“All the world is made of faith, and trust, and pixie dust.” ― J.M. Barrie – Peter Pan

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.” – Lord Acton

Who do you trust? Do you trust the President? Do you trust Congress? Do you trust the Treasury Secretary? Do you trust the Federal Reserve? Do you trust the Supreme Court? Do you trust the Military Industrial Complex? Do you trust Wall Street bankers? Do you trust the SEC? Do you trust any government agency or regulator? Do you trust the corporate mainstream media? Do you trust Washington think tanks? Do you trust Madison Avenue PR maggots? Do you trust PACs? Do you trust lobbyists? Do you trust government unions? Do you trust the National Association of Realtors? Do you trust mega-corporation CEOs? Do you trust economists? Do you trust billionaires? Do you trust some anonymous blogger? You can’t even trust your parish priest or college football coach anymore. A civilized society cannot function without trust. The downward spiral of trust enveloping the world is destroying our global economy and will lead to collapse, chaos and bloodshed. The major blame for this crisis sits squarely on the shoulders of crony capitalists that rule our country, but the willful ignorance and lack of civic accountability from the general population has contributed to this impending calamity. Those in control won’t reveal the truth and the populace don’t want to know the truth – a match made in heaven – or hell.

“Most ignorance is vincible ignorance. We don’t know because we don’t want to know.” – Aldous Huxley

The fact that 86% of American adults have never heard of Jamie Dimon should suffice as proof regarding the all-encompassing level of ignorance in this country. As the world staggers under the unbearable weight of debt built up over decades, to fund a fantasyland dream of McMansions, luxury automobiles, iGadgets, 3D HDTVs, exotic vacations, bling, government provided pensions, free healthcare that makes us sicker, welfare for the needy and the greedy, free education that makes us dumber, and endless wars of choice, the realization that this debt financed Ponzi scheme was nothing but a handful of pixie dust sprinkled by corrupt politicians and criminal bankers across the globe is beginning to set in. A law abiding society that is supposed to be based on principles of free market capitalism must function in a lawful manner, with the participants being able to trust the parties they do business with. When trust in politicians, regulators, corporate leaders and bankers dissipates, anarchy, lawlessness, unscrupulous greed, looting, pillaging and eventually crisis and panic engulf the system.

Our myopic egocentric view of the world keeps most from seeing the truth. Our entire financial system has been corrupted and captured by a small cabal of rich, powerful, and prominent men. It is as it always has been. History is filled with previous episodes of debt fueled manias, initiated by bankers and politicians that led to booms, fraud, panic, and ultimately crashes. The vast swath of Americans has no interest in history, financial matters or anything that requires critical thinking skills. They are focused on the latest tweet from Kim Kardashian about her impending nuptials to Kanye West, the latest rumors about the next American Idol judge or the Twilight cheating scandal.

Bubble, Bubble, Toil & Trouble

Economist and historian Charles P. Kindleberger in his brilliant treatise Manias, Panics, and Crashes details the sordid history of unwitting delusional peasants being swindled by bankers and politicians throughout the ages. Human beings have proven time after time they do not act rationally, obliterating the economic teachings of our most prestigious business schools about rational expectations theory and efficient markets. The only thing efficient about our markets is the speed at which the sheep are butchered by the Wall Street slaughterhouse. If humanity was rational there would be no booms, no busts and no opportunity for the Corzines, Madoffs, and Dimons of the world to swindle the trusting multitudes. The collapse of a boom always reveals the frauds and swindlers. As the tide subsides, you find out who was swimming naked.

“The propensity to swindle grows parallel with the propensity to speculate during a boom… the implosion of an asset price bubble always leads to the discovery of frauds and swindles”— Charles P. Kindleberger, economic historian

The historically challenged hubristic people of America always think their present-day circumstances are novel and unique to their realm, when history is wrought with similar manias, panics, crashes and criminality. Kindleberger details 38 previous financial crises since 1618 in his book, including:

- The Dutch tulip bulb mania

- The South Sea bubble

- John Law Mississippi Company bubble

- Banking crisis of 1837

- Panic of 1857

- Panic of 1873

- Panic of 1907 – used as excuse for creation of Federal Reserve

- Great Crash of 1929

- Oil Shock of 1974-75

- Asian Crisis of 1998

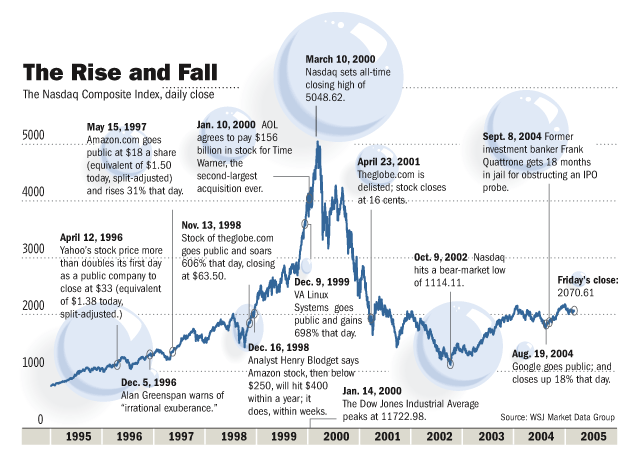

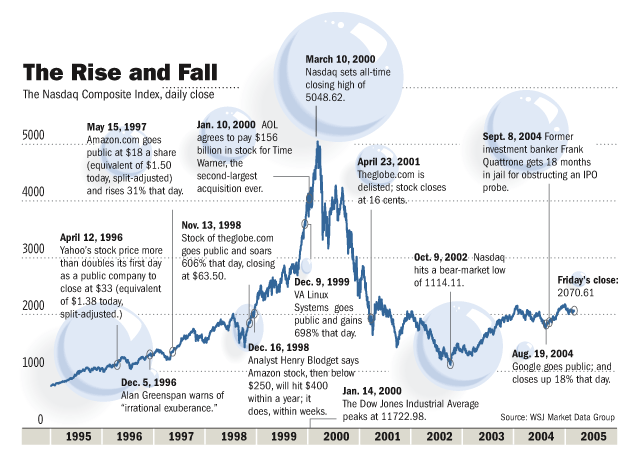

Kindleberger wrote his book in 1978 and had to update it three more times to capture the latest and greatest booms and busts. His last edition was published in 2000. He died in 2003. Sadly, he missed being able to document two of the biggest manias in history – the Internet bubble that burst in 2001 and the housing/debt bubble that continues to plague the world today. Every generation egotistically considered their crisis to be the worst of all-time as seen from quotes at the time:

- 1837: “One of the most disastrous panics this nation ever experienced.”

- 1857: “Crisis of 1857 the most severe that England or any other nations has ever encountered.”

- 1873: “In 56 years, no such protracted crisis.”

- 1929: “The greatest of speculative boom and collapse in modern times – since, in fact, the South Sea Bubble.”

Human beings have not changed over the centuries. We are a flawed species, prone to emotional outbursts, irrational behavior, alternately driven by greed and fear, with a dose of delusional thinking and always hoping for the best. These flaws will always reveal themselves because even though times change, human nature doesn’t. The cyclical nature of history is a reflection of our human foibles and flaws. The love of money, power, and status has been the driving force behind every boom and bust in history, as noted by historian Niall Ferguson.

“If the financial system has a defect, it is that it reflects and magnifies what we human beings are like. Money amplifies our tendency to overreact, to swing from exuberance when things are going well to deep depression when they go wrong. Booms and busts are products, at root, of our emotional volatility.” – Niall Ferguson

Not only are our recent booms and busts not unique, but they have a common theme with all previous busts – greedy bankers, excessive debt, non-enforcement of regulations, corrupt public officials, rampant fraud, and unwitting dupes seeking easy riches. Those in the know use their connections and influence to capture the early profits during a boom, while working the masses into frenzy and providing the excessive leverage that ultimately leads to the inevitable collapse. As the bubble grows, rationality is thrown out the window and all manner of excuses and storylines are peddled to the gullible suckers to keep them buying. Nothing so emasculates your financial acumen as the sight of your next door neighbor or moronic brother-in-law getting rich. As long as all the participants believe the big lie, the bubble can inflate. As soon as doubt and mistrust enter the picture, someone calls a loan or refuses to be the greater fool, and panic ensues. This is when the curtain is pulled back on the malfeasance, frauds, deceptions and scams committed by those who engineered the boom to their advantage. As Kindleberger notes, every boom ends in the same way.

“What matters to us is the revelation of the swindle, fraud, or defalcation. This makes known to the world that things have not been as they should have been, that it is time to stop and see how they truly are. The making known of malfeasance, whether by the arrest or surrender of the miscreant, or by one of those other forms of confession, flight or suicide, is important as a signal that the euphoria has been overdone. The stage of overtrading may well come to an end. The curtain rises on revulsion, and perhaps discredit.” – Charles P. Kindleberger – Manias, Panics, and Crashes

When mainstream economists examine bubbles, manias and crashes they generally concentrate on short-term bubbles that last a few years. But some bubbles go on for decades and some busts have lasted for a century. The largest bubble in world history continues to inflate at a rate of $3.8 billion per day and has now expanded to epic bubble proportions of $15.92 trillion, up from $9.65 trillion in September 2008 when this current Wall Street manufactured crisis struck. A 65% increase in the National Debt in less than four years can certainly be classified as a bubble. We are currently in the mania blow off phase of this bubble, but it began to inflate forty years ago when Nixon closed the gold window. This unleashed the two headed monster of politicians buying votes with promises of unlimited entitlements for the many, tax breaks for the connected few and pork projects funneled to cronies, all funded through the issuance of an unlimited supply of fiat currency by a secretive cabal of central bankers running a private bank for the benefit of other bankers and their politician puppets. Crony capitalism began to hit its stride after 1971.

The apologists for the status quo, which include the corporate mainstream media, intellectually dishonest economist clowns like Krugman, Kudlow, Leisman, and Yun, ideologically dishonest think tanks funded by billionaires, and corrupt politicians of both stripes, peddle the storyline that a national debt of 102% of GDP, up from 57% in 2000, is not a threat to our future prosperity, unborn generations or the very continuance of our economic system. They use the current historically low interest rates as proof this Himalayan Mountain of debt is not a problem. Of course it is a matter of trust and faith in the ability of a few ultra-wealthy, sociopathic, Ivy League educated egomaniacs that their brilliance and deep understanding of economics that will see us through this little rough patch. The wisdom and brilliance of Ben Bernanke is unquestioned. Just because he missed a three standard deviation bubble in housing and didn’t even foresee a recession during 2008, doesn’t mean his zero interest rate/screw grandma policy won’t work this time. It’s done wonders for Wall Street bonus payouts.

The growth of this debt bubble is unsustainable, as it is on track to breach $20 trillion in 2015. The only thing keeping interest rates low is coordinated manipulation by Ben and his fellow sociopathic central bankers, the insolvent too big to fail banks using derivative weapons of mass destruction, and politicians desperately attempting to keep the worldwide debt Ponzi scheme from imploding on their watch. Their “solution” is to kick the can down the road. But there is a slight problem. The road eventually ends.

At some point a grain of sand will descend upon a finger of instability in the sand pile and cause a collapse. No one knows which grain of sand will trigger the crisis of confidence and loss of trust. But with a system run by thieves, miscreants, and scoundrels, one of these villains will do something dastardly and the collapse will ensue. Ponzi schemes can only be sustained as long as there are enough new victims to keep it going. As soon as uncertainty, suspicion, fear and rational thinking enter the equation, the gig is up. Kindleberger lays out the standard scenario, as it has happened numerous times throughout history.

“Causa remota of the crisis is speculation and extended credit; causa proxima is some incident that snaps the confidence of the system, makes people think of the dangers of failure, and leads them to move from commodities, stocks, real estate, bills of exchange, promissory notes, foreign exchange – whatever it may be – back into cash. In itself, causa proxima may be trivial: a bankruptcy, suicide, a flight, a revelation, a refusal of credit to some borrower, some change of view that leads a significant actor to unload. Prices fall. Expectations are reversed. The movement picks up speed. To the extent that speculators are leveraged with borrowed money, the decline in prices leads to further calls on them for margin or cash and to further liquidation. As prices fall further, bank loans turn sour, and one or more mercantile houses, banks, discount houses, or brokerages fail. The credit system itself appears shaky, and the race for liquidity is on.” – Charles P. Kindleberger – Manias, Panics, and Crashes

Despite centuries of proof that human nature will never change, there are always people (usually highly educated) who think they are smart enough to fix the markets when they breakdown and create institutions, regulations and mechanisms that will prevent manias, panics and crashes. These people inevitably end up in government, central banks and regulatory agencies. Their huge egos and desire to be seen as saviors lead to ideas that exacerbate the booms, create the panic and prolong the crashes. They refuse to believe the world is too complex, interconnected and unpredictable for their imagined ideas of controlling the levers of economic markets to have a chance of success. The reality is that an accident may precipitate a crisis, but so may action designed to prevent a crisis or action by these masters of the universe taken in pursuit of other objectives. Examining the historical record of booms and busts yields some basic truths. The boom and bust business cycle is the inevitable consequence of excessive growth in bank credit, exacerbated by inherently damaging and ineffective central bank policies, which cause interest rates to remain too low for too long, resulting in excessive credit creation, speculative economic bubbles and lowered savings.

Low interest rates tend to stimulate borrowing from the banking system. This expansion of credit causes an expansion of the supply of money through the money creation process in our fractional reserve banking system. This leads to an unsustainable credit-sourced boom during which the artificially stimulated borrowing seeks out diminishing investment opportunities. The easy credit issued to non-credit worthy borrowers results in widespread mal-investments and fraud. A credit crunch leading to a bust occurs when exponential credit creation cannot be sustained. Then the money supply suddenly and sharply contracts as fear and loathing of debt replace greed and worship of debt. In theory, markets should clear through liquidation of bad debts, bankruptcy of over-indebted companies and the failure of banks that made bad loans. Sanity is restored to the marketplace through failure, allowing resources to be reallocated back towards more efficient uses. The housing boom and bust from 2000 through today perfectly illustrates this process. Of course, Bernanke declared housing to be on solid footing in 2007.

The housing market has not been allowed to clear, as Bernanke has artificially kept interest rates low, government programs have created false demand, and bankers have shifted their bad loans onto the backs of the American taxpayer while using fraudulent accounting to pretend they are solvent. Our owners are frantically attempting to re-inflate the bubble, just as they did in 2003. Our deepest thinkers, like Greenspan, Krugman, Bush, Dodd, and Frank knew we needed a new bubble after the Internet bubble blew up in their faces and did everything in their considerable power to create the first housing bubble. If at first you don’t succeed, try, try again.

Human nature hasn’t changed in centuries. We have faith that humanity has progressed, but the facts prove otherwise. We are a species susceptible to the passions of power, greed, delusion, and an inflated sense of our own intellectual superiority. And we still like to kill each other in the name of country and honor. There is nothing progressive about crashing the worldwide economic system and invading countries for “our” oil.

History has taught that there will forever be manias, bubbles and the subsequent busts, but how those in power deal with these episodes has been and will be the determining factor in the future of our economic system and country.

Humanity is deeply flawed; the average human life is around 80 years; men of stature, wealth, over-confidence in their superior intellect, and egotistical desire to leave their mark on history, always rise to power in government and the business world; this is why history follows a cyclical path and the myth of human progress is just a fallacy.

“That men do not learn very much from the lessons of history is the most important of all the lessons that History has to teach” – Aldous Huxley

In Part 2 of this three part series I will examine the one hundred year experiment of trusting a small cabal of non-elected bankers to manage and guide our economic system for the benefit of the American people.