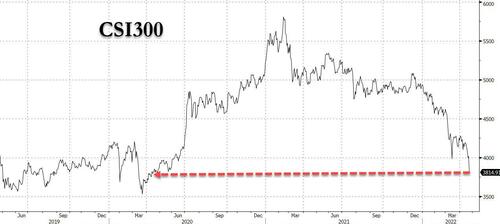

Last week’s dead cat bounce in Chinese stocks – after Beijing did everything but launch a multi-trillion fiscal stimmy bazooka (something it will do, later if not sooner) – is a distant memory, and as Asian markets open for trading in the news week, Chinese markets are cratering with the Shanghai Composite plunging as much as 3.1% to a fresh five-year low..

… while the broader CSI 1,000 Index is also in free-fall and also on pace to re-test the 2018 lows with as many as 990 of the 1000 companies of the index in the red.