class student loans, social security, Medicare, the SBA and export-import bank loans to Boeing and General Electric, among countless others— while insisting that no tax-payer should suffer the inconvenience of higher taxes to pay Uncle Sam’s bloated bills.

We thus ended up with the New Year’s Day Folly of 2013. Save for the top 2 percent of taxpayers who were being generously taken care of by the Fed already, all of America got a huge permanent tax cut—-amounting to $2 trillion over the coming decade alone.

Never mind that the Democrats had spent the entire prior decade denouncing the Bush tax cuts as fiscal madness. Now, the tax bidding war which had started in the Reagan White House in May 1981 became institutionalized in the Oval Office.

The so-called Progressive Left was in charge of the veto pen, of course, but the latter was found wanting for ink and in that outcome the nation’s fiscal demise was sealed. There was no progressive case whatsoever for extending the Bush tax cuts because, as Willard M. Romney had so inartfully taught the nation during the Presidential campaign, the bottom 47 percent of households don’t pay any income tax in the first place!

In short, the most left-wing President ever elected in America was showering the upper middle-class with trillions in extra spending loot for no reason of policy—-except to ensure that they would buy more Coach Bags and flat screen TVs.

The fiscal end game—policy paralysis and the eventual bankruptcy of the state—thus became visible. All of the beltway players—-Republican, Democrats and central bankers alike—-are now so hooked on the Keynesian cool-aid that they cannot imagine the Main Street economy standing on its own two feet without continuous, massive injections of state largesse.

Indeed, the lunacy of the Fed’s trickle-down-to- the-rich was justified last week by Bernanke himself on the grounds that the minor fiscal pinprick owing to the budget sequester was keeping the GDP from growing at its appointed rate.

Based on the same logic the GOP’s most fearsome fiscal hawk, Congressman Paul Ryan, proposed a budget which actually increased the deficit by $200 billion over the next three years on the grounds that the economy was too weak to tolerate fiscal rectitude in the here and now. In the manner of St. Augustine, the Ryan budget got to balance in the by-in-by—that is, in 2037 to be exact— pleading “Lord, make me chaste— but not just now”.

In other words, the entire fiscal and monetary apparatus of the state has become a jobs program. Progressives pleasure households earning a quarter million dollars annually with tax cuts so that they will hire another gardener; conservatives support modernization of our already lethal fleet of 10,000 M-1 tanks to keep the production line open in Lima, Ohio—-notwithstanding that no nation in the world can invade the US homeland and that the American people are tired of invading the homelands of innocent peoples abroad.

In the same vein, by all accounts the US income tax code is a disgrace— a milk-cow for the K-street lobbies, a briar patch of screaming inequities and the leakiest revenue raising system ever concocted.

But it also amounts to 70,000 pages of jobs programs. None of these can be spared, according to the beltway consensus, so long as GDP and job growth is not up to snuff—that is, as long as they fall short of the American economy’s so-called full employment potential. The latter is an ethereal number known only to the Keynesian priesthood, led by the great thinker’s current vicar on earth, professor Larry Summers, who during his tenure in the White House turned Art Laffer’s napkin upside down and wrote “$800 billion” on the back.

That was the magic number which, when multiplied by another magic number called the fiscal multiplier, would generate an amount of incremental GDP exactly equal to the gap between actual GDP in early 2009 and potential GDP, as calibrated by the vicar.

This might be called the bath-tub theory of macroeconomics because according to Summers and the White House, it didn’t matter much what was in the $800 billion package—-the urgent matter was to get Washington’s fiscal pumping machinery operating at full-tilt.

Accordingly, once the magic number had been scribbled on the White House napkin, the nation’s check-writing pen was handed off to Speaker Nancy Pelosi and Harry Reid, who conducted the most gluttonous feeding frenzy every witnessed along the corridors of K-Street.

In exactly twenty-two days from the inauguration, the new administration conceived, drafted, circulated, legislated and signed into law an $800 billion omnibus package of spending and tax cutting that amounted to nearly 6 percent of GDP. I had been part of a new administration that moved way too fast on a grand plan and had seen the peril first hand. But the Reagan fiscal mishap did not even remotely compare to the reckless, unspeakable folly conducted by the Obama White House.

In fact, the stimulus bill was not a rational economic plan at all; it was a spasmodic eruption of beltway larceny that has now become our standard form of governance.

Stated differently, the stimulus bill was a Noah’s ark which had welcomed aboard every single pet project of any organization domiciled in the nation’s capital with a K-street address. Most items were boarded without any policy review or adult supervision, reflecting a rank exercise in political log-rolling that proceeded straight down the gang planks to the bulging decks below.

Indeed, the true calamity of the Obama stimulus was not merely its massive girth, but the cynical, helter-skelter process by which the public purse was raided. At the end of the day, it was a startling demonstration that the power of a bad idea—-the Keynesian predicate—-when coupled with the massive money power of the PACs and K-Street lobbies, has rendered the nation fiscally incontinent.

This unhinged modus operandi undoubtedly accounts for the plethora of sordid deals that an allegedly “progressive” White House waived through. Thus, the homebuilders were given “refunds” of $15 billion for taxes they had paid during the bubble years; manufacturers got 100 percent first year tax write-offs for equipment that should have been written off over a decade or longer; and crony capitalist investors got $90 billion for uneconomic solar, wind and electric vehicle projects under the fig leaf of “green energy”.

Likewise, insulation suppliers got a $10 billion hand-out via tax credits to homeowners to improve the thermal efficiency of their own properties; congressman on the public works committees got $10 billion earmarked for pork barrel water and reclamation projects in the home districts; and the already corpulent budget of the Pentagon was handed another $10 billion for base construction it most definitely didn’t need—to say nothing of a new headquarters for the insanely bloated and incompetent Homeland Security Department

Moreover, the big ticket stuff was far worse. Nearly $50 billion was allocated to highway construction—much of it for repaving highways that didn’t need it or building interchanges where the traffic didn’t warrant it; and, in any event, it should have been paid for with user gasoline taxes, not permanent debt on the general public.

Still, the real pyramid building gambit was the $30 billion or so for transit and high speed rail. Forty-five years of mucking around with the abomination know as Amtrak proves unequivocally that cross-country rail can never be viable in the US because it cannot compete with air travel among the overwhelming majority of city-pairs.

Presently, every single ticket sold on the Sunset Limited from New Orleans to Los Angeles, for example, requires a subsidy that is nearly double the cost of an airline ticket, and is indicative of why we pour $1 billion down the drain each year subsidizing the public transit myth —a boondoggle that will become all the greater owing to the distribution of billions of high speed rail “stimulus” funds which were not subject to even a single hour of hearings.

Then there was $80 billion for education but the only rhyme or reason to it was the list of K-Street lobbies that had lined-up outside Speaker Pelosi’s door: to wit, the National Education Association, the school superintendents lobby, the textbook publishers, the school construction industry, the special education complex, the pre-school providers association, and dozens more.

In a similar manner, the nursing home lobby, home health providers, the hospital association, the knee and hip replacement manufactures, the scooter chair hawkers and the Medicaid mills were all delighted to pocket an extra $80 billion of Federal funding, thereby relieving pressures for reimbursement reductions from the regular state Medicaid programs.

Finally, there was the Obama “money drop” whereby $250 billion was dispersed in helicopter fashion to 140 million tax filers and 65 million citizens who receive social security, veterans and other benefit checks. But there was virtually no relationship to need: tax filers with incomes up to $200,000 were eligible, or about 95 percent of the population.

And among the beneficiary population receiving a $250 stimulus check, less than 10 percent were actually means-tested— while millions of these checks went to affluent social security retirees happy to have Uncle Sam pay for an extra round or two of golf.

Indeed, there was no public policy purpose at all to Obama’s quarter trillion dollar money drop except filling the Keynesian bath-tub with make believe income, hoping that citizens would use it to buy a new lawnmower , a goose-down comforter, dinner at the Red Lobster or a new pair of shoes.

Yet ensnared in the Keynesian delusion that society can create wealth by mortgaging its future, the stimulus-besotted denizens of the beltway blew it entirely on the one true domestic function of the state—even under the regime of crony capitalism that now prevails. That imperative is to maintain and adequately fund a sturdy safety net to support citizens who cannot work due to age or health, and to supplement the incomes of families whose marketplace earnings fall below a minimum standard of living.

Yet notwithstanding the feeding frenzy on K-Street to fill-in the Keynesian vicar’s $800 billion blank check in a record twenty-two days, only 3.8 percent of the total—-a mere $30 billion—was allocated to means-tested cash benefits which actually fund the safety net for the needy. Yet with $17 trillion of national debt on the books already, and the certainty that will double or triple in the decades immediately ahead, indiscriminately filling the Keynesian bathtub with borrowed money is not only reckless, but also a cruel insult to any reasonable standard of equitable justice.

The fiscal madness of the Obama era cannot be excused on the grounds that the nation was faced with Great Depression 2.0. We weren’t and the widespread belief that we were so threatened is almost entirely attributable to Ben Bernanke’s faulty scholarship about the Fed’s alleged mistake of not undertaking a massive government debt buying spree to counter-act the Great Depression.

The latter, in turn, was borrowed almost entirely from Milton Friedman’s primitive quantity theory of money which was wrong in 1930 and ridiculously irrelevant to the circumstances of 2008. Nevertheless, it was the basis for Bernanke’s panicked flooding of Wall Street with indiscriminate bailouts and endless free liquidity after the Lehman event.

But what was actually happening was that the giant credit and housing bubble, which had been created by the Greenspan-Bernanke Fed in the wake of the bursting dotcom bubble, which it had also created, was being liquidated. Most of the carnage was happening within the gambling halls of Wall Street because it was the wholesale money market and the shadow banking system that was experiencing a run, not the retail banks of main street America.

The so-called financial crisis, therefore, consisted first and foremost of a violent mark-down of hugely leveraged, multi-trillion Wall Street balance sheets that were loaded with toxic securities— that is, the residue of speculative trading books and undistributed underwritings of sub-prime CDOs, junk bonds, commercial real estate securitizations, hung LBO bridge loans, CDOs squared—- and which had been recklessly funded with massive dollops of overnight repo and other short-term wholesale money.

This was just one more iteration of the speculator’s age old folly of investing long and illiquid and funding short and hot.

By the time of the frenzied bailout of AIG on September 16th, led by Bernanke and Hank Paulson, the most dangerous unguided missile every to rain down on the free market from the third floor of the Treasury building, it was nearly all over except for the shouting. Bear Stearns, Lehman and Merrill Lynch were already gone because they were insolvent and should have been liquidated—-including the bondholders who have foolishly invested in their junior capital for a few basis points of extra yield.

Likewise, Morgan Stanley was bankrupt, too—-propped up ultimately by $100 billion of Fed loans and guarantees that accomplished no public purpose whatsoever, except to keep a gambling house alive that the nation doesn’t need, and to rescue the value of stock held by insiders and bonds owned by money manager who had feasted for years on its reckless bets and rickety balance sheet.

Indeed, at the end of the day the only real purpose of the September 2008 bailouts was to rescue Goldman Sachs from short-sellers who would have taken it down, had not Paulson and Bernanke bailed out Morgan Stanley first, and then outlawed the right of free citizens to sell short the stock of any financial company s until the crisis had passed.

The case for bailing out AIG was even more sketchy. It had around $800 billion of mostly solid assets in the form of blue chip stocks, bonds, governments, GSE securities and long-term, secured aircraft leases, among others.

So the great global empire of dozens of insurance and leasing companies that Hank Greenburg had built over the decades wasn’t really insolvent: the problem was that its holding company, which had written hundreds of billions of credit default swaps, was illiquid.

It couldn’t met margin calls against the CDS it had written because state insurance commissioners in their wisdom had imposed capital requirements and dividend stoppers on AIG’s far flung insurance subsidiaries—-precisely so that policy-holders couldn’t be fleeced by holding company executives and Boards needing to fund their gambling debts.

In short, virtually none of the AIG subsidiaries would have failed; millions of life insurance policies and retirement annuities would have been money good, and the fire insurance on factories in Peoria would have remained in force.

The only thing that really happened was that something like twelve gunslingers based in London, who sold massive amounts of loss insurance on sub-prime mortgage bonds to about a dozen multi-trillion global banks, would have had to hire protection on their lives in the absence of the bailout. These CDS policies issued by the AIG holding company, in fact, were almost completely bogus and would have generated about $60 billion in losses among Goldman, JPMorgan, Barclays, Deutsche Bank, SocGen, BNP-Paribas, Citi bank and a handful other giants with combined balance sheet footings of $20 trillion.

So the loss would have been less than one-half of one percent of the aggregate balance sheet of the global banks impacted—that is, a London Whale or two, and nothing more

But by dishing out around $15 billion of bailout money to each of the above named institutions, the American taxpayer kindly protected the P&L of these banks from a modest one-time hit, and kept executive bonuses in the money, too. It also left AIG under the care of unreconstructed princes of Wall Street whose claims to entitlement know no bounds, as exemplified by Mr. Benmosche’s recent stupefying inability to distinguish between a lynching and the loss of undeserved bonuses.

But as they say on late night TV, there’s more. We were told that ATMs would go dark, big companies would miss payrolls for want of cash and the $3.8 trillion money market fund industry would go down the tubes.

All of these legends are refuted in the section of my book called the Blackberry Panic of 2008—-the title being a metaphor for the fact that the Treasury Department of the US government was in the hands of Wall Street plenipotentiaries who could not keep their eyes off the swooning price charts for the S&P 500 and Goldman Sachs flickering red on their blackberry screens.

But just consider this. Fully $1.8 trillion or 50 percent of total money market industry was in the form of so-called “government only” funds or Treasury paper. Not a single net dime left these funds during the panic and for the good reason that treasury interest payments were never in doubt.

Likewise, the other half of the industry consisted of so-called “prime” funds which included modest amounts of commercial paper along with governments and bank obligations. About $400 billion or 20 percent of these holdings did leave these “prime” funds.

Yet, the overwhelming share of these withdrawals—upwards of 85 percent—simply migrated within money fund companies from slightly risky “prime” funds to virtually riskless “government only” funds. In effect, the much ballyhooed flight from the money market funds consisted of professional investors hitting the “transfer” button on their account pages.

Worse still, the only significant investor loss in this $4 trillion sector, which was supposedly ground zero of the meltdown, was on about $800 million of Lehman commercial paper held by the industry’s largest operation called the Reserve Prime Fund. The loss amounted to 0.002 percent of the money market industry’s holdings on the eve of the crisis.

In a similar vein, the $2 trillion commercial paper market was said to be melting down, but this too is an urban legend fostered by the nation’s leading crony capitalist, Jeff Imelt of GE. Unaccountably, the latter did manage to secure $30 billion of Fed guarantees for General Electric’s AAA balance sheet, thereby obviating any need to do the right free market thing—that is, to make a dilutive issue of stock or long-term debt to pay down some cheap commercial paper that could not be rolled during the crisis.

Accordingly, GE Capital’s practice of funding long-term, sticky assets with short-term hot money should have caused shareholders to take a hit, and the company’s executives to be brought up short on the bonus front.

Instead, the bailout of GE’s commercial paper gave rise to the urban legend that companies could not fund their payrolls, when the truth is that every single industrial company that had a commercial paper facility also had back-up lines at their commercial bank, and not a single bank refused to fund, meaning no payroll disbursement was every in jeopardy.

What actually shrank, and deservedly so, was the $1 trillion asset-backed commercial paper market—a place where banks go to refinance credit card and auto loan receivables so that they can book the lifetime profits on these loans upfront—literally the instant your card is swiped— under the “gain-on-sale” accounting scam.

Consequently, the subsequent sharp decline of the ABCP market has been entirely a matter of bank profit timing. It never prevented a single consumer from swiping a credit card or obtaining an auto loan.

In short, by the time of TARP and the massive liquidity injections into Wall Street by the Fed——when it doubled its 94 year-old balance sheet in seven weeks thru October 25, 2008—the meltdown in the canyons of Wall Street had pretty much burned itself out.

Had Mr. Market been allowed to have his way with the street, a healthy purge of decades’ worth of speculative excesses would have occurred. Indeed, the main effect would be that perhaps a half-dozen “sons of Goldman” would be operating today, not the vampire squid which remains—-and they would be run by chastened people who would have lost their stake during the free market’s cleansing interlude.

In a similar manner, the one-time hit to GDP and jobs which resulted from economically warranted collapse of the housing, commercial real estate and the consumer credit bubbles was actually over within nine months.

The ensuring rebound that incepted in June 2009 reflected the regenerative powers of the free market, and not the Fed’s mad-cap money printing or the Obama fiscal stimulus. The Fed did lower interest rates to zero, and thereby it revived the speculative juices on Wall Street. But the plain fact is that household and business credit continued to contract on Main Street long after the June 2009 bottom, and for good reason: both sectors were massively over-leveraged after three decades of continuous, pell mell credit expansion.

The household sector, for example, had $13 trillion of debt which represented 205 percent of wage and salary income—compared to the historic ratio of under 90 percent which had prevailed during healthier times prior to 1980. So the Fed’s massive balance sheet expansion did nothing to cause higher borrowing, spending, output or employment on Main Street, even as it put the hedge funds back into the carry-trade business—now with essentially zero cost of funds.

By the time the rebound began in June 2009 not even $75 billion of the stimulus bill—that is, one-half of one percent of GDP—- had hit the spending stream, meaning, again, that the recovery already underway was self-generating.

As it happened, the initial wave of business inventory liquidation and labor-shedding triggered by the Wall Street meltdown had burned itself out quickly during the first nine months after the Lehman crisis. Thus, business inventories totaled $1.54 trillion in August 2008, and dropped by a total of $215 billion or 14 percent during the course of the recession. Yet fully $185 billion of that liquidation occurred before June 2009, and inventories started to actually rebuild a few months later.

The story was similar for non-farm payrolls. Nearly 7.6 million jobs were shed during the Great Recession but fully 6.6 million or 90 percent of the adjustment was completed by June 2009. Indeed, the idea that this short but sharp recession had anything to do with the Great Depression is essentially ludicrous, and fails completely to note the vast structural differences between the two eras.

During the early 1930, the US was the great creditor and exporter to the world, with 70 percent of GDP accounted for by primary production industries—-agriculture, mining and manufacturing— which have long pipelines of crude, intermediate and finished inventory.

By the time of the 2008 Wall Street meltdown, however, the primary production sector had become a mere shadow of its former self, accounting for only 17 percent of GDP. Accordingly, when recession hit the American economy this time, the downward spiral of inventory liquidation was muted—-with the total inventory liquidation amounting to 2 percent of GDP in 2008-09 compared to 20 percent in the early 1930s.

Indeed, the inherent recession dynamics of the contemporary US service economy— with its massive built-in stabilizers in the form of transfer payment and huge government payrolls— militated against the entire scare story of a Great Depression 2.0.

During the nine months thru June 2009, for example, government transfer payments for foods stamps, unemployment insurance, Medicaid, cash assistance and social security disability soared at a $300 billion annual rate, thereby more than off-setting the $275 billion drop in total wage and salary income.

Likewise, government wages and salaries actually rose during the period, and the vast US service sector payrolls were tapered back modestly, rather than going dark in the form of traditional factory shutdowns. Aerobics class instructors, for example, experienced modestly reduced paid hours, but unlike factories and mines, fitness centers did not go dark in order to burn off excess inventories; they stuck to burning off calories at a modestly reduced rate.

In fact, by 2008 China, Australia and Brazil had become the world’s new mining and manufacturing economy—that is, the US economy of the 1930s. When upwards of 50 million Chinese migrant workers were sent home from idle Chinese export factors, the villages of China’s vast interior became the “Hoovervilles “of the present era.

In short, Bernanke’s depression call was reckless and uninformed. The real challenge facing the American economy was to get off the massive credit binge which had bloated and inflated output, jobs and incomes for more than two decades.

Instead, Washington poured gasoline on the fire, thereby re-igniting an even great bubble that will ultimately end in state-wreck—that is, in the thundering collapse of the financial markets. Indeed, the nation’s rogue central bank will eventually be engulfed in the Wall Street hissy fit it fears—undone by waves of relentless selling when the monetary politburo finally loses control of panicked day traders and raging robo trading machines.

Likewise, the Federal budget has become a doomsday machine because the processes of fiscal governance are paralyzed and broken. There will be recurrent debt ceiling and shutdown crises like the carnage scheduled for next week, as far as the eye can see.

Indeed, notwithstanding the assurances of debt deniers like professor Krugman, the honest structural deficit is $1-2 trillion annually for the next decade and then it will get far worse. In fact, when you set aside the Rosy Scenario used by CBO and its preposterous Keynesian assumption that we will reach full employment in 2017 and never fall short of potential GDP ever again for all eternity, the fiscal equation is irremediable.

It looks like worthless government drones aren’t exclusive to the U.S. Postal Service. While the TSA was patting down a 95 year old grandmother in her wheelchair, they allowed a little 9 year old potential terrorist without a ticket to board a flight to Vegas. It seems what happened in Vegas didn’t stay in Vegas. The TSA – keeping us safe from phantom terrorists.

MINNEAPOLIS – A 9-year-old runaway went through security, boarded a plane at the Minneapolis-St. Paul International Airport without a ticket and flew to Las Vegas, an airport spokesman said Sunday.

Security officials screened the Minneapolis boy at the airport shortly after 10:30 a.m. Thursday after he arrived via light rail, Metropolitan Airports Commission spokesman Patrick Hogan said. The boy then boarded a Delta flight that left for Las Vegas at 11:15 a.m.

The flight was not full, Hogan said, and the flight crew became suspicious midflight because the boy was not on their list of unattended minors. The crew contacted Las Vegas police, who met them upon landing and transferred the boy to child protection services, Hogan said.

“It’s hard to piece anything together from his stories why he got on the flight and went to Las Vegas,” Hogan said.

Minneapolis police Sgt. Bill Palmer said officers talked to the family after Las Vegas police contacted them. A family member told police the boy ran away and was last seen earlier Thursday.

The boy had been at the airport on Wednesday as well, Hogan said. Video shows him grabbing a bag from the carousel and ordering lunch at a restaurant outside of the security checkpoints.

He ate and then told the server he had to use the bathroom. He left the bag and never returned to pay, Hogan said. Airport officials returned the bag to its owner.

Delta and the Transportation Security Administration said in separate statements that they were investigating.

Hennepin County Child Protection Services also was looking into it, Palmer said. County spokeswoman Carolyn Marinan said Sunday she couldn’t confirm or deny the agency’s involvement because the case involves a juvenile and data privacy issues.

The boy was expected to return to the Twin Cities, but Hogan didn’t know Sunday if that had happened yet.

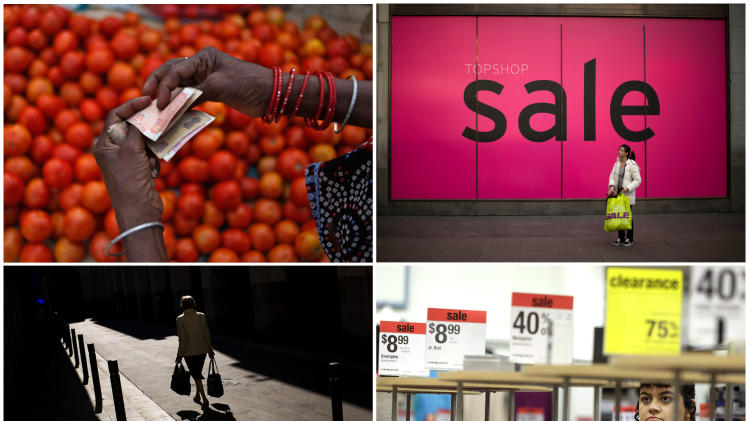

The theme of this article is that people across the globe have been hoarding cash since the financial crisis ended. The journalist doesn’t realize the Crisis never ended. It will be a 20 year Crisis that profoundly changes the world as we have known it. The hoarding of cash by people is related to the mood change that has occurred in this Fourth Turning. Rational thinking people have lost faith in a corrupt financial system. Bernanke and the ruling class have tried everything in their bag of debt tricks to convince the masses to resume credit card financed consumption. It has failed. They’ve created a stock market bubble through the creative use of printing $85 billion per month and handing it to the Wall Street banks. And still the people are hoarding their cash. Individual investors have been nowhere to be found. There has been a profound mood change in this country and around the world since September 2008. Those in power continue to view history and economics as linear. The cyclical mood driven aspect of history will ultimately be their downfall.

An Associated Press analysis of households in the 10 biggest economies shows that families continue to spend cautiously and have pulled hundreds of billions of dollars out of stocks, cut borrowing for the first time in decades and poured money into savings and bonds that offer puny interest payments, often too low to keep up with inflation.

“It doesn’t take very much to destroy confidence, but it takes an awful lot to build it back,” says Ian Bright, senior economist at ING, a global bank based in Amsterdam. “The attitude toward risk is permanently reset.”

A flight to safety on such a global scale is unprecedented since the end of World War II.

The implications are huge: Shunning debt and spending less can be good for one family’s finances. When hundreds of millions do it together, it can starve the global economy.

Weak growth around the world means wages in the United States, which aren’t keeping up with inflation, will continue to rise slowly. Record unemployment in parts of Europe, higher than 35 percent among youth in several countries, won’t fall quickly. Another wave of Chinese, Brazilians and Indians rising into the middle class, as hundreds of millions did during the boom years last decade, is unlikely.

Some of the retrenchment is not surprising: High unemployment in many countries means fewer people with paychecks to spend. Some people who lost jobs got new ones that pay less or are part time. But even people with good jobs and little fear of losing them remain cautious.

“Lehman changed everything,” says Arne Holzhausen, a senior economist at global insurer Allianz, based in Munich. “It’s safety, safety, safety.”

The AP analyzed data showing what consumers did with their money in the five years before the Great Recession began in December 2007 and in the five years that followed, through the end of 2012. The focus was on the world’s 10 biggest economies — the U.S., China, Japan, Germany, France, the United Kingdom, Brazil, Russia, Italy and India — which have half the world’s population and 65 percent of global gross domestic product.

Key findings:

— RETREAT FROM STOCKS: A desire for safety drove people to dump stocks, even as prices rocketed from crisis lows in early 2009, and put their money into bonds. Investors in the top 10 countries pulled $1.1 trillion from stock mutual funds in the five years after the crisis, or 10 percent of what they had invested at the start of that period, according to Lipper Inc., which tracks funds.

They put even more money into bond mutual funds — $1.3 trillion — even as interest payments on bonds plunged to record lows.

— SHUNNING DEBT: Household debt surged at an unprecedented rate in the five years before the financial crisis. In the U.S., the U.K. and France, it soared more than 50 percent per adult, according to Credit Suisse. For all 10 countries, it jumped 34 percent. Then the financial crisis hit, and people slammed the brakes on borrowing. Debt per adult in the 10 countries fell 1 percent in the 4½ years after 2007. Economists say debt hasn’t fallen in sync like that since the end of World War II. People chose to shed debt even as lenders slashed rates on loans to record lows. In normal times, that would have triggered an avalanche of borrowing.

“Given what they’ve lived through, households are loath to borrow again,” says Jack Ablin, chief investment officer of BMO Private Bank in Chicago. “They’re not going to stretch. They want a cushion.”

— HOARDING CASH: Looking for safety for their money, households in the six biggest developed economies added $3.3 trillion, or 15 percent, to their cash holdings in the five years after the crisis, slightly more than they did in the five years before, according to the Organization for Economic Cooperation and Development.

The growth of cash is remarkable because millions more were unemployed, wages grew slowly and people diverted billions to pay down their debts. They also poured money into bank accounts knowing they would earn little interest on their deposits, often too little to keep up with inflation.

— SPENDING SLUMP: Cutting debt and saving more may be good in the long term, but to do that, people have had to rein in their spending. Adjusting for inflation, global consumer spending rose 1.6 percent a year during the five years after the crisis, according to PricewaterhouseCoopers, an accounting and consulting firm. That was about half the growth rate before the crisis and only slightly more than the annual growth in population during those years.

Consumer spending is critically important because it accounts for more than 60 percent of GDP.

— DEVELOPING WORLD NOT HELPING ENOUGH: When the financial crisis hit, the major developed countries looked to the developing world to take over in powering global growth. The four big developing countries — Brazil, Russia, India and China — recovered quickly from the crisis. But the potential of the BRIC countries, as they are known, was overrated. Although they have 80 percent of the people, they accounted for only 22 percent of consumer spending in the 10 biggest countries last year, according to Haver Analytics, a research firm. This year, their economies are stumbling.

Consumers around the world will eventually shake their fears, of course, and loosen the hold on their money. But few economists expect them to snap back to their old ways.

One reason is that the boom years that preceded the financial crisis were as much an aberration as the last five years have been. Those free-spending days, experts now understand, were fueled by families taking on enormous debt, not by healthy wage gains. No one expects a repeat of those excesses.

More importantly, economists cite a psychological “scarring” that continues to shape behavior. Scarring is a fear of losing money that grips people during a period of collapsing jobs, incomes and wealth, and then doesn’t let go.

The desire for safety remains even after jobs return, wages rise and financial and housing markets recover. Think of Americans who suffered through the Great Depression and stayed frugal for decades, even as the U.S. economy boomed after World War II.

Although not on a level with the Depression, some economists think the psychological blow of the financial crisis was severe enough that households won’t increase their borrowing and spending to what would be considered normal levels for another five years or longer.

To better understand why people remain so cautious five years after the crisis, AP interviewed consumers around the world. A look at what they’re thinking — and doing — with their money:

___

INVESTING

Rick Stonecipher of Muncie, Ind., doesn’t like stocks anymore, for the same reason that millions of investors have turned against them — the stock market crash that began in October 2008 and didn’t end until the following March.

“My brokers said they were really safe, but they weren’t,” says Stonecipher, 59, a substitute school teacher.

That individual investors would sell while markets plunged is not surprising. Households nearly always bail out as stocks drop, only to buy again after they rise.

But this time was different. In the U.S., the Dow Jones industrial average rocketed 118 percent over the next four years and reached a record high in March. In Germany, the DAX Index soared 116 percent and hit a record in May. In the U.K., the FTSE 100 index rose 85 percent. Yet small investors mostly sold during that period, an extraordinary vote of no confidence.

Americans pulled the most money out over five years — $521 billion from stock mutual funds, or 9 percent of their holdings, according to Lipper. But investors in other countries sold an even larger share of their holdings: Germans dumped 13 percent; Italians and French, more than 16 percent each.

The French are “not very oriented to risk,” says Cyril Blesson, an economist at Pair Conseil, an investment consultancy in Paris. “Now, it’s even worse.”

It’s gotten worse in China, Russia, Japan and the United Kingdom, too.

Fu Lili, 31, a psychologist in Fu Xin, a city in northeastern China, says she made about 20,000 yuan ($3,267) buying and selling stocks before the crisis, more than 10 times her monthly salary then. But she won’t touch them now, because she’s too scared.

In Moscow, Yuri Shcherbanin, 32, a manager for an oil company, says the crash proved stocks were dangerous and he should content himself with money in the bank.

Hirokazu Suyama, 26, a musician in Tokyo, dismisses stock investing as “gambling.”

In London, Pavlina Samson, 39, owner of a jewelry and clothes shop, says stocks are too “risky.” What’s also driving her away may be something that runs deeper: “People feel like they’re being ripped off everywhere,” she says.

Holzhausen, the Allianz economist, says people are shunning stocks for the same reason they’re shunning other investments that involve risk — less a cold calculation of whether the price is right and more a mistrust of nearly everything financial.

“People want to get as much distance as possible from the financial system,” he says. “They want to be in control of their financial matters. People no longer trust in the markets.”

In India, where the growing middle class seems perfect for stocks, people were pulling out even before the economy deteriorated in recent months. Indians dumped 15 percent of their holdings in the five years after the crisis.

Pradeep Kumar, owner of a fast-expanding manufacturer of water pumps and parts for electric fans, says he finds stocks confusing and prefers investing in real estate and plowing money back into his business.

“I will not venture into something I don’t understand,” says Kumar, 41, a father of two from Varanasi in northern India.

What people do understand are bonds — boring, seemingly safe and, in terms of interest payments, unrewarding. In the five years after the crisis struck, investors in the six biggest developed countries poured $2 trillion into bond mutual funds, an increase of 60 percent. During that time, interest payments fell by half.

Investors have barely been compensated for inflation, if at all.

Consider a favorite German investment: funds run by insurers that hold mostly government bonds. Half the payments investors receive are tax free if they hold onto the funds long enough. Even with that tax savings, though, the investor returns can be dreadfully low. For new policies, the guaranteed interest rate is currently 1.75 percent a year, roughly the rate of inflation.

In recent months, Americans have shown more courage, inching back into stock mutual funds. But they’ve bought one week, only to sell the next, and they appear almost as wary of the market as they were during the crisis.

In April, one month after the Dow recovered the last of its losses from the crisis and reached a record high, 75 percent of Americans in an AP-GfK poll described the stock market as “risky.” That was only slightly better than the 78 percent who felt that way in a CBS News/New York Times poll in January 2009 when the market was plunging.

____

DEBT