Via Doug Ross

Tag: David Stockman

ARROGANT MONETARY POLITBURO

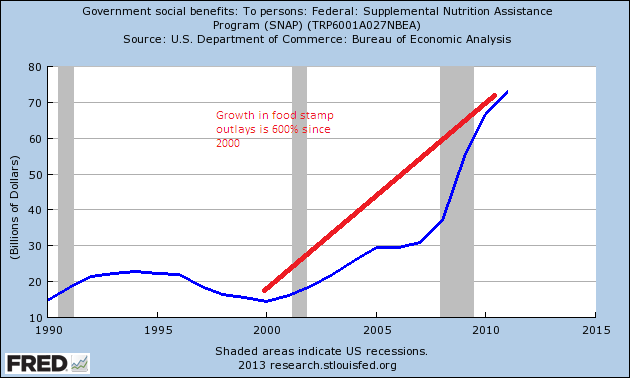

That didn’t take long. Mortgage purchase applications are at 14 year lows, but home prices had miraculously risen by double digits last year. The Wall Street Muppet Fleecing Machine has been in full fuck America mode for the last two years, taking free Bennie Bucks and becoming landlords to the ignorant masses. This priced first time buyers and real Americans out of the home market. But that’s all right. Wall Street shysters were able to pay themselves $26.7 billion in bonuses for fucking over the people once again. At least prices in the Hamptons will stay elevated.

What we do know id that Wall Street is filled with lemmings. Their little MBA created financial models are all blinking red right now. That means sell. They have stopped buying and are now seeking the greater fools and clueless dupes. One problem. The average American is dead broke. Ask Radio Shack, Sbarro, JC Penney and Sears.

There are no buyers for what Wall Street wants to sell. Look out below folks. Housing crash 2.0 has arrived. Those paper gains over the last two years are going to vaporize. POOF!!!! Like they never even happened. Thank Bennie, Janet, Jamie, Lloyd, Fink and the rest of the psychopathic assholes on Wall Street. They make Gordon Gekko look like an upstanding citizen.

Guest Post by David Stockman

The Wall Street Home Buying Binge Is Over….Already!

It seems like only yesterday I was lamenting the arrival of housing bubble 2.0 and the Fed’s nefarious policy of distributing ZERO-COGS (i.e. nearly zero short-term borrowing costs) to Wall Street speculators— which had then swooped into busted housing markets from Phoenix to Florida looking for the next big carry trade. This stampede of $5,000 suits riding John Deere lawnmowers into the likes of Scottsdale AZ had commenced less than 24 months ago, but already it had levitated prices by 25-50 percent in some of these markets.

It had also given rise to rivers of ink in the financial press about a “new asset class” called “buy-to-rent” single family homes. Right on time, it had already resuscitated Wall Street’s meth labs of financial innovation, which were busy “slicing and dicing” single-family rental streams into this year’s favorite flavor of toxic waste.

I also ventured the guess that these new Harvard Business School ”landlords” would turn tail and run the minute prices stopped bounding upward because it was all a speculative frenzy, not an investment program, in the first place. They self-evidently had no core competence in managing 200,000 single family homes scattered all over America’s sand belt suburbia. In a post called “Housing Bubble 2.0 ” I further suggested:

“The idea that Colony Capital of Los Angeles or Blackstone of Park Avenue posses magical economies of scale in the nationwide single family rental market is just plain bonkers…..(this time) instead of millions of Main Street speculators who believed up to the very end that housing prices would rise to the sky, we now have a few thousand institutional speculators who will head out of town on their John Deere’s as fast as they came….”

Actually, that was all said, well, yesterday! Today a Bloomberg headline updated the story:

”Home Buying Binge Ends as Prices Surge”

Bloomberg reported that:

Blackstone Group LP (BX) is slowing its purchases of houses to rent amid soaring prices after a buying binge made it the biggest U.S. single-family home landlord. Blackstone’s acquisition pace has declined 70 percent from its peak last year, when the private equity firm was spending more than $100 million a week on properties”’(and) investing $8 billion since April 2012 to buy 43,000 homes in 14 cities…..”

As for the new “asset class” that only a few months ago was being touted as a sure bet for $1 trillion status, the #1 real estate honcho in all of Wall Street and long time head of Blackstone’s hit-and-run real estate campaigns, Jonathan Gray, told Bloomberg quite succinctly:

“The institutional wave has passed…..It’s at a much lower level than it was 12 or 24 months ago.”

Well, that’s bubble finance at work. Home prices in hundreds of Sunbelt cities had been painfully brought down to earth during 2008-20011. Affordability based on sound mortgage underwriting and honest household income was being slowly restored. Yet right then and there the lunatic QE policies of the Bernanke-Yellen claque catalyzed Wall Street’s short-lived housing stampede. In the process, honest wage-earners got squeezed out of the market and the get-rich-quick contagion was once again unleashed in America’s suburban expanse.

So the questions recurs: Does our arrogant monetary politburo have the slightest idea what it is doing? Sadly, the Bloomberg headline makes the answer abundantly clear. The Eccles Building is clueless!

Blackstone Group LP Global head of real estate Jonathan Gray

DAVID STOCKMAN OFFICIALLY LAUNCHES HIS CONTRACORNER WEBSITE

David Stockman officially launched his new website today. It’s called David Stockman’s ContraCorner. He’s been running it for about a month in pilot mode. It’s already one of my go to sites in the morning. How he finds time to write these great articles is beyond me. He asked me to be part of his contra-club of guest posters. Below is his latest obliteration of the Federal reserve and their policies designed to benefit the crony capitalists. Checkout his website every day. It will make you smarter.

Yellenomics: The Folly of Free Money

by David Stockman •

The Fed and the other major central banks have been planting time bombs all over the global financial system for years, but especially since their post-crisis money printing spree incepted in the fall of 2008. Now comes a new leader to the Eccles Building who is not only bubble-blind like her two predecessors, but is also apparently bubble-mute. Janet Yellen is pleased to speak of financial bubbles as a “misalignment of asset prices,” and professes not to espy any on the horizon.

Let’s see. The Russell 2000 is trading at 85X actual earnings and that’s apparently “within normal valuation parameters.” Likewise, the social media stocks are replicating the eyeballs and clicks based valuation madness of Greenspan’s dot-com bubble. But there is nothing to see there, either–not even Twitter at 35X its current run-rate of sales or the $19 billion WhatsApp deal. Given the latter’s lack of revenues, patents and entry barriers to the red hot business of free texting, its key valuation metric reduces to market cap per employee–which computes out to a cool $350 million for each of its 55 payrollers. Never before has QuickBooks for startups listed, apparently, so many geniuses on a single page of spreadsheet.

Tesla: Valuation Lunacy Straight From the Goldman IPO Hatchery

Indeed, as during the prior two Fed-inspired bubbles of this century, the stock market is riddled with white-hot mo-mo plays which amount to lunatic speculations. Tesla, for example, has sold exactly 27,000 cars since its 2010 birth in Goldman’s IPO hatchery and has generated $1 billion in cumulative losses over the last six years—–a flood of red ink that would actually be far greater without the book income from its huge “green” tax credits which, of course, are completely unrelated to making cars. Yet it is valued at $31 billion or more than the born-again General Motors, which sells about 27,000 autos every day counting weekends.

Even the “big cap” multiple embedded in the S&P500 is stretched to nearly 19X trailing GAAP earnings—the exact top-of-the-range where it peaked out in October 2007. And that lofty PE isn’t about any late blooming earnings surge. At year-end 2011, the latest twelve months (LTM) reported profit for the S&P 500 was $90 per share, and during the two years since then it has crawled ahead at a tepid 5 percent annual rate to $100.

So now the index precariously sits 20% higher than ever before. Yet embedded in that 19X multiple are composite profit margins at the tippy-top of the historical range. Moreover, the S&P 500 companies now carry an elephantine load of debt—$3.2 trillion to be exact (ex-financials). But since our monetary politburo has chosen to peg interest rates at a pittance, the reported $100 per share of net income may not be all that. We are to believe that interest rates will never normalize, of course, but in the off-chance that 300 basis points of economic reality creeps back into the debt markets, that alone would reduce S&P profits by upwards of $10 per share.

America’s already five-year old business recovery has also apparently discovered the fountain of youth, meaning that recessions have been abolished forever. Accordingly, the forward-year EPS hockey sticks touted by the sell-side can rise to the wild blue yonder—even beyond the $120 per share “ex-items” mark that the Street’s S&P500 forecasts briefly tagged a good while back. In fact, that was the late 2007 expectation for 2008—a year notable for its proof that the Great Moderation wasn’t all that; that recessions still do happen; and that rot builds up on business balance sheets during the Fed’s bubble phase, as attested to by that year’s massive write-offs and restructurings which caused actual earnings to come in on the short side at about $15!

In short, recent US history signifies nothing except that the sudden financial and economic paroxysm of 2008-2009 arrived, apparently, on a comet from deep space and shortly returned whence it came. Nor are there any headwinds from abroad. The eventual thundering crash of China’s debt pyramids is no sweat because the carnage will stay wholly inside the Great Wall; and even as Japan sinks into old-age bankruptcy, it demise will occur silently within the boundaries of its archipelago. No roiling waters from across the Atlantic are in store, either: Europe’s 500 million citizens will simply endure stoically and indefinitely the endless stream of phony fixes and self-serving lies emanating from their overlords in Brussels.

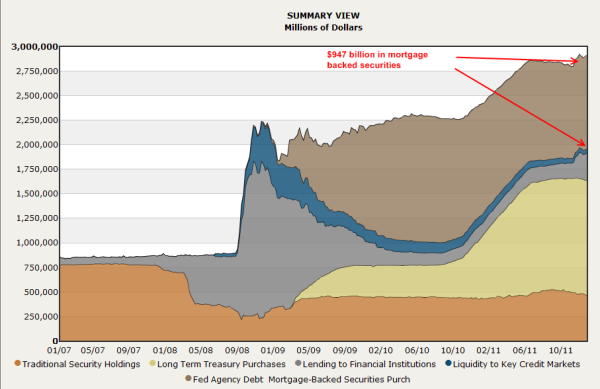

Meanwhile, what hasn’t been creeping along is the Fed’s balance sheet, which has exploded by $1.2 trillion or 41 percent versus two years ago and the S&P price index, which is up 47 percent in that span. Likewise, the NASDAQ index is up 60 percent compared to earnings growth that languishes in single digits.

Not Even Orange?

Still, Dr.Yellen recently told a credulous Congressman that “I can’t see threats to financial stability that have built to the point of flashing orange or red.”

Not even orange? Apparently, green is the new orange. The truth is, the monetary central planners ensconced in the Eccles Building are terrified of another Wall Street hissy-fit. So they strive by word cloud and liquidity deed to satisfy the petulant credo of the fast money gamblers—namely, that the stock indices remain planted firmly in the green on any day the market’s open. It is not a dearth of clairvoyance, then, but a surfeit of mendacity which causes our mad money printers to ignore the multitude of bubbles in plain sight.

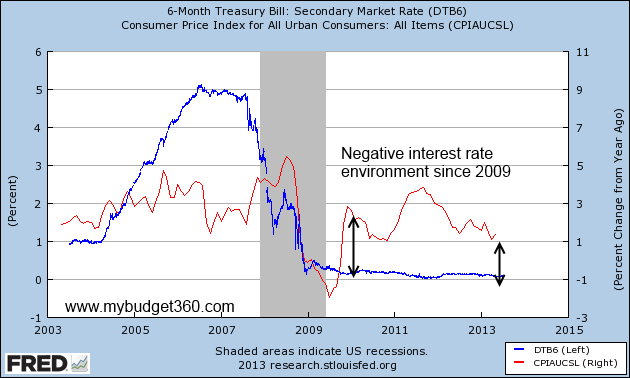

Actually, the Fed’s bubble blindness stems from even worse than servility. The problem is an irredeemably flawed monetary doctrine that tracks, targets and aims to goose Keynesian GDP flows using the crude tools of central banking. Yet these tools of choice— pegged interest rates and stock market puts—actually result not in jobs and income for Main Street but ZERO-COGS for Wall Street. And the latter is an incendiary, avarice-inducing financial stimulant that enables speculators to chase the price of financial assets to the mountain tops and beyond. So at the heart of our drastically over-financialized, bubble-ridden economy is this appalling truth: the speculator’s COGS—that is, his entire “cost of goods”—consists of the funding expense of carried assets, and the Fed’s prevailing doctrine is to price that at near zero for at least seven years running through 2015.

Pricing anything at zero is a recipe for trouble, but the last thing on earth that should deliberately be made free is the credit lines of gamblers and speculators. That is especially so when the free stuff—-repo, short-term unsecured paper, the embedded carry cost in options, futures and OTC derivatives—-is guaranteed to remain free through a extended time horizon by the central banking branch of the state. In that respect and even with tapering having allegedly commenced, just look at the two-year treasury benchmark. In the world of fast money speculation the latter time horizon is about as far as the eye can see, but the cost to play amounts to a paltry 37 basis points.

Even J.M. Keynes Knew Better

Once upon a time traders confronted reasonably honest two-way money markets. When they woke up in the morning in 1980-1981 they most definitely did not believe that the money market rate was pegged even for the day–let alone seven years. Instead, by allowing short rates to soar to market-clearing levels, the Volcker Fed laid low the carry trade in commodities, thereby reminding speculators that spreads can go negative—suddenly,sharply and even catastrophically

Owing to the reasonably honest money markets of the Volcker era, the leading edge of inflation–soaring commodity prices—was decisively crushed and the inflationary fevers were quickly drained from the system. But more importantly, the vastly swollen level of capital pulled into the carry trades during the 1970s Great Inflation was reduced to its natural minimum—that is, to the amount needed by professional market-makers to arbitrage-out imbalances in the term structure of interest rates. Under those conditions, fund managers made a living actually investing capital, not chasing carry.

But nowadays, by contrast, the central bank’s free money guarantee nullifies all that and induces massive inflows to speculative positions in any and all financial assets that can generate either a yield or an appreciation rate slightly north of zero. To adapt Professor Keynes’ famous aphorism, the Fed’s quasi-permanent regime of ZERO-COGS “engages all of the hidden forces of economic law on the side of [speculation], and does it in a manner that not one in [nineteen members of the Fed] is able to diagnose”.

Indeed, no less an authority on the great game of central bank front-running than Pimco’s Bill Gross trenchantly observed last week: “Our entire finance-based system….is based on carry and the ability to earn it.”

Stated differently, the preponderant effect of the Fed’s horribly misguided ZIRP has been to unleash a global horde of financial engineers, buccaneers and plain old punters who ceaselessly troll for carry. The spreads they pursue may be derived from momentum-driven stock appreciation and credit risk premiums or, as Bill Gross further observed, they may be “duration, curve, volatility or even currency related…..but it must out-carry its bogey until the system itself breaks down.”

Not surprisingly, therefore, our monetary central planners are always, well, surprised, when financial fire storms break-out. Even now, after more than a half-dozen collapses since the Greenspan era of Bubble Finance incepted in 1987, they don’t recognize that it is they who are carrying what amounts to monetary gas cans. Having no doctrine at all about ZERO-COGS, they pour on the fuel completely oblivious to its contagious, destabilizing and perilous properties. Nor is recognition likely at any time soon. After all, ZERO-COGS is an artificial step-child of central bankers’ writ; its what they do, not a natural condition on the free market.

The Prehistoric Era of Volcker the Great vs. Bathtub Economics

When money market yields and the term structure of interest rates are not pegged by the Fed but cleared by the market balance between the supply of economic savings and the demand for borrowed funds, the profit in the carry trades is rapidly arbitraged away—as last demonstrated during the pre-historic era of Volcker the Great. So the way back home is clear: liberate interest rates from the destructive embrace of the FOMC and presently money markets would gyrate energetically and the global horde of carry-seekers would shrink to a corporals’ guard. Pimco’s mighty balance sheet would also end-up nowhere near $2 trillion gross, if it survived at all.

By contrast, as we approach the bursting of the third central banking bubble of this century, the fates have saddled the world with the most oblivious and therefore dangerous Keynesian Fed-head yet. Not only does Yellen not have the slightest clue that ZERO-COGS is a financial time-bomb, she is actually so invested in the archaic catechism of the 1960s New Economics that she mistakes today’s screaming malinvestments and economic deformations for “recovery.”

In that regard, the ballyhooed housing recovery in the former sub-prime disaster zones is not exactly all that. Instead, the housing price indices in Phoenix, Los Vegas, Sacramento, the Inland Empire and Florida went screaming higher in 2011-2013 due to speculator carry trades.

Stated differently, the 29-year olds in $5,000 suits riding into Scottsdale AZ on the back of John Deere lawnmowers are not there owing to their acumen as landlords of single-family, detached homes, nor do they bring competitively unique skills at managing crab-grass in the lawns, insect infestations in the trees and mold in the basement. What they bring is cheap funding for the carry. They will be gone as soon as housing prices stop climbing, which in many of these precincts has already happened.

Similarly, the auto sector has rebounded smartly, but the catalyst there is not hard to spot either—namely, the re-eruption of auto debt and especially of the sub-prime kind. The latter specie of dopey credit had almost been killed off by the financial crisis—when issuance plummeted by 90%, and properly so. After all, sub-prime “ride” loans had been mainly issued against rapidly depreciating used cars and down-market new vehicles at 115% loan-to-value ratios for seven year terms to borrowers living paycheck-to-paycheck, meaning that they had an excellent chance of defaulting if the Fed’s GDP levitation game failed and their temp jobs vanished.

All the forgoing transpired in 2008-2009, of course, but that is ancient credit market history that has now been forgiven and forgotten. Since those clarifying moments, sub-prime car loans have soared 10X—-rising from $2 billion to $22 billion last year, when issuance clocked in above the frenzied level of 2007. Sub-prime loans now fund a record 55% of used car loans and 30% of new car loans, but there’s more. The Wall Street meth labs have already produced a credit mutant called “deep sub-prime” which now account for one-in-eight car loans. Borrowers able to post a shot-gun or PlayStation as downpayment can get a loan even with credit scores below 580.

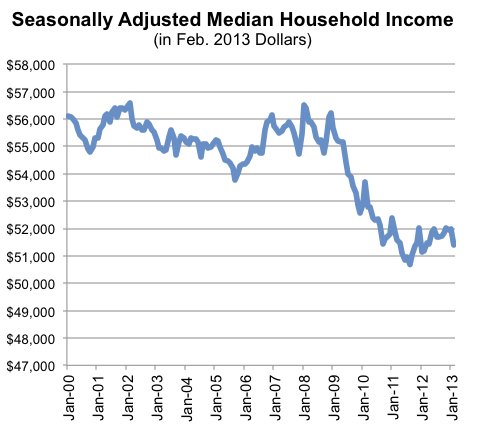

In short, even as real wage and salary incomes grew by less than 1% last year, new vehicle sales boomed by 25% during the last two years to nearly the pre-crisis level of 16 million units. The yawning disconnect between stagnant incomes and soaring car sales is readily explained, of course, by the usual suspect in our debt-besotted economy—namely, auto loans, which were up 25% since the post-crisis bottom and now at an all-time high.

This reversion to borrowing our way to prosperity also highlights the untoward pathways through which the Fed’s toxic medicine of cheap debt disperses through the body economic. Much of the dodgy auto paper now flowing out of dealer showrooms is not coming from Dodd-Frank disabled banks, but from non-banks like Exeter Finance and Santander Consumer USA that have a tell-tale capital structure. They are funded with a dollop of “private equity” from the likes of Blackstone and KKR and tons of junk bonds that have been voraciously devoured by yield hungry money managers who have been flushed out of safer fixed income investments by the monetary central planners in the Eccles building.

The Financial Crime of ZERO-COGS

At the end of the day, the financial crime of ZERO-COGS is a product of the primitive 1960s ”bathtub economics” of the New Keynesians. Not coincidentally, their leading light was professor James Tobin, who was not only the architect of the disastrous Kennedy-Johnson fiscal and financial policies that caused the breakdown of Bretton Woods and its serviceably stable global monetary order, but who was also PhD advisor to Janet Yellen. To this day Tobin’s protégé ritually incants all the Keynesian hokum about slack aggregate demand, potential GDP growth shortfalls and central bank monetary “accommodation” designed to guide GDP and jobs toward full capacity.

In more graphic terms, however, the fancy theories of Tobin-Yellen reduce to this: the $17 trillion US economy amounts to a giant bathtub that must be filled to the brim at all times in order to insure full employment and maximum societal bliss. But it is only the deft management of the fiscal and monetary dials by enlightened PhDs that can that can keep the water line snuff with the brim–otherwise known as potential GDP. Indeed, left to its own devices, market capitalism tends in the opposite direction—that is, a circling motion toward the port at the bottom.

For nigh onto fifty years, however, it has been evident that the bathtub economics of the New Keynesians was fundamentally flawed. It incorrectly assumes the US economy is a closed system and that artificial demand induced by the fiscal or monetary authorities will cause idle domestic labor and productive assets to be mobilized. Well, we now have $8 trillion of cumulative and chronic current account deficits that prove the opposite—that is, the relevant labor supply is the 2 billion or so workers who have come out of the EM rice paddies and the relevant industrial capacity is the massive excess supply of steel mills, shipyards, bulk-carriers and iron ore mines that have been built all over the planet based on export demand originating in the borrowed prosperity of the West and ultra-cheap capital flowing from central bank printing presses around the world.

The truth is, pumping up the American ”demand” mobilizes lower cost factors of production abroad in a great economic swapping game. Exchange rate-pegging, mercantilist-oriented central banks in the EM swap the sweat of their domestic workers and the resource endowments of their lands for the paper emissions of the US and other DM treasuries. And the $5.7 trillion of USTs held abroad, mostly by central banks, proves that proposition, as well. In any event, it is not Uncle Sam’s fiscal rectitude that has created the EMs’ ginormous appetite for pint-sized yields on America’s swelling debts.

So through all the twists and turns of Keynesian demand management since the days when Tobin and his successors and assigns supplanted the four-square orthodoxy of President Dwight Eisenhower and Chairman William McChesney Martin, what really happened was not the triumph of modern policy science or economic enlightenment in Washington, as Kennedy’s arrogant PhD’s then averred. Instead, “policy” spent nearly a half-century using up the balance sheet of the American economy and all its components on a one-time basis. Total credit market debt—-including business, household, financial and government–went from its historic ratio of 1.5X GDP to 3.5X at the crisis peak in 2007—where it remains until this day.

The $30 Trillion Rebuke To Keynesian Professors

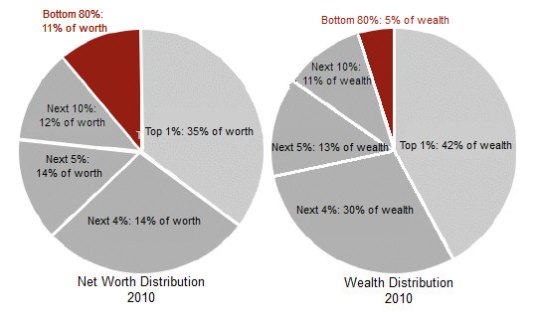

Those extra two turns of aggregate debt amount to $30 trillion—a one time exploitation of American balance sheets that did seemingly accommodate Keynesian miracles of demand management. GDP was boosted by households that were enabled to spend more than they earned and a national economy that was empowered to consume more than it produced.

But there was nothing enlightened about the rolling national LBO over the decades since Professor Tobin’s unfortunate arrival in Washington. It was then—and always has been—just a cheap debt trick. During each successive business cycle’s stimulus phase, debt ratios were ratcheted up to higher and higher levels. But now we have hit peak debt in both the public and private sectors, and there is no ratchet left because balance sheets have been exhausted.

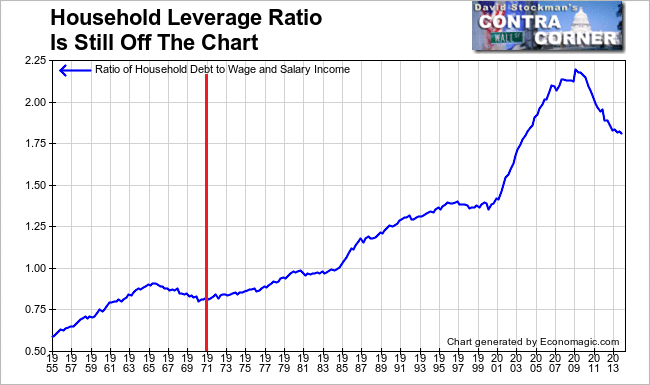

The household sector data tell the story of the cheap debt trick which is now over. The relevant leverage ratio here is household debt to wage and salary income, because the NIPA “personal income” metric is now massively bloated by $2.5 trillion of transfer payments—-flows which come from debt and taxes, not production and supply.

As shown below, the ratchet was powerful. During the 1980-1985 cycle, the household debt ratio jumped from 105% to 117% of wage and salary income; then it ratcheted from 130% to 147% during the 1990-1995 cycle; thereafter it climbed from 160% to 190% during 2000-2005; and it finally peaked out at almost 210% at the 2007 peak.

That’s the Keynesian cheap debt trick in a nutshell: it does not describe a timeless science that can be applied over and over again, but merely a one-time party that is over. As shown below, the ratio has now retraced to the 180s, but that’s still high by historic standards, and more importantly, is the reason that Professor Larry Summers can be seen on most days sucking his thumb, looking for “escape velocity” that can’t happen.

The up-ratchet in private and public leverage ratios is over, and that means that the Keynesian monetary policy is done, too. It worked for a few decades thru the credit transmission mechanism to the household sector, but one thing is now certain: the only part of household debt that is growing is NINJA loans to students and what amounts to de facto rent-a-car deals in autos, which in due course will lead to a new pile-up of defaulted paper and acres of repossessed used cars.

Meanwhile, Yellen and her mad money printers keep “accommodating” as they try to fill to the brim an imaginary bathtub of potential GDP. The exercise would be laughable, even stupid, if it were not for its true impact, which is ZERO-COGS. The latter, unfortunately, is fueling the mother of all bubbles here and abroad; crushing savers and fixed income retirees; showering the fast money traders and 1% with unspeakable windfalls of ill-gotten “trickle-down”; and placing control of the very warp and woof of our $17 trillion national economy in the hands of unelected, academic zealots.

The worst thing is that Yellenomics is just getting started because the whole crony capitalist dystopia that has become America can not function for more than a few days without another dose of its deadly monetary heroin.

DAVID STOCKMAN OBLITERATES A WALL STREET DOUCHEBAG & HIS FANNIE/FREDDIE SCAM

Submitted by David Stockman via Contra Corner blog,

The Fed’s serial bubble machine has not only bestowed massive speculative windfalls on the 1%, but it has also fostered a noxious culture of plunder and entitlement in the gambling casinos of Wall Street. After each thundering sell-off during the bust phase, crony capitalist gamblers have been gifted with ill-gotten windfalls during the Fed’s subsequent maniacal money printing spree.

Worse still, this trash-to-riches syndrome has unfolded so consistently since the late 1980s that there now exists a marauding gang of permanent vulture-speculators who impudently claim entitlement to any and all action by the state that might be needed to quickly reflate their gleanings from the bottom. The passel of hedge funds led by Elliot Capital which blackmailed the Obama White House into paying billions for the worthless debt of Delphi during the GM bailout is only one especially odious example.

In this context comes Bruce Berkowitz “scolding” and firing “salvos” at Washington from the front page of the Wall Street Journal. As it has happened, the usually craven denizens of the beltway have so far managed to ignore his petulant demands for a multi-billion payday on the worthless Fannie and Freddie preferred stock that his fund scooped up after the housing bust. Recall, these were the securities issued in 2008 at $25 per share to shore up the tottering housing finance agencies just before Hank Paulson’s bazooka sputtered.

Not inappropriately, when the Republican White House nationalized Freddie and Fannie in September 2008 these preferred shares plunged to 25 cents—-their true value all along. The fact is, the so-called GSEs do not “earn” profits; they merely book bloated accounting margins that reflect nothing more profound than the fact that Freddie and Fannie drastically underpay for renting Uncle Sam’s balance sheet. As finally became official when the U.S. Treasury threw them a $180 billion lifeline, the GSEs are now—and have always been—a branch office of the U.S. Treasury Department.

The only reason Freddie and Fannie are not prosecuted for filing fraudulent accounting statements, therefore, is the beltway fiction that they are “off-budget”. This convenient scam was first invented by Lyndon Johnson to magically shrink his “guns and butter” fiscal deficits, but it has since metastasized into a giant business fairy tale—namely, that behind the imposing brick façade of Fannie Mae there is a real company generating value-added services that are the source of its reported profits and current multi-billion pink sheet valuation. In fact, there is nothing behind those walls except a stamping machine that embosses the signature of the American taxpayer on every billion dollar package of securitized mortgages it guarantees and on all the bonds it issues to fund a giant portfolio of mortgages and securities from which it strips the interest.

If we wanted to have honest socialist mortgage finance, a handful of GS-14s could run Freddie and Fannie out of the U.S. Treasury building. Civil servants could emboss the taxpayers’ guarantee on every family’s home mortgage just as proficiently as the make-believe business executives who populate the GSEs today; and in the process we could dispense with the sheer waste involved in applying GAAP accounting to the operations of a mere government bureau.

In an alternative political universe not corrupted by crony capitalist mythology about the elixir of homeownership, of course, there would be no need for a Treasury Bureau of Home Mortgage Finance. The decision to own own or rent would be made by 115 million American households based on their best lights, not the inducements and favors of the state. Markets would clear the interest price of mortgage debt and set credit terms and maturities consistent with the risks involved. Undoubtedly, rates would be a few hundred basis points higher and 30-year fixed rates mortgages quite rare. And like in the seemingly prosperous precincts of Germany, the home-ownership rate might be 55% or any other number not selected by pandering politicians of the type who pinned the 70% disaster on the wall during the Clinton-Bush era.

At the end of the day, having 40 million renter-households and 25 million mortgage-free owner-households provide (in their capacity as taxpayers) trillions of subsidized credit to upwards of 50 million mortgage-encumbered households is absurd. Yet it could be dismissed as just another expression of the capricious and random shuffling of income among American citizens that is the tradecraft of the Washington puzzle palace.

Unfortunately, the reality is not so anodyne. In order to hide this random redistribution mischief, the Treasury Bureau of Home Mortgage Finance has been gussied-up to form the simulacrum of a profit-making enterprise—otherwise known as a GSE. In that posture, the GSEs have been repeatedly plundered by insiders like Franklin Rains, the 90 million dollar man who drove Fannie off the cliff; and by fast money stock speculators who managed to drive the combined market cap of Freddie and Fannie to the lunatic level of $140 billion during their hay-day at the turn of the century; and by the Wall Street dealers and so-called fund managers who inventory trillions of GSE debt securities in order to scalp profits from the economically pointless spread between regular treasury bonds and the GSE variant of the same thing.

All of these hundreds of billions were pocketed by adept cronies and speculators in the various debt, equity and preferred securities of the GSEs during the decades culminating in the 2008 financial crisis. Given the trauma of those events, Secretary Paulson’s desperate and ill-disguised nationalization of Freddie and Fannie should have put an end to the plunder.

But it hasn’t because there is no end to the zero cost-of-goods carry trades by which speculators scoop-up and fund financial assets—busted and not—during the Fed’s money printing marathons. Likewise, there is no end to crony capitalist marauders like Berkowitz, who have the temerity to demand make-wholes from the state, and K-Street hirelings—lawyers, accountants and consultants— who are skilled at the manufacture of specious public policy rationalizations for outright thievery.

So now comes the patented crony capitalist rush. The worthless Freddie and Fannie preferreds have lately erupted from $0.25 per share to $12, meaning that some speculators have already garnered a paper return of 48X. And why did this revival miracle transpire? Quite simply because Berkowitz’s Fairholme Capital and his posse of punters—-John Paulson, Perry Capital and Pershing Square, among others—have taken turns bidding up the paper.

Meanwhile, their deplorable plan to do the American people a favor and swap these bogus securities for those of a new tax-payer underwritten, mortgage guarantee stamping machine, has but one objective—that is, to put a statutory floor under the current $12 per share price and enable them to dicker with Capitol Hill staffs for an ultimate take-out at par($25) under the guise of “privatization”. The larceny intended here is not modest: the payday for Berkowitz and his hedge fund posse would amount to $35 billion on toxic paper which was purchased for rounding errors.

To be sure, Berkowitz and his sharpies blather that Freddie and Fannie have now returned $200 billion to the US Treasury, thereby repaying the original $180 billion drawdown, with some change to spare. But what hay wagon do they think even the clueless officialdom of Washington rides upon? Roughly $50 billion of that was for writing-up a “tax asset” that had earlier been written-down, owing to the fact that absent nationalization the GSEs had no prospect of booking even accounting income in the future. And the remaining $150 billion represents dividends paid to the Treasury since 2009 based on using Uncle Sam’s credit card to issue the bonds and guarantees which fund the assets from which these so-called GSE dividends are scalped.

In other words, the Berkowitz Gang wants to be paid a king’s ransom for ownership shares in what amounts to a bureau of the US Treasury. And yet these con men pound the table demanding to “wake up the (GSE) boards” so that they will execute their “fiduciary responsibility”. Indeed, so shameless are Wall Street’s princes of plunder that Berkowitz told a skeptical CNBC questioner last fall “we’ve helped before with AIG”, and that he now merely seeks a “win-win” to “help with jobs, help with the economy, help with the dream of homeownership”!

That gibberish is the measure of the crony capitalist deformation that has infested the nation’s financial markets and system of political governance. The obvious thing for Washington to do is close the doors at Fannie and Freddie and allow their $5 trillion portfolio to run-off in the manner of any liquidation. And if it must subsidize home mortgage credit, just bring back the metal filing cabinets in the Treasury Building where the so-called “secondary mortgage market” was birthed in 1938. Yet what it dare not do is succumb to the bogus bombast of the punters and sharpies who troll the financial wreckage inexorably created by the Fed’s serial bubble machine.

If it does, the people will find their pitchforks and torches – one of these days.

Stop The War Party Now!

Submitted by David Stockman

Pat Buchanan’s take re-posted below is so cogent and clear. Contrary to the bombast, jingoism and shrill moralizing flowing from Washington and the mainstream media, we have no interest in the current spat between Putin and the mobs of Kiev. For several centuries the Crimea has been Russian; for even longer, the Ukraine has been a cauldron of ethnic and tribal conflict, rarely an organized, independent state, and always a meandering set of borders looking for a redrawn map. Surely Washington jests when it threatens to organize another feckless set of economic sanctions against a nation that’s got the gas which Europe needs.

The source of the current calamity-howling about Russia is the Warfare State–that is, the existence of vast machinery of military, diplomatic and economic maneuver that is ever on the prowl for missions and mandates and that can mobilize a massive propaganda campaign on the slightest excitement. The post-1991 absurdity of bolstering NATO and extending it into eastern Europe, rather than liquidating it after attaining “mission accomplished”, is just another manifestation of its baleful impact. In truth, the expansion of NATO is one of the underlying causes of America’s needless tension with Russia and Putin’s paranoia about his borders and neighbors. Indeed, what juvenile minds actually determined that America needs a military alliance with Slovenia, Slovakia, Bulgaria and Romania!

So the resounding clatter for action against Russia emanating from Washington and its house-trained media is not even a semi-rational response to the facts at hand; its just another destructive spasm of Warfare State maneuver and propaganda that can have nothing but ill effect.

Tune Out the War Party!

By Patrick J. Buchanan

March 4, 2014

With Vladimir Putin’s dispatch of Russian troops into Crimea, our war hawks are breathing fire. Russophobia is rampant and the op-ed pages are ablaze here.

Barack Obama should tune them out, and reflect on how Cold War presidents dealt with far graver clashes with Moscow.

When Red Army tank divisions crushed the Hungarian freedom fighters in 1956, killing 50,000, Eisenhower did not lift a finger. When Khrushchev built the Berlin Wall, JFK went to Berlin and gave a speech.

When Warsaw Pact troops crushed the Prague Spring in 1968, LBJ did nothing. When, Moscow ordered Gen. Wojciech Jaruzelski to smash Solidarity, Ronald Reagan refused to put Warsaw in default.

These presidents saw no vital U.S. interest imperiled in these Soviet actions, however brutal. They sensed that time was on our side in the Cold War. And history has proven them right.

What is the U.S. vital interest in Crimea? Zero. From Catherine the Great to Khrushchev, the peninsula belonged to Russia. The people of Crimea are 60 percent ethnic Russians.

And should Crimea vote to secede from Ukraine, upon what moral ground would we stand to deny them the right, when we bombed Serbia for 78 days to bring about the secession of Kosovo?

Across Europe, nations have been breaking apart since the end of the Cold War. Out of the Soviet Union, Czechoslovakia and Yugoslavia came 24 nations. Scotland is voting on secession this year. Catalonia may be next.

Yet, today, we have the Wall Street Journal describing Russia’s sending of soldiers to occupy airfields in Ukraine as a “blitzkrieg” that “brings the threat of war to the heart of Europe,” though Crimea is east even of what we used to call Eastern Europe.

The Journal wants the aircraft carrier George H. W. Bush sent to the Eastern Mediterranean and warships of the U.S. Sixth Fleet sent into the Black Sea.

But why? We have no alliance that mandates our fighting Russia over Crimea. We have no vital interest there. Why send a flotilla other than to act tough, escalate the crisis and risk a clash?

The Washington Post calls Putin’s move a “naked act of armed aggression in the center of Europe.” The Crimea is in the center of Europe? We are paying a price for our failure to teach geography.

The Post also urges an ultimatum to Putin: Get out of Crimea, or we impose sanctions that could “sink the Russian financial system.”

While we and the EU could cripple Russia’s economy and bring down her banks, is this wise? What if Moscow responds by cutting off credits to Ukraine, calling in Kiev’s debts, refusing to buy her goods and raising the price of oil and gas?

This would leave the EU and us with responsibility for a basket-case nation the size of France and four times as populous as Greece.

Are Angela Merkel and the EU ready to take on that load, after bailing out the PIIGS — Portugal, Ireland, Italy, Greece and Spain?

If we push Russia out of the tent, to whom do we think Putin will turn, if not China?

This is not a call to ignore what is going on, but to understand it and act in the long-term interests of the United States.

Putin’s actions, though unsettling, are not irrational.

After he won the competition for Ukraine to join his customs union, by bumping a timid EU out of the game with $15 billion cash offer plus subsidized oil and gas to Kiev, he saw his victory stolen.

Crowds formed in Maidan Square, set up barricades, battled police with clubs and Molotov cocktails, forced the elected president Viktor Yanukovych into one capitulation after another, and then overthrew him, ran him out of the country, impeached him, seized parliament, downgraded the Russian language, and declared Ukraine part of Europe.

To Americans this may look like democracy in action. To Moscow it has the aspect of a successful Beer Hall Putsch, with even Western journalists conceding there were neo-Nazis in Maidan Square.

In Crimea and eastern Ukraine, ethnic Russians saw a president they elected and a party they supported overthrown and replaced by parties and politicians hostile to a Russia with which they have deep historical, religious, cultural and ancestral ties.

Yet Putin is taking a serious risk. If Russia annexes Crimea, no major nation will recognize it as legitimate, and he could lose the rest of Ukraine forever. Should he slice off and annex eastern Ukraine, he could ignite a civil war and second Cold War.

Time is not necessarily on Putin’s side here. John Kerry could be right on that.

But as for the hawkish howls, to have Ukraine and Georgia brought into NATO, that would give these nations, deep inside Russia’s space, the kind of war guarantees the Kaiser gave Austria in 1914 and the Brits gave the Polish colonels in March 1939.

Those war guarantees led to two world wars, which historians may yet conclude were the death blows of Western civilization.

Memo to Obama: This Was Their Red Line!

Submitted by David Stockman, via his new blog Contra Corner

Memo to Obama: This Was Their Red Line!

![Ethnolingusitic_map_of_ukraine[1]](http://davidstockmanscontracorner.com/wp-content/uploads/2014/03/Ethnolingusitic_map_of_ukraine1-640x447.png) In 1783 the Crimea was annexed by Catherine the Great, thereby satisfying the longstanding quest of the Russian Czars for a warm-water port. In fact, over the ages Sevastopol emerged as a great naval base at the strategic tip of the Crimean peninsula, where it became home to the mighty Black Sea Fleet of the Czars and then the commissars.

In 1783 the Crimea was annexed by Catherine the Great, thereby satisfying the longstanding quest of the Russian Czars for a warm-water port. In fact, over the ages Sevastopol emerged as a great naval base at the strategic tip of the Crimean peninsula, where it became home to the mighty Black Sea Fleet of the Czars and then the commissars.

For the next 171 years Crimea was an integral part of Russia—a span that exceeds the 166 years that have elapsed since California was annexed by a similar thrust of “Manifest Destiny” on this continent, thereby providing, incidentally, the United States Navy with its own warm-water port in San Diego. While no foreign forces subsequently invaded the California coasts, it was most definitely not Ukrainian and Polish riffles, artillery and blood which famously annihilated The Charge Of The Light Brigade at the Crimean city of Balaclava in 1854; they were Russians defending the homeland.

And the portrait of the Russian ”hero” hanging in Putin’s office is that of Czar Nicholas I—whose brutal 30-year reign brought the Russian Empire to its historical zenith, and who was revered in Russian hagiography as the defender of Crimea, even as he lost the 1850s war to the Ottomans and Europeans. Besides that, there is no evidence that Putin does historical apologies, anyway.

In fact, its their Red Line. When the enfeebled Franklin Roosevelt made port in the Crimean city of Yalta in February 1945 he did know he was in Soviet Russia. Maneuvering to cement his control of the Kremlin in the intrigue-ridden struggle for succession after Stalin’s death a few years later, Nikita Khrushchev allegedly spent 15 minutes reviewing his “gift” of Crimea to his subalterns in Kiev in honor of the decision by their ancestors 300 years earlier to accept the inevitable and become a vassal of Russia.

Self-evidently, during the long decades of the Cold War, the West did nothing to liberate the “captive nation” of the Ukraine—with or without the Crimean appendage bestowed upon it in 1954. Nor did it draw any red lines in the mid-1990?s when a financially desperate Ukraine rented back Sevastopol and the strategic redoubts of the Crimea to an equally pauperized Russia.

In short, in the era before we got our Pacific port in 1848 and in the 166-year interval since then, the security and safety of the American people have depended not one wit on the status of the Russian-speaking Crimea. Should the local population now choose fealty to the Grand Thief in Moscow over the ruffians and rabble who have seized Kiev, what’s to matter! Worse still, how long can America survive the screeching sanctimony and mindless meddling of Susan Rice and Samantha Power? Mr. President, send them back to geography class; don’t draw any new Red Lines. This one has been morphing for centuries among the quarreling tribes, peoples, potentates, Patriarchs and pretenders of a small region that is none of our damn business.

Keynesian Myths, Monetary Central Planning and The Triumph of The Warfare State

Guest post by David Stockman from his great new website.

Flask in hand, Boris Yelstin famously mounted a tank outside the Soviet Parliament in August 1991. Presently, the fearsome Red Army stood down—an outcome which 45 years of Cold War military mobilization by the West had failed to accomplish.

At the time, the U.S. Warfare State’s budget— counting the pentagon, spy agencies, DOE weapons, foreign aid, homeland security and veterans—-was about $500 billion in today’s dollars. Now, a quarter century on from the Cold War’s end, that same metric stands at $900 billion.

This near doubling of the Warfare State’s fiscal girth is a tad incongruous. After all, America’s war machine was designed to thwart a giant, nuclear-armed industrial state, but, alas, we now have no industrial state enemies left on the planet.

The much-shrunken Russian successor to the Soviet Union, for example, has become a kleptocracy run by a clever thief who prefers stealing from his own citizens rather than his neighbors.

Likewise, the Red Chinese threat consists of a re-conditioned aircraft carrier bought second-hand from a former naval power—-otherwise known as the former Ukraine. China’s bubble-ridden domestic economy would collapse within six weeks were it to actually bomb the 4,000 Wal-Mart outlets in America on which its mercantilist export machine utterly depends.

On top of that, we’ve been fired as the world’s policeman, al Qaeda has essentially vanished and during last September’s Syria war scare the American people even took away the President’s keys to the Tomahawk missile batteries. In short, the persistence of America’s trillion dollar Warfare State budget needs some serious “splainin”.

The Great War and Its Aftermath

My purpose tonight is to sketch the long story of how it all happened, starting precisely 100 years ago in 1914.

In that year the Fed opened-up for business just as the carnage in northern France closed-down the prior magnificent half-century era of liberal internationalism and honest gold-backed money.

The Great War was self-evidently an epochal calamity, especially for the 20 million combatants and civilians who perished for no reason that is discernible in any fair reading of history, or even unfair one.

Yet the far greater calamity is that Europe’s senseless fratricide of 1914-1918 gave birth to all the great evils of the 20th century— the Great Depression, totalitarian genocides, Keynesian economics, permanent warfare states, rampaging central banks and the exceptionalist-rooted follies of America’s global imperialism.

Indeed, in Old Testament fashion, one begat the next and the next and still the next.

This chain of calamity originated in the Great War’s destruction of sound money, that is, in the post-war demise of the pound sterling which previously had not experienced a peacetime change in its gold content for nearly two hundred years.

Not unreasonably, the world’s financial system had become anchored on the London money markets where the other currencies traded at fixed exchange rates to the rock steady pound sterling—which, in turn, meant that prices and wages throughout Europe were expressed in common money and tended toward transparency and equilibrium.

This liberal international economic order—that is, honest money, relatively free trade, rising international capital flows and rapidly growing global economic integration—-resulted in a 40-year span between 1870 and 1914 of rising living standards, stable prices, massive capital investment and prolific technological progress that was never equaled—either before or since.

During intervals of war, of course, 19th century governments had usually suspended gold convertibility and open trade in the heat of combat. But when the cannons fell silent, they had also endured the trauma of post-war depression until wartime debts had been liquidated and inflationary currency expedients had been wrung out of the circulation.

This was called “resumption” and restoring convertibility at the peacetime parities was the great challenge of post-war normalizations.

The Great War, however, involved a scale of total industrial mobilization and financial mayhem that was unlike any that had gone before. In the case of Great Britain, for example, its national debt increased 14-fold, its price level doubled, its capital stock was depleted, most off-shore investments were liquidated and universal wartime conscription left it with a massive overhang of human and financial liabilities.

Yet England was the least devastated. In France, the price level inflated by 300 percent, its extensive Russian investments were confiscated by the Bolsheviks and its debts in New York and London catapulted to more than 100 percent of GDP.

Among the defeated powers, currencies emerged nearly worthless with the German mark at five cents on the pre-war dollar, while wartime debts—especially after the Carthaginian peace of Versailles—–soared to crushing, unrepayable heights.

In short, the bow-wave of debt, currency inflation and financial disorder from the Great War was so immense and unprecedented that the classical project of post-war liquidation and “resumption” of convertibility was destined to fail. In fact, the 1920s were a grinding, sometimes inspired but eventually failed struggle to resume the international gold standard, fixed parities, open world trade and unrestricted international capital flows.

Only in the final demise of these efforts after 1929 did the Great Depression, which had been lurking all along in the post-war shadows, come bounding onto the stage of history.

I.

The Great Depression’s tardy, thoroughly misunderstood and deeply traumatic arrival happened compliments of the United States.

In the first place, America’s wholly unwarranted intervention in April 1917 prolonged the slaughter, doubled the financial due bill and generated a cockamamie peace, giving rise to totalitarianism among the defeated powers and Keynesianism among the victors. Choose your poison.

Even conventional historians like Niall Ferguson admit as much. Had Woodrow Wilson not misled America on a messianic crusade, the Great War would have ended in mutual exhaustion in 1917 and both sides would have gone home battered and bankrupt but no danger to the rest of mankind.

Indeed, absent Wilson’s crusade there would have been no allied victory, no punitive peace, and no war reparations; nor would there have been a Leninist coup in Petrograd or Stalin’s barbaric regime.

Likewise, there would have been no Hitler, no Nazi dystopia, no Munich, no Sudetenland and Danzig corridor crises, no British war to save Poland, no final solution and holocaust, no global war against Germany and Japan and no incineration of 200,000 civilians at Hiroshima and Nagasaki.

Nor would there have followed a Cold War with the Soviets or CIA sponsored coups and assassinations in Iran, Guatemala, Indonesia, Brazil, Chile and the Congo, to name a few.

Surely there would have been no CIA plot to assassinate Castro, or Russian missiles in Cuba or a crisis that took the world to the brink of annihilation. There would have been no Dulles brothers, no domino theory and no Vietnam slaughter, either.

Nor would we have launched Charlie Wilson’s War to arouse the mujahedeen and train the future al Qaeda. Likewise, there would have been no shah and his Savak terror, no Khomeini-led Islamic counter-revolution, no US aid to enable Saddam’s gas attacks on Iranian boy soldiers in the 1980s.

Nor would there have been an American invasion of Arabia in 1991 to stop our erstwhile ally Hussein from looting the equally contemptible Emir of Kuwait’s ill-gotten oil plunder—or, alas, the horrific 9/11 blowback a decade later.

Most surely, the axis-of-evil—-that is, the Washington-based Cheney-Rumsfeld-neocon axis—- would not have arisen, nor would it have foisted a $1 trillion Warfare State budget on 21st century America.

II.

But….I digress!

The real point is that the Great War enabled the already rising American economy to boom and bloat in an entirely artificial and unsustainable manner for the better part of 15 years. The exigencies of war finance also transformed the nascent Federal Reserve into an incipient central banking monster in a manner wholly opposite to the intentions of its great legislative architect—the incomparable Carter Glass of Virginia.

The 1914-1929 Boom Was An Artifact of War and Money Printing

In the first stage, America became the granary and arsenal to the European Allies—-triggering an eruption of domestic investment and production that transformed the nation into a massive global creditor and powerhouse exporter virtually overnight.

American farm exports quadrupled, farm income surged from $3 billion to $9 billion, land prices soared, country banks proliferated like locusts and the same was true of industry—where steel production, for example, rose from 30 million tons annually to nearly 50 million tons.

Altogether, in six short years $40 billion of money GDP became $92 billion in 1920—a sizzling 15 percent annual rate of gain.

Needless to say, these fantastic figures reflected an inflationary, war-swollen economy—-a phenomena that prudent finance men of the age knew was wholly artificial and destined for a thumping post-war depression. This was especially so because America had loaned the Allies massive amounts of money to purchase grain, pork, wool, steel, munitions and ships. This transfer amounted to nearly 15 percent of GDP or $2 trillion equivalent in today’s economy, but it also amounted to a form of vendor finance that was destined to vanish at war’s end.

As it happened, the nation did experience a brief but deep recession in 1920, but this did not represent a thorough-going end-of-war “de-tox” of the historical variety. The reason is that America’s newly erected Warfare State had hijacked Carter Glass “banker’s bank” to finance Wilson’s crusade.

Indeed, when Congress acted just six months before Archduke Ferdinand’s assassination, it had provided no legal authority whatsoever for the Fed to buy government bonds or undertake so-called “open market operations” to finance the public debt. In part this was due to the fact that there were precious few Federal bonds to buy. The public debt then stood at just $1.5 billion, which is the same figure that had pertained 51 years earlier at the battle of Gettysburg, and amounted to just 4 percent of GDP or $11 per capita.

Thus, in an age of balanced budgets and bipartisan fiscal rectitude, the Fed’s legislative architects had not even considered the possibility of central bank monetization of the public debt, and, in any event, had a totally different mission in mind.

The new Fed system was to operate decentralized “reserve banks” in 12 regions—most of them far from Wall Street in places like San Francisco, Dallas, Kansas City and Cleveland. Their job was to provide a passive “rediscount window” where national banks within each region could bring sound, self-liquidating commercial notes and receivables to post as collateral in return for cash to meet depositor withdrawals or to maintain an approximate 15 percent cash reserve.

Accordingly, the assets of the 12 reserve banks were to consist entirely of short-term commercial paper arising out of the ebb and flow of commerce and trade on the free market, not the debt emissions of Washington. In this context, the humble task of the reserve banks was to don green eyeshades and examine the commercial collateral brought by member banks, not to grandly manage the macro economy through targets for interest rates, money growth or credit expansion—to say nothing of targeting jobs, GDP, housing starts or the Russell 2000, as per today’s fashion.

Even the rediscount rate charged to member banks for cash loans was to float at a penalty spread above money market rates set by supply and demand for funds on the free market.

The big point here is that Carter Glass’ “banker’s bank” was an instrument of the market, not an agency of state policy. The so-called economic aggregates of the later Keynesian models—-GDP, employment, consumption and investment—were to remain an unmanaged outcome on the free market, reflecting the interaction of millions of producers, consumers, savers, investors, entrepreneurs and even speculators.

In short, the Fed as “banker’s bank” had no dog in the GDP hunt. Its narrow banking system liquidity mission would not vary whether the aggregates were growing at 3 percent or contracting at 3 percent.

What would vary dramatically, however, was the free market interest rate in response to shifts in the demand for loans or supply of savings. In general this meant that investment booms and speculative bubbles were self-limiting: When the demand for credit sharply out-ran the community’s savings pool, interest rates would soar—thereby rationing demand and inducing higher cash savings out of current income.

This market clearing function of money market interest rates was especially crucial with respect to leveraged financial speculation—such as margin trading in the stock market. Indeed, the panic of 1907 had powerfully demonstrated that when speculative bubbles built up a powerful head of steam the free market had a ready cure.

In that pre-Fed episode, money market rates soared to 20, 30 and even 90 percent at the peak of the bubble. In short order, of course, speculators in copper, real estate, railroads, trust banks and all manner of over-hyped stock were carried out on their shields—-even as JPMorgan’s men, who were gathered as a de facto central bank in his library on Madison Avenue, selectively rescued only the solvent banks with their own money at-risk.

Needless to say, these very same free market interest rates were a mortal enemy of deficit finance because they rationed the supply of savings to the highest bidder. Thus, the ancient republican moral verity of balanced budgets was powerfully reinforced by the visible hand of rising interest rates: deficit spending by the public sector automatically and quickly crowded out borrowing by private households and business.

And this brings us to the Rubicon of modern Warfare State finance. During World War I the US public debt rose from $1.5 billion to $27 billion—an eruption that would have been virtually impossible without wartime amendments which allowed the Fed to own or finance U.S. Treasury debt. These “emergency” amendments—it’s always an emergency in wartime—enabled a fiscal scheme that was ingenious, but turned the Fed’s modus operandi upside down and paved the way for today’s monetary central planning.

As is well known, the Wilson war crusaders conducted massive nationwide campaigns to sell Liberty Bonds to the patriotic masses. What is far less understood is that Uncle Sam’s bond drives were the original case of no savings? No credit? No problem!

What happened was that every national bank in America conducted a land office business advancing loans for virtually 100 percent of the war bond purchase price—with such loans collateralized by Uncle Sam’s guarantee. Accordingly, any patriotic American with enough pulse to sign the loan papers could buy some Liberty Bonds.

And where did the commercial banks obtain the billions they loaned out to patriotic citizens to buy Liberty Bonds? Why the Federal Reserve banks opened their discount loan windows to the now eligible collateral of war bonds.

Additionally, Washington pegged the rates on these loans below the rates on its treasury bonds, thereby providing a no-brainer arbitrage profit to bankers.

Through this backdoor maneuver, the war debt was thus massively monetized. Washington learned that it could unplug the free market interest rate in favor of state administered prices for money, and that credit could be massively expanded without the inconvenience of higher savings out of deferred consumption. Effectively, Washington financed Woodrow Wilson’s crusade with its newly discovered printing press—-turning the innocent “banker’s bank” legislated in 1913 into a dangerously potent new arm of the state.

III

It was this wartime transformation of the Fed into an activist central bank that postponed the normal post-war liquidation—-moving the world’s scheduled depression down the road to the 1930s. The Fed’s role in this startling feat is in plain sight in the history books, but its significance has been obfuscated by Keynesian and monetarist doctrinal blinders—that is, the presumption that the state must continuously manage the business cycle and macro-economy.

Having learned during the war that it could arbitrarily peg the price of money, the Fed next discovered it could manage the growth of bank reserves and thereby the expansion of credit and the activity rate of the wider macro-economy. This was accomplished through the conduct of “open market operations” under its new authority to buy and sell government bonds and bills—something which sounds innocuous by today’s lights but was actually the fatal inflection point. It transferred the process of credit creation from the free market to an agency of the state.

As it happened, the patriotic war bond buyers across the land did steadily pay-down their Liberty loans, and, in turn, the banking system liquidated its discount window borrowings—-with a $2.7 billion balance in 1920 plunging 80 percent by 1927. In classic fashion, this should have caused the banking system to shrink drastically as war debts were liquidated and war-time inflation and malinvestments were wrung out of the economy.

But big-time mission creep had already set in. The legendary Benjamin Strong had now taken control of the system and on repeated occasions orchestrated giant open market bond buying campaigns to offset the natural liquidation of war time credit.

Accordingly, treasury bonds and bills owned by the Fed approximately doubled during the same 7-year period. Strong justified his Bernanke-like bond buying campaigns of 1924 and 1927 as helpful actions to off-set “deflation” in the domestic economy and to facilitate the return of England and Europe to convertibility under the gold standard.

But in truth the actions of Bubbles Ben 1.0 were every bit as destructive as those of Bubbles Ben 2.0.

In the first place, deflation was a good thing that was supposed to happen after a great war. Invariably, the rampant expansion of war time debt and paper money caused massive speculations and malinvestments that needed to be liquidated.

Likewise, the barrier to normalization globally was that England was unwilling to fully liquidate its vast wartime inflation of wage, prices and debts. Instead, it had come-up with a painless way to achieve “resumption” at the age-old parity of $4.86 per pound; namely, the so-called gold exchange standard that it peddled assiduously through the League of Nations.

The short of it was that the British convinced France, Holland, Sweden and most of Europe to keep their excess holdings of sterling exchange on deposit in the London money markets, rather than convert it to gold as under the classic, pre-war gold standard.

This amounted to a large-scale loan to the faltering British economy, but when Chancellor of the Exchequer Winston Churchill did resume convertibility in April 1925 a huge problem soon emerged. Churchill’s splendid war had so debilitated the British economy that markets did not believe its government had the resolve and financial discipline to maintain the old $4.86 parity. This, in turn, resulted in a considerable outflow of gold from the London exchange markets, putting powerful contractionary pressures on the British banking system and economy.

Real Cause of the Great Depression: Collapse of the Artificial Boom

In this setting, Bubbles Ben 1.0 stormed in with a rescue plan that will sound familiar to contemporary ears. By means of his bond buying campaigns he sought to drive-down interest rates in New York relative to London, thereby encouraging British creditors to keep their money in higher yielding sterling rather than converting their claims to gold or dollars.

The British economy was thus given an option to keep rolling-over its debts and to continue living beyond its means. For a few years these proto-Keynesian “Lords of Finance” —- principally Ben Strong of the Fed and Montague Norman of the BOE—-managed to kick the can down the road.

But after the Credit Anstalt crisis in spring 1931, when creditors of shaky banks in central Europe demanded gold, England’s precarious mountain of sterling debts came into the cross-hairs. In short order, the money printing scheme of Bubbles Ben 1.0 designed to keep the Brits in cheap interest rates and big debts came violently unwound.

In late September a weak British government defaulted on its gold exchange standard duty to convert sterling to gold, causing the French, Dutch and other central banks to absorb massive overnight losses. The global depression then to took another lurch downward.

But central bankers tamper with free market interest rates only at their peril—-so the domestic malinvestments and deformations which flowed from the monetary machinations of Bubbles Ben 1.0 were also monumental.

Owing to the splendid tax-cuts and budgetary surpluses of Secretary Andrew Mellon, the American economy was flush with cash, and due to the gold inflows from Europe the US banking system was extraordinarily liquid. The last thing that was needed in Roaring Twenties America was the cheap interest rates—-at 3 percent and under—that resulted from Strong’s meddling in the money markets.

At length, Strong’s ultra-low interest rates did cause credit growth to explode, but it did not end-up funding new steel mills or auto assembly plants. Instead, the Fed’s cheap debt flooded into the Wall Street call money market where it fueled that greatest margin debt driven stock market bubble the world had ever seen. By 1929, margin debt on Wall Street had soared to 12 percent of GDP or the equivalent of $2 trillion in today’s economy.

As is well known, much economic carnage resulted from the Great Crash of 1929. But what is less well understood is that the great stock market bubble also spawned a parallel boom in foreign bonds—-specie of Wall Street paper that soon proved to be the sub-prime of its day.

Indeed, Bubbles Ben 1.0 triggered a veritable cascade of speculative borrowing that soon spread to the far corners of the globe, including places like municipality of Rio de Janeiro, the Kingdom of Denmark and the free city of Danzig, among countless others.

It seems that the margin debt fueled stock market drove equity prices so high that big American corporations with no needs for cash were impelled to sell bundles of new stock anyway in order to feed the insatiable appetites of retail speculators. They then used the proceeds to buy Wall Street’s high yielding “foreign bonds”, thereby goosing their own reported earnings, levitating their stock prices even higher and causing the cycle to be repeated again and again.

As the Nikkei roared to 50,000 in the late 1980s, the Japanese were pleased to call this madness “zaitech”, and it didn’t work any better the second time around. But the 1920s version of zaitech did generate prodigious sums of cash that cycled right back to exports from America’s farms, mines and factories. Over the eight years ending in 1929, the equivalent of $1.5 trillion was raised on Wall Street’s red hot foreign bond market, meaning that the US economy simply doubled-down on the vendor finance driven export boom that had been originally sparked by the massive war loans to the Allies.

In fact, over the period 1914-1929 the U. S. loaned overseas customers—-from the coffee plantations of Brazil to the factories of the Ruhr—-the modern day equivalent of $3.5 trillion to prop-up demand for American exports. The impact was remarkable. In the 15 years before the war American exports had crept up slowly from $1.6 billion to $2.4 billion per year, and totaled $35 billion over the entire period. By contrast, shipments from American farms and factors soared to nearly $11 billion annually by 1919 and totaled $100 billion—three times more—over the 15 years through 1929.

So this was vendor finance on a vast scale——reflecting the exact mercantilist playbook that Mr. Deng chanced upon 60 years later when he opened the export factories of East China, and then ordered the People’s Bank to finance China’s exports of T-shirts, sneakers, plastic extrusions, zinc castings and mini-backhoes via the continuous massive purchases of Uncle Sam’s bonds, bills and guaranteed housing paper.

Our present day Keynesian witch doctors antiseptically label the $3.8 trillion that China has accumulated through this massive currency manipulation and repression as “foreign exchange reserves”, but they are nothing of the kind. If China had honest exchange rates, it reserves would be a tiny sliver of today’s level.

In truth, China’s $3.8 trillion of reserves are a gigantic vendor loan to its customers. This is a financial clone of the $3.5 trillion equivalent that the great American creditor and export powerhouse loaned to the rest of the world between 1914 and 1929.

Needless to say, after the October 1929 crash, the Wall Street foreign bond market went stone cold, with issuance volume dropping by 95 percent within a year or two. Thereupon foreign bond default rates suddenly soared because sub-prime borrowers all over the world had been engaged in a Ponzi—-tapping new money on Wall Street to pay interest on the old loans.

By 1931 foreign bonds were trading at 8 cents on the dollar—-not coincidentally in the same busted zip code where sub-prime mortgage bonds ended up in 2008-2009.

Still, busted bonds always mean a busted economic cycle until the malinvestments they initially fund can be liquidated or repurposed. Thus, the 1929 Wall Street bust generated a devastating crash in US exports as the massive vendor financed foreign demand for American farm and factory goods literally vanished. By 1933 exports had slipped all the way back to the $2.4 billion level of 1914.

That’s not all. As US export shipments crashed by 70 percent between 1929 and 1933, there were ricochet effect throughout the domestic economy.

This artificial 15-year export boom had caused the production capacity of American farms and factories to become dramatically oversized, meaning that during this interval there had occurred a domestic capital spending boom of monumental proportions. While estimated GDP grew by a factor of 2.5X during 1914-1929, capital spending by manufacturers rose by 7X. Auto production capacity, for example, increased from 2 million vehicles annually in 1920 to more than 6 million by 1929.

Needless to say, when world export markets collapsed, the US economy was suddenly drowning in excess capacity. In short order, the decade-long capital spending boom came to a screeching halt, with annual outlays for plant and equipment tumbling by 80 percent in the four years after 1929, and shipments of items like machine tools plummeting by 95 percent.

Not surprisingly, in the wake of this drastic downshift in output, American business also found itself drowning in excess inventories. Accordingly, nearly half of all production inventories extant in 1929 were liquidated by 1933, resulting in a shocking 20 percent hit to GDP—a blow that would amount to a $3 trillion drop in today’s economy.

Finally, Bubbles Ben 1.0 had induced vast but temporary “wealth effects” just like his present day successor. Stock prices surged by 150 percent in the final three years of the mania. There was also an explosion of consumer installment loans for durable goods and mortgages for homes. Indeed, mortgage debt soared by nearly 4X during the decade before the crash, while boom-time sales of autos, appliances and radios nearly tripled durable goods sales in the eight years ending in 1929.

All of this debt and wealth effects induced spending came to an abrupt halt when stock prices came tumbling back to earth. Durable goods and housing plummeted by 80 percent during the next four years. In the case of automobiles, where stock market lottery winners had been buying new cars hand over fist, the impact was especially far reaching. After sales peaked at 5.3 million units in 1929, they dropped like a stone to 1.4 million vehicles in 1932, meaning that this 75 percent shrinkage of auto sales cascaded through the entire auto supply chain including metal working equipment, steel, glass, rubber, electricals and foundry products.

Thus, the Great Depression was born in the extraordinary but unsustainable boom of 1914-1929 that was, in turn, an artificial and bloated project of the warfare and central banking branches of the state, not the free market.

Nominal GDP, which had been deformed and bloated to $103 billion by 1929, contracted massively, dropping to only $56 billion by 1933. Crucially, the overwhelming portion of this unprecedented contraction was in exports, inventories, fixed plant and durable goods—the very sectors that had been artificially hyped. These components declined by $33 billion during the four year contraction and accounted for fully 70 percent of the entire drop in nominal GDP.

So there was no mysterious loss of that Keynesian economic ether called “aggregate demand”, but only the inevitable shrinkage of a state induced boom. It was not the depression bottom of 1933 that was too low, but the wartime debt and speculation bloated peak in 1929 that had been unsustainably too high.

The Mythical Banking Crisis and the Failure of the New Deal

IV

The Great Depression thus did not represent the failure of capitalism or some inherent suicidal tendency of the free market to plunge into cyclical depression—absent the constant ministrations of the state through monetary, fiscal, tax and regulatory interventions. Instead, the Great Depression was a unique historical occurrence—the delayed consequence of the monumental folly of the Great War, abetted by the financial deformations spawned by modern central banking.

But ironically, the “failure of capitalism” explanation of the Great Depression is exactly what enabled the Warfare State to thrive and dominate the rest of the 20th century because it gave birth to what have become its twin handmaidens—-Keynesian economics and monetary central planning. Together, the latter two doctrines eroded and eventually destroyed the great policy barrier—-that is, the old-time religion of balanced budgets— that had kept America a relatively peaceful Republic until 1914.

To be sure, under Mellon’s tutelage, Harding, Coolidge and Hoover strove mightily, and on paper successfully, to restore the pre-1914 status quo ante on the fiscal front. But it was a pyrrhic victory—since Mellon’s surpluses rested on an artificially booming, bubbling economy that was destined to hit the wall.

Worse still, Hoover’s bitter-end fidelity to fiscal orthodoxy, as embodied in his infamous balanced budget of June 1932, got blamed for prolonging the depression. Yet, as I have demonstrated in the chapter of my book called “New Deal Myths of Recovery”, the Great Depression was already over by early summer 1932.

At that point, powerful natural forces of capitalist regeneration had come to the fore. Thus, during the six month leading up to the November 1932 election, freight loadings rose by 20 percent, industrial production by 21 percent, construction contract awards gained 30 percent, unemployment dropped by nearly one million, wholesale prices rebounded by 20 percent and the battered stock market was up by 40 percent.

So Hoover’s fiscal policies were blackened not by the facts of the day, but by the subsequent ukase of the Keynesian professoriat. Indeed, the “Hoover recovery” would be celebrated in the history books even today if it had not been interrupted in the winter of 1932-1933 by a faux “banking crisis” which was entirely the doing of President-elect Roosevelt and the loose-talking economic statist at the core of his transition team, especially Columbia professors Moley and Tugwell.