Guest Post by Charles Hugh Smith

Leaders face a no-win dilemma: any change of course will crash the system, but maintaining the current course will also crash the system.

The end-state of unsustainable systems is collapse. Though collapse may appear to be sudden and chaotic, we can discern key structures that guide the processes of collapse.

Though the subject is complex enough to justify an entire shelf of books, these six dynamics are sufficient to illuminate the inevitable collapse of the status quo.

1. Doing more of what has failed spectacularly. The leaders of the status quo inevitably keep doing more of what worked in the past, even when it no longer works. Indeed, the failure only increases the leadership’s push to new extremes of what has failed spectacularly. At some point, this single-minded pursuit of failed policies speeds the system’s collapse.

2. Emergency measures become permanent policies. The status quo’s leaders expect the system to right itself once emergency measures stabilize a crisis. But broken systems cannot right themselves, and so the leadership is forced to make temporary emergency measures (such as lowering interest rates to zero) permanent policy. This increases the fragility of the system, as any attempt to end the emergency measures triggers a system-threatening crisis.

3. Diminishing returns on status quo solutions. Back when the economic tree was loaded with low-hanging fruit, solutions such as lowering interest rates had a large multiplier effect. But as the tree is stripped of fruit, the returns on these solutions diminish to zero.

4. Declining social mobility. As the economic pie shrinks, the privileged maintain or increase their share, and the slice left to the disenfranchised shrinks. As the privileged take care of their own class, there are fewer slots open for talented outsiders. The status quo is slowly starved of talent and the ranks of those opposed to the status quo swell with those denied access to the top rungs of the social mobility ladder.

5. The social order loses cohesion and shared purpose as the social-economic classes pull apart. The top of the wealth/power pyramid no longer serves in the armed forces, and withdraws from contact with the lower classes. Lacking a unifying social purpose, each class pursues its self-interests to the detriment of the nation and society as a whole.

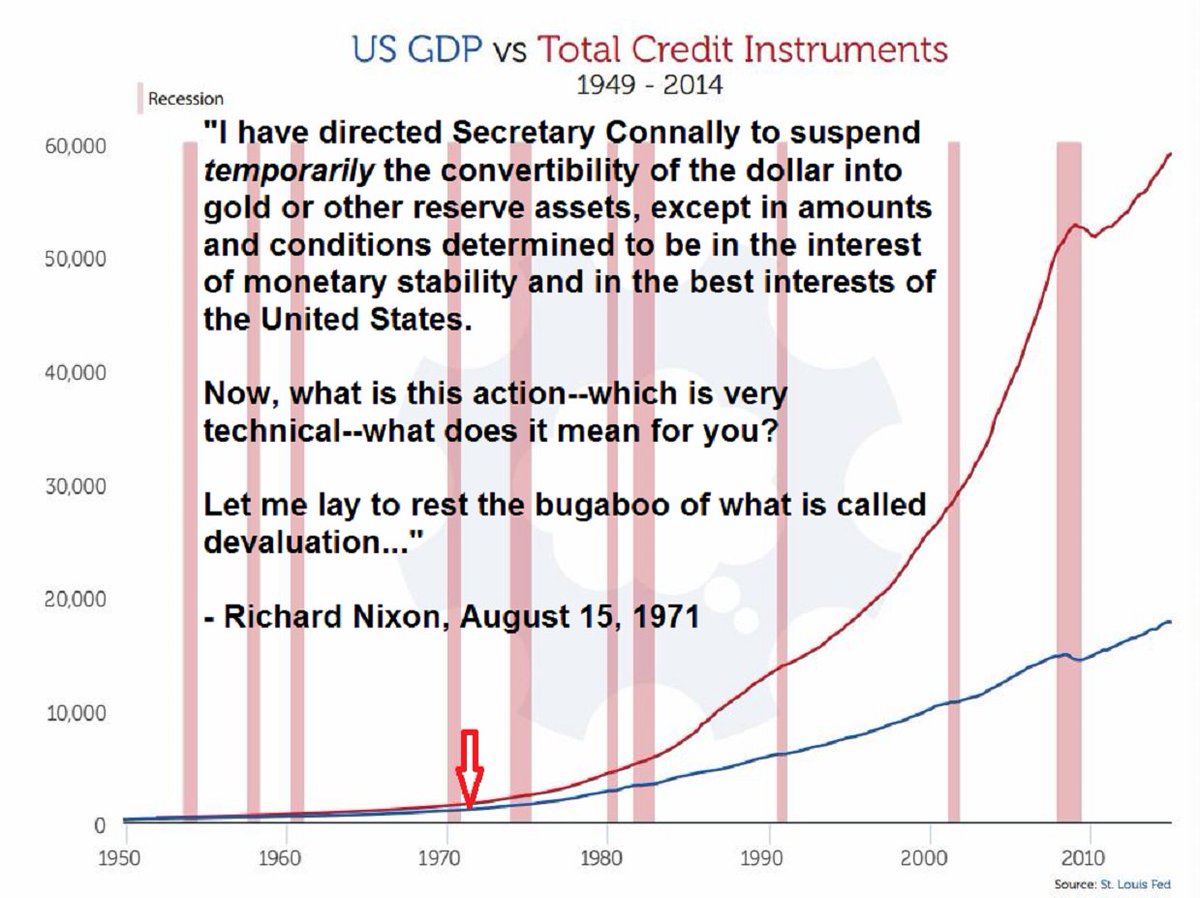

6. Strapped for cash as tax revenues decline, the state borrows more money and devalues its currency as a means of maintaining the illusion that it can fulfill all its promises. As the purchasing power of the currency declines, people lose faith in the state’s currency. Once faith is lost, the value of the currency declines rapidly and the state’s insolvency is revealed.

Each of these dynamics is easily visible in the global status quo.

As an example of doing more of what has failed spectacularly, consider how financialization inevitably inflates speculative bubbles, which eventually crash with devastating consequences. But since the status quo is dependent on financialization for its income, the only possible response is to increase debt and speculation—the causes of the bubble and its collapse—to inflate another bubble. In other words, do more of what failed spectacularly.

This process of doing more of what failed spectacularly appears sustainable for a time, but this superficial success masks the underlying dynamic of diminishing returns: each reflation of the failed system requires greater commitments of capital and debt. Financialization is pushed to new unprecedented extremes, as nothing less will generate the desired bubble.

Rising costs narrow the maneuvering room left to system managers. The central bank’s suppression of interest rates is an example. As the economy falters, central banks lower interest rates and increase the credit available to the financial system.

This stimulus works well in the first downturn, but less well in the second and not at all in the third, for the simple reason that interest rates have been dropped to zero and credit has been increased to near-infinite.

The last desperate push to do more of what failed spectacularly is for central banks to lower interest rates to below-zero: it costs depositors money to leave their cash in the bank. This last-ditch policy is now firmly entrenched in Europe, and many expect it to spread around the world as central banks have exhausted less extreme policies.

The status quo’s primary imperative is self-preservation, and this imperative drives the falsification of data to sell the public on the idea that prosperity is still rising and the elites are doing an excellent job of managing the economy.

Since real reform would threaten those at the top of the wealth/power pyramid, fake reforms and fake economic data become the order of the day.

Leaders face a no-win dilemma: any change of course will crash the system, but maintaining the current course will also crash the system.

Welcome to 2016-2019.